On July 18th 2017, Slater and Gordon Lawyers wrote me the below email. Lawyer Steve Kuncewicz clearly stated that Slater and Gordon acted for their client: Blackmore Global PCC Limited; Phillip Nunn and Patrick McCreesh. The full transcript is below – complete with my comments in bold. This is a 25-page document, so I don’t expect most people (except the most tenacious and determined) to read all of it. So I have put the basic highlights below.

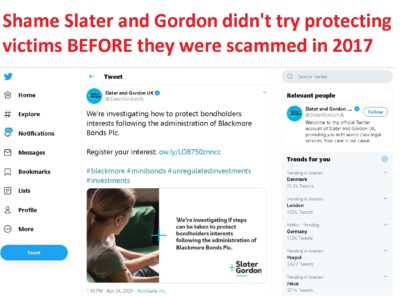

It is clear that Slater and Gordon was a poacher back in July 2017 when the firm represented clients Blackmore, Nunn and McCreesh. And now in 2020, Slater and Gordon, is an even bigger poacher as it attempts to profit from the losses suffered by Blackmore Bond victims.

As Bond Review reported yesterday that the FCA knew all about the doomed Blackmore Bond three years ago, it is clear that Blackmore’s own lawyers – Slater and Gordon – also knew what Nunn and McCreesh were up to at the same time, but did not report their clients to the authorities as they should have done (not that it would have done any good). But both the FCA and Slater and Gordon could have prevented the Blackmore Bond tragedy and saved hundreds of victims from losing their life savings.

Meanwhile, Slater and Gordon is now advertising all over social media:

We’re investigating how to protect bondholders interests following the administration of Blackmore Bonds Plc.

Slater and Gordon is also denying that Blackmore, Nunn and McCreesh were ever their clients. Slater and Gordon is now trying to attract clients by promising:

“We’re keen to assist investors and help them understand their position. We’re investigating if any steps can be taken to protect their interest in the funds within Blackmore’s mini-bond schemes, following the administration of Blackmore Bonds Plc. These schemes promised a high rate of return to investors but continually failed to pay-out. If you invested in mini-bonds or an ISA through Blackmore, we’re keen to speak with you. “

Although the communication with Slater and Gordon is more about the Blackmore Global Fund scam than the mini-bond, it does cover a number of crucial issues including:

- Slater and Gordon confirmed that they acted for their clients: Blackmore, Nunn and McCreesh in both a ” business and personal capacity “

- Slater and Gordon was trying to shut me up so that their clients could keep scamming hundreds of victims out of their pensions and life savings

- Slater and Gordon was falsely portraying their client as: “a prestigious, multi-asset investment house with over £60 million in assets under management, offering institutional and high net-worth clients access to a wide variety of investment products in order to maximise their returns”. This was completely false as Blackmore only targeted retail investors with small pension pots or personal savings – with their entirely unsuitable, illiquid, high-risk investments

- Slater and Gordon claimed: “The Blackmore Group was founded on the core belief of putting the needs of its clients first, developing diverse portfolios backed by real assets containing a blend of capital growth and fixed income”. This is nonsense: Blackmore worked closely with known, serial scammers to promote their products and target naive, vulnerable victims. They locked pension savers into their fund scam for ten years without their knowledge and they spent the bondholders’ money on huge amounts of promotion fees (e.g. Surge Group) and commissions for the scammers who helped distribute their toxic wares.

But most serious of all is this next point:

5. Your only intention can be to divert business from them and to cause serious financial harm as a result.

I replied: “I have no interest in causing your clients financial harm – why would I? But I do think that vulnerable pension savers have a right to know the background of the people behind a fund which is being promoted to retail, UK-resident investors.”

A lot of the Blackmore Bond victims invested AFTER this letter. Slater and Gordon did NOTHING to warn the public about their client. All they did was to try to shut me up and prevent me from warning the public.

And now they want to make money out of the Blackmore Bond victims? Seriously?

| Slater Gordon Lawyers 18 July 2017 URGENT — IF YOU DO NOT RESPOND TO THIS CORRESPONDENCE, COURT PROCEEDINGS MAY BE ISSUED AGAINST YOU WITHOUT FURTHER NOTICE Ms Brooks t/a Pension-Life.com 24 Calle Cuatro Esquinas Lanjaron 18420, Granada SPAIN |

58 Mosley Street

Manchester

M2 3HZ

DX 14340

Manchester 1

Tel: 0161 383

3500 Fax: 0161 383 3636 wwwslatergordon.co.uk Your Contact: Steve Kuncewicz Assistant: Rebecca Young Direct Tel: 01613833708 Email: Steve.Kuncewicz@slatergordon.co.uk Your Ref: Our Ref: RZY03/UM1389098 |

BY E-MAIL AND

RECORDED DELIVERY POST:

anqiebrookspension-life.com

Dear Madam

Our Clients: Blackmore Global PCC Limited, Philip Nunn and Patrick McCreesh Proposed Claim for Defamation and Malicious Falsehood

We act for the aforementioned clients in their business and personal capacity and have been instructed to contact you in relation to various untrue, defamatory and wholly unjustifiable allegations published on your website at httq://pension-life.com (the Website) relating to our clients, their products and services which are designed to (and in fact already have, as set out below) damage their respective reputations and financial interests.

Our client, Blackmore Global PCC Limited, is part of the Blackmore Group which is a prestigious, multi-asset investment house with over £60 million in assets under management, offering institutional and high net-worth clients access to a wide variety of investment products in order to maximise their returns.

If it is indeed true that Blackmore Group is a prestigious organisation, then I have no doubt the directors will be keen to ensure that the damage done to victims’ pensions is put right and that Blackmore’s purported “good name” is protected. However, when you Google Blackmore Group PCC nothing comes up about it being “prestigious” – but what does come up is a link to one of Offshore Alert’s warnings regarding Brian Weal – – and as you know at least one of the underlying assets was run by Weal.

Further, there are cautionary warnings on the Money Saving Expert forum which mentions that investors were given a “pension review” by Aspinal Chase (run by your clients) and promised 10% returns p.a. There is absolutely nothing available on Google which describes Blackmore Global as “prestigious”.

Further, the clients are not high net-worth, under the FCA definition. Are you aware of the FCA definition of “High net-worth”? Your clients, with 25 years’ experience, will know this. Just to remind you, a high net-worth client, according to the FCA has-

- an annual income to the value of £100,000 or more. Annual income for these purposes does not include money withdrawn from pension savings (except where the withdrawals are used directly for income in retirement).

- net assets to the value of £250,000 or more.

The definition specifically excludes pension savings. Yet, your clients are involved in the marketing, processing and investing of retail pensions of those that are not high net-worth clients. I would be interested to see if ANY sophisticated or institutional investors are in the Blackmore Global Funds. Surely, such experienced investors would demand audited accounts.

“The Blackmore Group was founded on the core belief of putting the needs of its clients first, developing diverse portfolios backed by real assets containing a blend of capital growth and fixed income.” (Steve Kuncewicz of Slater and Gordon – 18.7.2017)

If the assets are “real” – tell us what they are. Do you even know what they are? Have you seen an independent audit or are you relying solely on what your client is telling you?

Blackmore Global PCC Limited offers a medium to long-term investment vehicle for its clients with a diversified investment portfolio under one structure which allocates investment between four distinct protected cells which diversify assets between property, sustainable energy, private equity and lifestyle. In order to take advantage of as wide a range of investments as possible, it invests in a number of vehicles including funds, companies, joint venture projects and equities.

I know all about the cells as they are described in the factsheet and brochure. However, based on the fact that we know some of the information contained therein is untrue, I am not sure the cell information can necessarily be relied on. What we really need to know is exactly what the assets are. Steve, I mean no disrespect but your letter contains 21,290 words – and not one word about what the assets really are. You seem to be trying to claim your clients have done nothing wrong – but you are providing no evidence.

Further, among those many words, you refer to loss suffered by your clients multiple times, but you never once refer to the considerable loss and distress suffered by the Blackmore Global investors (or indeed the Capita Oak and Henley ones).

Patrick McCreesh and Philip Nunn founded the Blackmore Group (of which Blackmore Global PCC forms part) in 2013,

That would be just after the Capita Oak and Henley scams, which Nunn and McCreesh were promoting, collapsed.

and jointly have more than 25 years’ experience in the financial services sector, growing their business to the extent of it having over £17m of assets under management across multiple asset classes.

With respect, if they have jointly more than 25 years’ experience in the financial services sector, they should know that their fund is not suitable for pension schemes – just as they should have known that empty boxes (store pods) were not suitable investments for the Capita Oak and Henley victims. And I sincerely hope that (apart from the victims of which I am aware) none of the remaining £17m represents pension investments.

By contrast, the Website describes your activities as follows:

“Depending on the type of pension or investment scam a victim has been involved in, there are various things we can do to help. We charge annual membership fees so that members know exactly what they will have to pay and there will be no legal or accountancy fees on top.

- Deal with trustees, advisers and fund managers

- Complain to regulators and ombudsmen

- Appeal tax liabilities with HMRC and the Tax Tribunals

- Analyse and quantify investments, losses and fees/commissions

- Instruct solicitors to make a claim against negligent parties to obtain redress for losses and liabilities (paid for by litigation funding)”

Am not sure what the point is that you are trying to make here. You have used the phrase “by contrast” which to me suggests you are trying to ascertain that, unlike your clients, I have never been involved in running or promoting a pension or investment scam. Which, of course, I haven’t. Indeed, I vigorously oppose such crimes and am working with the regulators, police and ombudsmen to help stamp out such activities and bring those responsible to justice.

Notably, you refer to yourself as “one of the leading experts on pension liberation scams”.

Indeed, I am widely acknowledged as such. Further, in your above statements, you have now correctly identified the following problems associated with Blackmore Global:

- Problem no. 1: the victims were neither “institutional” nor “high net-worth”. They should never have had their pensions invested in the Blackmore Global fund at all.

- Problem no.2: you have said Blackmore develops “diverse portfolios backed by real assets”. So what are these “real” assets? Do you even know? Has Blackmore ever told you or shown you proof? Because they won’t tell the victims what the assets are. Nor will they tell the pension trustees.

- Problem no. 3: Blackmore Global offers a “medium to long-term investment vehicle”. So, not suitable for pensions then. Members of a pension scheme have a statutory right to a transfer as well as to be able to reach the age of 55, or retire or die, so there must be liquidity. Also, at least one victim was close to retirement age when he entered the scheme so he should never have been put into long-term investments.

- Problem no. 4: Blackmore Global has £17m worth of assets – if these are all members of pension schemes such as the victims who are members of the Pension Life Group Action, then there is a very serious problem indeed for your clients.

You refer to my activities and expertise on pension liberation scams – if you need any clarification or corroboration of this I am sure your colleague Craig will be happy to fill you in.

The Website contains a number of posts which refer, either directly or indirectly, to our clients, specifically:

- “Action Fraud are nobody and have no authority”: John Ferguson, Square Mile Financial Services: November 30, 2016;

- Government Consultation on Pension and Investment Scams (The Square Mile): December 5, 2016;

- “Scammers Are Criminals” : April 11, 2017;

- “Gambling With Your Pension”: May 14, 2017;

- “Serious Fraud Office Requests Pension And Investment Scam Reports” : May 24, 2017; and

- “Blackmore Global Fund — Asset Or Black Hole?”: July 7, 2017

Copies of these posts are attached to this letter marked Annex 1.

The content of these various posts (and the content of various other social media posts and other direct communications with third-party professional intermediaries who refer work and clients to our clients, which will be adduced in evidence in due course), led our clients to write to you on January 17 this year to put you on notice of their objection to your various claims.

Forgive me, but I am not sure what point you are making. Ferguson did indeed write to a victim and state that “Action Fraud are nobody and have no authority”. He even copied in his lawyer to this. There was indeed a government consultation on pension and investment scams. Scammers are indeed criminals (as confirmed by the Pensions Regulator). Gambling with your pension is not advisable. The Serious Fraud Office has indeed requested reports on a number of pension scams – some of which your clients were involved with. Finally, we don’t know whether Blackmore Global is an asset or a black hole because there is no independent audit. Until and unless the long-awaited audit is forthcoming, the jury will have to remain out on that.

As our clients summarised, borne out by the contents of the Website, you purport to act in a professional capacity for individuals who are beneficiaries of trusts or pension schemes, who have been advised by independent financial advisers (including, without limitation, Square Mile, who are also referred to at various points in the posts referred to above) to transfer some or all of their existing pension funds to the Optimus Pension Scheme using an Investor Trust Wrapper.

As I am sure you will realise, Slater and Gordon already did comprehensive due diligence on me and the Group Actions several years ago, so there is no need to “purport” – just ask Craig McAdam.

As our clients stated, they understand that some of these individuals may have invested certain of their pension fund assets into underlying investments which may include investments managed by our client. As you will be well aware our client as an investment house has never, nor would they, ever deal directly with any of your “clients” as beneficiaries.

I have never said Blackmore Global (of which Messrs Nunn and McCreesh are directors) did deal direct with the investors. However, they do run a cold calling/lead generation business called Aspinal Chase which dealt direct with the clients. See below the details of the Aspinal Chase website:

Registrant

Organization: Nunn McCreesh

Registrant Street: Albion

Wharf

Registrant City: Manchester

Registrant

State/Province: Manchester

Registrant Postal Code: M1

5LN

Registrant Country: GB

Registrant

Phone: +44.1612346506

Registrant

Phone Ext:

Registrant Fax Ext:

Registrant

Email: patrick@nunnmccreesh.com

Registry

Admin ID:

Admin Name: Phillip Nunn

Admin

Organization: Nunn McCreesh

Admin Street: Albion

Wharf

Admin City: Manchester

Admin State/Province:

Manchester

Admin Postal Code: M1 5LN

Admin Country:

GB

Admin Phone: +44.1612346506

I am not sure you understand how this unpleasant, calculated and deliberate targeting of unsophisticated retail pensions operated. Let me spell it out for you.

Your clients (again I refer to the individuals – as I they cannot hide behind the corporate entity) had websites offering pension reviews and cold-called members of the public. Those that agreed to a review were introduced to what they believed was an IFA (and IFA has a duty to look at the whole market and act in the clients’ best interests). The “IFA” then assessed the client’s needs and objectives and recommended Blackmore Global. Then, your clients dealt with the processing of the transfer from the ceding trustees into a pension and their own funds. At no time was the client ever informed of the conflict of interest. There was never an intention to provide the client with a pension review, it was just a calculated ruse by your clients to get their hands on the pension funds of gullible members of the public.

So effectively, your clients were generating leads and introducing people to their own fund via Aspinal Chase.

It is further evidenced that Messrs Nunn and McCreesh’s firm Pension & Life were acting as pension transfer administrators for the victims who were subsequently invested in the Blackmore Global fund:

“Subject – Transfer from: Unisys Pension Scheme Member name: Mr A B C Driver: Our reference: Transfer Out – 9999999 Your reference: B00047 We have been advised by Pension & Life UK Ltd to proceed with the transfer of this member’s benefits from Unisys Pension Scheme to Optimus Retirement Benefit Scheme No 1. We can confirm that the member has received appropriate independent advice in respect of the transfer to the receiving arrangement. The total transfer value amounts to £4xx,xxx.xx and has been paid direct to your bank account.”

Please note, that your clients – in their role as transfer administrators Pension & Life – confirmed to the ceding provider that Mr. Driver had “received appropriate independent advice”. However, with their 25 years’ experience Messrs Nunn and McCreesh should have known full well that the advice had come from a firm which was not regulated for pension and investment advice.

We now direct our and your attention (to the extent that you were not fully aware of their content, which we doubt), to the specific posts on your Website, and how the same are both untrue and seriously defamatory of our clients.

I am not sure what you mean by this statement – how could I not be aware of the content of the blogs on my website? I wrote them all personally. Not a single one is untrue.

Below, in accordance with the Pre-Action Protocol, we set out what we consider to be the defamatory comments (Defamatory Comments)

- “Action Fraud are nobody and have no authority”: John Ferguson, Square Mile Financial Services

And what is your point? John Ferguson wrote this statement. I didn’t write it – I only quoted it. There is nothing defamatory about repeating this – it is a clearly evidenced fact.

The above post contains the following statements:

“Mr. Ferguson has invested a number of victims’ pensions in the Blackmore Global and Symphony funds and was asked to provide a copy of the audit for Blackmore Global which his firm has been promoting and which appears to have some questionable assets — described as “esoteric” and “alternative”. He was also asked to provide evidence of his firm’s regulation to provide pension and investment advice.”

Again, I am not sure what your problem is with this – it is perfectly true and clearly evidenced that Ferguson (and other unregulated advisers) have indeed invested victims’ pensions in Blackmore Global. The assets of the fund are indeed questionable – and will remain so until the audit is produced. The fund is invested in esoteric and alternative assets. Ferguson has been asked to provide evidence of his firm’s regulation to provide pension and investment advice on several occasions but he has never done so.

“One victim had threatened to report the matter to Action Fraud when he discovered multiple irregularities with his pension scheme”

Again, this is perfectly true – and evidenced.

“The factsheet for the Blackmore Global fund had falsely claimed a firm in Barcelona was the Investment Manager for the fund — robustly denied by the furious firm in question.”

And? Both the factsheet and the brochure stated this – falsely.

Meaning

On any consideration of the above two paragraphs, this post is intended to cause damage to Blackmore Global PCC Ltd’s reputation and its business by suggesting that our client’s underlying assets into which funds are invested are “questionable”.

The questions are “where is the audit” and “what are the assets”? There was no intention to cause damage to anyone’s reputation and business – but every intention to discover what the assets are. There is compelling evidence that the assets are linked to very suspicious investments and people with a track record of dealing in investment scams. In fact, if you were genuinely interested in protecting your clients’ reputation and good name, you would simply send me a statement confirming what the assets are. The very fact that you haven’t suggests you don’t know and your clients haven’t told you. So how can you refute that the assets are questionable?

The natural and ordinary meaning attached to the suggestion that an investment is “questionable” is that it is disreputable, uncertain as to its credibility or validity, and generally morally suspect. You seek to further compound the damage to our client’s reputation by describing the assets as “alternative” and “esoteric”.

For a pension saver, the investment is indeed questionable. And the evidence is that the assets are alternative and esoteric – and there is nothing to prove otherwise. If you can prove that the fund is not disreputable, I will happily apologise. But even if it turns out that the underlying assets are low-risk, prudent, diverse and suitable for pensions, the fact that there is a ten-year lock-in precludes the fund from being suitable for pensions.

Even more seriously, however, this post makes the most serious of defamatory allegations in that it alleges that our client is involved in investments which should be (reported?) to the police, via Action Fraud, and that our client is therefore engaged in unlawful, criminal activity.

Your client was indeed engaged in unlawful, criminal activity in the Capita Oak and Henley schemes as well as various SIPPS invested in Store First. I cannot comment further on this because the matter is now in the hands of the Serious Fraud Office.

Please be clear that my motive and intention was not to cause damage to Blackmore Global’s reputation, but to get the victims disinvested as quickly as possible and further to warn the public that they too might be in danger of being similarly invested in this fund by unregulated “Chiringuitos”. The distress caused to the victims who are invested in Blackmore Global has already been appalling and as a solicitor you too have a duty to help protect the public.

You have claimed I intended to cause damage by stating that the fund’s underlying assets are “questionable”. So what are they? Prove they are not questionable – of course you can’t, because there is no audit. The audit was promised last summer, then xmas, then Easter. Either Grant Thornton can’t find the assets or somebody doesn’t want the audit made public because of what it will reveal.

You go on to state that our client has produced Factsheets containing “false information”. This is strongly rejected by our client. Our client’s investments, and their underlying asset classes, are wholly reputable and completely transparent to investors.

I am sorry but this is absolute nonsense. The factsheet did contain false information. The investments and underlying assets are not at all transparent – there has been no audit and your clients won’t tell anybody what they are. And to be fair, you keep going on about the assets, but you won’t say what they are – so you are being just as opaque as your clients. We know what the asset classes are – and the explanation of the sub classes are horrendous as they contain all the usual asset types so beloved by investment scammers (gaming, spread betting, wine, waste to energy etc.). One victim has written:

“All I can offer, is to reiterate, that I have no recollection of any correspondence with an IFA prior to signing up with Harbour Pensions and Blackmore Global. It was always, Aspinal Chase and in particular Marc Rees. He told me what a great move it all was, how it made sense to have all my individual pension funds in one place, that having a fund of over £250k, I’d get a personal manager that would work specifically on my fund and keep me regularly updated. Needless to say this never happened. In addition, Marc told me that investing in Malta, with Harbour, would give me better returns and be tax efficient. I took this all as “advice”. Only after a few years, when I wasn’t getting updates and I had to ask for them, and I asked him some questions about surrendering, did he say that was bordering on advice which he wasn’t qualified to answer, and my IFA, David Vilka, would contact me. He never did. I badgered Harbour Pensions and got fobbed off. Then Vilka emailed me to say he understood I was in discussion with Harbour Pension and he couldn’t do anything more than what I was doing myself.”

Marc Rees- a name familiar to your clients as he worked for them.

Go to individuals and click on Previous Involvement…

I

| Name | Individual reference number | Status |

| David Marc Lewis Rees | DMR01166 | Inactive |

It is correct to describe the underlying asset classes as “alternative” in that they are not what would otherwise be classified as “mainstream” investments such as gilts or shares in publicly listed companies. Investments into property or renewable energy sources are considered “alternative”. However, the manner in which you seek to adopt this term is to the detriment of our client by implying that the asset classes themselves are irregular. An investment is “alternative” where it departs from the norm. Therefore, the threshold by which an investment could be determined as “alternative” is low.

You are mixing apples and oranges: asset classes are one thing; actual assets are another thing. But again, I come back to the simple resolution to this debate: provide me with a list of the underlying assets and then we can put this issue to bed once and for all. In fact, it is interesting to note that you have never once stated what the assets are and I have to assume you simply don’t know as your clients have not disclosed them to you.

I think we should get comment from professional qualified advisers and actuaries to see if they think the funds are irregular for retail pensions. I will happily be guided by them on this matter. Remind me, what qualifications do your clients hold that would prove they are competent to run such a fund? We already know one of their colleagues, Brian Weal, was found to be incompetent.

It is further correct to describe the investments as being “esoteric,” that is, out of the ordinary and traditional model of investments. It is common for investment portfolios to have an element of “esoteric” asset classes, as part of a wider diversification of assets and potentially offering the higher returns that investors require to achieve their objectives, based upon the input of independent financial advisers. However, you seek to adopt this term, which you will be well placed to understand as being regularly used within the media in a negative sense, whilst referring to alleged “victims” of our client’s allegedly unlawful behaviour, as referred to above. It is used frequently in a negative sense by the media and other professionals within the context of financial services, hence why you have chosen to do so.

I am afraid I would have to correct you on the assertion that it is common for an element of esoteric asset classes to be used as part of an investment portfolio for pensions. Perhaps for sophisticated investors or HNW individuals who like a bit of risk – but not pensions. The term “esoteric” is indeed frequently used by the media in a negative sense – and there is a good reason for that: many of the failed funds which have destroyed victims’ life savings have been invested in esoteric assets.

You cannot possibly believe or claim that alternative and esoteric assets are suitable for pensions. Why not provide me with a definitive list of the assets and then we can debate this properly. You must surely know that funds for pensions must, by definition, be low-risk, liquid, prudent and diverse – which Blackmore Global clearly is not.

To clarify the position in regards to our client’s Factsheet, our client’s investment manager in relation to the background to which this post refers was one Gerald Rodriguez, who formerly operated the firm IIG Financial Services before moving under the banner of Meriden Capital. Mr. Rodriguez is no longer responsible for the management of this fund.

I did indeed state that your client has produced Factsheets containing “false information”. This is true and clearly evidenced by both the Blackmore Global factsheet and brochure. Both documents claim that the Investment Manager for the fund is Meriden Capital Partners in Barcelona. But the directors of Meriden state they have never heard of Nunn, McCreesh, Ferguson or Vilka – or indeed Blackmore Global. However, when I jogged their memory that they had actually completed an application form to become the Investment Manager, their English suddenly got worse. But they still insisted they had never been the Investment Manager to the fund as they were not regulated to carry out such a task.

Your explanation about Gerald Rodriguez of IIG Financial Services being the Investment Manager is, I am afraid, mistaken. I called Mr. Rodriguez (19th July) who now works for the Gibraltar International Bank. He confirmed that he did once work for IIG but that it was many years ago. He also confirmed that he had never been the investment manager for Blackmore Global – indeed he had never even heard of it – and that he had never worked for Meriden Capital Partners. Perhaps you should ask your clients to conjure up another answer to that one.

2. Government Consultation on Pension and Investment Scams (The Square Mile)

We direct your attention to the entire blog posting at Annex 1, and below we set out the extracts which are most concerning, and defamatory, to our client.

“Blackmore Global was full of toxic, illiquid, high-risk assets, had no audit and as a UCIS (unregulated collective investment scheme) was illegal to promote to a retail UK investor. The brochure made a fraudulent claim as to who the investment manager was.”

“The trouble is, while Mr Driver has fought hard to get some of his money back, there are around 1,100 other victims stuck in this fund who may yet have no idea their pensions are invested in —how shall I say this- worthless crap”

Meaning

This post purports to discuss alleged pension and/or investment “scams”. By including a

reference to our client within this blog, the clear inference is that our client is such a “scammer”, that is, behaving dishonestly and not in accordance with clear ethical and regulatory guidelines, and in breach of its obligations (both express and implied) to its stakeholders. Again, this is a most serious allegation to make, and is repeated across the post, through repeated and unjustified allegations that our client is involved in criminal activity.

Our client, Blackmore Global PCC Ltd, is an investment company based in the Isle of Man. It was set up as an unregulated investment company under the Companies Act 2006, to operate in that jurisdiction.

I am not at all sure what you mean by “unjustified allegations”. It is evidenced on the FCA website that it is illegal to promote UCIS funds to UK retail investors.

You have kindly confirmed that your client is an unregulated investment company – and there is no argument about the fact that it has been promoted by, among others, associates of Nunn and McCreesh: Ferguson and Vilka, (not regulated to provide investment or pension advice) to retail, low-risk pension savers. And further, Nunn and McCreesh were involved in the promotion of a number of pension scams which are now under investigation by the Serious Fraud Office. What do you have a problem with?

Your reference to our client’s investment company being “toxic, illiquid, (and containing) high risk assets” has a natural and ordinary meaning that the product is harmful to an individual’s pension, worthless and of little value as there is no market within which it can be re-sold. You cannot have underestimated the significance of calling the product in question “toxic” to our client and its reputation. You go on to describe it as being “worthless crap”, the meaning of which we trust we need not set out in correspondence save to confirm that the use of vulgar abuse does not offset or place into favourable context your other allegations, as referred to above.

I see no merit in further debating this point: you are aware of my position on the assets of the fund but you repeatedly fail to provide any evidence to prove me wrong. You cannot object to my references, descriptions and allegations unless you disprove them. Tell me what the assets are, provide independent and credible valuations, and disprove what I have written. Your repeated failure to disclose what the assets are merely serves to reinforce the point that the fund is opaque and your clients are failing to be transparent with the victims or the trustees – or, indeed, you.

We understand that the value of Blackmore Global PCC Ltd has increased some 11% since its inception.

Exactly how do you “understand” this? Have you seen an audit? Have you seen the accounts? Have you got evidence of 11% growth since inception? If you are right, then 11% since 1.5.14 isn’t actually that much at all – a simple tracker fund would have done just as well, been cheaper, much lower risk and not had the ten-year lock in. And further, if the fund has grown, why did Mr Driver get less back than the scammers invested in the fund in the first place?

We again note that you fail to make any mention of this fact, which ultimately would not further your evident intention to damage our client’s reputation and blatant attempt to self-promote your own “business”.

What fact? Provide the facts.

I genuinely do not understand why you think my intention is to damage your client’s reputation. What benefit would that produce for anyone? Nunn and McCreesh do indeed have a chequered history because of their involvement with Capita Oak, Henley and multiple SIPPS invested 100% in Store First, but I wouldn’t have a motive to take the slightest interest in their reputation. But I would most definitely want to prevent more victims from having their pensions invested in Blackmore Global – and I am sure the existing victims would attest to that intention because of the profound distress they have gone through. But I am not sure how or why you think commenting on the unsuitability of your clients’ fund does anything to “self-promote” my business.

It is correct that the product referred to in this post as “illiquid”. Our client offers a ten-year close- ended product that is not designed to be liquid. It is entirely normal for illiquid products to be offered for investment, where the investment opportunity is designed to be long-term. In itself, the term illiquid is correct, however the manner and context in which it is adopted by you, alongside the terms “toxic” and “scam” is clearly designed to be harmful to our client’s reputation.

I am beginning to realise you know little or nothing about investments in general or investments for pensions in particular. It is also clear you are relying entirely on what you “understand” from your clients – and it has been evidenced that some of this is not true. Investors who specifically want an illiquid investment into which they are locked for ten years, would have no problem with Blackmore Global. Or at least, they would have no problem if they knew what the assets were (which clearly you don’t). Provided the assets were not toxic or associated with known investment scammers, then a sophisticated, HNW investor could do his own due diligence and decide for himself. But illiquid funds are not suitable for pensions.

I would contend that no one would lock up their funds for 10 years. I have spoken to a number of Chartered advisers who all have this opinion.

One raised an extremely good point. Among the spurious reasons that were used to entice people out of perfectly sound pensions was the promise of access from the age of 55. Yet, all the people that I have spoken to, invested in Blackmore, are over 45 years of age. The sales pitch of 55 is meaningless. Of even greater concern is that their whole pension fund is locked up to 10 years in some cases and this is an outrage!

What if an investor were to die within 10 years, how would the family get the much needed funds? If you have any conscience at all, think about that.

It is incorrect to describe the product as “solely high risk”. As with any balanced investment portfolio, there will and should be asset classes within it which fall within the definition of “high risk”. Overall, however, the overall apportionment of such “high risk” assets is low and, the portfolio in question is balanced.

Without knowing what the assets are, neither you nor anyone else could make that statement with any confidence. How can you state that the overall apportionment of high risk assets is low and the portfolio in question is balanced if you don’t know what the assets are and have never seen an audit?

If it is so good, I am sure you have invested all your own pension savings into the Blackmore Fund. I look forward to seeing your investment statement.

The sweeping statements you make regarding suitability, or any purported lack thereof, of our corporate client’s close ended investment are of serious concern, especially when made without any objective attempt at justification. There can be no justification for your assertion that the products in issue are wholly unsuitable for any pension fund or that its nature as a 10-year, closed-ended product renders it “worthless crap”.

If you are so sure that I am wrong about Blackmore Global, give me the evidence – and also provide me with evidence that confirms you yourself have seen and know what the assets are. You cannot argue that the Blackmore Global fund is not harmful to individuals’ pensions, because one has suffered loss upon redemption already (£1,663.17) and others are being denied their statutory right to transfer out of their schemes because no reputable pension trustee would accept an in specie transfer in something so illiquid and with no audit.

I will be able to get a considerable number of high profile, well-known and respected advisers to assert that the product is wholly unsuitable for retail pensions. And, since they were sold in the UK, why was the commission filched from the funds not disclosed?

You state that you “understand that the value of Blackmore Global has increased 11% since inception”. How did you come to that conclusion? Did you see an audit – or are you taking your clients’ word for it? If your client’s word on the value of the fund is anything like their word on who the Investment Manager was, I would think you are making a somewhat shaky assumption.

Blackmore Global PCC Ltd is not a UCIS.

Yes it is.

Again, the suggestion that our client “promotes” itself to consumers/customers and that such activity is illegal is a most serious of allegations to make.

Your client promotes itself to consumers through Aspinal Chase.

The product in issue is a closed-ended investment and not a UCIS.

It is a UCIS

Furthermore, our client’s customers are not “retail’ clients. Instead, they are investment managers, professional pension trustees or the like rather than investors in their own right.

This is a common ruse employed by scammers to deflect attention from their negligent or fraudulent advice or investments – and I am disappointed to see you using it. You know very well that we are talking about ordinary people with pensions so please don’t be obscure and opaque.

The trustees I have spoken to have made it clear that they are not the clients. The investor is the client and the recommendations for the investment was made to the individual client. All the money going into the fund is from retail clients’ pension funds. Of course the customer is a retail client, it is the retail clients’ money that is invested.

We addressed above the position in regards to the identity of the investment manager in question,

Yes you did – falsely. Can you please tell me the truth now?

and again we are gravely concerned as to your use of the word “fraudulent” within your blog.

It was indeed fraudulent to state that Meriden Capital Partners was the Investment Manager when it clearly was not. Then, the subsequent “explanation” about Mr. Rodriguez of IIG being the Investment Manager was also wholly untrue.

Your conclusion that this implies “criminal, deceitful and dishonest conduct seeking to scam people” is perfectly natural. Indeed, if you would like to call Mr. Gerald Rodriguez at the Gibraltar International Bank – +350 200 13900 I am sure he will confirm to you himself that your client is lying. https://www.gibintbank.gi/contact

The natural and ordinary meaning which our client attributes to it is that it is involved in criminal, deceitful and dishonest conduct, through which it seeks to “scam” people of their pensions.

Your client is indeed involved; has clearly exhibited deceitful and dishonest conduct, and people have been scammed out of their pensions. I have explained how the deceit was organized, all verifiable.

Such a description of our client can only seek to lower its reputation in the eyes of the reasonable reader, without any exercise in strained construction.

If your client helps the victims to redeem their Blackmore Global investments without further delay, there is no reason why their reputation should not recover. Your clients need to acknowledge that the fund should never have been used for pensions and put right any loss or damage suffered by the victims.

Our client is not involved in the provision of financial advice to consumers/customers. Its ultimate clients are pension trustees, and it has no direct communication with underlying beneficiaries. Our client is not in any way involved in the provision of advice to consumers who go on to invest. There is no obligation upon our client to have their company “audited”. Despite such, our corporate client has voluntarily sought an audit of its business by Grant Thornton,

The fund was indeed promoted to numerous UK residents – illegally. I have their details and documentary evidence. The clients are not the investment managers or the trustees – but the investors themselves. This is a ruse frequently used by scammers to justify investing clients’ pensions in high-risk, toxic, illiquid – sometimes professional-investor-only – funds and instruments. Please be clear, the “advice” was given to the clients – not investment managers or trustees. This is clearly evidenced and confirmed by the trustees.

Your client was involved from the targeting of prospects, through to the advice process and investment into their own funds.

which remains underway and to which you refer. The product is administered through registered regulated custodians and agents, who control all relevant bank accounts.

And who are these custodians and agents? The factsheet and brochure state they are Corporate Options Ltd and OrmCo Ltd. Corporate Options (IoM) claims to provide the following: company management and administration; offshore company formation and management; ship and yacht registration; e-gaming; bookkeeping and accountancy; intellectual property rights; IoM relocation; services for IoM businesses and individuals.

Based on these claims, I see no reason why Corporate Options should not simply provide a print out of the investments – if indeed they do the bookkeeping and accountancy for Blackmore Global. How difficult would it have been for them to simply provide a transaction report to the victims, trustees, you and me? Instead of making vague, unsubstantiated claims about the quality of the assets, and refuting my fears about the toxicity of the fund, you could have simply provided the evidence instead of demonstrating you have no idea what the assets are.

OrmCo PLC is staffed by qualified chartered accountants. So, again, there is no reason why the accounts for Blackmore Global could not have been easily produced. In fact, it is becoming more and more ludicrous (and suspicious) that neither Corporate Options nor OrmCo nor Grant Thornton nor Blackmore Global has produced a transaction history of the investments.

We understand from our clients that your references to Mr Driver are also factually incorrect. Optimus was the entity who recommended Blackmore Global PCC Limited, and who contracted with our corporate client, rather than Mr Driver. Blackmore Global is, once again, a 10-year investment and contractually there is no right to redeem before the end of that 10-year period. Any early redemption fee that would have applied to that investment was in fact waived in full by our clients as a gesture of goodwill, which would usually amount to 7% of the funds invested.

Optimus was the trustee, not the adviser. The adviser was Square Mile – a firm in the Czech Republic which was not regulated for pension or investment advice. I hope your clients have made you aware that Mr Driver has this confirmed in writing by the FCA. Mr. Driver was not aware that his pension had been invested in a fund with a 10-year lock in. The early redemption fee was not waived but eventually refunded retrospectively.

There was no financial detriment to Mr Driver. Yes there was. The loss was only relatively small, but there should not have been any loss – since according to you the fund has grown 11% since inception. So Mr. Driver not only suffered an actual loss but also lack of growth for the period his pension was invested in Blackmore Global.

Additionally, he was advised to transfer out of a final salary pension with no proper analysis. Something that would result in a UK FCA registered adviser being closed down. No doubt the poorly qualified and unregulated adviser from Square Mile will say that there was no obligation for a non-UK firm to provide this analysis at the time. However, the movement from a final salary scheme will have resulted in substantial and, as yet, unquantifiable detriment. How many others suffered the same fate? On that note, does your client ensure that the advisers are all properly qualified to undertake pension transfer activities?

The structures into which his funds were invested are registered in a variety of commonly-used and well-regulated financial jurisdictions subject to appropriate trust and segregation arrangements, and far from the “scam”, “toxic fund’ or “swamp” to which you refer. The allegation that our clients’ products are “toxic” is simply the worst description which can be applied to a product in the investment market, and cannot be justified on any basis, objective or otherwise.

Given the recent spate of fund failures in the Isle of Man, I would question the well-regulated jurisdiction comment.

I absolutely stand by the terms I used to describe the fund. Indeed, this is borne out by the description of the cells in the Blackmore Global documentation:

“Lifestyle Cell”: gaming, spread betting, sports events, construction of facilities, travel solutions, fine wines, art and antiques.

These are all categories of investments which are typical of the classic investment scams and are certainly not suitable for pensions.

“Private Equity Cell”: venture capital, growth capital and leveraged buyouts.

Very high risk and entirely unsuitable for pension investments.

“Property Cell”: commercial and residential property developments.

Illiquid, speculative and high risk. Entirely unsuitable for pension investments.

“Sustainable Cell”: renewable energy including biomass, solar, wind, hydro and waste to energy projects.

Again, illiquid, speculative and high risk. Entirely unsuitable for pension investments.

3. Scammers are Criminals

As the title to this post suggests, herein you discuss the alleged lack of regulation and activity taken by regulators and the police to prevent “scams” and to sanction those involved in the same. By including our client within this post, the clear inference is that our client is involved in fraudulent, criminal and deceptive conduct. You go to list a number of “failed” investments including Capita Oak and Ark, and the implication of such is that our corporate client is or was involved in those investments or seeking to promote a similar product.

You need to be clear about which clients you are referring to. You have three clients (according to your own letter): 1. Blackmore Global 2. Phillip Nunn 3. Patrick McCreesh. Blackmore Global is a corporate entity so cannot of itself “do” or “say” anything – except those in control of the entity, i.e. Messrs Nunn and McCreesh, can. Messrs Nunn and McCreesh were involved in the promotion of Capita Oak and Henley and numerous SIPPS – all of which were 100% invested in Store First store pods. Store First is subject to a winding up petition and the entire schemes and all parties involved in the promotion, distribution and administration of the schemes are subject to a Serious Fraud Office investigation.

The deceitful conduct of your clients is clear and detailed above.

“This so-called Malta-based pension trustee is running the Optimus Retirement Benefit Scam No. 1 QROPS. it is illegally promoting UCIS funds to UK residents and these include toxic, illiquid funds such as Blackmore Global and Richard Reinert’s Symphony.”

A QROPS on its own is merely a wrapper and on its own is relatively harmless – except for the fact that should HMRC decide at some point it does not meet the requirements, it can be removed from the QROPS list without notice to the members of the scheme. However, it should not have been promoted to UK residents at all, should not have accepted transfers from advisers (Square Mile) who were not licensed for pension advice, should not have allowed investments in entirely unsuitable UCIS funds such as Blackmore Global – a high risk, opaque fund with no tradable assets.

QROPS are sold to UK residents, in these cases, for one reason. To get the funds away from the regulated jurisdiction of the FCA where UCIS and undisclosed fees are rife. A real IFA would recommend regulated funds in a UK pension at a fraction of the cost, with no commissions being taken.

“Optimus permitted UK residents to be put into a QROPS and then be invested in Blackmore Global and Symphony UCIS funds: toxic, high risk, illiquid and volatile. Blackmore Global is run by Nunn McCreesh: one of the cold calling scammers behind Capita Oak, Henley and other scams invested 100% in Store First — the promoters are now under investigation by the Serious Fraud Office and Store First is subject to five winding-up petitions.”

Correct.

Meaning

Again, you describe our corporate client’s products as being “toxic, illiquid funds”. Correct.

We address above that, whilst it is correct to describe the product as “illiquid” the manner and context in which that term is used is designed to be harmful to our client. My intention is to warn the public against having their pensions invested in the fund as it is indeed entirely unsuitable for pension investments.

The funds are not liquid, hence the term illiquid.

The product offered is not worthless or “toxic” as you repeatedly seek to describe it as. So prove it. You keep claiming it is not worthless and toxic, but you provide no evidence and you clearly don’t even know what the assets are.

The value of the product has in fact increased since its inception and, again, is designed as a long-term investment of 10 years. As above: prove it.

For the sake of clarity, Nunn McCreesh was a financial advisory firm established in around 2008 to 2009 by our clients, Phillip Nunn and Patrick McCreesh. Nunn McCreesh has been dormant since 2013, and is now wound up. Both our clients Messrs Nunn and McCreesh were directors of this firm. It was never involved in “cold calling”.

Nunn McCreesh was involved in cold calling and I have several witnesses prepared to testify to this, and are looking forward to their chance to do so.

For the sake of clarity, I will also refer you to the Insolvency Service’s witness statement dated 27.5.2015:

- Documents and information received from four members of CAPITA OAK indicated they were initially contacted by Craig Mason or Patrick McCreesh of Nunn McCreesh of Its Your Pension Ltd and offered pension review services prior to them being referred to JACKSON FRANCIS or Sycamore for the transfer of their pension to CAPITA OAK.

- On 3.3.15 I received an undated letter in which it was stated that Its Your Pension had not traded and was a dormant company and that Nunn McCreesh had traded as an insurance brokerage between 2009 and 2012 when they entered into a verbal arrangement with TRANSEURO where in return for providing pension leads to JACKSON FRANCIS they received a commission from TRANSEURO.

- Nunn McCreesh provided JACKSON FRANCIS with 100-200 leads per month which were provided by email and/or telephone for which they received £899,829.86 from TRANSEURO during the period 26.3.12 to 14.5.14.

As your clients clearly received a substantial sum of money from the Transeuro scam, perhaps you would like to suggest they return this money to the victims to help them with their profound distress, loss of their life savings and tax liabilities? I am sure this would be much appreciated and would mitigate some of their inevitably poor reputation.

Rather, it generated business through the purchase of leads through reputable providers such as moneysupermarket.com. This is a well-known and established practice that many businesses engage in, and this business was largely an insurance brokerage, also dealing in wealth management.

This is also an established practiced used widely by scammers. Nunn McCreesh only had a license for selling insurance so if it was also dealing in wealth management, then it was doing so illegally. Also, Nunn McCreesh was an appointed representative of Sage Financial Services which had gone into administration by July 2012 – just before the Capita Oak et al scams were launched.

As part of that business’ operations, it inevitably generated leads for mortgages or investments in respect of which it would give customers/consumers the option to refer to another firm that may be able to assist them. As clearly evidenced by the Insolvency Service’s witness statement, Nunn McCreesh and Its Your Pension were supplying up to 200 leads per month to Jackson Francis – one of the cold calling scammers involved in these schemes.

Our clients had no control over what financial investment advice may have subsequently been given to customers/consumers, and whether those customers/consumers then acted upon that advice. Nonsense. Your clients had already entered into an agreement with Transeuro regarding the 100% investment of all 1,000+ victims’ pensions into Store First store pods and would have shared some of the 46% commission (of £120 million) – 16% of which had been stolen/defrauded from the victims.

I have already proved your clients gave the advice (Remember Marc Rees for example?) and they dealt with the UK trustees to move the funds into Blackmore. I would call that control, what would you call it?

It is wholly false to state that our clients are “behind” Capita Oak or Henley. Read what the Insolvency Service wrote: it was clear the Messrs Nunn and McCreesh were central to the promotion and distribution of Capita Oak and Henley. Given their purported “25 years’ experience in financial services”, had they possessed any ethics or conscience they would have tried to stop this scam rather than becoming part of it.

Furthermore, it is utterly untrue and wholly insupportable to suggest that our client is now under investigation by the Serious Fraud Office. Again, I can only refer you to what the Insolvency Service has stated, and also what the Serious Fraud Office has put in the public domain. Numerous victims have made their statements to the SFO personally and under oath – as indeed have I.

The implication of your reference to “promoters” is that you are referring to Messrs McCreesh and Nunn. By seeking to associate our clients with funds such as Capita Oak and Henley, the clear inference is that our clients are unskilled, dishonest and deceptive so as to mislead their clients and stakeholders. That could not be further from the truth. As above: Again, I can only refer you to what the Insolvency Service has stated, and also what the Serious Fraud Office has put in the public domain. Numerous victims have made their statements – as indeed have I.

- “Gambling with your Pension”

We direct you to the above post on the Website, and are gravely concerned as to its content.

“So, make sure you only use an advisory firm which is licensed to provide pension and investment advice….I have no idea who the jolly pair of gamblers are in the photo on this blog, but I am sure no informed person would entrust them with a pension and I reckon Kipling would have had a thing or two to say about them. Away from the fun fun fun of Vegas, these two amiable-looking scallywags could probably scrub up and look like respectable independent financial advisers with a business-like suit and a leather portfolio full of impressive documentation about funds with imaginative names such as “Symphony” and “Blackmore Global”. But if they did so without a license, they would be criminals.”

Do you have permission to use the Las Vegas picture? Investors Trust are very worried that people are using this photograph as it is their property.

Meaning

Our client is not an “advisory firm”. Our corporate client is in no way involved in the provision of advice to consumers/customers, as we make clear above. Again, you need to be clear which client you are talking about. Blackmore Global the corporate entity or Messrs Nunn and McCreesh. Nunn and McCreesh was indeed involved in introducing/promoting investment into Blackmore Global.

If a customer/consumer considers that they were inappropriately advised upon the risks associated with an investment, or the fact that they would be locked into an investment for a period of 10 years, their first and only recourse is to seek redress from the relevant financial advisor. Had your clients not been actively promoting the Blackmore Global fund themselves to unlicensed firms purporting to be financial advisers, I might have agreed with you to a limited extent.

The clear inference from your blog is that our corporate client is deceptive, deceitful and dishonest in the promotion of its products, and in its literature, that is distributed to customers/consumers by any financial advisor. We have already established that the inclusion of Meriden Capital Partners as Investment Manager was deceitful and dishonest – as was the subsequent claim made by you that Gerald Rodriguez of IIG was the Investment Manager.

The blog is clearly intended to harm our client’s reputation by dissuading any investment in its products. You stated earlier in your letter that the fund was for High Net Worth individuals – and I seriously doubt that my blog would dissuade them from investing in Blackmore Global if they were enthusiastic about investing blindly in high risk, illiquid funds with no audit. The intention was to warn cautious, low-risk, pension savers against the dangers of having their entire life savings invested in such a fund.

Reference to “imaginative names” suggests that the product themselves are imaginary and do not exist, or are presented in a manner to infer respectability or credibility where none exists or could exist. This again could not be further from the truth. Blackmore Global is a well-established investment house, with clear documentary evidence demonstrating its existence and into what products monies are invested. We have already established that the documentary evidence (factsheet and brochure) contained false statements. Further, there is no audit so there is no evidence as to where the monies are invested – and even you don’t know.

- “Serious Fraud Office Requests Pension and Investment Scam Reports”

Again, this post begins with reference to an “investigation” by the Serious Fraud Office into Capita Oak and other funds, where it is well reported within the media that retirees have lost the entirety or significant portions of pensions as a result of investments into them. By deliberately linking our client to these entities, Your clients are linked to these entities – as clearly evidenced by the Insolvency Service’s witness statement

your only intention can be to divert business from them and to cause serious financial harm as a result. We quote below the salient paragraphs within the post, which refer to our clients. I have no interest in causing your clients financial harm – why would I? But I do think that vulnerable pension savers have a right to know the background of the people behind a fund which is being promoted to retail, UK-resident investors.

“Of course the blooming obvious happened — all the scammers went on to operate further scams and ruin thousands more victims’ lives. The cold calling firm, Nunn McCreesh, went on to operate the toxic UCIS fund, Blackmore Global; many of the cold callers upgraded their operations to “introducers” and the Ginger Scammer promoted himself to fund investment manager in the Trafalgar Multi Asset Fund (£21 million now suspended).”

And all of that paragraph is 100% true.

Meaning:

On any ordinary consideration, a reference to “all the scammers went on to operate further scams and ruin thousand more victims’ lives” is intended to create the impression that our clients are criminals, and have engaged in fraudulent and deceitful practices, which they are seeking to replicate through Blackmore Global PCC Ltd. You adopt highly emotive language in describing those that invested in funds that have “failed”, but what you neglect to accurately describe is our clients’ (limited) involvement. Your clients’ involvement was far from “limited” as you put it. Nunn McCreesh earned £900k providing up to 200 leads a month to a cold-calling scam outfit (Jackson Francis) over a two year period. They had entered into an agreement with Transeuro, so they were in on the plan from the start.

A reference to our clients’ former business, Nunn McCreesh, as being a “cold calling firm” is clearly intended to discredit our clients. The reality is that at no point was Nunn McCreesh a cold calling firm, as set out above. Nunn McCreesh had indeed been cold calling directly, as well as working closely with cold calling scammers – feeding them thousands of leads.

Referring to our client, Blackmore Global PCC Ltd, as a toxic, UCIS fund is an attempt to describe its business as worthless. It is not, as you will be aware, a fund. Rather, it is, as set out above, a closed-ended investment company. The underlying asset classes are not “worthless”, but rather have increased in value since establishment. Again, you are confusing the asset classes with the assets themselves. The classes may not be worthless – because they are generic and loosely refer to a type of asset. But the assets themselves may or may not be worthless – we won’t know until the mysterious, long-promised audit makes an appearance. My worry is that the sustainable cell which states it invests in “waste to energy projects”, might contain some Premier New Earth Recycling – which is indeed now worthless.

6. Blackmore Global Fund — Asset or Black Hole?

Of serious concern to our clients is your most recent post entitled “Blackmore Global Fund —Asset or Black Hole”. By reference to the title alone, the clear inference is that our corporate client’s product is worthless and that any monies invested have been forever lost. So, provide the accounts and the audit and prove what the fund is worth. It is simply not credible that a firm like Grant Thornton could take almost a year to produce an audit. I think we can agree the lack of information about the fund could be referred to as a black hole.

We set out below the salient paragraphs of the post:

“A fund like Blackmore Global really ought to be audited as soon as possible — to make sure it isn’t simply a “black hole” into which victims’ hard-earned pensions have sunk. Numerous worried pension savers are stuck in the Blackmore Global Fund and finding it difficult — if not impossible — to get out. They are seemingly “locked in” for ten years.”

“Nunn and McCreesh generated up to 200 leads a month to pension scammers in relation to a series of pension/investment scams which are now under investigation by the Serious Fraud Office. This entailed £120 million worth of pensions being invested in Store First store pods which are now the subject of a winding up petition — and arguably worthless.”

“The Blackmore Global NAV Factsheet also states that there is a ten-year lock-in to the fund. So why would anyone invest a pension in such a fund? A pension saver has a statutory right to a transfer and might want to take his PCLS — 25% tax free withdrawal at age 55 — or retire, or even die. What on earth is the point in using Blackmore Global for a pension at all? Ever.”

“Most of the victims of the Blackmore Global fund were initially cold-called by a firm called Aspinal Chase. And all the victims were advised by unregulated investment advisers such as

Forth Capital and Square Mile Financial Services (an insurance license does not cover regulated investment advice). But more worryingly, all of them were put into a QROPS in Malta or the Isle of Man. So why were UK residents transferred to an offshore pension at all, and why were most or all of their pension funds invested in a UCIS which is illegal to be promoted to UK residents?”

“And here, we get back to whether the unscrambling of these pension and investment scams is more about who you know rather than what you know. One victim had his pension invested 75% in Blackmore Global and 25% in Symphony. Symphony was a fund invested in derivatives and highly leveraged.”

“Now we have gone round in a complete circle. A catalogue of lies, deception, fraud, mis-selling, negligence and incompetence.”

“I don’t envy Grant Thornton (if indeed they are the auditors) because they have got to unscramble this unholy mess. And I strongly suspect that, behind the scenes, there are certain parties who are busting a gut to ensure the audit is never published. Two of these may well be John Ferguson and David Vilka of Square Mile in the Czech Republic who seem to have a strong vested interest in promoting this black hole of a fund.”

“Meanwhile, the longer the victims are held back from transferring out of this toxic swamp of a fund, the more serious the complaints against the various parties involved will be. These will include the cold-calling scammers; introducers; advisers; pension trustees and insurance companies such as Investors Trust who allowed this investment and the pensions transfers from unlicensed advisers.” And? All of the above is true.

Meaning

You describe investors in our client’s products as being “stuck” and “locked in”, with numerous “worried pension savers”. The natural and ordinary meaning of this statement is that investors cannot exit the fund and that their investment potentially forever lost in a “black hole”. This highly emotive paragraph can only be intended to create fear and misstates the fact that the product in question is, as set out elsewhere, intended to be fixed for a period of 10 years. The purpose of fixing the product for a 10-year period is to ultimately increase returns for investors and to enable the underlying asset classes to embed, generating the highest return whilst allowing a period where investors do not call upon the company to extract monies invested. So tell your clients to let the retail investors out of the fund – and give them a copy of the audit. I am sure there will be enough sophisticated and institutional investors that wish to remain. Have you asked your clients what percentage of the funds come from UK retail pensions and from sophisticated investors/institutions? This will be a question raised in court.

The suggestion that our clients Messrs Nunn and McCreesh, generated up to 200 leads to advisors now under investigation by the Serious Fraud Office, as it led to investment into assets that are now worthless, is obviously designed to impact our clients’ credibility and reputation. It doesn’t matter what the “design” was – it is true and clearly evidenced. There is quite enough smoke and mirrors already without trying to hide your clients’ background.

The natural and ordinary meaning of such a statement, to any ordinary reader, is that our clients facilitated or engaged in conduct that is criminal, and in fact the most serious of conduct that deceived retirees and led to the loss of their pension funds. Capita Oak and Henley were repeatedly determined by the Pensions Ombudsman as being scams. And scammers are criminals (as confirmed by the Pensions Regulator). Your clients, Messrs Nunn and McCreesh did facilitate and were engaged in the promotion and distribution of Capita Oak and Henley and had entered into an agreement with Transeuro – so they would have known the pensions were going to be invested in store pods. You claimed several thousands of words ago that your clients had 25 years’ experience in the financial services sector – therefore they should have known better than to get involved in such an obvious scam which would inevitably ruin thousands of people’s lives. They would have known that the object of the exercise was to earn substantial amounts of investment introduction commission from Store First at the expense of the victims.

This statement is wholly untrue. As above, your clients had an agreement with Transeuro and knew what the whole scheme was about.

In fact, the correct position is that through Nunn McCreesh they purchased leads through reputable companies, such as moneysupermarket.com. Where that lead potentially also generated opportunities which were not serviced by Nunn McCreesh, on the consent of the customer/consumer how did the consumer “consent”?, this was referred to several other firms. Yes, the cold-calling scammers who were also involved in the whole scheme.

Our clients had no control whatsoever over the advice subsequently given, as set out above, and whether that advice was acted upon. But they knew that every lead which was successfully converted would end up with the investor losing his or her entire pension as it was due to be 100% invested in store pods.

Our clients were not involved the process of giving that advice. They were a part of the conduit which harvested the leads and passed them over for conversion to the scammers. They were the process.

Our clients are, in reality, no more responsible than the company from which they first purchased the relevant lead. Your clients were an integral part of the whole process and were fully aware that every lead they passed on was in danger of facing financial ruin.

However, you seek to present our clients as dishonest and deceptive, and imply that their conduct/involvement is also under investigation by the Serious Fraud Office. This is an extremely serious allegation to make and one without any factual basis or truth. How would you describe a firm that passes on 200 leads a month for two years knowing that if converted, each individual’s entire pension would be invested in store pods, and that the value of the assets would immediately drop by at least 46% due to the investment introduction commissions (in which they shared to the tune of £900k)?

DEFAMATORY MEANING

Your comments appear to be based on a number of fundamental misconceptions and errors:

As we refer to above, our corporate client’s product Blackmore Global is not a UCIS. Yes it is.

It is, again as set out elsewhere and above, a 10-year closed-ended product and as promoted by an unregulated investment company. Your statements that Blackmore Global is a UCIS fund at all, and also that it is a UCIS fund that is being illegally promoted to retail investors are simply wrong. This has already been dealt with several times above.

In any event, and again as stated above, our corporate client does not and has never contracted directly with retail investors (ie. individual personal investors) in respect of the Blackmore Global product. Your corporate client is a corporate entity which cannot of itself “do” anything. But the directors can and do. Messrs Nunn and McCreesh ran Aspinal Chase which was a cold calling, lead generating introducer, which was contacting members of the public so that they could have their pensions invested in Blackmore Global. Mr. Driver mainly dealt with Aspinal Chase, and the pension transfer administration was handled by Pensions & Life – another company run by Messrs Nunn and McCreesh.

It only contracts with professional and institutional investment entities. The individual investors (who you are wrongly describing as “victims”) are in fact (and again, as set out above) direct clients of those professional investment entities who make investment recommendations to their personal clients. Already dealt with above.

Once again, our corporate client provides no advice or recommendation as to the suitability (or otherwise) of the relevant product to the professional investment advisers. Any complaints about the unsuitability of an investment choice for a particular individual are a matter for that individual to take up with their own professional investment adviser. Our client has no relationship with those individuals, and only with professional and institutional investors who undertake their own extensive due diligence on all of its investment products. Your client has no relationship with anybody – there is no communication with the trustees or the investors.

If this gets to court, I will be demanding to see evidence of the extensive due diligence. Since there are no accounts, no valuations, a banned fund manager involved in other scams (Weal), evidence of collaboration with the Capita Oak scam (subject to an SFO investigation) and no evidence of your clients’ qualifications to run a fund- I would question the word “extensive”.

Accordingly, whether a fund is “wholly unsuitable for a pension fund” is a matter to be taken up with the relevant independent financial adviser involved and assessed on each individual case. So why were your clients Messrs Nunn and McCreesh, acting as Aspinal Chase, contacting retail members of the public in the UK in order to persuade them to move their pensions to a QROPS so that they could be invested in their own fund, Blackmore Global? Why was the adviser they introduced, after an assessment, recommending their funds?

There can be no justification for your assertion that our clients’ products are, without exception, unsuitable for any pension funds when in fact they will in many cases be wholly, suitable. There is, indeed, every justification – because until and unless the mythical audit appears, we won’t know for certain what the underlying assets are. There is very compelling evidence that the assets have clear links to other investment scams, but let us wait and see when the audit comes out.

Furthermore, your various inferences of conflicts of interests are made without any semblance of objective foundation or justification. It is a clear conflict of interest for your clients to be promoting the fund as well as running the fund to the general public – i.e. ordinary, retail pension savers.

Blackmore Global is not a toxic investment. Based on the clear evidence we already have which is published on your clients’ own documentation, it most certainly is a toxic investment. This can be further reinforced or refuted once the audit is available. But to be honest Steve, to keep on repeating statements about the fund without having a clue what the investments are is pointless.

Despite the length and content of your various posts, without carrying out your own detailed due diligence (no evidence of which is present in any of them), you simply cannot be in a position to make the Defamatory Statements, either as statements of opinion or fact. This being the case, and based upon the serious financial harm already done to our clients’ interests as a result of their content, your various claims are seriously defamatory and allow our client to seek redress from the Queen’s Bench Division of the High Court. This begs the question whether you yourself have carried out any detailed due diligence. You keep denying that Blackmore Global is toxic, but you haven’t a clue what the assets are.