I’ve been very concerned about Dolphin Trust GmbH for some time. There’s an awful lot of pension money being loaned to this company – and I don’t get to hear of many (in fact any) people who have had their loans repaid. That doesn’t mean they haven’t been repaid – it just means I haven’t heard about it.

I’ve been very concerned about Dolphin Trust GmbH for some time. There’s an awful lot of pension money being loaned to this company – and I don’t get to hear of many (in fact any) people who have had their loans repaid. That doesn’t mean they haven’t been repaid – it just means I haven’t heard about it.

The things that bothers me about Dolphin Trust are:

- There are no audited accounts available

- Dolphin has been used by an awful lot of pension and investment scammers – including Stephen Ward in the London Quantum pension scam (now in the hands of Dalriada Trustees)

- “Introducers” get paid eye-watering commissions of up to 25%

- If the assets and projects are so good, why pay private lenders 10% interest (on top of the 25% commission) – why not just go to the bank?

- I have recently heard that Dolphin and some of their dodgy “introducers” are now trying to convince lenders to take their loans back in the form of shares in the company

But the biggest concern I have is that Dolphin Trust formed a major part of the underlying investments in the Trafalgar Multi-Asset Fund scam – run by XXXX XXXX of Global Partners Limited and STM Fidecs in Gibraltar. This fund is now being wound up by Stephen Doran, of Doran + Minehane.

The Trafalgar Multi-Asset Fund and XXXX XXXX are currently under investigation by the Serious Fraud Office. Ironically, Justin Caffrey of Harbour Pensions once told me that XXXX came to see him to try to flog the obviously dodgy Trafalgar fund. Caffrey claimed he could see XXXX was an obvious spiv straight away and that Trafalgar was clearly bad news – so he sent the ginger scammer packing.

And then STM Group bought out Harbour Pensions and got custody of some of Caffrey’s Blackmore Global Fund worthless crap to keep the Trafalgar Multi Asset Fund worthless crap company. You couldn’t make it up! A bunch of toxic rubbish flogged by scammers Phillip Nunn and XXXX XXXX.

STM Fidecs had notified the hundreds of victims that there would be a distribution in early 2018 once Doran + Minehane had got rid of some of the Dolphin Trust loan notes. But then STM did a U-turn and announced there wouldn’t be a distribution at all. Clearly, getting shot of the loan notes was more difficult (or impossible) than Mr Doran first imagined. Or perhaps he did get rid of them – but got shares in Dolphin Trust or Vordere instead (and this is the reason for the lack of distribution by STM Fidecs).

Any way you look at it, Dolphin Trust is looking dodgier than ever now it is well known that there are £21 million worth of Trafalgar Multi Asset Fund loan notes out there looking for a warm and cosy (and gullible) home.

Quite apart from the fact that no self-respecting introducer or financial adviser should EVER be caught selling high-risk, unregulated, non-standard “assets” in the first place, surely nobody would ever want to be caught flogging the same stuff that the likes of XXXX XXXX and Stephen Ward were making a fortune out of.

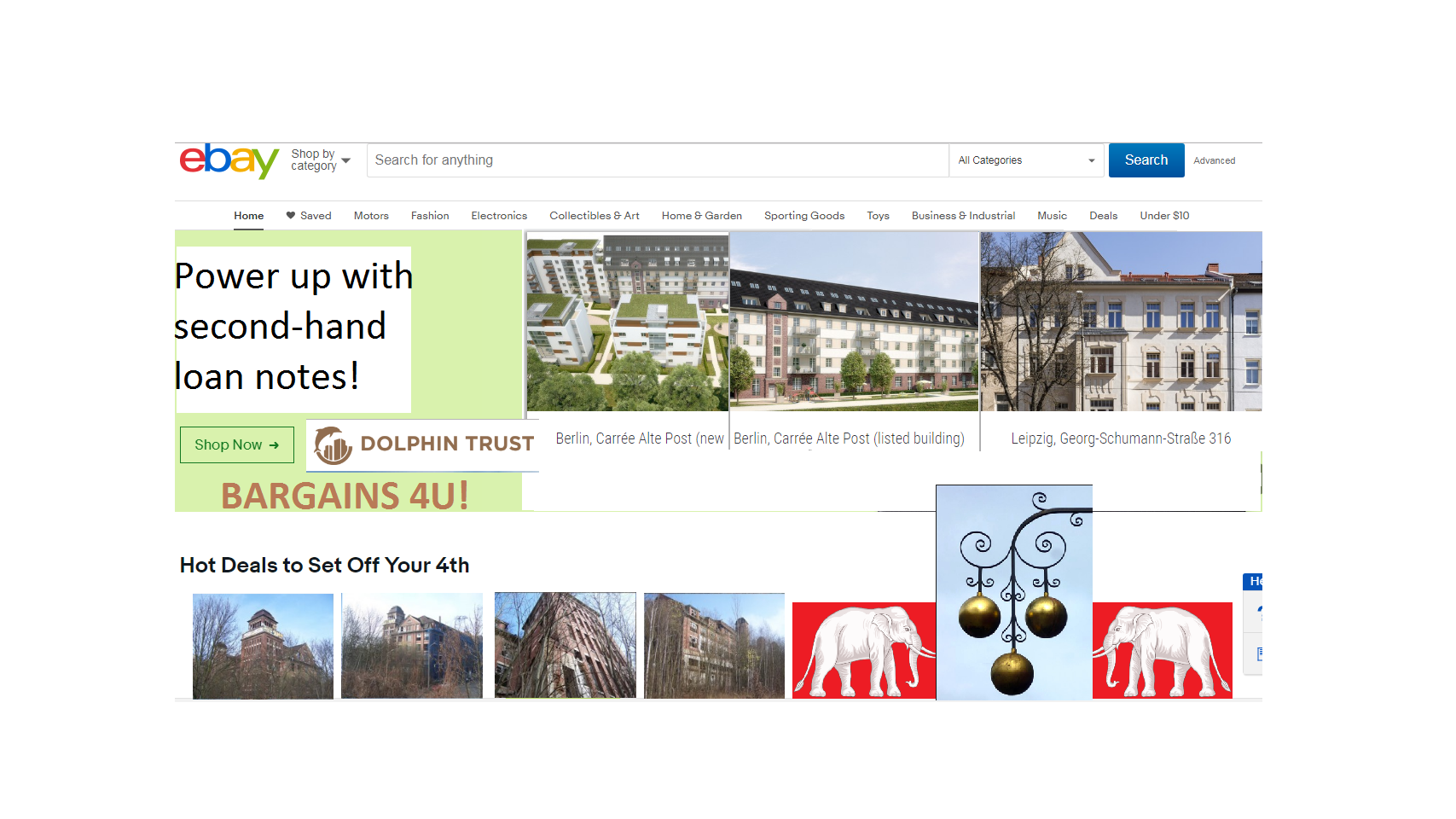

Without the benefit of any assurances from the nice men at Dolphin Trust – Charles Smethurst, Helmut Freitag, Axel Krechberger and Matthias Ruhl – we will just have to hope that Mr Doran manages to offload the second-hand loan notes that STM Fidecs allowed 400+ victims’ life savings to be invested in. Perhaps I’ll drop him a friendly note and suggest he tries ebay.

Without the benefit of any assurances from the nice men at Dolphin Trust – Charles Smethurst, Helmut Freitag, Axel Krechberger and Matthias Ruhl – we will just have to hope that Mr Doran manages to offload the second-hand loan notes that STM Fidecs allowed 400+ victims’ life savings to be invested in. Perhaps I’ll drop him a friendly note and suggest he tries ebay.

i am also waiting for my money to be repaid after maturity. it is over a month now and it does seem like a scam. for me this is the second one Lomax trust also went bankrupt. afterwards, i discovered that they only had shares in Lomax halls which is still thriving, the directors who were architects etc for Lomax halls parent company sold off the shares and went bankrupt leaving us mugs penniless. seems like this is another though again i was informed this that we had a first call on their property/

Hi George

I have money invested with Dolphin Trust, and I received my annual statement September 2018 and I am still waiting for my money to be released.

Can you tell me what the complaints procedure is please? or who you spoke to at Dolphin? I am worried that I have lost my life savings.

Thanks

Sam Hields

Sam. Have u received your money We were also expecting money in March But received a phone call asking us to wait another month and we would be paid an extra bonus for waiting however we have not heard from them since

since this, i have received my payment in full. Dolphin trust does seem ti have a problem with communication but since complaining, i have received the money with a 1% bonus. they turned £80,000 to £160,000 in five years. I understand also that no investor in Dolphin Trust so far has not had the interest paid or their loan returned. Unlike Lomax find that was a scam Dolphin Trust is genuine.

George,

I wonder if you could help me, I am currently waiting for my money from them too. How did you manage to get your money? I’m not receiving a date from them and no one is telling me no information, my money matured on August 5th and I’ve had nothing.

Hi George I too have invested my pension with Dolphin capital and should have been paid October 2018 but nothing and keep getting fobbed off can you help as to where I can contact anyone to get it back

Now June 2019.

What I don’t understand is why Dolphin isn’t communicating with the lenders/investors. It just makes Dolphin look like obvious scammers because that is what these criminals typically do when a scam collapses. They hang the victims out to dry.

Hi George

I have funds invested in dolphin trust, as you say not good at communication.

can you advise on who to contact ?

Regards D Taylor

this article seems sensational and unfounded about Dolphin Trust. I invested in Dolphin Trust and got paid with all returns and on time. They have vast properties all over Germany and actually encourage investor visits to their properties before investment. You appear to be over critical of ALL investments with no actual due diligence yourself.

I too am waiting for my money to be paid. It is six weeks since my loan note matured. Whenever I contact them (weekly) they assure me it will be paid by the end of the week. I wanted to reinvest a portion of the money with them. This is now very unlikely!

Hi, I was shown the small brochure today by a Financial Advisor. I liked your comment “Quite apart from the fact that no self-respecting introducer or financial adviser should EVER be caught selling high-risk, unregulated, non-standard “assets” in the first place, surely nobody would ever want to be caught flogging the same stuff that the likes of xxxx xxxx and Stephen Ward were making a fortune out of.”

Is there any further news on this company as I have a meeting with the Advisor next week. Just looking forward to the look on his face. 25% intro commission is what he failed to tell me. I wonder why?

Thank you for your article.

Hi I am waiting for details upon my investment. It matured on the 15th of August 2018, to date I have not heard anything at all despite numerous calls and e-mails. I have been informed that after maturity date it takes 15 days for funds to be transferred. 7 weeks down the line nothing to report.

I am afraid this is an all too familiar story. Dolphin seem to have run out of cash and many investors (in reality, lenders) are being fobbed off with excuses. In fact, many victims are being conned into trading their loan notes for worthless shares in Vordere.

I thought I could rely on my Financial Advisor who lives in a large house in Holywood, Northern Ireland and he also used a prime fancy office in Belfast town Centre. Prior to giving him my money to invest he assured me and showed me papers that he was a regulated Financial Advisor. He also assured me the companies he was putting my money into were regulated and protected. He invested my funds in Dolphin Capital and Colonial Capital. Colonial Capital was an elaborate scam, I lost my £11,000 investment. Now I am stressed to the max regarding my three Dolphin Investments. One was paid out last year, this week I am due £20,000 having read the above information and knowing about the scam of Colonial Capital it is no wonder I feel stressed worrying about what I am due this month and next. Once I learned that Colonial Capital was a scam I tried to get my money out of Dolphin Capital they refused to pay out. The Financial Advisor I had trusted failed to inform me he was struck off. Every fibre in my body hates that man for the stress he has put my family and I through. Check and double check credentials of any Advisors and Companies you invest in.

Let me have the details of your financial adviser and I will put a warning out about him to make sure no other members of the public get scammed by him in the future.

Angie, My money was due 17/11/18, how do I go about to get my money back from Dolphin Trust? No joy with agent or any response from Dolphin trust.

Hi, I believe you had your full investment returned maybe the problem was communication but this investment was returned + interest.

Hi,

Sorry to bother you, I wonder if you can help.

I also invested 10 thousand with Dolphin which should have paid out 18/10/2018, after constant chasing I was told yesterday I will have to wait another 12 months, i don’t know who to turn to for help, have you had any success many thanks Karen

Hi Karen,

In my experience i guess you would always speak to your pension company regarding that.

Good news for me! Dolphin Trust paid up in full today. Last week I spoke with an administration manager for Dolphin who explained when the payment would be made. It doubled my original investment so with hindsight it was worth the anxiety!

I heard of another investor who got his due interest payment, although not his principal amount. But well done you if you’ve got the whole lot back. You must be tremendously relieved.

All my interest payments have been in full and on time too.

Wonder if this “Angie” character is just a bitter old harridan with a bee in her bonnet….

…or possibly worse (gulp!!):

https://pension-life.pissedconsumer.com/angela-brooks-201808101326390.html

What a load of sensationalist tripe!

Dolphin trust have never failed to pay out in full. Introducers do not get anywhere near 25% commission (max 10%). The share scheme is not worthless in fact quite the opposite and gives bond holders greater liquidity.

This is a genuine, honourable company and idiots like the write should do a bit more research before spouting such nonsense

I wonder what you do – let me guess: Dolphin Trust introducer? You might want to ask some of the Trafalgar Multi-Asset Fund victims about “great liquidity”. If Dolphin Trust is genuine and honourable, I am sure it will repay all the distressed scam victims. Aren’t you?

Interesting that I’ve stumbled on this site.

My experience of Dolphin since 2012 has been broadly positive though half-yearly interest has been increasingly slow to come through. Recently they’ve blamed AML admin delays etc. That may be plausible – I’ve friends overseas who find normal bank transfers can take weeks now, but I’d expect transfers within the EU should be timely.

Dolphin’s communication with lenders seems dire. Likewise Vordere’s communication with shareholders – see how few RNS’s they’ve issued. Dolphin never offered me the option to swap for VOR shares in 2017. My ‘introducer’ mentioned it, giving a brief summary of +’s and -‘s. Actually he thought a reason for the offer was that Dolphin had previously relied on a large proportion of SIPP money being recycled into new loans on maturity, but this refinancing stream had dried up when most SIPP administrators started refusing to accept new 3rd party loans from 2015-ish. Again that sounds plausible and could certainly explain redemption delays. However, it’s naive in the extreme to expect to be able to redeem a substantial volume of loan notes before maturity – the world just doesn’t work that way. Either the lenders would have to be offered a substantial haircut, or the equity swap (which may be a haircut in disguise).

I don’t know what to make of the recent tie-in with Red Rock Group. What is Dolphin/Vordere’s link to this? I assume it’s a move to broaden the lender base in some way.

Red Rock Group used to be called Bit By Bit. I guess that describes pretty accurately how they scam thousands of victims out of their savings: bit by bit.

I would gladly hear how to get Dolphin to respond as I have been waiting for payment since the beginning of October. My recent emails to Germany and a UK customer relations manager get no response which does create concern.

Any advice appreciated

Tony

How much did you lend to Dolphin and why? I can’t see why anyone would lend money to a property developer with no audited accounts. Also, did you have an adviser who conned you into lending money to Dolphin? And, if so, how much commission was he paid?

Can anyone on here give me a name and number or email to contact at Dolphin? I am owed over £30k and worries this is a scam

Thanks

Hi,

Have you been paid yet?

I am now becoming very concerned. I have a large amount of money now 8 months overdue

Hi Ken,

Here in Asia , we are already seeing 13 months over due from them.

Asian investor here. I just went to their Singapore office. It seems the projects that have been paid in full were the ones that were supposedly exiting in December 2017. Mine was on January 2018. i hope we can get paid soon. At least they were actually open enough to explain…

Hi Chandra, I am interested to see what can be done to recover the money and if we can have other investors in the same situation. Let me know.

Ken, have you had any joy recovering your money?

Ken, have you had any joy recovering your money?

Hi, Singapore investor here as well. There are large investments in SG not being paid by Dolphin for more than 10-12 months. My due date was June 2018 still to date no payments. The promises we got were Dec 2018 but immediately during Dec the deadline was updated with strong promises as due dates Feb 2019. Now we are in March and still nothing or any new communications with the new dates. Is there anyone interested here to start legal actions to recover our investments?

If they are facing cashflow problems and or registry problems, sueing them may not help to get any dollar back, only pushing them to run away… Best is to visit them to talk… i think.

M Singapore,

May I ask have you receive back your investment?

Have you contacted them, any repayment updates after Feb 2019.? I was thinking taking legal action may force them further away…. any thoughts.?

Hi,

No, I did not receive any money back.

I also tried to contact them via multiple way like emails, phone calls etc and no feedback as well.

Legal actions will force them to get their assets blocked and can be sold at a price just to recover our investments. Rest it is their problem like profits or to recover their costs.

Tze, you look very active on this forum ….

I contacted them, no response no explanations. There are no payments for projects due in Jan 2018 and not Feb 2019. those who got the latest cents in Jan 2019 were those with deadline in Dec 2017.

Yes, taking legal actions work – the assets will be blocked and forced to be sold in their existing stage and we recover the money. EU does not joke with these time of situations. Recovering my money is a priority and rest is not part of my responsibilities like how they will recover their costs and their obligations. I deliver on my contractual obligations, I waited for additional fake deadlines and now I am ready to take actions to get money back and let this behind.

I would like to get some other people so we action together and recover our money together.

My loan note matured 28th August 2018 and still nothing . Just talked to whites who are acting for dolphin and been told they have run out of cash but not to worry as my investment is safe ? How can it be safe if you’ve run out of cash ?

I’m getting very concerned now.

Cris

What I kniw was projects due/expires in june 2018 and sept 2018 have been fully paid off in feb 2019.

But there are still projects due in early 2018 which are not paid till today..

They delayed repayment… but at least still paying… till now. Running out of cash may also mean having cashflow problems, which need time to resolve..

Was told they have sold some properties but facing Germany registry issues and thats why the delay.. but not sure if its true or not.

We are also very worried about our repayment.

Tze, I can confirm that none of the projects due June 2018 has been paid. People with due dates in Feb 2018 also did not get their money back. How I know this? I have some contacts I keep on asking what is the status on their side and this is what I am told and I got these contact during last year meeting in June in Singapore with Charles Smethurst.

So, there is more than 1 year delay and no money back, no communications no nothing. I tried all channels and nothing.

“Projects due/expires in june 2018 and sept 2018 have been fully paid off in feb 2019” – this is not true. I did not get my money back and my due contractual date is June 2018.

How this company can threat their clients, investors with respect and transparency? I believed that being a German company this is all about trust, transparency, delivery on time.

I’m from Singapore. My project matured in May 2018 and yet to receive my payout. Now they have resort to getting someone to call us and read from a prepared script that there will be further delay but no further details offered. This is not good.

https://chat.whatsapp.com/invite/6kgQ2reEiXQ03aCDQZbEsa

Please join this for Sg investors

Dolphin investor,

is there anyone else in this chat group. why is it called Dakota Project?

Hi Grey,

I am glad others like you also can hear they reading from a script… and yes, the so call “clients relations experts” know nothing. Its just drama and buying time..

My brother and I were due a yield payment of 10% in Oct 2018 this was not paid and all investors were eventually assured that payments would be paid by March 2019 at the very latest, needless to say that deadline was not met and furthermore there is a total lack of communication from Dolphin. We are due another payment at the end of April but I find it increasingly unlikely that we will get that either. I’ve talked to Best International, the financial advice firm who introduced this “product”,they say they are pressing Dolphin for answers but I’m very concerned that we’ve lost out initial investment to say nothing of the dividend payments.

MY wife and I had interest payments on time (ish) until Feb & March 2019. Our July/Aug payments have not happened and now we’ve had the letter from GPG.

I suspect most of our funds are safe but these delays are concerning when you get evidence of past lies about payments and dates being missed.

However for the last 5 years or more Dolphin HAVE paid on time – and I suspect are fundamentally not a scam – but they could still be a poorly run company unable to meet its obligations. Any company can go bust.

I’d love to get my money back – but I’m also glad I stopped my wife from converting to shares at 17p which are now trading at 10p.

Lets keep the info coming – please post if you HAVE had any interest returned in 2019, or even better return of Original Capital.

M,

The chatgroup was originally created for north dakota investors…this one has gone south for more the 2 years now….since then dolphin and ritz G5 investors have joined in this chat group

Just found these details and thought to share it:

Charles Smethurst, former CEO of Dolphin Trust ….Dolphin Trust’s company filings indicate he stepped down as CEO in September 2018, replaced by Helmut Freitag

Dolphin Trust was renamed German Property Group GmbH in March 2019.

What do you think about these developments?

https://bondreview.co.uk/2019/04/03/we-review-grounds-investments-cash-investments-paying-up-to-7-per-year/

M Singapore, may i know yours was in bonds/notes or in property development.? All Those I had mentioned were told to me by the agent, unless he was told to lie, and likewise all agents… However, from what I heard and gather, the repayment is not entirely based on due dates, the specific projects also matters…

M Singapore,

I wonder about the rational behind those few top guys in Dolphin doing up the different companies, Grounds Investment Plc owned by small listed company, Grounds Real Estate Development Ag, which is 70% owned by Charles who step down as Dolphin’s CEO and Dolphin Trust renamed to Dolphin Property Group now headed by Helmit Freitage… do they do this so to raise funds by “whatever” means in order to cover different holes and to repay investors or really to continue their real estate development business or simply to their “whatever doings”

https://www.northdata.de/German+Property+Group+GmbH,+Langenhagen/Amtsgericht+Hannover+HRB+203123

If this link is allowed, please check it out.

Use Google translate to help, but mostly it’s self-explanatory.

Dolphin Trust Investors,

Please contact me by email at Dolphin-Trust-Action-Group[at]yandex.ru and provide the following:

1-Name or nickname if you prefer

2-Product Invested In (e.g. 5 year growth loan note)

3-Amount Invested

4-Maturity Date

5-Name of the SPV on your loan note instrument or certificate (e.g. Dolphin Capital 120. Projekt GmbH & Co. KG)

6-Mobile number (optional)

Thank you,

Dolphin Trust Action Group

We have moved from Yandex to Hotmail. Please contact us at DTAG80[at]hotmail.com

Hi I have also lost a large sum of money that should have been paid out Nov 2018. Can anyone advise what can be done the financial advisors who recommended Dolphin originally have been wound up by HMRC. I can’t get any answers from anyone and my SIP providers are threatening legal action for their final administration fee.

Get in touch: [email protected]

I also have a considerable amount outstanding. Outstanding Payment since August 2018. Also communication has stopped since December 2018. We have to take initiative and make a list of creditors, report it and take join legal action.

We also have 3 loan notes with Dolphin – the first was due to mature last month and were advised of the Land Registry issues . The others are not due for another 2 years. So concerned now on reading all of these comments online. Just at a loss as to where to go next….

I am £620,000. out which was largely due November 2018. on 5 year Loan Notes and accrued interest.

Solicitors recorded delivery letters just ignored £300,000 promised for last Nov without fail, never materialised. It now transpires that Charles Smethurst CEO resigned. his position last SEPT, although his colleagues have been telling me , he is the only person that can solve this matter.

WE need the name of whoever is responsible, how we can contact them. and a commitment to transparency, so that we can start examining the security available to us, and how it can be realised.

I am 74 years old and this has totally devastated my and my families life.

I am happy to cooperate with any legitimate solution.

We paid Bottermann Solicitors our money, not Dolphin, on the basis that they would hold the deeds, in our names, until PAID IN FULL. Without this release, how can the apartment holders receive the deeds for their investments? Answer………..Legitimatley they can’t.

Hello, can anyone give me advise.

Dolphin have now told me my investment that should have been paid out 1810/2018 could now take another 12 months, I am devastated, just been made redundant, single parent with a mortgage, many thanks Karen

Anyone listened to the BBC radio 4 you and yours programme on this?

Anyone got paid by Dolphin group/german property group in May and June 2019.? Anyone knows of any update about them? Please share.. thanks

Was due an income payment on June 20, got nothing, no reply either.

How much did you lend Dolphin? Who was your adviser?

For this income, EUR 10000; then another 10000 deferred expiring this november (passed to RedRock), and another 10000 deferred expiring next June. Lent through Emerging Developments.

Who was the adviser? Whoever it was would have earned up to 25% commission so you should be speaking to them as a matter of urgency.

Spoke with Dolphin yesterday. They said they are now 30-40 working days late, so I should get my payment in the first half of August, but the schedule could change, in which case they will update me.

Problem should be temporary, due to issues at the land registry with sales.

Did not receive my income.

They sent a letter stating that for the next 3 months, income will not be paid, rather added to principal and paid at the end of term.

Anybody else received this letter?

Loaned a substantial sum to Dolphin due to mature last June. No money back or last interest payment. Requested a lette from Dolphibr one month ago that I need for the tax authorities and they still have not sent it.

Got one on 4th May, one on 10th June, however was due further payment on 24th June, that has not been paid.

Has anyone who invested in property (not funds or mini bonds) with Dolphin Trust ever exercise their First Charge on the property to recover their investment.? Or considering doing so… please share.

An interesting question. I think the problem is that the charge was not specifically registered on any particular property – but this is something worth exploring perhaps?

Angie, how do you know that clients’ First Charge on the property “was not specifically registered on any particular property”.? Can you confirm if this is true on ALL the properties which clients had invested but have yet to exit.?

I have seen no evidence either way, but the investigative journalists who have been having the drains up on Dolphin have reported this. I am considering starting a group action on this as there are so many people who are desperate to get their money back and if we don’t act quickly, it might be too late.

Group action… for property investors or funds investors.? How does it works and any guarantee to recover full invested amount + the agreed returns/interest and the timeline.?

Both property and fund investors – although pensions are slightly more complicated because it can be argued that the pension trustee is the rightful owner of the assets. Basically, a group of affected investors form a “cluster” and obtain legal opinion on the merits of legal action – alternatively (or sometimes in addition) regulatory or criminal action can be taken which does not cost any money. There are never any guarantees and the timeline can be as long as a piece of string. But it does work sometimes. You’d be surprised how quickly people will find some money when the handcuffs get jangled!

I think we should all stand back and give them a chance to sort the issues out.I have been advised that 20% or projects are delayed for one reason or another, thats 12 out of 60.I am also advised that they will be giving full information to all investors regarding security etc.Its my opinion that they are in the best position to realise the assets and taking any form of legal action is more likely to make matters worse rather than better.I, for one, do not fancy the idea of trying to appoint a german receiver to sell a listed building at a decent price…..Im sure the Dolphin guys can do better.Admittedly they shouldnt be given forever to do this but I understand they are taking steps to rectify the position.

Mark, thanks yours and I do understand your point. However can we really believe Dolphin/GPG words that only 20% of projects/investors are affected.? And may we know what security are you referring to.?

Our project exit/due on Dec.2018, they wrote to say to say they cant pay and would pay in Feb 2019, and came Feb, they wrote to say they cant pay, and they ignore all emails instantly for the next 3 months! End May they said would pay us in Aug, but end June they said they can only repay us in 11 installments over next 12 months instead of full repayment, and without Any form of guarantee that we will be paid each and every of the 11 installments… So they can drag us on forever.. This is totally unreasonable and unacceptable. Do we believe them anymore???

I assume you have seen the missive made available to investors together with details of the helpline they have set up? I fully agree that they have been far to secretive in the past but they do seem to be making some effort to rectify this.

I have a contact at the highest level and am trying to find out exactly what the position is.

I suspect the situation with different loan notes, securities and projects is a bit complex, but, they should know where everyones money was invested…if they did what they were supposed to do when it was invested.

If they are offering instalments, I can only assume that that project is a problem and they intend to generate the repayment form others.If a project is to be developed or sold then they should be able to repay in one go….again according to their stated process.

I have also been told they have the opportunity to refinance some projects and this should also release , what is expensive, loan note money.

My contact is visiting Germany shortly and I should have some news in the next few weeks.

In any event, any litigious attempt will be expensive and slow so I see no point in pursuing it at the moment.

Can you send a copy of the communication or a link to it please?

This was sent out at the end of June to introducers I think.IM not 100% certain as its taken from a whats app conversation.

In recent weeks you will have received a letter about Dolphin Trust GmbH’s rebrand to German Property Group GmbH. This change has been made to reflect our expertise in the real estate market, and also signals a renewed commitment to clarity and communication.

With that in mind, I write to you to explain why it is likely that maturity payments will be delayed by up to 12 months.

As has been publicised by German media, most property developers in the market are experiencing difficulties with finalising building permits and legal titles, and arranging third parties such as constructors.

I must stress at this juncture that your capital investment is not at risk. I share this with you to provide context, by no means as an excuse, and the board and I want to assure you of three things:

• We are making every effort to speed up payments as drawdowns for our projects begin to proceed at pace

• We are in the process of developing, selling and re-financing properties in order to release funds and reduce the delay in maturity payments. Interest will continue to accrue on your investment until the day it is returned to you.

• We are redoubling our focus on communications, including investing in a dedicated team that can talk you through our plans. Unless you specify otherwise, this team will call you every month with an update on your investment. In the coming weeks we will be providing you with a letter that will outline the security details for the legal charge on the property specific to your investment, showing how it is protected.

You may have already received a call from our client-relations team, and should you have any questions before your security details reach you, please don’t hesitate to phone them on 0191 500 5459 or via email on [email protected]

The board and I would like to thank you for your patience as we progress with German Property Group’s projects, and as always we thank you for choosing to invest with us.

Kind regards,

Charles Smethurst

German Property Group GmbH

(Ehemals Dolphin Trust GmbH)

In den Kolkwiesen 68

3085

Hi Mark, thanks for the details. However, I would emphasize that all those points stated in your previous (long) post are all repeat stories we have heard many times since Dec 2018, just in a little more detail. Their so called client relations hotline are manned by those who do not know any details, they are reading from a pre-written standard script when they call. Every month they would just call and apologise, they are unable to answer any of our questions regarding updates on project, sales, repayment schedule, etc, such phone calls are totally useless.

Our project was in Brandenburg, till today, nothing was done. On May 27 Charles told us personally in Singapore that the property Was Sold and said they will send us the Sales Contract, and said All investors will be repaid in Full by August 2019.

However, in late June, his assistant Mike, after our repeated emails, he sent a 1 line email stated it was Not sold and we would be paid over 11 installments. – This project exit/due in Dec 2018, GPG installment letter to us on late 28 June 2019 stated –

– Repayment of our Capital will only start on Jan 2020 over 6 installments,

– Repayment of agreed returns + late payment interest will only start on July 2020 in 5 installments, – Accured interest or late payment interest will Stop on June 2019.! Where is the interest from July to Dec 2019.? Where is the interest on outstanding balance after each installment from Jan 2020.?

– There is No Investors’ guarantee or security in place over the entire 11 installment period. Without his, they can just drag and delay our payments whenever they have issues, which we had experience since Dec 2018.! Such guarantee or security Must be in place.

I have emailed to Charles/Dolphin/GPG on 29 June 2019 that their installment plan is totally unreasonable and asked for a revised schedule and full repayment to be made by Aug 2019 as informed personally by Charles, they ignored and did not reply.

On 15 July 2019, I sent a follow up email to Charles/Dolphin/GPG, that their installment plan is totally unacceptable. We asked for a revised plan to pay us in Full by Aug 2019 Or Full Capital Repayment in Aug 2019 and All returns + interest on Sept 2019. We seek to have their reply by 30 July 2019, otherwise we shall, together with All other Brandenburg investors, proceed with whatever necessary action, including exercising Out First Charge on the property, till Full repayment is made.

Mark, we appreciate your sharing and noted that you have the contact at the highest level; and would you be so kind to please help us anyway you can regarding Brandenburg repayment. Thank you.

I suggest anyone with outstanding loan notes, whether they are due to be redeemed or are overdue, contacts the number above and registers their interest.

As mentioned before, DolphinTrust/GPG so called client relations hotline are manned by those who do not know any details, they are reading from a pre-written standard script when they call. Every month they would just call and apologise, they are unable to answer any of our/investors questions regarding updates on project, sales, repayment schedule, etc, such phone calls are totally useless; even sending many emails to them, we/investors are very unlikely to get any reply. All these are what we have experienced with them since Feb 2019 till present…

I will , of course, assist in any way I can.

I note your comments regarding recent broken promises on this particular project and will see if I can find anything out. The ” help line” was always going to be of limited use but its a start.

That said, if you do get your instalments as promised it may well be a better outcome than taking matters into your own hands. It will certainly take longer and require upfront investment on your part in fees etc.

I would still recommend you hang fire for a few more weeks as Im only just getting started on this.

Is there anything I should be doing, apart from ringing Dolphin and chasing. At the moment only one income payment that was due in June not received. More worrying large lump of capital due for return in November.

Mark, thank your very much your kind assistance.

On their proposed installment, it will only start in Jan 2020 in 6 ridiculous staggered percentages (16.6%, 6%, 8%, etc..) of installments… and thats only repayment of capital. Another 5 installments will start July 2020 for repaying agreed returns and interest over 5 even installments of 20%. but our contract is due in Dec 2018… If they have cashflow issues and can only pay in installments, they must at least start in Aug 2019 and in even percentages like 20% over 5 installments… I seriously hope you can help can materialise into something better… thank you once again. May I asked for your email address…so we can keep in touch.. thanks

I spoke at length with a lawyer in Germany yesterday. He said he believes it is urgent to take action quickly as the longer we leave it, the smaller the chance of getting anything back out of loans made to Dolphin. The writing is definitely on the wall, and those who shout loudest and quickest may get their money back, but the rest may not.

Hi

Can you please explain what you mean by this. This very concerning. I am due money since april 2019 which I am still waiting for plus overdue income payments???

I agree with Angie and the lawyer she spoke with in Germany.

When the BBC story broke, Dolphin Smethurst’s original promise (recorded on tape) was to pay back investors in full according to whose contract maturity date came first.

Then a few weeks later, Flipper offered instead the ridiculous installment payment plan for ALL.

What a devious attempt to keep everyone in line and especially those furthest down the line! That sneaky fish is living up to his Flipping name.

That is one way to stall investors from taking more affirmative actions.

And where was he going to find those funds? Through the sale of some run-down properties (unrenovated) bought with our money OR from new investors who are blind and deaf?

The long and the short of it is that Dolphin (or GPG) has run out of money. It has gone on paying out the early lenders, and paid the ridiculously fat commissions to the scammers who were selling Dolphin, until it has done what all Ponzi schemes do: implode. Lenders aren’t getting paid because all the money has gone. And what are the victims left with? Nothing. No audited accounts; no asset register; no evidence of any likelihood of ever getting any money back. Just a load of flim flam and lies from Smethurst and the rest of the scammers at Dolphin. I hate to be harsh about this, but everyone is gasping with surprise that this has happened – and so many so-called “experts” are opining that it will all come good in the end. Take a look at all the previous Ponzi-esque funds that collapsed: they all followed the exact same pattern. It isn’t rocket science: when the money dries up, the money dries up. If the disposable assets had been there (or saleable) in the first place, the money wouldn’t have dried up. Too much was paid out to the lenders (sorry, I know that won’t be popular, but it is true). And too much was paid out to the scammers who promoted Dolphin. And, probably, way too much was paid out to the Dolphin management team. There is only one way to go with this: take legal action against Dolphin. All the promises in the world are not going to magically restore the liquidity and pay back the lenders.

Angie, steady on….all loans are backed by security over assets ( unless they failed to put that into place ….if they did, its unlikely you will persuade them to do so by legal means), if they did as promised then everyone’s position is as secure as its going to be. They cannot start by paying back those who shout loudest as that would be preference and thats not allowed.If they go to the wall then the security kicks in and it could be the devil’s job trying to organise receivers in Germany…whilst Im an ex UK Insolvency Practitioner with a vast amount of experience in the property sector, I have no idea how to organise insolvency proceedings in Germany.

A lawyer will always advise you take proceedings as that’s how they make their living.

I already have a Tapatalk forum set up for those affected by this .

If anyone wants to join they will have to state their e mail details here and I will get the administrator to contact them and deal with their application to join.

There is no security – certainly not valid security that would provide any guarantee for the return of the capital. What’s a Tapatalk forum? Can you put a link to it on here?

Mark Hambling, thanks yours. My email is [email protected]

May I know whats the administrator’s email or name so I know its coming from the correct source instead of any other party. Thanks

[email protected]

Loan notes matured last Nov, £500,000 Capital plus accrued interest £630,000.

John Cooper

11 Wellington Drive

Wynyard Park

WYNYARD

Billingham. TS22 5 QJ

Cleveland

Where do you live and who was your adviser?

If it can be shown that DT have mislead, or lied about ANY issue, such as Land Registry issues, we only have issues with 20% of our properties, etc, then they will continually lie.

If they lie once and get away with it, nothing will stop them lying again.

If your Neighbour promised to turn down his radio, but did not, you either accept it, or call the police.

Hi Mark, thanks so much for organising a forum on this – Mine was supposed to be due in Feb18! I have called, emailed, with no response. They came to Singapore in Jun19 and we were also not advised. The lack of information has been disconcerting. Pls add my email to the forum pls [email protected]. Appreciate your kind efforts to help out the fellow investors. many tx!

I am seeing my solicitors next week so will see if we can get an action group going.

Mark,

security over assets ?? What about the liquidity issue? There’s millions in late/outstanding payments, how will this be realised exactly. To me, it seems like the whole operation has been like a sprat to catch a mackerel.

Communication and administration has always been atrocious and unprofessional, to say the least. Even after the CR Team were supposed to help put this right. They have not replied to our last email of two weeks ago and if their staff are aware of the whole situation, I wonder how many would leave. I guess they might be being fed BS too.

However, how much is it costing to run the customer relations outfit, who are a waste of space and just a smokescreen forming part of the delaying tactics, in my opinion.

All we have seen and experienced, is a long line of excuses and broken promises. Smoke and mirrors.

Why have we not seen a clear strategy or plan of action put in place ? Any credibility, for us, vanished the latter half of last year.

Smethurst, now seems merely a mouthpiece, no longer CEO/Director, and is signing worthless communications. Why ? We are also informed that he’s moved on to other interests.

Now, with the latest announcement that income payments are also being stopped, things appear to be deteriorating, rather than improving. That does not bode well.

On top of all this, they have the nerve to still promote the German market and entice the unknowing. That should not be allowed, as far as I am concerned. Unethical ?

How long before the drawbridge is pulled up ?

As tax breaks were part of the attraction, in Germany, perhaps Merkel, or someone should be keeping an eye on the situation.

I hope I am proved wrong, but I fear an unhappy ending for many.

I am only late on one income payment at present with large payout due in November, if collapse imminent let’s get started!

Does anyone have any information on Dolphin/GermanProperty Group GMBH

Projekt 80.Co KG.?.

I am in for £630K in Capital and deferred interest since November and neither myself or my solicitors can get answers to E mails or daily calls.

I am now told that there is a letter coming to my solicitors. It has been waiting for a week to be signed off. Any queries I raise with the client is allegedly raised with Germany, but NO information is forthcoming by return. The Client Relations team at Dolphin Trust-.com on Tel 0191500549. (Whites)

are a waste of space. albeit nice guys in a difficult position.

Anyone know the German position of “preference, if the oldest debts are not paid first?

What is needed is a meeting with Charles Smethurst where we can establish fact and agree a way forward. That is the least Dolphin/GPG. should do for us.

I am open to suggestions for a way forward (anything legal)

Mark, we appreciate if you or your contact have any updates on Dolphin/GPG. Thank you.

A group is being formed to try to claim back monie owed from Dolphin trust and associates [email protected] for details .

Mark Hambling – Thanks yours. My email is [email protected] May I know whats the administrator email or name so that I know thats the correct tapatalk forum admin instead of other group or persons. Thank you

Hi Mark

I am happy to join the tap talk forum my email is [email protected]. I am a concerned cash investor in dolphin trust loan notes. Who can i expect the email from just to make sure i join the right group

I am here to join the club, i was convinced by Landlords Pension (who i believe still promote this scheme) to invest my pension. I invested 33k into the scheme via an sipp pension. the whole thing was done by a financial adviser that they recommended. I was promised thjat after 5 years in march 2019 the funds would be returned almost doubled. i’ve had nothing but hot air and excuses. the pr office that Dolphin set up in the UK call me about once a month. they always say the same which is Dolphin have had some interest in selling a property so i may get some money soon but no idea when. I honestly dont believe this started as a scam but its gone very wrong somewhere thats for sure.

Firstly I’m not an investor in Dolphin Trust/ GPC. I am a Solicitor actively looking into these cases. I can see there are comments on here that won’t help reduce the anxiety of anyone who has made an investment, whether that’s post 5th year term and not re-paid or anyone awaiting periodic return/approaching full repayment position. The bulk of enquiries we’ve received are from clients that took un-regulated advice to invest (in to the un-regulated scheme) which creates issues on ability to recover. However those that took regulated advice to invest or have invested via their SIPP (with or without un-regulated advice) will have access to some form of redress. For cash investors there is a further option of a group claim against the parent company which is something we’re currently considering. Whilst the news reports and defaults create a poor outlook all is not lost. If you believe that we can assist please contact us on [email protected]. We work on a completely no win no fee basis and would be happy to have a free confidential chat with anyone who has been affected and who may want to seek compensation.

For further information please refer to our website https://www.smoothcl.co.uk/site/services/financial_mis-selling/mis-sold-pensions/missold-investments-services/dolphin-trust/

Anyone has any latest info to share on either charles, dolphin trust or german property grp.?

I am told two people close to Charles that negotiations are progressing and we should know something more firm by the end of the month.Meantime they are sorting out the securities etc. I know you’ve all heard this before but I truly believe its real this time ( hostage to fortune I am !).

As for legal redress, put it on the back burner… there is no pot of gold hiding somewhere, its all invested in property…they have around 4BILLION euros invested so its a bit early to be getting panicky… no doubt they have cash flow issues, but many companies do, especially when they are property companies.

Clearly they have had some mismanagement issues to get into this mess, but, I hope they can now also find a way out to the good of all concerned.

Check this out, if the directors knowingly continue insolvently they make themselves personally liable.https://iclg.com/practice-areas/corporate-recovery-and-insolvency-laws-and-regulations/germany

They must either be stupid, broke themselves or extremely confident that they can sort the issues out to risk this by continuing.

Hi Mark,

Thanks for the information. May I ask negotiation are progressing on selling properties or…? And would you able to find out which are the properties involved in the negotiations… many thanks.

I have been told that interest payments will resume again in 3 months. Gpg also have a website but most of the news on there is useless to investors. Also they are getting the security docs sent out so we will know what our first legal charge is actually secured against.

Let’s see if they deliver on this…

As I understand the way Dolphin Trust has been working, all Dolphin investors, whether they came through UK links, Singapore links or anywhere else were basically “LENDERS” only to Dolphin Trust.

None of us have legal title to any of the properties that Dolphin owns. Those legal charges are held by a number of SPVs created by #Spevurst for reasons we can probably guess.

The likelyhood that Dolphin had borrowed MUCH MORE money than those properties are worth is extremely high.

But what happened to the rest of the money, we may ask. Will the overfed Flipper tell us?

I doubt it.

Should we drown that bloody fish before he swims away to Paradise Island? Or at the very least, put him in a steel aquarium, after we extract all his blubber?

Lying with a smiling face is truly an abominable skill. Enough already.

DirkMoran,

You stated “None of us have legal title to any of the properties that Dolphin owns. Those legal charges are held by a number of SPVs”….

Are you 100% certain about this.?

Isn’t the title deeds and First Legal are being safekept by the Trustee.?

Or there is in actual fact…NO trustee at all.?

You may enlighten us all….

Of course we dont have legal title, why would we? A bank doesnt have legal title to your house when it lends a mortgage.You confuse title with security.The ownership of the property is supposed to be in a separate spv for each property, the loan notes were then supposed to be secured on it with a first charge.

Remember that once the property is developed or sold the charge is released and the funds were then sent back to the solicitors ready for the next purchase.

It is , of course possible that there is not enough security to go round but this should not be the case…we wont know until we get details of that security….or even if it exists at all.

Such speculation is counter productive, of no benefit to anyone and not helpful in any way ,shape ,or form….unless you want to scare lenders into forking out a fortune in legal fees ….when there may be no need to.

Perhaps deliberately, but not necessarily fraudulently, Dolphin are sorting everything out ( admittedly somewhat belatedly) so they can go to lenders with a coherent plan which ensures no one loses out. It will certainly be quicker for them to do this than a bunch of ambulance chasing lawyers.

I do know that a southeast asian institution purchased over 20 properties which Dolphin are converting on their behalf so this is a substantial company even if its communications are totally lacking.

I think we need to go right back to the beginning – square one. This was always a high-risk, illiquid strategy/fund. And, naturally, it attracted the very worst of financial services – the scammers (like xxxx xxxx and the Trafalgar Multi-Asset Fund which bought a shed load of Dolphin loan notes) and other introducers who were only chasing the fat the commissions. These scammers were, of course, perfectly ready and willing to put their “clients” funds at risk and tell a load of lies about how great Dolphin was. And, for a while, it was great. Lenders did get their returns: high returns for a high risk. But the bigger Dolphin got, the riskier it got. And, eventually, the thing that always happens to high risk funds happened: it collapsed. With these types of investment scams, the early investors can be lucky. It is the later ones who pay the price and get shafted.

Mark,

You highlighted…”a southeast asian institution purchased over 20 properties which Dolphin are converting on their behalf”…. i think you likely are referring to Korean Shinhan Investment, which I read were “stuck” just like numerous investors and may lost multi millions swimming with dolphins..

I love: “swimming with dolphins”! Title for a new blog perhaps?

Ok Mark, full disclosure: I am NOT an ambulance chasing lawyer, Nor do I know anyone high up in Dolphin Trust.

But I see a very angry victim of a smooth-talking liar who owes him and many of you lots of money. A liar who continues to make all kinds of excuses for why he has defaulted on some of you, I noted for over 20 months, to-date!

Of course DT (I meant Dolphin Trust, not the American Chosen One) will tell you not to stir shit, saying that will work against your interests. Now some of you may want to believe that Flipper is sincere and want to make things right because it is led by an honourable man with atrocious management skills.

Then there are some of you who think his behaviour and his many stories can’t hold water.

Is Dolphin Trust a failed business as he would have you believe or is it something more sinister? I agree with Angie and many of you here who are getting increasingly concerned about the numbers of victims coming forth with similar defaults of varying lengths and the enormous collective sums of your money that are facing serious risks of disappearing into ether.

So I therefore reject this paragraph completely

“…. Such speculation is counter productive, of no benefit to anyone and not helpful in any way ,shape ,or form….unless you want to scare lenders into forking out a fortune in legal fees ….when there may be no need to….”

with NO disrespect to you because you are ALL in the same sinking boat!

Clutching at straws will not help at all and I think deep down, most of you know this. Best of luck.

Sincerely

TerryM

Terry, what all these scams have in common is that the investors/victims keep hoping that somehow a magic fairy will come along and it will be alright. That despite all the overwhelming evidence – and the cries of “speculation is counter productive and unhelpful – don’t rock the boat or you won’t get your money back” the scheme will get back on track and they will get their money back. Anger and determination to take decisive action to recover the funds at risk tend to get tempered by that little spark of hope that at the end of the day they won’t lose out. This is entirely natural and is part of human nature and an understandable human trait: optimism. The reality is that there will be losses – this is mathematically inevitable. And those who are first to take firm action will be those most likely to get some of their money back.

I came across this blog purely by accident when I was researching real Dolphins that can do tricks but since I’m a retired professional who loved Perry Mason, I might be able to offer an obvious observation.

I presume the Trustee’s job is to look out for your interest. Examine your contract for the details of that part of the agreement. Now ask yourself whether you were informed by your Trustee as soon as there was a breach of the payment due date and the immediate risk to your capital being returned. If not you should worry.

Or maybe, the inclusion of a Trustee inside your agreement was just a “feel good” marketing ploy. Some scammers have been known to use one-man show Trustees whose only duty is to lend credibility.

Believe it or not, their alter ego is Dr Kildare. The nominated Trustee should know the details.

If you tell us his name and show us that part of the Trustee Agreement, we have some legal minds here who might be able to help.

Hi Terry, many thanks for your kind thoughts and inspiration. Now to have a different “take” on this problem. Generally speaking, a trustee is only ever involved (normally) when the funds are in a pension. This might, therefore, be a SIPPS or a QROPS, or possibly an occupational scheme. A professional trustee – such as STM (Gibraltar) should observe basic rules of fiduciary duty towards the pension scheme members and make sure that the advisers are properly regulated and qualified, and that the investments are suitable. Of course, that never happens!

Hi Terry,

Thank you for your comment and advice… and yes I am referring to the First Charge or Legal Charge document instead of the Title Deed. Our contract stated that the Land Charge Deed (executed by tge SPV with a Notary) and the Assignment Deed (assigning the Land Charge to the investor executed by the SPV with Germany Notary) are safekeeping bt the trustee – GC Trust GmbH at Amtsgericht Hannover HRB 213910 – as the beneficiary’s representative. The MD’s name stated is Stefan Kaatz. In fact, I have email to him before, asking where are our deeds and First Charge documents but there was no reply. Thats why we are very worried and since have sending numerous emails to Charles and the useless CR email and have been trying ways and means to recover our monies, until they came up with an installment plan which is totally absurd and unacceptable as there isnt any guarantee or security clause protecting investors stating they will pay each and every installments.! Without such security or protection clause, they can drag us for years….

Actually, reading all these emails – and with the benefit of 20/20 hindsight – this was just one big scam from the outset. Had it remained just a speculative “investment” (loan) for the few adventurous, sophisticated investors who genuinely woke up one morning and thought: “you know what – my ambition this year is to lend some money to a German property developer who specialises in renovating derelict government buildings”, then it would have remained a small, specialist venture for the adventurous few with money they could happily afford to risk. But the armies of scammers who were paid 25% commission made this succeed spectacularly – and in the process of earning these huge commissions Dolphin exploded far beyond the small, semi-legit enterprise it was set up to be. Ponzi schemes can succeed, providing there is a steady (and never-ending) stream of investors/lenders. And provided it never grows too big too quickly, they can continue for a long time without ruining anybody – except the last unlucky few. But the more a Ponzi scheme expands, the greater the risk of it collapsing. And this is exactly what has happened.

GC TRUST GmbH : EUR 25,000 paid-up capital, founded 21 Apr 2016, probably around the time your contract was signed. The age of this Trustee doesn’t exactly inspire confidence but maybe they have other virtues that appeal to Dolphin. Here are the links …

https://www.webvalid.de/company/GC+Trust+GmbH,+Laatzen/HRB+213910

https://www.northdata.de/GC+Trust+GmbH,+Laatzen/Amtsgericht+Hannover+HRB+213910

Bet you lot are glad you didn’t invest in Woodford, he cant pay his debts either and at this rate, he wont be able to give anyone cash back anytime soon.Dont see anyone crying Ponzi at him tho.

I think the ambulance chasers should be employed in that direction, nice easy, regulated target …. oh , and with almost exactly the same liquidity problems as Dolphin.,..strange that.

Mark, I agree with you wholeheartedly. In principle there is no difference. The elephant in the room is that neither Woodford nor Dolphin disclosed what the underlying investments were. We are hearing a lot about Woodford “rebalancing” the investments and veering towards less risky equities. But if investors had known what the investments were in the first place, people could have made an educated and informed decision about whether to invest. It is, of course, good that this is an FCA-regulated firm as opposed to an unregulated German firm. But I still think there are going to be some sticking points with Woodford – and some investors are going to catch a nasty cold. But the interesting parallel here is that in the case of Dolphin, those who promoted it as an “investment” scheme were a bunch of spivs and scammers – out and out criminals setting deliberately to defraud their “clients” and line their own pockets. But in the case of Woodford, the principal promoter was Hargreaves Lansdown. So, basically, a wolf in sheep’s clothing. The effect is the same: investors losing their money.

Do you really believe this is a scam and investors have lost all their money. I’m getting very concerned and apart from this thread I am nort.sure what to do.

Dear Jay, if Raymond Burr was here, he would say:

——————————————————-

If you look carefully in your contracts you will probably note that it is nothing more than a loan note, a money lending document which says you will be paid some income on periodic intervals and capital at maturity.

There would be no direct link of your money to any specific named asset. In some Singapore cases, Dolphin named properties that they do not own and have never own and could never own… like Badener Platz.

Dolphin literally said “Lend me your money because you believe in me and my type of very profitable (because I say so) business and I will pay you back (because I say so) generous interests and return your capital infull at maturity. Trust me. Would I lie to you?”

Now if your money is not linked to a specific property and you tend not to ask too many questions, you are like the ideal money lending institution that Dolphin is looking for. Because traditional banks whose lending rates are soooo much lower are damn Pesky and ask too many unnecessary unwelcome silly questions and insist on collateral which Dolphin would rather not give.

Being able to borrow unlimited amounts of money from strangers without needing to provide tangible collateral, other than “trust me, trust me” documents is a very tempting proposition for people who can tell lies with a smile.

So you can ask … Are you dealing with Dolphin Trust? Or as someone once said……….. Dolphin-(Can We)-Trust? When a company fails, it’s the company’s fault. It’s just business, nothing personal. And that’s the way it has been designed… just in case it fails.

No it is not a scam.It is an example of a company which has grown to quickly, got out of its depth, had some bad luck and now is struggling to meet its commitments. Angie is right that it has had some poor promoters but they are not all like that nor are all the investors likely to lose all their investments from what I hear. However, it is going to take a little time for the situation to become clear and for a way forward to be found. Im sure it will involve a degree of flexibility on the part of investors such as those that have posted from Singapore and may be repaid over 12 months. I know this is linked to an expected cashflow stream from developments that are sold or anticipated to be sold….hence the staggered cashflow. I cannot see how those people can achieve a better deal by taking the matter to lawyers…unless Dolphin fail to do what they have said.

I fully expect to be asked to extend my loans beyond the 5 year date,provided there is some interest compensation and proof of security (which is promised tho not yet to hand) then I will be fairly relaxed about this as I would have been looking to reinvest anyway as I believe in the business model and think it is a sound investment. Ive spent all my life in property and know how difficult it can be at times when cash is tight.

There is nothing to suggest that there are not adequate assets… Dolphin should do more to prove this to investors but it doesn’t mean that they dont exist.This is a liquidity issue faced by all businesses from time to time….even banks themselves are probably not able to hand all the cash back deposited by savers in one go….remember the crisis of 2008? This was exactly the problem.

Remember that the German property market has enjoyed substantial increase over the last few years whilst Dolphin has held these properties, also the loan notes are largely denominated in sterling which has depreciated close to 20% against the euro since the Brexit vote….this has reduced both the interest cost and the capital debt considerably making it more likely that equity is available ( albeit cash is scarce)…on several £100 million of debt this is a big saving.

Its a shame that Dolphin got involved with some promoters, particularly in they earlier days but they didn’t know how else to raise funds,and it also looks like they should never have issued loan notes in small amounts ( sub 50-100k) as thoise investors may not truly qualify for the ” sophisticated “. investor definition and consequently may have a greater need for their cash back on time…but we are where we are.

I fully accept that their customer communications are poor but I also know that they are restricted in what they can say and do because of the different types of investor that they have and red tape involved when dealing with pension trustees as opposed to individual cash investors.

Just be patient and I reckon all will become clear in the next few months and , with luck, no one need lose anything or pay for expensive legal advice which will prove unnecessary.

Just my humble opinion… but based on some serious conversations with some people very close to the heart of the organisation.

Two very interesting perspectives – opposing ones – from Terry and Mark. I would say that in their own way, they are both right. To a degree. I too would be tempted to say this was not a scam – were it not for the way that Dolphin is dealing with things. An honest and honourable company would come right out and admit their mistakes; immediately publish independent audited accounts and a detailed cashflow; they would respond to all lender queries promptly and transparently; they would disclose which of the “introducers” were fraudulently palming off loans as “investments” to large numbers of low-risk victims (especially those in pensions); they would make a very public statement about what went wrong and exactly how they plan to put things right. But they haven’t. And they won’t. I wish Mark were right: that sitting sit and quietly would be the best plan and that trusting Dolphin to do the right thing would come good. Eventually. But history tells us that this is not likely to happen. This has all the hallmarks of a scam and all the classic warning signs of a “fund” (investment/loan scheme) that is on the brink of collapse. And, sadly, history also tells us that those behind the scam will rinse out every last drop of liquidity and then do a runner. Call me a cynic if you like – I would love to be proved wrong, but doubt that I will be.

I consulted my brother, Barry who is a real estate Developer/Consultant about this Dolphin Trust thingy and here are his comments, copied and pasted from his email.

———————————————————-

Dear Terry,

What kind of crap have you got yourself mixed up in now? Can you just grow old graciously like any other 72-year old and not squander your inheritance on stupid things?

I had a look at that company you asked about, Dolphin Trust and its business model. Please refer to this YouTube clip (https://youtu.be/DJM1s7hv2R0) and let us hear it from the horse then try to make sense of what pours out from his mouth.

That fellow says that he raises funds (eg, EUR 1million) from investors (more like lenders) to buy delapidated properties in major cities of former East Germany and renovates them for resale as finished apartments to German buyers at 5X his acquisition cost.

And claims that as soon he finds an end buyer for the apartment unit, he would be able to access 30% of the sale price of the apt (supposedly EUR 5million) from the bank. And this 30% which is EUR 1.5 million should easily cover the original sum of 1 million IMMEDIATELY (meaning I assume, a very quick return)

Here are the obvious flaws in that marketing spiel:

(1) After paying off commissions to IFA’s and salesmen and hotel dinners, function room rentals, etc he would have been left with maybe EUR 700K to buy a run down property. Based on what the horse said, he would sell the finished apartment at about 7 times the acquisition cost. That is either a lot of money spent on renovation or an impossibly high profit margin.

Now any intelligent real estate professional will tell you the value of any property, particularly in prime districts, is mainly in the land. Whatever the initial dump had cost, it cannot be lower than a neighbouring piece of cleared land. The German Govt may be generous with special tax breaks but they are not stupid.

The end buyers may be willing to pay a slight premium for those special tax benefits but the price is still governed by the real market and competing neighbouring houses.

Notwithstanding that, Dolphin has no special advantage in this field as she appears to subcontract ALL the work, including the sourcing of funds.

This effectively negates that impression that the business model is so profitable that it can afford business loans of double digit interest rates, sky high agent commissions and still have enough left over to live like a king.

(2) The initial 30% disbursement from the bank was probably a progress payment, meant to cover construction costs. When the horse pays EUR 1million to the original lenders, he’s not left with much to buy materials needed for the renovation.

In addition, you need a reasonable number of apartments to be renovated at the same time so that you have economy of scale (another essential bit of knowledge required of a real estate developer).

How the Hell do you manage to get that many individual buyers of your proposed apartments at around the same time in order to access their bank’s money? As everyone knows, buyers can be as fickle as the weather.

(3) I hear there was talk of delays that was beyond the control of the developer (ie, the usual “it’s somebody else’s fault” excuse) Yes, I can confirm Developers use this excuse ALL the time but normal sale contracts have a very expensive penalty clause built-in for delays.

A genuine developer will gladly pay to move the Earth along quickly cos time is really money in this business. Unless of course he has misplaced his money.

I don’t think I need to go on. If you put any money into this harebrain venture, we will disown you.

But seriously, my professional advice: AVOID THIS! IT SMELLS LIKE A DEAD FISH!

Take care old man,

Your Younger BUT Smarter Brother,

Barry.

well there you have it, scam or not, take action or not, your choice….just like when you decided to invest…………….

So we are right back where we start: risk. A bit like gambling! Personally, I think the less risky option is to take action.

Also, they are now claiming that they are in process of finding and talking to potential buyers for the property which we have invested in Brandenburg kirchmöser, as they claimed they would prefer to sell it off undevelop to repay investors rather than the original plan to redevelop then sell it as it will take even a much longer time frame (which theu have been, for many months blame on the property market and the difficulties in finding skill workers). We do not know whether this is true or false and we are looking for ways and means to find out…

Angie thats your perogative but Im not sure its the less risky necessarily…it also definitely incurs some more cost to start.

If it were a scam why would they employ a communications director and team?

They are not taking in any new funds for the time being so ( they say) they cant be accused of paying for old debt with new money….even tho thats what company’s banks and countries do all the time.

Why are they going to the trouble of ” pretending ” to try and sort the situation out when they should be riding off into the sunset with their ill gotten gains?

As an aside, when I sold my business 15 years ago the deal was done in March but it took till December to complete and a further 4 years to get all the cash………..they were late paying off the last loans and I had security ( of sorts)….maybe not in Dolphin’s case here and now but patience paid off then and it still might.

It is all about risk, you cant expect to double your money in 5 years without a reasonable amount of it….you want no risk?…. pay the german government for the privelige of you lending it money.

As highlighted before, our contract was due in Dec 2018 – DolphinTrust/German Property Group and/or Charles Smethurst had failed to repay us in Dec 2018, and they had failed to repay us in Feb 2019 (which they had claimed they would in their earlier letter to us). Then they “disppeared” and ignored all emails sent to them from Feb2019 to May2019. Then on late May, they claimed they can repay us in full on Aug 2019 but again, they had failed to repay! Then on 28 June 2019 they sent us their repayment plan by 11 installments BuT will only start on Jan2020 and in absurdly erractic percentages every month instead of equal percentages, and they withhold nearly 44% of our capital repayment till the Last installment.!

We have email them many many times stating their installment repayment plan is totally unreasonable and unacceptable but were all ignored, and after we stated on our email that we will take class action against them (and we will), their only reply was trying to say – we are unable to do anything else.! All they had done was extremely bad and believe they will eventually get their retribution one day.

Most importantly, their installment repayment plan did not have any clause on guarantee, security or protection that thy will fuifill each and every of the 11 installments. Without such clause in place, they can drag and delay our repayments whenever they have cashflow issues of which we had experience since Dec 2018.!

Sorting out Security documents were mentioned on 28 June 2019 but since then and its now coming to Sept 2019, there is not a single sound from them.

Our contract stated that there is a Land Charge Deed (executed by the SPV with a Notary) and the Assignment Deed (assigning the Land Charge to the investor executed by the SPV with Germany Notary) and a Safekeeping mandate between the Spv, the investor (represented by trustee, GC Trust GmbH) and the Notary holding the Land Charge Deed and Assignment Deed. Till today, we have Not receive any of these documents. We email to GC Trust asking he whereabout these documents but they did not reply.

We need to find a way to find out whether our capital invested is indeed secure by a First Charge (as stated in our contract) against the specific property which we have invested, and where is this damn document, and how and when can we get a copy.

What is your proposed plan when you have taken this project from Dolphin then? You fancy living in Brandenburg??

Like all others, we are investors, we do not take over their project and do not at all thinking abt living in Brandenburg.

Dolphin Trust/German Property Group and/or Charles Smethurst and Mike Boyle are claiming that they are in process of finding and talking to potential buyers for the property in Brandenburg kirchmöser, because they claimed they would rather sell it undevelop to repay investors rather than their original plan to redevelop then sell it as it will take even a much longer time frame. We need to find out whether this is true or false.

They claimed they are in process of sorting out Security documents since 28 June 2019 but its now coming to Sept 2019, and there is not a sound from them about it.

We need to find out whether our investment is indeed secure by a First Charge (as stated in our contract) against the property in Brandenburg, and where is this damn document, and how and when can we can get a copy.

Thank you, Angie and Terry and Terry’s brother. Barry raised some thought provoking points about Dolphin Trust’s business model.

Quite often, in investment schemes like these that offer to pay very high returns, relative to what a normal savings account would offer, blind us from asking deep questions about the business model that can purportedly generate those returns, safely.

I have seen so many successful cons who tell you that your capital is safe because it is always protected … by:

(1) a capital protection insurance

(2) Insurance underwritten by Lloyd’s

(3) performance bonds

(4) an asset-backed guarantee

(5) money kept in an escrow account

(6) a Trustee overlooking your interests

(7) or any number of such type of feel-good masks

Invariably they gloss over details of how their businesses can generate those types of impossible returns in a competitive market. Realistically, what kind of business can afford to pay introducers commissions upwards of 25%?

Note that investors are paid many times higher than traditional sources of funds. Even Mark acknowledged that banks are begging you to borrow money from them at rock bottom rates yet these companies prefer to borrow at much higher interest from you, the lucky lender. It just doesn’t make sense.