Another high-risk investment fund goes belly up. London Capital & Finance (LCF) has gone into administration, not long after taking a whopping £236m of investments – much of which was from first-time investors. It is thought that 12,000 investors have been financially ruined.

Another high-risk investment fund goes belly up. London Capital & Finance (LCF) has gone into administration, not long after taking a whopping £236m of investments – much of which was from first-time investors. It is thought that 12,000 investors have been financially ruined.

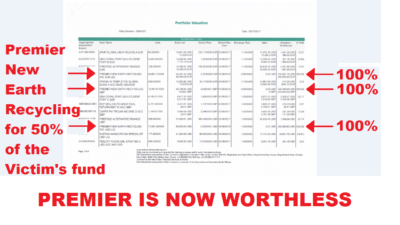

This tragic news comes as plans are being drawn up to take recovery action for the victims of three other failed funds: Axiom with £120m worth of investors’ funds (£30m of which was with life offices FPI and OMI); LM £456m (£90m with FPI and OMI); and Premier New Earth £207m (£62m with FPI and OMI).

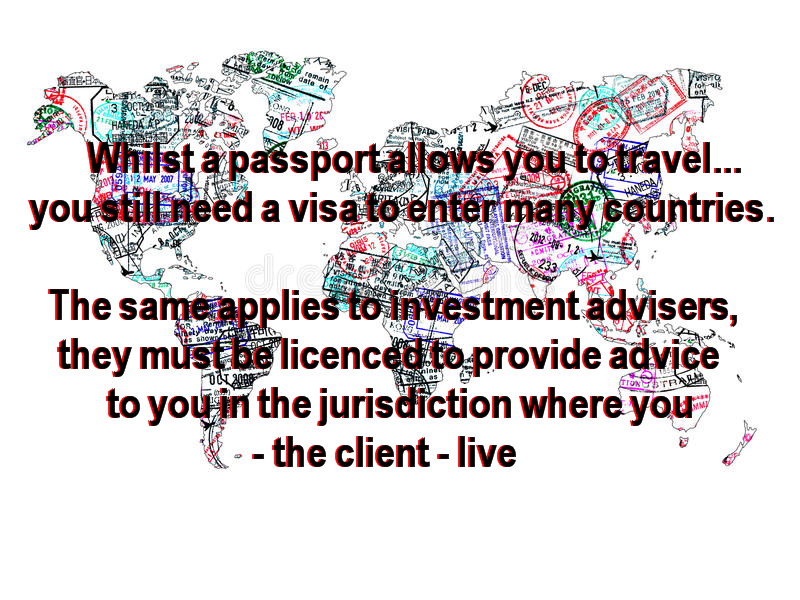

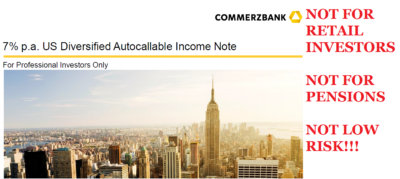

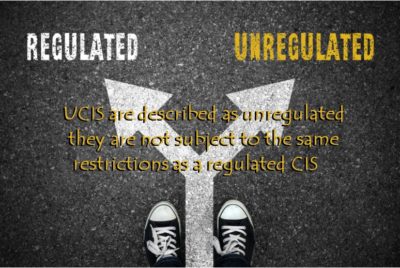

With so many millions having been lost between LCF, Axiom, LM and NERR – well over one billion pounds – this does beg the question as to when regulators are going to take some effective action to restrict the promotion of such funds to retail investors. Because, without the active and highly-efficient marketing machine which operates so successfully in so many jurisdictions, these no-hoper funds would never get off the ground. But, of course, they pay fat commissions to the introducers and brokers who peddle them. So, obviously, exposing naive-investor clients to high-risk funds was very profitable.

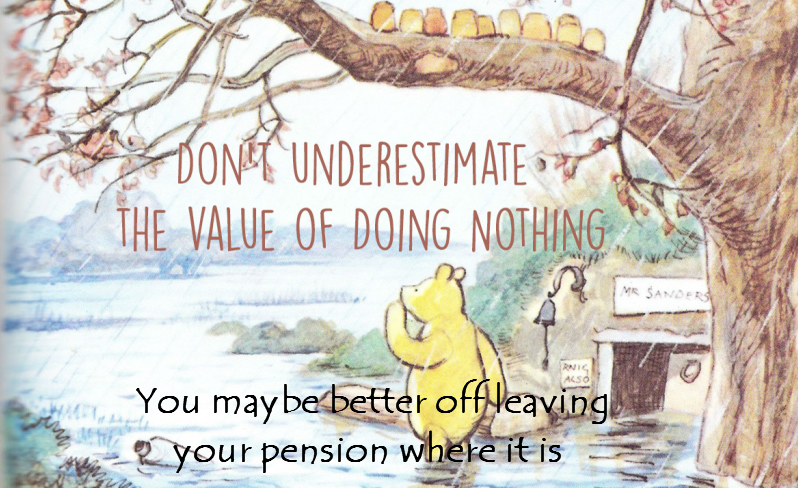

This also begs the question as to why the success of such dreadful funds continues to flourish – and why trustees and life offices continue to offer/accept them. Certainly, life offices have a great deal to answer for when it comes to doing due diligence on start-up funds with no decent provenance or evidence that they have even the tiniest chance of succeeding.

The London Capital & Finance investment bond was touted as a “Fixed-Rate ISA”, with promises of 8% returns over a fixed term of three years. BBC News reported on the collapse and stated that “Administrators said investors could get as little as 20% of their money back.” Read the full report.

What is interesting in this case, is that the promoters – a Brighton-based firm called Surge PLC – are the same marketing firm that Blackmore Global used to promote their very expensive Blackmore Global Bond. Another high-risk and expensive investment bond, that up until recently failed to be transparent about the costs involved in the investment.

It is thought that LCF paid Surge PLC some £60m to run their marketing campaign, which amounts to a commission of about 25%! Surge ran a series of marketing campaigns comparing the bonds from LCF to high-street bonds, promising consumers an 8% return. Comparison websites put LCF at the top of the retail market for bond investments and did not highlight the high risk of the bond.

These ads were pulled by the FCA, due to LCF being regulated and authorised to provide consumer financial advice ONLY. They were not regulated for the sale of bonds or ISAs. It has also been found that the comparison websites were not independent, but rather had a connection to Surge PLC and are also owned by Paul Careless – we have mentioned Paul Careless in other blogs: he is the Director of Surge PLC and seems to be one of the only parties involved in these high-risk investments to be making any profits!

These ads were pulled by the FCA, due to LCF being regulated and authorised to provide consumer financial advice ONLY. They were not regulated for the sale of bonds or ISAs. It has also been found that the comparison websites were not independent, but rather had a connection to Surge PLC and are also owned by Paul Careless – we have mentioned Paul Careless in other blogs: he is the Director of Surge PLC and seems to be one of the only parties involved in these high-risk investments to be making any profits!

As with so many high-risk unregulated investments like this, the age-old question is, “Where did the money invested into LCF´s bond go?”

We know that LCF paid Surge that huge commission fee, and this then meant returns of up to 44% would be required in order for LCF to make good on its promises. Even in a great investment, this is an unbelievably high return and totally unrealistic.

Once the investments had been completed, the money was then ‘loaned’ out to twelve other companies, and some of these companies then sub-loaned the money. There are concerns that the companies who received these ‘loans’ have a connection to the directors of London Capital & Finance. Many of the firms were very new and four of them have never filed any accounts!

Michael Andrew Thomson, known as Andy Thomson, took over as the boss of LCF in 2015 and is also director of horse riding company GT Eventing. He and Careless are under investigation over the mis-selling of this bond and their connection to the other companies invested in. However, Careless claims he has only carried out marketing practices that were requested of him and his 25% commission fee is in line with market averages.

Michael Andrew Thomson, known as Andy Thomson, took over as the boss of LCF in 2015 and is also director of horse riding company GT Eventing. He and Careless are under investigation over the mis-selling of this bond and their connection to the other companies invested in. However, Careless claims he has only carried out marketing practices that were requested of him and his 25% commission fee is in line with market averages.

BBC News spoke to Neil Liversidge – an IFA who came across the scheme back in 2015 and consequently wrote to the FCA to warn them about the connections and possible mis-selling of the investment.

Mr Liversidge said: “The way it was promoted, a great many people could have fallen for this. A client brought it to us, but when we looked into it there was a lot of interconnection between the people they were lending to and the management of LCF themselves. We warned our clients off and the same day we wrote to the regulator raising our concerns about the promotion.”

Mr Liversidge, of course, was proved to be absolutely right. But, u nfortunately, it took the FCA a further three years to shut the bond down, which ended up with 11,605 victims investing £236m in LCF’s bond. Investigations show that recovery is likely to be as low as 20% of the initial investments made.

nfortunately, it took the FCA a further three years to shut the bond down, which ended up with 11,605 victims investing £236m in LCF’s bond. Investigations show that recovery is likely to be as low as 20% of the initial investments made.

Whilst the investigation goes forward, there have been no promises of compensation from the Financial Services Compensation Scheme (FSCS).

BBC News reported:

“The FCA findings included that LCF’s bonds did not qualify to be held in an ISA account and therefore investors were being misled by being told the interest they earned would be tax free.

The FCA said it was “unlikely” investors of London City & Finance would be protected under the Financial Services Compensation Scheme (FSCS) but it was “for the FSCS to determine”.”

Yet again we see unregulated investments being mis-marketed, to innocent retail investors – and the high risks being masked by promises of high returns. With high commissions – also masked – lining the pockets of the introducers, these toxic investments only make those who receive the commissions any profit. The victims, again and again, lose their hard-earned savings and there is little that they can do to recover them without expensive litigation.

For more on this story listen to BBC Moneybox by clicking here.

The work of the air industry regulators, investigators and safety trainers never ceases with all parties constantly striving to maintain the highest possible standards of performance and safety. And when something goes wrong, everybody swings into action like the A-team, International Rescue and Tom Cruise combined.

The work of the air industry regulators, investigators and safety trainers never ceases with all parties constantly striving to maintain the highest possible standards of performance and safety. And when something goes wrong, everybody swings into action like the A-team, International Rescue and Tom Cruise combined. But Vueling provide people like me (who end up wearing the same orange jumper and purple socks two days in a row) with an easy to use, online complaints and redress facility. It wasn’t Vueling’s fault that my luggage got lost, but they take responsibility for it anyway because it is part of the whole flight “package”.

But Vueling provide people like me (who end up wearing the same orange jumper and purple socks two days in a row) with an easy to use, online complaints and redress facility. It wasn’t Vueling’s fault that my luggage got lost, but they take responsibility for it anyway because it is part of the whole flight “package”.

If I give my car keys to someone who is so drunk they can barely stand up – and certainly can’t spell either OMI or IOM – and there is a serious accident, whose fault is it? The drunk’s or mine?

If I give my car keys to someone who is so drunk they can barely stand up – and certainly can’t spell either OMI or IOM – and there is a serious accident, whose fault is it? The drunk’s or mine?