Can Blacktower Spain fare any better than other companies we have looked into? How many of their advisers will come out qualified and registered?

If you have been following Pension Life´s blogs you will know that we have been conducting a series of investigations into qualified and registered financial advisers in various firms. Today is Blacktower Spain – qualified and registered?

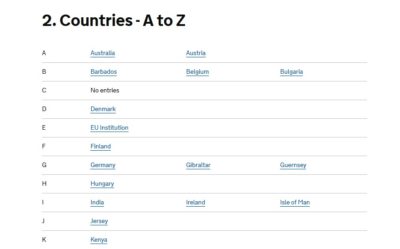

IFAs and their clients are invited to add to it, correct it, improve it. Here’s a link to the two registers if you want to double check:

http://www.cii.co.uk/web/app/membersearch/MemberSearch.aspx

https://www.cisi.org/cisiweb2/cisi-website/join-us/cisi-member-directory

Please note that this data is correct as of 9am 25/06/2018

edit: we have been informed that there is a third website we can check for qualifications, so this page is in the process of editing whilst we see if any names appear on the libf members website. 02/07/2018

https://www.libf.ac.uk/members-and-alumni/sps-and-cpd-register

Blacktower has several offices in Spain – so let’s see which one is the best.

Blacktower Spain – Barcelona

Andy Clelland – International Financial Adviser – not on either CII OR CISI register despite a long list of qualifications – not on libf.ac.uk

Francisco Mahfuz – Regional Manager Barcelona – Claims CII and CISI but does NOT appear on either register – not on libf.ac.uk

David Marks – International Financial Adviser – Claims CII – a Mr David Alan Marks DipPFS appears on the CII register. Also Claims CISI but not on the register – not on libf.ac.uk

Bernhard Rufli – International Financial Adviser – again a long list of qualifications claimed but alas NOT ON EITHER CII OR CISI REGISTER!– not on libf.ac.uk

Glenn Stroud – International Financial Adviser – CII registered – not on libf.ac.uk

Barcelona 1 out of 5!

No extra points using the libf register

*************************************

Black Tower Spain – Costa Calida

Keith Littlewood – Regional Manager – Claims a good list of qualifications – does not appear on either register – not on libf.ac.uk

Paul Price – International Financial Adviser – A Paul Anthony Price DipPFS does appear on the CII register – but it says he is based in Chelmsford – not on libf.ac.uk

A possible 1 out of 2 – but only possibly!

No extra points using the libf register

************************************

Blacktower Spain Costa Del Sol

Kenneth Baek – International Financial Adviser – Not on either register – not on libf.ac.uk

Richard Black – International Financial Adviser – claims the title FPC – but does not appear on any register – not on libf.ac.uk

Tim Govaerts – Associate Director – States he IS a CII member but he ISN´T registered

Patrick Macdonald – International Financial Adviser – claims to be a member of both – DOES NOT appear on either register – not on libf.ac.uk EDIT: Patrick Macdonald is now listed on the CISI membership website.

Richard Mills – International Financial Adviser – claims qualifications in CII and CISI – but does not appear on either register – not on libf.ac.uk

Jose Olabarrieta – International Financial Adviser – Not on either register – not on libf.ac.uk

Chris Pickering – International Financial Adviser – He states he is CISI qualified but he IS NOT on the register – not on libf.ac.uk

Craig Webb – International Financial Adviser – No claim to qualifications and not on either register – not on libf.ac.uk

Ian Scholes – International Financial Adviser – Lists that he is CII and he IS CII registered – not on libf.ac.uk

Quentin Sellar – International Financial Adviser – Boast a whole host of qualifications and he IS on the CII register – not on libf.ac.uk

Well done Sellar and Scholes

2 out of 10 for the Costa Del Sol!

No extra points using the libf register

************************************

Blacktower Spain Costa Blanca

Christina Brady – Associate Director – Claims two qualifications in CISI but does not appear on the register – not on libf.ac.uk

Wayne Martin – International Financial Adviser – Claims to be a member of both CII and CISI but only appears on the CII register – not on libf.ac.uk

Dave Diggle – International Financial Adviser – states his expertise is QROPS but he doesn´t appear on either register – not on libf.ac.uk

Richard Samuels – International Financial Adviser – his areas of expertise are Pension Planning/Transfers but he IS NOT on either register – not on libf.ac.uk

Graham Dixon – International Financial Adviser – IS CII registered! – not on libf.ac.uk

Andrew Gibson DipIP – International Financial Adviser – IS CII registered! – not on libf.ac.uk

2 out of 6 for the Costa Blanca team!

No extra points using the libf register

************************************

Gibraltar Head office

John Westwood – Group Managing Director – IS CII registered

Robert Mancera – Director and General Manager – IS CII registered

Ally Kerr – Group Director – Claims CII but DOES NOT appear on the register

Patricia Risso – Non-Executive Director – No claims and not listed on either register

Paul Rhodes – Associate Director – a Mr Paul John Rhodes Lakin ACII is listed on the CII register – could this be him?

Paul Howard – International Financial Adviser – Many Paul Howards are listed on the CII register – let’s hope one of them is him!

2 out of 6 definitely with a possible 4 out of 6 – not bad Gibraltar! You definitely come out as top office of Blacktower Spain – qualified and registered?

No extra points using the libf register

************************************

edit: despite the libf register NONE of the Blacktower Spain team appear on it, this means the original score sticks.

7 out of 29 qualified and registered in the Blacktower Spain office – 75% unqualified and unregistered!

Pretty poor result Blacktower.

Winky accused me of bombarding him with emails (about the Capita Oak scam). I counted them: 16 over an 8-week period. My calculator said that was approximately two per week.

Winky accused me of bombarding him with emails (about the Capita Oak scam). I counted them: 16 over an 8-week period. My calculator said that was approximately two per week.

I had to spell out some words several times as the man’s English seemed to get worse as the agonisingly painful conversation dragged on and on. When I had finished, exhausted and wondering if this was all a bad dream, the man said “OK, hand your documents into the post room”. We duly dropped the bulging envelope into the tiny little room just outside the entrance to the FCA building. I assume it was all shredded as we never even got an acknowledgement.

I had to spell out some words several times as the man’s English seemed to get worse as the agonisingly painful conversation dragged on and on. When I had finished, exhausted and wondering if this was all a bad dream, the man said “OK, hand your documents into the post room”. We duly dropped the bulging envelope into the tiny little room just outside the entrance to the FCA building. I assume it was all shredded as we never even got an acknowledgement.

Kenny told International Adviser:

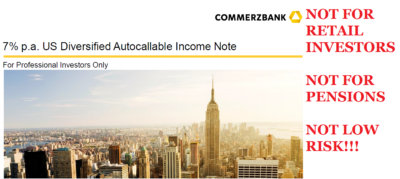

Kenny told International Adviser: Here at Pension Life, we do hope that even trainees at OMI are aware that pension fund members are retail investors and should be placed into low to medium risk, liquid investments. However, it seems that these details obviously don´t feature in OMI´s training manual.

Here at Pension Life, we do hope that even trainees at OMI are aware that pension fund members are retail investors and should be placed into low to medium risk, liquid investments. However, it seems that these details obviously don´t feature in OMI´s training manual. Regrettably for the investors who were victims of the CWM scammers and OMI, they most definitely did not possess the depth of knowledge required to fully understand the risks. They put their faith in the smartly- dressed scammers. With promises of high returns, the high risk of the investments and high fees to be charged were left unmentioned. OMI were supposed to protect the victims’ interests but failed dismally to lift a finger to help arrest the downward spiral of the funds.

Regrettably for the investors who were victims of the CWM scammers and OMI, they most definitely did not possess the depth of knowledge required to fully understand the risks. They put their faith in the smartly- dressed scammers. With promises of high returns, the high risk of the investments and high fees to be charged were left unmentioned. OMI were supposed to protect the victims’ interests but failed dismally to lift a finger to help arrest the downward spiral of the funds.

THIS SHOULD NEVER HAPPEN

THIS SHOULD NEVER HAPPEN

Two pension liberation scammers have been sentenced to time behind bars AND a recovery of funds after creating an elaborate pension liberation scam, involving around 23 victims and nearly 1 million pounds of pension funds. Successful Pensions sure was unsuccessful for all involved.

Two pension liberation scammers have been sentenced to time behind bars AND a recovery of funds after creating an elaborate pension liberation scam, involving around 23 victims and nearly 1 million pounds of pension funds. Successful Pensions sure was unsuccessful for all involved.

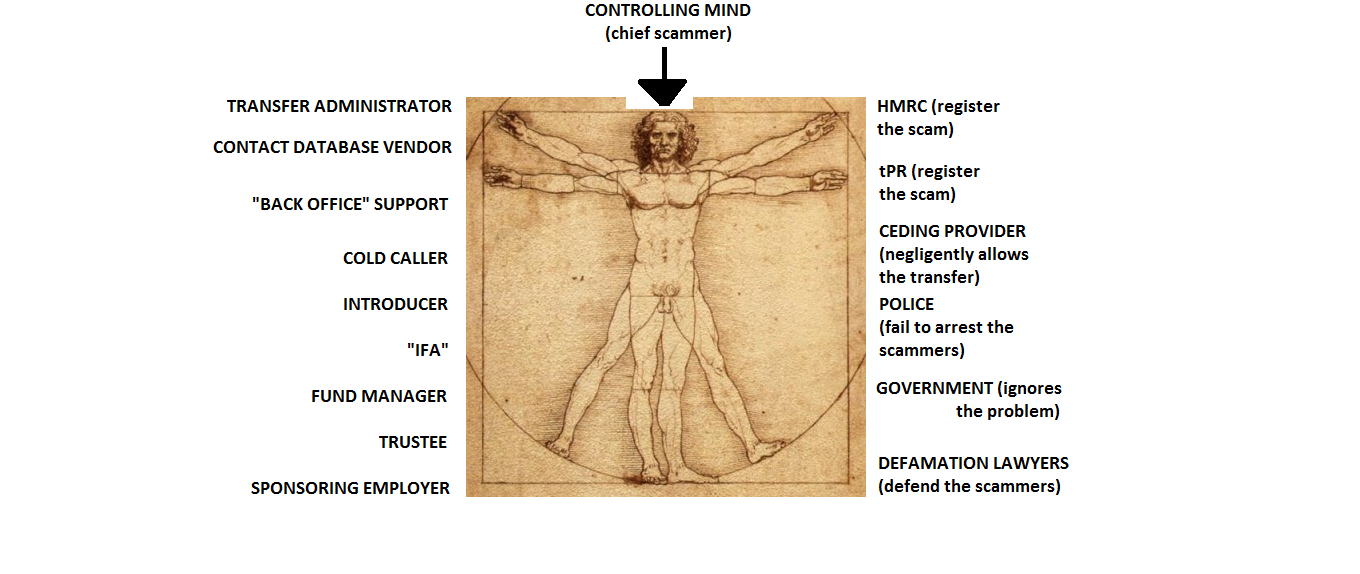

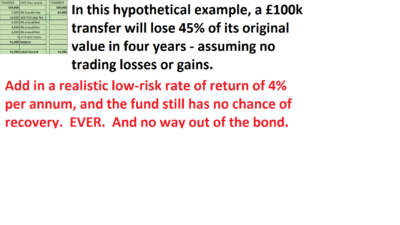

The illustration on the left is based on the

The illustration on the left is based on the

A happy tale for the end of the week… not just one but two firms have been told they must compensate clients for poor advice on SIPPS transfers. A great victory against all firms using SIPPS to disguise their ill-advised pension scams sorry schemes.

A happy tale for the end of the week… not just one but two firms have been told they must compensate clients for poor advice on SIPPS transfers. A great victory against all firms using SIPPS to disguise their ill-advised pension scams sorry schemes.

Mike’s non-pension savings then went through Active Wealth into Dolphin Trust GmbH, which specialises in the development of German-listed buildings and promises 10% returns on investment. He says he was unaware that he was signed up to a fixed term payment (minimum 2 years) and of the associated

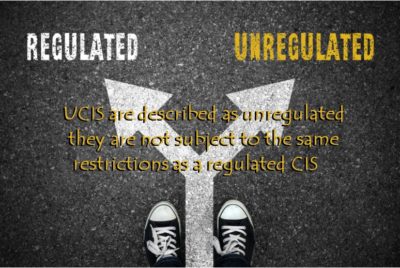

Mike’s non-pension savings then went through Active Wealth into Dolphin Trust GmbH, which specialises in the development of German-listed buildings and promises 10% returns on investment. He says he was unaware that he was signed up to a fixed term payment (minimum 2 years) and of the associated  It all started with a presentation made to British Steel Workers via Celtic Wealth. How on earth are these people were able to make a presentation to innocent victims-to-be for an UNREGULATED investment is beyond me. Especially when Celtic Wealth was not authorised to provide investment advice.

It all started with a presentation made to British Steel Workers via Celtic Wealth. How on earth are these people were able to make a presentation to innocent victims-to-be for an UNREGULATED investment is beyond me. Especially when Celtic Wealth was not authorised to provide investment advice. Transfers into self-invested personal pensions (SIPPS) dominated the

Transfers into self-invested personal pensions (SIPPS) dominated the