Old Mutual International filed a High Court application on 16th March 2018.

Old Mutual International filed a High Court application on 16th March 2018.

On 20.3.18, Old Mutual obtained a judgment in the High Court of Justice of the Isle of Man (Case Reference 18/0012). His Honour The Deemster Doyle, First Deemster and Clerk of the Rolls delivered his determination to OMI’s lawyer, Elizabeth Simpson of Simcocks.

But now Leonteq has been successful in having the proceedings transferred from the IoM to London. This will considerably help Leonteq and hinder OMI.

OMI’s case is that they are the victims of a fraud. Between 2012 and 2016, OMI invested approximately £200,000,000 in structured notes sold by Leonteq. The purchase of these notes was “conducted” on the truthfulness of representations made by Leonteq as to the amount of fees and costs to be deducted from the investments. OMI’s case is that what Leonteq claimed was false and fraudulent. The investments performed poorly as a result of the excessive level of fees. The losses are currently estimated to be well over £20,000,000 (although it is expected that this will increase – especially with the current devasting share price falls due to Covid 19).

OMI’s case is that they are the victims of a fraud. Between 2012 and 2016, OMI invested approximately £200,000,000 in structured notes sold by Leonteq. The purchase of these notes was “conducted” on the truthfulness of representations made by Leonteq as to the amount of fees and costs to be deducted from the investments. OMI’s case is that what Leonteq claimed was false and fraudulent. The investments performed poorly as a result of the excessive level of fees. The losses are currently estimated to be well over £20,000,000 (although it is expected that this will increase – especially with the current devasting share price falls due to Covid 19).

OMI’s case against Leonteq is on the basis of fraudulent misrepresentation, conspiracy, constructive trust, breach of fiduciary duty, knowing receipt, dishonest assistance and unjust enrichment.

Let us look in some detail at the above aspects of the case.

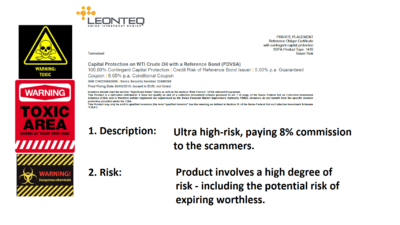

Leonteq Securities has gone from strength to strength since this fraud began – despite the disgrace of this criminal matter. Their net profit in the first half of 2018 was declared as £30.73 million, and turnover £104.31 million – up 36% on the previous year. My first question is: are they still selling ultra high-risk structured notes? My second question is: what was the difference between the “ordinary” notes which paid 6% commission to the scammers, and the fraudulent notes which paid 8% to the scammers. Were the latter 33% more risky? Looking at the victims’ statements, it is impossible to tell the difference between the 6% notes and the 8% ones. There is no obvious higher failure rate – they just all look equally dire.

Leonteq Securities has gone from strength to strength since this fraud began – despite the disgrace of this criminal matter. Their net profit in the first half of 2018 was declared as £30.73 million, and turnover £104.31 million – up 36% on the previous year. My first question is: are they still selling ultra high-risk structured notes? My second question is: what was the difference between the “ordinary” notes which paid 6% commission to the scammers, and the fraudulent notes which paid 8% to the scammers. Were the latter 33% more risky? Looking at the victims’ statements, it is impossible to tell the difference between the 6% notes and the 8% ones. There is no obvious higher failure rate – they just all look equally dire.

Right in the middle of the OMI/Leonteq matter, it was announced in 2014 that two salesmen were going to be added to the London branch: Walter Treur and Anders Stromberg joined on 25/27 June 2014. Treur was ex Commerzbank – another provider of toxic structured notes which also failed dismally and caused catastrophic losses to the Continental Wealth Management’s victims – and Stromberg was ex JP Morgan and Credit Suisse (although he had been unemployed for some time).

Another Leonteq employee, Michael Hartweg, left his job as deputy chief executive to spend all his time flogging the new business of toxic structured notes.

So, it is clear that Leonteq was making a lot of money out of these products. But, the question remains: was Leonteq complicit in fraud – or were they blissfully ignorant and just grateful for the huge profits they were pulling in?

In my humble view, structured notes are like a lot of other products which – if properly sold and used – can, in some cases, be beneficial/useful/enjoyable/harmless, but – if irresponsibly or inappropriately sold – can be deadly. Examples are: tobacco; alcohol; pornography; rat poison; fireworks; painkillers; kitchen knives; peanuts; plastic bags; cannabis.

Structured notes are “FOR PROFESSIONAL INVESTORS ONLY AND NOT FOR RETAIL DISTRIBUTION AND WARN OF DANGER OF LOSING PART OR ALL OF AN INVESTOR’S CAPITAL”.

Structured notes are “FOR PROFESSIONAL INVESTORS ONLY AND NOT FOR RETAIL DISTRIBUTION AND WARN OF DANGER OF LOSING PART OR ALL OF AN INVESTOR’S CAPITAL”.

I wonder which bit of that OMI failed to understand. They bought £200 million quid’s worth of the fraudulent 8% notes – how much of the 6% ones did they buy? We know that a large chunk of these went to the Continental Wealth victims and caused devastating losses. But that was just Leonteq – there was also Commerzbank, Royal Bank of Canada, Nomura and BNP Paribas. And there wasn’t just OMI – there was SEB and Generali doing the same thing.

Let’s be honest, the whole thing was a fraud. In the Continental Wealth Management case, CWM was a fraud; the structured notes were a fraud; the insurance bonds were a fraud; the hidden commissions on everything were a fraud. No party comes out of this with any honour. But, we must also bear in mind that OMI bought £200,000,000 of this toxic, fraudulent crap and allowed it to be used as investments for retail, low-risk pension savers. Additionally, OMI accepted dealing instructions from an unregulated firm which was selling the insurance bonds illegally. But let us not forget that Generali and SEB were just as bad.

Maybe Leonteq and OMI will volunteer to settle without a bloody legal battle – from which only the blood-sucking lawyers will win. The millions that both Leonteq and OMI will be paying over the coming months and years would be better spent on paying redress to the real victims in this disgraceful debacle – the Continental Wealth Management clients who entrusted their life savings to the scammers, the life offices and the structured note providers such as Leonteq – but let’s not forget Commerzbank, Royal Bank of Canada and Nomura.

Here’s the issue. The FCA advises a maximum of 15% of a portfolio be invested in Structured Products (notes used here in this article).

Regulated IFA’s that are experienced in this asset class do 2 things: a) they do NOT go above the FCA guidelines and b) they do not CHOOSE high risk structured products. In the UK, 97% of the time structured products deliver. Unfortunately these “offshore” products are VERY high risk and not like UK ones.

OMI SHOULD have been sufficiently expert enough a) to know of the FCA recommendation and realised the investments were well above that and b) the offshore products were high risk and not the same as those promoted in the UK.

This SHOULD have raised concerns within OMI and resulted in further DD by OMI. IF acting in their client’s best interest, OMI should have either a) refused the instructions or b) advised their client’s this may not be in their best interest.

Instead, this looks like OMI WERE putting business interest above the best interest of their clients. Profit above the best interest of their clients!

People do have the RIGHT to be scammed if they so wish, but many people ARE scammed BECAUSE they are persuaded by fraudulent misrepresentation by the scammers. If those with the expertise AND a duty of care, were to carry out their duty and inform their clients of what they suspect is going on, most people would think twice AND thank them for it.

In my experience, those with a duty of care simply ignore that duty and don’t advise their clients – it’s what happened to me! There were many, in my case, that had the OPPORTUNITY to tell me what they suspected was going on, but CHOSE to ignore it and then later blamed me – the IGNORANT VICTIM for not knowing what I don’t know! Then later, the two-bit lawyers representing the scammers claim I signed various documents saying I KNEW what the risks were! This is a CRAP argument! HOW can I know what the risks are when the scammers present the information FRAUDULENTLY! Get with the programme you shit arse lawyers!!!!

I WAS fraudulently misled, so what I signed was not based on TRUE information provided to me – a retail client – ignorant of the finer points of professional investment assets – and that probably goes for 100% of other victims! That is WHY legislation EXISTS to PROTECT ignorant retail clients from COMPLEX investment products and why those with the EXPERTISE to understand those products are CHARGED with the DUTY OF CARE to PROTECT their clients!

Later, when the client realises they were duped/scammed whatever you call it, the responsible entity that SHOULD have warned them, then tries to wriggle out of their negligence by blaming the client for contributory negligence – ie saying it was your own fault! This is garbage!

Those with the duty of care should indeed demonstrate they are REALLY are committed to a DUTY OF CARE and not just use it as a mantra!

Look after YOUR clients!!! You have the expertise, USE IT!!!

Stephen wrote .. ‘I WAS fraudulently misled, so what I signed was not based on TRUE information provided to me’

That is the difference is between you and me plus others who have been screwed by CWM .. I did not sign any of the dealing instructions. They forged my signature .. a signature that was identical on every dealing instruction and was so obvious that even the least observant ‘trustee’ would have noticed! That is assuming that they could be bothered to look!!

OK. That is a different situation indeed. Not all scams are so overtly fraudulent that signatures on dealing instructions are forged. That is without a doubt, criminal. However I did not sign any dealing instructions either. The receiving trustee decided the “unregulated adviser” was authorised to act as “investment manager” not just “adviser” but nowhere was I told of that, nor did I sign anything agreeing to that so not sure where that role came from! The adviser submitted one dealing instruction I was never asked to agree to but the Mickey Mouse Maltese regulator (MM-MFSA) decided the trustee did no wrong!

Most scams are carried out by unregulated advisers giving false information about the “funds” or “investments” and then they get you to sign saying you understood the risks – and the trustees get you to sign the trust deed which includes indemnity clauses against everything except wilful fraud by the trustee.

All this is then regurgitated by lawyers representing the scammers – and a recent example posted here https://pension-life.com/david-vilkas-vile-us-attorney/ – where the lawyer claims about me: “He read and signed multiple acknowledgements … showing very clearly that he knew what he was investing in and the inherent risks involved.”

Whilst it is true I signed ONE document “thinking” I knew the risks – “Multiple” might not be true – it turns out that actually the material facts given to me about the adviser, investments and risks was fraudulently misrepresented. For example: the adviser was unlicensed to give investment advice but claimed he was licensed; the QROP was approved by HMRC – untrue; fraudulent misrepresentation about tax advantages in using a QROP; the funds were unregulated but he fraudulently claimed they were; the funds were unaudited but he fraudulently claimed they were; the funds were not to be promoted to me but he claimed they were suitable for me – a retail client and so it goes on and on and on. Many victims will relate to this same experience.

I never signed any document saying I knew if the information given to me was true or false and I accepted the risks of being lied to!

The adviser made claims he had a specialist skill that I came to rely on; I relied on the “adviser” to tell the truth and he relied on me believing what he said was true and that I would act on his advice.

This is “tort by deceit”.

This is how most scams go. No one forged my signature.

Your situation is irrefutably criminal – my situation (and many others) is a “tortious” act which resulted in economic damage – however, that said, the adviser was acting unlawfully in promoting unregulated collectives in the UK but that is a matter for the FCA and Action Fraud but they ignored my complaints.