OMI IPO Profit Warning – urgent please read carefully.

Old Mutual International (OMI) have entered into an IPO – initial public offering. This means they have become a public company rather than a private one. Frequent readers of Pension Life blogs will know that OMI have featured heavily in our recent blogs with regards to issues with structured note provider Leonteq, the selling of fraudulent notes and their involvement in the CWM pension scam.

But now it is very important that the public, and future potential victims of OMI, should be very wary of investing in this company. I have serious concerns about the undisclosed current liabilities and future drops in profits.

I would like to disclose some information about OMI post IPO. Hopefully, this information will reach prospective buyers before they make any purchases of OMI shares. Also, I can see no evidence that OMI have disclosed this information publicly to warn potential investors.

ABOUT OLD MUTUAL INTERNATIONAL (OMI)

- OMI – a company that happily uses high-risk, toxic, illiquid, professional-investor-only notes for pension holders’ funds

- OMI – a company that refuses to take any responsibility for buying totally unsuitable products which end up destroying innocent victims’ hard-earned retirement savings

- OMI IPO – a strategic move forward to make more money from the unsuspecting public – whilst sweeping their past misdemeanours under the carpet

First, let me explain a little more about what an IPO is:

First, let me explain a little more about what an IPO is:

An IPO means that the company can sell stock to the public. Therefore, if a company seems viable to the public, investments into it will be made and these investments will make the company a lot of money.

An IPO can be seen as an exit strategy for the original founders of the company. The shares that are being sold to the public would originally have belonged to the founders and early investors of the company.

An IPO is a way for the original founders to claw back monies they may have invested into the company at the outset.

“Why go public, then? Going public raises a great deal of money for the company in order for it to grow and expand. Private companies have many options to raise capital – such as borrowing, finding additional private investors, or by being acquired by another company. But, by far, the IPO option raises the largest sums of money for the company and its early investors.”

Information from https://www.investopedia.com/university/ipo/ipo.asp

This does, however, mean that:

- The Company (in this case OMI) becomes required to disclose financial, accounting, tax, and other business information

So I wonder if the OMI IPO has disclosed the following information to warn the public of underlying liabilities which will inevitably affect future profits and net asset value:

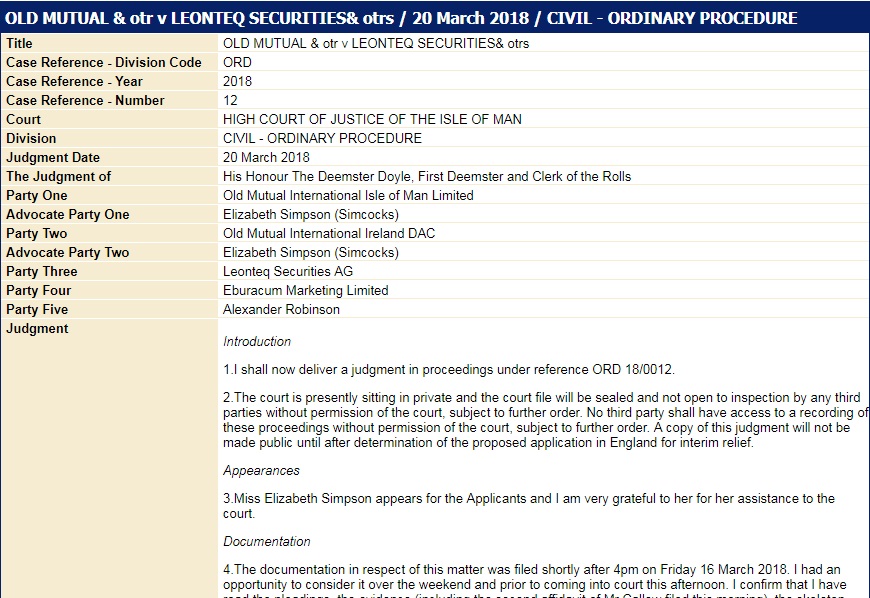

Between 2012 and 2016, OMI purchased £94m worth of fraudulent structured notes from Leonteq; presumably, a further £94m of non-fraudulent (but still unsuitable) notes from Leonteq; probably a further £94m worth each of Commerzbank, Royal Bank of Canada and Nomura (many of which performed as badly as the Leonteq fraudulent ones incidentally). Therefore, we could be looking at £470 million worth of structured notes with losses of at least £100 million – probably substantially more. And up to half of this could lie with the victims of the CWM scam.

OMI IPO Profit Warning

It would seem that the OMI IPO is a way for the company to make more money or just get out of losing money. With the High Court proceedings hanging over their heads, there is a chance that they will find themselves heavily in debt if they are instructed to pay back the crippling losses involved.

If I were a potential investor in OMI, I would ask myself why they haven’t used the £8.365 billion worth of profits they’ve just declared to compensate their thousands of victims who are facing crippling losses to their retirement funds. I would also think seriously about highly-likely sharp drops in OMI’s profits in the very near future. And if I were an investment adviser to any individual considering buying shares in OMI, I would firstly give them a dire profit warning, and secondly ask whether it is right to invest in such an unethical firm.

If I were a potential investor in OMI, I would ask myself why they haven’t used the £8.365 billion worth of profits they’ve just declared to compensate their thousands of victims who are facing crippling losses to their retirement funds. I would also think seriously about highly-likely sharp drops in OMI’s profits in the very near future. And if I were an investment adviser to any individual considering buying shares in OMI, I would firstly give them a dire profit warning, and secondly ask whether it is right to invest in such an unethical firm.

I should say unbelievable but what i have learned about in the last 10 months nothing surprises me with this disgusting company OMI.

I can not believe they are allowed to continue with an IPO whilst they have very serious court actions looming against them. I have pension funds lost due to THEIR negligence NOT market forces and am a group member of 270 who have suffered losses of £16 million. This not just money, this is existing and future pensioners lives destroyed! !

If your thinking of investing with OMI better to give the money to your kids, Grandkids, homeless, spend it down the pub, anything at all but not with these incompetent bandits