One of my all-time favourite comedy lines is Greg Davies describing his middle-aged love life as “like trying to stuff a marshmallow up a cat’s arse”. My second-favourite comedy line is “Andrew Bailey has been such a failure at the FCA, that we’re going to put him in charge of the Bank of England”. My third favourite is “the FCA’s practitioner panel is going to be headed up by Paul Feeney of Quilter”.

With the exception of Greg Davies’ somewhat risqué pun, the other two are both true and sickeningly serious.

Victims of the FCA’s multiple failures to take action (despite urgent warnings by courageous whistleblowers) will be horrified at Bailey’s elevation to the “top job” as his reward for betraying so many thousands of investors.

Victims of Quilter (previously Old Mutual International and Skandia) will be appalled that such a pariah of financial services can be held up to be an example to financial services practitioners.

It might, of course, be that I am mistaken – and that Feeney is being brought in as an example of how financial services should NOT be run, and how financial advice should NOT be provided.

But, sadly, I think the “old boys’ network” has worked its magic and the FCA elite have closed ranks with Quilter’s elite, to dominate control over pension and investment scams. It is clear that neither the so-called “City Watchdog” nor the insurance giant – specialising in pointless insurance bonds and toxic investments – want to see financial services cleaned up.

If any financial services consumer is unclear about the FCA’s multiple failures in the matter of the collapsed London Capital & Finance “bond”, they only need to read Bond Review’s piece on the Dame Gloster report. Along with “The FCA told potential investors that LCF was not a fraud, and FSCS protected“, “the FCA took no follow-up action to verify that all LCF’s investors qualified as high-net-worth and sophisticated” and “The FCA consistently treated LCF’s unregulated bonds as not its problem“, Dame Gloster pulls no punches when she outlines the FCA’s many disgraceful and negligent failures.

From Andrew Bailey at the top, to the members of FCA staff who defecated on the men’s bathroom floor at the bottom, Dame Gloster’s report demonstrates that the FCA simply doesn’t understand pension and investment scams. Apparently, an FCA supervisor had admitted that “there is little training on how to identify financial crime within the FCA’s Supervision division”.

Put simply, if the FCA can’t keep its own bathrooms clean, how on earth can it help clean up the crap in the world of financial fraud?

The FCA clearly does not understand that unregulated, high-risk, toxic investments are simply not suitable for ordinary retail investors. And this is why the appointment of Quilter’s Paul Feeney is so anomalous: Quilter has for years specialised in peddling these kinds of high-risk investments to low-risk investors. The graveyards of thousands of Quilter victims’ investment portfolios is littered with the rotting remains of many funds and structured notes.

A regulator’s “Practitioner’s Panel” should ideally be headed up by someone who understands how financial services firms should be run; someone who eschews the fraudulent and disloyal practices of the “cowboys” and “chiringuitos”; someone who has shown the will to outlaw illegally-sold insurance bonds whose sole purpose is to make thousands of victims poor and dozens of scammers rich.

Instead, the FCA’s panel is going to be under the control of someone who has actively promoted high-risk investments to low-risk investors.

So, it would seem there is no hope that the FCA will ever be reformed – just as there is no hope that the top dogs at Quilter will ever brought to justice for facilitating so much financial crime. The two rogue organisations are going to jog along cosily, side by side, with no remorse for their own failures and culpability.

It is hard for pension and investment scam victims to comprehend the apathy towards reform of regulation in the UK. Experts such as Henry Tapper, Mick McAteer, Martin Hague, Paul Carlier and Gina Miller have long banged the “reform” drum. But this has largely fallen on deaf ears. And, of course, Dame Gloster’s report will be largely ignored.

This is all cronyism at its worst. And shows that neither the Treasury nor Parliament truly understand what is so very wrong with financial services in the UK (and also offshore). Select Committees, such as the Work and Pensions one chaired by Stephen Timms, can debate all day long – but until the FCA is scrapped and rogue “wealth” and “life” (in reality, poverty and death) companies like Quilter are shut down, nothing will change.

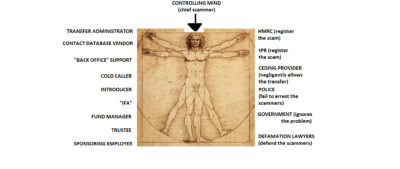

Dame Gloster has written about the “wickedness” of the FCA’s failures to protect the public (from investment scams such as London Capital & Finance). Part of this evil is the failure to recognise the dangers of unlicensed scammers – the motley assortment of unlicensed “introducers” – both onshore and offshore. But, of course, this is what Quilter’s business is based on – so the appointment of Quilter’s Paul Feeney will only protect and nurture this branch of financial crime.

Quilter has for many years given terms of business to assorted scammers, prostitutes, murderers, fraudsters and conmen (and women). With the acceptance of thousands of investment instructions from these unruly hordes of low-life, unlicensed, unqualified criminals, Quilter has built up a successful and profitable business based on ruining innocent victims’ lives (and killing some of them in the process).

Dame Gloster’s excellent, comprehensive and severely damning report provides almost 500 pages of details of the FCA’s disgraceful failings.

But if you haven’t got time to read it, just read FT Adviser’s one-page article on “Quilter boss Feeney to head up FCA panel”. Then zoom down to the bit that says: “Paul has served on the panel for a number of years and appreciates the important role it plays in ensuring our regulation is targeted and effective.”

THE DIZZEE RASCALS AT THE FCA:

THE DIZZEE RASCALS AT THE FCA: Before Debbie Gupta sticks her big foot in her mouth any further, I would suggest she attempts to learn something about scams, scammers and scamees. She should come and spend a week with me. Sit up until midnight talking distraught victims out of suicide a couple of times. She should go to Port Talbot with Al Rush and talk to some steelworkers and hear their tragic stories for herself.

Before Debbie Gupta sticks her big foot in her mouth any further, I would suggest she attempts to learn something about scams, scammers and scamees. She should come and spend a week with me. Sit up until midnight talking distraught victims out of suicide a couple of times. She should go to Port Talbot with Al Rush and talk to some steelworkers and hear their tragic stories for herself. All the above will save the FCA nearly three quarters of a million pounds a year.

All the above will save the FCA nearly three quarters of a million pounds a year.

International Investment has written a jolly good article about the recent action taken by the UAE Insurance Authority – headed up by His Excellency Ibrahim Al Zaabi. I quote from

International Investment has written a jolly good article about the recent action taken by the UAE Insurance Authority – headed up by His Excellency Ibrahim Al Zaabi. I quote from  The Gibraltar FSC

The Gibraltar FSC