COMPLAINT TO OMI, THE ISLE OF MAN FINANCIAL SERVICES AUTHORITY, THE CENTRAL BANK OF IRELAND, FINANCIAL SERVICES AND PENSIONS OMBUDSMAN AND THE ASSOCIATION OF INTERNATIONAL LIFE OFFICES

ATTENTION:

Martin Middleton, CEO

Michael Hampson

Complaints Handler | Complaints Team | Old Mutual International

T: 44 (0) 1624 655451 | Int Ext: 75451

F: 44 (0) 1624 611715

E: omifmcomplaints@ominternational.com | W: www.oldmutualinternational.com

Isle of Man Financial Services Authority

PO Box 58

Finch Hill House

Douglas

Isle of Man

IM99 1DT

info@iomfsa.im

GeneralMailbox.ATG@gov.im

Central Bank of Ireland:

enquiries@centralbank.ie

Financial Services and Pensions Ombudsman

Lincoln House, Lincoln Place, Dublin 2, D02 VH29. Tel: (01) 567 7000 Email: info@fspo.ie Website: www.fspo.ie

AILO – Association of International Life Offices

secretariat@ailo.org

COMPLAINT REGARDING OMI’S NEGLIGENCE, FAILED GOVERNANCE AND FACILITATION OF FINANCIAL CRIME – European Executive Investment Bond (EEIB)

OMI has facilitated financial crime over a period of many years; stood by while innocent victims’ retirement savings were destroyed; paid huge commissions to an unlicensed (and illegal in Spain) firm of scammers; continued charging crippling fees while victims’ funds dwindled away; extorted early exit penalties from victims unfairly and unreasonably; failed to take any action to stem the torrent of huge losses of millions of pounds’ worth of retirement savings for many years. And now it is failing to uphold the victims’ complaints.

OMI has been in receipt of a number of complaints (and will be in receipt of numerous further ones) regarding their negligence and facilitation of financial crime in offshore financial services. OMI has not upheld these complaints – and indeed has neglected to grasp the extent of their own multiple failings and errors.

The existing complaints do relate to serious regulatory breaches and fraud – as well as failing to adhere to OMI’s own terms and conditions. Much of the fraud was caused by the financial advisory firm: Continental Wealth Trust (which traded as Continental Wealth Management). However, the firm’s fraud was only successful because OMI facilitated it.

The complaints submitted to date include:

- That investments were made into high-risk professional-investor-only funds. Many of these failed and caused huge losses to victims’ funds.

- That OMI paid commissions/fees to CWM who not only held no investment licence – but also held no license of any kind.

- As a result of the huge, un-disclosed commission paid to CWM – an unlicensed firm – OMI imposes crippling early surrender charges on the victims.

OMI has responded that they are “very sympathetic to victims’ concerns” and has responded that it appreciates what a very worrying time this must be for those who have lost such huge amounts of their life savings.

OMI has also stated that the roles and responsibilities of all the parties involved with this fraud have got to be clarified. However, OMI claims – entirely disingenuously – it does not want victims to get the feeling it is trying to distance itself from the grievances.

In order to address what it refers to as “concerns”, OMI has attempted to “explain” matters. The use of the word “concerns” is obviously a really crass clanger on the part of OMI, since the victims are absolutely not just CONCERNED – they are furious, terrified and devastated at their dreadful losses. Some victims are suicidal, and many have had their health seriously compromised.

OMI has described the EEIB as being held by the trustee for the benefit of a member of their pension scheme, enabling policyholders to hold a “wide range of investments in one tax-efficient product wrapper”. OMI goes on to claim that policyholders and their investment advisers “have complete flexibility over the investments they place inside the EEIB”.

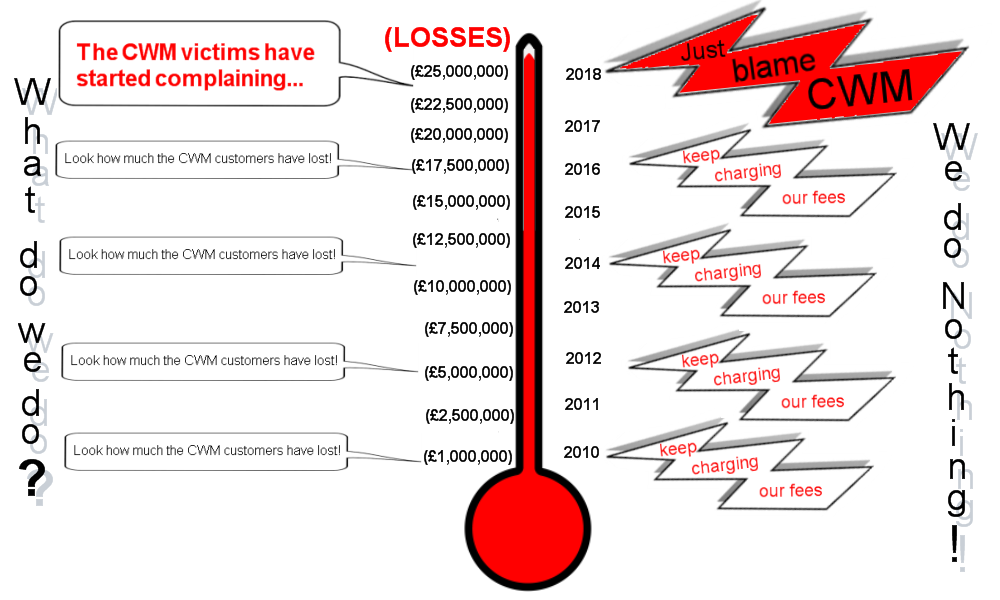

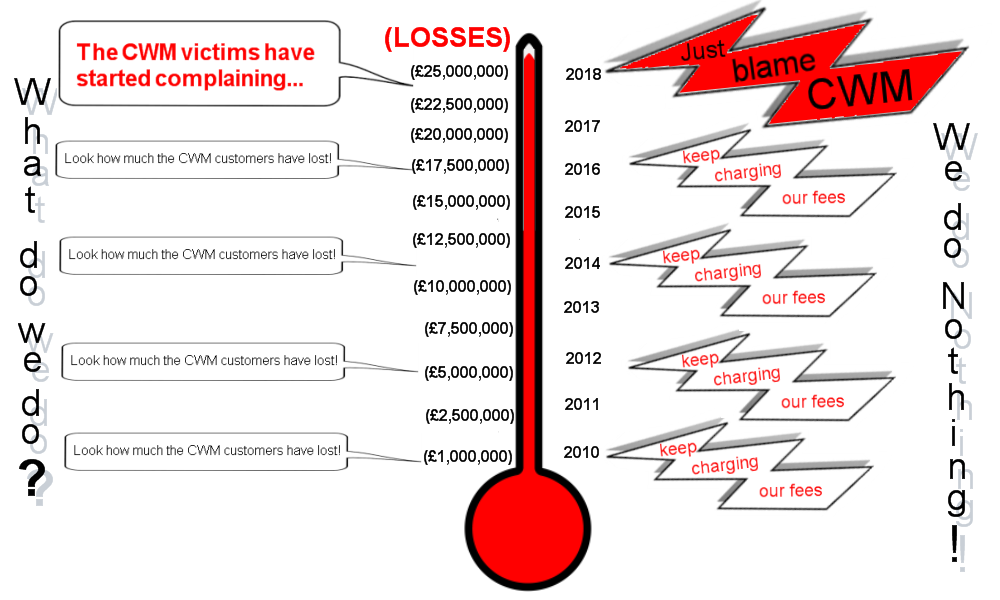

Some or all of the above may be true. However, that does not make it right that OMI has allowed unlicensed advisers to place clearly unsuitable investments inside their wrappers. Further, it does not make it right that OMI then stood by and watched the investments fail for many years AND DID ABSOLUTELY NOTHING EXCEPT KEEP ON TAKING FEES BASED ON THE ORIGINAL VALUE – AND NOT THE REDUCED VALUE OF THE FUND.

OMI claims that it reviews all investments to ensure they meet Irish regulatory requirements, and their own administration requirements.

If this is indeed true, it is a very serious indictment of the Irish regulator if their requirements are so appallingly lax. What OMI seems to be claiming is that both the Central Bank of Ireland and OMI have such low standards that they will allow low-risk pension savers to have their retirement funds invested purely in high-risk, professional-investor-only structured notes. If this is true, then the regulator is as bad as OMI in condoning an investment strategy which has no regard for suitability, liquidity, diversity and risk tolerance.

In fact, the Central Bank of Ireland has stated that it carried out a review of suitability requirements in 2017 and found that: “governance structures for the identification and treatment of vulnerable clients were absent or ineffective”. The CWM victims were about as vulnerable as it was possible to get – as their retirement savings were systematically and inexorably destroyed. And OMI’s governance structure was about as absent and ineffective as it is possible to get while it stood by and didn’t even bother to raise a red flag on the whole disaster as it unfolded.

There was no jangling of alarm bells as OMI watched millions of pounds wiped out. There was no expression of concern that the same toxic structured notes which had failed in earlier years were bought again and again by the same unlicensed scammers. There was no governance to protect new vulnerable victims from having their funds destroyed from 2015 onwards in the same way hundreds of victims had suffered in previous years.

OMI has claimed that customers/their appointed advisers are responsible for the suitability assessment and selection of the investments held in the policy – and that “it is important that customers read the prospectus/offering documents of investments carefully, before making any investment decisions”. However, OMI watched wholesale destruction taking place inside its own wrappers and took no action. Had OMI asked a few simple questions they would have found the following:

- The victims were being advised by a known firm of scammers which had been involved in cold calling in the Evergreen pension liberation scam in 2012

- The victims were being advised by a firm which was not licensed at all – for anything

- The victims had ALL insisted they wanted either low risk or no risk investments as they could not afford to lose any part of their retirement savings

- The victims had no idea their retirement savings were being invested in high-risk, professional-investor-only structured notes

- The victims’ signatures were repeatedly forged on the dealing instructions

- The victims were duped into a false sense of security when losses started to be reported on their statements by the scammers claiming these were not genuine losses but only “paper losses”

- The victims had no idea how high the charges and commissions were as these were not disclosed either by the scammers or by OMI

- The victims were not consulted as to whether they wanted or needed an entirely useless and exorbitantly expensive insurance bond

- The victims were unaware that tied agents are illegal in Spain

- The victims were unaware of the huge fees and commissions which were concealed by both the scammers and OMI

OMI claims that term 12 of the EEIB policy terms states that it is the policyholder who bears the risk of investment. But then OMI goes on to assert that the policyholder was the trustee who would be classed as a professional investor.

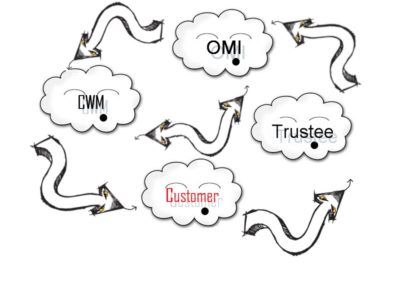

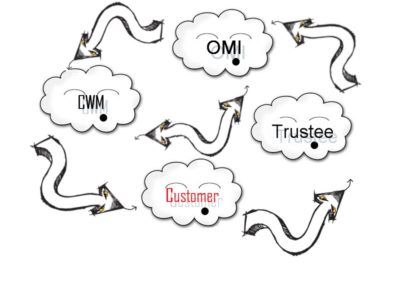

So OMI has got to make up its mind – it has already stated that: “customers/their appointed advisers are responsible for the suitability assessment and selection of the investments held in the policy”. So who is the customer? The victim or the trustee? And whom did the adviser advise – the customer or the trustee? Or OMI?

OMI goes on to refer to term 11.4 of the policy which confirms that it may allow investment into professional or experienced investor funds because it owns the investments held within the EEIB, rather than the policyholder.

So, who gave the advice and to whom? OMI can’t seem to make up its mind who the customer is: the victim; the trustee or OMI itself. If OMI is the customer, why is it charging the victim fees?

OMI goes on to quote policy term 11.4.1 – which apparently clearly highlights that professional-investor-only funds carry a high degree of risk. So who is taking the risk? The victim, the trustee or OMI?

Let us ask ourselves, where did the original funds come from? Not the trustee; not OMI; but the victim.

OMI then procedes to claim that it will “only accept applications via regulated financial advisers”. But Inter-Alliance was not licensed to provide investment advice – or indeed insurance advice. CWM was not licensed either. So why did OMI accept applications from unlicensed advisors (who were also known scammers)? Also, OMI failed to identify that tied (insurance) agents are illegal in Spain – so it shouldn’t have been dealing with them at all – let alone paying them huge commissions.

OMI states that CWM was a member of Inter-Alliance WorldNet, and obtained their authorization to act via that membership. But this is not true – Inter-Alliance was not licensed and therefore neither was CWM. The application form may, in some cases, have confirmed the appointment of CWM as investment adviser with full discretion – but why didn’t OMI check that CWM was licensed? In fact, most of the victims were under the impression that they would be consulted on the investments and that their risk tolerance would be respected – but this never happened in any of the cases.

OMI goes on to claim that CWM was able to submit investment instructions directly to OMI, without consulting the trustees. But that isn’t true either: dealing instructions were sent to the trustees first, and then the trustees sent on new instructions. How can OMI not even know how its own internal systems work?

OMI concludes that it is sorry the complaining investor is “disappointed with the performance of some of the investments selected by CWM” and then goes on to claim the investments “met the criteria for a permitted asset under the EEIB policy terms”.

So who at OMI was responsible for writing and updating EEIB policy terms? Did this person not notice the losses repeatedly decimating the funds? Did this person not see the same investment failures repeating in 2010, 2011, 2012, 2013, 2014, 2015, 2016 and 2017? Did this person not question whether the policy terms ought to be revised somewhat? The answer to these questions is, inevitably, a resounding and disgraceful “NO”.

OMI is now refusing to refund or waive early withdrawal charges on the basis that CWM was an appointed investment adviser. This is because OMI initially paid a big chunk of commission to CWM – an unlicensed adviser and known scammer. If a victim wants to get out of the toxic, pointless insurance wrapper, in order to put a stop to the exorbitant fees taken quarterly out of the fund – and based on the original value rather than the decimated value of the fund – he basically has to refund the commission OMI paid to the scammers.

The victims remain dissatisfied with OMI’s response, and the complaint is now being referred to the Irish Financial Services and Pensions Ombudsman. OMI has deliberately misunderstood and overlooked every aspect of the victims’ complaints and failed to address even the most basic issues surrounding OMI’s failures and negligence.

OMI has facilitated financial crime over a period of many years; stood by while innocent victims’ retirement savings were destroyed; paid huge commissions to an unlicensed (and illegal in Spain) firm of scammers; continued charging crippling fees while victims’ funds dwindled away; extorted early exit penalties from victims unfairly and unreasonably; failed to take any action to stem the torrent of huge losses of millions of pounds’ worth of retirement savings for many years. And now it is failing to uphold the victims’ complaints.

Two pension liberation scammers have been sentenced to time behind bars AND a recovery of funds after creating an elaborate pension liberation scam, involving around 23 victims and nearly 1 million pounds of pension funds. Successful Pensions sure was unsuccessful for all involved.

Two pension liberation scammers have been sentenced to time behind bars AND a recovery of funds after creating an elaborate pension liberation scam, involving around 23 victims and nearly 1 million pounds of pension funds. Successful Pensions sure was unsuccessful for all involved.

Seems we can´t get enough of Holborn Assets’ cheek this week. CEO Bob Parker has sent out a Q1 2018 newsletter and included on his mailing list a very unsatisfied and traumatised client who, through Holborn Assets’ negligence, has suffered a significant loss to her pension fund, with no compensation – or even apology.

Seems we can´t get enough of Holborn Assets’ cheek this week. CEO Bob Parker has sent out a Q1 2018 newsletter and included on his mailing list a very unsatisfied and traumatised client who, through Holborn Assets’ negligence, has suffered a significant loss to her pension fund, with no compensation – or even apology.

I might even nip down to Johannesburg and have a cup of tea and a cheeky biscuit with him. No doubt, he won’t want the sordid details of Holborn Assets’ scams to compromise his quest to conquer South Africa. If the natives find out just what his colleagues have been up to, he might find himself on the wrong end of a Zulu spear.

I might even nip down to Johannesburg and have a cup of tea and a cheeky biscuit with him. No doubt, he won’t want the sordid details of Holborn Assets’ scams to compromise his quest to conquer South Africa. If the natives find out just what his colleagues have been up to, he might find himself on the wrong end of a Zulu spear.

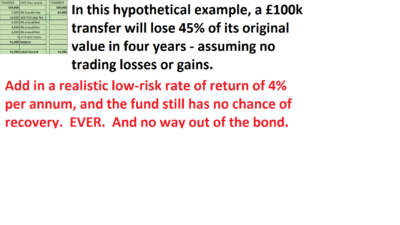

The illustration on the left is based on the

The illustration on the left is based on the

A happy tale for the end of the week… not just one but two firms have been told they must compensate clients for poor advice on SIPPS transfers. A great victory against all firms using SIPPS to disguise their ill-advised pension scams sorry schemes.

A happy tale for the end of the week… not just one but two firms have been told they must compensate clients for poor advice on SIPPS transfers. A great victory against all firms using SIPPS to disguise their ill-advised pension scams sorry schemes.

Mike’s non-pension savings then went through Active Wealth into Dolphin Trust GmbH, which specialises in the development of German-listed buildings and promises 10% returns on investment. He says he was unaware that he was signed up to a fixed term payment (minimum 2 years) and of the associated

Mike’s non-pension savings then went through Active Wealth into Dolphin Trust GmbH, which specialises in the development of German-listed buildings and promises 10% returns on investment. He says he was unaware that he was signed up to a fixed term payment (minimum 2 years) and of the associated  It all started with a presentation made to British Steel Workers via Celtic Wealth. How on earth are these people were able to make a presentation to innocent victims-to-be for an UNREGULATED investment is beyond me. Especially when Celtic Wealth was not authorised to provide investment advice.

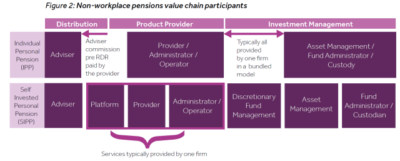

It all started with a presentation made to British Steel Workers via Celtic Wealth. How on earth are these people were able to make a presentation to innocent victims-to-be for an UNREGULATED investment is beyond me. Especially when Celtic Wealth was not authorised to provide investment advice. Transfers into self-invested personal pensions (SIPPS) dominated the

Transfers into self-invested personal pensions (SIPPS) dominated the

The bad news for investors in Capital Alternatives, is that the High Court’s decision is still open to appeal. The FCA can proceed to obtain monies from the Defendants only when no further appeals are made. In the meantime, the FCA is seeking new injunctions restraining the assets of some of the defendants. We sincerely hope this means there will be some funds left to be returned to the victims of this scam.

The bad news for investors in Capital Alternatives, is that the High Court’s decision is still open to appeal. The FCA can proceed to obtain monies from the Defendants only when no further appeals are made. In the meantime, the FCA is seeking new injunctions restraining the assets of some of the defendants. We sincerely hope this means there will be some funds left to be returned to the victims of this scam.

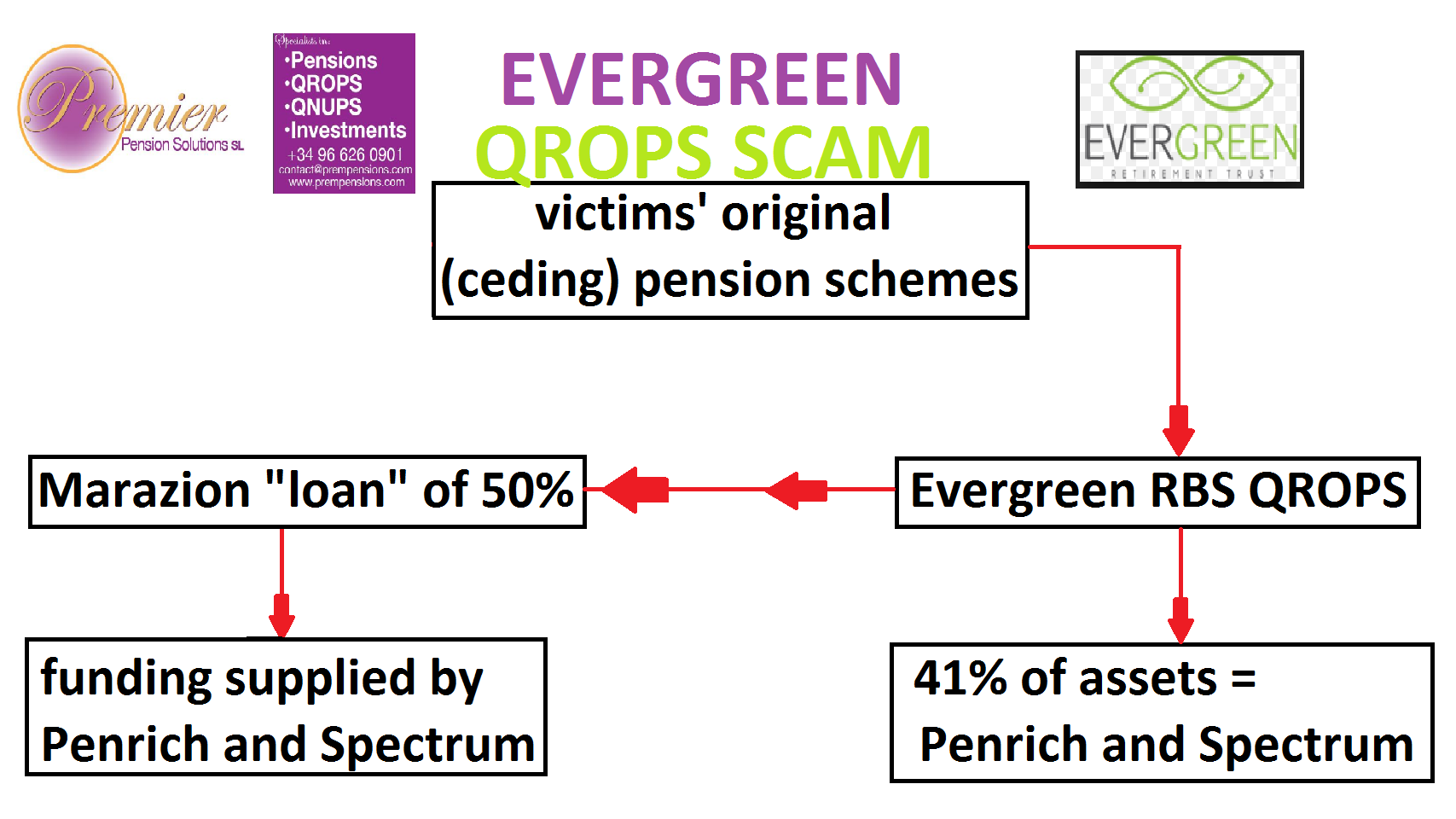

EVERGREEN RETIREMENT TRUST QROPS SCAM – HOW DID IT ALL WORK?

EVERGREEN RETIREMENT TRUST QROPS SCAM – HOW DID IT ALL WORK? CWM assured the victims that the 50% cash would not be taxable because the scheme was set up and run by international pensions expert and author of the Tolleys Pensions Taxation manual Stephen Ward of Premier Pension Solutions.

CWM assured the victims that the 50% cash would not be taxable because the scheme was set up and run by international pensions expert and author of the Tolleys Pensions Taxation manual Stephen Ward of Premier Pension Solutions. Victims were then forced to sign a five-year Marazion loan agreement. And forced to sign a five-year Evergreen “lock in”. Clearly, this was designed to stop victims from transferring out of Evergreen before their Marazion “loans” were paid off.

Victims were then forced to sign a five-year Marazion loan agreement. And forced to sign a five-year Evergreen “lock in”. Clearly, this was designed to stop victims from transferring out of Evergreen before their Marazion “loans” were paid off. Why is ERT being wound up? We all know exactly why ERT is being wound up. HMRC realised that the scheme was operating pension liberation fraud in partnership with Stephen Ward of Premier Pension Solutions early on – in 2012 – so removed it from the QROPS list in November 2012. Your Manager’s Report for the year ended 31.3.16 refers to “concerns raised by HMRC” but you do not disclose the fact that you had been caught and the scheme removed from the QROPS list as a result. The other reason the fund is being wound up is that you have run out of excuses now the five-year lock-in period is up. In your Manager’s Report, you claim that service contracts were entered into by Evergreen Retirement Trust for admin, trustee and other services which have minimum fixed fees. But you have never provided evidence of these alleged “contracts” – nor have you explained why you have carried on paying these unaffordable costs. You have been trying to obscure the fact that 41% of the underlying assets of the fund were in Penrich and Spectrum and that this is where the loan funds came from. You have for years tried to pretend that you knew nothing about the Marazion loans. But the original trustee –

Why is ERT being wound up? We all know exactly why ERT is being wound up. HMRC realised that the scheme was operating pension liberation fraud in partnership with Stephen Ward of Premier Pension Solutions early on – in 2012 – so removed it from the QROPS list in November 2012. Your Manager’s Report for the year ended 31.3.16 refers to “concerns raised by HMRC” but you do not disclose the fact that you had been caught and the scheme removed from the QROPS list as a result. The other reason the fund is being wound up is that you have run out of excuses now the five-year lock-in period is up. In your Manager’s Report, you claim that service contracts were entered into by Evergreen Retirement Trust for admin, trustee and other services which have minimum fixed fees. But you have never provided evidence of these alleged “contracts” – nor have you explained why you have carried on paying these unaffordable costs. You have been trying to obscure the fact that 41% of the underlying assets of the fund were in Penrich and Spectrum and that this is where the loan funds came from. You have for years tried to pretend that you knew nothing about the Marazion loans. But the original trustee –

QROPS provider

QROPS provider  In our opinion, there is nothing robust about Kentish and his various dodgy products. And the Gibraltar regulator shares our opinion as well as our concerns. In a letter dated 6.11.2017, the GFSC wrote to the directors of STM Fidecs about their concerns following a series of onsite visits:

In our opinion, there is nothing robust about Kentish and his various dodgy products. And the Gibraltar regulator shares our opinion as well as our concerns. In a letter dated 6.11.2017, the GFSC wrote to the directors of STM Fidecs about their concerns following a series of onsite visits: