Generali has responded to one of the complaints by CWM victims. I have transcribed it below and put my comments in bold.

Generali has responded to one of the complaints by CWM victims. I have transcribed it below and put my comments in bold.

First, let us look at what Generali says on its own website. It is utterly astonishing as it is a complete pack of lies and does nothing to prove it was not facilitating financial crime:

—————————————————————————————————————————————

Our Vision: Our purpose is to actively protect and enhance people’s lives

Our Vision: Our purpose is to actively protect and enhance people’s lives

- Actively: We play a proactive and leading role in improving people’s lives through insurance. This is untrue. Generali has neither been proactive nor played a leading role in improving people’s lives. It has taken no action to stop the scammers at CWM from destroying victims’ lives.

- Protect: We are dedicated to the heart of insurance – managing and mitigating risks of individuals and institutions. Totally untrue. Generali has neither managed nor mitigated victims’ risks. It has totally ignored the risks and simply stood by and watched hundreds of victims lose millions of pounds of their retirement savings.

- Enhance: Generali is also committed to creating value. What value? The only thing Generali is committed to is destroying value – and making money out of it.

- People: We deeply care about our clients’ and our peoples’ lives. For years, Generali has sat back and watched victims’ life savings being lost because of clearly unsuitable and risky structured notes. This demonstrates that Generali cares nothing about the clients and this is yet another black lie.

- Lives: Ultimately, we have an impact on the quality of people’s lives: wealth, safety, advice and service are instrumental in improving people’s chosen way of life for the long term. This is true – Generali has had a huge impact on the quality of hundreds of victims’ lives, by destroying their life savings.

We tie a long-term contract of mutual trust with our people, clients and stakeholders; all of our work is about improving the lives of our clients. Generali has destroyed rather than improved the lives of clients.

We tie a long-term contract of mutual trust with our people, clients and stakeholders; all of our work is about improving the lives of our clients. Generali has destroyed rather than improved the lives of clients.- We commit with discipline and integrity to bringing this promise to life and making an impact within a long lasting relationship. Another black lie. There has been no discipline and no integrity. The impact by Generali has been destructive, toxic and dishonest.

GENERALI RESPONSE TO COMPLAINT DATED 20TH APRIL 2018

Thank you for your email dated 23 February 2018 attaching your updated Letter of Complaint and further accompanying undated cover letter concerning the performance of your Trustees’ Portfolio.

And here we have the first and biggest part of the scam. Generali is trying to make out that the client is not the client – but the pension trustee is the client. The only reason a trustee is used is to comply with HMRC rules. In the UK, HMRC contributes tax relief to help individuals build up as much value as possible in their pensions. But if the fund is transferred offshore, it has to be sent to a QROPS (qualifying, recognised, overseas pension scheme) – otherwise HMRC will charge 55% tax on the transfer. A QROPS is just a wrapper used to hold the funds. The trustee is a custodian used to keep the funds on behalf of the beneficiary – i.e. the member.

And here we have the first and biggest part of the scam. Generali is trying to make out that the client is not the client – but the pension trustee is the client. The only reason a trustee is used is to comply with HMRC rules. In the UK, HMRC contributes tax relief to help individuals build up as much value as possible in their pensions. But if the fund is transferred offshore, it has to be sent to a QROPS (qualifying, recognised, overseas pension scheme) – otherwise HMRC will charge 55% tax on the transfer. A QROPS is just a wrapper used to hold the funds. The trustee is a custodian used to keep the funds on behalf of the beneficiary – i.e. the member.

It wasn’t the trustee who worked hard for years to build up this fund out of the money he or she earned. Just as it won’t be the trustee who will retire on the income generated by the fund.

Let us look at the risk profile issue. Whose risk profile is done using a fact find? Is it the trustee’s? Is the trustee asked about his assets, liabilities, age, retirement plans? No, of course not. Is the advice to transfer given to the trustee? Negative.

Let us look at the risk profile issue. Whose risk profile is done using a fact find? Is it the trustee’s? Is the trustee asked about his assets, liabilities, age, retirement plans? No, of course not. Is the advice to transfer given to the trustee? Negative.

Your complaint is addressed primarily to Old Mutual International (“OMI”) but it asserts that “Generali has acted in exactly the same manner as OMI, so although the complaint below relates to OMI, it is also appropriate for Generali. The problems complained about remain the same in both cases. We therefore respond to all the issues raised in the letter as if they are addressed directly to Generali Worldwide Insurance Company Limited (“Generali Worldwide”), as your complaint clearly intends.

It is clearly evidenced that Generali behaved as badly and negligently as OMI and SEB – and betrayed the victims in exactly the same way.

You have expressed deep concern that the Professional Portfolio has lost a significant proportion of its value because of the actions of the Portfolio Manager, Continental Wealth Management (”CWM”).

And herein lies the second part of the scam. Generali did no due diligence on CWM. They have referred to them as “Portfolio Manager”. But they had no license to be a portfolio manager – and they had a track record of cold calling and being involved in financial crime. So – irrespective of whether Generali thought the client/investor was the trustee or the victim – Generali should never have accepted investment dealing instructions from such a firm.

You also consider that Generali worldwide is ´complicit´ given we allegedly took no steps to stop the actions CWM took at the relevant time. Correct.

We are of course very sorry that the Portfolio has incurred losses following the investment decisions made by CWM. When did this “sorry” state begin? On the 23rd February 2018 when they received the letter of complaint? Or at some time during the past six years when they sat and watched hundreds of policy holders’ funds being systematically destroyed?

We address the specific issues raised in your letter below.

The Portfolio

In order to address the issues you have raised it is first necessary to consider the relationship between you, the trustee (that you instructed to purchase the Portfolio) and CWM. Don’t forget the life office – Generali – itself. It was an integral part of this scam.

The Portfolio was established by your nominated Pension Trustee Momentum Pensions Malta Limited (“Trustee”) on 30 January 2013. In total you remitted GBP 473,043.29 to the Trustee and they used these monies to purchase the Portfolio, which itself is held in a trust. So Generali admits that it was the member which remitted £473k in the first place.

You are the first life assured on the Portfolio. The Trustee is the legal owner of the Portfolio and, in the first instance, it is they that have suffered the investment losses. So, the member himself hasn’t lost half of his original £473k? Thank goodness! So, if he just redeems out of this useless, exorbitantly expensive insurance bond, he can have all of his £473k back?

The Trustees owe you fiduciary duties in respect of your money “Your money”? So, you are sure it is the victim’s money and not the trustee’s money? You can’t seem to make up your mind whose money it is. I think Generali is getting dementia as it can’t remember what lies it has just told. In one sentence it is the trustee’s money and in the next it is the victim’s.

(which was “settled” into the trust) as basis for remittance into the Portfolio.

As the legal owner of the portfolio, it is the trustee that appointed CWM as the Portfolio Manager pursuant to the Portfolio Management Agreement dated 7 November 2012 (“PMA”). But did you, Generali, not notice that CWM was an unlicensed scammer? And once you started seeing, and reporting on, the huge losses did you not consider you had some responsibility beyond just reporting on the repeated losses for years?

CWM therefore owed contractual duties to the Trustee in Respect of the management of the Portfolio. Yes. And you, Generali, also owed duties to the victim whose money was being frittered away by the scammers. You have admitted it was HIS money.

Issues Raised

The letter of Complaint raises various issues. We consider that these can be summarised as follows:

- You allege that CWM purchased “high risk, professional-investors-only structures notes” which you consider were unsuitable for your investment risk profile.

- You allege that CWM gave advice and instructed sales and purchase of investments despite the fact that they were “neither licensed for insurance nor for investment”.

- You have raised an issue with what you consider were the high commissions paid to CWM.

- You have alleged that you were not informed of the level of charges that would be taken pursuant to the portfolio´s terms and conditions.

- You allege that your signatures were “repeatedly forged on the dealing instructions”.

- Finally you agree CWM made misrepresentations to you about the losses you were incurring.

You have also stated that OMI, and therefore we assume Generali Worldwide, have “facilitated financial crime over a period of many years”. You have asked that Generali Worldwide “own up to the financial damage and crime it has facilitated over a period in excess of eight years” and compensate you for the losses the Portfolio has suffered.

Portfolio Management Agreement

The PMA (enclosed), authorised fees for the portfolio management services as rendered (being 1% per annum of the Investment Value). And, as we know, this is Generali’s way of clawing back the 8% commission paid to the scammers. There was no “portfolio management”. Had there been any kind of management, this would have included doing something about the inexorable losses rather than just sitting there watching this victim’s losses mounting over a period of years. Bearing in mind he was one of many in the same boat, this makes it doubly disgusting that Generali took no action. You must have been aware that this victim – along with all the hundreds of others – had their life savings used to purchase professional-investor-only and high-risk structured notes.

As such, all instructions in relation to your Trustees´ Portfolio were properly issued by CWM, which we acted properly on in accordance with the PMA. Not true. The members’ signatures were forged. That is fraud. And you, Generali, facilitated financial crime.

Please note that Generali Worldwide is not a party to (or aware of) any commission arrangements between CWM and any investment product issuers. Really? Did you think CWM was just selling these toxic products for fun? You didn’t consider that as the only reason for selling the insurance bond was for the 8% commission, there might be another 8% commission for selling the structured notes?

In appointing CWM as the portfolio manager under the PMA, the Trustee expressly warranted that it would be bound by the decisions of CWM and recognised that CWM were acting for them, not Generali Worldwide. Furthermore, in appointing CWM the Trustees agreed that Generali Worldwide “shall not be liable for any damages, losses, costs or expenses to the Plan assets arising from the appointment of, or the investment instructions given by the Portfolio Manager. There is an interesting parallel here. The CWM scammers all say the same thing: “it wasn’t my fault; I didn’t do anything wrong; it was the others”

This will include, without limitation, any action or failure to take actions on the part of the Portfolio Manager to produce a reasonable investment return, in relation to the plan. So, you are saying that it is reasonable for Generali to have just sat there and said/done nothing about the losses for years? You could see millions of pounds’ worth of life savings getting wiped out routinely and yet you did nothing to help the hundreds of victims. Your website claims that Generali “protects, manages and mitigates risks”. So that is obviously another lie.

The Trustee also agreed to “indemnify (Generali Worldwide) against any and all liability it may incur, as a consequence of, or arising from or in respect of the appointment, activities and performance of the Portfolio Manager…” But did the victim agree to indemnify Generali? You have already admitted that it was HIS money. On the Generali website it states: “Meeting your financial needs: Effective wealth management, investment and pension options that can successfully cater for the diverse needs of global investors”. So do the words “effective” and “successfully” include sitting back and doing nothing about the losses? Generali could have picked up the phone and spoken to the trustee and/or the victim (depending on which party you considered “owned” the money that day) and said something along the following lines:

“Look, mate, we’ve been having a bit of a look at this portfolio. We’ve spotted that over the past couple of years it has halved in value. We’ve also checked up on the adviser, CWM, and we’ve realised the firm is not licensed to give investment advice and is operating illegally in Spain. We’ve also found out that it has been scamming people for years. We’ve also noticed that 100% of the investments are toxic, high-risk structured notes which are FOR PROFESSIONAL INVESTORS ONLY. We’ve also realised that the combination of failed investments and our own huge charges are eventually going to wipe this (and many other) portfolios out altogether. Do you think we ought to do something? Or shall we just sit here and let it happen?”

Continental Wealth Management

CWM are an independent firm of brokers, No they were not. In Spain it is illegal to work as a broker – whether for insurance or investments – without a license. CWM had no license.

entirely distinct from Generali Worldwide. Under Guernsey law, Generali Worldwide is prohibited from appointing agents in the sale of its policies. Guernsey law is irrelevant. CWM was based in Spain. It is only Spanish law that counts. Generali should have checked up to see whether CWM was licensed and when it discovered it had no license, Generali should have refused to accept any further investment instructions from the firm.

CWM owed duties to you / the trustee alone in recommending the Portfolio and providing suitable financial advice prior to its purchase. I wish you would make up your mind. You can’t seem to decide whether it is the victim or the trustee who is the client/investor. And now you are trying to make out it is both.

It is CWM, not Generali Worldwide, that had a duty to advise you / the Trustee of the suitability of the portfolio and its terms, including the relevant fees. At the time of the trustee´s application, Generali Worldwide were not party to the discussions regarding your chosen risk profile. Whose risk profile? The victim’s or the trustee’s?

CWM are solely responsible for any advice provided to you / the Trustee. It is a common misunderstanding that Independent Financial Advisers and similar Intermediaries are “representatives” of the insurer even though as a matter of law that is not the case in circumstances such as these. CWM was indeed responsible for the scam which Generali facilitated. But CWM was not licensed to provide anybody, whether the victim or the trustee, with either insurance or investment advice. And yet Generali accepted hundreds – possibly thousands – of investment dealing instructions from them. And when the victims started losing millions of pounds, Generali never questioned whether this unlicensed advice was going terribly wrong.

If you believe that relevant information about your Portfolio was either misrepresented or not properly explained to you / the Trustee at the time of the application you should seek redress directly with CWM or your Trustee. Again, legally, if there is an issue with the portfolio itself, which is denied, the correct person to complain to Generali Worldwide is the Trustee. In turn, the trustee owes you fiduciary duties in respect of the money you provided to them on trust. Just like all the scammers at CWM: it is everybody else’s fault but not theirs. The issue with the portfolio itself was that it served no purpose except to pay commission to the scammers – and provided no protection or benefit to the victims whatsoever. Indeed, the Generali wrapper simply made matters considerably worse by constantly eroding what little was left of the ever-dwindling funds with the constant quarterly charges.

In respect of the allegations that CWM misrepresented the performance of the Portfolio, again this is a matter for CWM, and their successors in title, to address. Generali Worldwide are not party to the updates that were provided. However, we note that you had access to our Online Service Centre where it was possible to view the performance of the Portfolio at any time. But didn’t Generali view the performance of this portfolio – and hundreds of others – and question what the hell was going on with all the CWM victims?

Regarding the instructions from CWM and any “forged signatures”, we comment that all the instructions received by Generali Worldwide from CWM were properly executed by them as the portfolio manager. Does Generali seriously believe that an unlicensed firm, operating illegally in Spain, was executing millions of pounds’ worth of dealing instructions (most of which resulted in huge losses) “properly”? This is an unbelievable statement.

Given their status as portfolio manager, any instruction only needs to bear their signature (or alternatively the signature of the Trustees). Signatures of the life assured are not required, as there is no contractual relationship between Generali Worldwide and the lives assured (and consequently the lives assured do not have authority to issue dealing instructions). We are not able to comment on whether the other signatures that appear on the instruction were forged. However given the PMA, it is Generali Worldwide´s position that it was the signature of CWM (or the trustee) which validate the instructions. CWM had no status as portfolio manager. Neither the firm nor the individuals were licensed. No dealing instructions should have been accepted from them EVER, under any circumstances whatsoever. Why do you think Malta has just made changes to the regulations to stop this from happening again?

Notwithstanding this, we are concerned to note any potential allegations of fraudulent activity and would encourage you to escalate any issue in this regard to the competent authorities, as necessary. Generali has facilitated financial crime – irresponsibly and negligently. Generali is being reported to the competent authorities.

Contractual Terms and Conditions

The Portfolio is governed by and constructed in accordance with Guernsey law, with contract acceptance (and policy issuance) having taken place in Guernsey. Your Trustee´s application was accepted in good faith in Guernsey on an unsolicited basis in 2013. Based on completion of the application your Trustee thereby confirmed their acceptance, and understanding of the portfolio´s Terms and Conditions. But who is the client? The trustee or the victim. Generali seems to change its mind depending on what argument it is trying to make. The broker and the owner of the funds were based in Spain (and the trustee in Malta) so Guernsey law is irrelevant.

As noted in section 10 of the terms and conditions (enclosed), your Trustee and Portfolio Manager are responsible for investment decisions and any choice of Investment Instruments is entirely at your Trustee´s own risk and it is they that had oversight over the investment settings made. Generali Worldwide accepts no liability for the performance of investment instruments or for losses, damages or costs arising out of, or in connection with Generali Worldwide subscribing to, or otherwise acquiring an interest in an Investment Instrument for allocation to the Portfolio. You will also appreciate that Generali Worldwide was not party to the advice provided to you (or the Trustee), or the rationale for investment decisions made by CWM in respect of the Portfolio (which we note is described in your covering letter). Again, Generali can’t make up its mind whether the client is the victim or the trustee. Either way, this argument seems to make it clear that there was absolutely no point whatsoever in having an insurance bond at all. It provided no protection and only served to hasten the destruction of the funds.

In respect of the portfolio´s fees and charges, these are laid out in section 15 of the enclosed Terms and Conditions. In signing the application form dated 7 November 2012 your Trustee confirmed that they understood the Terms and Conditions. So, it was all the trustee’s fault? But what were these fees and charges for? For sitting there and doing nothing about the destruction of the funds and facilitating financial crime? Under the terms of the contract for this so-called life assurance policy, generali stands to earn £47,304.33 – but for doing what exactly? Bugger all as far as I can see.

It was CWM´s duty to advise the Trustee as well as yourself in respect of the Portfolio´s Terms and Conditions. But CWM was not licensed to give advice – so how could it?

We therefore consider the contractual terms associated with the fees and charges in relation to the Portfolio to be clear. I agree: it is 100% clear that the contract is for Generali to pay a huge commission to a known firm of unlicensed scammers, and to charge quarterly fees to provide no protection or management or mitigation of risks (as falsely claimed on the Generali website).

Discussions with the Trustee and Trafalgar

We have corresponded with both your Trustee and Trafalgar International GmbH (Trafalgar) following your complaint. Given that CWM have entered into liquidation, we understand that Trafalgar have now taken on any liability for the actions of CWM (and are in turn licensed in Germany). So, yet again it is everybody else’s fault and responsibility – except Generali’s.

From publicly available information we have seen that Trafalgar have engaged with your Trustee to try to provide a solution to the issues that they and their beneficiaries face as a result of CWM´s actions. We have also confirmed this directly with representatives of your Trustees and Trafalgar/GlobalNet. We also note from our files that CWM have previously recognised it was their actions that led to some of the losses on the Portfolios and made offers to compensate the beneficiaries. What relevance does this have? This is a complaint against Generali – not a complaint against CWM. The CWM scammers are long gone and the company is worthless.

We have written to Trafalgar regarding your complaint. But this is about a complaint against Generali. What is the point of Generali writing to Trafalgar? Trafalgar didn’t operate this insurance bond. Trafalgar wasn’t on the scene in 2013.

They have told us that they have been trying to provide redress to the former clients of CWM and will respond formally to us in this regard. As yet we have not received any further correspondence from them and we are following up further for any updates. Yet again, Generali is just trying to deflect attention from their own lies and failings. But at least there is a tacit acknowledgement that redress is not only required, but that Trafalgar is trying to provide it (with no help from Generali).

Conclusion

Again, we are very sorry to learn that your Trustee´s Portfolio has suffered the losses you described. We understand that this is a source of deep concern for you and the other former clients of CWM that have been adversely affected. However based on the above, regrettably Generali Worldwide is unable to provide the requested redress. Presumably, if the losses are to be borne by the trustees, then the victim can have all his money back? This constant banging on about the trustee “suffering the losses” is pointless. If it is really true, then as Generali has acknowledged that the victim owns the money, then give it back to him. In full.

CWM advised your Trustee in respect of the purchase of the Portfolio and its management pursuant to the PMA. But was not licensed to do so – and therefore did so illegally.

We repeat that CWM are not an agent of Generali Worldwide. Any fees, charges or commissions are in line with the Portfolio´s Terms and Conditions which we consider are clear. It was CWM´s responsibility to explain these to you / the Trustee at the time of their application. But it is also clear that CWM was not licensed, so this is irrelevant.

The Trustees are entirely responsible for any losses incurred on the Portfolio as a result of the actions undertaken by CWM. Generali Worldwide were not a party to any alleged misrepresentations regarding the Portfolio´s performance. All instructions received from CWM were valid and pursuant to the terms on the PMA. Does the PMA specifically state that instructions can be accepted “validly” from unlicensed, known scammers who are trading illegally? Perhaps when your pants catch fire, you’d like to go to an unqualified, unlicensed scammer posing as a doctor?

The Trustees are entirely responsible for any losses incurred on the Portfolio as a result of the actions undertaken by CWM. Generali Worldwide were not a party to any alleged misrepresentations regarding the Portfolio´s performance. All instructions received from CWM were valid and pursuant to the terms on the PMA. Does the PMA specifically state that instructions can be accepted “validly” from unlicensed, known scammers who are trading illegally? Perhaps when your pants catch fire, you’d like to go to an unqualified, unlicensed scammer posing as a doctor?

At no point did Generali Worldwide act improperly, and there is no contractual basis for deviating from the contract terms nor is there any justification for compensation from Generali Worldwide. So, you are acknowledging that there is absolutely no point whatsoever in having a Generali insurance bond? And admitting that the claims made on the Generali website are false?

Our purpose is to actively protect and enhance people’s lives

We play a proactive and leading role in improving people’s lives through insurance.

- We are dedicated to the heart of insurance – managing and mitigating risks of individuals and institutions.

- Generali is also committed to creating value

- We deeply care about our clients’ and our peoples’ lives

- We have an impact on the quality of people’s lives: wealth, safety, advice and service are instrumental in improving people’s chosen way of life for the long term.

For the avoidance of Doubt Generali Worldwide strenuously denies that we have committed or facilitated any financial crimes as alleged. But throughout this absurd denial, Generali has indeed admitted repeatedly that it has facilitated financial crime by placing so much emphasis and responsibility at the feet of an unlicensed firm of scammers operating illegally in Spain.

This complaint, and the ridiculous response by Generali, will now be referred to the Financial Crime Unit in Jersey as well as the:

Channel Islands Financial Ombudsman

PO Box 114

Jersey,

Channel Islands JE4 9QG

Email: enquiries@ci-fo.org

Website: www.ci-fo.org

Jersey phone: 01534 748610

Guernsey phone: 01481 722218

**************************************

What is a Pension Scam?

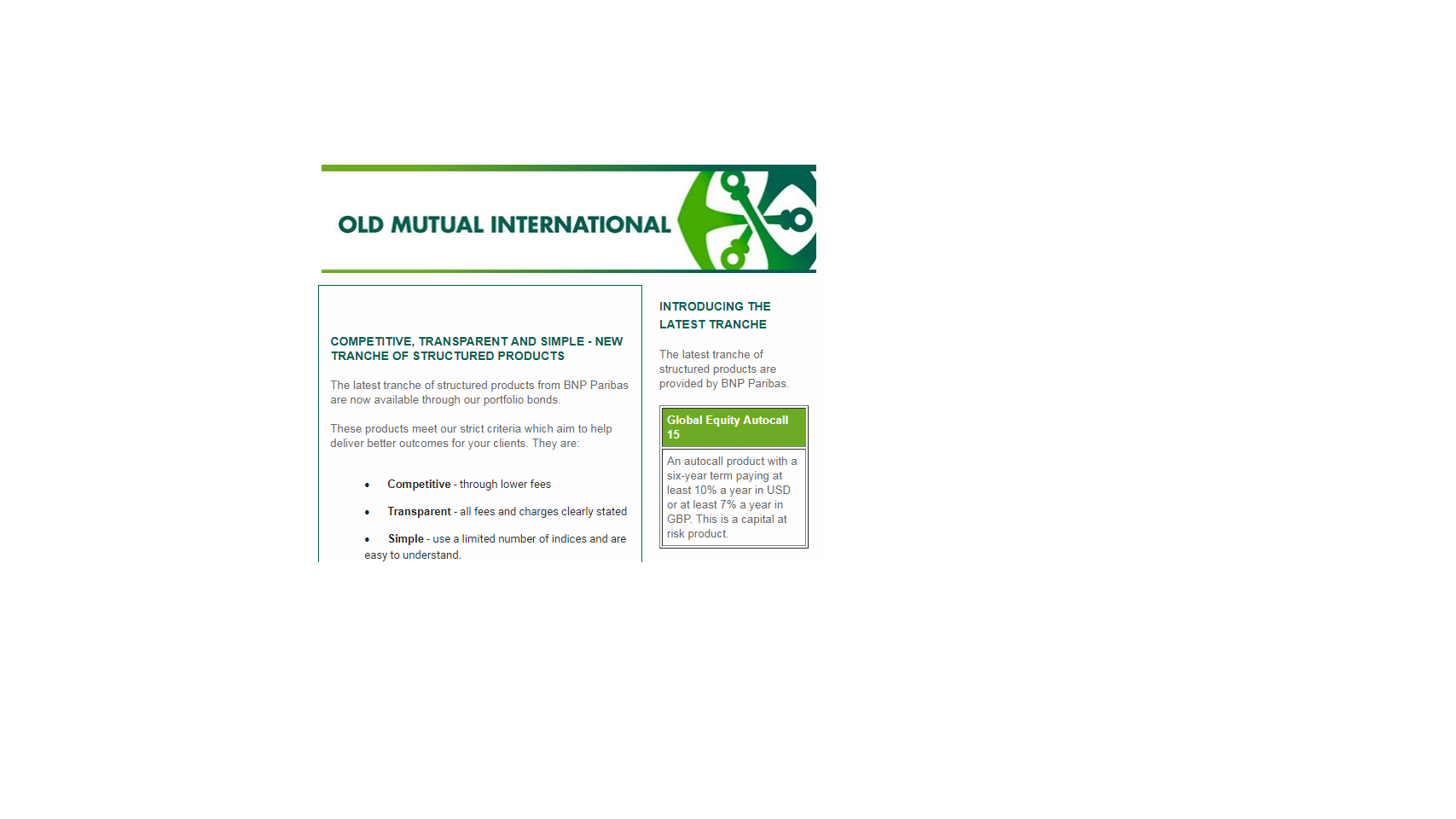

ROLL UP! ROLL UP! ME HEARTY SCAMMERS! OMI’S LATEST STRUCTURED NOTE SCAM IS ONLY AVAILABLE UNTIL SEPTEMBER 28TH SO GET A JIGGLE ON WHILE STOCKS OF THIS TOXIC CRAP LAST! WE ARE PROUD TO OFFER OUR VALUED SCAMMERS YET ANOTHER INVESTMENT SCAM

ROLL UP! ROLL UP! ME HEARTY SCAMMERS! OMI’S LATEST STRUCTURED NOTE SCAM IS ONLY AVAILABLE UNTIL SEPTEMBER 28TH SO GET A JIGGLE ON WHILE STOCKS OF THIS TOXIC CRAP LAST! WE ARE PROUD TO OFFER OUR VALUED SCAMMERS YET ANOTHER INVESTMENT SCAM  So, what are you waiting for? You’ll earn 8% by selling your victims a useless OMI “PORTFOLIO” bond (don’t mention this is illegal in Spain) and then a further 8% from selling this toxic, high-risk BNP Paribas structured note (rubbish inappropriate structured product) which will tie your victims in for six years.

So, what are you waiting for? You’ll earn 8% by selling your victims a useless OMI “PORTFOLIO” bond (don’t mention this is illegal in Spain) and then a further 8% from selling this toxic, high-risk BNP Paribas structured note (rubbish inappropriate structured product) which will tie your victims in for six years.

What a disgrace that Gillett can announce that he is “proud” of their performance over the last 20 years – proud of the misery and stress caused to the victims of the

What a disgrace that Gillett can announce that he is “proud” of their performance over the last 20 years – proud of the misery and stress caused to the victims of the  With the responsibility of Generali being passed over to LCCG, here at Pension Life, we wonder if LCCG will be taking responsibility for Generali´s past victims as well. Will LCCG apply their corporate risk solutions to those who have already been put at risk? Generali on their own certainly didn´t apply a high standard of risk solutions when they placed CWM victims´ funds into high-risk, toxic, professional-investor-only structured notes.

With the responsibility of Generali being passed over to LCCG, here at Pension Life, we wonder if LCCG will be taking responsibility for Generali´s past victims as well. Will LCCG apply their corporate risk solutions to those who have already been put at risk? Generali on their own certainly didn´t apply a high standard of risk solutions when they placed CWM victims´ funds into high-risk, toxic, professional-investor-only structured notes.

First, let me explain a little more about what an IPO is:

First, let me explain a little more about what an IPO is:

If I were a potential investor in

If I were a potential investor in

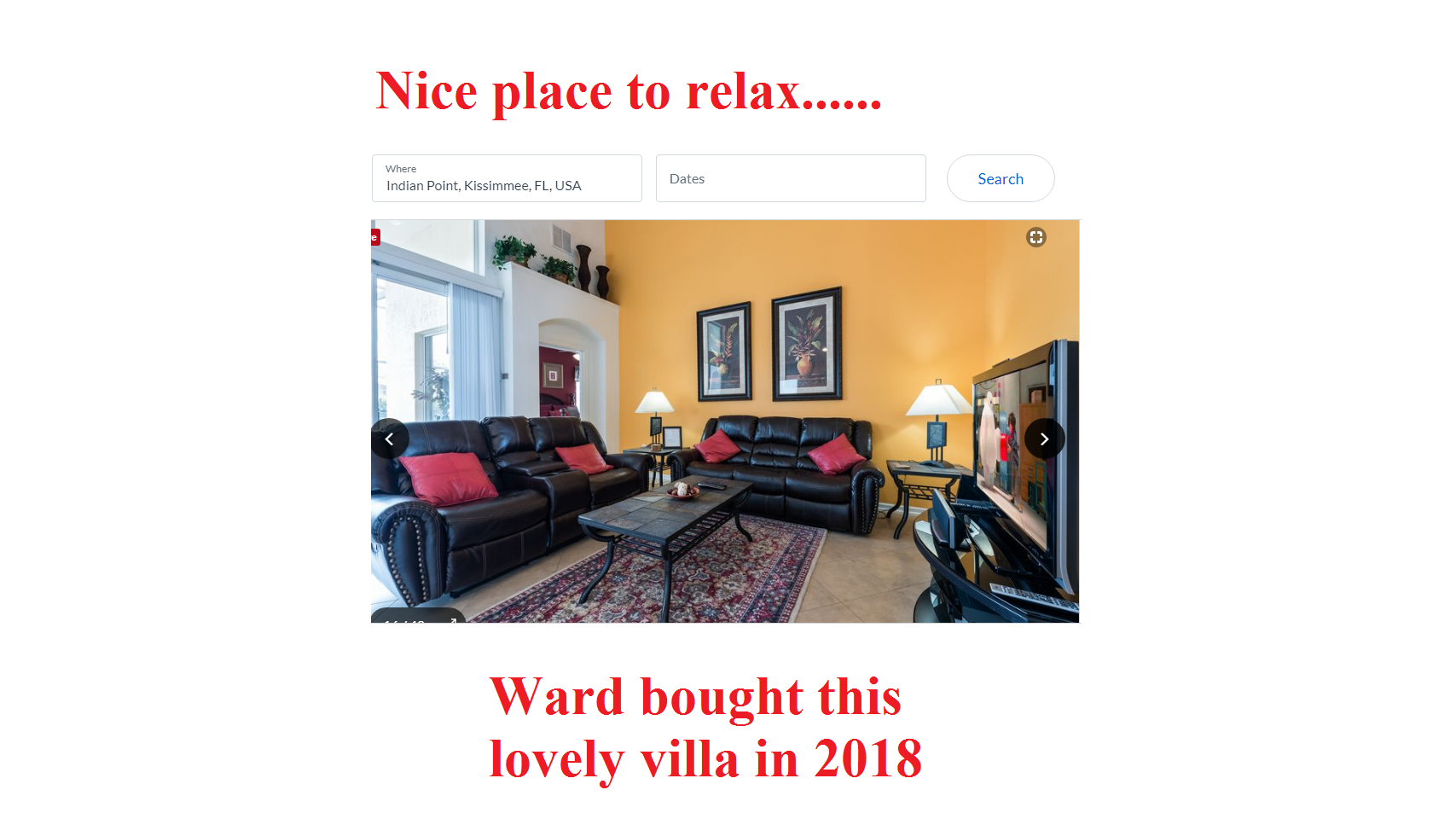

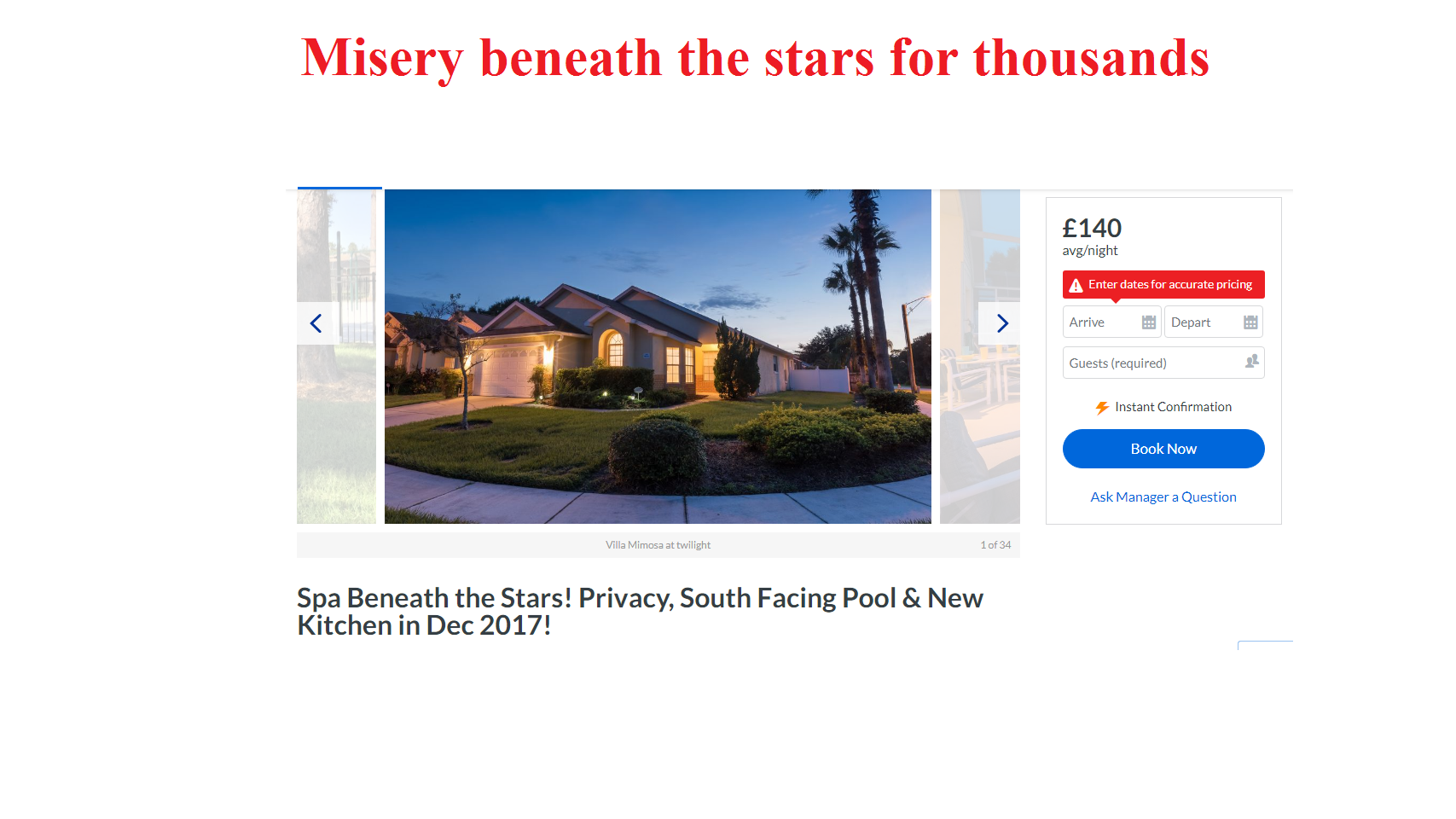

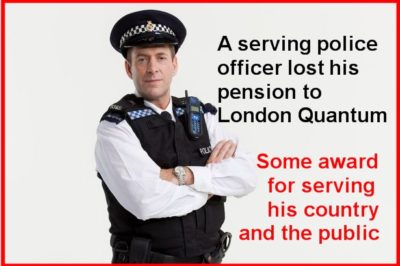

John Rodges had a pension pot of £202,000. He was cold called by a salesman called Dean Stogsdill and persuaded to transfer his pension fund to a QROPS (Qualifying Recognised Overseas Pension Scheme) with

John Rodges had a pension pot of £202,000. He was cold called by a salesman called Dean Stogsdill and persuaded to transfer his pension fund to a QROPS (Qualifying Recognised Overseas Pension Scheme) with

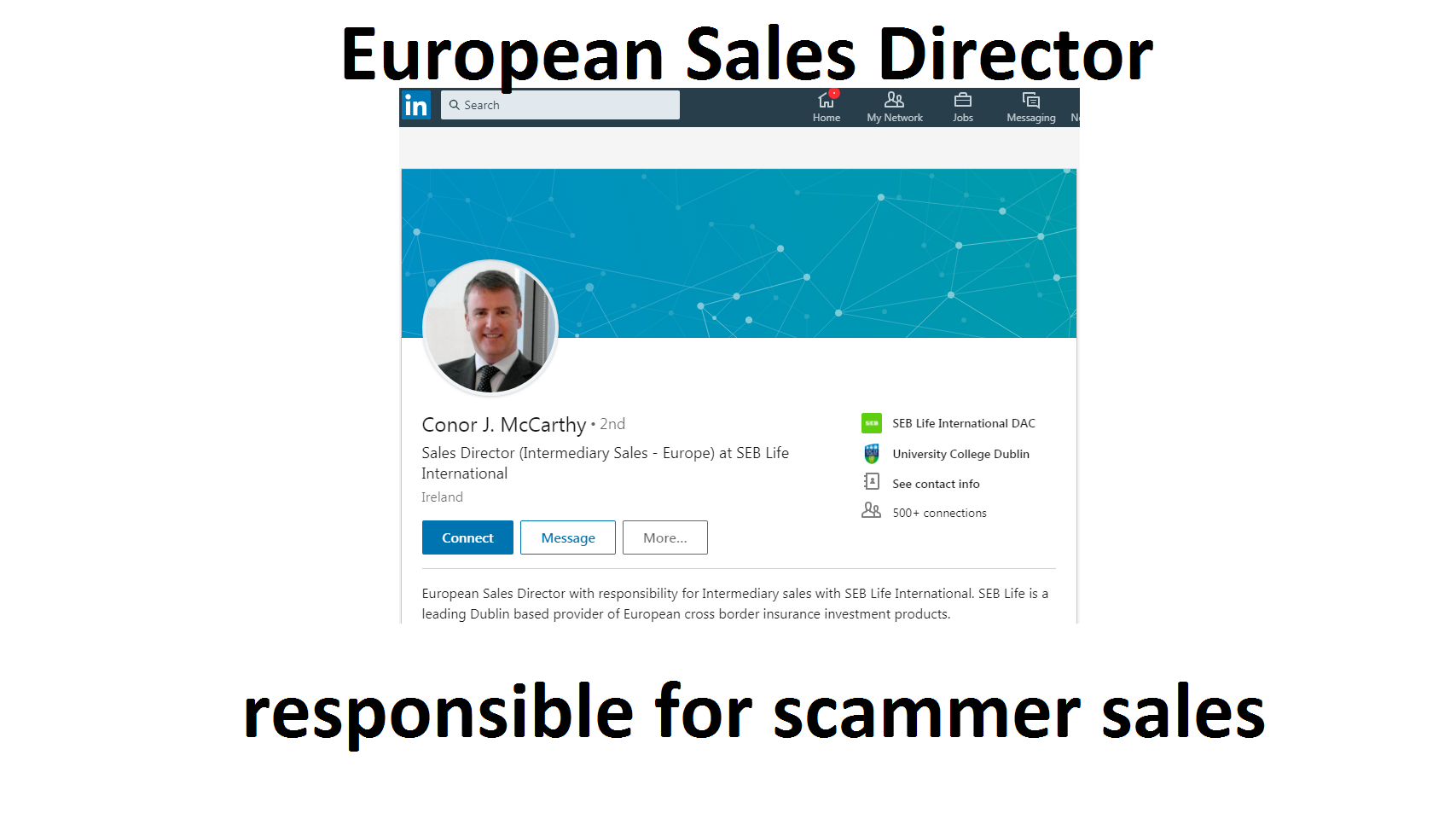

Who at SEB is responsible for the travesty of the destruction of hundreds of victims of the Continental Wealth Management scam? And the

Who at SEB is responsible for the travesty of the destruction of hundreds of victims of the Continental Wealth Management scam? And the  As a marketing graduate, Mr. McCarthy should understand that the best way to “market” a company is to compensate the victims without them having to sue SEB.

As a marketing graduate, Mr. McCarthy should understand that the best way to “market” a company is to compensate the victims without them having to sue SEB.

Generali has responded to one of the complaints by CWM victims. I have transcribed it below and put my comments in bold.

Generali has responded to one of the complaints by CWM victims. I have transcribed it below and put my comments in bold. Our Vision: Our purpose is to actively protect and enhance people’s lives

Our Vision: Our purpose is to actively protect and enhance people’s lives We tie a long-term contract of mutual trust with our people, clients and stakeholders; all of our work is about improving the lives of our clients. Generali has destroyed rather than improved the lives of clients.

We tie a long-term contract of mutual trust with our people, clients and stakeholders; all of our work is about improving the lives of our clients. Generali has destroyed rather than improved the lives of clients. And here we have the first and biggest part of the scam. Generali is trying to make out that the client is not the client – but the pension trustee is the client. The only reason a trustee is used is to comply with HMRC rules. In the UK, HMRC contributes tax relief to help individuals build up as much value as possible in their pensions. But if the fund is transferred offshore, it has to be sent to a QROPS (qualifying, recognised, overseas pension scheme) – otherwise HMRC will charge 55% tax on the transfer. A QROPS is just a wrapper used to hold the funds. The trustee is a custodian used to keep the funds on behalf of the beneficiary – i.e. the member.

And here we have the first and biggest part of the scam. Generali is trying to make out that the client is not the client – but the pension trustee is the client. The only reason a trustee is used is to comply with HMRC rules. In the UK, HMRC contributes tax relief to help individuals build up as much value as possible in their pensions. But if the fund is transferred offshore, it has to be sent to a QROPS (qualifying, recognised, overseas pension scheme) – otherwise HMRC will charge 55% tax on the transfer. A QROPS is just a wrapper used to hold the funds. The trustee is a custodian used to keep the funds on behalf of the beneficiary – i.e. the member.  Let us look at the risk profile issue. Whose risk profile is done using a fact find? Is it the trustee’s? Is the trustee asked about his assets, liabilities, age, retirement plans? No, of course not. Is the advice to transfer given to the trustee? Negative.

Let us look at the risk profile issue. Whose risk profile is done using a fact find? Is it the trustee’s? Is the trustee asked about his assets, liabilities, age, retirement plans? No, of course not. Is the advice to transfer given to the trustee? Negative.  The Trustees are entirely responsible for any losses incurred on the Portfolio as a result of the actions undertaken by CWM. Generali Worldwide were not a party to any alleged misrepresentations regarding the Portfolio´s performance. All instructions received from CWM were valid and pursuant to the terms on the PMA. Does the PMA specifically state that instructions can be accepted “validly” from unlicensed, known scammers who are trading illegally? Perhaps when your pants catch fire, you’d like to go to an unqualified, unlicensed scammer posing as a doctor?

The Trustees are entirely responsible for any losses incurred on the Portfolio as a result of the actions undertaken by CWM. Generali Worldwide were not a party to any alleged misrepresentations regarding the Portfolio´s performance. All instructions received from CWM were valid and pursuant to the terms on the PMA. Does the PMA specifically state that instructions can be accepted “validly” from unlicensed, known scammers who are trading illegally? Perhaps when your pants catch fire, you’d like to go to an unqualified, unlicensed scammer posing as a doctor?

SEB – DESTROYING LIFE SAVINGS – accepting business and investment instructions from unlicensed scammers.

SEB – DESTROYING LIFE SAVINGS – accepting business and investment instructions from unlicensed scammers.

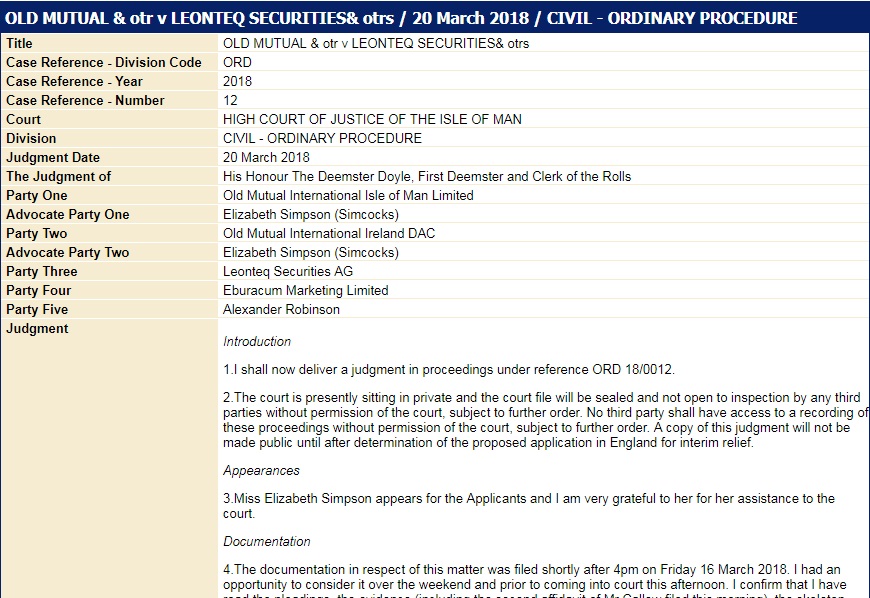

This is a major victory not only for the two claimants who were victims of financial loss at the hands of Abbey Financial Solutions and OMI, but also for Lawbird – as a firm which is prepared to stand up for justice and decency. This also signals an important precedent for the hundreds of victims of Continental Wealth Management (CWM) who have, between them, lost many £ millions of their retirement savings.

This is a major victory not only for the two claimants who were victims of financial loss at the hands of Abbey Financial Solutions and OMI, but also for Lawbird – as a firm which is prepared to stand up for justice and decency. This also signals an important precedent for the hundreds of victims of Continental Wealth Management (CWM) who have, between them, lost many £ millions of their retirement savings.

OMI cannot now try to cherry pick which bits of the scam should be brought to justice and which should be let off. OMI was in it with Leonteq – and idly sat by as the Leonteq notes failed and victims lost anything up to 100% of their funds due to the very high-risk nature of these toxic derivative investment products (which, in reality amount to nothing more than gambling).

OMI cannot now try to cherry pick which bits of the scam should be brought to justice and which should be let off. OMI was in it with Leonteq – and idly sat by as the Leonteq notes failed and victims lost anything up to 100% of their funds due to the very high-risk nature of these toxic derivative investment products (which, in reality amount to nothing more than gambling). Or maybe it will disappear altogether – and some good Samaritan will tow it out into the Atlantic for hosting and harbouring so many scams and scammers in recent years.

Or maybe it will disappear altogether – and some good Samaritan will tow it out into the Atlantic for hosting and harbouring so many scams and scammers in recent years. The Isle of Man is a small offshore territory between Ireland and England (and with which, now, neither will want to be associated). It does not belong to the EU (phew), but it does belong to the United Kingdom (not for long, hopefully), which provides it with a defense and foreign policy (but no guidance on avoiding scams and scammers). Despite having only 75,000 inhabitants, it has shown pride (in hosting so many financial scammers?).

The Isle of Man is a small offshore territory between Ireland and England (and with which, now, neither will want to be associated). It does not belong to the EU (phew), but it does belong to the United Kingdom (not for long, hopefully), which provides it with a defense and foreign policy (but no guidance on avoiding scams and scammers). Despite having only 75,000 inhabitants, it has shown pride (in hosting so many financial scammers?).