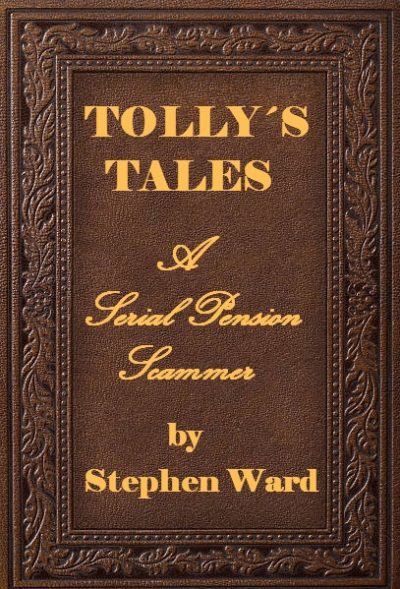

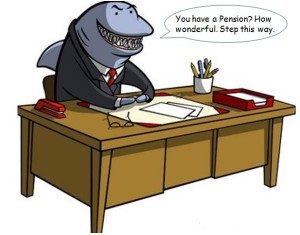

International Investment interview with Angie Brooks, founder of Pension Life this week. This blog is written by Kim, Angie´s Assistant. Here´s the interview video which explains how Pension Life works to help victims of pension and investment scams. The interview also raises the question as to why pension and investment scams are so prolific – despite Angie’s hard work to bring them into the public eye – and bring scammers to justice.

As Angie states in the video, Pension Life was originally founded to help victims of the ARK pension scam with their tax liabilities. However, four years on and Pension Life has evolved. Angie is now involved in helping 34 different groups of victims of pension and investment scams. Angie regularly goes to the regulators and ombudsmen in different jurisdictions and makes complaints on their behalf.

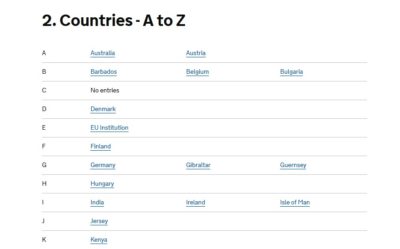

Pension Life is based in Spain, and Angie works with clients all over the world. Pension and investment scammers have no boundaries or borders and will weave their evil mischief wherever they can find British expats.

Pension Life is based in Spain, and Angie works with clients all over the world. Pension and investment scammers have no boundaries or borders and will weave their evil mischief wherever they can find British expats.

Angie offers her members a fixed membership fee, meaning “people know exactly what they are going to pay in advance”. Using privately-funded solicitors can be pricey and sometimes even non-starterer. Angie has, over the past four years, educated herself in pension and investment scams – how they work and how they are (constantly) evolving. Members can rest assured that they are being represented by a leading expert in the area of pension and investment scams.

If it were up to Angie, the people and firms responsible for pension and investment scams would all be sent to jail and the keys thrown away. With her weekly blogs and videos on the Pension Life website, and with the use of social media, Angie is hoping to get the word out there and warn both the public and the industry.

Angie stands up for the masses, where their single complaints are lost in a pile of excuses by the firms responsible for the destruction of their funds. She meets and speaks to as many victims as she can. Each victim has his or her own tragedy – often involving serious health issues and terrible financial hardship as a result of being scammed out of their life savings.

Angie stands up for the masses, where their single complaints are lost in a pile of excuses by the firms responsible for the destruction of their funds. She meets and speaks to as many victims as she can. Each victim has his or her own tragedy – often involving serious health issues and terrible financial hardship as a result of being scammed out of their life savings.

Some of Angie´s blogs are very hard hitting towards the firms and advisors who condone the use of pension and investment scams. The role Angie plays in uncovering the crooks of the industry is not without risk and often her outspoken words attract negative attention. Angie often receives threats of being sued by the lawyers who represent the companies she blogs about.

Angie states, “But If I was frightened I wouldn´t do it.”

Its not just solicitors who bombard her in outrage about the clearly-evidenced facts that Angie reports, she also has a herd of internet trolls who target her incessantly.

Angie says with reference to her blog trolls:

here is a reason why I write my blogs. Firstly to warn the public and expose the things that go wrong in the financial services industry – to try to help new people avoid falling victim to scams, negligence and mis-selling; secondly to bring firms to the table to negotiate a solution to a problem where a client has suffered losses in their pension or investment portfolio. Few people have funds to instruct lawyers to sue firms to force them to pay redress for clients’ losses, so it is much better and cheaper to get the firm to volunteer to do so amicably and in a non-contentious manner.

here is a reason why I write my blogs. Firstly to warn the public and expose the things that go wrong in the financial services industry – to try to help new people avoid falling victim to scams, negligence and mis-selling; secondly to bring firms to the table to negotiate a solution to a problem where a client has suffered losses in their pension or investment portfolio. Few people have funds to instruct lawyers to sue firms to force them to pay redress for clients’ losses, so it is much better and cheaper to get the firm to volunteer to do so amicably and in a non-contentious manner. I have in the past had very public spats on social media with deVere AND its CEO, Nigel Green, as well as the others who I have been accused of not writing about. And, if I need to have spats again in the future, I will not hesitate to do so. Like most firms, deVere has indeed made some serious mistakes in the past. However, I do not have any live, unresolved client complaints against the firm.

I have in the past had very public spats on social media with deVere AND its CEO, Nigel Green, as well as the others who I have been accused of not writing about. And, if I need to have spats again in the future, I will not hesitate to do so. Like most firms, deVere has indeed made some serious mistakes in the past. However, I do not have any live, unresolved client complaints against the firm.

But this is all just rubbish from scammers who are trying to deflect attention from the main issues that I am writing about. The commenters ignore the facts I am reporting about – i.e. real scams which destroy victims’ life savings – and pick away at me personally. That is absolutely fine, because I am more than happy to be criticised and lied about – because it says more about the writer than it does about me. The people who matter know the truth.

Regular readers of my blogs may notice that sometimes my blogs quietly disappear with no public explanation. There is a reason for that too. The blogs often bring firms to the table and we get stuff done. Sometimes firms even preempt matters and make contact even before I get a chance to do a blog.

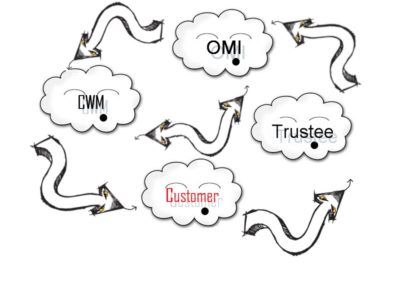

If I call a firm to discuss a problem and they enter into helpful and constructive dialogue over how to solve it, I don’t blog about it but keep the matter confidential. There are firms who quietly sort things out without making a fuss in a dignified and conscientious manner. In contrast, however, there are firms that just pull up the shutters – such as OMI and STM Fidecs. Hence why I keep blogging about them.

DeVere is indeed one of a number of firms I don’t currently blog about. So for the nice gentleman called Graham and another charming chap who calls himself “Innocent Bystander” who are accusing me of being partisan, don’t think just about what I do write, but about what I don’t write. There are good reasons for both.

I will continue to expose the actions, practices and vulgar conduct of firms who continue to ignore my questions; And I will tag all those who are stupid and irresponsible enough to keep on working for these firms and helping to fill these firms already bulging pockets. In contrast, however, Holborn Assets and Guardian Wealth Management have engaged in relation to complaints, and so I have removed all blogs which mention the firm.”

For the future, Angie hopes things will get better and that the war on pension and investment scams can be won. However, much help is needed and Angie calls for the whole industry to get involved and make it their business to know what is happening to expats worldwide.

Airing the problem is one of the best solutions and International Investment has taken a keen interest in the campaigning side of what Pension Life does. It would be a really good thing if some of the media tried to educate themselves on what are the key issues and avoid barking up the wrong trees.

Winky accused me of bombarding him with emails (about the Capita Oak scam). I counted them: 16 over an 8-week period. My calculator said that was approximately two per week.

Winky accused me of bombarding him with emails (about the Capita Oak scam). I counted them: 16 over an 8-week period. My calculator said that was approximately two per week.

I had to spell out some words several times as the man’s English seemed to get worse as the agonisingly painful conversation dragged on and on. When I had finished, exhausted and wondering if this was all a bad dream, the man said “OK, hand your documents into the post room”. We duly dropped the bulging envelope into the tiny little room just outside the entrance to the FCA building. I assume it was all shredded as we never even got an acknowledgement.

I had to spell out some words several times as the man’s English seemed to get worse as the agonisingly painful conversation dragged on and on. When I had finished, exhausted and wondering if this was all a bad dream, the man said “OK, hand your documents into the post room”. We duly dropped the bulging envelope into the tiny little room just outside the entrance to the FCA building. I assume it was all shredded as we never even got an acknowledgement.

Kenny told International Adviser:

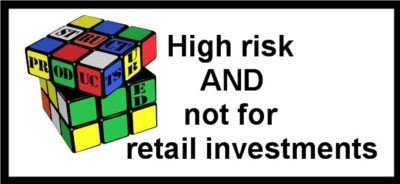

Kenny told International Adviser: Here at Pension Life, we do hope that even trainees at OMI are aware that pension fund members are retail investors and should be placed into low to medium risk, liquid investments. However, it seems that these details obviously don´t feature in OMI´s training manual.

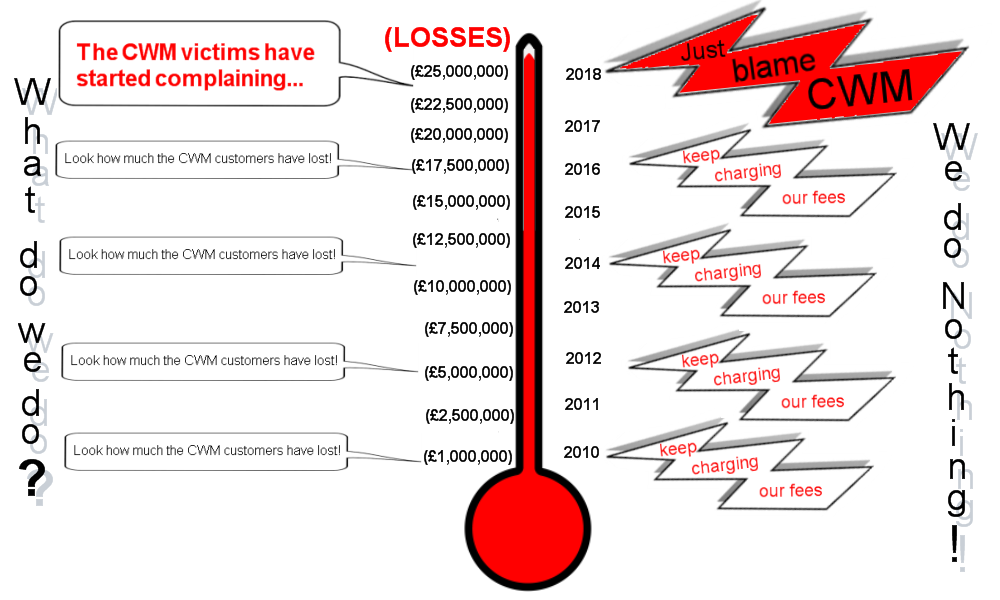

Here at Pension Life, we do hope that even trainees at OMI are aware that pension fund members are retail investors and should be placed into low to medium risk, liquid investments. However, it seems that these details obviously don´t feature in OMI´s training manual. Regrettably for the investors who were victims of the CWM scammers and OMI, they most definitely did not possess the depth of knowledge required to fully understand the risks. They put their faith in the smartly- dressed scammers. With promises of high returns, the high risk of the investments and high fees to be charged were left unmentioned. OMI were supposed to protect the victims’ interests but failed dismally to lift a finger to help arrest the downward spiral of the funds.

Regrettably for the investors who were victims of the CWM scammers and OMI, they most definitely did not possess the depth of knowledge required to fully understand the risks. They put their faith in the smartly- dressed scammers. With promises of high returns, the high risk of the investments and high fees to be charged were left unmentioned. OMI were supposed to protect the victims’ interests but failed dismally to lift a finger to help arrest the downward spiral of the funds.

THIS SHOULD NEVER HAPPEN

THIS SHOULD NEVER HAPPEN

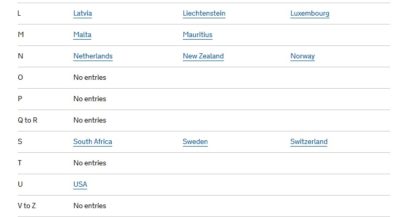

Seems we can´t get enough of Holborn Assets’ cheek this week. CEO Bob Parker has sent out a Q1 2018 newsletter and included on his mailing list a very unsatisfied and traumatised client who, through Holborn Assets’ negligence, has suffered a significant loss to her pension fund, with no compensation – or even apology.

Seems we can´t get enough of Holborn Assets’ cheek this week. CEO Bob Parker has sent out a Q1 2018 newsletter and included on his mailing list a very unsatisfied and traumatised client who, through Holborn Assets’ negligence, has suffered a significant loss to her pension fund, with no compensation – or even apology.

I might even nip down to Johannesburg and have a cup of tea and a cheeky biscuit with him. No doubt, he won’t want the sordid details of Holborn Assets’ scams to compromise his quest to conquer South Africa. If the natives find out just what his colleagues have been up to, he might find himself on the wrong end of a Zulu spear.

I might even nip down to Johannesburg and have a cup of tea and a cheeky biscuit with him. No doubt, he won’t want the sordid details of Holborn Assets’ scams to compromise his quest to conquer South Africa. If the natives find out just what his colleagues have been up to, he might find himself on the wrong end of a Zulu spear.

Mike’s non-pension savings then went through Active Wealth into Dolphin Trust GmbH, which specialises in the development of German-listed buildings and promises 10% returns on investment. He says he was unaware that he was signed up to a fixed term payment (minimum 2 years) and of the associated

Mike’s non-pension savings then went through Active Wealth into Dolphin Trust GmbH, which specialises in the development of German-listed buildings and promises 10% returns on investment. He says he was unaware that he was signed up to a fixed term payment (minimum 2 years) and of the associated  It all started with a presentation made to British Steel Workers via Celtic Wealth. How on earth are these people were able to make a presentation to innocent victims-to-be for an UNREGULATED investment is beyond me. Especially when Celtic Wealth was not authorised to provide investment advice.

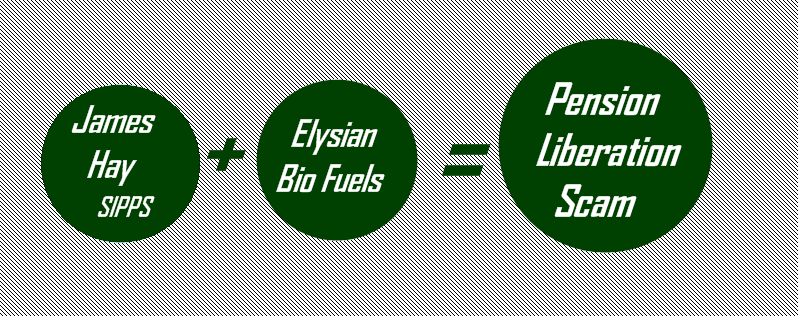

It all started with a presentation made to British Steel Workers via Celtic Wealth. How on earth are these people were able to make a presentation to innocent victims-to-be for an UNREGULATED investment is beyond me. Especially when Celtic Wealth was not authorised to provide investment advice. Transfers into self-invested personal pensions (SIPPS) dominated the

Transfers into self-invested personal pensions (SIPPS) dominated the

Having focused very much on bad pension investments, pension scams and how to avoid them, I´d like to talk a bit about PensionBee, a relatively new pension provider.

Having focused very much on bad pension investments, pension scams and how to avoid them, I´d like to talk a bit about PensionBee, a relatively new pension provider.

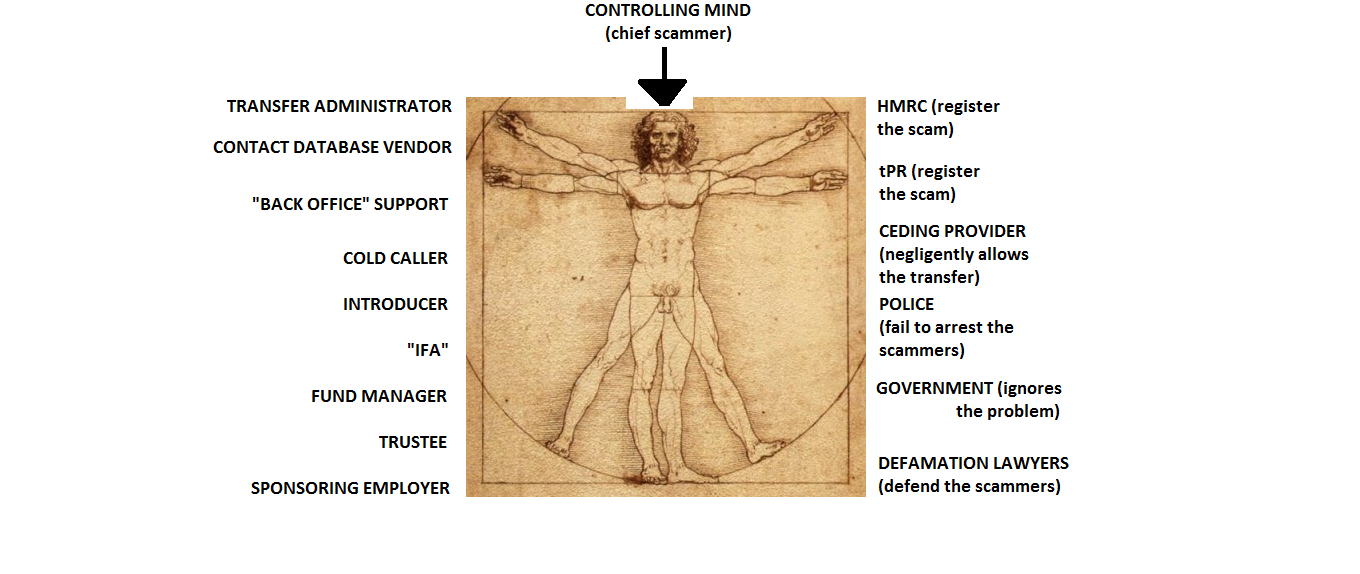

There are many different types of pension scam – just as there are many types of genuine pension scheme. This can sometimes make it difficult to tell the difference so we are her to help you inform you about, what is a pension scam.

There are many different types of pension scam – just as there are many types of genuine pension scheme. This can sometimes make it difficult to tell the difference so we are her to help you inform you about, what is a pension scam.