Intro written by Kim: ‘This week Angie travelled for work (yet again): she had to fly from Granada to Barcelona. Disaster struck – her baggage sadly did not make the full journey -it’s sitting in the triangle of lost luggage no doubt. The airline – Vueling – whilst only providing the flight, was still happy to take responsibility for the loss of her bag and its contents, and compensate her. That got her thinking: if an airline can take full responsibility for a loss, why are life offices like OMI turning a blind eye to the massive losses they have caused to thousands of pension scam victims’ funds?

Intro written by Kim: ‘This week Angie travelled for work (yet again): she had to fly from Granada to Barcelona. Disaster struck – her baggage sadly did not make the full journey -it’s sitting in the triangle of lost luggage no doubt. The airline – Vueling – whilst only providing the flight, was still happy to take responsibility for the loss of her bag and its contents, and compensate her. That got her thinking: if an airline can take full responsibility for a loss, why are life offices like OMI turning a blind eye to the massive losses they have caused to thousands of pension scam victims’ funds?

Over to Angie:

The financial services industry (especially offshore) has a lot to learn from the airline industry. Aviation stakeholders internationally provide the highest possible levels of safety for air travellers. This due diligence is constantly reviewed, updated and improved. The same standard of responsibility routinely happens in all jurisdictions. Regulators, as well as air crash investigators, work together when things go right. As well as when they don’t.

The work of the air industry regulators, investigators and safety trainers never ceases with all parties constantly striving to maintain the highest possible standards of performance and safety. And when something goes wrong, everybody swings into action like the A-team, International Rescue and Tom Cruise combined.

The work of the air industry regulators, investigators and safety trainers never ceases with all parties constantly striving to maintain the highest possible standards of performance and safety. And when something goes wrong, everybody swings into action like the A-team, International Rescue and Tom Cruise combined.

I know all this because one of my members is a Captain with a well-known airline (probably quite easy to guess which one!). He also trains pilots from a variety of other airlines in simulators – and this includes Vueling pilots. I will call him Captain BJ.

BJ is a thoroughly decent bloke and has a rather endearing fondness for chickens. He has devoted his professional life to the business of safety in travel. And behind him is a comprehensive and robust system of regulation – internationally. Financial services regulators, on the other hand, stand by and watch (with their hands firmly in their pockets – and their fingers compulsively searching for something with which to fiddle) as the equivalent of hundreds of passenger planes crash every month. The regulators stare blankly at the charred remains of the passengers’ life savings and shrug carelessly at the huge scale of human misery caused so routinely. With such flaccid regulatory regimes in so many jurisdictions, these chocolate-teapot regulators de facto facilitate and encourage losses caused by negligence and scams.

I know all this because Captain BJ is also a pension scam victim – courtesy of Stephen Ward’s Ark £27 million pension scam. Despite the extreme stress of losing his pension, he has to keep a stiff upper lip and continue with his daily routine of flying thousands of passengers safely around the skies of Europe.

My recent experience on a Vueling flight provides an interesting parallel with the “financial services” provided by Old Mutual International. Vueling sells flights. They provide the aircraft; the pilots and the cabin crew. They offer a selection of routes, food and drink, duty free goods, toilets and the expertise to get many thousands of passengers from one destination to another safely and on time; day after day after day.

What Vueling doesn’t do is operate a baggage handling service – this is provided by the airport you travel through. However, no matter how enjoyable a flight has been (if such a thing is possible!) and how punctual the take-off and landing are, the whole experience can be badly marred by the loss of a passenger’s luggage. While Vueling is responsible for the safety of the passengers, it is NOT responsible for the safety of the passengers’ luggage when it is not in the bowels of the aircraft. However, Vueling goes to extraordinary lengths to help people whose luggage has been delayed or lost. Vueling take full responsibility for a loss of luggage, luckily for me.

Earlier this week, it was the baggage handlers at either Granada airport or Barcelona airport who were responsible for my medium-sized, black, tatty suitcase. And they lost it. The case had been full of clothing typically worn by a slightly fat, grey-haired woman on the wrong side of something ending in a nought. So no desirable or valuable designer totty wear, expensive perfume or sparkly jewellery.

But Vueling provide people like me (who end up wearing the same orange jumper and purple socks two days in a row) with an easy to use, online complaints and redress facility. It wasn’t Vueling’s fault that my luggage got lost, but they take responsibility for it anyway because it is part of the whole flight “package”.

But Vueling provide people like me (who end up wearing the same orange jumper and purple socks two days in a row) with an easy to use, online complaints and redress facility. It wasn’t Vueling’s fault that my luggage got lost, but they take responsibility for it anyway because it is part of the whole flight “package”.

Contrast this with Old Mutual International (OMI) and the IoM regulator. And thank your lucky stars that they don’t try to run an airline (because if they did, it is unlikely any passengers or luggage would ever survive). OMI provides “insurance bonds” or bogus life assurance policies. These products serve no purpose except to pay fat commissions to rogue IFAs. And they feature a selection of risky investment products for the IFAs to earn even more commission. What OMI does not provide is financial advice – that is the job of someone else (i.e. the IFAs). But when the IFAs do the equivalent of losing the baggage, OMI takes no interest or responsibility other than to record the loss.

In the air industry, there are two things that can go wrong that can cause customers financial damage: flight delays and loss of luggage. A comprehensive complaints and redress system is routinely provided by all leading airlines. In the financial services industry, there are two things that can go wrong that can cause customers financial damage: investment failures and disproportionately high charges. No complaints and redress system is provided by life offices such as OMI and no one takes full responsibility for a loss.

If an airline experiences a crash, a huge machine swings into action to investigate the cause and take immediate remedial action to prevent the same or similar event from ever causing another accident. If a life office such as OMI experiences a crash, it pretends nothing has happened. Pension scam victims? No pension scam victims here! OMI denies all responsibility. And blames the IFA. Or the weather. Or Brexit. And keeps charging the victims the same disproportionately high fees based on the huge commissions they originally paid to the IFA that caused the crash.

Here are some examples of OMI’s crashes in the past six years:

* Axiom Litigation Fund – this was a PROFESSIONAL-INVESTOR-ONLY fund which was routinely used by rogue IFAs for ordinary, retail investors (and from which the IFAs earned fat commissions). OMI offered the Axiom fund on the bogus “life assurance” platform. And when the fund went into administration in December 2012, OMI shrugged its shoulders and said “not our problem“. And kept charging the victims the same fees as if the £120 million loss hadn’t happened.

OMI knew that many of the IFAs had been neither regulated nor qualified and that the investors were unsophisticated, low-risk, retail customers.

* LM Australian Property Fund – this was a PROFESSIONAL-INVESTOR-ONLY fund which was routinely used by rogue IFAs for ordinary, retail investors (and from which the IFAs earned fat commissions). OMI offered the LM fund on the bogus “life assurance” platform. And when the fund went into administration in March 2013, OMI shrugged its shoulders and said “not our problem“. And kept charging the victims the same fees as if the £240 million loss hadn’t happened.

OMI knew that many of the IFAs had been neither regulated nor qualified and that the investors were unsophisticated, low-risk, retail customers.

OMI knew that many of the IFAs had been neither regulated nor qualified and that the investors were unsophisticated, low-risk, retail customers.

* Premier New Earth Recycling Fund – this was a PROFESSIONAL-INVESTOR-ONLY fund which was routinely used by rogue IFAs for ordinary, retail investors (and from which the IFAs earned fat commissions). OMI offered the PNER fund on the bogus “life assurance” platform. And when the fund went into administration in June 2016, OMI shrugged its shoulders and said “not our problem“. And kept charging the victims the same fees as if the £800 million loss hadn’t happened.

OMI knew that many of the IFAs had been neither regulated nor qualified and that the investors were unsophisticated, low-risk, retail customers. That is £1.16 billion worth of fund losses in just over six years, but they take no responsibility for loss of funds and the pension scam victim gets no redress.

(Note – if you read the above three examples, you will see that although the funds, dates and amounts were different, the circumstances were EXACTLY the same!)

Add to this the £ billions lost through toxic, risky structured notes, and that adds up to quite a cricket score that OMI “wasn’t responsible for“.

The causes were all the same:

UNREGULATED ADVISORY FIRMS

UNQUALIFIED ADVISERS

FUNDS OFFERING HUGE COMMISSIONS

FUNDS SUITABLE FOR HIGH-RISK, PROFESSIONAL INVESTORS SOLD TO LOW-RISK, RETAIL INVESTORS

NO DUE DILIGENCE BY OMI

We know that OMI bought:

£200 million worth of failed Leonteq structured notes

between 2012 and 2016 as OMI is claiming to be suing Leonteq. But this does little to distract attention from OMI’s multiple, long-term failures for allowing such toxic investments in the first place and causing many people to become pension scam victims.

If I give my car keys to someone who is so drunk they can barely stand up – and certainly can’t spell either OMI or IOM – and there is a serious accident, whose fault is it? The drunk’s or mine?

If I give my car keys to someone who is so drunk they can barely stand up – and certainly can’t spell either OMI or IOM – and there is a serious accident, whose fault is it? The drunk’s or mine?

OMI’s CEO is a bloke called Peter Kenny who used to work for the IoM regulator. So he should know better. But he doesn’t. So we must assume he would be happy to hand his car keys over to a drunk or let an unqualified pilot fly a plane with a broken wing. And he would still claim it wasn’t his fault, despite the number of pension scam victims.

The moral of this blog is: never wear orange and purple on a flight; never use an OMI life bond; always use a qualified, regulated and insured IFA. Don’t become the next pension scam victim.

My next dilemma is what to buy with my Vueling compensation. I feel a trip to Marks and Sparks coming on. (I needed a bigger size anyway!).

(Huge thanks to Captain BJ – to whom I owe my sanity).

PS – since we wrote and published this blog, my luggage has been found. Apparently, it never left Granada airport. I suspect somebody pinched it – then found the clothes inside were so dull that they didn’t think it was worth taking it after all.

CWM Pension scam – A victim’s reconstruction

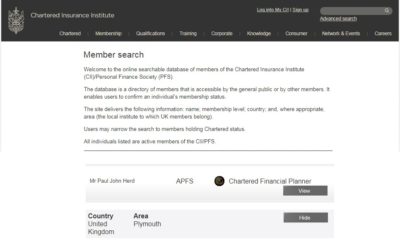

Before joining Elite Wealth Management, Paul Herd was with a firm called MFS Partnership – which went belly up. Now, I have never run a financial advisory firm. If I had a fanciful idea of starting one, I probably wouldn’t know where to start – but one thing is for sure: I would not employ anybody who had caused clients to lose £290k of their retirement savings.

Before joining Elite Wealth Management, Paul Herd was with a firm called MFS Partnership – which went belly up. Now, I have never run a financial advisory firm. If I had a fanciful idea of starting one, I probably wouldn’t know where to start – but one thing is for sure: I would not employ anybody who had caused clients to lose £290k of their retirement savings. This begs the question, why Paul Herd invested his clients’ fund in the New Earth Recycling fund. As in, all of it. The answer lies, of course, in the fact that Mr. Herd had heard that New Earth was paying big fat introduction commissions. And he had probably also herd (sorry, heard) that lots of scammers at leading scamming factory in Dubai,

This begs the question, why Paul Herd invested his clients’ fund in the New Earth Recycling fund. As in, all of it. The answer lies, of course, in the fact that Mr. Herd had heard that New Earth was paying big fat introduction commissions. And he had probably also herd (sorry, heard) that lots of scammers at leading scamming factory in Dubai,

Investors are likely to have lost all their money in

Investors are likely to have lost all their money in