January 28/29 2021 saw the cross examination of Stephen Ward in Pension Life’s criminal case in the Denia court. Ward gave the judge an elaborate explanation as to how and why none of the Continental Wealth Management pension and investment scams were his fault.

Ward provided the pension transfer “advice” to hundreds of Continental Wealth Management victims – facilitating the handing over of millions of pounds’ worth of personal and occupational pensions into the hands of well-known, firmly-established scammers. Once out of the relative safety of the UK, and into the offshore abyss, the scammers made millions out of undisclosed commissions on the victims’ life savings. The investments were, of course, largely worthless. Victims lost somewhere between a small percentage and a large percentage – with a few losing 100%. And a few more even going overdrawn on their pension accounts.

Ward’s Spanish firm Premier Pension Solutions, worked as “sister company” to Darren Kirby’s and Jody Smart’s Continental Wealth Management. After Ark in 2011, Ward moved straight onto the Evergreen New Zealand QROPS liberation scam. And CWM did the cold calling to sign up 300 victims to the toxic £10 million pension scam and so-called “loans” from Ward’s own finance company – Marazion.

Ark (and indeed Evergreen) victims may well want an answer to the question: why hasn’t Ward been prosecuted before now? The lack of any previous criminal proceedings against him, for the many other scams he was involved in, is – indeed – astonishing.

Capita Oak, Westminster, Southlands, Headforte, London Quantum et al – could all have been prevented had Ward been behind bars. Victims of all of those scams might still have their pensions had it not been for Ward.

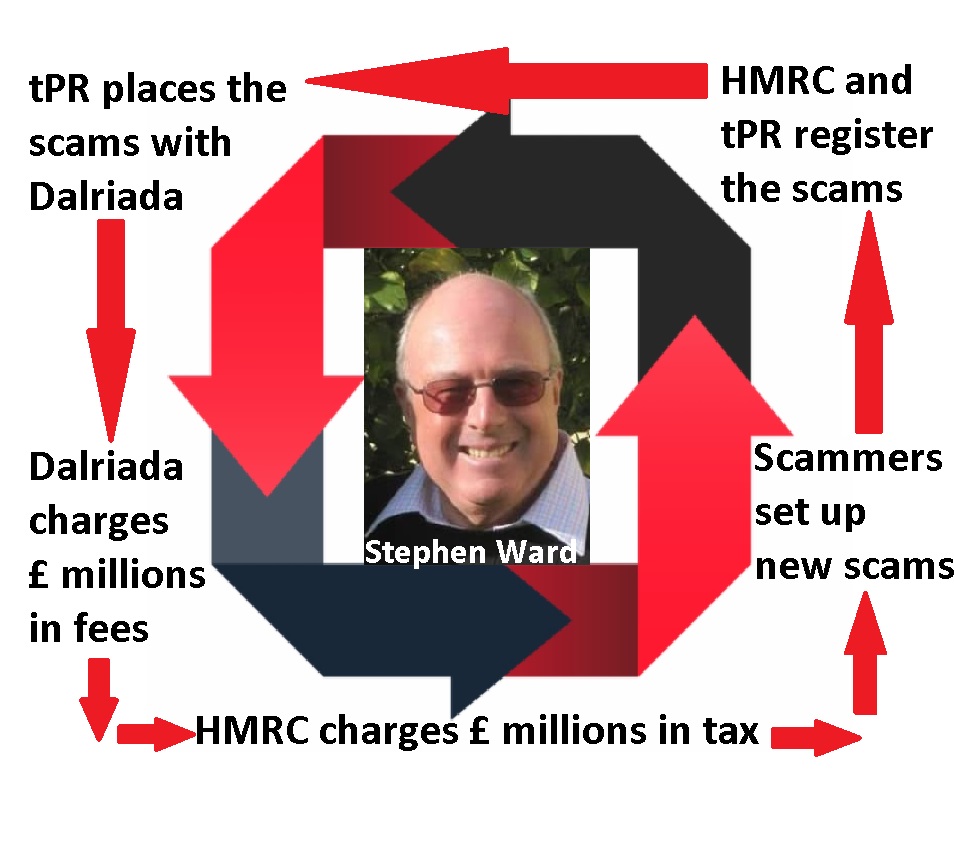

Part of the answer may lie with Dalriada Trustees. The firm was appointed by the Pensions Regulator to the Ark schemes as independent trustee on 31st May 2011. Over £27 million worth of pensions had been transferred from safe, professionally-run pension schemes into the six Ark schemes. Nearly 500 people are affected – many of whom had received reciprocal “loans” on the advice of Stephen Ward and his very convincing associates. Ward had assured all the victims that the loans would be “tax free”. But, of course, HMRC does not share that view – and the tax trial is starting in March 2021.

HMRC is looking to tax all those who did get “loans” and also all those who didn’t. HMRC’s argument is firstly that even if members didn’t get a loan, they had made the transfer with the intention of getting a loan, and secondly that they “made” a loan.

One of the first questions I ever asked Dalriada back in 2013 (appointed by the Pensions Regulator – who registered the Ark schemes in the first place) was:

“Why didn’t you bring criminal proceedings against Stephen Ward and all the other scammers who set up and ran Ark?”

Dalriada’s answer was:

“We didn’t think it was within our remit”.

So what is (or was) Dalriada’s remit? And has it fulfilled that remit? And how much has it cost?

DALRIADA’S REMIT:

- To suspend the Ark schemes so that no further “loans” could be made; no further victims lost their pensions; no further toxic investments could be made

- To investigate the schemes to find out how they had been run and where the money had gone

- To recover the toxic investments and return the money to the schemes

- To liaise with the members and keep them informed

- To liaise with HMRC on the unauthorised payment tax liabilities

The above points are all guesses on my part. Certainly, Dalriada has admitted that they didn’t really know where to start at the beginning. They had no idea what they would find, once they started investigating, and no clue as to how much work was going to be involved.

Dalriada has, indeed, recovered some of the toxic investments in the Ark schemes. But communications with the members have been limp at best. Dalriada has spent a lot of time, effort and money on taking proceedings against the victims themselves to recover the “loans”, but seems to have spent zero time, effort or money on pursuing the scammers.

Most important of all, Dalriada has not invested any of the money left in the Ark schemes – so members (victims) have missed out on the longest investment bull run in history. Bottom line: there’s been no growth in the value of the Ark funds – only shrinkage. Had the funds been invested in something as simple as a low-cost tracker fund, they could have grown by some 330% at least.

Of the original £27 million in the Ark schemes, Dalriada has spent more than £7.4 million on trustees’ and lawyers’ fees between 31st May 2011 and 31st May 2020. But isn’t it reasonable to ask: “Why couldn’t Dalriada have spent some of that money on criminal proceedings against Stephen Ward and some (or all) of the other scammers?”

Dalriada Trustees have been appointed to more than 100 pension scams in the past ten years (by the Pensions Regulator). But there is no evidence that any of the scammers – especially the prolific Stephen Ward – have ever had any CRIMINAL action taken against them by Dalriada in an effort to prevent further scams.

The Mail’s financial reporter Tom Kelly (who has been covering the CWM criminal trial in Spain) has published an article about Dalriada and their trusteeship of pension scams.

Kelly reports that “Pension scam victims have lost millions of pounds more to the government-appointed trustees hired to get their money back.” and that “Victims say Dalriada Trustees ‘inexplicably’ held their recovered retirement savings for years and then only paid a fraction of their money back.”

Kelly has been to meet me in Spain several times. He attended the Denia court for the first set of cross examinations in 2020, and reports that “tens of thousands of savers had lost up to £10 billion in rogue schemes that looked safe because they were registered by HMRC and overseen by the Pensions Regulator”.

Kelly goes on to cite the case of one victim who waited seven years to have his £157,000 pension pot returned to him by Dalriada. But they deducted £90,000 in charges before handing it back to him. And this was after Dalriada had rescued the fund in full, before the scammers had managed to invest the money in toxic, commission-paying assets.

With 5,400 pension scam victims having Dalriada as their trustees, it is perhaps time to ask whether this is a tenable solution. Scammers could, realistically, be forgiven for thinking that once Dalriada takes charge, this is merely a license for the next scam, and the next one, and the next one…… Because, Dalriada is never going to report the scammers for fraud. So they are free to keep on scamming people out of their pensions repeatedly.

THE DIZZEE RASCALS AT THE FCA:

THE DIZZEE RASCALS AT THE FCA: Before Debbie Gupta sticks her big foot in her mouth any further, I would suggest she attempts to learn something about scams, scammers and scamees. She should come and spend a week with me. Sit up until midnight talking distraught victims out of suicide a couple of times. She should go to Port Talbot with Al Rush and talk to some steelworkers and hear their tragic stories for herself.

Before Debbie Gupta sticks her big foot in her mouth any further, I would suggest she attempts to learn something about scams, scammers and scamees. She should come and spend a week with me. Sit up until midnight talking distraught victims out of suicide a couple of times. She should go to Port Talbot with Al Rush and talk to some steelworkers and hear their tragic stories for herself. All the above will save the FCA nearly three quarters of a million pounds a year.

All the above will save the FCA nearly three quarters of a million pounds a year.

The Spanish Insurance Regulator – the DGS (Dirección General de Seguros y Fondos de Pensiones) – has made a most welcome judgment. This outlaws the mis-selling of bogus life assurance policies as investment “platforms” – aka “life bonds”.

The Spanish Insurance Regulator – the DGS (Dirección General de Seguros y Fondos de Pensiones) – has made a most welcome judgment. This outlaws the mis-selling of bogus life assurance policies as investment “platforms” – aka “life bonds”.

So popular is the use of life bonds among the seedier sector of the financial services industry, that multi-national firm

So popular is the use of life bonds among the seedier sector of the financial services industry, that multi-national firm

Those of you who follow

Those of you who follow