The world of pension and investment scams is dominated and driven by commissions on investments (usually unregulated). The scammers’ strategy is always identical: get the pensions away from the safety of a reputable pension provider and into the hands of a SIPP, a SSAS or a QROPS. One purported benefit of these types of schemes is that the member has control over where the funds are invested. This means that the scammers have control over where the funds are invested. These types of schemes are open to abuse by unscrupulous commission hunters whose only mission is to fill their own pockets – at the expense of the victim. Once transferred, the victims’ retirement funds are controlled by the scammers and invested in unsuitable, unregulated investments which pay fat introduction commissions.

It could be argued, however, that not all the investments are necessarily bad. There are some basic rules for pension investments – so let’s take a look at the different types and how they could (or should) fit into a pension portfolio.

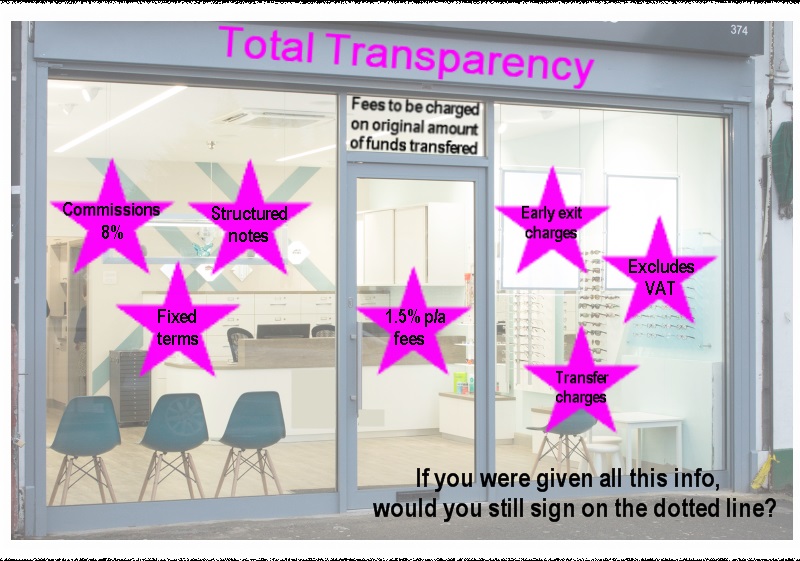

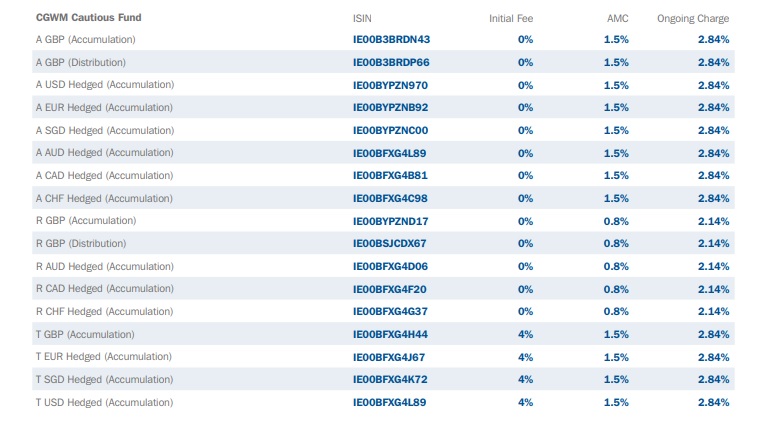

- Funds. Funds come in all shapes, sizes, flavours and types. As long as the funds are regulated, have a good track record, are appropriate to the risk profile of the individual investor and are competently managed by qualified investment professionals, they can be appropriate for a pension. However, pension scheme members must not be locked into any funds, and the charges must be transparent and affordable. There must not be any hidden commissions, and any one fund should form part of a diverse portfolio.

- Bonds. Bonds are term loans with supposed “guaranteed” returns or interest. They are not regulated investment products, so there is no guarantee or protection in the event that they fail (as they often do). Typically, they are sold to victims as being “asset backed” and with unrealistically high returns or interest. They also typically pay high commissions to the scammers who promote them. These should be avoided at all costs as they are entirely unsuitable, risky and illiquid for retail investors – and so many of them are out and out scams.

- Structured Notes. These are “derivatives” and are very complex instruments which are only suitable for sophisticated or professional investors. They also pay hefty commissions to the scammers who use them indiscriminately to “churn” their victims’ funds. Churning means investing the same sum of money multiple times in different structured notes to generate the maximum amount of (hidden) commissions. An experienced and sophisticated investor might want to consider having a small part of a pension portfolio invested in structured notes – as long as the commission taken by the “adviser” is low enough (or preferably non-existent).

- Property. Residential property cannot form part of a pension’s underlying assets. However, commercial or agricultural land or property is acceptable. The main problem with property, however, is that it is illiquid – so it should only be used with extreme caution as part of a diverse portfolio of well-spread assets. Property also typically attracts high commissions and can frequently be used and abused by scammers. Store pods and car parking spaces fall into this category, along with holiday accommodation, forestry and industrial units.

The key to building a sensible and appropriate portfolio of assets for a pension is to ensure that only a licensed and qualified adviser is used to recommend the investments. Such professionals should only be charging for advice – and should not be earning commission on the investment products which are sold. If an adviser is receiving commission from the investment provider, then he cannot be independent – and should not be giving advice at all.

The key to making sure that the whole pension investment package is in the interests of the investor – rather than purely in the interests of someone posing (often fraudulently) as an adviser – is to look at each stage in the process.

What I mean by the “package” is this:

A. The transfer out of the existing pension scheme should be in the interests of the investor

B. The transfer in to the new pension scheme should be in the interests of the investor

C. The investment of the pension fund should be in the interests of the investor – and not just the adviser (or introducer)

D. There must be no offers of “loans” or “cashback”

The timeline of the past eleven years is littered with sordid and tragic examples of the whole “package” being nothing but a scam. But often this is true even when one of the component parts is legitimate or even harmless. It is the combination of all the elements which can, together, produce a fatal result: loss (to the investor).

In the UK, every pension scheme member has a statutory right to a transfer from one HMRC-registered scheme to another HMRC-registered scheme. However, this can often be a terrible move if it results in the investment of the money falling under the control of a commission-hungry scammer who has no regard for the interests of the victim.

The most risky part of any pension transfer “package” is always the investment. Here are some examples:

Capita Oak

Bogus occupational scheme set up by a squad of known, serial scammers with a mythical sponsoring employer (in Cyprus). Promoted and distributed by boiler-room cold callers and “introducers”. 300 victims’ pensions transferred into the Capita Oak scheme, and all £10 million of their funds invested in Store First. The scammers behind the scheme earned up to 46% in commission. The scheme was placed in the hands of Dalriada by the Pension Regulator. Dalriada reported that the investments were worthless and Store First was placed into liquidation in 2019.

Carey Pensions

Hundreds of victims’ pensions were transferred to the Carey SIPP scheme purely so their funds could be invested in Store First. With the same result as in the Capita Oak scam, victims found that the “guaranteed” returns of 16% did not materialise. This was because the 16% had been paid “accidentally” to the scammers. One such victim – Russell Adams – took his case to the High Court and lost. But the judgement was overturned in the Court of Appeal and Carey must now reinstate his original pension. Other SIPP providers involved were Berkeley Burke, Montpelier (Curtis Banks) and Lifetime (Hartley).

London Quantum

Another bogus occupational scheme – run by the notorious Stephen Ward. 100 victims were scammed out of their pensions for the sole purpose of investing their funds in high-commission, unregulated funds and bonds. Investments included Quantum PYX – a forex trading fund; Dolphin Trust – now in liquidation; Park First Glasgow; Colonial Capital Loan Notes; The Resort Group holiday flats in Cape Verde and The Reforestation Group in Brazil. The scheme was placed in the hands of Dalriada by the Pension Regulator. Dalriada reports that most of the investments are worthless.

GFS Hong Kong QROPS

A group of known unlicensed scammers – including Square Mile in the Czech Republic – advised hundreds of UK residents to transfer their pensions to this Hong Kong scheme. All the victims had their pensions invested in worthless, high-commission, unregulated funds and bonds such as Blackmore Global, Swan, GRRE, Granite and Christianson Property Capital. The scheme is now being re-registered by the Hong Kong regulator – and the funds are deemed to be worthless.

Continental Wealth Management

Unlicensed CWM, based on the Costa Blanca in Spain, defrauded 1,000 British expats out of £100 million worth of pensions and life savings. Victims had their funds invested in high-risk (and high-commission) structured notes which were only suitable for professional investors. The clients’ signatures were forged on the investment dealing instructions. Most of the structured notes suffered catastrophic losses, and what little remained of the victims’ funds were further eroded by the high fees on the illegally-sold insurance bonds provided by Quilter, Utmost and SEB. The CWM crew – along with Stephen Ward of Premier Pension Solutions (who signed off all the pension transfers) – are now facing criminal charges of fraud and forgery in Spain.

When we buy certain products, they have a warning on them. Cigarette packets, for instance, state that smoking is bad for your health. The wrappers show hideous images of what might happen to you if you use tobacco.

When we buy certain products, they have a warning on them. Cigarette packets, for instance, state that smoking is bad for your health. The wrappers show hideous images of what might happen to you if you use tobacco. What worries us most is the lack of regulatory concern or control in respect of expensive and risky investment products. You can’t buy cigarettes without a stern health warning. The same goes for alcohol: bottles and cans clearly state how many units are in the container, and how many units men and women can safely drink per day. They also state that alcohol should not be consumed by pregnant women.

What worries us most is the lack of regulatory concern or control in respect of expensive and risky investment products. You can’t buy cigarettes without a stern health warning. The same goes for alcohol: bottles and cans clearly state how many units are in the container, and how many units men and women can safely drink per day. They also state that alcohol should not be consumed by pregnant women. You can’t buy a gun without going to a registered shop and having a licence. (Although, I guess on the black market you can). If you buy a gun on the black market, it is going to be ‘hot’. The person you buy it from is going to be dodgy and it certainly won’t come with the correct paperwork.

You can’t buy a gun without going to a registered shop and having a licence. (Although, I guess on the black market you can). If you buy a gun on the black market, it is going to be ‘hot’. The person you buy it from is going to be dodgy and it certainly won’t come with the correct paperwork.

In January 2019, we saw legal challenges going forward against not one but two SIPPS providers for their roles in using and promoting unregulated investments. Berkeley Burke SIPPS Administration and Carey Pensions (the latter now owned by rogue QROPS trustee firm STM Group).

In January 2019, we saw legal challenges going forward against not one but two SIPPS providers for their roles in using and promoting unregulated investments. Berkeley Burke SIPPS Administration and Carey Pensions (the latter now owned by rogue QROPS trustee firm STM Group). Tighter protocols on pension investments are something that we would happily welcome here at Pension Life. With higher standards of compliance and fewer small providers, people investing their pensions into SIPPS should hopefully have a clearer and safer picture.

Tighter protocols on pension investments are something that we would happily welcome here at Pension Life. With higher standards of compliance and fewer small providers, people investing their pensions into SIPPS should hopefully have a clearer and safer picture.

and quotes SCM Direct as saying “Its time for the chief executive of the FCA, Andrew Bailey, to demonstrate that he is willing to be the industry enforcer rather than the industry lapdog.”

and quotes SCM Direct as saying “Its time for the chief executive of the FCA, Andrew Bailey, to demonstrate that he is willing to be the industry enforcer rather than the industry lapdog.”

Just for a laugh, have a look on

Just for a laugh, have a look on