Intro written by Kim: ‘This week Angie travelled for work (yet again): she had to fly from Granada to Barcelona. Disaster struck – her baggage sadly did not make the full journey -it’s sitting in the triangle of lost luggage no doubt. The airline – Vueling – whilst only providing the flight, was still happy to take responsibility for the loss of her bag and its contents, and compensate her. That got her thinking: if an airline can take full responsibility for a loss, why are life offices like OMI turning a blind eye to the massive losses they have caused to thousands of pension scam victims’ funds?

Intro written by Kim: ‘This week Angie travelled for work (yet again): she had to fly from Granada to Barcelona. Disaster struck – her baggage sadly did not make the full journey -it’s sitting in the triangle of lost luggage no doubt. The airline – Vueling – whilst only providing the flight, was still happy to take responsibility for the loss of her bag and its contents, and compensate her. That got her thinking: if an airline can take full responsibility for a loss, why are life offices like OMI turning a blind eye to the massive losses they have caused to thousands of pension scam victims’ funds?

Over to Angie:

The financial services industry (especially offshore) has a lot to learn from the airline industry. Aviation stakeholders internationally provide the highest possible levels of safety for air travellers. This due diligence is constantly reviewed, updated and improved. The same standard of responsibility routinely happens in all jurisdictions. Regulators, as well as air crash investigators, work together when things go right. As well as when they don’t.

The work of the air industry regulators, investigators and safety trainers never ceases with all parties constantly striving to maintain the highest possible standards of performance and safety. And when something goes wrong, everybody swings into action like the A-team, International Rescue and Tom Cruise combined.

The work of the air industry regulators, investigators and safety trainers never ceases with all parties constantly striving to maintain the highest possible standards of performance and safety. And when something goes wrong, everybody swings into action like the A-team, International Rescue and Tom Cruise combined.

I know all this because one of my members is a Captain with a well-known airline (probably quite easy to guess which one!). He also trains pilots from a variety of other airlines in simulators – and this includes Vueling pilots. I will call him Captain BJ.

BJ is a thoroughly decent bloke and has a rather endearing fondness for chickens. He has devoted his professional life to the business of safety in travel. And behind him is a comprehensive and robust system of regulation – internationally. Financial services regulators, on the other hand, stand by and watch (with their hands firmly in their pockets – and their fingers compulsively searching for something with which to fiddle) as the equivalent of hundreds of passenger planes crash every month. The regulators stare blankly at the charred remains of the passengers’ life savings and shrug carelessly at the huge scale of human misery caused so routinely. With such flaccid regulatory regimes in so many jurisdictions, these chocolate-teapot regulators de facto facilitate and encourage losses caused by negligence and scams.

I know all this because Captain BJ is also a pension scam victim – courtesy of Stephen Ward’s Ark £27 million pension scam. Despite the extreme stress of losing his pension, he has to keep a stiff upper lip and continue with his daily routine of flying thousands of passengers safely around the skies of Europe.

My recent experience on a Vueling flight provides an interesting parallel with the “financial services” provided by Old Mutual International. Vueling sells flights. They provide the aircraft; the pilots and the cabin crew. They offer a selection of routes, food and drink, duty free goods, toilets and the expertise to get many thousands of passengers from one destination to another safely and on time; day after day after day.

What Vueling doesn’t do is operate a baggage handling service – this is provided by the airport you travel through. However, no matter how enjoyable a flight has been (if such a thing is possible!) and how punctual the take-off and landing are, the whole experience can be badly marred by the loss of a passenger’s luggage. While Vueling is responsible for the safety of the passengers, it is NOT responsible for the safety of the passengers’ luggage when it is not in the bowels of the aircraft. However, Vueling goes to extraordinary lengths to help people whose luggage has been delayed or lost. Vueling take full responsibility for a loss of luggage, luckily for me.

Earlier this week, it was the baggage handlers at either Granada airport or Barcelona airport who were responsible for my medium-sized, black, tatty suitcase. And they lost it. The case had been full of clothing typically worn by a slightly fat, grey-haired woman on the wrong side of something ending in a nought. So no desirable or valuable designer totty wear, expensive perfume or sparkly jewellery.

But Vueling provide people like me (who end up wearing the same orange jumper and purple socks two days in a row) with an easy to use, online complaints and redress facility. It wasn’t Vueling’s fault that my luggage got lost, but they take responsibility for it anyway because it is part of the whole flight “package”.

But Vueling provide people like me (who end up wearing the same orange jumper and purple socks two days in a row) with an easy to use, online complaints and redress facility. It wasn’t Vueling’s fault that my luggage got lost, but they take responsibility for it anyway because it is part of the whole flight “package”.

Contrast this with Old Mutual International (OMI) and the IoM regulator. And thank your lucky stars that they don’t try to run an airline (because if they did, it is unlikely any passengers or luggage would ever survive). OMI provides “insurance bonds” or bogus life assurance policies. These products serve no purpose except to pay fat commissions to rogue IFAs. And they feature a selection of risky investment products for the IFAs to earn even more commission. What OMI does not provide is financial advice – that is the job of someone else (i.e. the IFAs). But when the IFAs do the equivalent of losing the baggage, OMI takes no interest or responsibility other than to record the loss.

In the air industry, there are two things that can go wrong that can cause customers financial damage: flight delays and loss of luggage. A comprehensive complaints and redress system is routinely provided by all leading airlines. In the financial services industry, there are two things that can go wrong that can cause customers financial damage: investment failures and disproportionately high charges. No complaints and redress system is provided by life offices such as OMI and no one takes full responsibility for a loss.

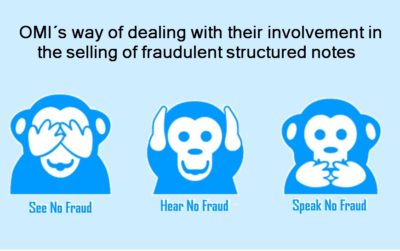

If an airline experiences a crash, a huge machine swings into action to investigate the cause and take immediate remedial action to prevent the same or similar event from ever causing another accident. If a life office such as OMI experiences a crash, it pretends nothing has happened. Pension scam victims? No pension scam victims here! OMI denies all responsibility. And blames the IFA. Or the weather. Or Brexit. And keeps charging the victims the same disproportionately high fees based on the huge commissions they originally paid to the IFA that caused the crash.

Here are some examples of OMI’s crashes in the past six years:

* Axiom Litigation Fund – this was a PROFESSIONAL-INVESTOR-ONLY fund which was routinely used by rogue IFAs for ordinary, retail investors (and from which the IFAs earned fat commissions). OMI offered the Axiom fund on the bogus “life assurance” platform. And when the fund went into administration in December 2012, OMI shrugged its shoulders and said “not our problem“. And kept charging the victims the same fees as if the £120 million loss hadn’t happened.

OMI knew that many of the IFAs had been neither regulated nor qualified and that the investors were unsophisticated, low-risk, retail customers.

* LM Australian Property Fund – this was a PROFESSIONAL-INVESTOR-ONLY fund which was routinely used by rogue IFAs for ordinary, retail investors (and from which the IFAs earned fat commissions). OMI offered the LM fund on the bogus “life assurance” platform. And when the fund went into administration in March 2013, OMI shrugged its shoulders and said “not our problem“. And kept charging the victims the same fees as if the £240 million loss hadn’t happened.

OMI knew that many of the IFAs had been neither regulated nor qualified and that the investors were unsophisticated, low-risk, retail customers.

OMI knew that many of the IFAs had been neither regulated nor qualified and that the investors were unsophisticated, low-risk, retail customers.

* Premier New Earth Recycling Fund – this was a PROFESSIONAL-INVESTOR-ONLY fund which was routinely used by rogue IFAs for ordinary, retail investors (and from which the IFAs earned fat commissions). OMI offered the PNER fund on the bogus “life assurance” platform. And when the fund went into administration in June 2016, OMI shrugged its shoulders and said “not our problem“. And kept charging the victims the same fees as if the £800 million loss hadn’t happened.

OMI knew that many of the IFAs had been neither regulated nor qualified and that the investors were unsophisticated, low-risk, retail customers. That is £1.16 billion worth of fund losses in just over six years, but they take no responsibility for loss of funds and the pension scam victim gets no redress.

(Note – if you read the above three examples, you will see that although the funds, dates and amounts were different, the circumstances were EXACTLY the same!)

Add to this the £ billions lost through toxic, risky structured notes, and that adds up to quite a cricket score that OMI “wasn’t responsible for“.

The causes were all the same:

UNREGULATED ADVISORY FIRMS

UNQUALIFIED ADVISERS

FUNDS OFFERING HUGE COMMISSIONS

FUNDS SUITABLE FOR HIGH-RISK, PROFESSIONAL INVESTORS SOLD TO LOW-RISK, RETAIL INVESTORS

NO DUE DILIGENCE BY OMI

We know that OMI bought:

£200 million worth of failed Leonteq structured notes

between 2012 and 2016 as OMI is claiming to be suing Leonteq. But this does little to distract attention from OMI’s multiple, long-term failures for allowing such toxic investments in the first place and causing many people to become pension scam victims.

If I give my car keys to someone who is so drunk they can barely stand up – and certainly can’t spell either OMI or IOM – and there is a serious accident, whose fault is it? The drunk’s or mine?

If I give my car keys to someone who is so drunk they can barely stand up – and certainly can’t spell either OMI or IOM – and there is a serious accident, whose fault is it? The drunk’s or mine?

OMI’s CEO is a bloke called Peter Kenny who used to work for the IoM regulator. So he should know better. But he doesn’t. So we must assume he would be happy to hand his car keys over to a drunk or let an unqualified pilot fly a plane with a broken wing. And he would still claim it wasn’t his fault, despite the number of pension scam victims.

The moral of this blog is: never wear orange and purple on a flight; never use an OMI life bond; always use a qualified, regulated and insured IFA. Don’t become the next pension scam victim.

My next dilemma is what to buy with my Vueling compensation. I feel a trip to Marks and Sparks coming on. (I needed a bigger size anyway!).

(Huge thanks to Captain BJ – to whom I owe my sanity).

PS – since we wrote and published this blog, my luggage has been found. Apparently, it never left Granada airport. I suspect somebody pinched it – then found the clothes inside were so dull that they didn’t think it was worth taking it after all.

CWM Pension scam – A victim’s reconstruction

Not sure why Kim had to write an “intro” but no matter …

Pensions – like flying – has many players to make the whole thing work like a well oiled machine.

Binding the pensions industry are regulations to ensure customers are protected – that’s the theory anyway.

In the case of flying, the regulations appear to work well; in financial services however, they fail spectacularly because the regulations, supported by legislation are not enforced.

Pension scams, like flying, does operate as a well oiled machine and thrives because the regulators let it happen.

Unlicensed “advisers” are the architects of the operation and their goal is to raise money for risky hare-brained schemes – unregulated funds paying huge commissions and managed by people who can’t get a real job and couldn’t manage a p*ss up in a brewery.

Irrefutable evidence of such an operation is: https://pension-life.com/not-so-square-mile-and-far-from-lilly-white/ and one of the hare-brained funds referred to is Blackmore Global https://pension-life.com/blackmore-global-pension-scam/ and one of the directors of that high risk hare-brained fund is Phillip Nunn – https://pension-life.com/phillip-nunn-scam-year-blackmore-global/ – who is still running risky unregulated schemes, his latest being Blackmore Bond, https://pension-life.com/blackmore-bond-shaken-not-stirred-careless-or-stupid/ and also a high risk crypto-currency investment club! They are like pilots without a licence and no one cares!

The “advisers” are more often than not unqualified and unregulated people – except in the case of Stephen Ward who was, by all accounts, regulated and knowledgeable but used that knowledge to turn to the dark side.

Giving investment advice is – in the UK – a regulated activity and it is unlawful for an unauthorised person to give investment advice to retail customers – see FSMA 2000 s.19, the General Prohibition. Scammers use a useless insurance bond in an attempt to circumvent that. Scammers argue they are actually selling “insurance” and to do that they only need to have “insurance mediation” permissions from the regulator. Apparently insurance mediation licence is easy to get – probably Buy One Get One Free even – whereas permission to give investment advice requires qualifications, something scammers are too stupid and too lazy to get. However, the FCA have told me, in writing that whilst there is an insurance element, it’s the investment rules that apply so it seems insurance mediation is insufficient to advise you to invest in these hare-brained schemes! Consequently these advisers are acting unlawfully.

To facilitate the mistaken belief that insurance mediation is all they need for legitimacy, the scammers have teamed up with offshore trustees that offer a QROP – a tax efficient wrapper for pensions that satisfies HMRC rules, an example being https://pension-life.com/azure-pensions-a-reputation-built-on-lack-of-trust/ and others being STM Fidecs and FNB (https://pension-life.com/fnb-international-trustees-guernsey/ ) – and they have teamed up with insurance companies to offer useless bonds as a wrapper for the unregulated hare-brained investment schemes – OMI is one example; another example is Investors Trust https://pension-life.com/serious-violation-of-investors-trust-by-investors-trust-life-office/ a Cayman Islands company that I believe is not even licensed to sell its products anywhere in the EU but was being used in Malta under the very nose of the MFSA!

So the stage is set, your money flies offshore (and just like luggage, is destined to be lost …) to the QROP, who are then happy to transfer it to the insurance company, who then are quite happy to send it to spivs like Nunn & McCreesh or xxxx xxxx – https://pension-life.com/stm-fidecs-trafalgar-multi-asset-scam/ – to spend on hare-brained private ventures.

Now each participant in this well oiled machine gets a BIG slice of your pension cake: the unqualified advisers get commission from the investment funds – cleverly disguised as a “distribution fee”; the QROP and insurance firm take annual “admin fees” and the managers of the hare-brained schemes take management fees for throwing your money away. Your pension now haemorrhages money at an alarming rate, often for ten years and more often than not, the hare-brained scheme fails, goes bust, money gone but the other players continue to charge you their fees for providing what now becomes “empty wrappers” – duty of care or just simply unjustifiable theft? You decide.

Aviation is a heavily regulated regime. Pilots are “tested” every 6 months for health and to ensure they can still cope with a variety of emergencies; the planes have strict maintenance schedules with every nut and bolt having a detailed history; before every flight, pilots go through a detailed checklist and the pilot even walks round the outside for a visual inspection and cabin crew check seat belts and luggage secured etc. I am sure the CAA audits each company regularly to ensure these checks are actually being performed. There are no doubt stiff penalties for non-compliance!

Financial services is also heavily regulated. For a decade now your ceding provider has been required to carry out some due diligence on all transfer requests and not just rubber stamp them – they don’t check and they do just rubber stamp it – but the Pensions Regulator is not checking and is failing to penalise providers. However, PO-12763 has set an interesting precedent – https://www.pensions-ombudsman.org.uk/determinations/2018/po-12763/the-police-pension-scheme/ – but it needs more testing by more people complaining to the Ombudsman. I have submitted my complaint against my ceding provider – Mercer – who have told me they think my case is weak and have even questioned (in writing) whether I was in a scam at all! That was a despicable and unsympathetic accusation imho and demonstrates their contempt for pension scams. I hope the Ombudsman throws the book at them!

The receiving trustee is governed by trust laws and also owes you a duty of care. They know full well the advisers are unqualified and unregulated; they know the schemes your money ends up in are high risk unregulated investments wholly unsuitable for low risk pensions; they know full well the insurance bond wrapper serves no purpose other than to pay fees to the insurance companies but they go ahead anyway. They flout their “duty of care” and regulators in the many Mickey Mouse jurisdictions favoured by scammers, do not stop them – like Malta, IoM, Guernsey and Gibraltar to name just a few.

Finally, unauthorised advisers are unlawfully carrying out a regulated activity and the FCA are doing nothing to stop it. When you report the advisers they tell you to contact Action Fraud but as as the architect of the scam I got caught in said to me when I threatened Action Fraud: “That’s fine, Action Fraud are nobody and have no authority” – https://pension-life.com/action-fraud-nobody-no-authority-john-ferguson-square-mile-financial-services/

At every step in a scam, those charged with a regulated responsibility, fail to carry it out and the authorities do not apply sanctions for those failures. Orchestrating a pension scam is so easy when the rewards are so lucrative and you don’t have to worry you will get caught and punished! The very system designed to protect you is actually facilitating the scams by making it so easy for the scammers.

Finally, to those people who then accuse victims of pension scams of being either greedy or stupid I say this: If you chose a low budget carrier and the plane crashed on take off and it turned out one or more organisations had cut corners in their checks or maintenance, would you be happy for people to accuse you of being stupid or greedy for choosing a cheap-sh*t budget carrier? Or would you blame those legally charged with a duty of care to you, for trading safety for profit and cutting corners? Would you also be happy for the CAA to be remiss in it’s obligations to investigate and let them off without sanctions? I doubt it very much!

Regulations are there for a reason and organisations that do business in any regulated industry should accept their responsibilities and if found wanting should be the ones penalised – not the victims of their negligence. For some reason pension scams are seen as the victim’s fault, not those negligent of their duties to the victims or those acting unlawfully.

Stephen – Kim wrote the intro because I was away in Barcelona. Your points are, of course, all valid. However, I still battle with so-called “experts” who accuse the victims of being their own worst enemies. This reminds me of Saudi Arabia where victims of rape are stoned to death.

I was unaware of the Saudi Arabia practice you describe, but what you describe is not so dissimilar in this country, where not so long ago victims of rape, or in a violent relationship, where it was often said: “they must have brought it on themselves …”.

Throughout history it has been held that “women” themselves are the reason for rape or violent abuse. In very recent times I have seen women who have been raped said to be responsible simply because they have dressed in a certain way that has “tempted” rape and so the “male cannot possibly be responsible!”

It’s a deplorable conclusion, but I have not heard of women being stoned for it, which is a completely barbaric act but not unexpected in the “backward” region you say it happens.

The world has a long – and I mean a loooong way to go before it can say it is truly “civilised”. Maybe in another 1000 or so year, if ever even! A sad state of affairs, but not one I will have to endure for too long I suspect, 10 years at most maybe?