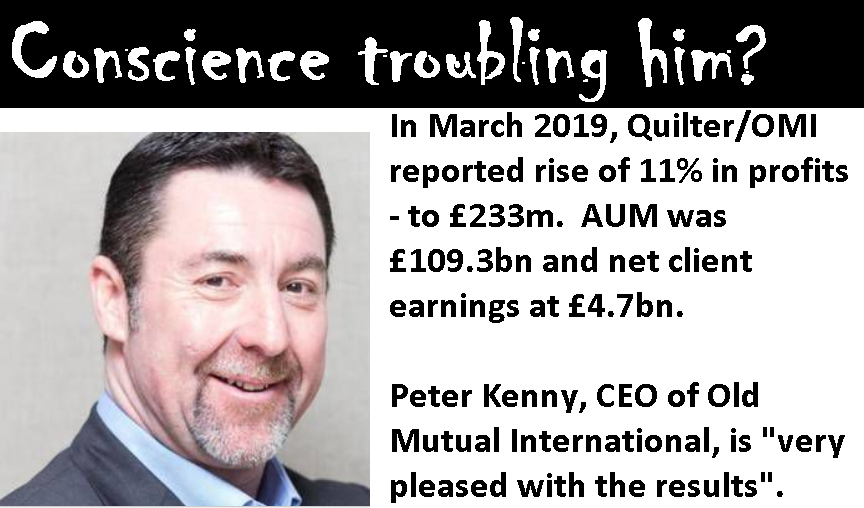

In 2018, Old Mutual International (now Utmost International) announced it was suing structured note provider Leonteq. This was over a series of rogue structured notes with an extra layer of secret commission paid to scammers without Utmost International’s knowledge (allegedly). These notes had failed because they were so enormously high risk. The result was thousands of Utmost’s victims losing huge amounts of their pensions and life savings.

On 28th May 2024, it was announced by QROPS trustees and Old Mutual (later renamed Quilter and now owned by Utmost International – formerly Generali) that Leonteq had settled out of court for the damages caused by these toxic structured notes to thousands of investors.

This announcement was reported by Momentum Pensions in Malta – among other QROPS trustees. Some victims of offshore pension scams facilitated by Old Mutual, Generali, Utmost, RL360, SEB and other life offices will get some compensation for a small part of their huge losses.

Old Mutual International, the life office responsible for thousands of ruined lives in Spain and beyond, announced in 2018 that it was suing structured-note provider Leonteq. There had been a series of extra toxic, high-risk notes for which Leonteq had been paying scammers additional commission “under the table” (i.e. not disclosed to Old Mutual). In early 2023 the matter was settled out of court for an undisclosed amount.

But this is no real compensation for the years of distress and poverty the many thousands of Utmost’s victims have gone through. Lives have been ruined. Families torn apart. Homes lost. Victims have died miserable, lonely deaths – leaving distraught and destitute spouses and partners.

It had originally been reported that Old Mutual had been suing Leonteq for somewhere between £94 million and £200 million. The basis for this action was undisclosed commissions – which is fraud. But Utmost (along with all other life offices) had been quite happy to pay millions in undisclosed commissions to the vast array of scammers who sell their offshore bonds and toxic investments (such as structured notes). But while Utmost had no problem with these outrageous commissions being kept secret from the victims, they objected to the Leonteq commissions being hidden from Utmost themselves.

Momentum is taking further advice on the legalities and tax implications of paying this compensation to pension scheme members. Presumably, STM, SEB and other QROPS providers who had facilitated this fraud will be doing likewise.

While this is indeed welcome news for the thousands of pension savers whose lives were ruined by these failed investments, it does leave many unanswered questions:

- Why did the life offices such as Utmost give terms of business to the scammers in the first place?

- Why didn’t Utmost ensure the scammers disclosed the commissions on the insurance bonds and also on the investments?

- Why did Utmost allow retail investors’ money to be invested in professional-investor-only, high-risk investments?

- Will Utmost be paying compensation for all the other structured notes which were toxic and which failed?

Utmost’s answer to these questions would, obviously, be: “We didn’t give investment advice”. And this is the excuse they will make when they testify in the Isle of Man court – where Signature Litigation and Forsters are suing them and Friends Provident International for £400 million for this very crime.

Utmost and all the other life offices did not – indeed – give investment advice. However, they did act on the investment instructions (often forged) of unlicensed scammers – and reported on the resulting crippling losses for thousands of policyholders. Despite being fully aware of these losses, Utmost continued accepting investment instructions (often with forged investor signatures) for years – paying the same undisclosed commissions to the same scammers, with the same resulting losses.

In fact, Utmost International continues with this fraud to this very day. And now there is evidence that they are paying even higher undisclosed commissions to the very same scammers who have already ruined so many lives for well over a dozen years.

Utmost had not been the only life office involved in the Leonteq structured note scandal. Friends Provident International, Generali, Investors Trust, Julius Baer, RL360 and SEB had all been similarly culpable. But it looks like Utmost had been the only one to sue Leonteq for this fraud.

And let us be clear, undisclosed commission does constitute fraud – irrespective of whether it is committed by the scammers, Leonteq or Utmost International.

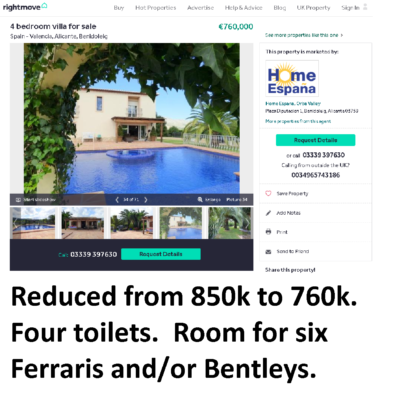

There had been many scammers involved in the receipt of the Leonteq extra (under-the-table) commissions. Known as “Chiringuitos Financieros” by the Spanish regulator, the CNMV, they included Finsbury Financial, Chase Buchanan, Square Mile (later known as Planet Pensions) and – of course – the notorious Continental Wealth Management in Spain.

Perhaps the biggest question which remains unanswered is why the regulator – the Isle of Man Financial Services Authority – has done nothing to sanction the likes of Quilter, Utmost, Friends Provident and RL360? The regulator’s Chair – Lillian Boyle – has been in place since 2015 so she must have known perfectly well how much fraud had been facilitated by the life offices.

Boyle had previously been the CEO, Director and Chair of Isle of Man international life companies and their overseas subsidiaries and branches. So she must have had intimate knowledge of how the secret-commission fraud worked. And yet she has stayed silent.

The IoM FSA’s Chief Executive is Bettina Roth. She has worked for the regulator in the Cayman Islands (that well-known jurisdiction for dodgy financial dealings – including the Trafalgar Multi Asset Fund investment scam). And yet she too has stayed silent. Both Boyle and Roth must know that the Isle of Man is under the spotlight with nearly half a billion pounds’ worth of claims against the death offices for fraud (and a billion more in the pipeline).

The IoMFSA’s own website claims it is “responsible for protecting consumers, reducing financial crime and maintaining confidence in the financial services sector through strong prudential supervision”. And yet the very financial crime that Old Mutual and Utmost International have been committing for more than a dozen years – under the very nose of the regulator – is ignored.

It is indeed great news that Leonteq has paid up. But, did that payment include all the extra-commission paid on the toxic structured notes? And any interest, damages and compensation for the losses and the fraud? And what about the other structured note providers whose toxic products caused just as much (and sometimes more) damage to thousands of victims?

Royal Bank of Canada, Nomura and Commerzbank also listed their toxic products on Utmost Internationals’ investment platforms. A multitude of scammers (who had terms of business with the life offices) used these to ruin their low-risk, retail victims. Did any of these big financial institutions care that they were facilitating financial crime on a massive scale – and ruining thousands of lives?

With the IoM regulator silent, this massive international fraud continues to this day. The life offices are still paying the scammers huge undisclosed commissions for both the insurance bonds and the investments listed on their platforms. In fact, the bond commission can be as high as 9% – for a product that nobody needs and which only serves to facilitate fraud against the policyholders.

In 2018, Utmost International commissioned a report on the Leonteq structured note scam from https://www.futurevc.co.uk/ – a consultancy firm which specialised in structured products systems and research analytics. Their Managing Director, T. M. Mortimer, analysed a test sample of 100 notes and reported the below fees and commission figures:

| Fee Level | Number of Occurrences |

| Less than 6% | 9 |

| 6% – 8% | 4 |

| 8% – 12% | 21 |

| 12% – 16% | 26 |

| 16% – 20% | 14 |

| 20% – 24% | 12 |

| 24% – 28% | 6 |

| 28% or more | 8 |

| 100 |

Mortimer concluded: “In my view a total fee of 8% taken between Leonteq and its associates would be reasonable. This corresponds to the entries in the first two rows in the table.”

This means that only 13% were reasonably (i.e. viably) priced. The remaining 87% were vastly overpriced with extortionate commissions paid to the scammers.

The insurance bond scam continues to flourish in all the typical British expat destinations – from Spain and Portugal to Thailand and the Middle East. Life offices such as Utmost International and RL360 continue to fuel the global undisclosed commission fraud machine – with scammers posing as financial advisers and selling over-priced products rather than proper financial advice.

Leonteq is still doing a roaring trade – thanks to the offshore scammers and the life offices. The secret-commission fraud still flourishes unhindered. Utmost International and Friends Provident International are throwing millions at defending the Signature and Forsters actions brought by thousands of victims. The regulators remain silent.

Every day more victims are created. How many more victims need to be ruined before something is done to put a stop to this huge-scale offshore financial crime? Leonteq may have paid up – but now the life offices themselves (including Utmost International, RL360 and SEB) need to pay up too.

Scams, and the lack of an active regulator in place to ensure their non-proliferation, undermine the reputation of the industry itself – and of any decent advisers out there.

Scams, and the lack of an active regulator in place to ensure their non-proliferation, undermine the reputation of the industry itself – and of any decent advisers out there.