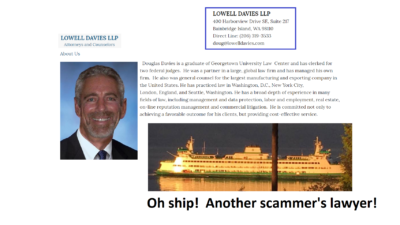

David Vilka of Square Mile International Financial Services has exactly the sort of lawyer one would expect: a scammer’s lawyer. Unsurprisingly, this dope can’t even spell Vilka’s victim’s name and has referred to him as “Mr Sexton” as opposed to “Mr Sefton”. But, again, this is no surprise.

David Vilka of Square Mile International Financial Services has exactly the sort of lawyer one would expect: a scammer’s lawyer. Unsurprisingly, this dope can’t even spell Vilka’s victim’s name and has referred to him as “Mr Sexton” as opposed to “Mr Sefton”. But, again, this is no surprise.

What I must challenge, however, is the fact that Mr. Sefton has referred to this clown as a “two-bit lawyer”. I really don’t think this is true – as he is a one-bit lawyer at best. He has a couple of glowing client testimonials going back to 2016 and 2015 on his amateurish website, and displays no evidence of experience or expertise in the arena of British pensions (and why would he? – he’s purportedly practising US law in the US).

One might forgive Mr. Davies for not understanding anything about UK pensions in general and pension scammers like David Vilka in particular, but to immediately jump into a firm conclusion that there has been defamation against his client shows that he hasn’t even made a one-bit attempt to understand what his client has been up to – or how many lives (like Mr Sefton’s) Vilka has ruined.

I must admit I am used to dealing with a much better class of scammers’ lawyer. Take DWF, for example: this large firm carelessly lost a team of 20 lawyers to rival Trowers and Hamlins a couple of years ago. This wasn’t long after they were caught representing both sides in a case: the Insolvency Service in the winding up of Capita Oak, and Stephen Ward who handled the transfer administration in the same scheme. But at least they dealt with the embarrassment of acting for both the poacher and the gamekeeper with a degree of dignity and elegance – a class act indeed. DWF comes into the same league as my other legal chums – including Carter Ruck and Mishcon de Reya. So, you can see I am more used to dealing with professional firms rather than twerps like this Mr Davies.

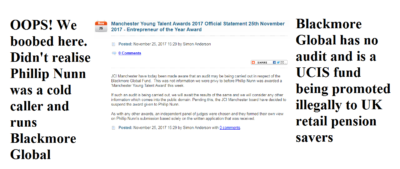

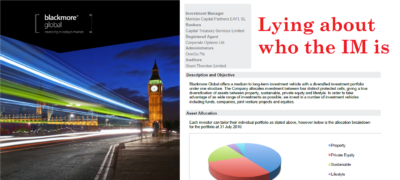

Mr. Davies is referring to the UCIS investment scam, Blackmore Global, which was illegally promoted to retail investors – and which is a fraud from start to finish.

Mr. Davies is referring to the UCIS investment scam, Blackmore Global, which was illegally promoted to retail investors – and which is a fraud from start to finish.

Anyway, I have answered his absurd email below with my usual comments in bold.

————————————————————————————————-

LOWELL DAVIES LLP

July 14, 2018

Ms. Angela Brooks, Director of Pension Life

Re: Defamation of Mr. David Vilka and Square Mile International

Dear Ms. Brooks:

I am an attorney You may well be, but you are clearly a US attorney – and that does not qualify you to deal with a matter which involves UK pensions

and represent Mr. David Vilka Bad luck

with respect to the defamatory article I never write defamatory articles – I only write the truth

published on your on-line site. Specifically, this complaint relates to the misstatements and misrepresentations made on

the following site:

BLACKMORE GLOBAL FUND – ASSET OR BLACK HOLE?

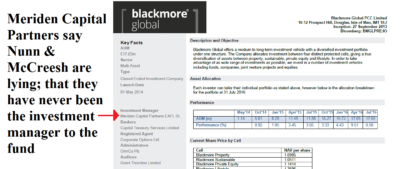

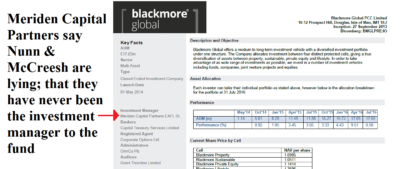

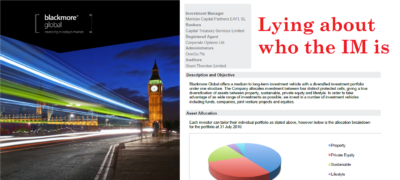

If I might sum up, each and every defamatory allegation with regard to Mr. Vilka and Square Mile International you assert are sourced to one disgruntled individual, Stephen Sexton, none of which allegations are supported by any evidence whatsoever. Wrong. Mr. Sefton is one of a number of victims of Vilka’s scams – many of which were invested in the same toxic, illegal UCIS fund as Mr. Sefton – Blackmore Global – and others were invested in other similar investment scams. Blackmore Global is run by another scammer, Phillip Nunn, who – along with his partner in crime Patrick McCreesh – ran the cold calling and lead generation services for the Capita Oak and Henley pension scams, now under investigation by the Serious Fraud Office.

Mr. Sexton was an unsolicited client of Mr. Vilka and Square Mile who had a substantial pension and for personal reasons of his own wanted to switch his pension and draw down sums for his personal use. When he says “unsolicited” he means not cold called, as was usually the case with Vilka. Vilka lied about being regulated to provide pension and investment advice, and the rest is history: Mr Sefton’s life savings were invested in two UCIS funds which were habitually promoted by Vilka: Blackmore Global and Symphony.

The switch in pension plans resulted in what Mr. Sexton felt were unreasonable fees (None of which went to Mr. Vilka or Square Mile). I wonder if this idiot would like to explain why Mr Sefton was put into a QROPS when he was a UK resident?

And despite the fact that Mr. Vilka was able to personally intervene and get Mr. Sexton’s monies returned less a nominal fee, Mr. Sexton continued to complain and when Square Mile attempted to make up even this nominal fee on its own part, Mr. Sexton continued to complain because he refused to sign a boilerplate settlement agreement containing a standard confidentiality agreement. It is true that Mr Sefton did, eventually, get around 85% of his original investment back – but only after a dogged fight which was backed up by the pension trustees Integrated Capabilities. There was no intervention by Vilka.

In your post on the Blackmore Fund you have the temerity to cast defamatory aspersions on Mr. Vilka and Square Mile based on your “strong suspicion” and you go on to assert they must have a “strong vested interest in promoting this black hole of a fund.” Why else would scammers such as Vilka promote such a fund? It is a UCIS, with no independent audit to verify whether the purported assets even exist.

Really? What proof of that would you have? Vilka must have had a very strong reason to promote the Blackmore Global investment fraud – why else would he have invested a further 64 victims’ pensions in this UCIS? This was a bunch of people he scammed into transferring their pensions to a Hong Kong QROPS.

And since you have none, we demand you remove this article and/or any reference to Mr. Vilka or Square Mile. I have plenty of evidence thank you.

Let me advise you that Mr. Vilka and Square Mile, contrary to your specious aspersions, are heavily regulated as is the industry. “Heavily”? What you actually mean is that neither Vilka nor Square Mile is regulated for pension or investment advice – only insurance mediation.

The Sexton matter was thoroughly investigated at the time by the appropriate regulators who found no irregularities. You don’t know that.

Mr. Sexton is not nor was he a perplexed victim of Mr. Vilka or Square Mile. He most certainly was – as Vilka and his accomplice John Ferguson know full well.

His pension is worth well over half a million pounds. No it isn’t. Did you do maths at school?

He read and signed multiple acknowledgements before he switched pensions showing very clearly that he knew what he was investing in and the inherent risks involved. No he didn’t. It was never disclosed that the scammers were going to invest his pension in a UCIS fund which is illegal to be promoted to retail UK investors.

And again, significantly, he was not cold-called. He sought out Mr. Vilka and Square Mile. Nor did Mr. Vilka or Square Mile receive any payment from the Blackmore fund or its partner firms regarding Mr. Sexton’s transaction as confirmed by the Czech National Bank which has direct access to Square Mile’s company bank accounts via an electronic data box. Are you talking about the accounts which haven’t been updated since 2014?

And again, significantly, he was not cold-called. He sought out Mr. Vilka and Square Mile. Nor did Mr. Vilka or Square Mile receive any payment from the Blackmore fund or its partner firms regarding Mr. Sexton’s transaction as confirmed by the Czech National Bank which has direct access to Square Mile’s company bank accounts via an electronic data box. Are you talking about the accounts which haven’t been updated since 2014?

In sum, there is no bases whatsoever for the specious and actionable statements you make in your referenced post with regard to Mr. Vilka and Square Mile International. I think you mean basis – and yes, there is a solid basis for all the statements I made in my post and not a single one of them is “specious” (although I am amazed you have even heard of the word).

Your comments have caused Mr. Vilka and Square Mile reputational damage, among others, and you are hereby instructed to delete the post immediately. I sincerely hope that the impact of my blog has caused Vilka and his accomplice Ferguson to turn over a new leaf and arrange to pay compensation for Mr. Sefton and all their other victims who have lost part or all of their pensions to the Square Mile scams.

Your failure to do so will result in further damages to Mr. Vilka and Square Mile International, the accrual of further legal fees and costs, and the likelihood of litigation, all of which damages and costs we will recover from you. Good luck with that.

If you have any questions or concerns or require further information, please don’t hesitate to contact me directly at (206) 319-3533. I look forward to confirmation of the removal of the identified defamatory materials. Thank you in advance for resolving this matter expeditiously. I have no questions, other than to enquire as to when your client intends to pay redress for the losses caused by his fraud.

Best regards,

LOWELL DAVIES LLP

LOWELL DAVIES LLP

Douglas Davies Attorney at Law

8497 Hemlock Drive

Bainbridge Island, WA 98110

Direct Line: (206) 319-3533

doug@lowelldavies.com

Tackling Caravan Crime – Chancellor Philip Hammond. Victims of pension fraud in scams such as Ark, Capita Oak, Westminster, London Quantum, Friendly Pensions and Salmon Enterprises – will not be surprised to hear that even the Crown Prosecution Service acknowledges that the fraudsters have defeated the system. Alison Saunders, head of the CPS, has stated publicly that the British justice system can’t cope. She is stepping down and is clearly disheartened by Britain’s failure to tackle crime – especially fraud. She has vented her frustration in an interview:

Tackling Caravan Crime – Chancellor Philip Hammond. Victims of pension fraud in scams such as Ark, Capita Oak, Westminster, London Quantum, Friendly Pensions and Salmon Enterprises – will not be surprised to hear that even the Crown Prosecution Service acknowledges that the fraudsters have defeated the system. Alison Saunders, head of the CPS, has stated publicly that the British justice system can’t cope. She is stepping down and is clearly disheartened by Britain’s failure to tackle crime – especially fraud. She has vented her frustration in an interview: But look hard enough, and you will see how tackling crime can be done successfully. As someone who constantly writes about the failure of our police and courts to bring criminals to justice, I was surprised to hear of a spectacular success story in leafy Surrey recently.

But look hard enough, and you will see how tackling crime can be done successfully. As someone who constantly writes about the failure of our police and courts to bring criminals to justice, I was surprised to hear of a spectacular success story in leafy Surrey recently. Mr. and Mrs. Shore of Thorpe, in Surrey, were successfully prosecuted and jailed for proceeds of crime. Residing in Runnymede Borough Council – presided over by Chancellor Phillip Hammond – this dastardly pair (in their sixties) were both sent down for a heinous crime under the Proceeds of Crime Act 2002 (“POCA”).

Mr. and Mrs. Shore of Thorpe, in Surrey, were successfully prosecuted and jailed for proceeds of crime. Residing in Runnymede Borough Council – presided over by Chancellor Phillip Hammond – this dastardly pair (in their sixties) were both sent down for a heinous crime under the Proceeds of Crime Act 2002 (“POCA”). This spectacular success story on the part of Hammond, Runnymede Borough Council and the CPS has left the good citizens of Surrey relieved that these dangerous caravan owners are now behind bars and dozens of homeless families are now living on the streets. Job done; justice served; well done Cutty Sark!

This spectacular success story on the part of Hammond, Runnymede Borough Council and the CPS has left the good citizens of Surrey relieved that these dangerous caravan owners are now behind bars and dozens of homeless families are now living on the streets. Job done; justice served; well done Cutty Sark! I am sure that the many thousands of people who have lost millions of pounds’ worth of life savings to scammers such as Stephen Ward, Julian Hanson, George Frost, XXXX XXXX, Phillip Nunn, Patrick McCreesh, Stuart Chapman-Clarke, David Vilka, David Austin, Darren Kirby, Dean Stogsdill, Anthony Downs and James Lau will now understand why the CPS couldn’t dedicate any resources to prosecuting them. And they will, no doubt, be glad that the priority of the judiciary was removing unauthorised caravans in Surrey.

I am sure that the many thousands of people who have lost millions of pounds’ worth of life savings to scammers such as Stephen Ward, Julian Hanson, George Frost, XXXX XXXX, Phillip Nunn, Patrick McCreesh, Stuart Chapman-Clarke, David Vilka, David Austin, Darren Kirby, Dean Stogsdill, Anthony Downs and James Lau will now understand why the CPS couldn’t dedicate any resources to prosecuting them. And they will, no doubt, be glad that the priority of the judiciary was removing unauthorised caravans in Surrey.

This week Henry Tapper wrote a blog entitled, “

This week Henry Tapper wrote a blog entitled, “ They have been asked to pay the money back but by the looks of their social media accounts, I don´t think there is much left. Camilla’s Facebook and Instagram accounts show her sunning herself on beaches and yachts around the world, and posing at luxury alpine ski resorts. David Austin is pictured on a gondola in Venice. They certainly got to enjoy the proceeds of their many victims’ pensions.

They have been asked to pay the money back but by the looks of their social media accounts, I don´t think there is much left. Camilla’s Facebook and Instagram accounts show her sunning herself on beaches and yachts around the world, and posing at luxury alpine ski resorts. David Austin is pictured on a gondola in Venice. They certainly got to enjoy the proceeds of their many victims’ pensions.

I would like to highlight that the rider of the jet ski does bear a remarkable resemblance to Phillip Nunn, cold caller and “fund manager” of the

I would like to highlight that the rider of the jet ski does bear a remarkable resemblance to Phillip Nunn, cold caller and “fund manager” of the

Interestingly,

Interestingly,

Investors’ trust is what gets violated in so many cases by irresponsible and negligent insurance companies such as Old Mutual International, SEB, Generali, RL360, Friends Provident International – and, of course, the firm in the Cayman Islands: Investors Trust. These companies – also known as “life offices” (although we prefer to call them “death offices” because they help destroy victims’ life savings – and sometimes cause the death of their distraught victims) – have a number of lethal practices which result in financial ruin for thousands of policyholders:

Investors’ trust is what gets violated in so many cases by irresponsible and negligent insurance companies such as Old Mutual International, SEB, Generali, RL360, Friends Provident International – and, of course, the firm in the Cayman Islands: Investors Trust. These companies – also known as “life offices” (although we prefer to call them “death offices” because they help destroy victims’ life savings – and sometimes cause the death of their distraught victims) – have a number of lethal practices which result in financial ruin for thousands of policyholders: A prime example of these vile practices was in the case of Mr. S – a driving instructor from Milton Keynes. His final salary pension scheme was transferred to a QROPS in Malta despite the fact that he was a UK resident and had no need for his pension to be transferred offshore. His “adviser” was David Vilka from a firm called Square Mile International Financial Services. This firm had an insurance license but no investment license. Therefore, Square Mile could legally sell insurance products such as dog insurance – but could certainly not provide investment advice.

A prime example of these vile practices was in the case of Mr. S – a driving instructor from Milton Keynes. His final salary pension scheme was transferred to a QROPS in Malta despite the fact that he was a UK resident and had no need for his pension to be transferred offshore. His “adviser” was David Vilka from a firm called Square Mile International Financial Services. This firm had an insurance license but no investment license. Therefore, Square Mile could legally sell insurance products such as dog insurance – but could certainly not provide investment advice.

Far from being contrite or apologetic, however, the scammer who risked Mr. S’ pension in the first place – David Vilka of Square Mile International Financial Services in the Czech Republic – showed no shame and made no attempt to recover the remainder of his victim’s pension. In fact, when I exposed Vilka’s vile scam, I was threatened by his two-bit American lawyer

Far from being contrite or apologetic, however, the scammer who risked Mr. S’ pension in the first place – David Vilka of Square Mile International Financial Services in the Czech Republic – showed no shame and made no attempt to recover the remainder of his victim’s pension. In fact, when I exposed Vilka’s vile scam, I was threatened by his two-bit American lawyer

Mr. Davies is referring to the UCIS investment scam, Blackmore Global, which was illegally promoted to retail investors – and which is a fraud from start to finish.

Mr. Davies is referring to the UCIS investment scam, Blackmore Global, which was illegally promoted to retail investors – and which is a fraud from start to finish. And again, significantly, he was not cold-called. He sought out Mr. Vilka and Square Mile. Nor did Mr. Vilka or Square Mile receive any payment from the Blackmore fund or its partner firms regarding Mr. Sexton’s transaction as confirmed by the Czech National Bank which has direct access to Square Mile’s company bank accounts via an electronic data box. Are you talking about the accounts which haven’t been updated since 2014?

And again, significantly, he was not cold-called. He sought out Mr. Vilka and Square Mile. Nor did Mr. Vilka or Square Mile receive any payment from the Blackmore fund or its partner firms regarding Mr. Sexton’s transaction as confirmed by the Czech National Bank which has direct access to Square Mile’s company bank accounts via an electronic data box. Are you talking about the accounts which haven’t been updated since 2014? LOWELL DAVIES LLP

LOWELL DAVIES LLP

In the wake of hundreds of victims fearing heavy pension losses in the Blackmore Global fund, we now have another disaster waiting to happen: Blackmore Bond.

In the wake of hundreds of victims fearing heavy pension losses in the Blackmore Global fund, we now have another disaster waiting to happen: Blackmore Bond. But here’s another puzzle: a geezer called

But here’s another puzzle: a geezer called  According to

According to

John (Gus) Ferguson’s firm, Square Mile International, is clearly not exactly square – and Lillywhite is a grubby shade of black.

John (Gus) Ferguson’s firm, Square Mile International, is clearly not exactly square – and Lillywhite is a grubby shade of black.

Having succeeded in recouping a good chunk of his money, he received an email from Square Mile International Financial offering him a bribe of £6,000 to cease all contact with outside sources. This included regulatory authorities and Action Fraud!

Having succeeded in recouping a good chunk of his money, he received an email from Square Mile International Financial offering him a bribe of £6,000 to cease all contact with outside sources. This included regulatory authorities and Action Fraud! David Vilka insists that Square Mile International Financial is a completely legitimate firm. He claims the firm has been “inspected and verified in full by numerous regulators”. Furthermore, Stephen’s reports to Action Fraud were returned saying it had not identified any leads to follow up.

David Vilka insists that Square Mile International Financial is a completely legitimate firm. He claims the firm has been “inspected and verified in full by numerous regulators”. Furthermore, Stephen’s reports to Action Fraud were returned saying it had not identified any leads to follow up.