When we buy certain products, they have a warning on them. Cigarette packets, for instance, state that smoking is bad for your health. The wrappers show hideous images of what might happen to you if you use tobacco.

When we buy certain products, they have a warning on them. Cigarette packets, for instance, state that smoking is bad for your health. The wrappers show hideous images of what might happen to you if you use tobacco.

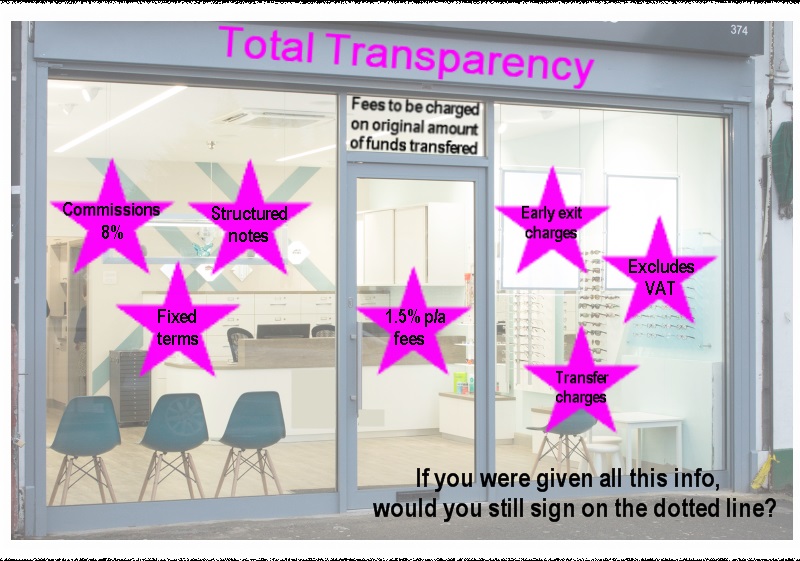

However, when it comes to investments, the ‘advisers’ selling dangerous investments are able to disguise the risks and costs. Offshore, there seems to be no effective code of conduct, or regulation as to what they must disclose and what they can conceal.

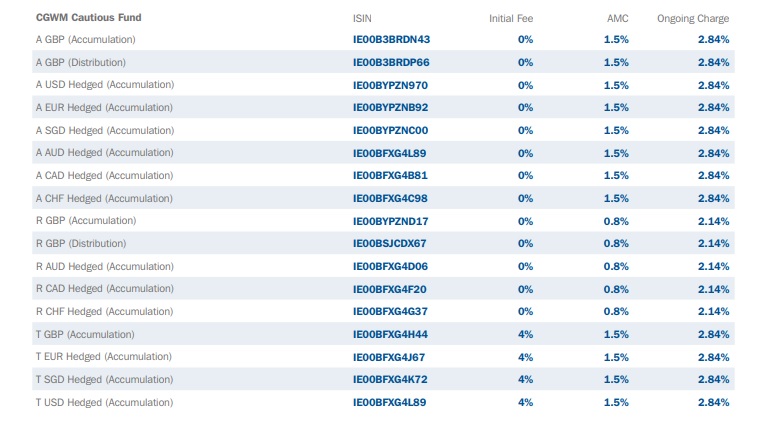

Last week the FCA slammed asset managers and retail investment firms over hidden fund charges.

When selling their investments, these firms are really good at omitting details of the full charges that will apply – not only initially – but on an ongoing annual basis as well. These hidden charges put your investment in danger.

The FCA has stated:

“In one case it found an asset manager had omitted a 4 per cent a year transaction cost from the UCITS Key Investor Information Document (KIID).”

In so many pension scams, we hear that the victims were sold a ‘free pension review’; they were not told about the transfer costs; that they were not told about annual fees either. In many cases, the transfer costs and fees work out to be considerably higher than if they had paid a proper fee for the review in the first place. These hidden costs put a huge strain on the fund and sometimes victims can lose up to 25% of their fund to hidden charges.

What worries us most is the lack of regulatory concern or control in respect of expensive and risky investment products. You can’t buy cigarettes without a stern health warning. The same goes for alcohol: bottles and cans clearly state how many units are in the container, and how many units men and women can safely drink per day. They also state that alcohol should not be consumed by pregnant women.

What worries us most is the lack of regulatory concern or control in respect of expensive and risky investment products. You can’t buy cigarettes without a stern health warning. The same goes for alcohol: bottles and cans clearly state how many units are in the container, and how many units men and women can safely drink per day. They also state that alcohol should not be consumed by pregnant women.

Alcohol companies manage to fit all this info about the dangers of drinking on a tiny label. And this poses the essential question as to why financial advisory firms are able to sell risky investments again and again – omitting clear warnings about the dangerous aspects of them.

Also highlighted in an article by Corporate Adviser:

“The FCA reserved its fiercest criticism for asset managers, saying it found instances where asset manager fact sheets or websites did not mention costs. When they did, they often gave the ongoing charge figure, which omitted transaction costs, performance fees and borrowing charges which are shown in the Key Information Document (KID). In one example, total charges in the PRIIPs KID equated to around 3 per cent per annum – but the only costs given in the fact sheet was the 1.2 per cent annual management charge (AMC).”

This is not news to us at Pension Life. It is something we have been writing about for sometime – and we have a great deal of evidence that hidden, excessive charges are a terrible blight on the face of financial services internationally. It is indeed excellent news that the FCA has finally highlighted the dangers of such hidden charges, but now we need to make sure these dangers are highlighted to the public. CLEARLY AND VISIBLY.

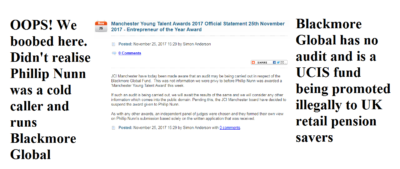

A prime example of advisers and hidden charges is the dastardly duo: Phillip Nunn and Patrick McCreesh. This pair of scammers received £ millions promoting the Capita Oak, Thurlstone Loans, Henley Retirement Benefits Scheme and Berkeley Burke SIPPS scams – leaving 1,200 victims facing poverty in retirement. With that disaster comfortably behind them, they then launched the £40 million Blackmore Global scam and now their network of scammers are promoting the Blackmore Bond which pays a 20% introduction commission to the introducers.

You can’t buy a gun without going to a registered shop and having a licence. (Although, I guess on the black market you can). If you buy a gun on the black market, it is going to be ‘hot’. The person you buy it from is going to be dodgy and it certainly won’t come with the correct paperwork.

You can’t buy a gun without going to a registered shop and having a licence. (Although, I guess on the black market you can). If you buy a gun on the black market, it is going to be ‘hot’. The person you buy it from is going to be dodgy and it certainly won’t come with the correct paperwork.

So if you are a normal, law-abiding citizen (and cautious investor), you would want a legitimate investment which fits your risk profile – and full paperwork disclosing ALL the charges. Make sure you pick the right adviser who will give you evidence of all these essential details.

Dodgy advisers are still getting away with selling ‘hot’ investments: funds that are clearly toxic and dangerous to your pension fund. These advisers manage to do this very successfully by wrapping them in a fluffy cover and selling them with an array of unrealistic promises of high returns and alleged capital protection to reel the victims in.

When considering a pension transfer, we urge you to familiarise yourself with our ten standards. Your adviser ought to adhere to these standards anyway – and if he doesn’t then walk away. Number eight covers what we have talked about in this blog: CHARGES.

Your adviser MUST GIVE YOU: Full disclosure of fees, charges and commissions on all products and services in writing, before you commit. So before you sign anything regarding a pension transfer and subsequent investment, please ensure you know exactly what charges will be applied to your fund: before, during AND after. It is also imperative to know if there is a lock-in period and early exit penalty and to make sure you are comfortable with that.

Excessive and concealed fees can ruin a once healthy and happy pension fund – just like smoking can ruin your lungs and drinking can ruin your liver. Hidden charges can put your funds in danger and ruin your retirement savings beyond repair.

Here is a list of our ten standards.

STANDARDS ACCREDITATION CHECKLIST FOR FINANCIAL ADVISERS:

- Proof of regulation for all services provided by the firm and individual advisers in the jurisdiction(s) where advice is given and the clients are based.

- Verifiable evidence of appropriate, registered qualifications and CPD for all advisers. (Where there are insufficient qualifications, there must be clear evidence of plans and preparation to achieve required goals within a reasonable, stated time frame).

- Professional Indemnity Insurance

- Details of how fact finds are carried out, how clients’ risk profiles are determined and adhered to.

- Details of the firm’s compliance procedures – assuring clients of the highest possible standards and assurance that risk profiles are always accurately and faithfully respected.

- Clear and consistent explanation and justification of the use of insurance bonds for investments.

- Unambiguous policy on structured notes, UCIS funds, in-house funds, non-standard assets and any ongoing commission-paying investments. Report of all investment recommendations for all clients and evidence as to how these match individual risk profiles.

- Disclosure of fees, charges and commissions on all products and services at time of sale, in writing, before clients commit.

- Account of how clients are updated on fund/portfolio performance.

- Public evidence of complaints made, rejected or upheld and redress paid.

For more in depth explanation check out our other blog on the ten standards:

Blacklist – “The Pension Scam (No 69)”

Blacklist – “The Pension Scam (No 69)” than one scam at a time (being male, he can’t multi-task).

than one scam at a time (being male, he can’t multi-task). Kentish is eager to know how much money can be made out of this plot. XXXX explains that 46% was earned out of his Capita Oak and Henley scams and that he hopes to make at least as much out of this one. With Kentish’s “help” (nudge nudge, wink wink). Of course, the proceeds could be split and plenty of brown envelopes used to disguise the handing over of the proceeds.

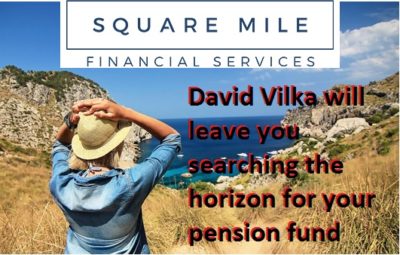

Kentish is eager to know how much money can be made out of this plot. XXXX explains that 46% was earned out of his Capita Oak and Henley scams and that he hopes to make at least as much out of this one. With Kentish’s “help” (nudge nudge, wink wink). Of course, the proceeds could be split and plenty of brown envelopes used to disguise the handing over of the proceeds. Now that the Trafalgar Multi-Asset Fund has been suspended – thanks to the hero of the hour: Reinert – Kentish decides to buy Caffrey’s QROPS firm, Harbour (which is full of Phillip Nunn’s Blackmore Global investment scam). Caffrey swans off into the sunset with £1 million burning a hole in his pocket, quietly humming “Oh Danny Boy”.

Now that the Trafalgar Multi-Asset Fund has been suspended – thanks to the hero of the hour: Reinert – Kentish decides to buy Caffrey’s QROPS firm, Harbour (which is full of Phillip Nunn’s Blackmore Global investment scam). Caffrey swans off into the sunset with £1 million burning a hole in his pocket, quietly humming “Oh Danny Boy”. Sadly, of course, it was real life. As more than 400 victims will attest. So no more script-writing for me. I will stick to blogs in the future.

Sadly, of course, it was real life. As more than 400 victims will attest. So no more script-writing for me. I will stick to blogs in the future.

This week Henry Tapper wrote a blog entitled, “

This week Henry Tapper wrote a blog entitled, “ They have been asked to pay the money back but by the looks of their social media accounts, I don´t think there is much left. Camilla’s Facebook and Instagram accounts show her sunning herself on beaches and yachts around the world, and posing at luxury alpine ski resorts. David Austin is pictured on a gondola in Venice. They certainly got to enjoy the proceeds of their many victims’ pensions.

They have been asked to pay the money back but by the looks of their social media accounts, I don´t think there is much left. Camilla’s Facebook and Instagram accounts show her sunning herself on beaches and yachts around the world, and posing at luxury alpine ski resorts. David Austin is pictured on a gondola in Venice. They certainly got to enjoy the proceeds of their many victims’ pensions.

and quotes SCM Direct as saying “Its time for the chief executive of the FCA, Andrew Bailey, to demonstrate that he is willing to be the industry enforcer rather than the industry lapdog.”

and quotes SCM Direct as saying “Its time for the chief executive of the FCA, Andrew Bailey, to demonstrate that he is willing to be the industry enforcer rather than the industry lapdog.”

Just for a laugh, have a look on

Just for a laugh, have a look on

In the

In the