COMPLAINT AGAINST HMRC 30.12.2016

RE ARK PENSION AND OTHER PENSION LIBERATION SCHEMES

COMPLAINANTS:

VICTIMS OF PENSION SCAMS AND MEMBERS OF THE PENSION LIFE GROUP ACTION:

AND MEMBERS OF THE PENSION LIFE GROUP ACTION:

AND MEMBERS OF THE PENSION LIFE GROUP ACTION:

- BACKGROUND:

- HMRC’S OBLIGATIONS AND OBJECTIVES:

- WHAT HMRC MUST NOW DO TO PUT THINGS RIGHT:

BACKGROUND

This complaint against HMRC for registering pension scams is one of a series of complaints against public bodies which have collectively failed British citizens and UK pension savers by omitting to take timely action to prevent and warn potential victims. The multiple failures of HMRC, the regulators, the DWP and the police authorities have contributed to numerous pension disasters – all of which could and should have been avoided.

To put this complaint into perspective, and highlight how HMRC have failed in their public duty over a period of many years and in many difference cases, it will be helpful to explain an exchange which happened in 2011 in the Salmon Enterprises case.

In the matter of TM8648, the Pensions Regulator and HMRC had been investigating the directors of Tudor Capital Management, a pension trustee and administration firm, for offences involving dishonesty, deception, fraud, cheating the Public Revenue and money laundering. This process had started in early 2010 and tPR’s Determinations Panel met several times over the next couple of years or so. The directors of Tudor Capital Management – Peter Bradley and Andrew Meeson (ex HMRC tax technicians) – were eventually jailed for eight years.

HMRC did nothing, however, to prevent these two suspected fraudsters (Bradley and Meeson) from registering further pension scams while they were under criminal investigation. These further scams included Hollywell, Pennines and Mendip – all operating pension liberation – well over a year after the criminal investigations had been launched.

In the Salmon Enterprises case – one of 25 registered by Tudor Capital Management, one victim’s ceding provider – Nationwide Building Society – was concerned about a transfer request in excess of GBP 200k and sought confirmation of Salmon Enterprises’ HMRC registration. HMRC responded in June 2011 to confirm that the scheme was indeed registered under Section 153 of the Finance Act 2004 – but made no mention of the trustees’ criminal investigation. Richard Farrell, Compliance Manager of Nationwide, then expressed further doubts to HMRC: “My concern about the scheme administrator, Tudor Capital Management, is based on the fact that an article appeared in the pensions press on 21.10.2010 stating that four people connected with Tudor Capital Management have been arrested on suspicion of fraud, cheating the Public revenue and money laundering”. HMRC replied that they were unable to disclose any information regarding Tudor Capital Management due to their “strict rules on confidentiality”.

Clearly, HMRC could and should have taken steps to de-register the Salmon Enterprises scheme but failed to do so. In the full knowledge that the scheme was being run by suspected fraudsters and was operating pension liberation, HMRC stood back and allowed 116 people to transfer into Salmon Enterprises, and then issued tax demands for unauthorised payment charges on the entire amount of all the transfers.

This echoes HMRC’s conduct in the Ark schemes: they were aware of the reciprocal “loan” system being operated by the trustees in quarter three of 2010. They made “enquiries” repeatedly until the end of the year and had a meeting with the operators at the end of February 2011. But still HMRC did nothing: did not de-register the schemes and did not issue any warnings to potential victims. At this time, there was GBP 7 million in Ark. By the time tPR eventually placed the schemes in the hands of Dalriada Trustees, there was GBP 30 million in Ark. HMRC had stood by for more than six months, and done nothing to prevent hundreds of victims from being scammed. But then sent out the tax demands for 55% tax on the “loans”.

HMRC registered the Ark and

schemes as occupational pension schemes in 2009/10 and will claim they had no obligation to perform any due diligence at the time of registration – and indeed that they had no responsibility for consumer protection. They will also claim that when a scheme is first registered – and before anyone transfers into the scheme – there is no evidence that there is anything wrong or that a scheme is being used fraudulently for liberation.

But, at some point before, during and after the registration of the Ark and Salmon Enterprises schemes, HMRC, the Crown Prosecution Service and tPR were already investigating Tudor Capital Management for fraud and were in regular communication with the operators of Ark. Tudor Capital Management had registered 25 different pension schemes in total – one of which was Salmon Enterprises. But long after HMRC knew the directors of Tudor was suspected of fraud, they left all these schemes operating and scamming hundreds of victims. In the full knowledge that both consumers and the pensions industry see HMRC registration as a robust reassurance that a receiving scheme is bona fide, HMRC took no action to warn the public as widely as possible that scams and scammers were proliferating, nor to warn the industry and make ceding pension trustees’ legal responsibilities and obligations clear to providers.

In fact, at the height of the flourishing growth of Ark, one ceding provider – HSBC – was contacted by a member for reassurance that the Ark scheme was indeed bona fide. HSBC assured the member that the only thing they were required to check was that the receiving scheme was HMRC registered. HSBC concluded that as the Ark scheme was indeed HMRC registered, there was no reason to perform any further due diligence.

During the same period, the disgraced former barrister Paul Baxendale-Walker was registering hundreds of pension schemes for liberation purposes. So, 2010 was a fertile and busy year for the scammers with large numbers of bogus occupational schemes being registered by HMRC and thousands of victims being scammed into losing their pensions. HMRC were not only fully aware of this, but had been investigating the criminal element of various schemes along with the Crown Prosecution Service for many months. Indeed, the first recorded pension liberation scam was investigated by HMRC in 1999 and the pair behind this fraud were jailed in 2003 – although not for defrauding the public but for defrauding HMRC.

So, from 2010 onwards, nobody at HMRC decided to “call time” on this obvious large-scale fraud and implement any degree of policing or researching schemes at the point of registration – to put in place some form of prevention rather than waiting until after thousands of lives had been ruined. Indeed, in the Ark case, HMRC had stood by between September 2010 and February 2011 and left the promoters and administrators to get on with building up a head of steam to the point where there was around £7 million in transfers (and presumably, half of that given out in MPVA loans).

From late February 2011, when HMRC met with Craig Tweedley and Stephen Ward, until the appointment of Dalriada on 31.5.2011, a further £23 million was transferred into Ark while HMRC allowed hundreds of victims to proceed to probable financial ruin. HMRC could have suspended the schemes at any point while they conducted their investigations – and indeed Craig Tweedley repeated offered to do so.

Ark, Tudor Capital Management/Salmon Enterprises and Baxendale Walker’s various schemes accounted for around £200 million worth of lost pensions and at least a further £60 million in tax liabilities. And yet since 1999, when Russell and Ferguson were jailed for five years for cheating the Public Revenue, the only criminal action taken by HMRC was against TCM directors Peter Bradley and Andrew Meeson who were jailed for pension tax fraud against HMRC. No action has ever been taken against any of the scammers for defrauding ordinary citizens. Thanks to HMRC considering consumer protection was not within their remit, the scammers have all been left to go on to set up and run dozens of further scams and ruin thousands more lives over the next several years.

- HMRC’S OBLIGATIONS AND OBJECTIVES:

HMRC have stated that their role is to “protect the valuable tax reliefs given to pension savings”. But if this were so, the question must be asked: why did HMRC do no due diligence at the point of registration of these various scams? Active consumer protection may well not be part of HMRC’s specific roles, but equally avoiding consumer damage should be an automatic matter of common sense and decency on the part of HMRC. It is well known that consumers and even industry professionals have assumed that HMRC registration strongly implies some form of “approval” – and indeed even former Pensions Minister Steve Webb used the term “HMRC Approval”. It makes no sense for HMRC to register so many pension schemes in the full knowledge that they could be used for scams without carrying out even the most basic checks. On the HMRC website, the Taxpayers’ Charter is published: “Your rights – what you can expect from us”:

https://www.gov.uk/government/publications/your-charter/your-charter

1.1 Respect you and treat you as honest

“We’ll treat you even-handedly, with courtesy and respect. We’ll listen to your concerns and answer your questions clearly. We’ll presume that you’re telling us the truth, unless we have good reason to think otherwise.”

How can it possibly be “even handed” to pursue the victims of scams so vigorously for unauthorised payment tax charges when no action is ever taken to pursue the scammers who caused the situation in the first place? This is inequitable. It is neither courteous nor respectful to demand tax which has arisen through no fault of the victim because they have been defrauded. HMRC has not listened to the concerns of the victims – either at meetings or in correspondence and has not answered any questions either clearly or at all in the Ark matter. For five years, HMRC has given confusing and contradictory answers to the question of if/how/where they intended to try to tax the Ark loans and claimed to be consulting tax experts. In the Salmon Enterprises case, HMRC have claimed they did not believe the loans were loans because there were no loan agreements produced by James Lau. Even though all the victims have made clear statements they were told the loans were indeed loans and that this was why they were not taxable, and HMRC has admitted they have had meetings with Lau, they are still treating the victims as though they are not telling the truth and denying their Protected Assessment appeals.

HMRC does not operate in a vacuum. HMRC has the power to influence outcomes for thousands of people and make the difference between financial ruin and financial stability; literally the difference between life and death for some people. Respect for their fellow man should be at the heart of HMRC’s operation. Taxes come from people – human beings. But it is not enough to claim to treat people with courtesy and respect – HMRC have to actually do it.

In their appeals against HMRC’s demands for unauthorised payment taxes, victims have repeatedly informed HMRC that they were victims of fraud, that they were told the transaction used a lawful tax “loophole” and that the “loan” would definitely not be taxable. And yet still HMRC treat the victims as though they were the dishonest ones and pursue them relentlessly for the tax, while completely ignoring the dishonest scammers themselves.

1.2 Provide a helpful, efficient and effective service

We’ll help you understand what you have to do and when you have to do it.

HMRC gave many of the victims no warning of their intention to issue Protected Assessments (tax demands) and accused the victims of not declaring their pension “loans” on their tax returns when the victims had had no idea the loans would be taxable. But there was no question of HMRC telling the victims anything or giving them any warning of the position.

We’ll deal with the information you give us quickly, efficiently, and keep any costs to you at a minimum.

HMRC have spent five years messing about with the Ark cases – giving contradictory and confusing information and opinions on the possible tax outcomes. To call this dealing “quickly” is totally untrue and misleading.

We’ll put any mistakes right as soon as we can.

It was a mistake to have registered the Ark schemes in the first place. And once HMRC knew or suspected – in Q3 2010 – that Ark was operating pension liberation, HMRC should have de-registered the schemes immediately. When HMRC held their meeting with Craig Tweedley and Stephen Ward in February 2011, they should have agreed to suspend the schemes – at the point when there was £7 million in the schemes. Instead, HMRC did nothing until tPR placed the schemes in the hands of Dalriada Trustees on 31.5.2011 at which point there was £27 million in the Ark schemes – and over the next three months a further £3 million was transferred in. Had HMRC taken action back in Q3 2010, or December 2010, or February 2011, hundreds of victims would have been saved £ millions in lost pension funds and tax liabilities. This was indeed a grave mistake, and HMRC has done nothing to put this right. Quite the reverse in fact.

1.7 Tackle those who bend or break the rules

We’ll identify those who are not paying what they owe or are claiming more than they should and recover the money. We’ll charge interest and penalties where appropriate and be reasonable in how we use our powers.

There is no evidence that apart from the four known prosecutions in the past thirteen years, that not a single one of the many other serial pension scammers has ever been brought to justice. Many – if not most – of these scammers have actively practised tax evasion themselves and had sheltered the £ millions earned out of scamming thousands of victims over a period of many years by sending the proceeds of their crimes offshore.

The Ark, Salmon Enterprises, Baxendale-Walker victims did not consciously or deliberately bend or break the rules. They were defrauded by bent financial advisers (and/or “introducers” posing as financial advisers – some regulated, some unregulated); a solicitor; an accountant and many other professionals. And HMRC know this perfectly well.

This complaint against HMRC concludes with the fact that in the full knowledge of who the scammers were, they allowed them to continue registering, promoting and operating new scams for years – in fact right up until the present day – unhindered. The scammers who were running the Ark schemes went on to run Capita Oak, Westminster and London Quantum. And even when HMRC were handed the evidence they still did nothing.

It is hard to quarrel with the victims who strongly suspect that HMRC themselves are guilty of a scam: allow the registration of a scam in the full knowledge that it is operating pension liberation, leave it to defraud hundreds of victims into participating, and then levy GBP millions worth of tax dem

3. WHAT HMRC MUST NOW DO TO PUT THINGS RIGHT:

- Declare an immediate amnesty for victims of pension fraud. HMRC’s failure to de-register scams was what led to the scammers defrauding the victims. This is akin to rape victims being punished in Middle Eastern countries, while the perpetrators are left free to re-offend as often as they like without sanction. The pension fraud victims have been through years of hell and should now be left alone by HMRC tormentors to get on with what is left of their lives in peace – and to try to find a way to avoid poverty and deprivation in retirement as most of them have lost their pensions.

- Pursue the perpetrators vigorously for tax evasion. Most of them have earned vast fortunes since 2010 and enjoy high standards of living complete with helicopters, private planes, sports cars, country houses, offshore property portfolios and champagne lifestyles. These are the people (and their assets) that HMRC should be pursuing – and not the hard-working, conscientious, innocent people who were defrauded by these monsters in the first place.

- Compensate the victims for losing their pensions avoidably. HMRC has failed to de-register so many schemes over so many years, and has caused financial ruin which could so easily and simply have been prevented and so many innocent people saved from the wretchedness of the past six years.

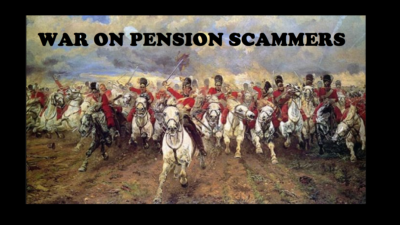

- Put in place a system of policing and properly approving pension scheme registrations. This should include (inter alia) the following basic and obvious steps:

- Check that the trustees/administrators of a scheme are not under criminal investigation

- Check that the registrants have not been involved in previous scams

- Check that the registrants’ address has not previously been used for scams – e.g. 31 Memorial Road, Worsley

- Check that an occupational scheme is genuine i.e. set up by a sponsoring employer which trades and employs people

- Check that an occupational scheme’s sponsoring employer actually exists

- Check that a scheme has a trust deed which is not forged

- Check that evidence that a trustee, administrator or scheme is a scam has not previously been provided to HMRC

- Check that legislation works. If it doesn’t, report it to the government and get it strengthened. The “not my job/responsibility/concern” approach is invalid and flies in the face of what a body of public servants should be doing – i.e. serving the public.

It is no good for HMRC simply to protest that when a scheme is first registered, there is no evidence that there is anything amiss. Taxpayers are supposed to be diligent, and there are severe penalties for failing to be so. The same applies to HMRC: it is supposed to serve the public – not fail and betray them.

Finally, HMRC must engage with all the other responsible authorities and be VIGILANT against pension scams. One of the most important examples of HMRC’s failure to carry out any due diligence is the case of the Barratt and Dalton scam (now in the hands of Dalriada Trustees). One of the main promoters of this scam was Julian Hanson who was a leading promoter and introducer in the Ark matter – and was responsible for GBP 5.5 million worth of transfers – second only to Stephen Ward’s GBP 10.6 million worth of transfers. And yet neither HMRC nor tPR nor any of the other public bodies (staffed by highly paid employees with healthy final salary pensions) bothered to pick up on this.

HMRC must now put their failures right, compensate their victims and put together a coherent plan to avoid this kind of negligent, incompetent performance in the future.

What is a Pension Scam?

Much as a master illusionist takes your breath away with his magic, a

Much as a master illusionist takes your breath away with his magic, a

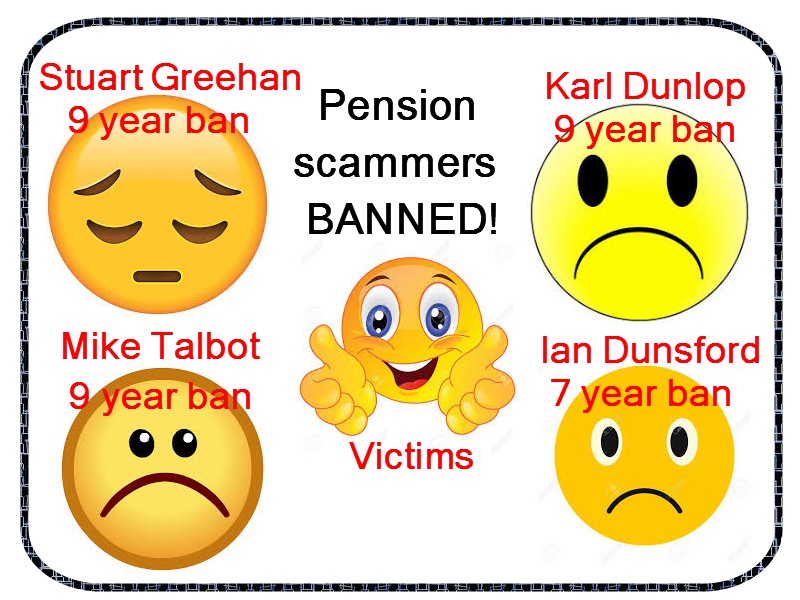

The words ¨accept¨ and ¨agreed¨ are used here, which gives the impression they all sat down to a nice lunch and “agreed” that they may have made a mistake and therefore “accepted” their bans! These people are financial criminals who left many lives ruined. The victims – many of which were already in financial hardship – now have no pension fund to look forward to.

The words ¨accept¨ and ¨agreed¨ are used here, which gives the impression they all sat down to a nice lunch and “agreed” that they may have made a mistake and therefore “accepted” their bans! These people are financial criminals who left many lives ruined. The victims – many of which were already in financial hardship – now have no pension fund to look forward to.

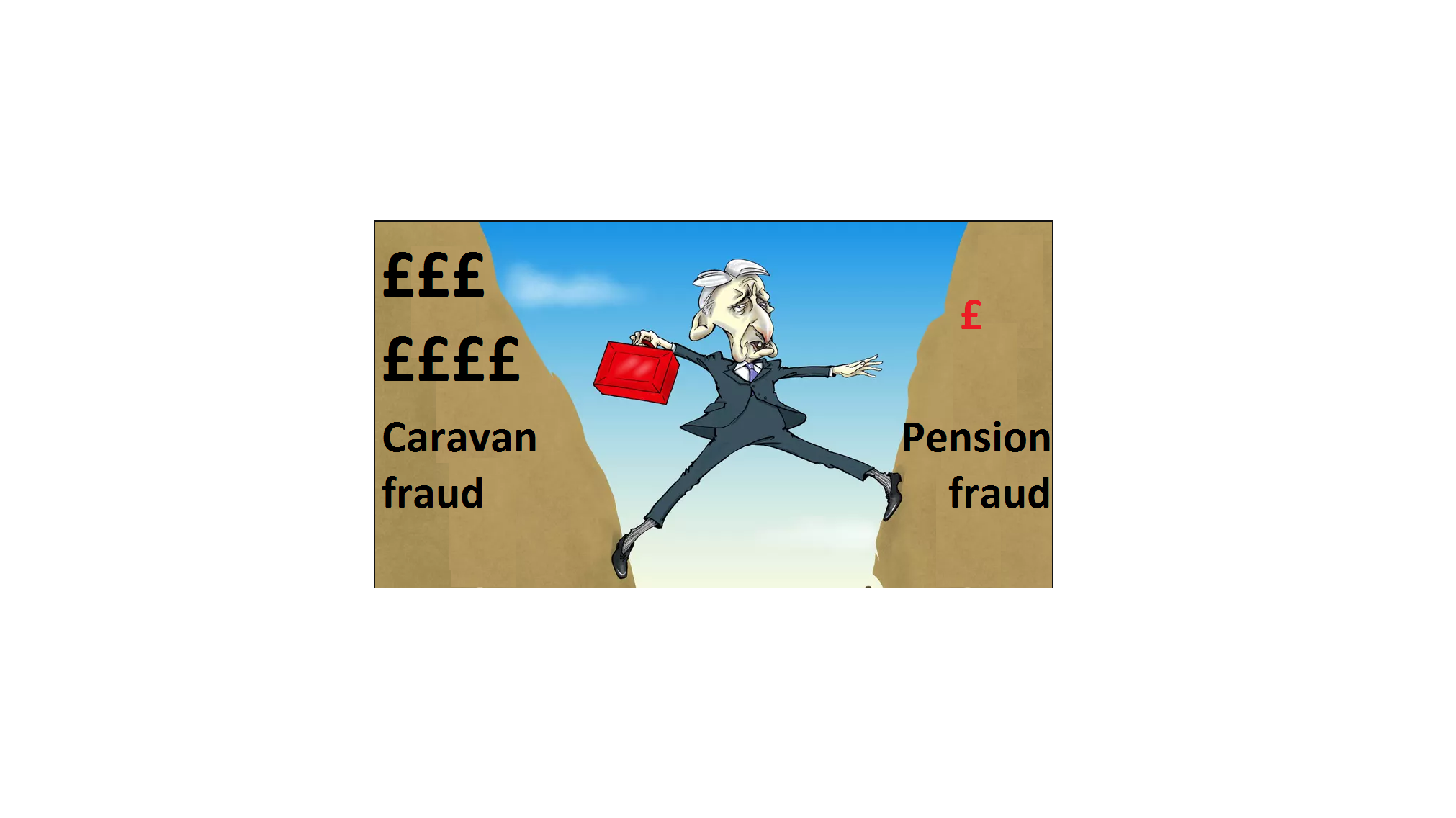

But look hard enough, and you will see how tackling crime can be done successfully. As someone who constantly writes about the failure of our police and courts to bring criminals to justice, I was surprised to hear of a spectacular success story in leafy Surrey recently.

But look hard enough, and you will see how tackling crime can be done successfully. As someone who constantly writes about the failure of our police and courts to bring criminals to justice, I was surprised to hear of a spectacular success story in leafy Surrey recently. Mr. and Mrs. Shore of Thorpe, in Surrey, were successfully prosecuted and jailed for proceeds of crime. Residing in Runnymede Borough Council – presided over by Chancellor Phillip Hammond – this dastardly pair (in their sixties) were both sent down for a heinous crime under the Proceeds of Crime Act 2002 (“POCA”).

Mr. and Mrs. Shore of Thorpe, in Surrey, were successfully prosecuted and jailed for proceeds of crime. Residing in Runnymede Borough Council – presided over by Chancellor Phillip Hammond – this dastardly pair (in their sixties) were both sent down for a heinous crime under the Proceeds of Crime Act 2002 (“POCA”). This spectacular success story on the part of Hammond, Runnymede Borough Council and the CPS has left the good citizens of Surrey relieved that these dangerous caravan owners are now behind bars and dozens of homeless families are now living on the streets.

This spectacular success story on the part of Hammond, Runnymede Borough Council and the CPS has left the good citizens of Surrey relieved that these dangerous caravan owners are now behind bars and dozens of homeless families are now living on the streets.  I am sure that the many thousands of people who have lost millions of pounds’ worth of life savings to scammers such as Stephen Ward, Julian Hanson, George Frost, XXXX XXXX, Phillip Nunn, Patrick McCreesh, Stuart Chapman-Clarke, David Vilka, David Austin, Darren Kirby, Dean Stogsdill, Anthony Downs and James Lau will now understand why the CPS couldn’t dedicate any resources to prosecuting them. And they will, no doubt, be glad that the priority of the judiciary was removing unauthorised caravans in Surrey.

I am sure that the many thousands of people who have lost millions of pounds’ worth of life savings to scammers such as Stephen Ward, Julian Hanson, George Frost, XXXX XXXX, Phillip Nunn, Patrick McCreesh, Stuart Chapman-Clarke, David Vilka, David Austin, Darren Kirby, Dean Stogsdill, Anthony Downs and James Lau will now understand why the CPS couldn’t dedicate any resources to prosecuting them. And they will, no doubt, be glad that the priority of the judiciary was removing unauthorised caravans in Surrey.

Stephen Ward of Premier Pension Solutions SL and Premier Pension Transfers Ltd

Stephen Ward of Premier Pension Solutions SL and Premier Pension Transfers Ltd Mark Manley of Manleys Solicitors – acting for XXXX XXXX.

Mark Manley of Manleys Solicitors – acting for XXXX XXXX. It is believed that cold calling techniques were used to lure unsuspecting victims into this series of unregulated investment scams. Victims’ pension savings were transferred into bogus occupational pension schemes whose trustees/administrators were Omni Trustees and Imperial Trustee Services. The schemes were

It is believed that cold calling techniques were used to lure unsuspecting victims into this series of unregulated investment scams. Victims’ pension savings were transferred into bogus occupational pension schemes whose trustees/administrators were Omni Trustees and Imperial Trustee Services. The schemes were

The Serious Fraud Office has asked victims of the

The Serious Fraud Office has asked victims of the

Meanwhile, the Ginger Scammer’s lawyer is complaining about an image on the Pension Life website. Trouble is, I can’t work out which one it is – I’ve searched and searched and I can’t find a single offensive photo. But then what is offensive to one person is inoffensive to another. I called the Ginger Scammer’s lawyer a “dick” once – maybe it should have been “tick”.

Meanwhile, the Ginger Scammer’s lawyer is complaining about an image on the Pension Life website. Trouble is, I can’t work out which one it is – I’ve searched and searched and I can’t find a single offensive photo. But then what is offensive to one person is inoffensive to another. I called the Ginger Scammer’s lawyer a “dick” once – maybe it should have been “tick”.

In the

In the