The following blog was written by Stephen Sefton: a Blackmore Global Victim who cares about pension scams.

Stephen was scammed by David Vilka of Square Mile International Financial Services around six or seven years ago. Vilka, who had neither qualifications nor a license to provide pension or investment advice, arranged the transfer of Mr. Sefton’s substantial final salary pension.

Stephen’s pension was transferred to the Optimus QROPS in Malta. It was placed in an Investors Trust offshore bond in the Cayman Islands. Then it was invested in high-risk, high-commission, unregulated funds. One of these was Blackmore Global.

A determined fight on the part of the tenacious Mr. Sefton did eventually result in the recovery of a large part of his funds. But his case was a rare exception. He was, indeed, very fortunate that he didn’t lose the whole lot. Most victims suffer total loss in such circumstances.

It is now looking very likely that Phillip Nunn and Patrick McCreesh’s Blackmore Global Fund is going to be as worthless as their other investment scam: Blackmore Bond (now in administration).

Pension Scam victim Stephen Sefton writes:

Finally, after two months of radio silence, Angie Brooks once again pens an article. It’s about time!

It’s an interesting title: “Who cares about Careys and the world of pension scams?”

I care. I don’t know why I should but I do. Maybe because I am seeing a media frenzy over the recent collapse of mini bonds in the UK. Especially LC&F and Blackmore Bonds plc to name just two. Meanwhile, victims of pension scams from the last decade are being forgotten and swept under the carpet. Much to the delight of many of those that oiled the wheels of the scams and helped them to happen – especially the QROPS and SIPPS!

There are many (especially the scammers) that really don’t like me. This is why they tried to offer me a paltry £6000 to silence me. Seriously?

There are many that don’t like my rhetoric and I regularly get blocked on Twitter, or thrown off Facebook. Here, I get to tell it like it is, however unpalatable the truth may be.

What I have learned over the years is that there’s an intricate web, woven around these scams. This interconnects a number of players whose names just keep on cropping up.

Malta was clearly the jurisdiction of choice for many pension scams. It seems to have hundreds, if not thousands, of victims. Many of these are not yet even aware that they face financial ruin in their retirement.

In my opinion, Malta has much to answer for and really should clean up its act. Journalists rarely focus their gaze on the real facilitators of pension scams: the Mickey Mouse jurisdictions that turn a blind eye and allow them on their patch.

Why are they not aware? QROPS Scheme Administrators are sending out fictitious statements implying members’ pensions are still intact. One member of STM Pensions Malta was sent a statement in Sep 2020 showing his pension still intact just one month after STM wrote to members invested in Blackmore Global – Nunn & McCreesh’s offshore unregulated collective – that in fact they (STM) have no idea what the value is!

As it happens, STM did manage to get Nunn & McCreesh to publish the underlying assets for Blackmore Global, in May 2020 (over 6 years since the fund was launched). Even with this list, there is little idea what the fund is worth because the underlying assets are themselves useless, opaque, private ventures in yet more Mickey Mouse jurisdictions. One offshore fund is already being pursued by Dalriada as part of other failed pension schemes from early in the last decade – but Dalriada are getting nowhere with it.

I am not convinced that “The Adams v Carey case is likely to herald a flood of similar claims …”.

The Ombudsman case that went in favour of Mr. N against the Northumbria Police Authority (PO-12763) in July 2018, was also a landmark case against a negligent UK pension provider that had a tick box culture. The ceding provider transferred Mr. N’s pension without due regard for the Pensions Regulator’s requirements of 2013 for extra due diligence when handling transfers.

That decision doesn’t appear to have “herald[ed] a [likewise] flood of similar claims” three years on.

Also, the landmark appeal, Khuller v First International Trustees Ltd (Guernsey) (“FNBIT”) that was won by Manita Khuller, hasn’t seen any likewise “flood of similar” cases.

Why not?

The reason, in my opinion, is twofold:

Firstly, the victims were targeted by scammers because they were “ignorant”. That’s not meant to be derogatory.

They knew diddly squat about pensions, regulations, investments – nothing! They trusted the “adviser” – the con man persuading them to transfer their pension. For a con to be successful you need the essential skill of gaining people’s trust. Scammers have this skill in abundance. The ignorant fall for it every time.

Victims not only knew nothing about pensions and investments, they didn’t even know how to spot they were being conned. They were the perfect mark for scammers. They didn’t know what they didn’t know. Like taking candy from a baby – although a baby knows it is being robbed and often screams quite loudly (so maybe not the best analogy).

Secondly, even if victims have now discovered they have lost their pension, they have absolutely no idea what next to do about it. The ones I have come across are like fish out of water. Completely at a loss of where to go.

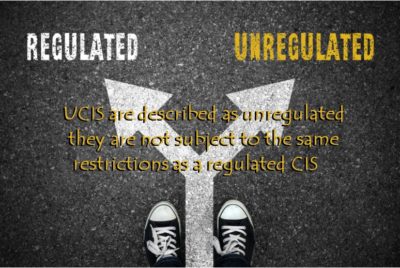

On Angie’s facebook group, one person recently told of their father’s loss of pension to Nunn & McCreesh’s Blackmore Global. In an attempt to do “something” the person went to the FCA on behalf of their father only to be told that investing in unregulated funds on the advice of unregulated advisers bars them from the compensation scheme and Ombudsman service. The FCA suggested looking into the Malta compensation scheme – which is a joke! That was the extent of help from the FCA. As useful as a chocolate teapot.

It hadn’t occurred to this person that either the ceding provider is guilty of maladministration for the transfer in the first place, AND/OR the receiving scheme in Malta is in “breach of trust” because it too is bound by legislation controlling its activities.

So the best next step is to pursue one or other side of the transfer – or both.

Manita Khuller went after the receiving trustee through the courts and eventually won. However, such legal action isn’t for the faint hearted. It cost her huge sums of money, which she took out loans to fund. Losing was not an option. On top of already losing her pension. It was a nightmare for her. I know – I was with her every step of the way since 2018 when we were introduced by a journalist. This was her only option because the Mickey Mouse jurisdiction, Guernsey, had no “Ombudsman” service. Moreover, the incestuous nature in Guernsey meant law firms declined to represent her. She had to go it alone for the first trial, adding a layer of stress no person should be subjected to. There are few victims with this determination or courage willing to take this course of action – so they don’t, even though she has paved the way.

We in the UK, at least, have the Ombudsman and now – relatively recently – Malta also has one (the Office of the Arbiter for Financial Services (“OAFS”)).

Guernsey is a backward, biased, Mickey Mouse, incestuous jurisdiction – which is why scammers love it.

The Scheme administrators on both sides of the transfer will fight tooth and nail and argue the victim is wholly to blame for their losses. Many victims just have no idea how to go about presenting their case.

There is no “free” professional service available to help victims navigate this minefield. Mr. N (referenced earlier) paid lawyers £25k to make his case. But the Ombudsman did not award costs – saying that it is not necessary to engage lawyers. However, it is not easy to fight a pension scheme that will employ a top notch law firm to present its defence. So by and large, the victims I have come across are at a serious disadvantage because they have no idea how to seek justice and have nowhere to go and don’t know how to present their case. That’s why they were targeted by scammers in the first place. They were (and still are) easy pickings.

In the article above, Ms. Brooks quoted from the appeal. I will do same. A more appropriate section, §115(i),

“… while consumers can to an extent be expected to bear responsibility for their own decisions, there is a need for regulation, among other things to safeguard consumers from their own folly.”

These victims are indeed victims of their own folly, but they never realised what they were doing. On both sides of the equation (ceding providers and the receiving schemes) there were duties of care designed to protect these victims “from their own folly”. In all cases I have come across, neither side fulfilled those duties of care. On the UK side there was contempt for the Pensions Regulator’s requirements of 2013, despite growing industry concerns for pension scams. On the receiving side, the QROPS didn’t (and still don’t) care about their members – period. And neither did the authorities in these Mickey Mouse jurisdictions. It was the perfect match and thousands of vulnerable victims are paying the price.

Carey Pensions was started in 2009 by the Carey Group. The Group is controlled in Guernsey by ten partners and ex-partners of the Law Firm Carey Olsen. This is an amusing coincidence in my opinion. Carey Olsen, perhaps the top law firm in Guernsey, represented FNBIT against Manita Khuller – and LOST at appeal by the way.

STM acquired Carey Pensions in 2019.

STM also had/has victims of the Trafalgar Multi Asset Fund scam which collapsed in 2016

STM announced its purchase of Harbour Pensions with some 1600 members. Some are invested in Blackmore Global.

At least one was invested in The Resort Group according to this money marketing article.

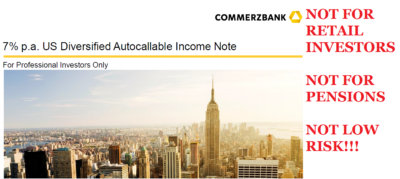

Harbour Pensions was started by Justin Caffrey, in 2013 and says in the STM announcement, “Harbour was always a five year plan…”. Justin made his money and now runs meditation classes (seriously?). He should meditate on the misery, caused by Nunn & McCreesh, of hundreds – if not thousands – of vulnerable victims of Blackmore Global that he allowed into his pension scheme, in my opinion, willingly and knowing the consequences of such an unsuitable investment. He permitted 100% allocation of one member’s pension into a fund that has never published audited accounts. At the material time, knowing the fund was opaque and unregulated, Harbour (and other QROPS) were happily permitting transfers and 100% allocations.

The fund’s offer document, which Harbour had, says the investment has a ten year lock-in. That condition, which the QROPS knew and willingly accepted, effectively locked Harbour (and subsequently STM) into an asset they knew nothing about – and still don’t – for ten years, with absolutely no knowledge or control of what Nunn & McCreesh were doing with the money.

The Scheme administrators in these QROPS in Malta were, and still are, completely at the whim of Nunn & McCreesh – who could misappropriate the pensions as they wish and the administrators could do absolutely nothing about it. The QROPS effectively abdicated all powers they had to run the scheme and mitigate risks in the interest of members, to Nunn & McCreesh. They have been passive bystanders to the destruction of their members’ pensions ever since. This is, in my opinion, in breach of the Malta Trust and Trustees Act. They are also willingly and knowingly in breach of trust.

All this really begs the question whether STM go looking for dodgy pension schemes or are they just plain stupid? What on earth is going on and why hasn’t the MFSA taken them to task? They seem to attract scams like flies to a pile of dung.

Blackmore Global Victim who cares about pension scams – says victims are being forgotten

Victims are being forgotten by the media and authorities. Victims had no idea what they were doing or how to seek restitution. They are guilty of nothing but ignorance and ALL the actors in these scams have gotten away with it. They have ALL dipped their hand in the pension pots and kept the spoils – and now moved on, leaving the pension pots empty.

This is frustrating in the extreme because I see no evidence of any “flood of similar claims”. The victims are, for the most part, still ignorant and there is no one “helping” them. This site (Pension Life) once purported to “help” victims but I am not at all convinced it has done much and now has long periods of radio silence. The newbies in this scam space, the journalists claiming to be the heroes that “blew the whistle” or warned the FCA, are just chasing big headlines for their editor on today’s flavour of the month: mini bonds. Soon the mini bond victims will be forgotten just like the victims of Defined Benefit Pension transfers. The blood sucking journalists will move on to the next headline. I have no time for these insincere upstarts because they don’t stay in it for the long haul.

Attention financial advisers in Spain/who provide financial advice to Spanish residents.

Attention financial advisers in Spain/who provide financial advice to Spanish residents.

International Adviser really can’t make up its mind whether it is organising a piss-up in a brewery, a news roundup carefully slewed in favour sponsors

International Adviser really can’t make up its mind whether it is organising a piss-up in a brewery, a news roundup carefully slewed in favour sponsors Bob Pain in the chair as quiz master. A bloke who ran Cayman Islands-based

Bob Pain in the chair as quiz master. A bloke who ran Cayman Islands-based  Capabilities and Harbour (n

Capabilities and Harbour (n Captain of the Army Team I nominate as Sam Instone of AES International. His experience as an Army officer should give him the leadership skills to oppose the Navel Team. Sam’s track record as the “enemy of traditional financial services” should give him the basis for a sound battle plan.

Captain of the Army Team I nominate as Sam Instone of AES International. His experience as an Army officer should give him the leadership skills to oppose the Navel Team. Sam’s track record as the “enemy of traditional financial services” should give him the basis for a sound battle plan.

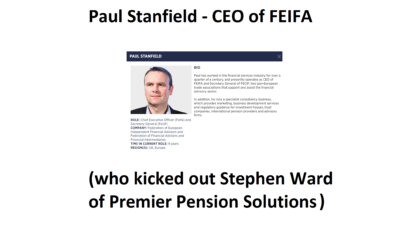

And the final member of the Army team will be Paul Stanfield, CEO of FEIFA (Federation of European Independent Financial Advisers). Another real gentleman – and handsome to boot – and one who understands the importance of outlawing scammers. Several years ago he excommunicated

And the final member of the Army team will be Paul Stanfield, CEO of FEIFA (Federation of European Independent Financial Advisers). Another real gentleman – and handsome to boot – and one who understands the importance of outlawing scammers. Several years ago he excommunicated

Investors’ trust is what gets violated in so many cases by irresponsible and negligent insurance companies such as Old Mutual International, SEB, Generali, RL360, Friends Provident International – and, of course, the firm in the Cayman Islands: Investors Trust. These companies – also known as “life offices” (although we prefer to call them “death offices” because they help destroy victims’ life savings – and sometimes cause the death of their distraught victims) – have a number of lethal practices which result in financial ruin for thousands of policyholders:

Investors’ trust is what gets violated in so many cases by irresponsible and negligent insurance companies such as Old Mutual International, SEB, Generali, RL360, Friends Provident International – and, of course, the firm in the Cayman Islands: Investors Trust. These companies – also known as “life offices” (although we prefer to call them “death offices” because they help destroy victims’ life savings – and sometimes cause the death of their distraught victims) – have a number of lethal practices which result in financial ruin for thousands of policyholders: A prime example of these vile practices was in the case of Mr. S – a driving instructor from Milton Keynes. His final salary pension scheme was transferred to a QROPS in Malta despite the fact that he was a UK resident and had no need for his pension to be transferred offshore. His “adviser” was David Vilka from a firm called Square Mile International Financial Services. This firm had an insurance license but no investment license. Therefore, Square Mile could legally sell insurance products such as dog insurance – but could certainly not provide investment advice.

A prime example of these vile practices was in the case of Mr. S – a driving instructor from Milton Keynes. His final salary pension scheme was transferred to a QROPS in Malta despite the fact that he was a UK resident and had no need for his pension to be transferred offshore. His “adviser” was David Vilka from a firm called Square Mile International Financial Services. This firm had an insurance license but no investment license. Therefore, Square Mile could legally sell insurance products such as dog insurance – but could certainly not provide investment advice.

Far from being contrite or apologetic, however, the scammer who risked Mr. S’ pension in the first place – David Vilka of Square Mile International Financial Services in the Czech Republic – showed no shame and made no attempt to recover the remainder of his victim’s pension. In fact, when I exposed Vilka’s vile scam, I was threatened by his two-bit American lawyer

Far from being contrite or apologetic, however, the scammer who risked Mr. S’ pension in the first place – David Vilka of Square Mile International Financial Services in the Czech Republic – showed no shame and made no attempt to recover the remainder of his victim’s pension. In fact, when I exposed Vilka’s vile scam, I was threatened by his two-bit American lawyer