As we reach the halfway point in the criminal trial of the Continental Wealth Management and Premier Pension Solutions companies, I regret I am unable to give a detailed update on the case at this point. The first half of the eight defendants have been cross examined by the judge’s lawyer, and the second batch of four further defendants are due to be cross examined on 7th April 2020 (in the Denia Court of First Instruction).

This, of course, assumes there is no disruption to the proceedings caused by the Corona virus lockdown.

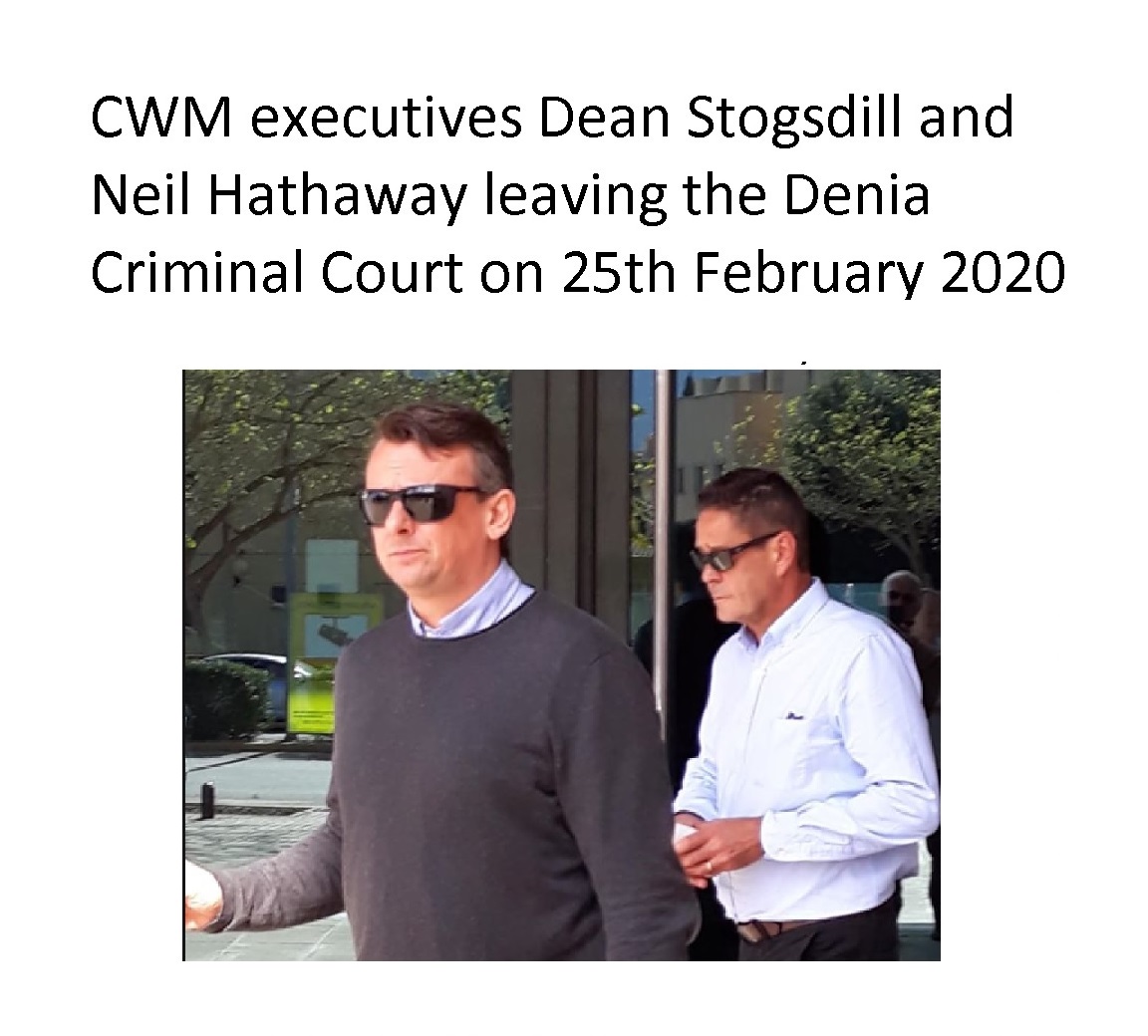

The first “batch” consisted of Patrick Kirby – Darren Kirby’s brother – who ran the CWM cold calling operation which sent so many hundreds of victims to their doom; Anthony Downs; Dean Stogsdill and Neil Hathaway who had various different titles at different times – ranging from Managing Director to Operations Director to Investment Director.

I can’t comment on the transcripts of the questions and answers on 24th and 25th February, and won’t be able to publish the full details of all cross examinations until all the defendants have appeared before the judge. The defendants on 7th April will be:

- Jody Smart – sole director and shareholder who paid herself over 1 million Euros in the last two years of the life of CWM – the money being paid into her two other businesses: property company Mercurio and fashion design company Jody Bell. In addition, she also paid money into her Grant A Wish “charity” and drew a hefty salary.

- Paul Clarke – founder of the original CWM company in partnership with Darren Kirby; Clarke left a year later to run AES International Spain, where he scammed more victims out of their life savings with expensive, unnecessary, illegally-sold insurance bonds, and high-risk structured notes – all sold for the fat commissions (despite the even fatter losses suffered by the victims). He also advised two victims to go into Stephen Ward’s Ark scam. Clarke now runs a firm called Roebuck Wealth and has scrubbed the internet of all trace of his history.

- Darren Kirby – founder along with Clarke and ultimate controller of the whole CWM operation throughout. Kirby made every attempt to divest himself of all legal responsibility for CWM. He gave away his shares in the company to his business/civil partner Jody Smart, and some of his employees. However, all the defendants (as well as victims) are bound to confirm Darren Kirby was the ultimate boss and controlling mind of the company.

- Stephen Ward – owner of Premier Pension Solutions SL. He was the person who signed off all the CWM clients’ pension transfers (for a fat fee). He knowingly condemned all pension holders whose transfers he signed off to inevitable partial or total loss. He was fully aware of CWM’s modus operandi as he himself used a similar investment model to that of CWM (and had taught them how to do it). Ward was routinely investing his own clients’ funds in a toxic, disloyal and irresponsible manner which was as bad – and sometimes even worse – than in the CWM cases.

As soon as I can publish the cross examination transcripts and further directions, I will do so.

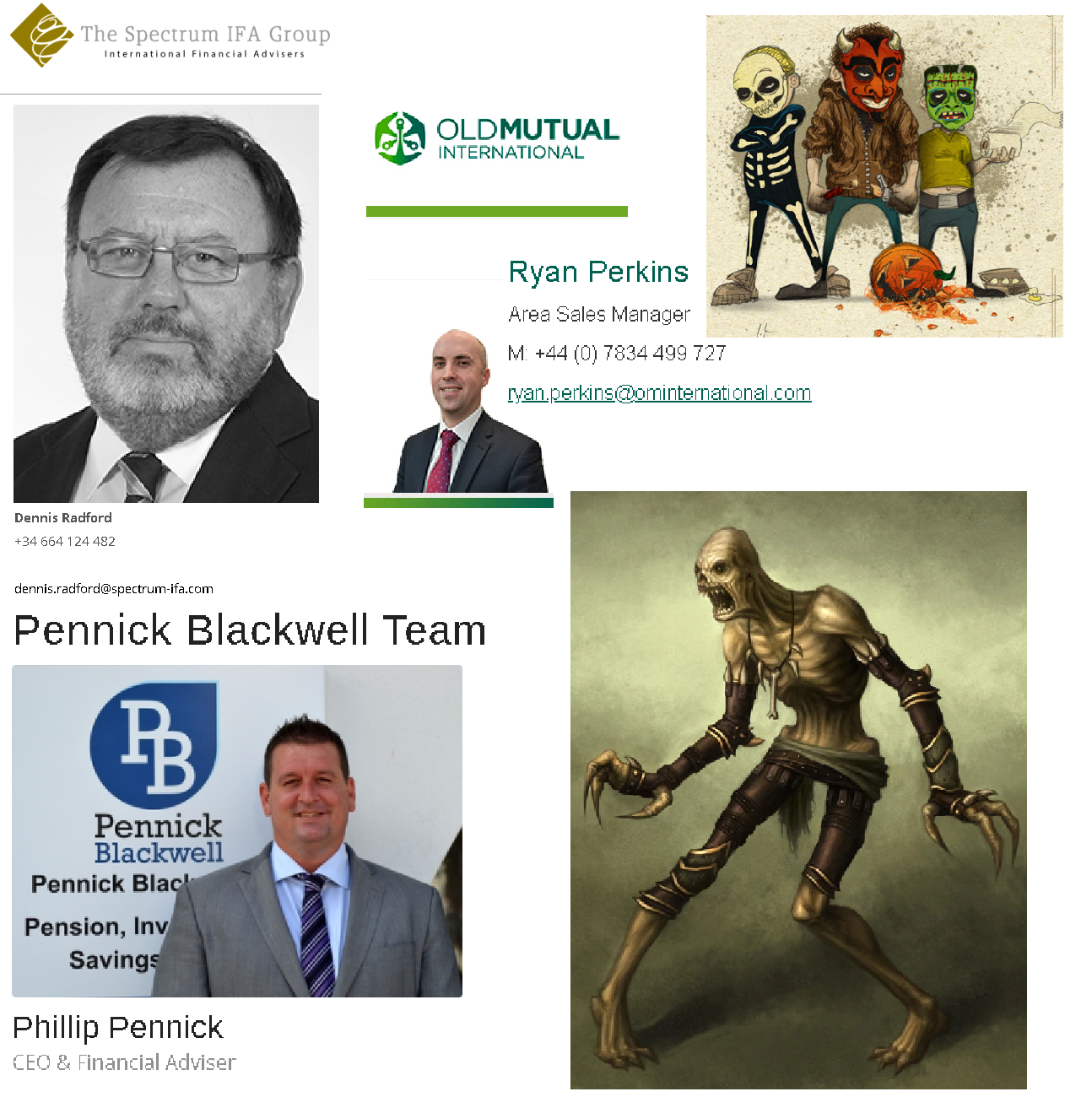

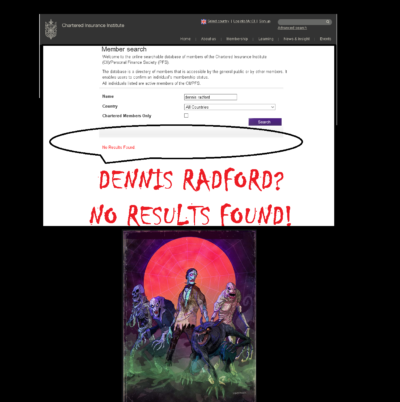

This landmark Continental Wealth Management criminal case will inevitably shine a much-needed spotlight on the issue of offshore financial services generally. CWM was just one example (albeit an extreme one) of an international financial services culture which generally disadvantages and/or defrauds consumers. The cause of this culture is a combination of the obsession with the insurance bond cartel: OMI, SEB, Generali, RL360 et al; the total reliance on (hidden) commission; the practice of churning (investing the same sum of money as often as possible to generate as much commission as possible) and the view that the client’s money and interests are secondary to the adviser’s.

Most victims – whether parties to the criminal proceedings or not – are aware of the demise of CWM in September 2017. The company was slowly dying because of the number of victims the CWM scammers had ruined: the word was getting out (which was bad for business) so the victims who shouted loudest were getting paid off. This was having a seriously detrimental effect on CWM’s cashflow.

The financial strain on the business was, however, made even worse by the fact that every last bit of spare cash in the CWM bank account was being used to keep Jody Smart in houses, frilly frocks, shoes and champagne. In 2017, the CWM bank statements show 158,614 EUR was transferred into her Mercurio property company bank account, and 123,400 EUR into her Jody Bell fashion design company bank account. But this was significantly down on the previous year: 386,921 EUR to Mercurio and 164,000 EUR to Jody Bell. The year before, 2015, 124,500 EUR into Mercurio and 39,000.00 into Jody Bell fashion. That’s almost 1 million EUR in two years pocketed by Jody – not counting the money paid into her Grant A Wish “charity” and her generous “salary”.

During the same period, however, the revenue was at least 3,391,876.28 EUR in commissions from insurance bonds and structured notes. On top of this was a substantial amount of extra secret commission from the ultra-high-risk Leonteq structured notes, plus whatever Darren Kirby could con out of victims such as Mark Davison (who subsequently died penniless) and the other claimants pursuing Kirby and CWM through the criminal court in Denia in separate proceedings which pre-date our Pension Life proceedings.

Looking back to the dying days of CWM when cashflow was slowly grinding to a halt as the company was paying out compensation to some of the worst-affected victims (and any remaining cash was being spent by Jody Smart on first-class flights to New York and champagne in five-star hotels – despite her claim to be working 24/7 on her Grant A Wish charity), there was a plan to “reinvent” and re-launch CWM. It eventually dawned on the CWM scammers that they couldn’t scam enough new victims quickly enough to pay out all the existing victims – so the answer was to start afresh with a brand new approach. The new approach was essentially the same as the old approach – except they aimed to sell more “products” and ruin more victims.

The rest is history and CWM collapsed at the end of September 2017 – when all related parties withdrew terms of business. It is worth taking a careful look at the business plan which CWM had been intending to use to re-launch the business. This plan makes it clear that this was an unlicensed, insurance bond sales outfit which intended to continue to operate in contravention of the Spanish insurance regulations. If you read the plan carefully, you will see that CWM operating model was always based on a high-pressure sales target which ignored the interests of the clients (victims).

CWM’s promotion had always been centered around the iniquitous cold call – but in addition the business plan reveals that Jody Smart’s Grant A Wish “charity” events had been used to “harvest” potential victims at scamming sales parties posing as bona fide fundraising efforts.

Read the below CWM “Relaunch Business Plan” carefully and you will see how the scam works. If a victim transfers a £100,000 pension, it will fall in value in the hands of CWM to £91,976,000 by the end of year 1. This means the first year fees would have totalled £4,000 set up fee plus £1,000 annual management fee to CWM; £1,490 QROPS fee; £1,534 to fee OMI. It is interesting that Stogsdill has made the assumption in the plan that all clients will be put into an OMI bond – long before they’ve even met the client and found out if they actually need an insurance bond (which they never do as they are too expensive and lock investors in for up to ten years).

The CWM “plan” shows how a victim’s fund could recover back up to £97,495 if it grows by 6%. But this doesn’t take into account the investment costs of between 5% and 8% – so that was never going to happen. So Dean Stogsdill of CWM – despite all the lessons which should have been learned from years of destroying victims’ funds, still fully intended to keep on doing the same to as many new victims as possible.

Continental Wealth Management Business Plan 2017 (by Dean Stogsdill)

Continental Wealth Management is an independent financial advice firm specialising in wealth management advice to English speaking expatriates throughout Europe – this statement is the key to CWM’s future success.

CWM must focus on expanding our circle of influence and create new business through strategic placement of data gatherers. We must take on the business of “hard targets”, created to allow the best we have to flourish, whilst removing the weaker members of the team by natural selection. This is not a system for solely the sales force, but for all aspects of the team including call centre operators, administration and directors.

CWM will have clear defined roles within the sales force with the addition of achievable, measurable targets on top of generous salaries which is the cornerstone of our payroll ethos. The business will flow from our Partners meaning the business can be closed efficiently and serviced by an experienced adviser who is well trained, knowledgeable and most importantly a “hungry individual”.

There is a simple calculation on £100,000.00:

£100,000 invested over 6 years in capital protected products will provide £6,250.00 in gross revenue.

£100,000 invested over 6 years in a fund yielding 3% per annum growth will provide £10,690 in gross revenue.

BACKGROUND

CWM is a financial services company founded in 2007 on the Costa Blanca. It is a company specialising in pension transfers, portfolio bonds, offshore investments and single premium investments. It is a non-regulated company which is owned and operated by the directors / shareholders and founder Darren Kirby. Recent investors are Timothy Benjamin, and Mark Davison with share capital having been distributed amongst these investors.

Directors / Shareholders

Founder / Majority Shareholder – Darren Kirby

Chairman – Neil Hathaway

CEO – Dean Stogsdill

COO – Anthony Downs

Key Personnel

Darren Kirby – He brings a wealth of experience in financial services with a keen head for figures and sales techniques. He has a strong view on the business and how it should be perceived by the clients, while strengthening our position through strategic investment decisions along with powerful leadership skills.

Neil Hathaway – Decades of experience in insurance and wealth management, he brings a strong personality and great sales skills with the qualifications to match. He is a knowledgeable asset to the management of the sales force and uses his skills to bring through the less experienced members of the team.

Dean Stogsdill – Strong sales record and up to date qualifications – he can sell at the most technical level and has a strong grasp of the investment market, regulation and products. Strong views on company direction.

Anthony Downs – Organised, driven and a sales record to match. He drives through the issuing business and captures all revenues and commissions in the most efficient manner. Anthony is key to the efficient stream of payments required for this business model.

Directors: Re-structure 2017

Darren Kirby

The final decision maker as majority shareholder means critical decisions will fall to him. A mandate to find new investors and revenue streams for CWM. An ambassadorial role and a creative thinker for the company, bringing fresh ideas on many aspects of the business both operational and non-operational.

Neil Hathaway

Key point of contact for the sales force. A remit to push the sales force to meet targets and close business. He will be in control of sales, possible bond lists as well as monitoring the business / LOA levels for each adviser. He will also have a key role in writing new business. This will be a target driven management position. All advisers will report directly to him.

Dean Stogsdill

Complete oversight of the business operationally with a close working relationship with the Chairman and COO. I will manage the company direction and overall development planning, strategies and high level management with department heads reporting directly to me. I will chair board meetings and deal with technical and regulatory planning. I will also be heavily involved in the efficient management of the investment book.

Anthony Downs

Full control of new business. A remit to drive through the revenues from written business to maximize the cashflow of the company. Target driven with targets based on company income needs, outstanding requirements and business written.

With the current admin levels and management restructure we should be able to easily handle up to 7 bonds per week, plus client after care, outstanding requirements, investment and re-investment. We do not hire any more administration in 2017. Although this will be adjusted if business levels exceed 7 bonds per week.

We are now a company where you perform, meet your target or you are replaced.

Of the 9 bond writers, we have 1 in France, 1 in Turkey, 1 in Portugal and the other 6 are in Spain. I believe that we need to build up the business levels so that 9 bond writers can meet a target of 30 bonds per man for the year or an average of 3 a month, based on a 10 month / 40-week year. This would mean a company wide total of 270 bonds, at our target average of €10,000 commission per bond that would mean turnover of 2.7 million plus trail of €300,000 meaning a total of €3,000,000 for 2017.

Call Centres – Cold calling with appointments made and revenue generated through call centres and call centres paid for on performance only.

Market history:

Historically we have concentrated on cold calling, Grant A Wish (“charity”) events, web videos, website and referrals from existing clients. The cold calling aspect is becoming more and more difficult and time consuming and other areas of marketing ourselves and our products must be found.

Competition – Blevins Franks; DeVere; Abbey Financial; Spectrum; Blacktower

Our average case size of £100,000 has costs associated with it as follows:

| Opening | |||

|

| Initial Single Premium | 100,000 | |

|

| Total | 100,000 | |

|

|

|

| |

| Charges | CWM | ||

|

| Initial CWM Set Up Charge | 4,000 | – |

|

| – | ||

|

| QROPS Set Up Charge and Annual Fee | 1,490 | |

|

| OMI Annual Management Charge | 1,150 | |

|

| CWM Annual Management Charge | 1,000 | |

|

| OMI Annual Administration Charge (paid Quarterly) | 384 | |

| Total Expenses | 8,024 | 3,354 | |

|

|

|

|

|

|

| Net | 91,976 | |

|

| Estimated Growth 6% | 5,519 | |

|

|

|

|

|

| Year End Balance | 97,495 | 99,789 | |

|

|

| ||

|

| – | – | |

|

| – | – | |

|

| – | – | |

|

| – | – | |

|

|

|

|

|

| Balance on Fund | 97,495 | 99,789 |

This gives us a year 1 price point of 8.02% and an ongoing of 3.3%.