EVERGREEN RETIREMENT TRUST QROPS SCAM – HOW DID IT ALL WORK?

EVERGREEN RETIREMENT TRUST QROPS SCAM – HOW DID IT ALL WORK?

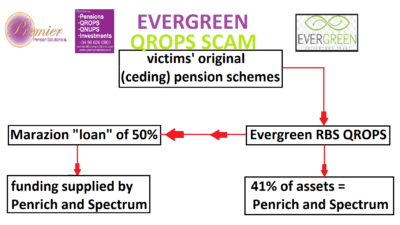

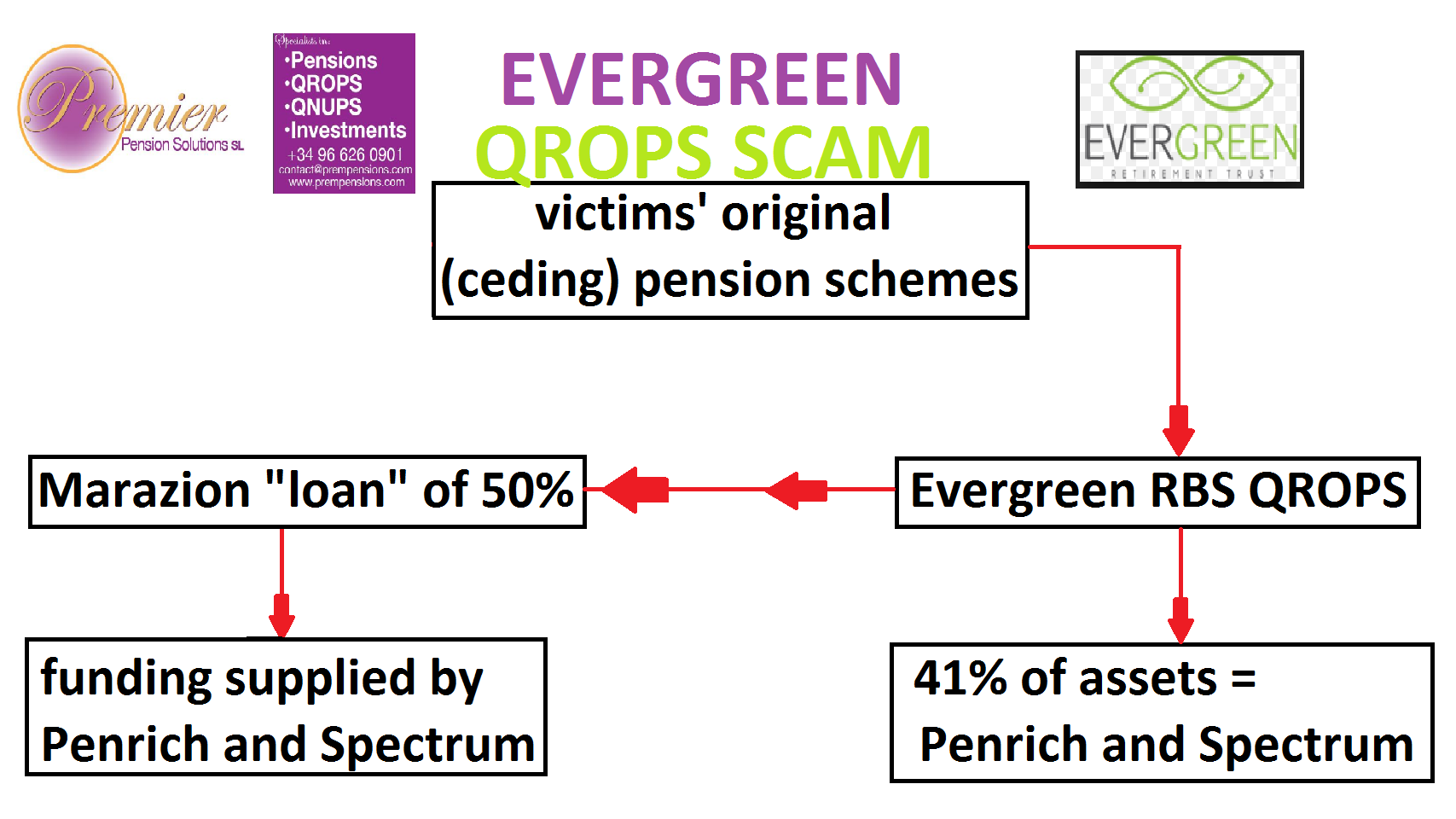

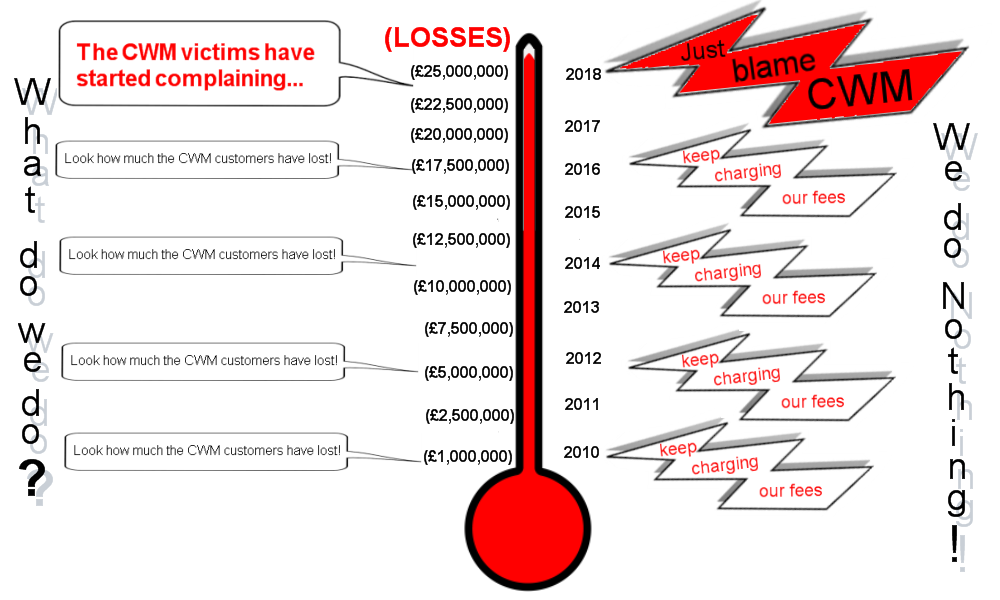

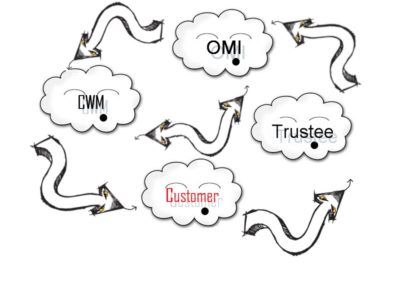

Victims were cold called by Continental Wealth Management (CWM) and duped into transferring their UK pensions into the Evergreen New Zealand QROPS on the promise that they could access 50% of their pension. CWM acted as the “sister” company to Stephen Ward’s Premier Pension Solutions (PPS).

Once the 300+ victims had been sold this idea – on the promise by pensions “expert” Stephen Ward of Premier Pension Solutions that the 50% in cash would not be taxable – the transfers went ahead. More than £10 million pounds’ worth.

CWM assured the victims that the 50% cash would not be taxable because the scheme was set up and run by international pensions expert and author of the Tolleys Pensions Taxation manual Stephen Ward of Premier Pension Solutions.

CWM assured the victims that the 50% cash would not be taxable because the scheme was set up and run by international pensions expert and author of the Tolleys Pensions Taxation manual Stephen Ward of Premier Pension Solutions.

Once the transfer had gone ahead, and the victims were eagerly awaiting their 50% in cash (albeit having to pay 10% in fees for the privilege), they then started to chase up their cash. There were delays after delays.

After many weeks of frustration, the victims were then told they had to apply for a loan. They were told that this was merely a formality – paperwork to ensure that the cash would not be taxable by HMRC. And they were sent loan application forms from a company called Marazion – Stephen Ward’s company in Cyprus.

Victims were then forced to sign a five-year Marazion loan agreement. And forced to sign a five-year Evergreen “lock in”. Clearly, this was designed to stop victims from transferring out of Evergreen before their Marazion “loans” were paid off.

Victims were then forced to sign a five-year Marazion loan agreement. And forced to sign a five-year Evergreen “lock in”. Clearly, this was designed to stop victims from transferring out of Evergreen before their Marazion “loans” were paid off.

Evergreen recently sent out a notice to victims advising them the Evergreen Scheme is being wound up. (Surprise surprise!!). Here is the Evergreen notice with my comments in bold:

Evergreen Retirement Trust – closure and winding up

We are writing to inform you that the Evergreen Retirement Trust (“ERT”) is being closed and wound up with effect from Friday, 6 April 2018. So why, just days earlier, were you writing to victims to tell them could take their 30% tax-free lump sum and transfer out? You knew this day and the winding up would eventually take place – and why as well as when. And yet you have misled and distressed a large number of your victims knowingly and intentionally.

Why is ERT being wound up? We all know exactly why ERT is being wound up. HMRC realised that the scheme was operating pension liberation fraud in partnership with Stephen Ward of Premier Pension Solutions early on – in 2012 – so removed it from the QROPS list in November 2012. Your Manager’s Report for the year ended 31.3.16 refers to “concerns raised by HMRC” but you do not disclose the fact that you had been caught and the scheme removed from the QROPS list as a result. The other reason the fund is being wound up is that you have run out of excuses now the five-year lock-in period is up. In your Manager’s Report, you claim that service contracts were entered into by Evergreen Retirement Trust for admin, trustee and other services which have minimum fixed fees. But you have never provided evidence of these alleged “contracts” – nor have you explained why you have carried on paying these unaffordable costs. You have been trying to obscure the fact that 41% of the underlying assets of the fund were in Penrich and Spectrum and that this is where the loan funds came from. You have for years tried to pretend that you knew nothing about the Marazion loans. But the original trustee – Perpetual Trust – even had a virtually identical logo to Marazion!

Why is ERT being wound up? We all know exactly why ERT is being wound up. HMRC realised that the scheme was operating pension liberation fraud in partnership with Stephen Ward of Premier Pension Solutions early on – in 2012 – so removed it from the QROPS list in November 2012. Your Manager’s Report for the year ended 31.3.16 refers to “concerns raised by HMRC” but you do not disclose the fact that you had been caught and the scheme removed from the QROPS list as a result. The other reason the fund is being wound up is that you have run out of excuses now the five-year lock-in period is up. In your Manager’s Report, you claim that service contracts were entered into by Evergreen Retirement Trust for admin, trustee and other services which have minimum fixed fees. But you have never provided evidence of these alleged “contracts” – nor have you explained why you have carried on paying these unaffordable costs. You have been trying to obscure the fact that 41% of the underlying assets of the fund were in Penrich and Spectrum and that this is where the loan funds came from. You have for years tried to pretend that you knew nothing about the Marazion loans. But the original trustee – Perpetual Trust – even had a virtually identical logo to Marazion!

We have been considering the future of ERT for some time. Despite our best efforts, ERT has not been as successful as we had originally hoped. This is the understatement of the century surely? Best efforts? I would really hate to see your worst efforts. You’ve spent the last five years telling members they can’t transfer out because of the five-year term Marazion loans – and knowing all along that you were always going to wind the scheme up because there was nothing to be done about at least 41% of the scheme being in illegal loans using Penrich and Spectrum funds – the underlying assets of the scheme.

The main reasons for this have been the inability to attract new membership into ERT and the increased compliance costs arising from transition to the new, more rigorous, Financial Markets Conduct Act regulatory framework that now applies to it. And what exactly did the “more rigorous regulatory framework” say about the scheme operating pension liberation fraud as part of the scheme?

Although we explored a number of avenues to resolve these issues, we ultimately determined that it would be in members’ best interests for ERT to be wound up and the scheme brought to a close. What would have been in the members’ best interests would have been to allow the members to transfer out several years ago when we first asked Evergreen for transfers. It is clear from your own accounts that you have indeed allowed 10 people to transfer out £500k worth of funds last year – presumably these were people without Marazion loans?

What happens next? Until 6 April 2018, ERT will continue as normal and you will have the same rights and benefits as before. On and from 6 April 2018, the assets in your member account will be realised and the proceeds paid into your nominated bank account after the deduction of applicable fees, expenses and any taxes in respect of the winding up process. So for people under the age of 55, you are proposing triggering an unauthorised payment which would be taxed at 55% by HMRC? Unbelievable.

A final set of scheme financial statements will be prepared, audited and sent to all members, and the relevant regulatory notifications will be filed. So how are you going to account for the Marazion loans? You must surely realise that this is a huge problem and you can’t just keep ignoring it and pretending you weren’t involved in this aspect of the scam.

To allow this process to occur in an orderly fashion, members will not be able to request transfers (except as set out below) or make further contributions, and benefit payments will be put on hold pending the final distribution of wind up proceeds. So how are you going to account for the Marazion loans? How will these be factored into the wind-up proceeds?

Some of the scheme’s assets are illiquid and as a consequence the winding up process could take some time. Why on earth are any of the assets illiquid? No pension scheme assets should be illiquid. You have been dealing with this matter for more than five years and you always knew that there was a purported five-year lock-in, timed to coincide with the five-year term of the Marazion loans. So why on earth invest in illiquid assets?

Based on current market conditions, we expect the winding-up process to be fully completed and a final distribution to be made around December 2019. So what you are saying is that you never intended to honour the five-year lock-in in the first place. You wanted a seven-year lock-in so that you could continue to hide the Marazion loans.

Prior to the final distribution of wind up proceeds, partial distributions may be made as assets are realised, provision for anticipated costs are made and as such funds become available to make those partial distributions. In 2016 you purchased £5.87 million worth of assets. Why – in the full knowledge that you were going to wind the fund up a couple of years later – did you buy illiquid assets?

What are my options? Unless you advise us otherwise by 6 June 2018, you will receive your winding up proceeds in cash to the bank account nominated in accordance with the requirements noted below once the winding up process above has been completed. For members under the age of 55, you cannot do this as it will trigger an unauthorised payment and the victims will get taxed at 55%.

For members who have not been tax resident outside the UK for five clear and consecutive UK tax years, receiving winding up proceeds in cash could have adverse UK tax consequences. We are therefore offering members the option of having their winding up proceeds transferred to another QROPS or registered UK pension scheme instead of being paid directly in cash. But you are asking other trustees to accept in specie transfers of unknown provenance (by your own admission at least half of the fund is illiquid) and with at least 40% of the fund subject to a fund which provided the Marazion loans.

These members are strongly encouraged to obtain professional tax advice from an independent and qualified UK tax adviser before making any decision. Of course they do – including tax advice on the 50% Marazion “loans” which you facilitated and of which you have always been not only aware but in which you have been complicit.

If you wish to have wind-up proceeds transferred to another scheme you will need to provide us with notification by 6 June 2018. And which “other scheme” is going to accept illiquid – possibly toxic – assets bought by a clearly inept and irresponsible trustee which has also facilitated pension liberation? Any members with a Marazion loan will be deemed to be “high risk” by any new pension trustee and a mechanism for repayment of the loan will need to be put in place.

Please note that transfer of the assets will occur over time, in line with the distribution of the funds to other members. What do I need to do? If you have been tax resident outside the UK for five or more clear and consecutive tax years then all you need to do is provide us with updated proof of identity and address documentation together with official bank documentation evidencing a nominated bank account held in your name (see the Appendix to this letter for more details about this requirement). But that only applies to those over the age of 55 and without a Marazion loan presumably?

Once that documentation has been provided, you will receive your winding up proceeds into your nominated bank account as funds become available through the winding up process. You will also receive copies of the final audited financial statements in due course. Do you mean once you have figured out how to account for the Marazion loans funded by Penrich and Spectrum?

If you have not been tax resident outside the UK for five complete and consecutive UK years, we strongly encourage you to seek professional tax advice from an independent qualified UK tax adviser. You should then advise us whether you wish to receive your winding up proceeds in cash, or transfer your member account to another QROPS or registered UK pension scheme. So what are you going to do if no trustee will accept an in specie transfer and the members are under the age of 55?

If you still wish to receive your proceeds in cash, you will need to provide us with the documentation (including official bank documentation evidencing a nominated bank account held in your name) referred to in the previous paragraph. In either case, if you wish to transfer your member account to another QROPS or registered UK pension scheme, please advise us before 6 June 2018 and we will send you the relevant transfer forms. It is now clear, beyond any shadow of a doubt, that you must immediately account for the Marazion loans and show how these are accounted for in the scheme accounts. You have avoided this question for several years and now is the time finally to come clean.

If the trustee of the other scheme agrees, a proportion of your transfer to that scheme might comprise a transfer of underlying investments of ERT, as well as cash. I doubt any receiving scheme will be thrilled at the thought of accepting any of ERT’s underlying investments in the full knowledge that approaching 50% of the original transfers were given out in fraudulent “loans”.

Please be aware that all payments made out of the scheme, including in the winding up process, are required to be reported to HM Revenue & Customs.

Who should I contact with questions? If you have any questions about the winding up process, you can contact our customer services team by email at transfers@evergreentrust.co.nz, by telephone on +64 3 974 1505 or by post to PO Box 36270, Merivale, Christchurch 8146. Please note that we do not provide financial advice or tax advice. Yours sincerely, The Directors Evergreen Capital Partners Limited So, will Evergreen finally answer the questions about the Marazion loans? Fully and transparently? I doubt it. And I would like to remind Evergreen that scammers are criminals.

In the wake of hundreds of victims fearing heavy pension losses in the Blackmore Global fund, we now have another disaster waiting to happen: Blackmore Bond.

In the wake of hundreds of victims fearing heavy pension losses in the Blackmore Global fund, we now have another disaster waiting to happen: Blackmore Bond. But here’s another puzzle: a geezer called

But here’s another puzzle: a geezer called  According to

According to

DEMAND FOR LEONTEQ’S

DEMAND FOR LEONTEQ’S

After losing a third of her pension, Jessica was then moved by

After losing a third of her pension, Jessica was then moved by

Having focused very much on bad pension investments, pension scams and how to avoid them, I´d like to talk a bit about PensionBee, a relatively new pension provider.

Having focused very much on bad pension investments, pension scams and how to avoid them, I´d like to talk a bit about PensionBee, a relatively new pension provider.

John (Gus) Ferguson’s firm, Square Mile International, is clearly not exactly square – and Lillywhite is a grubby shade of black.

John (Gus) Ferguson’s firm, Square Mile International, is clearly not exactly square – and Lillywhite is a grubby shade of black.

There are many different types of pension scam – just as there are many types of genuine pension scheme. This can sometimes make it difficult to tell the difference so we are her to help you inform you about, what is a pension scam.

There are many different types of pension scam – just as there are many types of genuine pension scheme. This can sometimes make it difficult to tell the difference so we are her to help you inform you about, what is a pension scam.