2,000 victims of fraudulent pension firms may be in with a chance of getting their funds back. In November, the FCA pushed for legal proceedings to go ahead against collapsed firm Avacade Limited, trading as Avacade Investment Options; and Alexandra Associates (UK) Limited, trading as Avacade Future Solutions.

2,000 victims of fraudulent pension firms may be in with a chance of getting their funds back. In November, the FCA pushed for legal proceedings to go ahead against collapsed firm Avacade Limited, trading as Avacade Investment Options; and Alexandra Associates (UK) Limited, trading as Avacade Future Solutions.

Past prosecutions made by the FCA:

In 2016, the FCA proposed Alistar Burns of TaylorMade International should face a fine of £233,600, along with a ban. Earlier this year the case was seen in the Upper Tribunal, whilst upholding the ban, they chosen to lower the fine to £60,000. Here I believe the FCA made a good strong decision, but the Upper Tribunal then let them down by reducing the fine.

Court proceedings against Capital Alternatives have been taking place since July 2013. The FCA alleged that Capital Alternatives used “false, misleading and deceptive statements” to lure unsuspecting investors into four toxic, high-risk investments (scams) between 2009 and 2013. Despite the High Court deciding in February 2014 that the schemes/scams were collective investment schemes, only two out of the sixteen defendants in this case have made settlements. Since this date, the other defendants have been appealing the decision and no other monies has been recouped.

This case demonstrates the problems surrounding prosecutions made, often the funds that have been scammed can not be located. Or the scammers hire good lawyers and squander money away by appealing the decisions again and again, causing massive delays on payback. Victims of Fast Pensions are also stuck with this problem.

*****

£86 million worth of pension funds were taken by Avacade and Alexandra Associates, and placed into Liberty SIPPS and then invested into dodgy investment schemes such as tree plantations.

It is not yet know how much of the pensioners´ money has been lost. However, it is clear that Alexandra Associates was not licensed to carry out the advice given.

Craig Lummis, Lee Lummis and Raymond Fox are named in the legal proceedings for being “knowingly concerned” in the alleged wrongdoing of Avacade and Alexandra Associates. The court has ordered that any wealth held by the companies should be used to compensate the victims.

Once again, this case highlights unregulated introducers – Alexandra Associates – posing as qualified financial advisory firms, offering “free pensions advice” to lure in unsuspecting victims. In many of my blogs, I try to raise awareness of this trick: nothing in life comes for free. Often, firms offering this “free review”, will be rogue firms. Whilst the review may well come for free, there are often undisclosed fees and costs that will be imposed on the value of your pension fund – often making a large dent in your savings.

Unfortunately for the victims, they will not notice these – usually higher than average – fees until it is too late. Pension Life has many blogs that can help you to avoid being scammed, recommending the right questions to ask your adviser – before you sign your precious pension fund over.

You can also read blogs that will help you know what qualifications your adviser should have in order to be in an educated and qualified position to legally advise you on a pension transfer and pension investments. If in doubt, you can say “NO” and walk away from the deal, providing you have not signed anything (although there should be a 30-day cooling off period). Try reading up on past scams and becoming familiar with the names of scammers working in the pensions field.

Mark Steward, director of enforcement at the City regulator, said:

“The FCA is seeking injunctions, declarations and restitution orders to prevent further breaches in schemes which were unlawfully promoted to the public using false, misleading and deceptive statements.”

What a relief to hear this statement being made by an employee of the FCA (about blooming time!). Pension Life has long been waiting for the FCA to pull their finger out and start prosecuting pension scammes. With positive action like this, we could have had all the pension scammers locked up by Christmas and the victims´ monies returned to them. I’m sure that those who have lost so much to these crooks would be over the moon to be able to tell their families that they are once again financially secure (rather than financially ruined).

I have a long list of fraudulent pension firms and serial scammers that I plan to forward to the FCA (yet again). However, in reality, I do wonder how many cases the FCA can actually deal with in one year. Given their past track record, I’d say this is their annual big bust. The other scammers are safe and the victims will be left to wait and wonder when their cases will be dealt with.

I have a long list of fraudulent pension firms and serial scammers that I plan to forward to the FCA (yet again). However, in reality, I do wonder how many cases the FCA can actually deal with in one year. Given their past track record, I’d say this is their annual big bust. The other scammers are safe and the victims will be left to wait and wonder when their cases will be dealt with.

On the plus side, the FCA have certainly had a busy month. Alongside their prosecutions, they have launched their ScamSmart campaign, teaming up with The Pensions Regulator. The campaign encourages people who are concerned that they may have been approached by fraudsters to report it via the ScamSmart website. It also raises awareness about checking that the firms consumers are using are regulated to provide the advice they are offering.

On the plus side, the FCA have certainly had a busy month. Alongside their prosecutions, they have launched their ScamSmart campaign, teaming up with The Pensions Regulator. The campaign encourages people who are concerned that they may have been approached by fraudsters to report it via the ScamSmart website. It also raises awareness about checking that the firms consumers are using are regulated to provide the advice they are offering.

I would like to highlight that the rider of the jet ski does bear a remarkable resemblance to Phillip Nunn, cold caller and “fund manager” of the

I would like to highlight that the rider of the jet ski does bear a remarkable resemblance to Phillip Nunn, cold caller and “fund manager” of the

Rental protected by Insurance

Rental protected by Insurance But, there is always a but! Since working for Pension Life, any investment opportunity that quotes the word ´bio´ gives me the heebie-jeebies. We have only to look back and remember the

But, there is always a but! Since working for Pension Life, any investment opportunity that quotes the word ´bio´ gives me the heebie-jeebies. We have only to look back and remember the

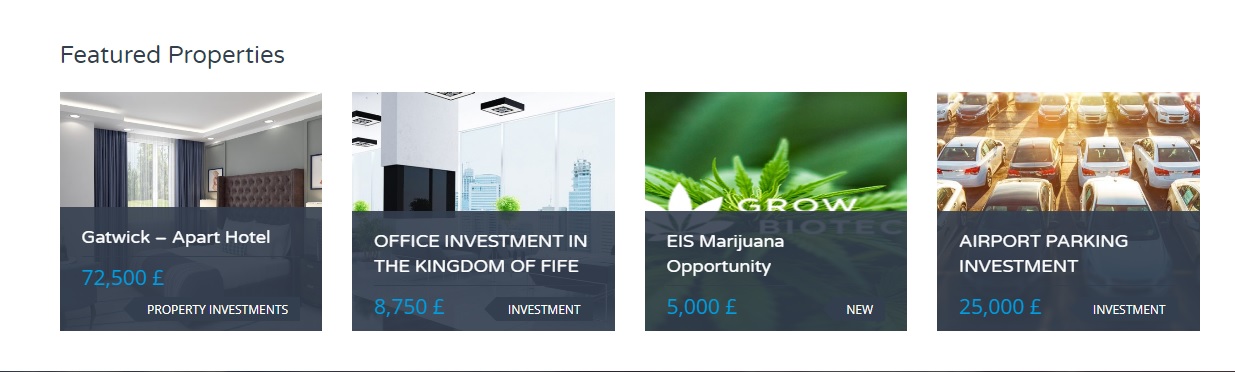

The types of investments offered by Katar Investments are high-risk and illiquid, if you have a spare five grand that you can afford to lose, then go for it: have a cheeky punt on Bio Grow. You may be pleasantly surprised and get the target return of £50 per £1 invested (just remember to duck smartly when those pink things with curly tails fly a bit too close!). However, if your money is dear to you and you cannot afford to lose it, please stay away from shiny pink and green investments like this.

The types of investments offered by Katar Investments are high-risk and illiquid, if you have a spare five grand that you can afford to lose, then go for it: have a cheeky punt on Bio Grow. You may be pleasantly surprised and get the target return of £50 per £1 invested (just remember to duck smartly when those pink things with curly tails fly a bit too close!). However, if your money is dear to you and you cannot afford to lose it, please stay away from shiny pink and green investments like this.

Interestingly,

Interestingly,

Victims of the unregulated

Victims of the unregulated

One of the updates is that STM Group have appointed a Group Internal Auditor. I wonder if this is going to make their trading any more honest. One can only hope that their future auditing will be considerably better than their past.

One of the updates is that STM Group have appointed a Group Internal Auditor. I wonder if this is going to make their trading any more honest. One can only hope that their future auditing will be considerably better than their past.

What a disgrace that Gillett can announce that he is “proud” of their performance over the last 20 years – proud of the misery and stress caused to the victims of the

What a disgrace that Gillett can announce that he is “proud” of their performance over the last 20 years – proud of the misery and stress caused to the victims of the  With the responsibility of Generali being passed over to LCCG, here at Pension Life, we wonder if LCCG will be taking responsibility for Generali´s past victims as well. Will LCCG apply their corporate risk solutions to those who have already been put at risk? Generali on their own certainly didn´t apply a high standard of risk solutions when they placed CWM victims´ funds into high-risk, toxic, professional-investor-only structured notes.

With the responsibility of Generali being passed over to LCCG, here at Pension Life, we wonder if LCCG will be taking responsibility for Generali´s past victims as well. Will LCCG apply their corporate risk solutions to those who have already been put at risk? Generali on their own certainly didn´t apply a high standard of risk solutions when they placed CWM victims´ funds into high-risk, toxic, professional-investor-only structured notes.

Independent News has written an article entitled –

Independent News has written an article entitled –

Who would have thought that the series of blogs, ….. company name … qualified and registered? would have caused such a stir? On one side I have anonymous readers attacking my words, on another I have grateful victims of pension scams thanking me for outing these companies. From a third direction, I have IFAs telling me they are

Who would have thought that the series of blogs, ….. company name … qualified and registered? would have caused such a stir? On one side I have anonymous readers attacking my words, on another I have grateful victims of pension scams thanking me for outing these companies. From a third direction, I have IFAs telling me they are

If I call a firm to discuss a problem and they enter into helpful and constructive dialogue over how to solve it, I don’t blog about it but keep the matter confidential. There are firms who quietly sort things out without making a fuss in a dignified and conscientious manner. In contrast, however, there are firms that just pull up the shutters – such as OMI and

If I call a firm to discuss a problem and they enter into helpful and constructive dialogue over how to solve it, I don’t blog about it but keep the matter confidential. There are firms who quietly sort things out without making a fuss in a dignified and conscientious manner. In contrast, however, there are firms that just pull up the shutters – such as OMI and  As I have pointed out, any self-respecting adviser with qualifications is happy to pay their membership fee, and is horrified that others who hold the same qualifications do not bother to do so. This, therefore, enables anyone to state “I do hold the qualification – I just don’t pay the membership fee”. If you have the qualification and are working as an adviser, why not pay the membership fee? Qualified advisers refusing to pay leaves the door wide open for the fraudsters posing as qualified advisers to get away with committing fraud TIME AND TIME AGAIN. This blatant lack of regard for the system – QUALIFICATIONS NEEDED AND REGULATIONS – that has been built up over many years, enables the bad and the ugly to roam free – with new pension scams being hatched daily.

As I have pointed out, any self-respecting adviser with qualifications is happy to pay their membership fee, and is horrified that others who hold the same qualifications do not bother to do so. This, therefore, enables anyone to state “I do hold the qualification – I just don’t pay the membership fee”. If you have the qualification and are working as an adviser, why not pay the membership fee? Qualified advisers refusing to pay leaves the door wide open for the fraudsters posing as qualified advisers to get away with committing fraud TIME AND TIME AGAIN. This blatant lack of regard for the system – QUALIFICATIONS NEEDED AND REGULATIONS – that has been built up over many years, enables the bad and the ugly to roam free – with new pension scams being hatched daily.

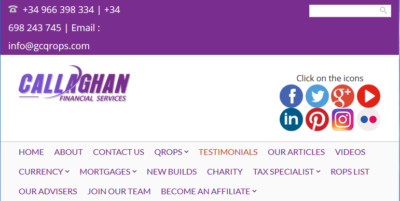

If you have been following Pension Life´s blogs, you will know that we have been conducting a series of investigations into

If you have been following Pension Life´s blogs, you will know that we have been conducting a series of investigations into

As shown in the image above there were lots of links to social media, so I chose to follow the Facebook one first. Here I was able to find an image of Graeme Callaghan of Callaghan QROPS Spain (and I also found out they were Callaghan QROPS Portugal too).

As shown in the image above there were lots of links to social media, so I chose to follow the Facebook one first. Here I was able to find an image of Graeme Callaghan of Callaghan QROPS Spain (and I also found out they were Callaghan QROPS Portugal too).

ONE THING THAT WORRIES US ABOUT THIS FIRM IS THAT THERE IS NO EVIDENCE WHATSOEVER OF THIS FIRM HAVING ANY INVESTMENT LICENSES – ONLY INSURANCE LICENSES.

ONE THING THAT WORRIES US ABOUT THIS FIRM IS THAT THERE IS NO EVIDENCE WHATSOEVER OF THIS FIRM HAVING ANY INVESTMENT LICENSES – ONLY INSURANCE LICENSES.