Who would have thought that the series of blogs, ….. company name … qualified and registered? would have caused such a stir? On one side I have anonymous readers attacking my words, on another I have grateful victims of pension scams thanking me for outing these companies. From a third direction, I have IFAs telling me they are qualified but don’t bother to pay their membership fees.

Who would have thought that the series of blogs, ….. company name … qualified and registered? would have caused such a stir? On one side I have anonymous readers attacking my words, on another I have grateful victims of pension scams thanking me for outing these companies. From a third direction, I have IFAs telling me they are qualified but don’t bother to pay their membership fees.

For those readers who follow Pension Life blogs, I would like to say that comments in response to my postings – whether they be positive or negative – are almost always approved – there is nothing to hide, despite what some of the trolls may suggest. Interestingly, the trolls that continue to post their nonsense, hide behind anonymous names and titles – either because they are cowards or because they are involved in pension scams themselves. However, comments which are clearly malicious and time-wasting, are popped into the spam bin. The trolls clearly hate the fact that we are educating the masses on how to avoid falling victim to a pension scam.

The Globaleye Dubai – qualified and registered? blog has had a lot of comments:

‘You do realise that these databases only carry the names of subscription paying members. I have 3 CII qualifications but do not pay their ‘admin’ fee so do not appear on the search. Therefore, your comments are irrelevant!’ Jo Kerr

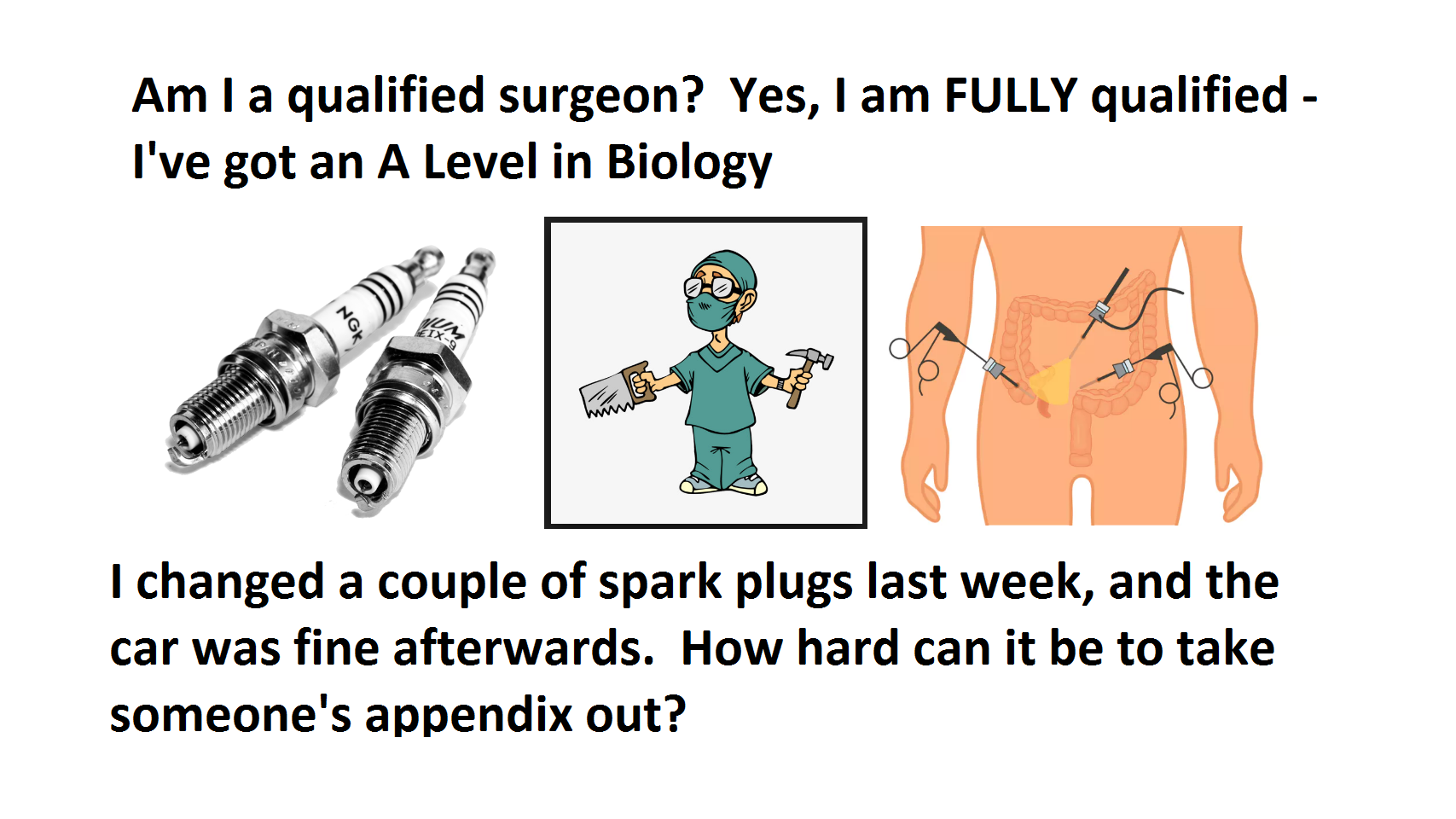

If my comments are irrelevant, why take the time to respond? What we are trying to highlight in this series of blogs is that offshore advisers are operating without the correct qualifications (or even with NONE AT ALL) to advise on pensions and investments. Without the correct qualifications, how can a client be sure that the adviser is working to their specific needs – as well as in an educated and trustworthy manner? If they do not belong to an association like the CII, what does govern them and ensure they are an honest and qualified adviser? The point of being qualified in a specific area is to enable the qualified person to provide a professional service to the client – (just as important as for doctors, lawyers, mechanics or plumbers).

If you are paying someone to do a job, you want them to be qualified to the highest standard. If they are not qualified appropriately, this is where ‘mistakes’ can happen. Whether it be by accident or on purpose (often because the defining factor is what earns the adviser the most commissions, rather than what is in the best interests of the client). Posing as a fully qualified IFA is simply wrong. Plus if you have the qualifications, then why not be proud of having them and pay the membership fee? Be transparent; let all clients and potential clients know that you have devoted yourself to studying for and achieving these qualifications.

Pension scams are no joke – they are not irrelevant to the victims whose lives have been left in tatters. Maybe “Jo Kerr” would like to field some of the calls I take – talk to victims who have lost their life savings by trusting unqualified, unregulated so-called advisers posing as fully qualified experts, placing hard-earned pension funds into toxic, high-risk investments, generally accompanied by high commissions. Maybe this callous joker could absorb some of the profound despair of the victims who are contemplating suicide. I guess you could simply say to them, ‘well I think it’s irrelevant’. But maybe you, like many other IFAs, just don’t care. It is irrelevant to you what happens to the funds of the victims, as long as the investments make you fat commissions.

Tell this victim of CWM’s ‘Blue chip notes’ pension scam – promoted by unregulated and unqualified IFAs that his loss is irrelevant:

The blogs we write at Pension Life are aimed at the public, the hard-working public who have saved much of their working life into a pension plan and want to put it somewhere safe. It is therefore their right to know which companies and advisers are fully qualified and regulated and which are not. The public need to be able to make educated and safe investment decisions. They need to know what questions to ask their IFA. They need to know what companies have been involved in past pension scams. They need to know as much as possible about how to invest their pension wisely.

With these blogs I hope to better educate the masses so that pension scammers and fraudsters can be stopped in their tracks – worldwide. The series of qualified and registered blogs has exposed many unqualified and unregistered advisers who work in the industry. I don’t quite get why so many of the comments are then so negative to this transparency – I wonder what those who make the negative comments have to hide? Are they the ones who are involved in the pension scams and realise that their misdemeanours are being publicised?

What I find most interesting, is that rather than question the companies as to the reason their IFAs lie about their qualifications, the readers placing the comments are more inclined to try to discredit me, my company and my staff.

Regular readers of my blogs may notice that sometimes my blogs quietly disappear with no public explanation. There is a reason for that too. The blogs often bring firms to the table and we get stuff done. Sometimes firms even preempt matters and make contact even before I get a chance to do a blog.

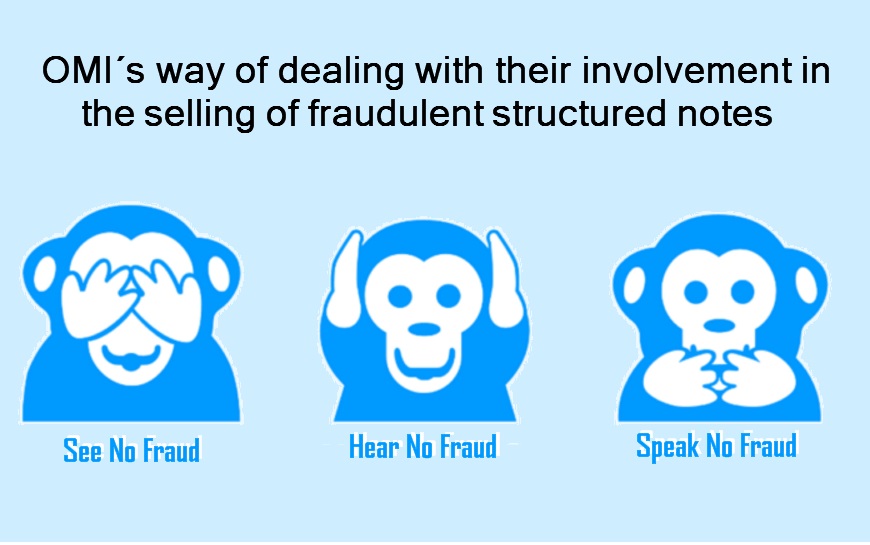

If I call a firm to discuss a problem and they enter into helpful and constructive dialogue over how to solve it, I don’t blog about it but keep the matter confidential. There are firms who quietly sort things out without making a fuss in a dignified and conscientious manner. In contrast, however, there are firms that just pull up the shutters – such as OMI and STM Fidecs. Hence why I keep blogging about them.

If I call a firm to discuss a problem and they enter into helpful and constructive dialogue over how to solve it, I don’t blog about it but keep the matter confidential. There are firms who quietly sort things out without making a fuss in a dignified and conscientious manner. In contrast, however, there are firms that just pull up the shutters – such as OMI and STM Fidecs. Hence why I keep blogging about them.

DeVere is indeed one of a number of firms I don’t currently blog about. So for the nice gentleman called Graham and another charming chap who calls himself “Innocent Bystander” who are accusing me of being partisan, don’t think just about what I do write, but about what I don’t write. There are good reasons for both.

I will continue to expose the actions, practices and vulgar conduct of firms who continue to ignore my questions; And I will tag all those who are stupid and irresponsible enough to keep on working for these firms and helping to fill these firms already bulging pockets. In contrast, however, Holborn Assets and Guardian Wealth Management have engaged in relation to complaints, and so I have removed all blogs which mention the firm.”

I would like to thank CII Member for their comment in response to Jo Kerr:

‘As a member of the CII, I am appalled by all of this.

‘It is a membership fee, not an “admin” fee, for a professional body. Qualified members, by being paid members, sign up to a code of conduct. Some are claiming to be members and some are using CII designations after their names without being members. This is expressly not allowed by the CII. I cannot comment about the CISI, though I am sure they will have similar rules.

The CII need to take firm action here to maintain the integrity of the Institute for those that are genuine, qualified members.

As I have pointed out, any self-respecting adviser with qualifications is happy to pay their membership fee, and is horrified that others who hold the same qualifications do not bother to do so. This, therefore, enables anyone to state “I do hold the qualification – I just don’t pay the membership fee”. If you have the qualification and are working as an adviser, why not pay the membership fee? Qualified advisers refusing to pay leaves the door wide open for the fraudsters posing as qualified advisers to get away with committing fraud TIME AND TIME AGAIN. This blatant lack of regard for the system – QUALIFICATIONS NEEDED AND REGULATIONS – that has been built up over many years, enables the bad and the ugly to roam free – with new pension scams being hatched daily.

As I have pointed out, any self-respecting adviser with qualifications is happy to pay their membership fee, and is horrified that others who hold the same qualifications do not bother to do so. This, therefore, enables anyone to state “I do hold the qualification – I just don’t pay the membership fee”. If you have the qualification and are working as an adviser, why not pay the membership fee? Qualified advisers refusing to pay leaves the door wide open for the fraudsters posing as qualified advisers to get away with committing fraud TIME AND TIME AGAIN. This blatant lack of regard for the system – QUALIFICATIONS NEEDED AND REGULATIONS – that has been built up over many years, enables the bad and the ugly to roam free – with new pension scams being hatched daily.

Also to add, as CII Member does, you need a level 4 if not 6 with the CII to be fully qualified to give UK pension advice. A level 3 does not qualify you to advise on pensions – as our previous blog outlines.

First, let me explain a little more about what an IPO is:

First, let me explain a little more about what an IPO is:

If I were a potential investor in

If I were a potential investor in

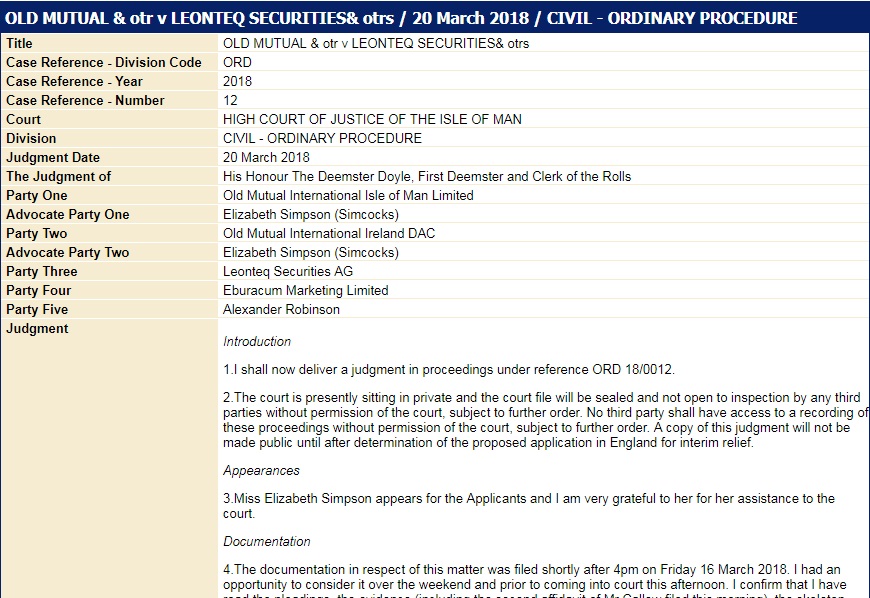

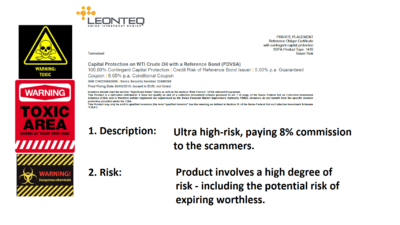

Leonteq Securities has gone from strength to strength since this fraud began – despite the disgrace of this criminal matter. Their net profit in the first half of 2018 was declared as £30.73 million, and turnover £104.31 million – up 36% on the previous year. My first question is: are they still selling ultra high-risk structured notes? My second question is: what was the difference between the “ordinary” notes which paid 6% commission to the scammers, and the fraudulent notes which paid 8% to the scammers. Were the latter 33% more risky? Looking at the victims’ statements, it is impossible to tell the difference between the 6% notes and the 8% ones. There is no obvious higher failure rate – they just all look equally dire.

Leonteq Securities has gone from strength to strength since this fraud began – despite the disgrace of this criminal matter. Their net profit in the first half of 2018 was declared as £30.73 million, and turnover £104.31 million – up 36% on the previous year. My first question is: are they still selling ultra high-risk structured notes? My second question is: what was the difference between the “ordinary” notes which paid 6% commission to the scammers, and the fraudulent notes which paid 8% to the scammers. Were the latter 33% more risky? Looking at the victims’ statements, it is impossible to tell the difference between the 6% notes and the 8% ones. There is no obvious higher failure rate – they just all look equally dire. Structured notes are “FOR PROFESSIONAL INVESTORS ONLY AND NOT FOR RETAIL DISTRIBUTION AND WARN OF DANGER OF LOSING PART OR ALL OF AN INVESTOR’S CAPITAL”.

Structured notes are “FOR PROFESSIONAL INVESTORS ONLY AND NOT FOR RETAIL DISTRIBUTION AND WARN OF DANGER OF LOSING PART OR ALL OF AN INVESTOR’S CAPITAL”.

David Vilka of

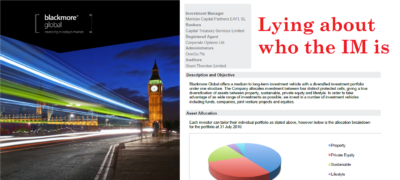

David Vilka of  Mr. Davies is referring to the UCIS investment scam, Blackmore Global, which was illegally promoted to retail investors – and which is a fraud from start to finish.

Mr. Davies is referring to the UCIS investment scam, Blackmore Global, which was illegally promoted to retail investors – and which is a fraud from start to finish. And again, significantly, he was not cold-called. He sought out Mr. Vilka and Square Mile. Nor did Mr. Vilka or Square Mile receive any payment from the Blackmore fund or its partner firms regarding Mr. Sexton’s transaction as confirmed by the Czech National Bank which has direct access to Square Mile’s company bank accounts via an electronic data box. Are you talking about the accounts which haven’t been updated since 2014?

And again, significantly, he was not cold-called. He sought out Mr. Vilka and Square Mile. Nor did Mr. Vilka or Square Mile receive any payment from the Blackmore fund or its partner firms regarding Mr. Sexton’s transaction as confirmed by the Czech National Bank which has direct access to Square Mile’s company bank accounts via an electronic data box. Are you talking about the accounts which haven’t been updated since 2014? LOWELL DAVIES LLP

LOWELL DAVIES LLP

At Pension Life we believe that all financial advisers should be appropriately qualified as well as registered with the institute from which they gained their qualifications. If they are a good, trustworthy FA then why would they object to these requirements? With so many rogues out there, and the figures of financial fraud totting up to millions, an honest FA should be proud for their name to appear on all the professional institutes’ registers to which they claim they are qualified.

At Pension Life we believe that all financial advisers should be appropriately qualified as well as registered with the institute from which they gained their qualifications. If they are a good, trustworthy FA then why would they object to these requirements? With so many rogues out there, and the figures of financial fraud totting up to millions, an honest FA should be proud for their name to appear on all the professional institutes’ registers to which they claim they are qualified.

If you have been following Pension Life´s blogs, you will know that we have been conducting a series of investigations into

If you have been following Pension Life´s blogs, you will know that we have been conducting a series of investigations into

As shown in the image above there were lots of links to social media, so I chose to follow the Facebook one first. Here I was able to find an image of Graeme Callaghan of Callaghan QROPS Spain (and I also found out they were Callaghan QROPS Portugal too).

As shown in the image above there were lots of links to social media, so I chose to follow the Facebook one first. Here I was able to find an image of Graeme Callaghan of Callaghan QROPS Spain (and I also found out they were Callaghan QROPS Portugal too).

If you have been following Pension Life´s blogs, you will know that we have been conducting a series of investigations into

If you have been following Pension Life´s blogs, you will know that we have been conducting a series of investigations into

And thus it always is: the perpetrators of financial scams fight back hard against their victims with fancy, overpaid lawyers (in fact, one pension scam victim calls them “bloodsuckers”). In my view, these lawyers are just as bad as their guilty clients. Any self-respecting lawyer ought to refuse to represent those who facilitate scams which ruin innocent victims. And any self-respecting judge should see through such obfuscation tactics in court.

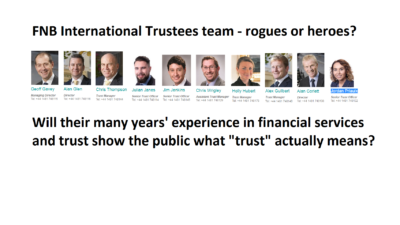

And thus it always is: the perpetrators of financial scams fight back hard against their victims with fancy, overpaid lawyers (in fact, one pension scam victim calls them “bloodsuckers”). In my view, these lawyers are just as bad as their guilty clients. Any self-respecting lawyer ought to refuse to represent those who facilitate scams which ruin innocent victims. And any self-respecting judge should see through such obfuscation tactics in court. Let us be clear: FNB is not any old dodgy trustee in a corrupt jurisdiction where the regulator, ombudsman and financial crime unit all play golf and quaff champagne with the perpetrators of financial crime. The firm holds itself out to be a responsible, professional and competent pension trustee. The so-called “key” people have, between them, many years of purported experience in financial services, trusts, banking and investments.

Let us be clear: FNB is not any old dodgy trustee in a corrupt jurisdiction where the regulator, ombudsman and financial crime unit all play golf and quaff champagne with the perpetrators of financial crime. The firm holds itself out to be a responsible, professional and competent pension trustee. The so-called “key” people have, between them, many years of purported experience in financial services, trusts, banking and investments.

Still, neither the regulators nor law enforcement agencies lifted a finger to stop the Moats: FAST PENSIONS – SLOW LAW ENFORCEMENT – STATIONARY REGULATORS, is the basis of this case.

Still, neither the regulators nor law enforcement agencies lifted a finger to stop the Moats: FAST PENSIONS – SLOW LAW ENFORCEMENT – STATIONARY REGULATORS, is the basis of this case. I’ve been very concerned about Dolphin Trust GmbH for some time. There’s an awful lot of pension money being loaned to this company – and I don’t get to hear of many (in fact any) people who have had their loans repaid. That doesn’t mean they haven’t been repaid – it just means I haven’t heard about it.

I’ve been very concerned about Dolphin Trust GmbH for some time. There’s an awful lot of pension money being loaned to this company – and I don’t get to hear of many (in fact any) people who have had their loans repaid. That doesn’t mean they haven’t been repaid – it just means I haven’t heard about it. Without the benefit of any assurances from the nice men at Dolphin Trust – Charles Smethurst, Helmut Freitag, Axel Krechberger and Matthias Ruhl – we will just have to hope that Mr Doran manages to offload the second-hand loan notes that STM Fidecs allowed 400+ victims’ life savings to be invested in. Perhaps I’ll drop him a friendly note and suggest he tries ebay.

Without the benefit of any assurances from the nice men at Dolphin Trust – Charles Smethurst, Helmut Freitag, Axel Krechberger and Matthias Ruhl – we will just have to hope that Mr Doran manages to offload the second-hand loan notes that STM Fidecs allowed 400+ victims’ life savings to be invested in. Perhaps I’ll drop him a friendly note and suggest he tries ebay.