As 2018 draws to a close, a recap is in order to review the year’s progress in the war against pension scammers. Let us not forget – in the immortal words of the Pensions Regulator’s Lesley Titcombe: “scammers are criminals“. However, the sad truth is that most of them have not been prosecuted or jailed.

As 2018 draws to a close, a recap is in order to review the year’s progress in the war against pension scammers. Let us not forget – in the immortal words of the Pensions Regulator’s Lesley Titcombe: “scammers are criminals“. However, the sad truth is that most of them have not been prosecuted or jailed.

The vast majority of the well-known pension scammers are still roaming free, busy thinking up yet more life-destroying schemes to make them rich and the victims poor. Whilst the scammers enjoy champagne this New Year’s Eve, many victims will be worrying themselves sick about their bleak financial future.

The Pensions Regulator, the Serious Fraud Office, the Insolvency Service, crime enforcement agencies and courts all seem to drag their feet when it comes to actually bringing charges against these criminals. Yet we see people being locked up for renting out caravans to help vulnerable homeless families! I would love it if this was a short and sweet blog, with many happy endings. But, alas, the scams are plentiful and the victims are left uncompensated for their losses.

Let’s have a quick round up of where we are with the scams and scammers. And remember: all the thousands of victims want to see the scammers sent to jail and the keys thrown away so they can’t ruin any more innocent people’s lives.

5G Futures

5G Futures: in May 2013 Garry John Williams and Susan Lynn Huxley were suspended as trustees of the 5G Futures pension scheme, and from trust schemes in general. Pi Consulting was appointed as the new trustee by the Pensions Regulator.

About 400 people had invested a total of £20m into the 5G Futures scheme – which was invested in high-risk, illiquid off-shore investments, with insufficient diversification making them completely unsuitable for pension scheme investments. There was no due diligence exercised by Williams and Huxley – and the scheme records were a mess.

The scheme operated pension liberation through ‘loans’ to members. Williams and Huxley were found to have taken very high commissions on the investments – taking nearly £900,00 in one year alone.

One of the most worrying things, however, is that the pension scammers don’t just leave the pensions industry and dedicate themselves to helping their many distressed victims – they start up all over again:

Garry Williams and Sue Huxley went on to run Corporate Futures.eu

Neither Garry Williams nor Sue Huxley has ever been convicted or jailed.

Neither Garry Williams nor Sue Huxley has ever been convicted or jailed.

Stephen Ward: (this will not be the last time you hear this name in this blog) was the mastermind behind this scam (dating back to 2010). It was his first known scam – but by no means his last one. What is left of the Ark fund, stands still frozen, in the hands of Dalriada Trustees, who continue to take their yearly costs and fees from what little is left. Dalriada has done nothing to ensure the scammers are prosecuted – saying it is “not within their remit”. The victims of the Ark scam also have the heavy hand of HMRC hanging over them. And let us not forget that it was HMRC who happily registered this scam and failed to withdraw the registration when they discovered that Stephen Ward was operating pension liberation fraud.

Dalriada has never reported Stephen Ward to the police as it is not “within their remit” to ensure the scammers are prosecuted.

In 2018 we saw Stephen Ward being banned from acting as a pension trustee. Eight years after his first scam, he has still not been imprisoned for the millions of pounds’ worth of life savings he has destroyed and the thousands of lives he has ruined.

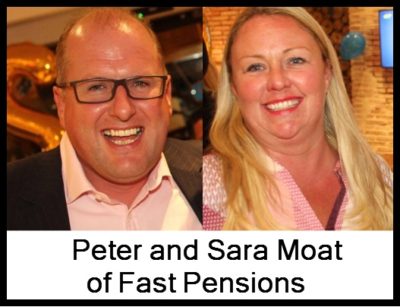

Other prominent figures in the Ark scam were Julian Hanson – who went on to play a key role in the Friendly Pensions scam; George Frost who went on to operate a new pension liberation scam using truffle trees as investments; Andrew Isles who went on to sell his accountancy business, Isles and Storer to LB Group; Peter Moat of Blu Debt Management who went on to operate the Fast Pensions scam. None of these scammers has ever been convicted or jailed.

Axiom

Another pension liberation scam, which saw victims with HMRC tax demands of 55%. Rex Ashcroft of Wealth Protection International was one of the main introducers of this scam. According to his Linkedin profile, he offers business development strategy planning for the UK, Spain, Portugal and France. He also offers “day-to-day application of wealth protection strategies”. Ashcroft lied to Axiom victims telling them they could access part of their pensions and not pay tax on the cash they took out.

Rex Ashcroft has never been convicted or jailed.

The Blackmore Global Fund saw UK-based victims conned into transferring their pension funds into QROPS in Malta and Hong Kong between 2014 and 2016. After the transfers, the funds were invested in the Blackmore Global UCIS fund (Unregulated Collective Investment Scheme) and the victims were locked in (unknowingly) for ten years. Huge commissions were taken by the introducers, Aspinal Chase and David Vilka of Square Mile International and the fund managers Phillip Nunn and Patrick McCreesh. Victims locked into ten-year fixed terms are still waiting for a copy of an independent audit – which was promised back in 2016! Despite media attention from the BBC, victims still do not know how much of their pension fund – if any – is left.

David Vilka, Phillip Nunn and Patrick McCreesh have never been convicted or jailed. Blackmore Global Group is still being promoted by Phillip Nunn! Nunn and McCreesh had been the main lead generators in the Capita Oak scam – earning nearly £1 million in the process.

This was another of Stephen Ward´s scams – on which he worked closely with his pensions lawyer Alan Fowler (ex Stevens and Bolton Solicitors) and his sidekick Bill Perkins. Ward carried out the transfer administration for this scam which was mainly operated by XXXX XXXX who offered victims 5% Thurlston “loans”. Over 300 victims are facing the partial or total loss of their pensions and are also now being pursued by HMRC for tax liabilities on the “loans”.

Capita Oak – like Ark – was placed in the hands of Dalriada Trustees. But Dalriada has never reported Stephen Ward – or any of the other scammers – to the police as it is not “within their remit” to ensure the scammers are prosecuted.

Stephen Ward, Alan Fowler, Bill Perkins and XXXX XXXX have never been convicted or jailed (although XXXX XXXX is under investigation by the Serious Fraud Office).

Stephen Ward’s firm Premier Pension Solutions (in Moraira, Spain) was the “sister” firm of Continental Wealth Management, run by scammer Darren Kirby. This was one of the biggest single scams – known as CWM – with around 1,000 victims losing part or all of their life savings. Other scammers involved were Anthony Downs, Dean Stogsdill, Alan Gorringe, Richard Peasley, and Neil Hathaway.

Stephen Ward’s firm Premier Pension Solutions (in Moraira, Spain) was the “sister” firm of Continental Wealth Management, run by scammer Darren Kirby. This was one of the biggest single scams – known as CWM – with around 1,000 victims losing part or all of their life savings. Other scammers involved were Anthony Downs, Dean Stogsdill, Alan Gorringe, Richard Peasley, and Neil Hathaway.

This scam was promoted by cold-calling victims and promising unrealistically high returns and “capital protection”. Darren Kirby and Anthony Downs used the victims’ funds to invest in totally unsuitable, high-risk, fixed-term structured notes. This scam saw huge commissions paid by the life offices – Old Mutual International, SEB, and Generali – as well as by the structured note providers: Leonteq, Commerzbank, Royal Bank of Canada, and BNP Paribas to this unregulated firm. Let us not forget that this was without question financial crime and was facilitated by the life offices.

Old Mutual International, run by ex IoM regulator Peter Kenny, was the leading life office which facilitated the CWM scam. Generali and SEB also routinely accepted business from these known scammers and unlicensed advisers.

Stephen Ward, Darren Kirby, Anthony Downs, Dean Stogsdill, Alan Gorringe, Richard Peasley, and Neil Hathaway have never been convicted or jailed.

Another Stephen Ward creation which was operating 80% liberation with the full cooperation of the SIPPS providers James Hay and Suffolk Life. The SIPPS providers and the victims could face tax charges of up to £20 million from HMRC.

Despite clear evidence that Stephen Ward pushed this scam in emails to Alan Fowler and Bill Perkins, neither Ward nor Fowler nor Perkins have ever been prosecuted or jailed.

EVERGREEN RETIREMENT TRUST NZ QROPS PENSION LOAN SCAM

When Ark got shut down, Stephen Ward went straight to New Zealand to set up his next pension liberation scam with Simon Swallow of Charter Square. A further 300 victims were scammed out of over £10 million and conned into Marazion “loans” AND locked into the Evergreen scheme for five years. After the five years victims were told: ´Despite our best efforts, Evergreen has not been as successful as we had originally hoped.´ Evergreen was wound up April 208.

This scam was promoted by Darren Kirby’s Continental Wealth Management which cold called the victims.

Stephen Ward, Darren Kirby, and Simon Swallow have never been convicted or jailed.

Fast Pensions, run by Peter and Sara Moat was wound up by the High Court 30th May 2018, after the six companies and 15 occupational schemes were put into liquidation in March 2018. £21m was transferred into the schemes under Peter Moat’s set of Blu loan companies. However, there was no information on the pension portfolios and what happened to the investors’ funds. Other persons named as being involved in this scam are Miss Jane Wright (who acted as a trustee) and a Mr Chapman. Maladministration was noted by the ombudsman back in 2016. However, nothing was done to stop the Moats.

Fast Pensions, run by Peter and Sara Moat was wound up by the High Court 30th May 2018, after the six companies and 15 occupational schemes were put into liquidation in March 2018. £21m was transferred into the schemes under Peter Moat’s set of Blu loan companies. However, there was no information on the pension portfolios and what happened to the investors’ funds. Other persons named as being involved in this scam are Miss Jane Wright (who acted as a trustee) and a Mr Chapman. Maladministration was noted by the ombudsman back in 2016. However, nothing was done to stop the Moats.

It was determined that there is no doubt this was a scam.

Peter and Sara Moat and their accomplices have never been convicted or jailed.

Friendly Pensions Limited (FPL)

Back in January of 2018, the Pensions Regulator asked the High Court to act on their behalf in the Friendly Pensions matter. Scammers: David Austin, Susan Dalton, Alan Barratt and Julian Hanson (also involved in ARK) were ordered to pay back £13.7 million they took from their victims and banned from being pension trustees. However, Dalriada the independent trustee appointed by TPR to take over the running of the schemes, is in charge of confiscating the scammers’ assets for the benefit of their victims. (Who knows how long this could take: how long is a piece of string?) As yet, no compensation has been offered to the victims.

David Austin, Susan Dalton, Alan Barratt and Julian Hanson and their accomplices have never been convicted or jailed. However, there have recently been some arrests – so let us hope this results in maximum sentences.

Two bogus “occupational pension schemes” set up for pension liberation fraud by Stephen Ward after the Evergreen QROPS scam hit the rocks (when HMRC removed Evergreen from the QROPS list). Victims have no idea where or how their pensions are invested. The pensions are allegedly invested in “The Treasury Plus Fund” (whatever that might be – and it is not likely to be anything good) and the trustee is Ward’s bogus trustee firm Dorrixo Alliance.

Nobody knows the total aggregate value of lost pensions and tax liabilities Ward has caused – we hazard a guess at a figure in the region of £100 million +.

Stephen Ward has never been convicted or jailed.

Henley Retirement Benefit Scheme

Another double act by Stephen Ward and XXXX XXXX. This was the “sister” scheme to Capita Oak. Ward did the transfer administration – from safe, well-known and regulated pension providers to this bogus occupational scheme run by XXXX.

Neither Stephen Ward nor XXXX XXXX has ever been convicted or jailed.

Another pension liberation scam – placed in the hands of Dalriada Trustees by the Pensions Regulator.

Incartus was placed in the hands of Dalriada Trustees by the Pensions Regulator. But Dalriada has never reported the scammers to the police as it is not “within their remit” to ensure the scammers are prosecuted.

None of the Incartus or Bluefin trustees scammers has ever been convicted or jailed.

£11.9 million worth of transfers were made, with the victims receiving approximately 50% of their pension as a loan and the promise of the rest being invested into a high-interest generating SIPPS. The loans were made from the pensions and therefore the victims have the usual HMRC tax demand letters. Further to the victims’ misery, the other 50% of the funds was not invested as promised. Most of the funds were swallowed by high commissions paid to the scammers.

None of the KJK Investments/G Loans scammers has ever been convicted or jailed.

Another of Stephen Ward’s many pension scams, this one was courtesy of his bogus pension trustee firm Dorrixo Alliance, his accomplice Gary Barlow at Gerard Associates, and introducers at Viva Costa International. Like Ward´s other scams, London Quantum scam was never set up for the benefit of the victims, but in the interests of Stephen Ward and his team of scammers to earn the maximum amount of commission out of the toxic, illiquid, high-risk investments.

Another of Stephen Ward’s many pension scams, this one was courtesy of his bogus pension trustee firm Dorrixo Alliance, his accomplice Gary Barlow at Gerard Associates, and introducers at Viva Costa International. Like Ward´s other scams, London Quantum scam was never set up for the benefit of the victims, but in the interests of Stephen Ward and his team of scammers to earn the maximum amount of commission out of the toxic, illiquid, high-risk investments.

The London Quantum scam is now in the hands of Dalriada Trustees.

London Quantum – like Ark, Capita Oak and Fast Pensions – was placed in the hands of Dalriada Trustees by the Pensions Regulator. But Dalriada has never reported Stephen Ward – or any of the other scammers – to the police as it is not “within their remit” to ensure the scammers are prosecuted.

Stephen Ward and Gary Barlow have never been convicted or jailed.

This pension liberation scam dating back to 2013 and 2014, involved around £1m of victims pension funds. Anthony Locke, was sentenced to a five-year jail term and Ray King, 54, who was employed by Lock, was given a three-year jail sentence.

It is great that these two crooks received jail terms, however, they are relatively “small fry” in comparison to the other serial scammers who are still walking free! The question remains: why have two minor players such as Locke and King been convicted and jailed while the “big fish” remain free to keep on scamming?

116 victims were scammed out of their pensions by James Lau of FCA-regulated Wightman Fletcher McCabe. Victims were assured the loans they were given did not come from their pension funds and would not be taxable by HMRC. The trustees of the scheme – Peter Bradley and Andrew Meeson (both ex HMRC) of Tudor Capital Management – were jailed for eight years for cheating the Public Revenue. James Lau is currently under criminal investigation by the Insolvency Service. The victims are awaiting a verdict on whether they will still have to pay the tax penalties.

116 victims were scammed out of their pensions by James Lau of FCA-regulated Wightman Fletcher McCabe. Victims were assured the loans they were given did not come from their pension funds and would not be taxable by HMRC. The trustees of the scheme – Peter Bradley and Andrew Meeson (both ex HMRC) of Tudor Capital Management – were jailed for eight years for cheating the Public Revenue. James Lau is currently under criminal investigation by the Insolvency Service. The victims are awaiting a verdict on whether they will still have to pay the tax penalties.

James Lau has not yet been convicted or jailed – although he is clearly a wanted man.

This fund, created by XXXX XXXX, loaned most of the £21m invested by hundreds of victims to Dolphin Trust. Dolphin Trust is a UCIS which was illegal to be sold to UK residents. The Trafalgar Multi-Asset fund was suspended back in September 2016 and victims are still waiting to find out if they will ever get their money back.

This scam was facilitated by STM Fidecs in Gibraltar – one of Europe’s biggest QROPS providers. The regulator did order Deloittes to carry out an inspection into STM Fidecs’ books, but no action was taken against STM Fidecs for their part in this scam.

STM Fidecs accepted transfers into the QROPS by UK-resident victims “advised” by XXXX XXXX – even though he was not licensed to give financial advice. And then XXXX’s clients were 100% invested in XXXX’s own fund.

XXXX XXXX has not yet been convicted or jailed – although he is clearly under investigation by the Serious Fraud Office.

Another of the schemes under investigation by the SFO. This liberation scam with more than £3 million worth of (now worthless) investments was registered and administered by Stephen Ward.

Windsor Pensions

A no-frills pension liberation scam run by Florida-based Steve Pimlott. This scam has been going on for years and there is no sign of any let up – despite the fact that the regulators and ombudsman are well aware of Pimlott’s modus operandi. Pimlott doesn’t bother with any attempt to conceal the loans with fancy “loans” or complex mechanisms to try to “distance” the liberation from the pension transfer. He uses QROPS and a fraudulently-set-up bank account in the Isle of Man (of course!). HMRC catches many of the victims and charges them 55% tax on the liberated amount. Pimlott charges around 15% for the liberation.

Steve Pimlott has not yet been convicted or jailed

What a sorry state of affairs that out of all the pension schemes I have mentioned here, only one of them has seen the scammers jailed. Serial scammers like Stephen Ward and XXXX XXXX seem to slip the noose of justice again and again.

Trustees have the power to block pension transfers if they suspect a scam – they must use it! Now the

Trustees have the power to block pension transfers if they suspect a scam – they must use it! Now the  Predators Stalk Your Pension

Predators Stalk Your Pension In 2015, we went to see the Pensions Regulator to talk about the failings of the Scorpion campaign – as well as the failings of the Regulator. Two Ark victims and I met the then

In 2015, we went to see the Pensions Regulator to talk about the failings of the Scorpion campaign – as well as the failings of the Regulator. Two Ark victims and I met the then