Pension Life is now submitting complaints to the Pensions Ombudsman against ceding pension trustees who handed over members’ pension funds to scams and scammers. These negligent transfers have ruined thousands of lives and cost victims hundreds of millions of pounds’ worth of losses. Some victims have already died and others are contemplating suicide. Complaints against negligent trustees will be published so their negligence will be clearly displayed in the public domain.

Pension Life is now submitting complaints to the Pensions Ombudsman against ceding pension trustees who handed over members’ pension funds to scams and scammers. These negligent transfers have ruined thousands of lives and cost victims hundreds of millions of pounds’ worth of losses. Some victims have already died and others are contemplating suicide. Complaints against negligent trustees will be published so their negligence will be clearly displayed in the public domain.

LAZY, NEGLIGENT, BOX-TICKING CEDING PENSION TRUSTEES

WHICH HAND OVER PENSION FUNDS TO THE SCAMMERS

BACKGROUND AND LANDSCAPE:

Pension scams have been around for many years. Understanding how they operate and evolve over the years, as well as the ever-shifting risks to victims, should be at the core of any pension trustee’s professional knowledge. Warning members who are potentially transferring into a scam should be any trustee’s first duty. Remember: every pension scam starts with a negligent transfer from a box-ticking trustee.

Trustees have been repeatedly warned of the fundamental obligation to watch out for scams for many years. Yet it matters not how many times they are warned and informed. They simply ignore the warnings, fail to carry out any CPD, and keep on negligently handing pension funds over to obvious scams and scammers.

Here is a list of some of the official warnings, regulations and legislation over the past quarter of a century:

1993 Pension Schemes Act

2000 Trustees Act

2002 OPRA (later tPR) warned about pension liberation

2003 FSA started to take enforcement action against pension unlocking

2004 Pension liberation is first identified within regulations

2006 FSA continues taking enforcement action against pension unlocking

2007 ‘Inducement Offers’ guidance published

2009 Code of Practice No. 7

2010 the Pension Regulator provided guidance to trustees

2012 further tPR guidance

2013 Scorpion

2014 tPR guidance updated

By 2010, the regulators were very fearful of a ‘box-ticking‘ culture by pension scheme administrators and warned trustees to be on their guard – advising them that:

“Any administrator who simply ticks a box and allows a transfer post July 2010 is failing in their duty as a trustee and as such are liable to compensate the beneficiary.”

In 2015, HMRC wrote to Pension Life: “members and pension providers at the time of transfers in January 2012 would have been aware of warnings/tax consequences prior to the transfer of pension funds to (a pension scam), as there were sufficient warnings and publicity available within the public domain from regulator websites, such as HMRC’s, the Pension Regulator’s and the Financial Conduct Authority’s – as well as a number of pension provider websites.’

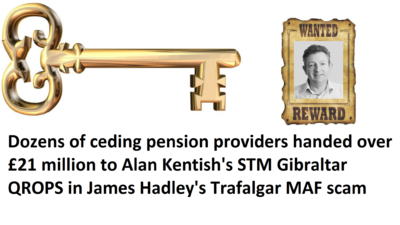

Pension scams have evolved since 2010 from straightforward liberation fraud, as in the case of the Ark schemes, to a mixture of liberation and investment fraud as in the case of the Capita Oak, Henley and Westminster scams (now under investigation by the Serious Fraud Office); to pure investment fraud, as in the later cases of London Quantum and the STM QROPS/Trafalgar Multi Asset Fund scam – also under investigation by the Serious Fraud Office.

The use of offshore sponsoring employers for UK-based occupational schemes, and QROPS in a variety of jurisdictions ranging from Guernsey, Gibraltar and Malta to New Zealand and Hong Kong, has clearly demonstrated that the reach of this type of financial crime is global. Consequently, it has for many years been clear that CPD by ceding providers is needed not just constantly but on an ever-widening geographical basis.

Tragically, the Pensions Ombudsman’s incorrect assumption that trustees had never been warned prior to the launch of tPR’s Scorpion campaign in 2013 has let many lazy, negligent, box-ticking trustees “off the hook”. Had decisive action been taken against these firms years earlier, many of the subsequent tragedies could have been avoided.

It is important to examine some concrete examples of the despicable behaviour of ceding pension trustees which has been fuelled by the Pensions Ombudsman’s refusal to acknowledge the clear warnings given a quarter of a century prior to 2013.

The below trustees transferred hundreds of members with millions of pounds’ worth of pensions into scams from Ark in 2010/11 and to investment scams in a Hong Kong QROPS in 2015:

Aegon

Armed Forces

Aviva

Clerical Medical

Equiniti

Friends Life

HSBC

Legal and General

Mercer

NHS

Phoenix Life

Prudential

Royal London

Royal Mail

Scottish Life

Scottish Widows

Standard Life

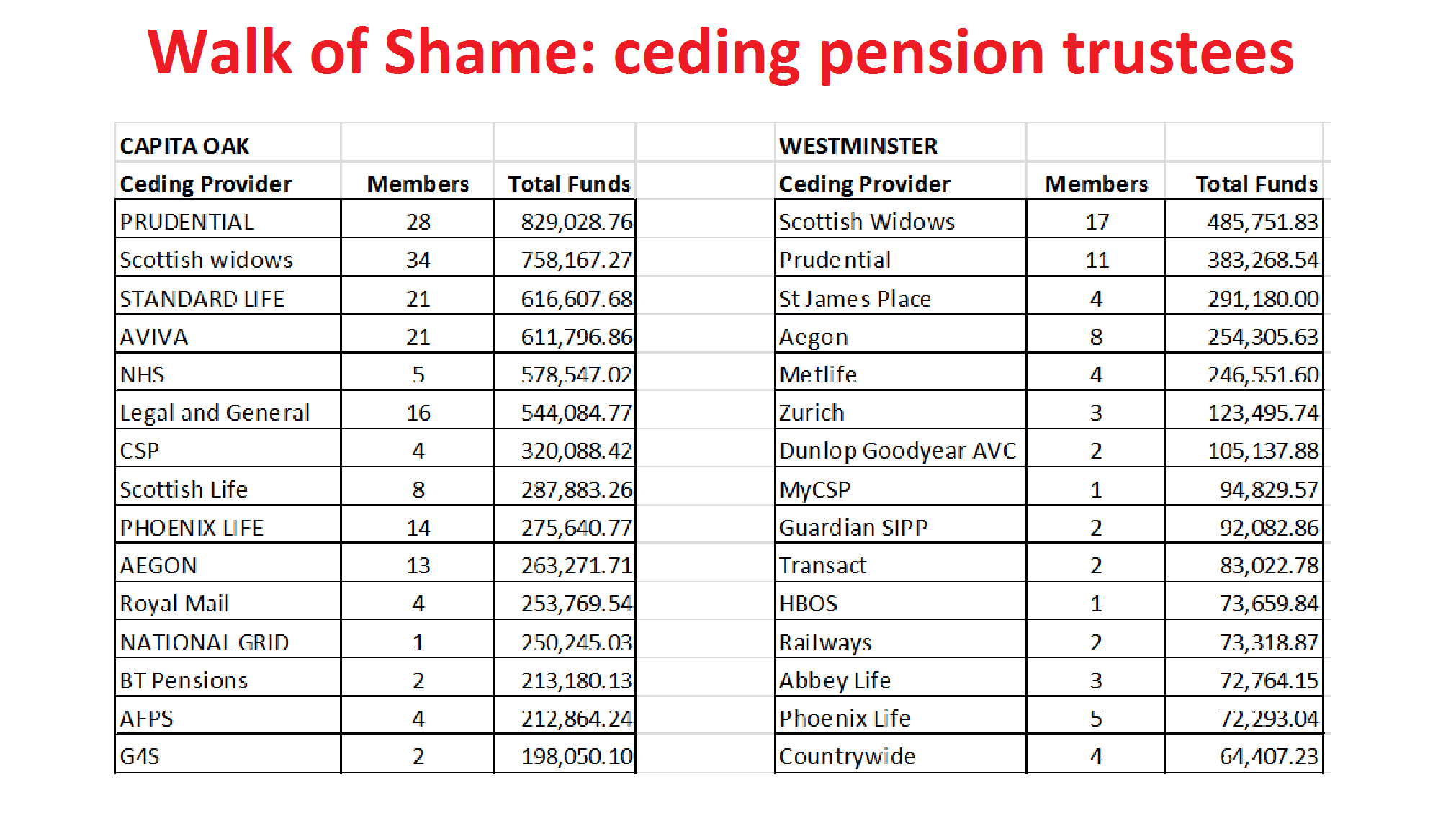

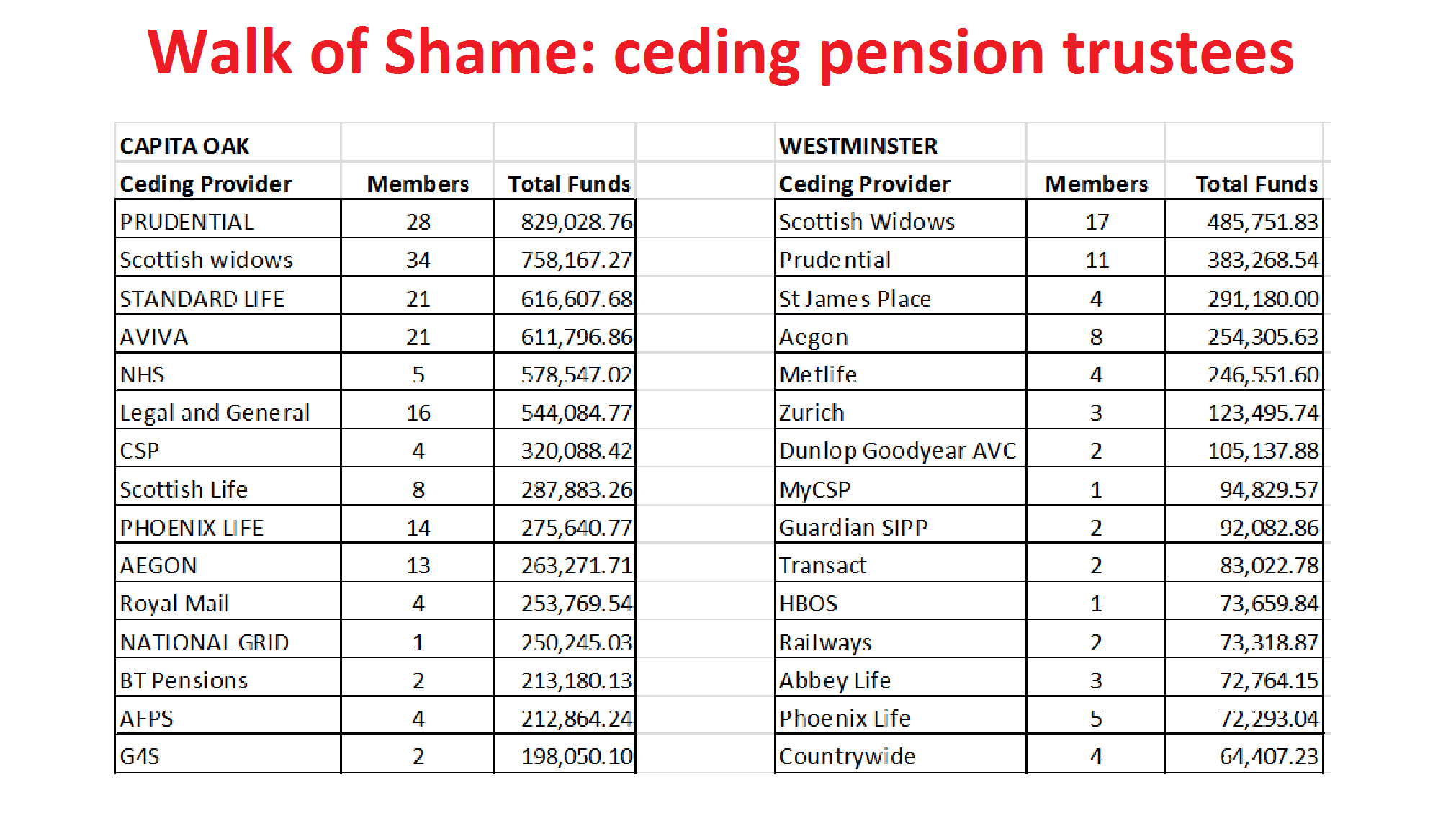

In the Capita Oak and Westminster scams – during 2012 and 2013 (both pre and post Scorpion) – the worst-performing ceding trustees were:

Capita Oak

Prudential

Scottish Widows

Standard Life

Aviva

NHS

Legal and General

Westminster

Scottish Life

Phoenix Life

Aegon

Royal Mail

National Grid

Overall, the worst performing personal pension trustee is Standard Life, and the worst performing occupational pension trustee is Royal Mail.

Overall, the worst performing personal pension trustee is Standard Life, and the worst performing occupational pension trustee is Royal Mail.

Perhaps the two worst examples of box-ticking negligence were Friends Life who transferred a victim into a Danish OPS called Danica which wasn’t even on the HMRC QROPS list at the time of the transfer and sent the funds to a fraudulently-set-up bank account in the Isle of Man; and Nationwide which made a transfer to the Salmon Enterprises occupational scheme even after knowing that the trustees had been arrested for fraud (and were later jailed).

CURRENT SCAM TRENDS IN 2019

It was evident from Stephen Ward’s London Quantum scam placed in the hands of Dalriada Trustees by the Pensions Regulator in 2015 that the trend had moved away from liberation and towards the much more lucrative and trouble-free scam of investment commissions. London Quantum invested victims’ pension funds in a variety of toxic, high-risk, illiquid, unregulated funds and loan notes paying very high commissions. This trend has continued with an assortment of funds, loans, structured notes and insurance bonds – all purely used for the commissions payable to the adviser/broker/introducer, and totally outside the investors’ risk parameters. The so-called advisers are mostly unregulated, unqualified opportunists posing as independent financial advisers or “wealth managers”. If these parties do have any form of regulation it is only for selling insurance rather than providing investment advice.

The current trend is very much geared towards getting pension savers away from the UK and into QROPS beyond the reach of the FCA or the Pensions Regulator, where the scammers have complete freedom to invest the funds into whatever is paying the highest commissions. It is not unusual to see 20% to 25% – plus 8% on insurance bonds used as bogus “platforms”.

OUTLINE COMPLAINT:

- This complaint is against the ceding trustee for transferring the pension fund to a new pension scheme without having conducted adequate checks in relation to the receiving scheme. The ceding trustee failed to provide sufficient warning as required by the Pensions Regulator. As a result of the trustee’s omissions, the entire pension fund may have been lost or misappropriated.

- The ceding trustee failed to conduct adequate checks and enquiries in relation to the new pension scheme; and either did not send a copy of the Pensions Regulator’s transfer fraud warning leaflet to the member, or may only have sent a copy to the scammer instead. If a copy was sent to the victim, there was no accompanying explanation that amplified the details of the warning signs beyond liberation. The ceding trustee also failed to engage directly with the victim regarding the concerns it should have had with the transfer request, had it properly assessed it.

- The ceding trustee’s various failures constitute – both individually and collectively – maladministration. But for this maladministration, the victim would not have proceeded with the transfer and suffered a loss.

- To put matters right, the ceding trustee is asked to reinstate the victim’s accrued benefits in the ceding scheme, or to provide equivalent benefits – adjusting for any revaluation that has arisen since the transfer. To avoid “double counting”, the ceding trustee will be entitled to recover from the victim the amount of his pension fund that the trustees of the new pension scheme are able to retrieve for him, if any.

- The ceding trustee is also asked to pay the victim an appropriate sum to reflect the materially significant distress and inconvenience suffered as a result of appropriate checks not having been made by it, and the recommended warning information not having been given directly to the victim.

MATERIAL FACTS

- The victim was a member of the ceding scheme.

- The victim was persuaded to make changes to his pension arrangements.

- In February 2013, the Pensions Regulator issued an action pack for pension professionals headed “Pension liberation fraud – The predators stalking pension transfers”. On page 12 this said that:

“Government enforcement agencies and advisory services have worked in conjunction to produce a short leaflet that you can use to help pension scheme members understand the risks and warning signs of pension liberation fraud. The member leaflet is available at www.pensionsadvisoryservice.org.uk and you may want to include a copy with any member correspondence that you issue.”

- Like the action pack, the leaflet that it mentioned (the scorpion warning) depicted distinctive scorpion imagery to illustrate the threat to people’s pensions.

- Under the heading, “Looking out for pension liberation fraud”, page 8 of the action pack said: “Here are some of the things to look out for:

- Receiving scheme not registered, or only newly registered, with HM Revenue & Customs

- Member is attempting to access their pension before age 55

- Member has pressured trustees/administrators to carry out transfer quickly

- Member was approached unsolicited

- Member informed that there is a legal loophole

- Receiving scheme was previously unknown to you, but now involved in more than one transfer request

If any of these statements apply, then you can use the checklist on the next page to find out more about the receiving scheme and how the member came to make the request.”

LEGAL LANDSCAPE

Quite apart from the February 2013 Scorpion warning, however, there were pre-existing laws and duties with which the trustee failed to comply.

The Trustees had a duty to comply with their common law and statutory duties of care to the beneficiaries of the scheme. The Trustees Act 2000 provides at section (1):

- Whenever the duty under this subsection applies to a trustee, he must exercise such care and skill as is reasonable in the circumstances, having regard in particular –

- To any special knowledge or experience that he has or holds himself out as having, and

- If he acts as trustee in the course of a business or profession, to any special knowledge or experience that it is reasonable to expect of a person acting in the course of that kind of business or profession.

(2) provides that the duty applies to those provisions set out in schedule 1 of the Act including ‘The duty of care applies to a trustee when exercising the general power of investment or any other power of investment, however conferred’.

Section (2) provides for the duty to arise when actioning transfer requests as this involves an exercise of the Trustees’ power over the beneficiaries’ investment.

Actioning a transfer request must, therefore, be conducted by the Trustees with such care and skill which the professional trustees should reasonably be expected to have.

It appears this victim submitted an application for a transfer and received a confirmation from the ceding trustee which was compliant with S.95(2)(b) Pension Schemes Act 1993 (PSA93).

S.99 of the PSA93 provides for some duties to the Trustees after the customer has exercised this option.

S.99(1)(b) states that: “…the trustees or managers of the scheme have done what is needed to carry out what the member requires… the trustees or managers shall be discharged from any obligation to provide benefits…”

The question to be considered is whether: ‘the Trustees did what was needed to carry out what the member required?’ One of the Trustees’ requirements was to make a decision as to whether they were able to make the transfer and to act with skill and care in making that decision.

PSA93 provides the victim with the ability to request a transfer. But no transfer is allowable if it is not an authorised transfer or is for the purposes of liberation. Any competent trustee would know that HMRC registration does not offer reassurance of compliance, approval or certification. It is simply a vehicle to register for tax purposes and not regulatory or common law compliance.

The above legal landscape creates an onerous duty on pension trustees and administrators to ensure that the beneficiaries of the pension scheme are not subject to charges, unauthorised payments, unauthorised transfers and other provisions as outlined above. This duty applies to both the transferring pension scheme and the pension scheme to which funds are being transferred.

REGULATIONS, REGULATORY WARNINGS AND POS DETERMINATIONS – PRE AND POST SCORPION

The Pensions Regulator produces guidance and codes of Practice to define the level of knowledge and care a trustee should have. This is not prescriptive, but provides indicative markers as to whether a duty has been breached or not.

The relevant guidance referred to is Code of Practice No. 7 “Trustee Knowledge and Understanding” (TKU). This code provides at paragraph 14 and 15:

“Para 14 “ …. Individual trustees must have appropriate knowledge and understanding of the law relating to pensions and trusts……”

Para 15 “ The degree of knowledge and understanding required is that appropriate for the purposes of enabling the individual properly to exercise the function in question.”

Para 19 “ A trustee must ensure that any individual who exercises a function in relation to the scheme as a director of a trustee company, or in any other capacity, has the appropriate level of knowledge and understanding of the same matters as if the person were an individual member of a trustee board.”

Para 23 “ the scope of knowledge and understanding that is required under the legislation is set out as a list of items in the scope guidance.”

The Scope guidance, in force at the time, was published in 2009 and the relevant scope includes:-

“1c Professional advice and decision-making including the need to obtain professional advice in reaching decisions in Risk management, decision making and delegation

2a Occupational pensions legislation

2c. Money laundering employment legislation, compensation arrangements

5b the importance of the member understanding investment risk (which includes transferring out of the fund)”

Code of Practice No 7 also provides at paragraph 47 that:

“…Trustees must have the appropriate knowledge and understanding. ‘Appropriateness’ includes the notion that trustees should keep their knowledge and understanding up to date so that it remains relevant.”

Paragraph 52 provides that External changes, which may prompt trustees to look again at their knowledge base, could include changes in relevant investment markets or in the law. Further topics may be suggested by the Pension Regulator website.

At the time of the transfer, there was sufficient information in the public realm of which a pension scheme properly discharging its duty would have been aware. In failing to take into account that information, the ceding trustee has caused a loss to the victim.

The Pension Ombudsman, in the decision PO-1837, carefully outlines at pages 7, 8, 9 and 10 a regulatory warning posted in February 2012. The Pension Regulator noted that it had published details of investigation in two cases which had resulted in the appointment of an independent trustee and included advice to pension scheme members about pension liberations schemes; including comments from HM Revenue and Customs and the FSA (FCA). At the same time the Pension Regulator published a fact sheet “Pension Liberation Fraud” giving information for scheme members and the FSA published its own material directed to consumers.

A year later in February 2013 the Pensions Regulator published “Pension Liberation Fraud. An Action Pack for Pension Professionals” in conjunction with a number of bodies including HMRC and the FSA, directed to trustees, administrators and providers. The Pensions Regulator’s guidance was updated in July 2014 but was substantially the same as that provided in February 2013.

It is clear in the case of PO-1837 what level of care is required. In that case Zurich took steps to ensure that they were able to perform the transfer that Mrs Kenyon wished to take place. Zurich had to hand a press release from the Pensions Regulator and provided that to Mrs Kenyon on 28 November 2012. Zurich refused to make the transfer as they could not be sure that the transfer request was a recognised transfer under Section 169 of FA04, but would continue to investigate.

In this case, the reality is that the victim did not have a statutory right to make the transfer requested, and was unaware of that as he or she had been misled by the advisers who were not regulated for pension transfer services, pensions in general or investments.

In the case of PO-1837, the Pension Ombudsman determined that the only directly relevant regulatory and general legal obligation would have been for Zurich to act with integrity, honestly and fairly in the best interest of Mrs Kenyon and consistently with the duty and care they owed to her. The Pension Ombudsman determined that Zurich should have made enquiries as to whether Mrs Kenyon had a right – but notwithstanding the fact that they did not comply with that duty they were right not to make the transfer. It is determined at paragraph 101 of that determination that if a transfer may be for pension liberation purposes (perhaps because the receiving scheme and/or those connected have a history) it may be good reason for delaying the transfer and asking relevant questions during the statutory period allowed for the transfer. Those enquiries may lead to the transfer being withdrawn.

The case of PO-3809, involving Mrs Sharon Jerrard, the Ombudsman came to a very similar determination as the decision of PO-3105 for Mr Gregory Stobie.

More recently of note is a case of Mr Andrew Johnston, PO-5869, in which at paragraph 22 it states that The Pension Regulator did not issue guidance to providers about pension liberation and the danger of pensions scams until February 2013. This is clearly incorrect as previous determinations pointed out and the facts are that the first regulatory warning was considered by the Pension Ombudsman in those cases to be in July 2010 (see below) and then again in February 2012 and not February 2013.

It is not accepted in these submissions that it was only in February 2012 or February 2013 that a properly administered pension scheme should have been alerted to an act of pension liberation and the type of enquiry that was needed in order to delay a transfer.

The legislation dates back to 1993. Pension liberation is first identified within regulations of 2004. Pension administrators therefore were alerted to their statutory obligations of enquiry as to:

- Whether a transfer is authorised; and

- Whether the intention to transfer is to liberate a pension.

Considering the statutory framework at this time alone, regardless of any other information in the public realm, the trustee failed to make any enquires or determination and simply rubber stamped the transfer request.

On Tuesday 13 July 2010 the Pension Regulator provided guidance to trustees as follows:

“A strengthened position on transfer incentives has been outlined in guidance published for consultation today by the Pensions Regulator.

It clarifies the role of the employer and trustee and aims to ensure that trustees become actively involved in managing the risks of such exercises. The guidance is accompanied by a new e-learning module and a joint statement with the FSA, all available on the regulator’s website.

The regulator’s position is in accordance with that of the FSA and the guidance replaces the ‘Inducement Offers’ guidance published in 2007. It highlights that trustees should start from the presumption that such exercises and transfers are not in members’ interests and should therefore approach any exercise cautiously and actively.

Trustees play an important role in ensuring that scheme members are in the best possible position to make the right decision in relation to their benefits. In order for transfer exercises to be conducted in an open, fair and transparent way, the regulator expects:

- members to be provided with clear information that is not misleading;

- members to be provided with impartial and independent advice to ensure they make the right decisions;

- trustees to engage in the offer process and apply a high level of scrutiny to all incentive exercises to ensure members’ interests are protected;

- employers to ensure that any offers made are consistent with the principles in the guidance; and

- no pressure of any sort to be placed on members to make a decision to accept the offer.”

The regulator’s chair David Norgrove said:

“As our guidance emphasises, any transfer exercise should be conducted with the highest regard to members’ interests. Trustees should start from the presumption that such exercises are not in members’ interests and should be approached with caution.

Since we published our initial guidance in 2007, we have seen behaviour that concerns us. There has been a box-ticking approach that has led to exercises being run without due consideration to scheme members.

As a result we will be looking closely at exercises and working with other regulatory bodies to ensure that standards are improved. We expect trustees to play an active role in ensuring that members are able to make informed decisions.”

Mr Norgrove added:

“The Pensions Ombudsman will take this guidance into account to determine whether any complaint is upheld. He can then direct trustees or employers to compensate members accordingly.”

The above clearly demonstrates a fear by the regulators of a ‘box-ticking‘ culture by pension scheme administrators and warns trustees to be on their guard.

Any administrator who simply ticks a box and allows a transfer post July 2010 is failing in their duty as a trustee and as such are liable to compensate the beneficiary.

Other information within the public realm preceding February 2013 – the date of the launch of the Pension Regulator’s Scorpion Campaign warning pension trustees and the public against the dangers of pension fraud:

It is our submission that there was sufficient information in the public domain upon which a pension scheme administrator or trustee properly discharging their duty should have been aware of. We list those below.

- On 25th February 2010 an article was published in Professional Adviser magazine and also found at www.professionaladviser.com. This describes a case of Mr Kent who made a transfer of £55,354 from two approved pension schemes to the Home Limited Pension Plan. HMRC alleged that the payment to Mr Kent was an unauthorised scheme payment as the law stood in 2001 to 2002 and the payment was treated as income. In order for the Home Plan to be a proper occupation scheme it was accepted that Mr Kent would need to be an employee of Home Limited and the transfer was therefore unauthorised. The case law considered in this case went back to Ready Mixed Concrete (South East) Limited v Minister of Pensions and National Insurance [1968] 2 QB 497 to determine the definition of employment.

- This was by no means a unique case. HMRC were routinely seeking tax payments from people who had made pension transfers. An administrator of a pension scheme would properly be abreast of the issue of unauthorised transfers from occupation schemes to occupation scheme. An obvious enquiry would be to request evidence of the transferee that they are employed by the company operating the occupation pension scheme.

- The predecessor of The Pension Regulator, The Occupation Pension Regulatory Authority (OPRA) warned about the practices of pension liberation as long ago as 2002. Between 2003 and 2006 the FSA took enforcement action against a number of IFAs in relation to unsuitable pension unlocking advice. July 2010 a guidance news release from the Pension Regulator to trustees with regards to how requests to transfers should be considered.

- On 11 December 2007 an article was published on www.sackers.com. This describes the case of Mr Dunne who appealed against an amendment on his self-assessment tax return which resulted in an increase to his tax liability following a transfer of his benefits from one pension scheme to another.

- The Pensions Regulator’s “Alert in the economic downturn” (April 2009 Statement) warned of dishonesty and fraud being a real risk, including targeting members to access their pension assets through trust busting or other pension liberation activities.

- HMRC wrote to Pension Life on the 2 June 2015 in respect of tax appeals. They stated “members and pension providers at the time of transfers in January 2012 would have been aware of warnings/tax consequences prior to the transfer of pension funds to (a pension scam), as there were sufficient warnings and publicity available within the public domain from regulator websites, such as HMRC’s, the Pension Regulator’s and the Financial Conduct Authority’s – as well as a number of pension provider websites.’

The current position as set out in the case of Mr Johnston PO-5869, is clearly unsustainable. The duties of a trustee are onerous. They have a high level duty of care to the beneficiaries of their scheme. In this case, the ceding trustee/administrator failed in discharging that duty and is liable for the loss sustained.

If the Trustees had kept properly abreast of the issues and met the standard of care and knowledge expected by the Regulator of a Trustee, they should have as a minimum made a simple enquiry of the victim. A simple enquiry by the Trustees to the victim in any form would have elicited a reasonable suspicion but no such enquiry was made.

It is not acceptable for an administrator, properly following the functions of a scheme, to simply rubber stamp a transfer allowing it to take place. At the forefront of any administrator’s mind should be whether a transfer is authorised or not authorised. Having breached their duty, the trustees have caused a substantial loss to the victim. That loss is the transfer value minus any available assets that the new trustees are able to recover.

Redress for the loss should also cover tax penalties associated with the transfer as the scheme administrators should know this and the victim would not. Such loss is commensurate with legal principles that the loss was foreseeable and caused by the failure in duty of the Trustees to discharge its obligations in a proper manner. Further evidence can be provided of the loss suffered to the victim through the distress caused by potentially losing the whole pension. We therefore ask that you uphold this complaint and put matters right as laid out in points 4 and 5 on page one.

The mis-selling of life assurance policies and long-term savings plans has been a regular topic in our blogs. Many victims of pension scams see their funds mis-invested into life assurance policies. These life assurance policies do little more than drain the fund value with their expensive fees and costs.

The mis-selling of life assurance policies and long-term savings plans has been a regular topic in our blogs. Many victims of pension scams see their funds mis-invested into life assurance policies. These life assurance policies do little more than drain the fund value with their expensive fees and costs.

Please note these figures are correct as at 2017/2018, so today’s value is now even lower. Despite the funds’ huge decrease in value, Generali continues to take their fees (based on the original amount deposited – not the current depleted value). Therefore, these amounts will continue to fall AND despite the massive loses be locked in for a fixed term.

Please note these figures are correct as at 2017/2018, so today’s value is now even lower. Despite the funds’ huge decrease in value, Generali continues to take their fees (based on the original amount deposited – not the current depleted value). Therefore, these amounts will continue to fall AND despite the massive loses be locked in for a fixed term. Generali are not the only life office guilty of financial crimes: Old Mutual International and SEB were even worse – facilitating losses on a massive scale in the Continental Wealth Management case. OMI bought £94,000,000 worth of ultra-high-risk structured notes for retail investors – resulting in huge losses. Old Mutual was also heavily involved in more than £1,000,000,000 worth of losses in the Axiom, LM and Premier investment scams.

Generali are not the only life office guilty of financial crimes: Old Mutual International and SEB were even worse – facilitating losses on a massive scale in the Continental Wealth Management case. OMI bought £94,000,000 worth of ultra-high-risk structured notes for retail investors – resulting in huge losses. Old Mutual was also heavily involved in more than £1,000,000,000 worth of losses in the Axiom, LM and Premier investment scams.

Pension Life is now submitting complaints to the Pensions Ombudsman against ceding pension trustees who handed over members’ pension funds to scams and scammers. These negligent transfers have ruined thousands of lives and cost victims hundreds of millions of pounds’ worth of losses. Some victims have already died and others are contemplating suicide. Complaints against negligent trustees will be published so their negligence will be clearly displayed in the public domain.

Pension Life is now submitting complaints to the Pensions Ombudsman against ceding pension trustees who handed over members’ pension funds to scams and scammers. These negligent transfers have ruined thousands of lives and cost victims hundreds of millions of pounds’ worth of losses. Some victims have already died and others are contemplating suicide. Complaints against negligent trustees will be published so their negligence will be clearly displayed in the public domain.

Overall, the worst performing personal pension trustee is Standard Life, and the worst performing occupational pension trustee is Royal Mail.

Overall, the worst performing personal pension trustee is Standard Life, and the worst performing occupational pension trustee is Royal Mail.

Another worrying thing about Blackmore Global is that they use Surge Financial to promote their toxic wares – and has paid this firm £5.1 million in one year for “marketing services”. Surge Financial is run by Paul Careless, and was promoting the failed

Another worrying thing about Blackmore Global is that they use Surge Financial to promote their toxic wares – and has paid this firm £5.1 million in one year for “marketing services”. Surge Financial is run by Paul Careless, and was promoting the failed

Much as a master illusionist takes your breath away with his magic, a

Much as a master illusionist takes your breath away with his magic, a

When we buy certain products, they have a warning on them. Cigarette packets, for instance, state that smoking is bad for your health. The wrappers show hideous images of what might happen to you if you use tobacco.

When we buy certain products, they have a warning on them. Cigarette packets, for instance, state that smoking is bad for your health. The wrappers show hideous images of what might happen to you if you use tobacco. What worries us most is the lack of regulatory concern or control in respect of expensive and risky investment products. You can’t buy cigarettes without a stern health warning. The same goes for alcohol: bottles and cans clearly state how many units are in the container, and how many units men and women can safely drink per day. They also state that alcohol should not be consumed by pregnant women.

What worries us most is the lack of regulatory concern or control in respect of expensive and risky investment products. You can’t buy cigarettes without a stern health warning. The same goes for alcohol: bottles and cans clearly state how many units are in the container, and how many units men and women can safely drink per day. They also state that alcohol should not be consumed by pregnant women. You can’t buy a gun without going to a registered shop and having a licence. (Although, I guess on the black market you can). If you buy a gun on the black market, it is going to be ‘hot’. The person you buy it from is going to be dodgy and it certainly won’t come with the correct paperwork.

You can’t buy a gun without going to a registered shop and having a licence. (Although, I guess on the black market you can). If you buy a gun on the black market, it is going to be ‘hot’. The person you buy it from is going to be dodgy and it certainly won’t come with the correct paperwork.

“Information on scams is not readily available at an organisational level”.

“Information on scams is not readily available at an organisational level”. “The Scams Code is seen as a good basis for due diligence”

“The Scams Code is seen as a good basis for due diligence” “Significant time and effort goes into protecting members from scams”

“Significant time and effort goes into protecting members from scams” “The more detailed the due diligence, the more suspicious traits are identified”

“The more detailed the due diligence, the more suspicious traits are identified” SIPPS (including international SIPPS) are the vehicle of choice by scammers

SIPPS (including international SIPPS) are the vehicle of choice by scammers “Quality of adviser tops the list of practitioner concerns, with member awareness a close second”

“Quality of adviser tops the list of practitioner concerns, with member awareness a close second” “Sharing of intelligence would help avoid duplication of effort”

“Sharing of intelligence would help avoid duplication of effort”

Every year we are seeing an increase in the number of victims falling for pension and investment scams. Despite warnings in the public domain and a huge array of information about how to avoid falling victim to a scam, it seems the scammers are so skilled at their sales techniques, that even the cleverest of people can fall for their slick pitches. Often the scammers use cold-calling techniques to initiate these pitches: using emails, texts, mail shots and the good ol’ phone.

Every year we are seeing an increase in the number of victims falling for pension and investment scams. Despite warnings in the public domain and a huge array of information about how to avoid falling victim to a scam, it seems the scammers are so skilled at their sales techniques, that even the cleverest of people can fall for their slick pitches. Often the scammers use cold-calling techniques to initiate these pitches: using emails, texts, mail shots and the good ol’ phone. Listen to the show here:

Listen to the show here: Ironically, Standard Life has been one of the worst performers in terms of ceding pension providers who have recklessly and negligently handed over millions of pounds’ worth of pensions to the scammers. Completely ignoring the Pensions Regulator’s warnings in 2010, they shoveled £millions across to pension scams such as Ark, Capita Oak, Westminster, Continental Wealth Management, Global Fiduciary Services and many other QROPS scams.

Ironically, Standard Life has been one of the worst performers in terms of ceding pension providers who have recklessly and negligently handed over millions of pounds’ worth of pensions to the scammers. Completely ignoring the Pensions Regulator’s warnings in 2010, they shoveled £millions across to pension scams such as Ark, Capita Oak, Westminster, Continental Wealth Management, Global Fiduciary Services and many other QROPS scams. It seems the only way to escape the scammers – anywhere in the world – is not to fall for their lies. But the challenge is to know what is true and what is false. And that isn’t easy – the scammers are very clever and can adapt quickly to invalidate public warnings and even use them to their advantage. In addition to the scammers, there are now

It seems the only way to escape the scammers – anywhere in the world – is not to fall for their lies. But the challenge is to know what is true and what is false. And that isn’t easy – the scammers are very clever and can adapt quickly to invalidate public warnings and even use them to their advantage. In addition to the scammers, there are now

Another victim of Berkeley Burke SIPPS investments into Store First storage pods has come forward. 55-year-old factory worker Robert McCarthy, of Ebbw Vale, said he has lost more than £30,000 through a Self-Invested Personal Pension (SIPP). He was duped into the transfer and investment by unregulated firm Jackson Francis which was liquidated in 2014. His investment may or may not be worthless – depending on whether Store First is wound up later in 2019.

Another victim of Berkeley Burke SIPPS investments into Store First storage pods has come forward. 55-year-old factory worker Robert McCarthy, of Ebbw Vale, said he has lost more than £30,000 through a Self-Invested Personal Pension (SIPP). He was duped into the transfer and investment by unregulated firm Jackson Francis which was liquidated in 2014. His investment may or may not be worthless – depending on whether Store First is wound up later in 2019.

Victims were also invested into the Store First storage pods via

Victims were also invested into the Store First storage pods via  Stephen Ward

Stephen Ward

Attention financial advisers in Spain/who provide financial advice to Spanish residents.

Attention financial advisers in Spain/who provide financial advice to Spanish residents.

The Spanish Insurance Regulator – the DGS (Dirección General de Seguros y Fondos de Pensiones) – has made a most welcome judgment. This outlaws the mis-selling of bogus life assurance policies as investment “platforms” – aka “life bonds”.

The Spanish Insurance Regulator – the DGS (Dirección General de Seguros y Fondos de Pensiones) – has made a most welcome judgment. This outlaws the mis-selling of bogus life assurance policies as investment “platforms” – aka “life bonds”.

So popular is the use of life bonds among the seedier sector of the financial services industry, that multi-national firm

So popular is the use of life bonds among the seedier sector of the financial services industry, that multi-national firm

Blacklist – “The Pension Scam (No 69)”

Blacklist – “The Pension Scam (No 69)” than one scam at a time (being male, he can’t multi-task).

than one scam at a time (being male, he can’t multi-task). Kentish is eager to know how much money can be made out of this plot. XXXX explains that 46% was earned out of his Capita Oak and Henley scams and that he hopes to make at least as much out of this one. With Kentish’s “help” (nudge nudge, wink wink). Of course, the proceeds could be split and plenty of brown envelopes used to disguise the handing over of the proceeds.

Kentish is eager to know how much money can be made out of this plot. XXXX explains that 46% was earned out of his Capita Oak and Henley scams and that he hopes to make at least as much out of this one. With Kentish’s “help” (nudge nudge, wink wink). Of course, the proceeds could be split and plenty of brown envelopes used to disguise the handing over of the proceeds. Now that the Trafalgar Multi-Asset Fund has been suspended – thanks to the hero of the hour: Reinert – Kentish decides to buy Caffrey’s QROPS firm, Harbour (which is full of Phillip Nunn’s Blackmore Global investment scam). Caffrey swans off into the sunset with £1 million burning a hole in his pocket, quietly humming “Oh Danny Boy”.

Now that the Trafalgar Multi-Asset Fund has been suspended – thanks to the hero of the hour: Reinert – Kentish decides to buy Caffrey’s QROPS firm, Harbour (which is full of Phillip Nunn’s Blackmore Global investment scam). Caffrey swans off into the sunset with £1 million burning a hole in his pocket, quietly humming “Oh Danny Boy”. Sadly, of course, it was real life. As more than 400 victims will attest. So no more script-writing for me. I will stick to blogs in the future.

Sadly, of course, it was real life. As more than 400 victims will attest. So no more script-writing for me. I will stick to blogs in the future. The sophistication of investment scams has reached new levels in Singapore

The sophistication of investment scams has reached new levels in Singapore This is a story about how scammers have used the loopholes within the law to fleece hundreds of millions of dollars

This is a story about how scammers have used the loopholes within the law to fleece hundreds of millions of dollars