BREXIT is the question on everybody’s lips at the moment. BREXIT: will we? won´t we? deal? no deal? So many unanswered questions and so much scaremongering. We would like to offer some helpful words and hopefully protect you from making rash decisions. This could help you to safeguard your pension. Many scammers are trying to cash in on Brexit – make sure sure you’re not their next victim.

Remember I am not a financial adviser. I am a blogger, and I write about financial crime. I provide information about past scams and on how to avoid falling victim to new scams – especially pension scams. The words I write are aimed to help you safeguard your pension from the many offshore scammers.

So, Expats, what does Brexit mean for your pension rights? The short answer is that we really do not know! There are currently lots of “coulds” and “mights” being thrown around, but no certainties. And herein lies the risk that you and your pension could fall victim to a scam with all this scaremongering.

We are seeing a lot of adverts for expats to transfer into a QROPS before the dreaded 11pm on March 29, 2019. One company I have noticed that seems to be using Brexit to attract customers is Spectrum IFA. Back on 1st July 2018, we wrote a qualified and registered blog about Spectrum IFA. They didn´t do too well.

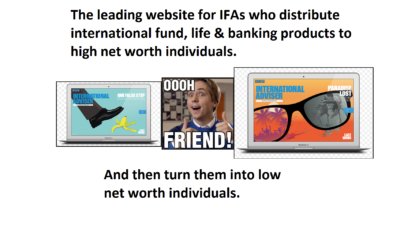

Firstly, despite Spectrum IFA advertising themselves as “international financial advisers”, with some digging we were able to find out that they DO NOT in fact have an investment licence. This means they are not legally allowed to advise on pensions or investments. Secondly, they scored rather poorly on the qualified and registered percentage too. Out of the 16 advisers we checked up on, only four were registered with the appropriate institutes. The rest came up red – meaning the institute had no record of them.

Worrying isn´t it? Offshore companies can try to claim they are international financial advisers, but actually be unregulated and unqualified to carry out the very service they offer! The “advisory” firms have flash websites, and some have several offices around Europe and beyond. Their PR is great at scaremongering expats about their pension investments in the lead up to Brexit.

Worrying isn´t it? Offshore companies can try to claim they are international financial advisers, but actually be unregulated and unqualified to carry out the very service they offer! The “advisory” firms have flash websites, and some have several offices around Europe and beyond. Their PR is great at scaremongering expats about their pension investments in the lead up to Brexit.

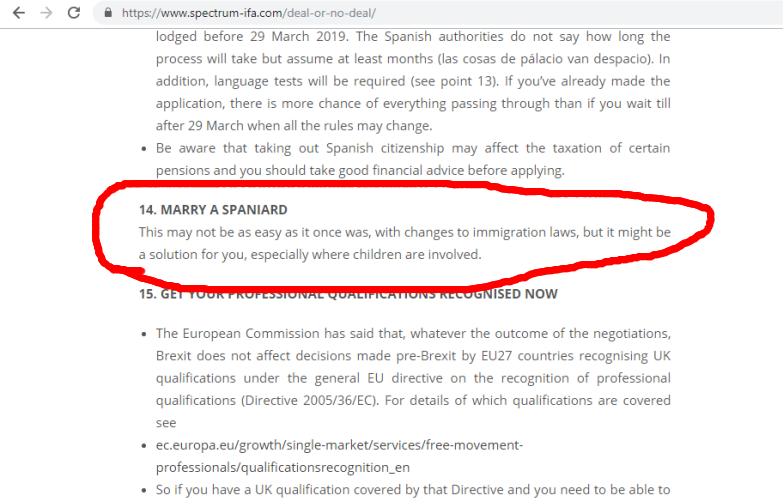

In Spectrum’s ´Deal or no deal´ article number 14, they suggest you marry a Spaniard in order to prepare for Brexit. I´m not sure about you, but I feel that getting hitched to a native to be able to stay in Spain is a pretty drastic measure and definitely more than a little illegal.

Spectrum IFA is just one example of a firm that probably ought to be given a wide berth when transferring your precious pension fund offshore. Safeguard your pension by avoiding unregulated and unqualified firms like this one.

********

It may seem daunting when you read that your UK pension could be subjected to extra taxes if we leave the EU on a no-deal basis. You may be thinking that you should transfer into a QROPS quickly, to save on these taxes. But what you really need to know is that a QROPS is not without punitive costs of its own. They can be expensive and unless you have a good lump sum to transfer you could see a huge chunk of your pension pot taken in transfer and set-up fees anyway! Potentially making you worse off.

Unfortunately, until we make a deal or actually go through with Brexit, nothing is very clear for expats. Which leaves us in an uncertain time and situation. This, I understand, may be daunting for many people, but I urge you to take a deep breath before considering any speedy offshore pension transfers. Thousands of people – especially those who have already fallen victim to scammers such as Continental Wealth Management – would give you exactly the same urgent advice.

If you do want to transfer your pension, please heed this advice to safeguard your pension:

Make sure you choose a reputable firm – one that is regulated, insured and employs fully qualified (and registered) advisers.

We did a series of blogs last year on offshore companies and their advisers. The results were extremely worrying. Aside from their blatant disregard for the necessity of these qualifications – due to being offshore – the number of unqualified advisers offshore was cause for serious concern. Many of the firms had not one single qualified and registered adviser on their team.

Qualified & registered? We do not need to be – we are offshore!

Know all the correct questions to ask an adviser before you sign on the dotted line.

Know all the correct questions to ask an adviser before you sign on the dotted line.

A reputable firm will have a fact-find procedure, and adhere to a client’s risk profile.

A reputable firm will have compliance procedure.

A reputable firm will have clear and consistent explanations and justifications for the use of insurance bonds.

Where will your funds be invested, and how will you know if this is in line with your risk profile?

A pension fund should be placed into a low-medium risk investment.

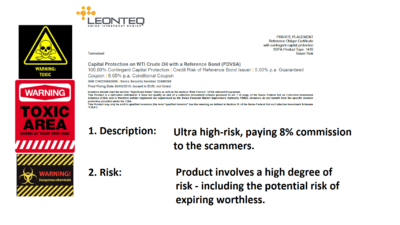

Scammers tend to go for high-risk, professional-investor-only investments as they offer them the best commissions. But a pension fund should have more protection than this. Avoid investments that involve structured notes (like CWM´s Blue Chip notes), UCIS funds (like Blackmore Global), in-house funds, non-standard assets and any ongoing commission-paying investments.

Insurance bonds – often used by scammers – are usually an unnecessary double wrapper on your fund, that costs you more in fees and charges than a straightforward platform, lining the pockets of the scammers – but making your fund smaller.

How much will the fees and charges be? Remember NO pension transfer is free.

How much will the fees and charges be? Remember NO pension transfer is free.

Legitimate firms will normally have a small transfer charge and a small annual fee.

Scammers will often be vague about fees and charges, and avoid giving you a straight answer so they can cover up the true figures. These hidden figures can see your pension fund decrease by 25% or even more in some cases.

A reputable firm should offer you regular updates on the progress of your fund.

You should receive an annual review and a quarterly update showing the fees, charges and growth of your fund.

If your new firm and adviser fail to do this, alarm bells should ring loudly.

Finally, a reputable company will publish evidence to show records of complaints made, rejected or upheld and redress paid.

If the adviser cannot show you all this information, do not trust them.

If it all sounds to good to be true, it probably is – RUN!

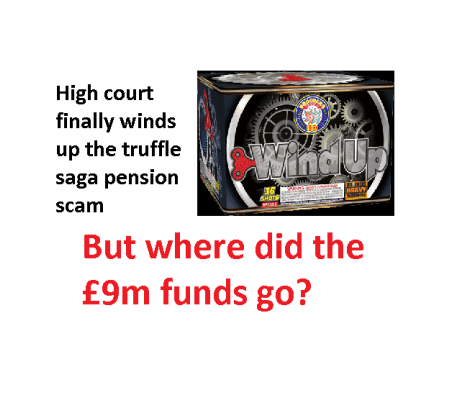

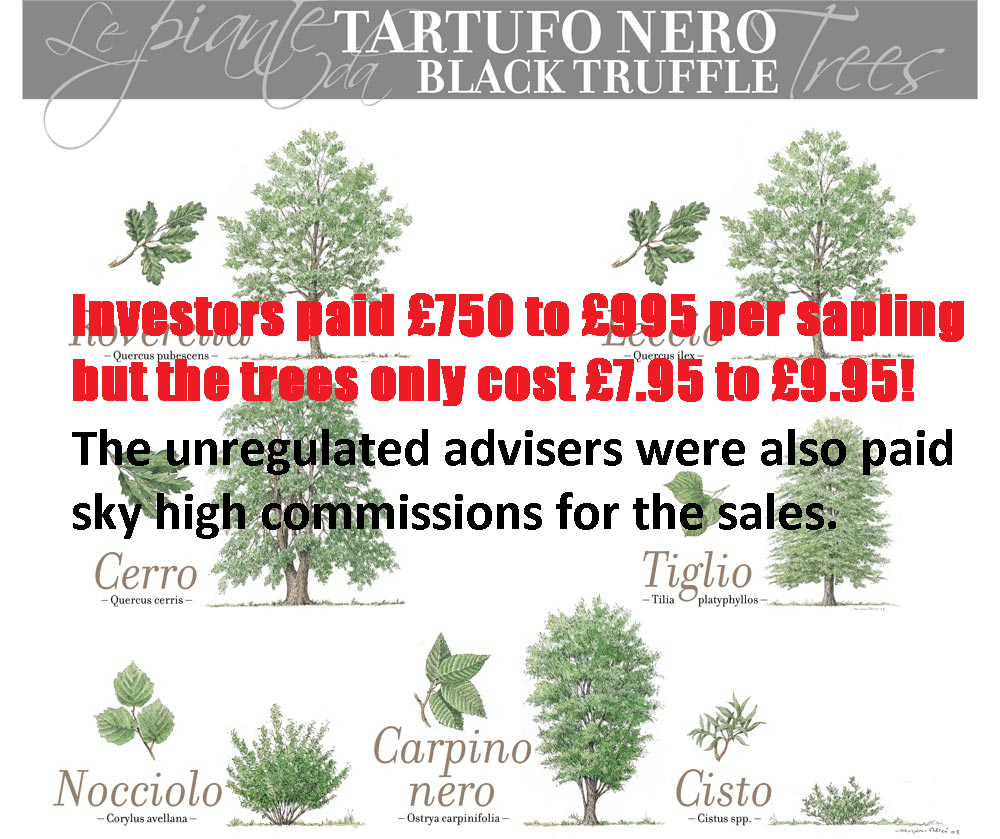

This could possibly be described as wonderful news for the victims of Viceroy Jones New Tech Ltd, Viceroy Jones Overseas PCC Limited, Westcountrytruffles Limited, Truffle Sales Ltd and Credit Free Limited. Or maybe not. The whereabouts of the funds is unknown. This pension liberation and investment scam saw 100 investors conned out of £9m of their pension savings.

This could possibly be described as wonderful news for the victims of Viceroy Jones New Tech Ltd, Viceroy Jones Overseas PCC Limited, Westcountrytruffles Limited, Truffle Sales Ltd and Credit Free Limited. Or maybe not. The whereabouts of the funds is unknown. This pension liberation and investment scam saw 100 investors conned out of £9m of their pension savings.

However, I feel I have to disagree.

However, I feel I have to disagree. Winding up these companies is often of little help to the scam victims. What is left of their funds (if any) is passed on to another trustee (often Dalriada) to deal with the ‘clean up’. This action, however, is not without cost and often the funds just sit there doing nothing.

Winding up these companies is often of little help to the scam victims. What is left of their funds (if any) is passed on to another trustee (often Dalriada) to deal with the ‘clean up’. This action, however, is not without cost and often the funds just sit there doing nothing.

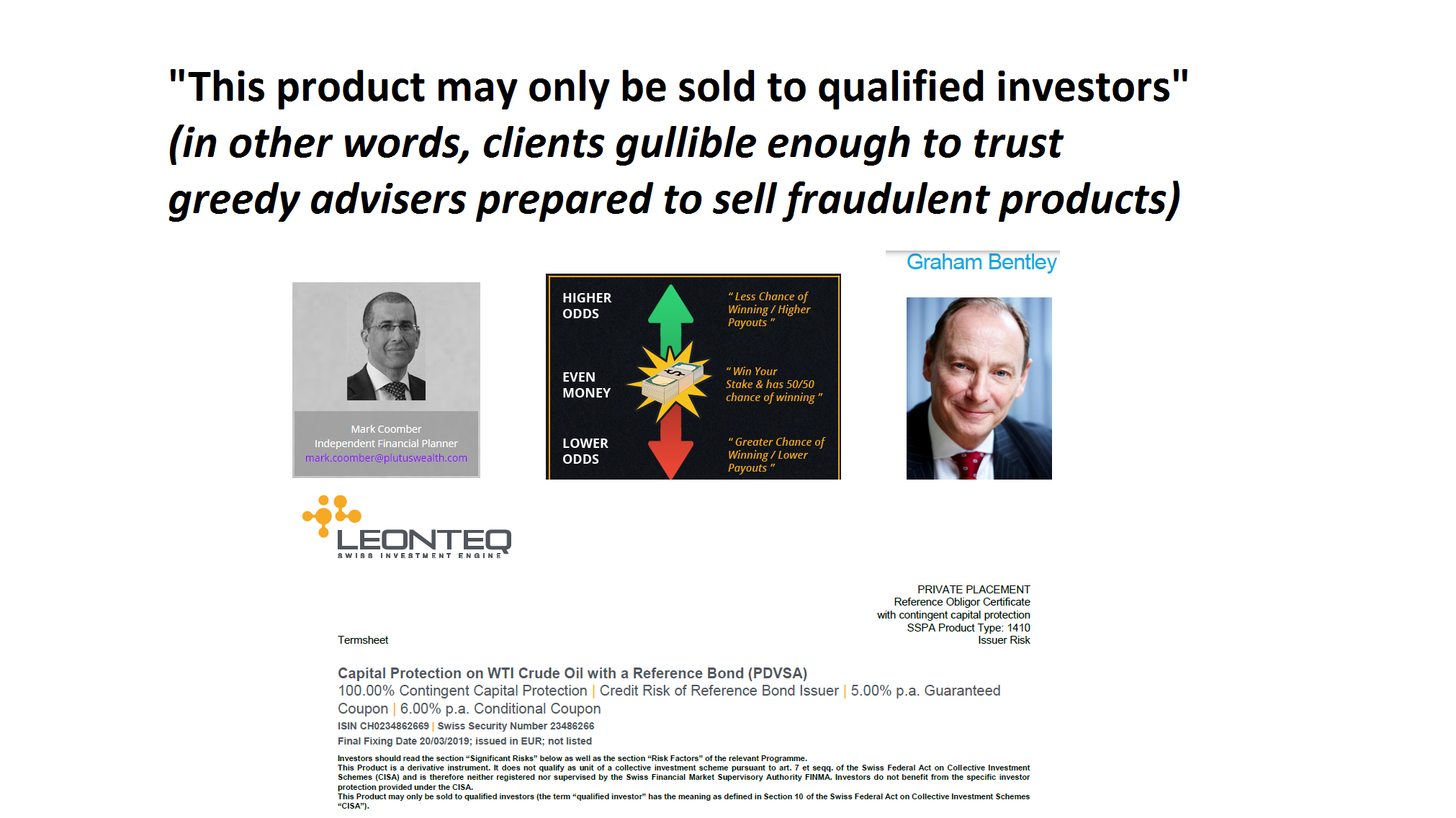

Nitwit or Dragonfly? Gambling or Investing? Are investment losses as a result of a bad adviser or a bad investment? Or both? The real question is: how does the consumer tell the difference? A favourite episode of Fawlty Towers involved Basil’s ill-fated bet on a racehorse called Dragonfly. Confusion sets in – fuelled by the easily-confused Manuel – and “Dragonfly” gets muddled up with “Nitwit”. And that is how clients get confused just as easily: by advisers who spout the usual rubbish: capital protected; guaranteed returns; blue-chip investments; solid providers etc. They just leave out the three most important things: the fat commissions paid to the adviser; the high-risk nature of the “investment” and the fact that

Nitwit or Dragonfly? Gambling or Investing? Are investment losses as a result of a bad adviser or a bad investment? Or both? The real question is: how does the consumer tell the difference? A favourite episode of Fawlty Towers involved Basil’s ill-fated bet on a racehorse called Dragonfly. Confusion sets in – fuelled by the easily-confused Manuel – and “Dragonfly” gets muddled up with “Nitwit”. And that is how clients get confused just as easily: by advisers who spout the usual rubbish: capital protected; guaranteed returns; blue-chip investments; solid providers etc. They just leave out the three most important things: the fat commissions paid to the adviser; the high-risk nature of the “investment” and the fact that  And this guy is chartered! As a member of the CISI he should know better than to spout such rubbish – and I feel deeply sorry for any clients of Plutus Wealth Management as they are clearly in danger of being sold these toxic products. In fact, I would go further and suggest the public should be warned about the dangers of using this firm, as Coomber clearly has every intention of flogging his victims these high-risk products. If he is stupid enough to use them for his own gambling fun, good luck to him. But he has no right to inflict them on retail clients.

And this guy is chartered! As a member of the CISI he should know better than to spout such rubbish – and I feel deeply sorry for any clients of Plutus Wealth Management as they are clearly in danger of being sold these toxic products. In fact, I would go further and suggest the public should be warned about the dangers of using this firm, as Coomber clearly has every intention of flogging his victims these high-risk products. If he is stupid enough to use them for his own gambling fun, good luck to him. But he has no right to inflict them on retail clients. The term sheet did, to be fair, give a clear warning:

The term sheet did, to be fair, give a clear warning:

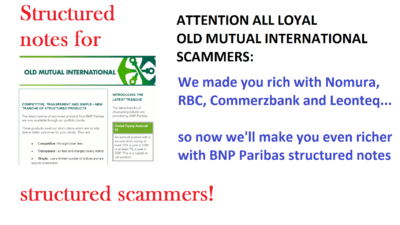

ROLL UP! ROLL UP! ME HEARTY SCAMMERS! OMI’S LATEST

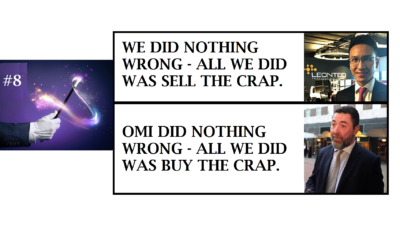

ROLL UP! ROLL UP! ME HEARTY SCAMMERS! OMI’S LATEST  So, what are you waiting for? You’ll earn 8% by selling your victims a useless OMI “PORTFOLIO” bond (don’t mention this is illegal in Spain) and then a further 8% from selling this toxic, high-risk BNP Paribas structured note (rubbish inappropriate structured product) which will tie your victims in for

So, what are you waiting for? You’ll earn 8% by selling your victims a useless OMI “PORTFOLIO” bond (don’t mention this is illegal in Spain) and then a further 8% from selling this toxic, high-risk BNP Paribas structured note (rubbish inappropriate structured product) which will tie your victims in for

Governments in the UK and all expat jurisdictions must wake up to scams – both offshore and at home. They must empower/galvanise law-enforcement agencies and give them the resources to tackle financial crime.

Governments in the UK and all expat jurisdictions must wake up to scams – both offshore and at home. They must empower/galvanise law-enforcement agencies and give them the resources to tackle financial crime. Regulators must put together effective regulations – and then ENFORCE them. Regulations on their own are worthless and pointless – the industry must be policed and failure to comply with regulations must be severely sanctioned.

Regulators must put together effective regulations – and then ENFORCE them. Regulations on their own are worthless and pointless – the industry must be policed and failure to comply with regulations must be severely sanctioned.

.

. Advisers must be appropriately qualified. If they don’t have the right qualifications, they must demonstrate that they are studying and aiming to qualify within a reasonable, pre-determined time frame.

Advisers must be appropriately qualified. If they don’t have the right qualifications, they must demonstrate that they are studying and aiming to qualify within a reasonable, pre-determined time frame.

QROPS providers must also ensure they have understood and verified the members’ risk profiles – and then ensure that any investments made on behalf of those members are in line with their risk profile.

QROPS providers must also ensure they have understood and verified the members’ risk profiles – and then ensure that any investments made on behalf of those members are in line with their risk profile. Life offices must stop accepting business from known scammers and unregulated firms – and cease investing victims’ life savings in unsuitable assets – such as structured notes and UCIS funds.

Life offices must stop accepting business from known scammers and unregulated firms – and cease investing victims’ life savings in unsuitable assets – such as structured notes and UCIS funds.

Leonteq Securities has gone from strength to strength since this fraud began – despite the disgrace of this criminal matter. Their net profit in the first half of 2018 was declared as £30.73 million, and turnover £104.31 million – up 36% on the previous year. My first question is: are they still selling ultra high-risk structured notes? My second question is: what was the difference between the “ordinary” notes which paid 6% commission to the scammers, and the fraudulent notes which paid 8% to the scammers. Were the latter 33% more risky? Looking at the victims’ statements, it is impossible to tell the difference between the 6% notes and the 8% ones. There is no obvious higher failure rate – they just all look equally dire.

Leonteq Securities has gone from strength to strength since this fraud began – despite the disgrace of this criminal matter. Their net profit in the first half of 2018 was declared as £30.73 million, and turnover £104.31 million – up 36% on the previous year. My first question is: are they still selling ultra high-risk structured notes? My second question is: what was the difference between the “ordinary” notes which paid 6% commission to the scammers, and the fraudulent notes which paid 8% to the scammers. Were the latter 33% more risky? Looking at the victims’ statements, it is impossible to tell the difference between the 6% notes and the 8% ones. There is no obvious higher failure rate – they just all look equally dire. Structured notes are “FOR PROFESSIONAL INVESTORS ONLY AND NOT FOR RETAIL DISTRIBUTION AND WARN OF DANGER OF LOSING PART OR ALL OF AN INVESTOR’S CAPITAL”.

Structured notes are “FOR PROFESSIONAL INVESTORS ONLY AND NOT FOR RETAIL DISTRIBUTION AND WARN OF DANGER OF LOSING PART OR ALL OF AN INVESTOR’S CAPITAL”.

International Investment has written a jolly good article about the recent action taken by the UAE Insurance Authority – headed up by His Excellency Ibrahim Al Zaabi. I quote from

International Investment has written a jolly good article about the recent action taken by the UAE Insurance Authority – headed up by His Excellency Ibrahim Al Zaabi. I quote from  The Gibraltar FSC

The Gibraltar FSC Looking at International Adviser’s 2017 awards, I really think the judges were having a

Looking at International Adviser’s 2017 awards, I really think the judges were having a  I HAVE DECIDED TO INVITE MY FRIENDS AT INTERNATIONAL ADVISER TO LAUNCH A NEW AWARDS CEREMONY:

I HAVE DECIDED TO INVITE MY FRIENDS AT INTERNATIONAL ADVISER TO LAUNCH A NEW AWARDS CEREMONY:

Mark Coomber, Chartered MCSI Independent Financial Planner at Plutus Wealth Management