Katar Investments say they give UK and overseas investment advice in a simple way. However, the types of investment opportunities they are offering are, unfortunately, once again, making my red beacon flash. So, with Déjà vu, let me tell you why. Please make sure you are comfy, this might take a while!

Firstly, I had a quick look into their team. In my opinion, you would hope that some of the people advertising about giving you advice on investments would hold some sort of financial qualification. However, out of the five team members listed only one mentions a background in finance, the others only list sales experience.

I had a quick check on the registers to see if the one team member who states she has 10 years´ experience in the financial sector, holds any qualifications with the CII, CISI etc. – she did not appear to have any registered financial qualifications.

Now, forgive me if I am slightly biased and ever so critical when it comes to firms giving investment advice, but I would hope that any firm giving me advice on what to invest in, would have a team of fully qualified financial advisers. Not just sales experts. Or am I just being fussy?

Katar Investments state:

“Whether you are looking for a steady income investment, a property investment with high capital growth and a quick turn around of your capital or an opportunity in the latest emerging market, we have something to offer you.

We are highly committed to our investors and are focussed (their spelling mistake – not mine) on delivering a level of customer service which is above and beyond. So rest assured our agents will strive to provide you a class A service when you Invest with Katar Investments.”

I feel that the salespeople who work for Katar Investments may well be driven solely by earning high commissions when it comes to offering class A services. But, again, maybe I am biased! Let’s move on to what investments they offer.

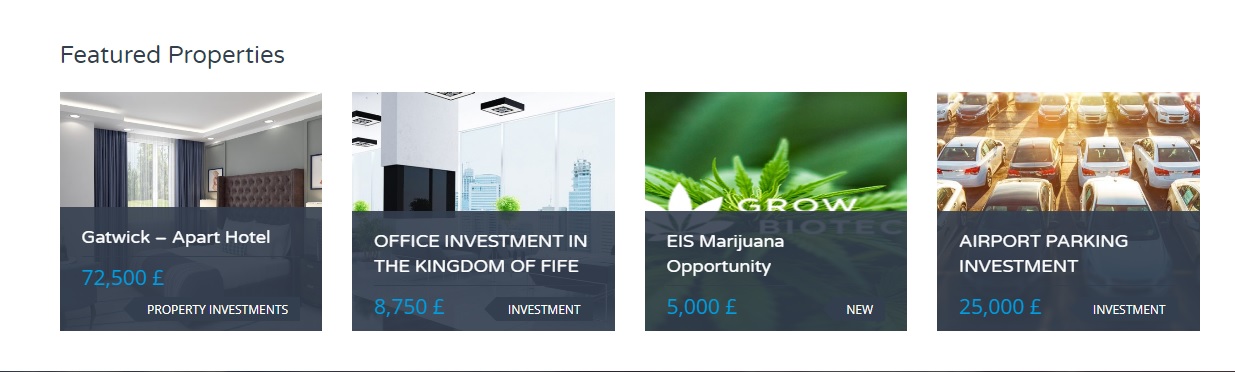

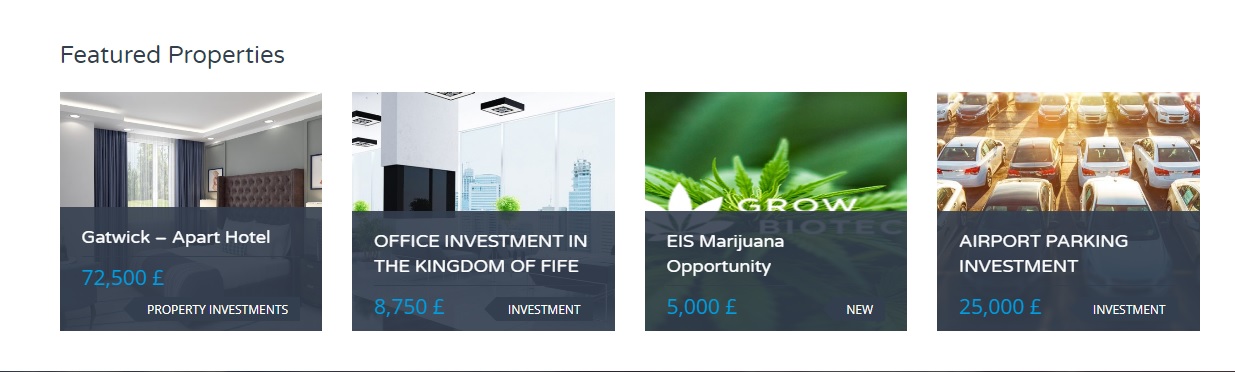

Gatwick – Apart Hotel – This is a serviced apartment/Hotel investment with a minimum investment of 72,500 GBP. The figure states “from”, so I assume you can throw a bit more in for good measure. The promised outcomes:

- 12 Months rental paid in advance

Rental protected by Insurance

Rental protected by Insurance- 5 Years Rental 8%

- 2% profit paid on exchange deposit during refurbishment

- 7 days free stay subject to 1 months notice

- Buy back at 110% after 10 years

- 40% Finance on units over £140,000

- Luxury furniture pack included with every purchase

- Completion date: March 2019

This is a fixed term investment of 10 years and it has not been built yet (check the completion date). To me, an investment like this would ring alarm bells, as you are purchasing property that has yet to be completed. All sorts of hiccups could occur before the investment was up and running. An illiquid, high-risk investment, only for those who can afford a potential loss on the funds used.

Office investment in the Kingdon of Fife – Another illiquid and fixed-term investment, although slightly lower in price than the Gatwick offer.

- Structured exit plan at 10 and 15 years

This means your money is trapped for an awfully long time. If the market sways, you could be set for a loss and often with fixed-term structured investments there are fees and charges. Investments like this can, if they go wrong, result in you, the investor, falling into negative equity.

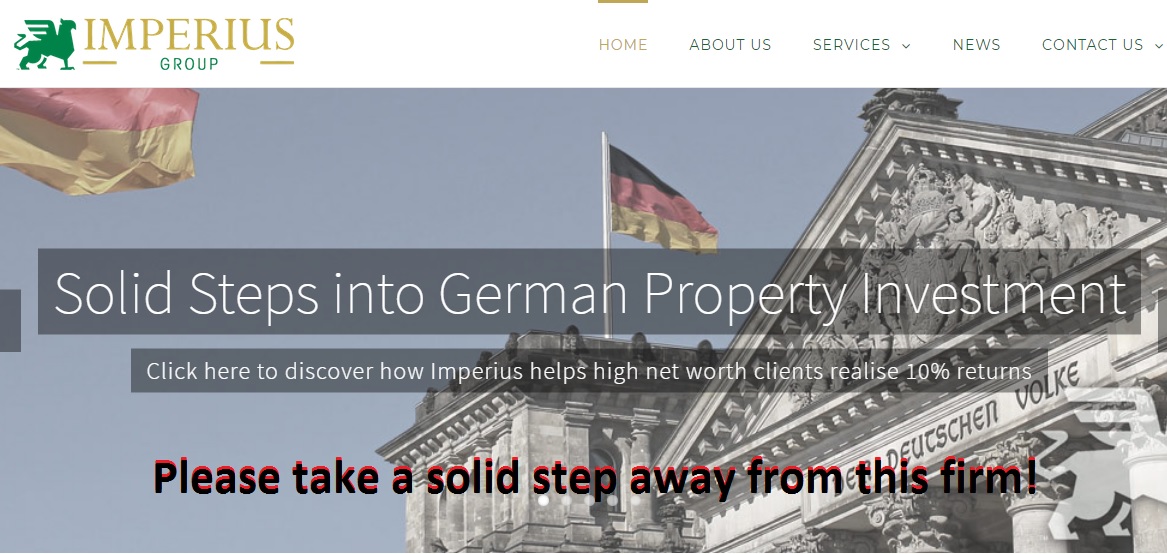

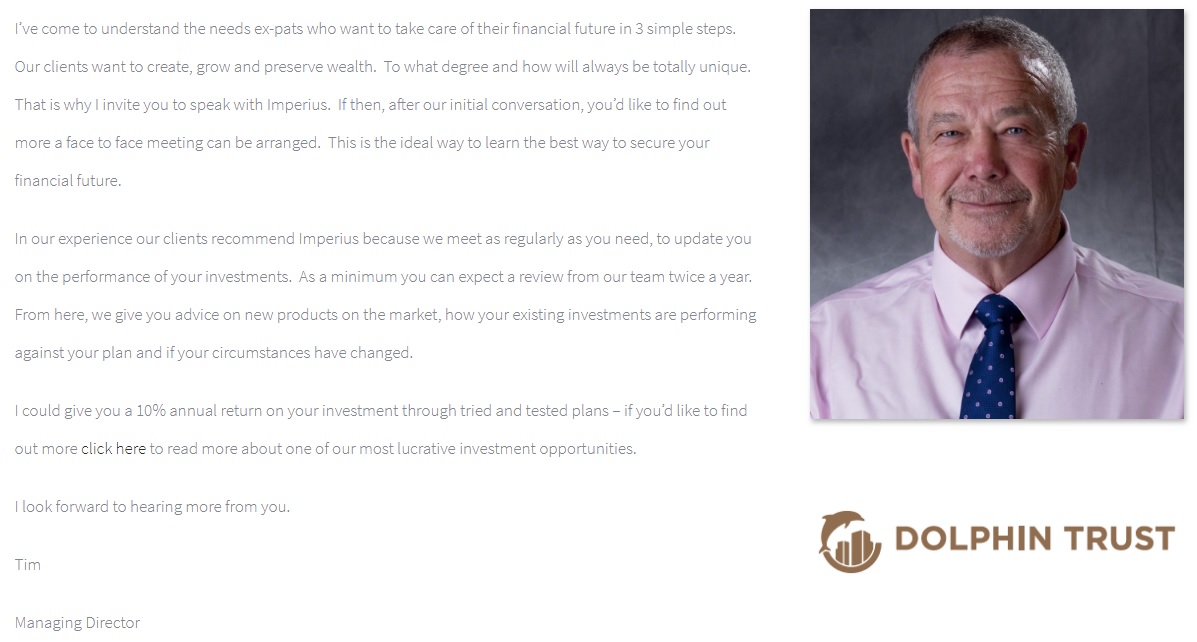

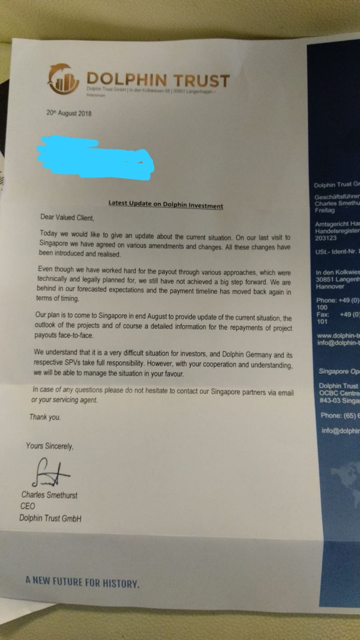

Property investments like these, ring similar to that of the Dolphin Trust´s German property investments – high-risk, unregulated, non-standard “assets”. An awful lot of pension money has been loaned to this company – many DB pensions earned by British Steelworkers were invested here. Introducers saw commissions of up to 25% and in the case of British Steelworkers, Celtic Wealth – who are now in liquidation- were the introducers. The victims do not know where their pension funds are or if they will get any return. Dolphin Trust are still selling their assets, despite the lack of funds being released to mature investors.

EIS marijuana opportunity – Grow Biotec, there is a lot of press going around at the moment into the medical uses of marijuana and possibilities of a change in legislation in the UK. In many states of America, the use of marijuana for medical use has been decriminalized. As an avid supporter of natural remedies and healing through nature, the use of CBD extracted from the marijuana plant interests me immensely, the idea of investing in this potentially lifesaving product does have a certain draw.

But, there is always a but! Since working for Pension Life, any investment opportunity that quotes the word ´bio´ gives me the heebie-jeebies. We have only to look back and remember the Elysian Bio Fuels liberation scam promoted by James Hay. The victims of this scam have been left penniless AND with huge tax bills from HMRC.

But, there is always a but! Since working for Pension Life, any investment opportunity that quotes the word ´bio´ gives me the heebie-jeebies. We have only to look back and remember the Elysian Bio Fuels liberation scam promoted by James Hay. The victims of this scam have been left penniless AND with huge tax bills from HMRC.

Another ´bio´investment disaster was Sustainable Agroenergy (SAE) Plc, investors were told their investments were in biofuel products, that land was owned in Cambodia and planted with Jatropha trees – a tree with highly toxic fruit that could be used to produce biofuel. Unfortunately, the Jatropa trees were not as fruitful as originally thought. The perpetrators, were thankfully convicted of fraud and bribery offenses.

The reasons I doubt this as a good investment are the vague promises and the over promises.

´It is a private offer raising £5 million to develop one of the world’s most valuable portfolios of cannabis-IP assets by 2022.´

What will be the outcome should this £5 million not be made? A possibility of loss of all or part of your investment.

´We are seeking to develop one of the world’s most valuable portfolios of cannabis-IP assets by 2022.´

Meaning this is a fixed-term investment, with potentially no return for at least 4 years, if not longer, AND only if successful.

- Projected high returns: Target return of £50 per £1 invested (not guaranteed)

- EIS Tax relief: up to 50% income tax and capital gains tax relief. Remember tax rules can change and benefits depend on circumstances.

If it sounds too good to be true – it probably is. Plus this figure is not guaranteed and seems to me like it was just plucked out of the sky, nice and high, to lure investors in.

Airport Parking Investments,

These investments are what we in the industry call illiquid. Once your money is in, then it´s pretty hard to get it out quick AND unless the venture does well there will be no return. With regards to pension investments, these are the very worst, toxic assets to invest in.

Unfortunately, they are often the assets which pay handsome investment introduction commissions to the salesperson, and this is why serial scammers, like Ward, love them. They go in with the ´eco-bio´ sale pitch or the glamorous property ownership – withholding the high-risk, fixed-term rules surrounding the investment.

A pension fund is a retail investment that should be placed in a low to medium-risk asset. Fixed terms, high-risk and illiquid investments should be avoided at all costs.

The types of investments offered by Katar Investments are high-risk and illiquid, if you have a spare five grand that you can afford to lose, then go for it: have a cheeky punt on Bio Grow. You may be pleasantly surprised and get the target return of £50 per £1 invested (just remember to duck smartly when those pink things with curly tails fly a bit too close!). However, if your money is dear to you and you cannot afford to lose it, please stay away from shiny pink and green investments like this.

The types of investments offered by Katar Investments are high-risk and illiquid, if you have a spare five grand that you can afford to lose, then go for it: have a cheeky punt on Bio Grow. You may be pleasantly surprised and get the target return of £50 per £1 invested (just remember to duck smartly when those pink things with curly tails fly a bit too close!). However, if your money is dear to you and you cannot afford to lose it, please stay away from shiny pink and green investments like this.

When it comes to your precious pension fund it is always best to air on the side of caution and go for the safe bet. It might not pay the highest interest, however, slow and steady wins the race. Meaning you will be able to enjoy your hard earned pennies in your retirement – stress free.

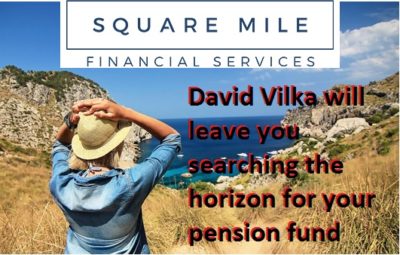

John Rodgers wishes he had said no to the offers of Continental Wealth Management.

Pension scammers have a “code”. Rather like pirates, they are not to be trusted. They pick their words carefully, revealing little; they are sneaky and lack any morals. They are good at disguises and if they fear they may be rumbled, they will disappear over the horizon, never to be seen again. They certainly won’t hang around to help pick up the pieces after their victims have been ruined. Rest assured, they will take as much as they can get and show no remorse. Living the Life of Riley on your hard-earned money is their reward.

Pension scammers have a “code”. Rather like pirates, they are not to be trusted. They pick their words carefully, revealing little; they are sneaky and lack any morals. They are good at disguises and if they fear they may be rumbled, they will disappear over the horizon, never to be seen again. They certainly won’t hang around to help pick up the pieces after their victims have been ruined. Rest assured, they will take as much as they can get and show no remorse. Living the Life of Riley on your hard-earned money is their reward. Those of you who follow Pension Life, will know that we want to put a stop to pension scammers and are trying our hardest to get as much information as possible out to the public about how to avoid being scammed. We want to educate the masses and stop pension scammers worldwide.

Those of you who follow Pension Life, will know that we want to put a stop to pension scammers and are trying our hardest to get as much information as possible out to the public about how to avoid being scammed. We want to educate the masses and stop pension scammers worldwide.

International Adviser and the Old Mutual International/Quilter Scams. Today’s jolly:

International Adviser and the Old Mutual International/Quilter Scams. Today’s jolly: International Adviser should hang its head in shame for failing to make sure that the perpetrators – especially Old Mutual International/Quilter – are brought to justice publicly for the destruction of hundreds of millions of pounds’ worth of life savings. And yet IA’s Old Mother Hubbard is consorting with them and giving Quilter’s Ryan Gardner a speaking slot on the

International Adviser should hang its head in shame for failing to make sure that the perpetrators – especially Old Mutual International/Quilter – are brought to justice publicly for the destruction of hundreds of millions of pounds’ worth of life savings. And yet IA’s Old Mother Hubbard is consorting with them and giving Quilter’s Ryan Gardner a speaking slot on the

2,000 victims of fraudulent pension firms may be in with a chance of getting their funds back. In November, the FCA pushed for legal proceedings to go ahead against collapsed firm Avacade Limited, trading as Avacade Investment Options; and Alexandra Associates (UK) Limited, trading as Avacade Future Solutions.

2,000 victims of fraudulent pension firms may be in with a chance of getting their funds back. In November, the FCA pushed for legal proceedings to go ahead against collapsed firm Avacade Limited, trading as Avacade Investment Options; and Alexandra Associates (UK) Limited, trading as Avacade Future Solutions.

I have a long list of fraudulent pension firms and serial scammers that I plan to forward to the FCA (yet again). However, in reality, I do wonder how many cases the FCA can actually deal with in one year. Given their past track record, I’d say this is their annual big bust. The other scammers are safe and the victims will be left to wait and wonder when their cases will be dealt with.

I have a long list of fraudulent pension firms and serial scammers that I plan to forward to the FCA (yet again). However, in reality, I do wonder how many cases the FCA can actually deal with in one year. Given their past track record, I’d say this is their annual big bust. The other scammers are safe and the victims will be left to wait and wonder when their cases will be dealt with. On the plus side, the FCA have certainly had a busy month. Alongside their prosecutions, they have launched their

On the plus side, the FCA have certainly had a busy month. Alongside their prosecutions, they have launched their  I would like to highlight that the rider of the jet ski does bear a remarkable resemblance to Phillip Nunn, cold caller and “fund manager” of the

I would like to highlight that the rider of the jet ski does bear a remarkable resemblance to Phillip Nunn, cold caller and “fund manager” of the

Rental protected by Insurance

Rental protected by Insurance But, there is always a but! Since working for Pension Life, any investment opportunity that quotes the word ´bio´ gives me the heebie-jeebies. We have only to look back and remember the

But, there is always a but! Since working for Pension Life, any investment opportunity that quotes the word ´bio´ gives me the heebie-jeebies. We have only to look back and remember the

The types of investments offered by Katar Investments are high-risk and illiquid, if you have a spare five grand that you can afford to lose, then go for it: have a cheeky punt on Bio Grow. You may be pleasantly surprised and get the target return of £50 per £1 invested (just remember to duck smartly when those pink things with curly tails fly a bit too close!). However, if your money is dear to you and you cannot afford to lose it, please stay away from shiny pink and green investments like this.

The types of investments offered by Katar Investments are high-risk and illiquid, if you have a spare five grand that you can afford to lose, then go for it: have a cheeky punt on Bio Grow. You may be pleasantly surprised and get the target return of £50 per £1 invested (just remember to duck smartly when those pink things with curly tails fly a bit too close!). However, if your money is dear to you and you cannot afford to lose it, please stay away from shiny pink and green investments like this.

ROLL UP! ROLL UP! ME HEARTY SCAMMERS! OMI’S LATEST

ROLL UP! ROLL UP! ME HEARTY SCAMMERS! OMI’S LATEST  So, what are you waiting for? You’ll earn 8% by selling your victims a useless OMI “PORTFOLIO” bond (don’t mention this is illegal in Spain) and then a further 8% from selling this toxic, high-risk BNP Paribas structured note (rubbish inappropriate structured product) which will tie your victims in for

So, what are you waiting for? You’ll earn 8% by selling your victims a useless OMI “PORTFOLIO” bond (don’t mention this is illegal in Spain) and then a further 8% from selling this toxic, high-risk BNP Paribas structured note (rubbish inappropriate structured product) which will tie your victims in for

Interestingly,

Interestingly,

Victims of the unregulated

Victims of the unregulated