The Spanish Insurance Regulator – the DGS (Dirección General de Seguros y Fondos de Pensiones) – has made a most welcome judgment. This outlaws the mis-selling of bogus life assurance policies as investment “platforms” – aka “life bonds”. Read the translated summary below.

The Spanish Insurance Regulator – the DGS (Dirección General de Seguros y Fondos de Pensiones) – has made a most welcome judgment. This outlaws the mis-selling of bogus life assurance policies as investment “platforms” – aka “life bonds”. Read the translated summary below.

The iniquitous practice of scamming victims into these expensive, pointless bonds – so beloved by the “chiringuitos” (scammers) on the Costa Blanca and Costa del Sol for many years – will now result in criminal convictions for the peddlers of these toxic products.

The DGS’ judgment has provided reinforcement to the earlier Spanish Supreme Court’s ruling that life assurance contracts used to hold “single-premium” investments are invalid. This heralds a huge step forward in cleaning up the filthy scams which have for so long proliferated in popular British expat communities – making the victims poor and the perpetrators rich. This evil practice came to a head when scammers Continental Wealth Management collapsed in a pile of debris in September 2017. The main perps: Darren Kirby, Dean Stogsdill, Anthony Downs, Richard Peasley, Alan Gorringe, Neil Hathaway, Antony Poole all ran for the hills. Other scammers who played supporting roles – including Stephen Ward, Martyn Ryan and Paul Clarke – slithered away quietly to ply their scams elsewhere.

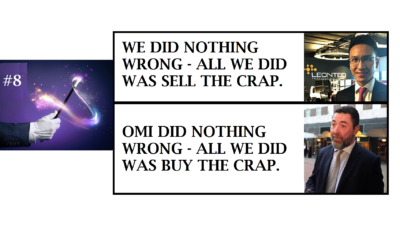

The DGS ruling has opened the way for criminal prosecutions against all those at Continental Wealth Management who profited so handsomely from flogging “life bonds” by Old Mutual International (aka OMI and Royal Skandia), Generali and SEB. While it goes without saying there will be a hearty cheer about the jailing of Darren Kirby and his merry men, they will soon be joined by other individuals who have joined in the bogus life insurance fest just as enthusiastically. And, of course, the life offices – from OMI, Generali and SEB, to Friends Provident and RL360 – will be treated to a proceeds-of-crime party.

Guest of honour will, of course, be Peter Kenny of OMI. But just to make sure nobody feels left out, Hansard and Investors Trust will certainly get their invites. Maybe Wormwood Scrubs will set up their own wing for life-office scammers.

Guest of honour will, of course, be Peter Kenny of OMI. But just to make sure nobody feels left out, Hansard and Investors Trust will certainly get their invites. Maybe Wormwood Scrubs will set up their own wing for life-office scammers.

It has long seemed curious that such a delightful part of Spain as the Costa Blanca should have fostered such an evil industry. From the arch scammer himself – Stephen Ward of Premier Pension Solutions, and his many associates including Paul Clarke who was helping him flog Ark before he joined CWM to learn to scam on a much larger scale. But anywhere along that delightful stretch of coastline running from Valencia to Alicante there are dozens of firms giving the life bond machine plenty of welly.

So popular is the use of life bonds among the seedier sector of the financial services industry, that multi-national firm Blevins Franks have their own their “exclusive” offering of bogus Lombard bonds. And you can see why: these scammers earn 8% from flogging these bogus life assurance policies. That’s 8% for doing nothing – and for trapping their victims into paying back this commission over up to ten years. Often long after the victims have worked out that the bond serves no purpose except to prevent the funds from ever growing.

So popular is the use of life bonds among the seedier sector of the financial services industry, that multi-national firm Blevins Franks have their own their “exclusive” offering of bogus Lombard bonds. And you can see why: these scammers earn 8% from flogging these bogus life assurance policies. That’s 8% for doing nothing – and for trapping their victims into paying back this commission over up to ten years. Often long after the victims have worked out that the bond serves no purpose except to prevent the funds from ever growing.

The victims themselves – hundreds of which lost most (or in some cases all) of their life savings to Continental Wealth Management – will indeed see the DGS’ ruling as wonderful news. They will certainly celebrate the fact that justice has at last prevailed and that the law in Spain has made it clear that selling life assurance policies the traditional scamming way is illegal.

Continental Wealth Management (CWM – “sister company” to Stephen Ward’s Premier Pension Solutions) was set up initially to provide the cold calling and lead generation services to support Ward’s many scams – including the Evergreen (New Zealand) QROPS scam. Evergreen was swiftly followed by the Capita Oak and Westminster scams (now under investigation by the Serious Fraud Office). Unregulated, and staffed by unqualified salesmen who took it in turns to sport grand titles such as “Managing Director” and “Investment Director”, most of these spivs had been car salesmen or estate agents before flogging QROPS and life assurance contracts used to hold the toxic structured notes which destroyed so many millions of pounds’ worth of the victims’ life savings. Many of these bonds were supplied by Old Mutual International, who despite the huge losses on the funds, continued to take their fees monthly.

Back in April 2018, OMI and the IOM were defeated by Spanish courts ruling that the jurisdiction in litigation against them for facilitating financial crime should be in Spain. This was a welcomed victory for the victims in the face of so much corruption and fraud in Spain for many years. It is certainly a turning point in the quest for justice by the thousands of victims of scammers such as Continental Wealth Management and life offices such as Old Mutual International, Generali and SEB.

I will be writing to all advisory firms who are selling life bonds to victims in Spain to advise them that this is now a criminal matter and to warn them that they will be reported to the DGS.

————————————————————————————————————————————————————–

Madrid, 10 January 2019

General Directorate of Insurance and Pension Funds (DGS)

Complaints service file number 268/2016

COMPLAINT BY A CONTINENTAL WEALTH CLIENT IN RESPECT OF HEAVY LOSSES INCURRED ON HIS PENSION TRANSFERRED TO A BOURSE QROPS AND PLACED IN A GENERALI INSURANCE BOND.

The Directorate General of Insurance and Pension Funds is competent under the powers conferred on it by Article 46 of Law 26/2006 of 17 July, on the mediation of private insurance and reinsurance, to examine the claim formulated for the purpose of determining non-compliance with current regulations on the mediation of private insurance and reinsurance, and whether this is decisive for the adoption of any of the relevant administrative control measures, particularly those of administrative sanction, which contravene the aforementioned Law.

Article 6 of Law 26/2006, of 17 July, on private insurance and reinsurance mediation, which regulates the general obligations of insurance intermediaries, states:

“Insurance intermediaries shall provide truthful and sufficient information in the promotion, supply and underwriting of insurance contracts, and, in general, in all their advisory activity….”

Article 26 paragraphs 2 and 3 of Law 26/2006, of 17 July, on private insurance and reinsurance mediation, which refers to insurance brokers, establishes the following:

“Insurance brokers must inform the person who tries to take out the insurance about the conditions of the contract which, in their opinion, it is appropriate to take out and offer the cover which, according to their professional criteria, is best adapted to the needs of the former. The broker must ensure the client’s requirements will be met effectively by the insurance policy.”

Article 42 of the Private Insurance and Reinsurance Mediation Act, which refers to the information to be provided by the insurance intermediary prior to the conclusion of an insurance contract, provides:

“Before an insurance contract is concluded, the insurance intermediary must, as a minimum, provide the customer with the following information:

- a) The broker’s identity and address.

- b) The Register in which the broker is registered, as well as the means of verifying such registration.”

Insurance agents must inform the customer of the names of the insurance companies with which they can carry out the mediation activity in the insurance product offered.

In order for the client to be able to exercise the right to information about the insurance entities for which they mediate, insurance agents must notify the client of the right to request such information.

Banking and insurance operators, in addition to the provisions of the previous letter, must inform their clients that the advice given is provided for the purpose of taking out an insurance policy and not any other product that the credit institution may market.

Insurance brokers must inform the client that they provide advice in accordance with the following obligations:

“Insurance brokers are obliged to carry out and provide (to the customer) an objective analysis on the basis of a comparison of a sufficient number of insurance contracts offered on the market for the risks to be covered. Brokers must do this so that they can formulate an objective recommendation.”

On the basis of information provided by the customer, insurance intermediaries shall specify the requirements and needs of the customer, as well as the reasons justifying any advice they may have given on a particular insurance. The intermediary must answer all questions raised by the client regarding the function and complexity of the proposed insurance contract.

All intermediaries operating in Spain must comply with the rules laid down for reasons of general interest and the applicable rules on the protection of the insured, in accordance with the provisions of Article 65 of the Law on the Mediation of Private Insurance and Reinsurance.

Every insurance intermediary is obliged, before the conclusion of the insurance contract, to provide full disclosure. In the event that a mediator was an Insurance Broker or independent mediator, he is also obliged to give advice in accordance with the obligation to carry out an objective analysis. This must be provided on the basis of the analysis of a sufficient number of insurance contracts offered on the market for the risks to be covered. The mediator can then formulate a recommendation, using professional criteria, in respect of the insurance contract that would be appropriate to the needs of the client.

In the case in question, there is no evidence that the aforementioned information was provided to the client before the investment product was contracted. Therefore, Article 42 of the regulations has been breached.

Therefore, this Claims Service concludes that the mediator must justify the information and prior advice given to his client, so that the obligations imposed by the Law of Mediation can be understood to be fulfilled with the aim of protecting the insured. Failure to comply with their obligations could be considered as one of the causes of the damage that would have occurred to their client.

The claim is understood to be founded. In the opinion of this Claims Service, the mediating entity has committed a breach of the regulations regulating the mediation activity – specifically of the provisions of articles 6 and 42 of Law 26/2006 of Mediation of Private Insurance and Reinsurance.

The DGS requires the mediating entity to account to this Service, within a period of one month from the notification of this report, for the decision adopted in view of it, for the purposes of exercising the powers of surveillance and control that are the responsibility of the Ministry of Economy and Enterprise.

The interested parties are informed that there is no appeal to this judgment. Both the claimant and the mediating entity are made aware of their right to resort to the Courts of Justice to resolve any differences that may arise between them regarding the interpretation and compliance with the regulations in force regarding the mediation of private insurance and reinsurance, in accordance with the provisions of articles 24 and 117 of the Constitution.

Chief Inspector of Unit

Ministry of Economy and Enterprise

Secretary of State for the Economy and Business Support

Furthermore, if someone does approach you via a cold call claiming to be a viable company with a convincing sales pitch – how do you know if what they are saying is genuine? How do you know if they are a

Furthermore, if someone does approach you via a cold call claiming to be a viable company with a convincing sales pitch – how do you know if what they are saying is genuine? How do you know if they are a

FT adviser published an article entitled,

FT adviser published an article entitled,  To my relatively informed eye, it was obvious these were scam emails, but the offer of money back from

To my relatively informed eye, it was obvious these were scam emails, but the offer of money back from  So, as we cannot count on our government to protect us from the cold calling scams, Pension Life is here to help.

So, as we cannot count on our government to protect us from the cold calling scams, Pension Life is here to help.

ROLL UP! ROLL UP! ME HEARTY SCAMMERS! OMI’S LATEST

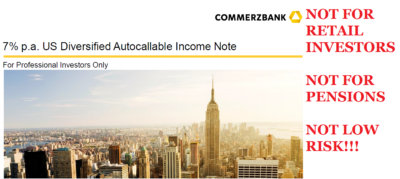

ROLL UP! ROLL UP! ME HEARTY SCAMMERS! OMI’S LATEST  So, what are you waiting for? You’ll earn 8% by selling your victims a useless OMI “PORTFOLIO” bond (don’t mention this is illegal in Spain) and then a further 8% from selling this toxic, high-risk BNP Paribas structured note (rubbish inappropriate structured product) which will tie your victims in for

So, what are you waiting for? You’ll earn 8% by selling your victims a useless OMI “PORTFOLIO” bond (don’t mention this is illegal in Spain) and then a further 8% from selling this toxic, high-risk BNP Paribas structured note (rubbish inappropriate structured product) which will tie your victims in for

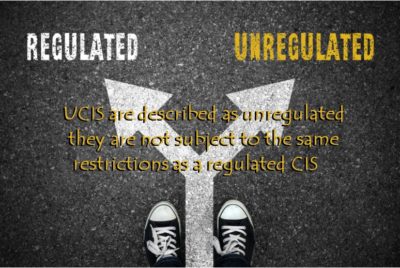

Investors’ trust is what gets violated in so many cases by irresponsible and negligent insurance companies such as Old Mutual International, SEB, Generali, RL360, Friends Provident International – and, of course, the firm in the Cayman Islands: Investors Trust. These companies – also known as “life offices” (although we prefer to call them “death offices” because they help destroy victims’ life savings – and sometimes cause the death of their distraught victims) – have a number of lethal practices which result in financial ruin for thousands of policyholders:

Investors’ trust is what gets violated in so many cases by irresponsible and negligent insurance companies such as Old Mutual International, SEB, Generali, RL360, Friends Provident International – and, of course, the firm in the Cayman Islands: Investors Trust. These companies – also known as “life offices” (although we prefer to call them “death offices” because they help destroy victims’ life savings – and sometimes cause the death of their distraught victims) – have a number of lethal practices which result in financial ruin for thousands of policyholders: A prime example of these vile practices was in the case of Mr. S – a driving instructor from Milton Keynes. His final salary pension scheme was transferred to a QROPS in Malta despite the fact that he was a UK resident and had no need for his pension to be transferred offshore. His “adviser” was David Vilka from a firm called Square Mile International Financial Services. This firm had an insurance license but no investment license. Therefore, Square Mile could legally sell insurance products such as dog insurance – but could certainly not provide investment advice.

A prime example of these vile practices was in the case of Mr. S – a driving instructor from Milton Keynes. His final salary pension scheme was transferred to a QROPS in Malta despite the fact that he was a UK resident and had no need for his pension to be transferred offshore. His “adviser” was David Vilka from a firm called Square Mile International Financial Services. This firm had an insurance license but no investment license. Therefore, Square Mile could legally sell insurance products such as dog insurance – but could certainly not provide investment advice.

Far from being contrite or apologetic, however, the scammer who risked Mr. S’ pension in the first place – David Vilka of Square Mile International Financial Services in the Czech Republic – showed no shame and made no attempt to recover the remainder of his victim’s pension. In fact, when I exposed Vilka’s vile scam, I was threatened by his two-bit American lawyer

Far from being contrite or apologetic, however, the scammer who risked Mr. S’ pension in the first place – David Vilka of Square Mile International Financial Services in the Czech Republic – showed no shame and made no attempt to recover the remainder of his victim’s pension. In fact, when I exposed Vilka’s vile scam, I was threatened by his two-bit American lawyer

Governments in the UK and all expat jurisdictions must wake up to scams – both offshore and at home. They must empower/galvanise law-enforcement agencies and give them the resources to tackle financial crime.

Governments in the UK and all expat jurisdictions must wake up to scams – both offshore and at home. They must empower/galvanise law-enforcement agencies and give them the resources to tackle financial crime. Regulators must put together effective regulations – and then ENFORCE them. Regulations on their own are worthless and pointless – the industry must be policed and failure to comply with regulations must be severely sanctioned.

Regulators must put together effective regulations – and then ENFORCE them. Regulations on their own are worthless and pointless – the industry must be policed and failure to comply with regulations must be severely sanctioned.

.

. Advisers must be appropriately qualified. If they don’t have the right qualifications, they must demonstrate that they are studying and aiming to qualify within a reasonable, pre-determined time frame.

Advisers must be appropriately qualified. If they don’t have the right qualifications, they must demonstrate that they are studying and aiming to qualify within a reasonable, pre-determined time frame.

QROPS providers must also ensure they have understood and verified the members’ risk profiles – and then ensure that any investments made on behalf of those members are in line with their risk profile.

QROPS providers must also ensure they have understood and verified the members’ risk profiles – and then ensure that any investments made on behalf of those members are in line with their risk profile. Life offices must stop accepting business from known scammers and unregulated firms – and cease investing victims’ life savings in unsuitable assets – such as structured notes and UCIS funds.

Life offices must stop accepting business from known scammers and unregulated firms – and cease investing victims’ life savings in unsuitable assets – such as structured notes and UCIS funds.

International Investment has written a jolly good article about the recent action taken by the UAE Insurance Authority – headed up by His Excellency Ibrahim Al Zaabi. I quote from

International Investment has written a jolly good article about the recent action taken by the UAE Insurance Authority – headed up by His Excellency Ibrahim Al Zaabi. I quote from  The Gibraltar FSC

The Gibraltar FSC

I have been working for

I have been working for

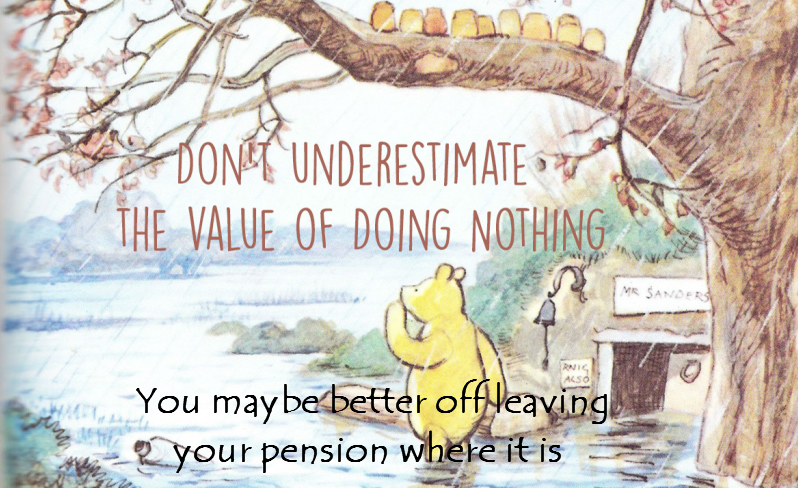

Get all the information in hard copy and read it at least three times or however many times you need to read it to be completely comfortable that you understand everything.

Get all the information in hard copy and read it at least three times or however many times you need to read it to be completely comfortable that you understand everything.

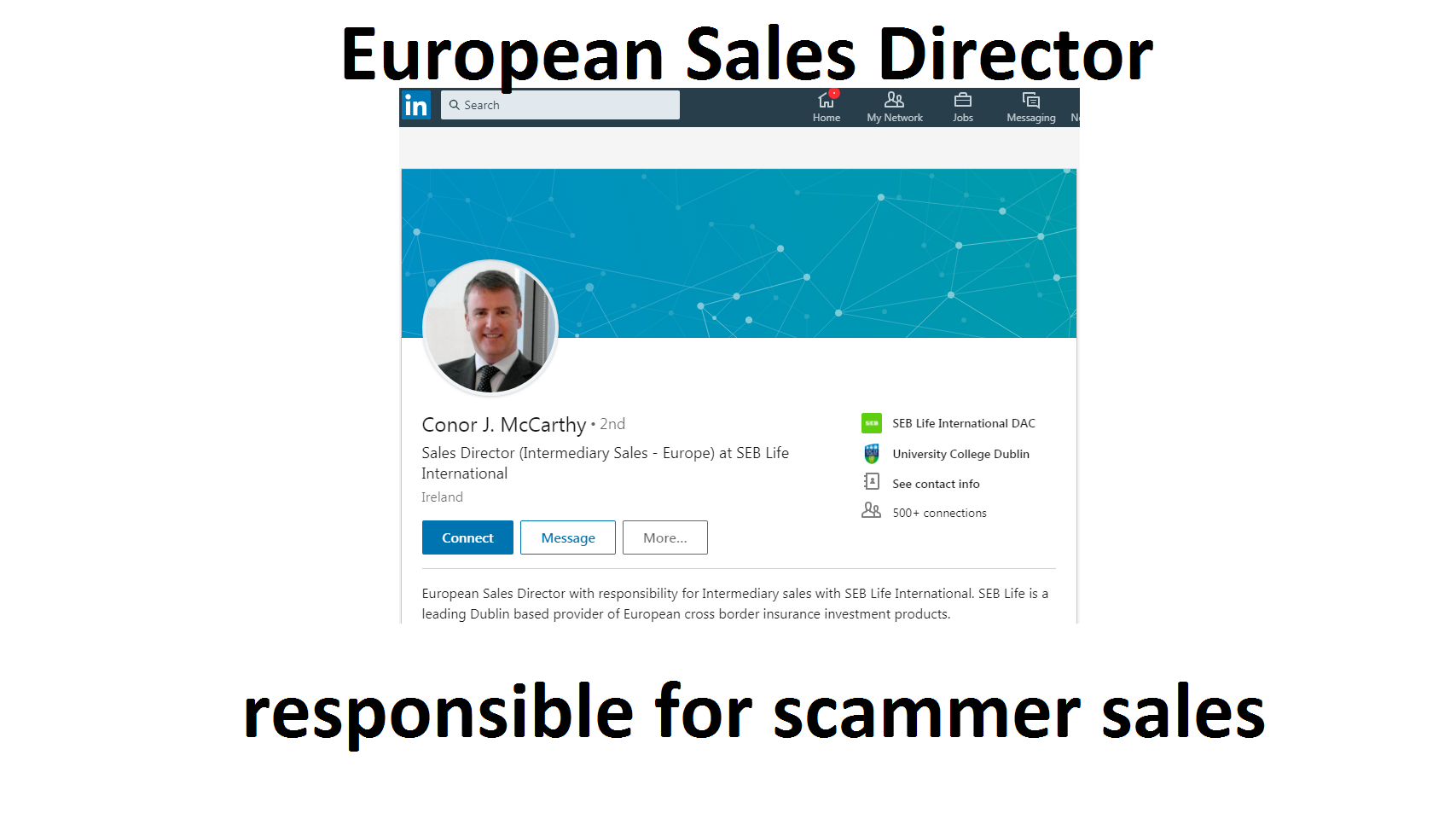

Who at SEB is responsible for the travesty of the destruction of hundreds of victims of the Continental Wealth Management scam? And the

Who at SEB is responsible for the travesty of the destruction of hundreds of victims of the Continental Wealth Management scam? And the  As a marketing graduate, Mr. McCarthy should understand that the best way to “market” a company is to compensate the victims without them having to sue SEB.

As a marketing graduate, Mr. McCarthy should understand that the best way to “market” a company is to compensate the victims without them having to sue SEB.