This week Henry Tapper wrote a blog entitled, “The wheels of the law turn (too) slowly”. He exposes the fact that when it comes to financial crime the justice system in place just isn´t enough. I think he was being generous with his title. The wheels of the law don’t just turn slowly – they just don’t turn at all. Friendly Pensions has been in the news this week.

This week Henry Tapper wrote a blog entitled, “The wheels of the law turn (too) slowly”. He exposes the fact that when it comes to financial crime the justice system in place just isn´t enough. I think he was being generous with his title. The wheels of the law don’t just turn slowly – they just don’t turn at all. Friendly Pensions has been in the news this week.

In the case of Friendly Pensions, we know ringleader David Austin is guilty of setting up 11 fake schemes, with toxic investments including a truffle farm. We know that he and his partners in crime, Susan Dalton, Alan Barratt and Julian Hanson (also connected to the Ark Scam), are guilty of scamming 245 pension savers out of £13.7 million. We knew all of this back in January 2018, yet no arrests have been made!

The FCA has, however, just yesterday, managed to enforce the following:

“David Austin, 52, has been banned from serving as a pension trustee and disqualified from working as a company director for 12 years. His business partners Susan Dalton, Alan Barratt, and Julian Hanson have also been barred from trustee roles.

David Austin’s daughter, 25-year-old Camilla, has been banned from serving as a director for four years for helping him with the scheme.”

They have been asked to pay the money back but by the looks of their social media accounts, I don´t think there is much left. Camilla’s Facebook and Instagram accounts show her sunning herself on beaches and yachts around the world, and posing at luxury alpine ski resorts. David Austin is pictured on a gondola in Venice. They certainly got to enjoy the proceeds of their many victims’ pensions.

They have been asked to pay the money back but by the looks of their social media accounts, I don´t think there is much left. Camilla’s Facebook and Instagram accounts show her sunning herself on beaches and yachts around the world, and posing at luxury alpine ski resorts. David Austin is pictured on a gondola in Venice. They certainly got to enjoy the proceeds of their many victims’ pensions.

Camilla Austin was a central part of the operational side of the Friendly Pensions scam. She and a number of her girlfriends went into nursing homes and approached elderly, frail and vulnerable elderly people. They easily conned them into signing transfer request forms – all that is required to get their hands on millions of pounds’ worth of pension funds. And, of course, we all know that the ceding providers do nothing to stop fraudulent transfers.

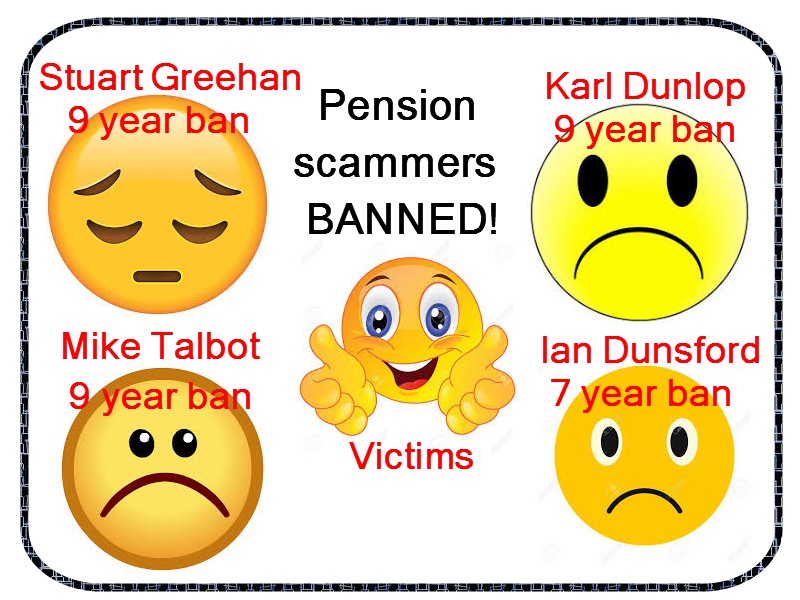

As Henry points out, banning these people from acting as trustees or directors, does little to deter past, present and future pension scammers. A ban is barely a slap on the wrist as far as we are concerned; these scammers can still launch any number of future dodgy schemes by simply finding the next crooked stooge – just as XXXX XXXX used the idiotic Karl Dunlop to be a director in the Capita Oak scam.

Keeping pension savers safe from financial crime should be at the top of the list – but, instead, it is at the bottom. Pension scammers are left free to commit their crimes over and over again. Take Julian Hanson: he was busily scamming dozens of Ark victims out of more than £5.3 million worth of pensions back in 2011 and 2012, yet he was not prosecuted or jailed. Hence, he was still able to get “friendly” with David Austin and go on to scam hundreds more victims out of their pensions.

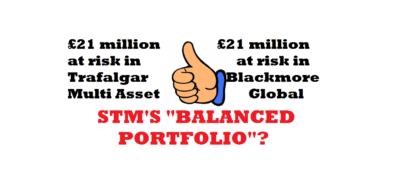

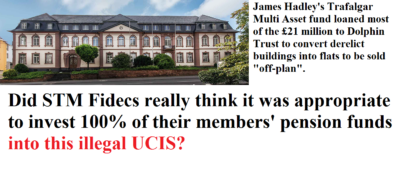

Remember the Capita Oak, Henley Retirement Benefits and Westminster pension scams? These were scams run by XXXX XXXX of Nationwide Benefit Consultants. However, XXXX was never brought to justice and so went on to operate the Trafalgar Multi Asset Fund/Victory Asset Management scam (STM Fidecs acted as the trustees here). So hundreds more people were again scammed out of their pensions. XXXX is currently under investigation by the Serious Fraud Office – but effectively still free to operate more scams. We already have our suspicions about his connections to new scams.

Capita Oak was registered by HMRC on 23.7.2012 (PSTR 00785484RM) by Stephen Ward of Premier Pension Transfers of 31 Memorial Road, Worsley and Premier Pension Solutions of Moraira, Spain. Ward was responsible for the ARK debacle – also with Dalriada – the scam that was to create the birth of Pension Life.

Despite investigations being made into these schemes, Ward was still able to go on and create the CWM monster scheme that saw around 1,000 victims conned out of their pension funds. Ward is hovering somewhere between his collection of luxury villas in Florida and the Spanish Costa Blanca – but at least he is no longer doing pension transfers. Over the past nine years, Ward can be linked to dozens more pension scams that have left thousands of victims’ funds decimated.

These cases are just the tip of the iceberg. We must not forget Philip Nunn and Patrick McCreesh´s investment scam Blackmore Global. This was in the wake of them doing the lead generation for the Capita Oak and Henley Retirement Fund scams. The Insolvency Service has wound up these schemes, yet Nunn and McCreesh remain free to defraud more victims as they have never been brought to justice.

David Vilka of Square Mile International was one of the main promoters of the Blackmore Global Fund scam. He “advised” dozens – possibly hundreds – of victims to invest their pensions in this scam (despite the fact that he is neither qualified nor regulated to give investment advice). Again, he has never been prosecuted or jailed, so still remains at large – free to continue scamming people out of their pensions.

We published the Top 10 Deadliest Pension Scammers blog back in February 2018. In this blog, you can read about Fast Pensions and the Moats, as well as Steve Pimlott of Windsor Pensions. Whilst the Fast Pensions scheme has been wound up by the high court and placed in the hands of Dalriada, neither Sara nor Peter Moat is behind bars.

You can see a depressing pattern here: these words are about cold, hard facts. The authorities are leaving known scammers free to keep scamming.

Victims of these scams have been left in misery and financial ruin. Some have taken their own lives. Yet the perpetrators, those guilty of these repeated financial crimes, are free to do as they please.

Stephen Ward of Premier Pension Solutions SL and Premier Pension Transfers Ltd

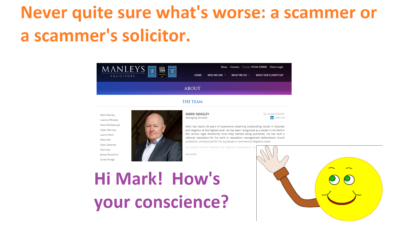

Stephen Ward of Premier Pension Solutions SL and Premier Pension Transfers Ltd Mark Manley of Manleys Solicitors – acting for XXXX XXXX.

Mark Manley of Manleys Solicitors – acting for XXXX XXXX. It is believed that cold calling techniques were used to lure unsuspecting victims into this series of unregulated investment scams. Victims’ pension savings were transferred into bogus occupational pension schemes whose trustees/administrators were Omni Trustees and Imperial Trustee Services. The schemes were

It is believed that cold calling techniques were used to lure unsuspecting victims into this series of unregulated investment scams. Victims’ pension savings were transferred into bogus occupational pension schemes whose trustees/administrators were Omni Trustees and Imperial Trustee Services. The schemes were

One of the updates is that STM Group have appointed a Group Internal Auditor. I wonder if this is going to make their trading any more honest. One can only hope that their future auditing will be considerably better than their past.

One of the updates is that STM Group have appointed a Group Internal Auditor. I wonder if this is going to make their trading any more honest. One can only hope that their future auditing will be considerably better than their past.

International Investment has written a jolly good article about the recent action taken by the UAE Insurance Authority – headed up by His Excellency Ibrahim Al Zaabi. I quote from

International Investment has written a jolly good article about the recent action taken by the UAE Insurance Authority – headed up by His Excellency Ibrahim Al Zaabi. I quote from  The Gibraltar FSC

The Gibraltar FSC

Now, of course, Deloittes and STM Fidecs are celebrating, as the GFSC has done nothing to stop this iniquitous, dishonest, incompetent and negligent firm from trading. Whether STM Fidecs bribed the Gibraltar FSC, or merely got them drunk on the golf course, we will never know. And it makes no difference. But certainly the matter has been brusquely brushed under the carpet and the hundreds of ruined lives have been conveniently ignored and forgotten.

Now, of course, Deloittes and STM Fidecs are celebrating, as the GFSC has done nothing to stop this iniquitous, dishonest, incompetent and negligent firm from trading. Whether STM Fidecs bribed the Gibraltar FSC, or merely got them drunk on the golf course, we will never know. And it makes no difference. But certainly the matter has been brusquely brushed under the carpet and the hundreds of ruined lives have been conveniently ignored and forgotten.

I will, of course, be more than happy to help Deloittes see the whole picture – rather than just what the Fraudsters want them to see. I will happily buy a whole shed full of spades as well as several boxes of latex gloves and surgical masks. However, the most important way in which I can assist them is to give them details of the various scams which the Fraudsters have operated and facilitated.

I will, of course, be more than happy to help Deloittes see the whole picture – rather than just what the Fraudsters want them to see. I will happily buy a whole shed full of spades as well as several boxes of latex gloves and surgical masks. However, the most important way in which I can assist them is to give them details of the various scams which the Fraudsters have operated and facilitated. Deloittes will need to concentrate on at least three main areas: Trafalgar Multi-Asset Fund;

Deloittes will need to concentrate on at least three main areas: Trafalgar Multi-Asset Fund;