Attention financial advisers in Spain/who provide financial advice to Spanish residents.

Attention financial advisers in Spain/who provide financial advice to Spanish residents.

18th February 2019

DEATH OF THE LIFE BOND:

The Spanish insurance and pensions regulator, the DGS, made a judgment against Costa Blanca-based Continental Wealth Management (CWM) on 10.1.2019. The order (translated and summarised below) confirmed that there are strict regulations in Spain for the sale of insurance products. The DGS also made it clear that even if a firm is not regulated in Spain by the DGS, it must conform to the Spanish regulations.

The deadline for compliance with the order was Monday 11th February. Unsurprisingly, CWM failed to comply. CWM had collapsed in September 2017 and all the scammers who worked for the firm headed for the hills (or Australia). We are now enforcing this order by criminal action against all those responsible. This also opens the way for similar action against any other firms who have mis-sold insurance products without complying with the Spanish regulations.

In certain, limited circumstances, insurance bonds can be beneficial. But in the vast majority of cases they are entirely mis-sold, and the underlying commissions concealed. These hidden commissions prevent the funds from growing and have an ever-increasing detrimental effect on the value of the fund. I have seen evidence of an entire fund being destroyed by irresponsible, risky, commission-laden investments. The life offices (such as OMI, SEB, FPI, RL360 and Generali) continue to apply their quarterly charges while the funds are being destroyed – sometimes even pushing the funds into negative territory.

Why should the use of life bonds be strictly controlled?

I have transcribed the DGS’ judgment below. It is an abbreviated, translated version of the original. I also set out below the reasons why life bonds should now be strictly controlled and only sold/advised by qualified, regulated firms. Once an international standards agreement has been established, it should be possible to ensure that only those firms who understand how to use these products properly will use them in future.

I hope that all advisers providing insurance advice in Spain – and beyond – will now ensure that losses caused by the mis-selling of life bonds are put right. I also hope that this policy will be adopted throughout Europe and in all other jurisdictions so that the worldwide mis-selling scandal can finally be ended.

There will be criminal proceedings – and these will extend to the life offices themselves for profiting from financial crime. The many victims whose life savings have been destroyed by the life offices and their toxic practices will welcome this news. The victims themselves know intimately the numerous faults of the life offices:

- accepting business from (and paying undisclosed commissions to) known scammers and unregulated advisory firms

- offering high-risk, unregulated funds such as Axiom, LM, Premier New Earth and other no-hoper funds

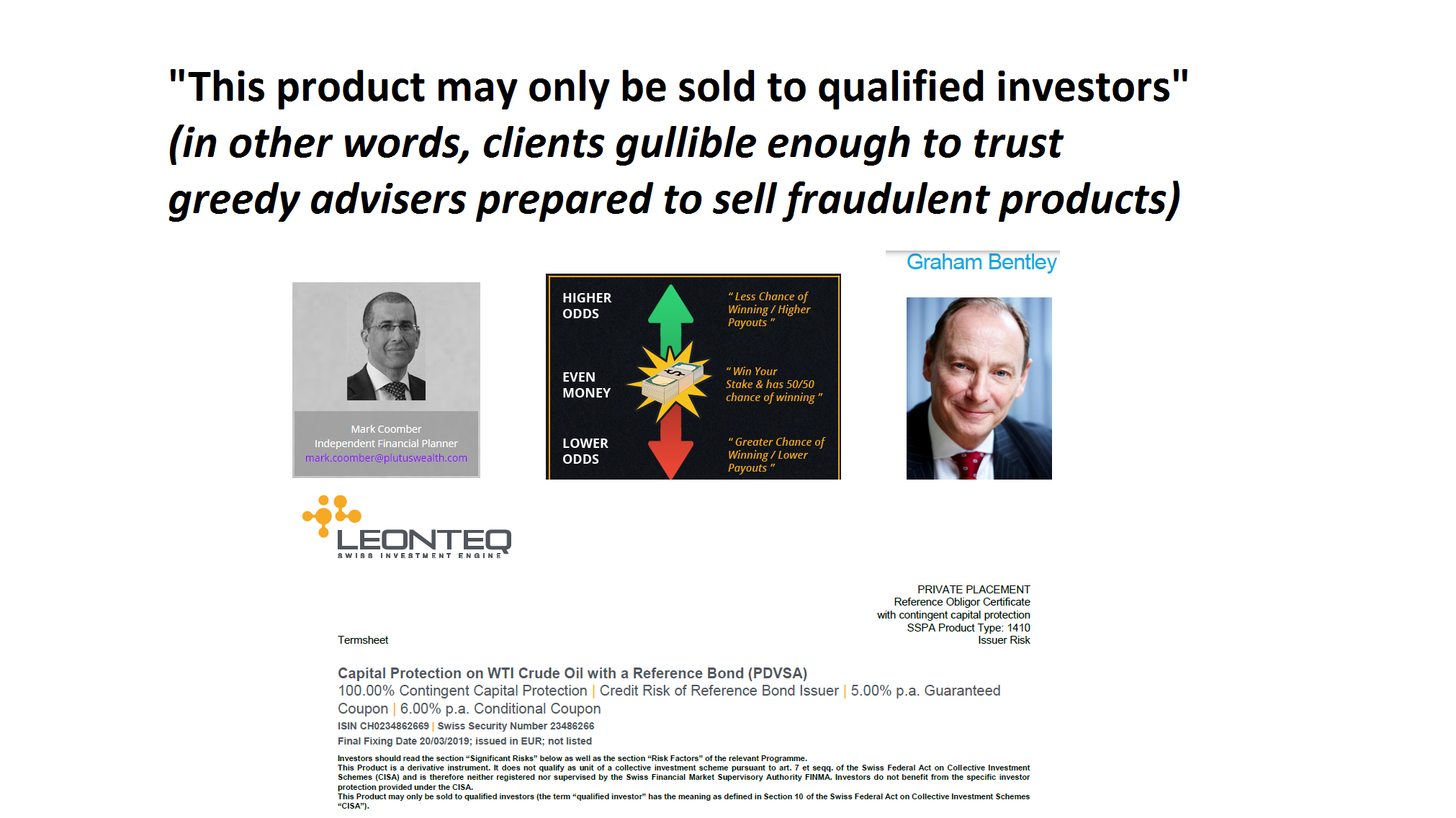

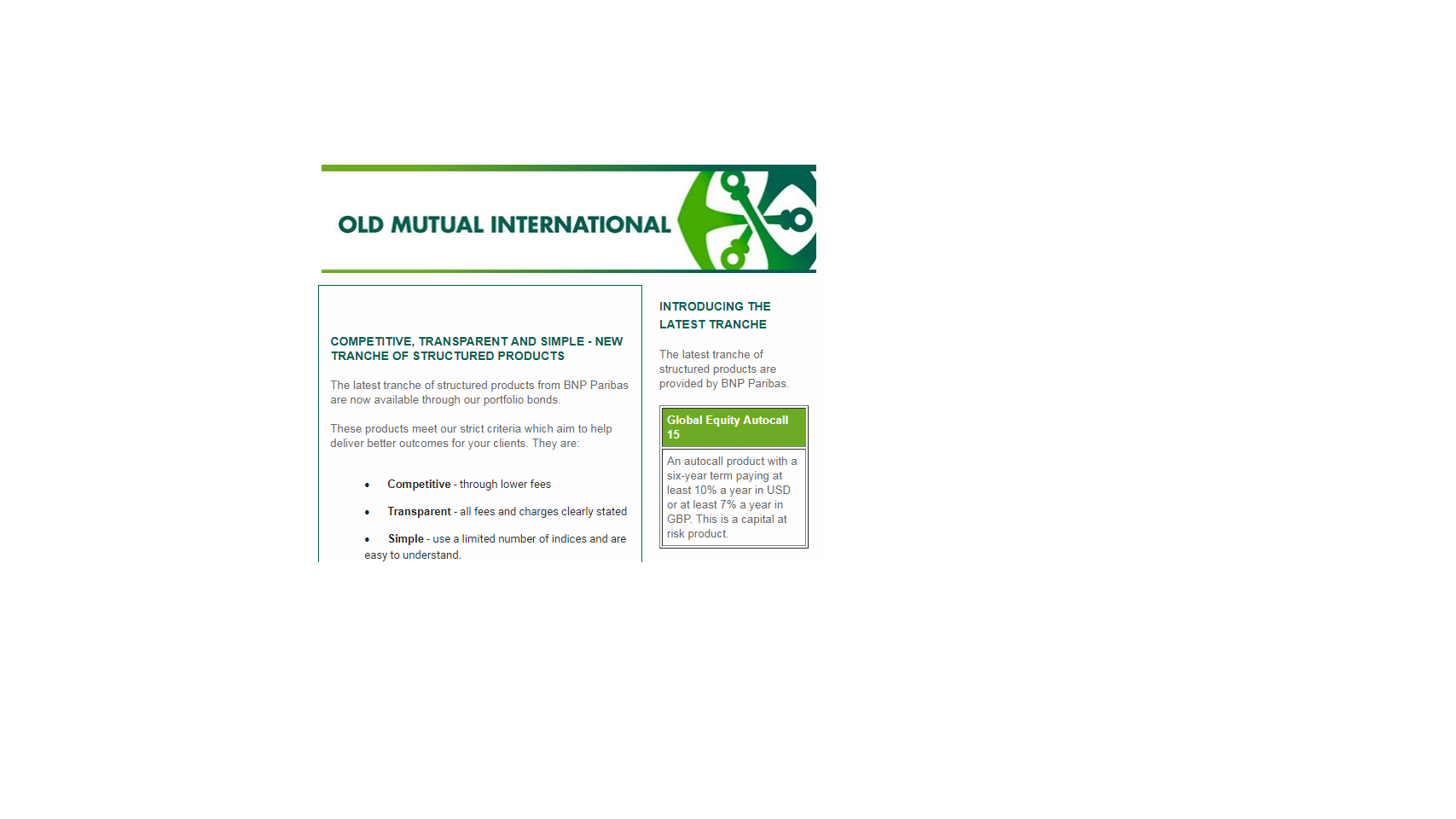

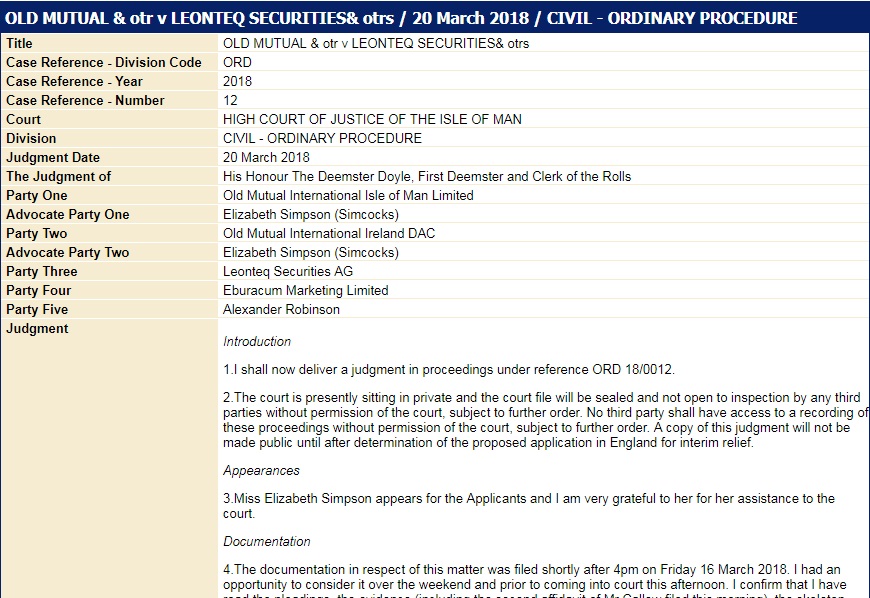

- offering professional-investor-only structured notes from providers such as Leonteq, Commerzbank and Nomura

- reporting the inexorable losses but taking no remedial action

- locking victims into the expensive, pointless bonds long after the majority of the funds had been destroyed

This latest development with the DGS judgment will help the victims take action against negligent life offices such as Old Mutual International and Friends Provident International. This will be a powerful weapon in the recovery process against these parasitic, negligent and greedy insurance companies.

I set out below, in red, reasons why insurance bonds should now be strictly controlled internationally. This is not just my opinion – but an order by the Spanish government. In my view, this is a very sensible and useful order which is in the interests of all consumers throughout Europe and the wider world.

Decent, ethical, regulated firms will comply with the DGS’ judgment. The scammers will not.

——————————————————————————————————————————————————

Madrid, 10 January 2019 – Complaints service file number 268/2016

Chief Inspector of Unit – Ministry of Economy and Enterprise

Secretary of State for the Economy and Business Support

General Directorate of Insurance and Pension Funds (DGS)

Article 6 of Law 26/2006, of 17 July, on private insurance and reinsurance mediation, which regulates the general obligations of insurance intermediaries, states:

“Insurance intermediaries shall provide truthful and sufficient information in the promotion, supply and underwriting of insurance contracts, and, in general, in all their advisory activity….”

The scammers do not, of course, comply with this regulation. In fact, scammers rarely tell their clients that they are going to be put into an insurance bond. Unscrupulous advisers often conceal how the bond will work or for how many years they will be locked in for. Normally, scammers wave an agreement for an OMI, SEB, Generali, FPI or RL360 bond under the nose of the clients – and ask them to sign the agreement with no explanation. Rarely do the scammers allow the client to read the document properly, or disclose the commission they will receive from selling the often pointless bond.

Victims will be locked into the bond long after they have worked out that the adviser has mis-sold the product purely for the 8% commission – and that the charges will prevent the fund from ever growing. In fact, even if the underlying asset were to perform reasonably well, it would struggle to keep up with the combination of the bond and adviser costs.

It is rarely explained that the bond is a bogus life assurance policy (or series of policies); that any life cover is only actually 101% of the original value of the funds the victim has unwittingly placed into the bond. If all the clients had wanted was life cover in the first place, this product would represent terrible value for money. The Spanish Supreme Court has already ruled that life assurance policies are void for the purpose of holding investments – because the life office takes no risk.

Therefore, the life bond fails on three counts:

- it is a useless life assurance policy

- it is a useless investment platform

- it does not comply with Spanish regulations.

I could go on: the life bond is expensive; fails to disclose adviser commissions; offers high-risk, unregulated funds; accepts business from known scammers and unregulated firms; allows professional-investor-only structured notes for retail investors. The list is endless.

Article 26 paragraphs 2 and 3 of Law 26/2006, of 17 July, on private insurance and reinsurance mediation, which refers to insurance brokers, establishes the following:

“Insurance brokers must inform the person who tries to take out the insurance about the conditions of the contract which, in their opinion, it is appropriate to take out and offer the cover which, according to their professional criteria, is best adapted to the needs of the former. The broker must ensure the client’s requirements will be met effectively by the insurance policy.”

If the client had stipulated that he needed a life assurance policy (which he usually didn’t), the adviser should have explained fully how and why any product offered fitted the client’s needs. This virtually never happens. The adviser has already decided (long before he has even met the client – let alone carried out a fact find) – that he is going to flog him a bond from whichever life company is paying the highest commission. And this is how so many victims end up with useless insurance products from OMI, SEB, Generali, RL360, Friends Provident International, Hansard, Investors Trust etc.

Even if the client had specifically asked for – say – £100,000 worth of life cover, these “life” policies could never guarantee to provide that cover. In a proper, bona fide life assurance contract (where the client pays a monthly premium for the life of the policy) the pay-out is guaranteed. In these bogus life assurance policies, the value of the pay-out inevitably decreases as the charges eat into the fund. This is normally the case when disproportionately risky investments are made by the life offices.

Article 42 of the Private Insurance and Reinsurance Mediation Act, which refers to the information to be provided by the insurance intermediary prior to the conclusion of an insurance contract, provides:

“Before an insurance contract is concluded, the insurance intermediary must, as a minimum, provide the customer with the following information:

- a) The broker’s identity and address.

- b) The Register in which the broker is registered, as well as the means of verifying such registration.”

This rarely happens in practice – unless the broker is one of the very few professional and ethical firms in the expat world. An adviser might claim to be based in one jurisdiction, but could – in fact – be based in an entirely different one. “Passporting” is often misused as advisers “fly in under the radar” and provide advice in jurisdictions where they have no legal right to operate.

Insurance agents must inform the customer of the names of the insurance companies with which they can carry out the mediation activity in the insurance product offered.

Agents often have terms of business with more than one life office – but will rarely disclose the fact that some or all of them have a long history of facilitating financial crime internationally.

In order for the client to be able to exercise the right to information about the insurance entities for which they mediate, insurance agents must notify the client of the right to request such information.

I have never seen an instance of this happening – which is not to say it doesn’t happen. Just that I haven’t seen it. But then people don’t come to me when things are going swimmingly – they only come when they have lost some, most or all of their fund.

Banking and insurance operators must inform their clients that the advice given is provided for the purpose of taking out an insurance policy and not any other product that the credit institution may market.

And herein lies the problem: the advice is rarely provided for the purpose of taking out an insurance policy – the advice is usually given because the client wants his pension or life savings invested safely, prudently and profitably. Few – if any – clients come to the adviser to ask for a life assurance policy. But they get one, whether they need it – or can afford it – or not.

Insurance brokers must inform the client that they provide advice in accordance with the following obligations:

“Insurance brokers are obliged to carry out and provide (to the customer) an objective analysis on the basis of a comparison of a sufficient number of insurance contracts offered on the market for the risks to be covered. Brokers must do this so that they can formulate an objective recommendation.”

I have never seen an example of an adviser offering a client a selection of possible insurance contracts. The adviser has normally decided which life product he is going to flog long before the client even walks through the door. In a normal insurance contract relationship, it is the insurer which takes the risk. But in life bond contracts, it is the insured who takes the risk – i.e. that his life cover will be substantially lower than that originally contracted and that, indeed, his fund will be severely impaired by the costs of the contract.

On the basis of information provided by the customer, insurance intermediaries shall specify the requirements and needs of the customer, as well as the reasons justifying any advice they may have given on a particular insurance. The intermediary must answer all questions raised by the client regarding the function and complexity of the proposed insurance contract.

I have never seen this happen – which is not to say that it doesn’t happen. But the adviser could only explain to the customer that the sole purpose of the life bond is to pay him 8% commission. And that would inevitably spook the customer – so the adviser doesn’t bother. There will surely be all sorts of flim-flam about the life bond allegedly providing tax efficiency. However, any real tax savings will be resoundingly eclipsed by the high charges.

All intermediaries operating in Spain must comply with the rules laid down for reasons of general interest and the applicable rules on the protection of the insured, in accordance with the provisions of Article 65 of the Law on the Mediation of Private Insurance and Reinsurance.

I have never seen a single instance of an intermediary complying with the DGS rules in Spain or anywhere else. But that is because I only ever hear about cases where the clients suffer losses. The people who are well looked after by competent, professional, ethical brokers never bother contacting me – because they don’t need to! However, I would love to hear from advisers who do abide by the rules.

Every insurance intermediary is obliged, before the conclusion of the insurance contract, to provide full disclosure.

Never happens in my experience. The commission is normally concealed, and the inflexibility of the lock-in period is rarely explained. The victims usually only find this out after they have realised they have been scammed.

In the event that a mediator was an Insurance Broker or independent mediator, he is also obliged to give advice in accordance with the obligation to carry out an objective analysis.

Never happens in my experience. The adviser/mediator doesn’t use the life assurance product for life assurance, but as a bogus “wrapper” for holding investments. Therefore, the likely outcome of any objective analysis is very unlikely ever to be fulfilled.

This must be provided on the basis of the analysis of a sufficient number of insurance contracts offered on the market for the risks to be covered. The mediator can then formulate a recommendation, using professional criteria, in respect of the insurance contract that would be appropriate to the needs of the client.

I have never seen an instance of a mediator offering a selection of possible contracts – and there are no risks to be covered, as the insurer takes no risks. This is why these products have been deemed by the Spanish Supreme Court to be invalid. However, if a mediator were to offer a “selection” of life bonds, they would all be identical as they are all just as bad as each other.

In the case in question, there is no evidence that the aforementioned information was provided to the client before the investment product was contracted. Therefore, Article 42 of the regulations has been breached.

As it has in just about every instance I have ever seen in Spain – and beyond. In fact, one firm in Spain – Blevins Franks – only offers one insurance product and that is Lombard. This is completely illegal.

Therefore, this Claims Service concludes that the mediator must justify the information and prior advice given to his client, so that the obligations imposed by the Law of Mediation can be understood to be fulfilled with the aim of protecting the insured. Failure to comply with their obligations could be considered as one of the causes of the damage that would have occurred to their client.

I have never seen an instance of any firm complying with the obligations imposed by law in Spain. That doesn’t mean it doesn’t happen – and I would love to hear from firms who do comply with this law so that my knowledge can be broadened. However, if this does happen, it is only likely to be in the case of ethical firms, and they are unlikely to use these bogus life assurance policies anyway.

The claim is understood to be founded. In the opinion of this Claims Service, the mediating entity has committed a breach of the regulations regulating the mediation activity – specifically of the provisions of articles 6 and 42 of Law 26/2006 of Mediation of Private Insurance and Reinsurance.

The DGS requires the mediating entity to account to this Service, within a period of one month from the notification of this report, for the decision adopted in view of it, for the purposes of exercising the powers of surveillance and control that are the responsibility of the Ministry of Economy and Enterprise.

The entity – Continental Wealth Management – did not, indeed, comply with the DGS’ requirement. This now gives the green light for this firm and the directors and shadow directors associated with it – as well as the life office which was complicit in this scam – to be subject to criminal proceedings. The life offices, in this case, were complicit as they were effectively profiting from financial crime.

The interested parties are informed that there is no appeal to this judgment. Both the claimant and the mediating entity are made aware of their right to resort to the Courts of Justice to resolve any differences that may arise between them regarding the interpretation and compliance with the regulations in force regarding the mediation of private insurance and reinsurance, in accordance with the provisions of articles 24 and 117 of the Constitution.

THE DEATH OF THE LIFE BOND

I think it would be no understatement to say that this heralds the end of the mis-use and abuse of life bonds (also known as portfolio bonds or insurance bonds). Not just in Spain, but throughout Europe and beyond. This will be warmly welcomed by the thousands of victims who have lost their life savings to rogue insurance companies such as OMI, SEB, FPI and Generali, and unregulated scammers such as Continental Wealth Management.

The ethical sector of the financial advice industry will, of course, be delighted – and there will be a mad scramble by the rogues to find a way round this ruling. And they will fail.

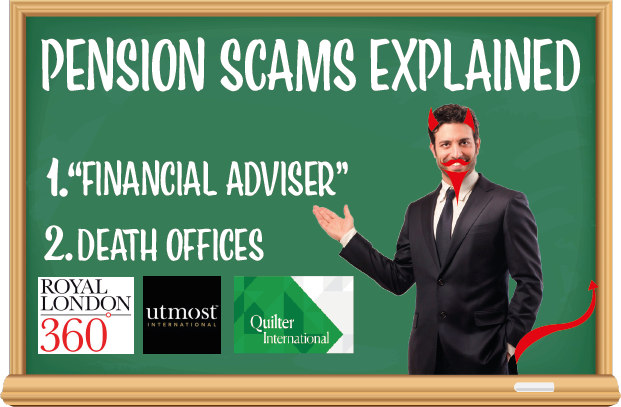

Fighting pension scams:

Fighting pension scams:  LCF Bond, Blackmore Bond, Blackmore Global Fund, LM, Axiom and Premier New Earth

LCF Bond, Blackmore Bond, Blackmore Global Fund, LM, Axiom and Premier New Earth

Serial

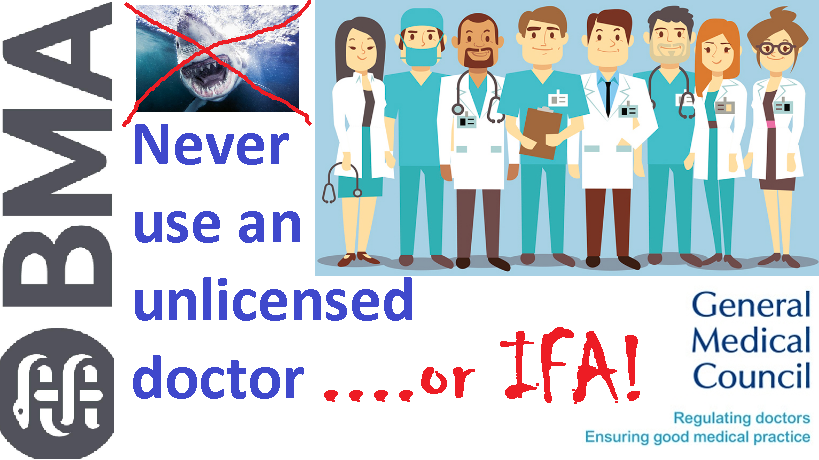

Serial  Firms that give unlicensed advice are breaking the law. Unlicensed advisers often use insurance bonds. These bonds pay high commissions. The funds these advisers use also pay high commissions. The advisers get rich. The clients get fleeced. The funds get destroyed. Insurance bonds such as

Firms that give unlicensed advice are breaking the law. Unlicensed advisers often use insurance bonds. These bonds pay high commissions. The funds these advisers use also pay high commissions. The advisers get rich. The clients get fleeced. The funds get destroyed. Insurance bonds such as  Unlicensed firms

Unlicensed firms  People can avoid being victims of

People can avoid being victims of

The Spanish Insurance Regulator – the DGS (Dirección General de Seguros y Fondos de Pensiones) – has made a most welcome judgment. This outlaws the mis-selling of bogus life assurance policies as investment “platforms” – aka “life bonds”.

The Spanish Insurance Regulator – the DGS (Dirección General de Seguros y Fondos de Pensiones) – has made a most welcome judgment. This outlaws the mis-selling of bogus life assurance policies as investment “platforms” – aka “life bonds”.

So popular is the use of life bonds among the seedier sector of the financial services industry, that multi-national firm

So popular is the use of life bonds among the seedier sector of the financial services industry, that multi-national firm

The work of the air industry regulators, investigators and safety trainers never ceases with all parties constantly striving to maintain the highest possible standards of performance and safety. And when something goes wrong, everybody swings into action like the A-team, International Rescue and Tom Cruise combined.

The work of the air industry regulators, investigators and safety trainers never ceases with all parties constantly striving to maintain the highest possible standards of performance and safety. And when something goes wrong, everybody swings into action like the A-team, International Rescue and Tom Cruise combined. But Vueling provide people like me (who end up wearing the same orange jumper and purple socks two days in a row) with an easy to use, online complaints and redress facility. It wasn’t Vueling’s fault that my luggage got lost, but they take responsibility for it anyway because it is part of the whole flight “package”.

But Vueling provide people like me (who end up wearing the same orange jumper and purple socks two days in a row) with an easy to use, online complaints and redress facility. It wasn’t Vueling’s fault that my luggage got lost, but they take responsibility for it anyway because it is part of the whole flight “package”.

If I give my car keys to someone who is so drunk they can barely stand up – and certainly can’t spell either OMI or IOM – and there is a serious accident, whose fault is it? The drunk’s or mine?

If I give my car keys to someone who is so drunk they can barely stand up – and certainly can’t spell either OMI or IOM – and there is a serious accident, whose fault is it? The drunk’s or mine?

Nitwit or Dragonfly? Gambling or Investing? Are investment losses as a result of a bad adviser or a bad investment? Or both? The real question is: how does the consumer tell the difference? A favourite episode of Fawlty Towers involved Basil’s ill-fated bet on a racehorse called Dragonfly. Confusion sets in – fuelled by the easily-confused Manuel – and “Dragonfly” gets muddled up with “Nitwit”. And that is how clients get confused just as easily: by advisers who spout the usual rubbish: capital protected; guaranteed returns; blue-chip investments; solid providers etc. They just leave out the three most important things: the fat commissions paid to the adviser; the high-risk nature of the “investment” and the fact that

Nitwit or Dragonfly? Gambling or Investing? Are investment losses as a result of a bad adviser or a bad investment? Or both? The real question is: how does the consumer tell the difference? A favourite episode of Fawlty Towers involved Basil’s ill-fated bet on a racehorse called Dragonfly. Confusion sets in – fuelled by the easily-confused Manuel – and “Dragonfly” gets muddled up with “Nitwit”. And that is how clients get confused just as easily: by advisers who spout the usual rubbish: capital protected; guaranteed returns; blue-chip investments; solid providers etc. They just leave out the three most important things: the fat commissions paid to the adviser; the high-risk nature of the “investment” and the fact that  And this guy is chartered! As a member of the CISI he should know better than to spout such rubbish – and I feel deeply sorry for any clients of Plutus Wealth Management as they are clearly in danger of being sold these toxic products. In fact, I would go further and suggest the public should be warned about the dangers of using this firm, as Coomber clearly has every intention of flogging his victims these high-risk products. If he is stupid enough to use them for his own gambling fun, good luck to him. But he has no right to inflict them on retail clients.

And this guy is chartered! As a member of the CISI he should know better than to spout such rubbish – and I feel deeply sorry for any clients of Plutus Wealth Management as they are clearly in danger of being sold these toxic products. In fact, I would go further and suggest the public should be warned about the dangers of using this firm, as Coomber clearly has every intention of flogging his victims these high-risk products. If he is stupid enough to use them for his own gambling fun, good luck to him. But he has no right to inflict them on retail clients. The term sheet did, to be fair, give a clear warning:

The term sheet did, to be fair, give a clear warning:

4. Insurance bonds are an expensive and unnecessary

4. Insurance bonds are an expensive and unnecessary  8. Time and time again, we see pension scam victims receiving the paperwork on the pension transfer ‘deal’ they have signed, only to realise that large fees and charges have been applied. The scammers are experts at hiding the charges and often quote the term: ‘free pension review’. Whilst they do not charge for all their visits and advice before you sign on the dotted line, they make up for this in transfer fees, commissions and often quarterly charges too! The quarterly charges will be applied no matter how your fund is doing. We have seen pension scam victims´ funds end up in negative equity due to being placed into an inappropriate fund which causes losses and second, continuing fees being applied. (Fees are normally based on the start value of the fund).

8. Time and time again, we see pension scam victims receiving the paperwork on the pension transfer ‘deal’ they have signed, only to realise that large fees and charges have been applied. The scammers are experts at hiding the charges and often quote the term: ‘free pension review’. Whilst they do not charge for all their visits and advice before you sign on the dotted line, they make up for this in transfer fees, commissions and often quarterly charges too! The quarterly charges will be applied no matter how your fund is doing. We have seen pension scam victims´ funds end up in negative equity due to being placed into an inappropriate fund which causes losses and second, continuing fees being applied. (Fees are normally based on the start value of the fund).

International Adviser and the Old Mutual International/Quilter Scams. Today’s jolly:

International Adviser and the Old Mutual International/Quilter Scams. Today’s jolly: International Adviser should hang its head in shame for failing to make sure that the perpetrators – especially Old Mutual International/Quilter – are brought to justice publicly for the destruction of hundreds of millions of pounds’ worth of life savings. And yet IA’s Old Mother Hubbard is consorting with them and giving Quilter’s Ryan Gardner a speaking slot on the

International Adviser should hang its head in shame for failing to make sure that the perpetrators – especially Old Mutual International/Quilter – are brought to justice publicly for the destruction of hundreds of millions of pounds’ worth of life savings. And yet IA’s Old Mother Hubbard is consorting with them and giving Quilter’s Ryan Gardner a speaking slot on the  ROLL UP! ROLL UP! ME HEARTY SCAMMERS! OMI’S LATEST

ROLL UP! ROLL UP! ME HEARTY SCAMMERS! OMI’S LATEST  So, what are you waiting for? You’ll earn 8% by selling your victims a useless OMI “PORTFOLIO” bond (don’t mention this is illegal in Spain) and then a further 8% from selling this toxic, high-risk BNP Paribas structured note (rubbish inappropriate structured product) which will tie your victims in for

So, what are you waiting for? You’ll earn 8% by selling your victims a useless OMI “PORTFOLIO” bond (don’t mention this is illegal in Spain) and then a further 8% from selling this toxic, high-risk BNP Paribas structured note (rubbish inappropriate structured product) which will tie your victims in for

First, let me explain a little more about what an IPO is:

First, let me explain a little more about what an IPO is:

If I were a potential investor in

If I were a potential investor in

Mark Coomber, Chartered MCSI Independent Financial Planner at Plutus Wealth Management