For over a decade, life offices (more accurately known as “death” offices) have been the centre of millions of pounds’ worth of destroyed pensions. So here we are going to name the top 3 worst life offices…

These are just some of the things they’ve been up to:

- Collaborating with scammers: unregulated, rogue firms posing as “advisory” firms

- Giving terms of business to firms run by people with criminal records for embezzlement, fraud, theft and proceeds of crime (as well as murderers, drug dealers and prostitutes)

- Paying hidden commissions to unlicensed, unqualified advisers with a long track record of scamming

- Accepting obviously forged investment dealing instructions from the scammers

- Reporting on huge losses in pension portfolios without warning the victims not to use the scammers responsible any longer

- Continuing to charge disproportionate fees even after the loss of half or more of the pension. (There are, in fact, some victims whose entire portfolios have been destroyed – but the death offices keep on applying their charges long after there is nothing left)

- Offering high risk, toxic investments paying huge commissions to unqualified advisers and scammers on their investment platforms

- Failing to disclose the secret commissions paid to the scammers

- Failing to treat investors as “retail” or unsophisticated investors

- Failing to obtain confirmation from the victims that they understand the risks involved in both the insurance bonds and the toxic investments – which are only suitable for professional investors

In fact, much of what these death offices have been up to is outright fraud. The public needs to be warned. The existing victims are suffering terribly – dealing with poverty and extreme distress. Some of them are dying; some of them have died – killed by the death offices’ and the scammers they do business with.

The most important thing of all is to try to prevent further victims. But this is difficult because so many scammers are still aggressively selling their victims these toxic, unnecessary and expensive death bonds. Also known as “portfolio bonds”, “offshore bonds” and “wrappers”, these products pay the scammers huge commissions which are hidden from the victims.

So who are the three worst offenders:

Number 3. Friends Provident International – based in the Isle of Man and run by David Kneeshaw – Executive Director and Group Chief Executive Officer. Kneeshaw also runs RL360 – another death office – which bought Friends Provident International a couple of years ago for a quarter of a billion pounds. Friends Provident International has a long history of investing its victims’ life savings and pensions in toxic, risky funds such as Axiom Legal Financing, LM Managed Performance, Premier New Earth, Premier Eco Resources, and Kijani . These investments were high risk and unregulated as well as only suitable for sophisticated or professional investors.

Number 2. Generali (now known as Utmost International) – based in Guernsey and with the head office in London. Utmost has terms of business with the worst of the scammers in the advisory community – paying the illegal, secret and abusive commissions and featuring the worst of the highest-risk investments (including structured notes with a risk to the investor of total loss). Run by Paul Thompson – who claims to have over 30 years of industry experience as an investment banker. Generali – or Utmost – has a track record even worse than Friends Provident International’s. The same secret commissions are paid to the same scammers – with the same result – crippling losses, poverty, misery – and even death for the victims.

Number 1. Old Mutual International (now known as Quilter International) – Based in the Isle of Man and the Republic of Ireland, this death office used to be run by Peter Kenny who was a former Isle of Man regulator. But being a former regulator didn’t stop Kenny from doing business with the worst of the unlicensed pension scammers and allowing them to forge signatures on investment dealing instructions. Being a former regulator didn’t stop Kenny from paying out millions in illegal commissions to the dross of the offshore financial services community – for illegally-sold death bonds and unregulated investments and structured notes. Quilter International was sold to Utmost International last year (2021) for nearly half a billion pounds. Because there’s money in misery; there are fortunes to be made out of trading with criminals; there are huge profits to be made out of contravening pretty much all of the EU regulations.

All of the worst three life/death offices are still doing a roaring trade. Business has returned to pre-pandemic levels. Europe is their biggest market – with many of their victims based in Spain, Italy, Germany and other expat countries.

International Adviser – the advertising and marketing rag for the death offices – reported last week that not only was business booming for the death offices, but was now exceeding pre-pandemic levels. In 2020 they wrote £58 billion worth of business. And in 2021 it was £68 billion.

Fighting pension scams:

Fighting pension scams:  LCF Bond, Blackmore Bond, Blackmore Global Fund, LM, Axiom and Premier New Earth

LCF Bond, Blackmore Bond, Blackmore Global Fund, LM, Axiom and Premier New Earth

Serial

Serial  Firms that give unlicensed advice are breaking the law. Unlicensed advisers often use insurance bonds. These bonds pay high commissions. The funds these advisers use also pay high commissions. The advisers get rich. The clients get fleeced. The funds get destroyed. Insurance bonds such as

Firms that give unlicensed advice are breaking the law. Unlicensed advisers often use insurance bonds. These bonds pay high commissions. The funds these advisers use also pay high commissions. The advisers get rich. The clients get fleeced. The funds get destroyed. Insurance bonds such as  Unlicensed firms

Unlicensed firms  People can avoid being victims of

People can avoid being victims of

n the news again is the troubled Blackmore Group. This time we read that they have ‘temporarily’ closed their bond – the Blackmore Bond – to new business. Just a few weeks ago, Blackmore Bond changed the wording of the sales material on this product.

n the news again is the troubled Blackmore Group. This time we read that they have ‘temporarily’ closed their bond – the Blackmore Bond – to new business. Just a few weeks ago, Blackmore Bond changed the wording of the sales material on this product. Another questionable investment from the Blackmore Group is the

Another questionable investment from the Blackmore Group is the

In every pension scam there is one beginning, lots of middles, and always a wretched ending for the victim and a profitable ending for the scammers. The beginning is always a negligent, lazy, box-ticking transfer by a ceding provider – the worst of which always tend to be the likes of

In every pension scam there is one beginning, lots of middles, and always a wretched ending for the victim and a profitable ending for the scammers. The beginning is always a negligent, lazy, box-ticking transfer by a ceding provider – the worst of which always tend to be the likes of

Another high-risk investment fund goes belly up. London Capital & Finance (LCF) has gone into administration, not long after taking a whopping £236m of investments – much of which was from first-time investors. It is thought that 12,000 investors have been financially ruined.

Another high-risk investment fund goes belly up. London Capital & Finance (LCF) has gone into administration, not long after taking a whopping £236m of investments – much of which was from first-time investors. It is thought that 12,000 investors have been financially ruined.

Michael Andrew Thomson, known as Andy Thomson, took over as the boss of LCF in 2015 and is also director of horse riding company GT Eventing. He and Careless are under investigation over the mis-selling of this bond and their connection to the other companies invested in. However, Careless claims he has only carried out marketing practices that were requested of him and his 25% commission fee is in line with market averages.

Michael Andrew Thomson, known as Andy Thomson, took over as the boss of LCF in 2015 and is also director of horse riding company GT Eventing. He and Careless are under investigation over the mis-selling of this bond and their connection to the other companies invested in. However, Careless claims he has only carried out marketing practices that were requested of him and his 25% commission fee is in line with market averages. nfortunately, it took the FCA a further

nfortunately, it took the FCA a further

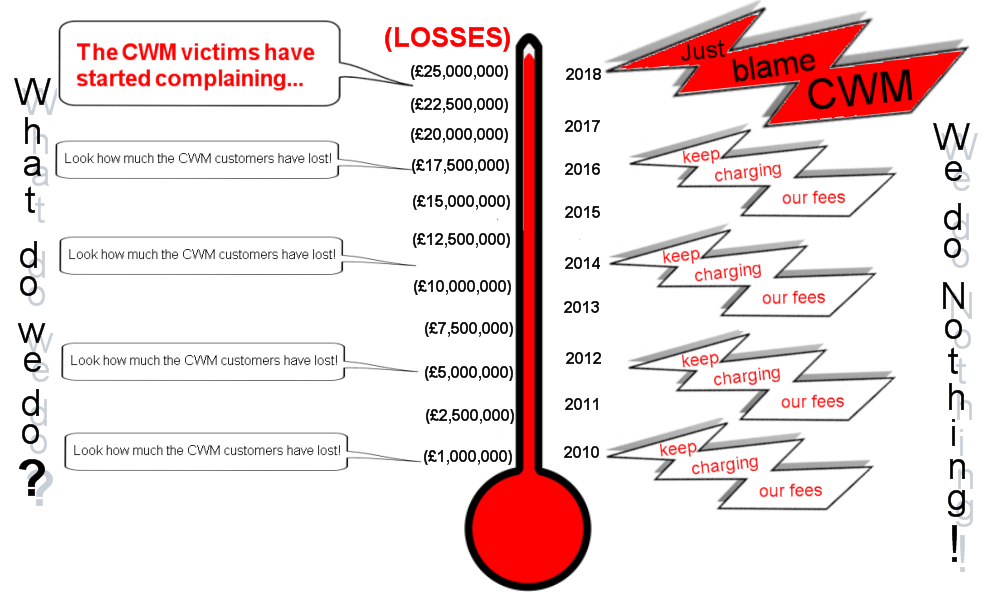

Please note these figures are correct as at 2017/2018, so today’s value is now even lower. Despite the funds’ huge decrease in value, Generali continues to take their fees (based on the original amount deposited – not the current depleted value). Therefore, these amounts will continue to fall AND despite the massive loses be locked in for a fixed term.

Please note these figures are correct as at 2017/2018, so today’s value is now even lower. Despite the funds’ huge decrease in value, Generali continues to take their fees (based on the original amount deposited – not the current depleted value). Therefore, these amounts will continue to fall AND despite the massive loses be locked in for a fixed term. Generali are not the only life office guilty of financial crimes: Old Mutual International and SEB were even worse – facilitating losses on a massive scale in the Continental Wealth Management case. OMI bought £94,000,000 worth of ultra-high-risk structured notes for retail investors – resulting in huge losses. Old Mutual was also heavily involved in more than £1,000,000,000 worth of losses in the Axiom, LM and Premier investment scams.

Generali are not the only life office guilty of financial crimes: Old Mutual International and SEB were even worse – facilitating losses on a massive scale in the Continental Wealth Management case. OMI bought £94,000,000 worth of ultra-high-risk structured notes for retail investors – resulting in huge losses. Old Mutual was also heavily involved in more than £1,000,000,000 worth of losses in the Axiom, LM and Premier investment scams.