Just as predicted, the scammers have managed to sidestep the cold-calling ban on pension selling by using a slightly different tactic. No surprise there then. Just as they morphed from pension liberation into high commission investments, it was only a matter of time – well just two weeks to be precise – before a firm called Cadde Wealth Management approached the matter from a different angle. There really is no escape from the cold-calling snake-oil salesmen: lawless, shameless and – unfortunately – quick-witted.

Just as predicted, the scammers have managed to sidestep the cold-calling ban on pension selling by using a slightly different tactic. No surprise there then. Just as they morphed from pension liberation into high commission investments, it was only a matter of time – well just two weeks to be precise – before a firm called Cadde Wealth Management approached the matter from a different angle. There really is no escape from the cold-calling snake-oil salesmen: lawless, shameless and – unfortunately – quick-witted.

City Wire report that they have seen emails from Adviser Breakthrough on the success of their new pitch. The email reports that appointments had been made for Cadde Wealth Management for pensions advice through cold calling. The firm’s chief executive, Paul Cadde, is also the chief executive of Adviser Breakthrough.

The advice is that they can continue to cold call as long as the intro to the call doesn’t mention “pension advice”. Instead, they are calling and asking if the call receiver needs reviews of ISAs, bonds, cash, unit trusts and any other investments. It seems that these calls can then follow along the lines of the conversation drifting towards the cold-call receiver wanting pension advice. Thus the cold caller can claim they are not cold calling about pensions, but can offer advice in pensions as an after thought.

Oh, how so smart of these silver-tongued, evil con men. They worm their way into people’s heads and finances with a change of script, to escape the new laws. All it seems we can do here in the Pension Life office is sit here wincing and waiting for news of the next big pension scam. Our senses tell us that there is bound to be a rise in QROPS and SIPPS pension scams.

We can see the way these cold calls will work:

We can see the way these cold calls will work:

Cold calling snake, “Hi, I’m calling to see if you would like a free review on the performance of any ISA’s you own?”

Call victim, “Well, I’m currently very happy with my ISA’s performance, but I am a little worried about my pension plan. Can you help me with my pension?“

Cold calling snake, (rubbing his scales together in glee at the free ride) “I certainly can.”

Bish, Bash, Bosh, the cold-calling snake didn’t call directly regarding pensions advice; the receiver actively asked for it. Therefore, the cold- calling snake committed no offence. Our advice in regards to cold calling is – and always will be – the same: just hang up.

I wouldn’t be surprised if these snake-oil salesmen could master a technique whereby they start off offering double glazing and turn the call into a pension scam call!

Regular readers know how much we love researching financial advisory firms so here goes on Cadde Wealth Management.

Cadde Wealth Management have a TrustPilot score of 7.4 and three and a half stars. However, they have only had one reviewer, so we can’t really trust that!

On to their website – https://www.cadde.co.uk/ – Growing and preserving family finances since 1985.

Run by a feller named Paul Cadde – who apparently qualified as a financial adviser in 1985. We were deeply disappointed to find that he had no registered membership with the CII or the CISI. If you are unsure on what these are please check out our qualified and registered blog.

Not really a great start for Cadde Wealth Management: not only is Mr. Cadde happy to ignore the cold calling ban, but he is also unqualified and unregistered to give financial advice! Also listed on their financial team: Peter Staple, Wyn Matthews, Graham Dragon, Nikki Cadde and Katy Comber. None of these team members are listed on any of necessary financial institutes’ websites’ registers. They also mention Henry the dog: I would suggest he is probably the most honest member of the office!

So, the advice we give is simple: “cold called by a firm called Cadde Wealth Management? Just hang up!”

A firm with advisers who are unwilling to answer all of the questions you ask them is clearly a firm to be avoided.

A firm with advisers who are unwilling to answer all of the questions you ask them is clearly a firm to be avoided.

In January 2019, we saw legal challenges going forward against not one but two SIPPS providers for their roles in using and promoting unregulated investments. Berkeley Burke SIPPS Administration and Carey Pensions (the latter now owned by rogue QROPS trustee firm STM Group).

In January 2019, we saw legal challenges going forward against not one but two SIPPS providers for their roles in using and promoting unregulated investments. Berkeley Burke SIPPS Administration and Carey Pensions (the latter now owned by rogue QROPS trustee firm STM Group). Tighter protocols on pension investments are something that we would happily welcome here at Pension Life. With higher standards of compliance and fewer small providers, people investing their pensions into SIPPS should hopefully have a clearer and safer picture.

Tighter protocols on pension investments are something that we would happily welcome here at Pension Life. With higher standards of compliance and fewer small providers, people investing their pensions into SIPPS should hopefully have a clearer and safer picture.

Furthermore, if someone does approach you via a cold call claiming to be a viable company with a convincing sales pitch – how do you know if what they are saying is genuine? How do you know if they are a

Furthermore, if someone does approach you via a cold call claiming to be a viable company with a convincing sales pitch – how do you know if what they are saying is genuine? How do you know if they are a

In many pension scam cases, we find victims telling us that they were

In many pension scam cases, we find victims telling us that they were  So how does this illicit commission work? And how do the hidden charges damage a victim’s fund?

So how does this illicit commission work? And how do the hidden charges damage a victim’s fund? The only way forward is to go fee-based. And to outlaw commissions and hidden charges altogether. The scammers won’t do it – but decent, ethical firms will. The hard part will be to warn expats against vultures. Ethical firms will help with this initiative. Obviously, the scammers won’t.

The only way forward is to go fee-based. And to outlaw commissions and hidden charges altogether. The scammers won’t do it – but decent, ethical firms will. The hard part will be to warn expats against vultures. Ethical firms will help with this initiative. Obviously, the scammers won’t.

Worrying isn´t it? Offshore companies can try to claim they are international financial advisers, but actually be unregulated and unqualified to carry out the very service they offer! The “advisory” firms have flash websites, and some have several offices around Europe and beyond. Their PR is great at scaremongering expats about their pension investments in the lead up to Brexit.

Worrying isn´t it? Offshore companies can try to claim they are international financial advisers, but actually be unregulated and unqualified to carry out the very service they offer! The “advisory” firms have flash websites, and some have several offices around Europe and beyond. Their PR is great at scaremongering expats about their pension investments in the lead up to Brexit.

Know all the correct questions to ask an adviser before you sign on the dotted line.

Know all the correct questions to ask an adviser before you sign on the dotted line.  How much will the fees and charges be? Remember NO pension transfer is free.

How much will the fees and charges be? Remember NO pension transfer is free.

SCAMMER JAILED! Hip hip hooray! we say. What a great start to the new year. Neil Bartlett, 53, of Delamere Road, Ainsdale, used £4.5m of his victims’ money to fund an extravagant lifestyle of foreign travel, top hotels and gambling.

SCAMMER JAILED! Hip hip hooray! we say. What a great start to the new year. Neil Bartlett, 53, of Delamere Road, Ainsdale, used £4.5m of his victims’ money to fund an extravagant lifestyle of foreign travel, top hotels and gambling.

AND to rub salt into the wounds of the Trafalgar victims,

AND to rub salt into the wounds of the Trafalgar victims,  In follow up to our blog ´

In follow up to our blog ´

A quick google search of cold call gives untold amounts of advice on how to do it efficiently in 2019! Whilst some of these companies aren´t UK based, the evidence is clear. Cold calling pays and the companies that benefit from cold calling are not going to suddenly stop making them.

A quick google search of cold call gives untold amounts of advice on how to do it efficiently in 2019! Whilst some of these companies aren´t UK based, the evidence is clear. Cold calling pays and the companies that benefit from cold calling are not going to suddenly stop making them. FT adviser published an article entitled,

FT adviser published an article entitled,  To my relatively informed eye, it was obvious these were scam emails, but the offer of money back from

To my relatively informed eye, it was obvious these were scam emails, but the offer of money back from  So, as we cannot count on our government to protect us from the cold calling scams, Pension Life is here to help.

So, as we cannot count on our government to protect us from the cold calling scams, Pension Life is here to help.

Berkeley Burke SIPPS – A SLIP OF THE TICK WITH THE SIPPS

Berkeley Burke SIPPS – A SLIP OF THE TICK WITH THE SIPPS I dread to think how much the lazy, negligent ceding trustees spend on pencils every year for ticking boxes, and blindfolds for making sure the transfer admin staff don’t ever see the scam warnings. The worst performers are always the same old same old names:

I dread to think how much the lazy, negligent ceding trustees spend on pencils every year for ticking boxes, and blindfolds for making sure the transfer admin staff don’t ever see the scam warnings. The worst performers are always the same old same old names:

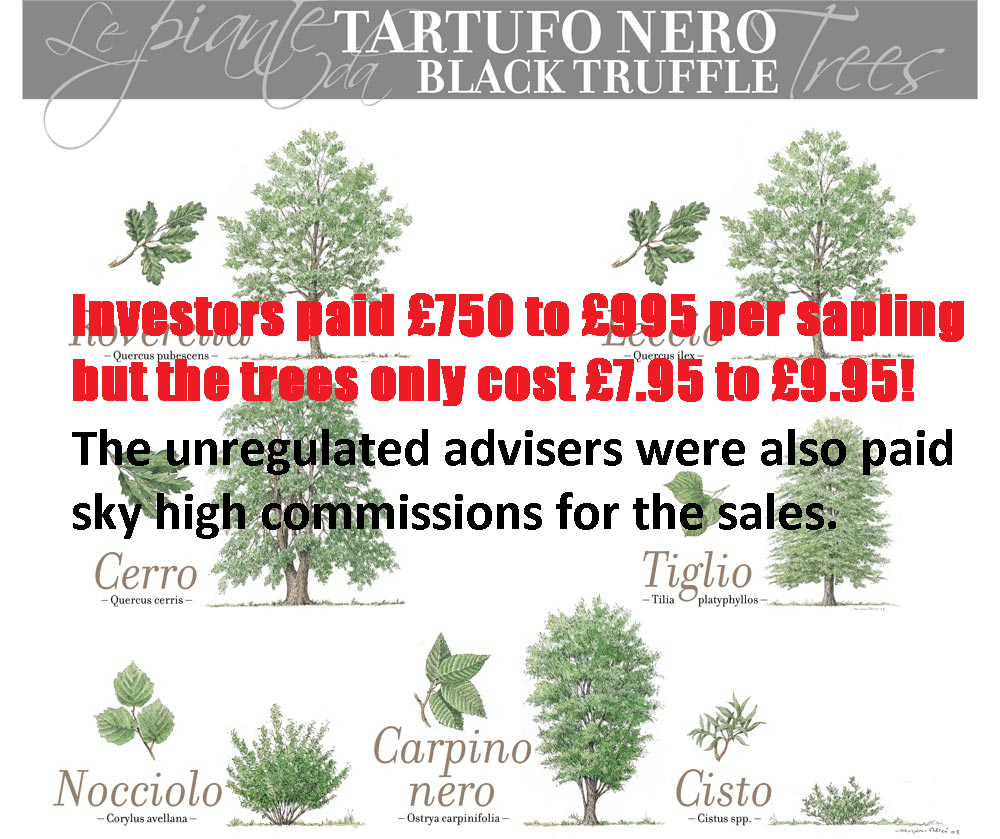

This could possibly be described as wonderful news for the victims of Viceroy Jones New Tech Ltd, Viceroy Jones Overseas PCC Limited, Westcountrytruffles Limited, Truffle Sales Ltd and Credit Free Limited. Or maybe not. The whereabouts of the funds is unknown. This pension liberation and investment scam saw 100 investors conned out of £9m of their pension savings.

This could possibly be described as wonderful news for the victims of Viceroy Jones New Tech Ltd, Viceroy Jones Overseas PCC Limited, Westcountrytruffles Limited, Truffle Sales Ltd and Credit Free Limited. Or maybe not. The whereabouts of the funds is unknown. This pension liberation and investment scam saw 100 investors conned out of £9m of their pension savings.

However, I feel I have to disagree.

However, I feel I have to disagree. Winding up these companies is often of little help to the scam victims. What is left of their funds (if any) is passed on to another trustee (often Dalriada) to deal with the ‘clean up’. This action, however, is not without cost and often the funds just sit there doing nothing.

Winding up these companies is often of little help to the scam victims. What is left of their funds (if any) is passed on to another trustee (often Dalriada) to deal with the ‘clean up’. This action, however, is not without cost and often the funds just sit there doing nothing.

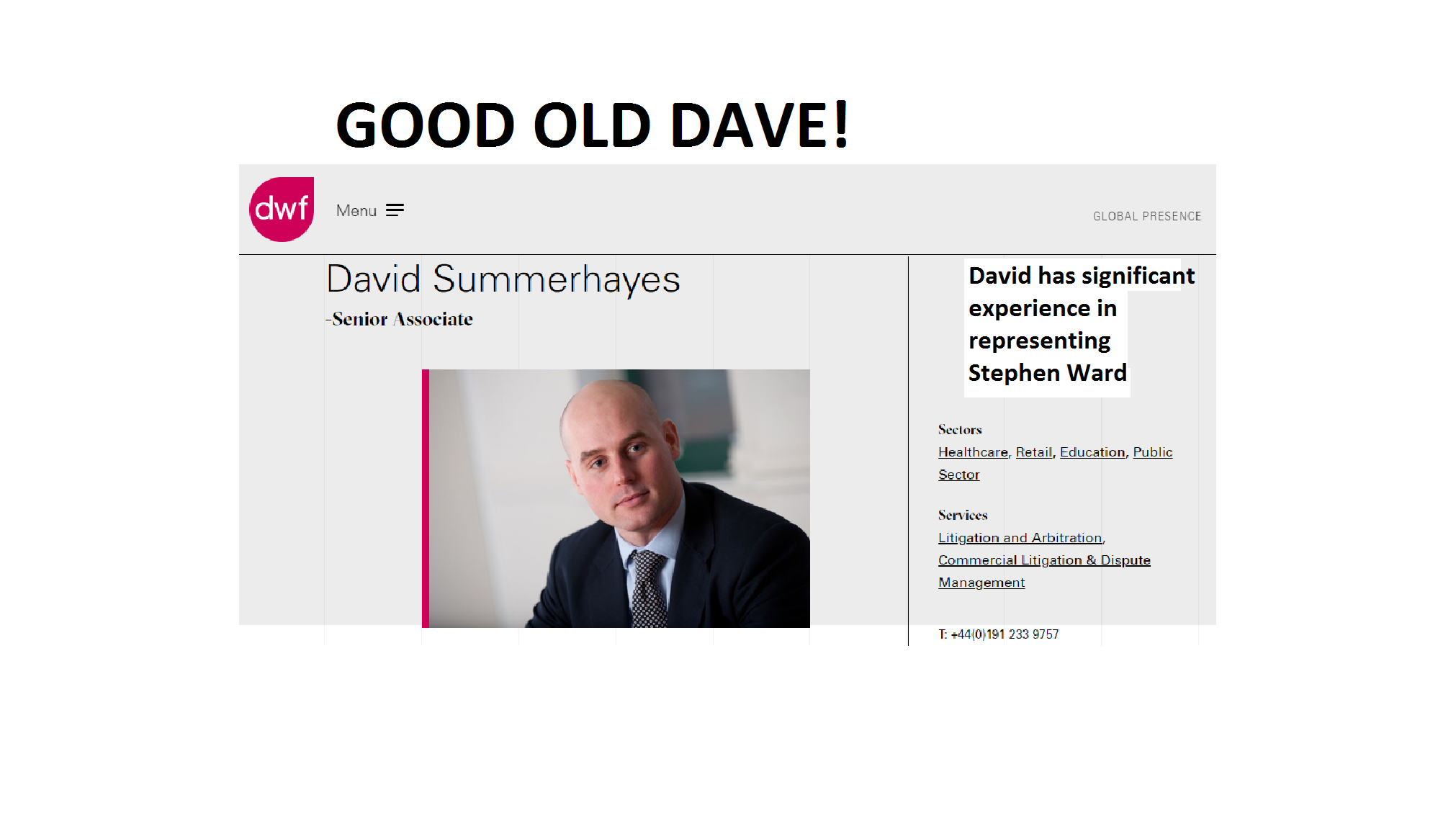

DWF’s clever PR chaps have come up with some impressive words to sell this law firm’s services: “We connect expert services with innovative thinkers across diverse sectors wherever our clients do business.”

DWF’s clever PR chaps have come up with some impressive words to sell this law firm’s services: “We connect expert services with innovative thinkers across diverse sectors wherever our clients do business.” “We act on behalf of

“We act on behalf of  Moving forward to 2018, we now have the announcement that DWF is acting for the

Moving forward to 2018, we now have the announcement that DWF is acting for the  So just to show Dave Summerhayes there are no hard feelings about his unfriendly threats to me back in 2014, I’m going to give DWF a few friendly hints as to how they might approach their case in the High Court in April 2019. I’m going to be generous because I wouldn’t want them to look silly – so here are some points they might want to mention to the judge:

So just to show Dave Summerhayes there are no hard feelings about his unfriendly threats to me back in 2014, I’m going to give DWF a few friendly hints as to how they might approach their case in the High Court in April 2019. I’m going to be generous because I wouldn’t want them to look silly – so here are some points they might want to mention to the judge: