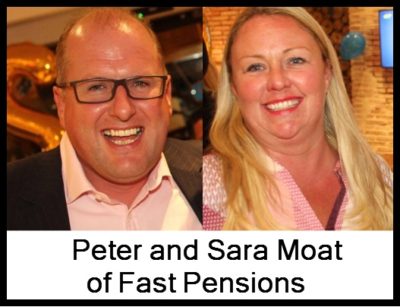

Fast Pensions – Slow Law Enforcement – Stationary Regulators – same old, same old. Looks like the embarrassment of our hopeless, lazy and impotent regulators and limp law enforcement when it comes to financial crime has struck yet another blow for justice and another goal for the scammers in this case the Moats of Fast Pensions.

his case the Moats of Fast Pensions.

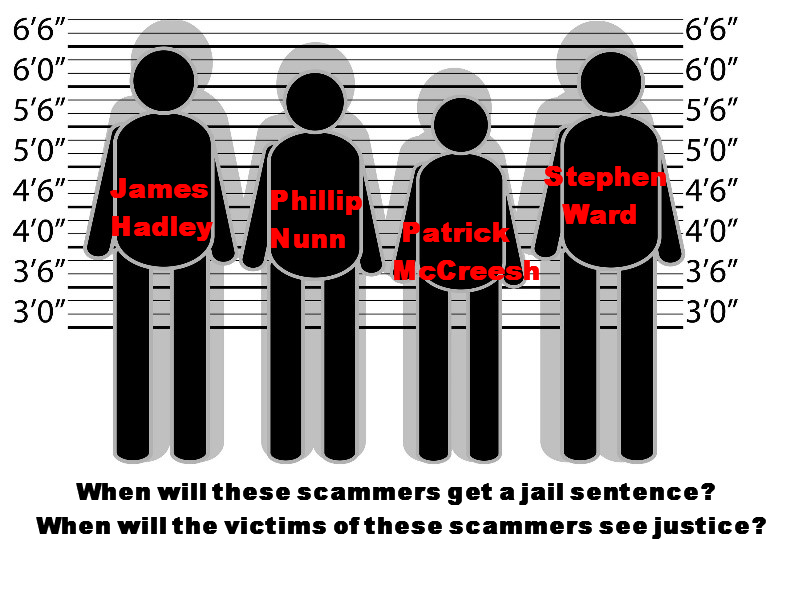

The Fast Pensions scam couldn’t have been much more obvious: a known scammer – Peter Moat of Blu Debt Management (one of the promoters of the Ark Pension scam and associate of Stephen Ward) had set up a very clumsy pension liberation scam. It was loosely modeled on Ward’s Ark scam, but as Moat was clearly nowhere near as intelligent and crafty as Ward, it was screamingly obvious from square one that it was an outright fraud.

The Fast Pensions scam couldn’t have been much more obvious: a known scammer – Peter Moat of Blu Debt Management (one of the promoters of the Ark Pension scam and associate of Stephen Ward) had set up a very clumsy pension liberation scam. It was loosely modeled on Ward’s Ark scam, but as Moat was clearly nowhere near as intelligent and crafty as Ward, it was screamingly obvious from square one that it was an outright fraud.

In fact, if you think about how the Moats got this scam got off the ground, it was the usual routine:

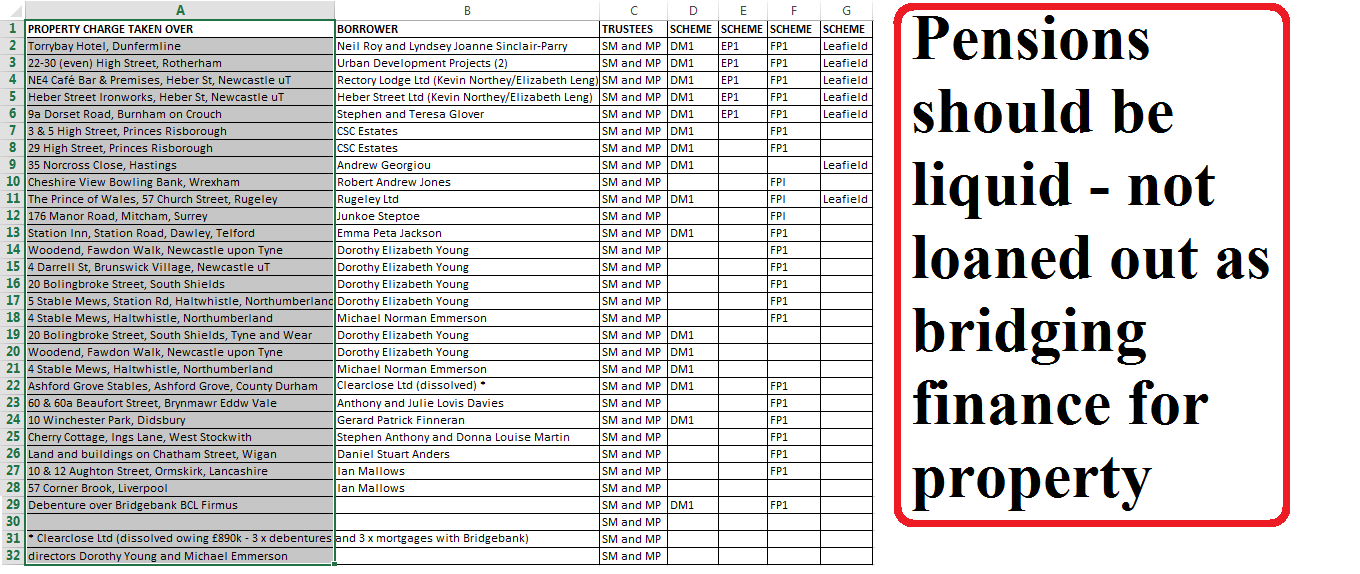

- HMRC registered 15 occupations pension schemes (whereas with Ark it was 14)

- The sponsoring employer had never traded, nor had any prospect of ever trading or employing anyone

- The trustee firm, FP Scheme Trustees, had a sole director: Jane Wright. A young woman who worked as Peter Moat’s bookkeeper – with no experience in being a pension trustee and was only paid to be a “stooge” to keep Peter Moat’s name out of the scheme

- Peter Moat’s main business was loans – personal and bridging

HMRC and the Pensions Regulator did nothing to check this obvious scam out. All the might of Britain’s regulators and law enforcement stood by while, courtesy of the Moats, more than 400 people were defrauded out of their life savings – FAST PENSIONS – SLOW LAW ENFORCEMENT – STATIONARY REGULATORS.

Between November 2016 and May 2017, there were 18 complaints by Fast Pensions victims to the Pensions Ombudsman. All 18 were upheld. It was clear from the complaints and the Ombudsman’s determinations that the scheme was a scam and that the Moats, Peter and his wife Sara, were out and out fraudsters.

Still, neither the regulators nor law enforcement agencies lifted a finger to stop the Moats: FAST PENSIONS – SLOW LAW ENFORCEMENT – STATIONARY REGULATORS, is the basis of this case.

Still, neither the regulators nor law enforcement agencies lifted a finger to stop the Moats: FAST PENSIONS – SLOW LAW ENFORCEMENT – STATIONARY REGULATORS, is the basis of this case.

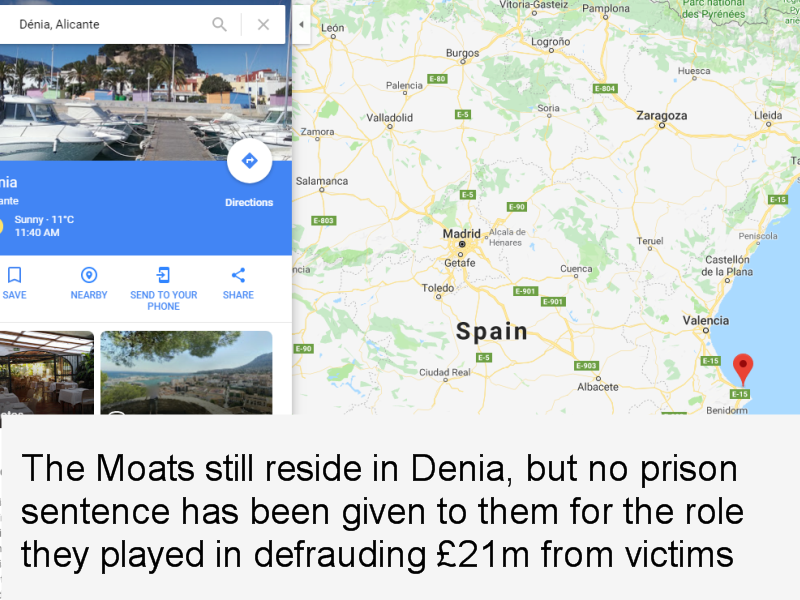

The Moats remain living in luxury in their palatial villa in Javea on the Costa Blanca – driving around in their flash cars. What paid for this gorgeous lifestyle was £millions stolen from innocent, hard-working British citizens – while the callous, lazy, impotent regulators and law-enforcement agencies stood by and watched.

As the great parliamentarian Edmund Burke said, “The only thing necessary for the triumph of evil is for good men to do nothing.” In my humble view, what is even worse is for hopeless and uncaring men to do worse than nothing: to pretend to be good men.

On this sad and disgusting topic, I will write no more – but leave this blog’s words to the son of one of the victims who attended the High Court hearing in the matter of the winding up petition by the Insolvency Service against Peter and Sara Moat, Fast Pensions, FP Scheme Trustees, the 15 bogus occupational pension schemes and Moat’s various loan companies.

Fast Pensions Victim

Vs

Fast Pensions Ltd.

Claimant: Fast Pensions Victim

(Fast Pensions Ltd DM1 Scheme member)

Defendant:

Fast Pensions Ltd

Manchester Court of Justice

Date: 30th May 2018 Time: 14:00.

Case Reference: Claim No XXXX of 2018.

Case:

In 2012 my father had a personal pension fund which had accumulated to over £XXXX as a result of him working hard and saving over a number of years.

In September of that year my father took a “cold call” from a gentleman representing a

consultancy firm called Capital Consulting. He was informed that by transferring his pension funds from the existing scheme to another pension scheme he would benefit in as much that he could withdraw 25% of his pension fund (tax-free) on the transfer and sign up to a Five-Year Fixed

Plan giving my father a fixed 5% bonus each year over the 5 years, and at the end of the 5

years could have a payout without any fixed penalties.

My father thought through this proposal, as there had been and still were serious issues with the Equitable regarding pension schemes, so my father arranged to have a home visit from Capital Consulting.

He listened to their proposals and then decided to accept the proposal. My father signed into the DM1 Retirement Plan on the 4th. October 2012, the administrators were to be AC. Management & Administration Ltd, who at that time were based in Gorseinon, South Wales. A sum of over £XXXX was then transferred into the ACMA Client Account of Barclays Bank Cardiff.

On the 26th October 2012 my father received a letter from a Jane Wright (Pension

Processor) stating that the 5 Year Plan had now started with Fast Pensions. Soon after signing up to the scheme some of the initial promises of the scheme did not materialise so my father made numerous phone calls on the one phone no. that was available 08453730569 which would transfer onto answerphone on most occasions.

My father’s main concern related to the following. “We have just recently developed a client

login area and this should be available shortly. This will enable you to track your pension.”

My father phoned regarding this facility and on the few occasions he managed to receive an

answer he spoke to Jane Wright who stated that there was IT issues but it would be up and

running shortly. My father is still waiting.

My father received annual statements for his DMI Retirement Plan for 2013/2014/2015.

My father did not contact Fast Pensions Ltd again until June 2015, when he applied

for a Flexi Drawdown Payment of £XXXX. The drawdown application was made on the 20th

June 2015. Legislation had been introduced in April 2015, whereby a member of a pension

scheme had the option of using this legislation to withdraw an amount from their pension

fund, so my father took up this option from Fast Pensions.

The drawdown application was made on the 20th June 2015. It was eventually paid out as

two payments. The first payment of £XXXX was paid in October 2015 as an interim payment

and the balance was paid on the 9th November 2015.

There are number of reasons why this took so long and for the money to be received. The

main reason was the total lack of communication from Fast Pensions.

Fast Pensions Ltd had, as already mentioned, one contact number which was an 0845

number which would obviously cost more than the standard rate to call often to be met by

an answering machine, and incidentally cost my father a large amount of money. When my

father did manage to succeed, it was from a Paul Bennett (Pension Administrator) who was

so unhelpful and uncooperative towards my father’s questions. He would often be met with

“I will have to speak to my manager Mr Gary Henderson and get him to come back to you”

During these months I personally spoke to Paul Bennett as he would often ignore calls from

my father’s mobile and found if I called from a withheld number he would accept the call. I

personally found Mr Bennett to be constantly unable to answer questions often just finding

excuses to the questions in which he was presented with. Mr Bennett on one occasion told

me he could not speak to me as I was not the policy holder. Mr Bennett was provided with a

letter of authority from my father to enable me to act on his behalf.

Owing to the lack of responses, my father asked Paul Bennett for Mr Henderson’s email or

telephone number but was told” it was not company policy to issues clients with direct

contact details.”

Throughout the period of time dealing with Mr Bennett there would be long delays between

his emails and responses so again adding to a further delay of dealing with the drawdown

application.

My father was asked to return the completed application forms to the registered address in

London (being a “virtual address”). He duly sent the paperwork to this address to have it

returned to sender, so my father sent it again, this time by recorded delivery which was also

returned by the Royal Mail stating “no one is available to sign for it”. My father actually

spoke to Head of Operations at the Westminster sorting office to verify this. Mr. Bennett on

the rare occasion my father actually spoke to him, stated there had been problems but had

now been rectified. It certainly had not.

This was further evidence of a total breakdown of communication and excuses for not

dealing with my father’s request. Eventually Mr Bennett responded to this issue and issued

the forms again which were this time sent by e-mail. My father was then informed by Mr

Bennett that he had missed the deadline for the end of August pay run and he would not

receive it that month. The delays were simply down to lack of cooperation and

communication from Mr Bennett and Fast Pensions Ltd. At this point Fast Pensions paid an

interim payment of £XXXX as my father had repeatedly told Paul Bennett that he was

struggling financially.

He was later quoted by Mr Bennett that the balance of the drawdown payment would reach

his account by 30th September 2015, not surprisingly this did not happen. He did although

receive a payment slip with the current amounts of the drawdown, £XXXX gross and

£XXXX net. My father received the notification from the HMRC that Fast Pensions Ltd had

informed them of the payment, which my father finally received in full as already mentioned

by the 9thNovember 2015. I will point out at this time, that this transaction to the HMRC will

have been completed with an RTI. Note what occurs when Fast Pensions try to send the RTI

for the second drawdown payment.

On several occasions my father requested an explanation and apology for the total lack of

communication, payment delays, mal-administration, and mismanagement from Fast

Pensions Ltd. This was never received.

Owing to the serious issues concerning Fast Pensions my father decided to seek advice from

an independent regulated Financial Advisor. They highlighted various issues, including the

way the transfer from the Equitable to Fast Pensions had been organised.

At this time my father requested the paperwork from both Fast Pensions Ltd and the

Equitable Life regarding the transfer of funds. One of the main questions which came out of

the independent advice and requested from Fast Pensions Ltd was details of the pension

fund and the fund portfolio. My father never received this information.

Over the previous few months the worry, financial distress and health issues caused by Fast

Pensions Ltd was having an effect on my father, so he took a break before he applied for his

next drawdown payment.

On the 29th January 2016 my father contacted Fast Pensions Ltd to apply for his next

drawdown. He requested the payment after the 5th April 2016. This was to give Fast Pensions

enough time to process the application and fall into the 2016/2017 tax year.

At this point we were aware of Fast Pensions Ltd being under investigation by South Wales

Fraud Squad. My father had provided South Wales Fraud Squad with several pieces of

evidence in relation to his dealings with Fast Pensions Ltd.

In February 2016 my father received several emails from Paul Bennet quoting that the

request was received and would be processed, but it was becoming evident that from the

end of February 2016, there was no answer from Fast Pensions Ltd and all communication

ceased. No emails or telephone calls were received from Mr Bennett from the end of

February 2016. On 23rd March 2016, my father received an email from DC. Andy Holmes of

the Economic Crime Unit who informed my father that Paul Bennett had terminated all links

with Fast Pensions Ltd and had left at the end of February 2016.

Mr. Bennett had quoted on his LinkedIn profile that he was employed by a company called

Jackson Wood from August 2014 until February 2016. (No mention of Fast Pensions) I then

decided to enquire about Jackson Wood Ltd and found a familiar name as the Director. Mr

Ian Stuart Chapman, who is also the director of

– Umbrella Loans. (07331044)

– Blu Financial Services Ltd. (05912973)

– Blu Debt Management (06699233)

My father was later made aware by DC Andy Holmes (Economic Crime Unit, Wales) that

Paul Bennett had been helping with enquiries in relation to Fast Pensions Ltd. He also

informed my father that Paul Bennet had left Fast Pensions Ltd without informing him.

From the period of Paul Bennet ceasing communication at the end of February my

father could not contact anyone at Fast Pensions.

My father, at a later date checked Mr Bennett’s profile and noted that he had

moved to a company called Silverene Administration of 50, Chorley Road, Bolton, BL1

4AP, (company no 09088060). He has again moved on and is now employed by a

company called Cranfords, Pension Administrators.

The Director of Silverene Administration Ltd is a Merle Oper who was also the founder

of Umbrella Loans Ltd from 2010-April 2014.

Mr Bennett provided my father with an email to contact Sara Moat

(sara.moat@blupropertygroup.com) surprisingly Sara Moat never replied to any of my

father’s emails.

My father did not receive any communication from Fast Pensions from February 2016

until May 2016. This was when he received a letter from Sara Moat informing my father

that Paul Bennett had left Fast Pensions (it had only taken three months for Fast

Pensions to mention this)) and due to his departure, they had experienced difficulties

and delays. Sara Grace Moat quoted in this letter that the ongoing request had been

sent to payroll department, and my father would receive confirmation of this within 14

days. My father is still waiting for that confirmation.

It was now becoming a very serious situation as all communication with Fast Pensions had

ceased and this was continuing to cause my father further stress, financial difficulties, and

ongoing health issues.

“If you believe that a firm has promoted or sold you a UCIS that is not suitable for you,

sold a UCIS to you unlawfully or without fully explaining the risks, you should make a

complaint to the firm involved”. (www.fca.org.uk)

Regarding the above reference from the FCA website, the amount of times me and

my father have complained about the conduct of Fast Pensions – it is all recorded and has

also being made available to those requesting it, i.e. Economic Crime Unit, Serious Fraud

Office and others.

After several requests for information on my father’s investment, including the

investment portfolio, and an up to date statement, I do believe that the reason you have

not made it available, is that it was put into a UCIS.

Therefore, I find myself alongside my father reading peoples experiences, comments

and consequences resulting from Fast Pensions. Not to mention the contact with the

Serious Fraud Unit and Economic Crime Unit who are all actively investigating Fast

Pensions. Hence the reason why my father and I openly and transparently discuss all

emails to them relating to Fast Pensions Limited.

Angie Brooks’ is also against the miss-selling of Pension Schemes which are sold by

introducers or untrustworthy IFA’s. In the case of my father was ill-informed and misled as

to the DM1 pension scheme and the fact is being an unregulated scheme, of which you

have admitted to in your IDRP response. I am only too aware of the risks with

unregulated schemes after several hours of research, because of my father’s experience

with Fast Pensions Ltd.

I am also aware of the relationship Angie Brooks has with the Pension Regulator, HMRC,

Insolvency Services and the FCA, and the assistance my father is giving to the Serious

Fraud Office. At this moment in time Fast Pensions Ltd and its Trustees have stated

nothing to defend or deny these comments, in fact they are simply adding to the negative

experiences the members are having with Fast Pensions.

The appellant’s statement descibed above is followed by more than 30,000 words describing the catalog of lies and obfuscation by the Moats and their associates, and the deterioration in his vicim’s health. During this whole time, there were no arrests and no action by the regulators – FAST PENSIONS – SLOW LAW ENFORCEMENT – STATIONARY REGULATORS – disgusting all round!

The Insolvency Service has now, finally, placed the various entities involved into liquidation. It remains to be seen whether any money will ever be traced and recovered from this scam.

![]()

The Pension Scams Industry Group (PSIG) has carried out a pilot survey on pension scams. The survey has identified seven key findings and concluded that most scams are carried out by rogue advisers and unregulated “introducers”. This is something we write about regularly, so it is great that PSIG has finally caught up.

The Pension Scams Industry Group (PSIG) has carried out a pilot survey on pension scams. The survey has identified seven key findings and concluded that most scams are carried out by rogue advisers and unregulated “introducers”. This is something we write about regularly, so it is great that PSIG has finally caught up. You may think you can trust a financial adviser, but we live in a world full of scammers and crooks – quite a few of which are financial advisers. Some of them are very greedy and will stop at nothing to fatten their bank balance at your expense. They have no conscience when it comes to living a lavish lifestyle funded from another’s grim fate.

You may think you can trust a financial adviser, but we live in a world full of scammers and crooks – quite a few of which are financial advisers. Some of them are very greedy and will stop at nothing to fatten their bank balance at your expense. They have no conscience when it comes to living a lavish lifestyle funded from another’s grim fate.

SCAMMER JAILED! Hip hip hooray! we say. What a great start to the new year. Neil Bartlett, 53, of Delamere Road, Ainsdale, used £4.5m of his victims’ money to fund an extravagant lifestyle of foreign travel, top hotels and gambling.

SCAMMER JAILED! Hip hip hooray! we say. What a great start to the new year. Neil Bartlett, 53, of Delamere Road, Ainsdale, used £4.5m of his victims’ money to fund an extravagant lifestyle of foreign travel, top hotels and gambling.

AND to rub salt into the wounds of the Trafalgar victims,

AND to rub salt into the wounds of the Trafalgar victims,

As 2018 draws to a close, a recap is in order to review the year’s progress in the war against pension scammers. Let us not forget – in the immortal words of the Pensions Regulator’s Lesley Titcombe: “

As 2018 draws to a close, a recap is in order to review the year’s progress in the war against pension scammers. Let us not forget – in the immortal words of the Pensions Regulator’s Lesley Titcombe: “ Neither Garry Williams nor Sue Huxley has ever been convicted or jailed.

Neither Garry Williams nor Sue Huxley has ever been convicted or jailed.

Stephen Ward’s firm Premier Pension Solutions (in Moraira, Spain) was the “sister” firm of Continental Wealth Management, run by scammer Darren Kirby. This was one of the biggest single scams – known as

Stephen Ward’s firm Premier Pension Solutions (in Moraira, Spain) was the “sister” firm of Continental Wealth Management, run by scammer Darren Kirby. This was one of the biggest single scams – known as

Fast Pensions

Fast Pensions

Another of Stephen Ward’s many pension scams, this one was courtesy of his bogus pension trustee firm

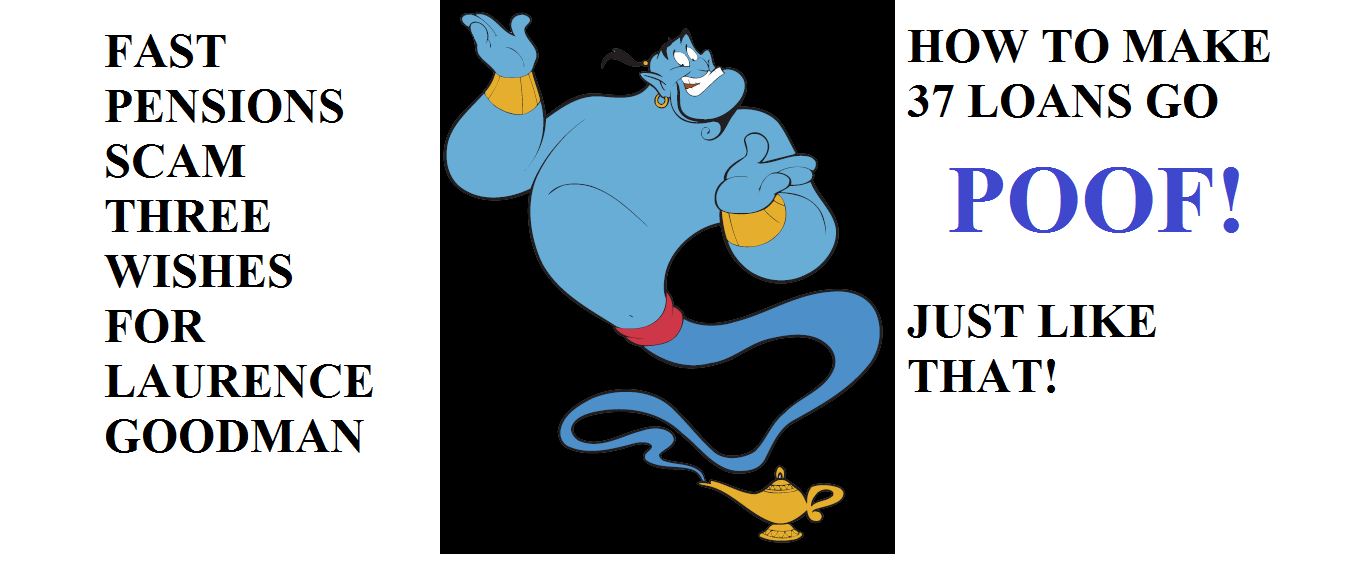

Another of Stephen Ward’s many pension scams, this one was courtesy of his bogus pension trustee firm  116 victims were scammed out of their pensions by James Lau of FCA-regulated Wightman Fletcher McCabe. Victims were assured the loans they were given did not come from their pension funds and would not be taxable by HMRC. The trustees of the scheme – Peter Bradley and Andrew Meeson (both ex HMRC) of Tudor Capital Management – were jailed for eight years for cheating the Public Revenue. James Lau is currently under criminal investigation by the Insolvency Service. The victims are awaiting a verdict on whether they will still have to pay the tax penalties.

116 victims were scammed out of their pensions by James Lau of FCA-regulated Wightman Fletcher McCabe. Victims were assured the loans they were given did not come from their pension funds and would not be taxable by HMRC. The trustees of the scheme – Peter Bradley and Andrew Meeson (both ex HMRC) of Tudor Capital Management – were jailed for eight years for cheating the Public Revenue. James Lau is currently under criminal investigation by the Insolvency Service. The victims are awaiting a verdict on whether they will still have to pay the tax penalties.

This week Henry Tapper wrote a blog entitled, “

This week Henry Tapper wrote a blog entitled, “ They have been asked to pay the money back but by the looks of their social media accounts, I don´t think there is much left. Camilla’s Facebook and Instagram accounts show her sunning herself on beaches and yachts around the world, and posing at luxury alpine ski resorts. David Austin is pictured on a gondola in Venice. They certainly got to enjoy the proceeds of their many victims’ pensions.

They have been asked to pay the money back but by the looks of their social media accounts, I don´t think there is much left. Camilla’s Facebook and Instagram accounts show her sunning herself on beaches and yachts around the world, and posing at luxury alpine ski resorts. David Austin is pictured on a gondola in Venice. They certainly got to enjoy the proceeds of their many victims’ pensions.

Still, neither the regulators nor law enforcement agencies lifted a finger to stop the Moats: FAST PENSIONS – SLOW LAW ENFORCEMENT – STATIONARY REGULATORS, is the basis of this case.

Still, neither the regulators nor law enforcement agencies lifted a finger to stop the Moats: FAST PENSIONS – SLOW LAW ENFORCEMENT – STATIONARY REGULATORS, is the basis of this case.

Scammers are loathed by victims, regulators, police, ombudsmen and financial services professionals whose professional reputations are compromised by the nefarious practices of the scam merchants. But however damning the hard evidence is about the scams and the various promoters, introducers, advisers, administrators behind them, the scammers still protest their innocence.

Scammers are loathed by victims, regulators, police, ombudsmen and financial services professionals whose professional reputations are compromised by the nefarious practices of the scam merchants. But however damning the hard evidence is about the scams and the various promoters, introducers, advisers, administrators behind them, the scammers still protest their innocence.