Attention financial advisers in Spain/who provide financial advice to Spanish residents.

Attention financial advisers in Spain/who provide financial advice to Spanish residents.

18th February 2019

DEATH OF THE LIFE BOND:

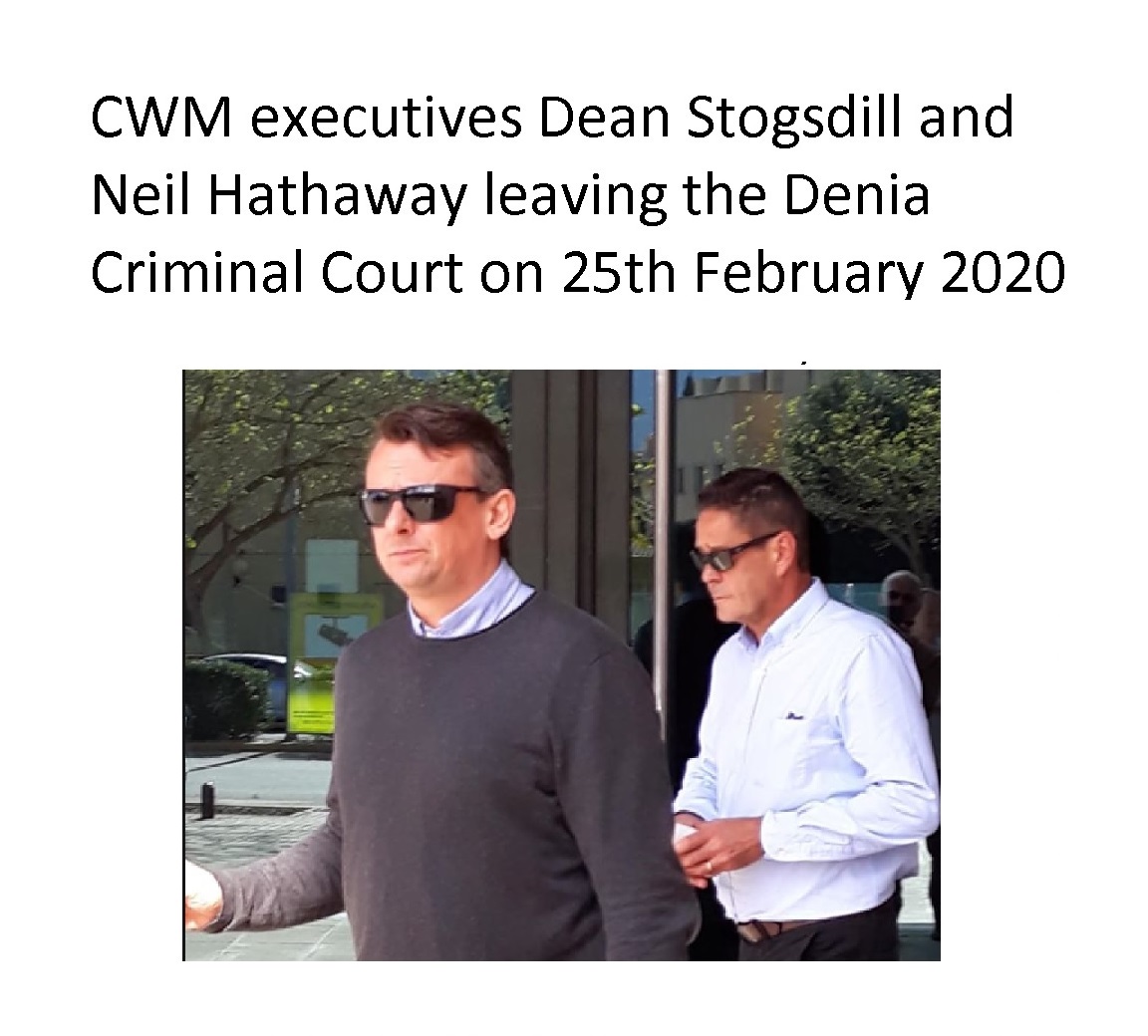

The Spanish insurance and pensions regulator, the DGS, made a judgment against Costa Blanca-based Continental Wealth Management (CWM) on 10.1.2019. The order (translated and summarised below) confirmed that there are strict regulations in Spain for the sale of insurance products. The DGS also made it clear that even if a firm is not regulated in Spain by the DGS, it must conform to the Spanish regulations.

The deadline for compliance with the order was Monday 11th February. Unsurprisingly, CWM failed to comply. CWM had collapsed in September 2017 and all the scammers who worked for the firm headed for the hills (or Australia). We are now enforcing this order by criminal action against all those responsible. This also opens the way for similar action against any other firms who have mis-sold insurance products without complying with the Spanish regulations.

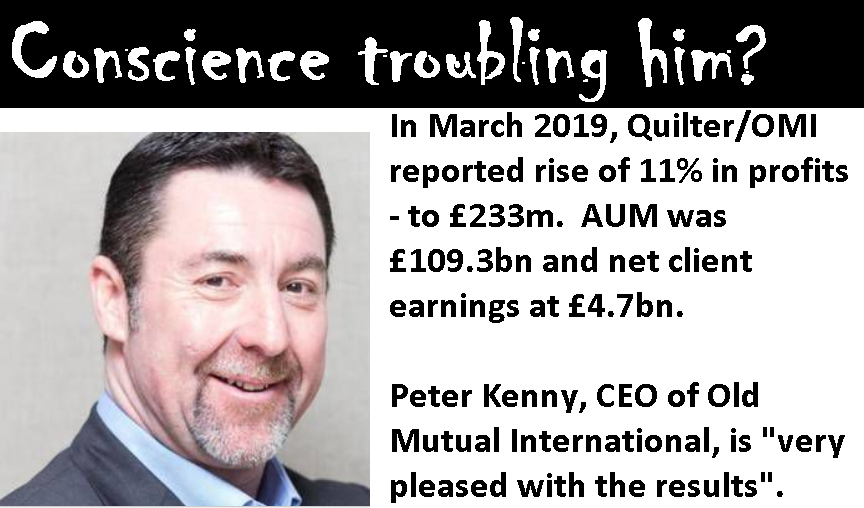

In certain, limited circumstances, insurance bonds can be beneficial. But in the vast majority of cases they are entirely mis-sold, and the underlying commissions concealed. These hidden commissions prevent the funds from growing and have an ever-increasing detrimental effect on the value of the fund. I have seen evidence of an entire fund being destroyed by irresponsible, risky, commission-laden investments. The life offices (such as OMI, SEB, FPI, RL360 and Generali) continue to apply their quarterly charges while the funds are being destroyed – sometimes even pushing the funds into negative territory.

Why should the use of life bonds be strictly controlled?

I have transcribed the DGS’ judgment below. It is an abbreviated, translated version of the original. I also set out below the reasons why life bonds should now be strictly controlled and only sold/advised by qualified, regulated firms. Once an international standards agreement has been established, it should be possible to ensure that only those firms who understand how to use these products properly will use them in future.

I hope that all advisers providing insurance advice in Spain – and beyond – will now ensure that losses caused by the mis-selling of life bonds are put right. I also hope that this policy will be adopted throughout Europe and in all other jurisdictions so that the worldwide mis-selling scandal can finally be ended.

There will be criminal proceedings – and these will extend to the life offices themselves for profiting from financial crime. The many victims whose life savings have been destroyed by the life offices and their toxic practices will welcome this news. The victims themselves know intimately the numerous faults of the life offices:

- accepting business from (and paying undisclosed commissions to) known scammers and unregulated advisory firms

- offering high-risk, unregulated funds such as Axiom, LM, Premier New Earth and other no-hoper funds

- offering professional-investor-only structured notes from providers such as Leonteq, Commerzbank and Nomura

- reporting the inexorable losses but taking no remedial action

- locking victims into the expensive, pointless bonds long after the majority of the funds had been destroyed

This latest development with the DGS judgment will help the victims take action against negligent life offices such as Old Mutual International and Friends Provident International. This will be a powerful weapon in the recovery process against these parasitic, negligent and greedy insurance companies.

I set out below, in red, reasons why insurance bonds should now be strictly controlled internationally. This is not just my opinion – but an order by the Spanish government. In my view, this is a very sensible and useful order which is in the interests of all consumers throughout Europe and the wider world.

Decent, ethical, regulated firms will comply with the DGS’ judgment. The scammers will not.

——————————————————————————————————————————————————

Madrid, 10 January 2019 – Complaints service file number 268/2016

Chief Inspector of Unit – Ministry of Economy and Enterprise

Secretary of State for the Economy and Business Support

General Directorate of Insurance and Pension Funds (DGS)

Article 6 of Law 26/2006, of 17 July, on private insurance and reinsurance mediation, which regulates the general obligations of insurance intermediaries, states:

“Insurance intermediaries shall provide truthful and sufficient information in the promotion, supply and underwriting of insurance contracts, and, in general, in all their advisory activity….”

The scammers do not, of course, comply with this regulation. In fact, scammers rarely tell their clients that they are going to be put into an insurance bond. Unscrupulous advisers often conceal how the bond will work or for how many years they will be locked in for. Normally, scammers wave an agreement for an OMI, SEB, Generali, FPI or RL360 bond under the nose of the clients – and ask them to sign the agreement with no explanation. Rarely do the scammers allow the client to read the document properly, or disclose the commission they will receive from selling the often pointless bond.

Victims will be locked into the bond long after they have worked out that the adviser has mis-sold the product purely for the 8% commission – and that the charges will prevent the fund from ever growing. In fact, even if the underlying asset were to perform reasonably well, it would struggle to keep up with the combination of the bond and adviser costs.

It is rarely explained that the bond is a bogus life assurance policy (or series of policies); that any life cover is only actually 101% of the original value of the funds the victim has unwittingly placed into the bond. If all the clients had wanted was life cover in the first place, this product would represent terrible value for money. The Spanish Supreme Court has already ruled that life assurance policies are void for the purpose of holding investments – because the life office takes no risk.

Therefore, the life bond fails on three counts:

- it is a useless life assurance policy

- it is a useless investment platform

- it does not comply with Spanish regulations.

I could go on: the life bond is expensive; fails to disclose adviser commissions; offers high-risk, unregulated funds; accepts business from known scammers and unregulated firms; allows professional-investor-only structured notes for retail investors. The list is endless.

Article 26 paragraphs 2 and 3 of Law 26/2006, of 17 July, on private insurance and reinsurance mediation, which refers to insurance brokers, establishes the following:

“Insurance brokers must inform the person who tries to take out the insurance about the conditions of the contract which, in their opinion, it is appropriate to take out and offer the cover which, according to their professional criteria, is best adapted to the needs of the former. The broker must ensure the client’s requirements will be met effectively by the insurance policy.”

If the client had stipulated that he needed a life assurance policy (which he usually didn’t), the adviser should have explained fully how and why any product offered fitted the client’s needs. This virtually never happens. The adviser has already decided (long before he has even met the client – let alone carried out a fact find) – that he is going to flog him a bond from whichever life company is paying the highest commission. And this is how so many victims end up with useless insurance products from OMI, SEB, Generali, RL360, Friends Provident International, Hansard, Investors Trust etc.

Even if the client had specifically asked for – say – £100,000 worth of life cover, these “life” policies could never guarantee to provide that cover. In a proper, bona fide life assurance contract (where the client pays a monthly premium for the life of the policy) the pay-out is guaranteed. In these bogus life assurance policies, the value of the pay-out inevitably decreases as the charges eat into the fund. This is normally the case when disproportionately risky investments are made by the life offices.

Article 42 of the Private Insurance and Reinsurance Mediation Act, which refers to the information to be provided by the insurance intermediary prior to the conclusion of an insurance contract, provides:

“Before an insurance contract is concluded, the insurance intermediary must, as a minimum, provide the customer with the following information:

- a) The broker’s identity and address.

- b) The Register in which the broker is registered, as well as the means of verifying such registration.”

This rarely happens in practice – unless the broker is one of the very few professional and ethical firms in the expat world. An adviser might claim to be based in one jurisdiction, but could – in fact – be based in an entirely different one. “Passporting” is often misused as advisers “fly in under the radar” and provide advice in jurisdictions where they have no legal right to operate.

Insurance agents must inform the customer of the names of the insurance companies with which they can carry out the mediation activity in the insurance product offered.

Agents often have terms of business with more than one life office – but will rarely disclose the fact that some or all of them have a long history of facilitating financial crime internationally.

In order for the client to be able to exercise the right to information about the insurance entities for which they mediate, insurance agents must notify the client of the right to request such information.

I have never seen an instance of this happening – which is not to say it doesn’t happen. Just that I haven’t seen it. But then people don’t come to me when things are going swimmingly – they only come when they have lost some, most or all of their fund.

Banking and insurance operators must inform their clients that the advice given is provided for the purpose of taking out an insurance policy and not any other product that the credit institution may market.

And herein lies the problem: the advice is rarely provided for the purpose of taking out an insurance policy – the advice is usually given because the client wants his pension or life savings invested safely, prudently and profitably. Few – if any – clients come to the adviser to ask for a life assurance policy. But they get one, whether they need it – or can afford it – or not.

Insurance brokers must inform the client that they provide advice in accordance with the following obligations:

“Insurance brokers are obliged to carry out and provide (to the customer) an objective analysis on the basis of a comparison of a sufficient number of insurance contracts offered on the market for the risks to be covered. Brokers must do this so that they can formulate an objective recommendation.”

I have never seen an example of an adviser offering a client a selection of possible insurance contracts. The adviser has normally decided which life product he is going to flog long before the client even walks through the door. In a normal insurance contract relationship, it is the insurer which takes the risk. But in life bond contracts, it is the insured who takes the risk – i.e. that his life cover will be substantially lower than that originally contracted and that, indeed, his fund will be severely impaired by the costs of the contract.

On the basis of information provided by the customer, insurance intermediaries shall specify the requirements and needs of the customer, as well as the reasons justifying any advice they may have given on a particular insurance. The intermediary must answer all questions raised by the client regarding the function and complexity of the proposed insurance contract.

I have never seen this happen – which is not to say that it doesn’t happen. But the adviser could only explain to the customer that the sole purpose of the life bond is to pay him 8% commission. And that would inevitably spook the customer – so the adviser doesn’t bother. There will surely be all sorts of flim-flam about the life bond allegedly providing tax efficiency. However, any real tax savings will be resoundingly eclipsed by the high charges.

All intermediaries operating in Spain must comply with the rules laid down for reasons of general interest and the applicable rules on the protection of the insured, in accordance with the provisions of Article 65 of the Law on the Mediation of Private Insurance and Reinsurance.

I have never seen a single instance of an intermediary complying with the DGS rules in Spain or anywhere else. But that is because I only ever hear about cases where the clients suffer losses. The people who are well looked after by competent, professional, ethical brokers never bother contacting me – because they don’t need to! However, I would love to hear from advisers who do abide by the rules.

Every insurance intermediary is obliged, before the conclusion of the insurance contract, to provide full disclosure.

Never happens in my experience. The commission is normally concealed, and the inflexibility of the lock-in period is rarely explained. The victims usually only find this out after they have realised they have been scammed.

In the event that a mediator was an Insurance Broker or independent mediator, he is also obliged to give advice in accordance with the obligation to carry out an objective analysis.

Never happens in my experience. The adviser/mediator doesn’t use the life assurance product for life assurance, but as a bogus “wrapper” for holding investments. Therefore, the likely outcome of any objective analysis is very unlikely ever to be fulfilled.

This must be provided on the basis of the analysis of a sufficient number of insurance contracts offered on the market for the risks to be covered. The mediator can then formulate a recommendation, using professional criteria, in respect of the insurance contract that would be appropriate to the needs of the client.

I have never seen an instance of a mediator offering a selection of possible contracts – and there are no risks to be covered, as the insurer takes no risks. This is why these products have been deemed by the Spanish Supreme Court to be invalid. However, if a mediator were to offer a “selection” of life bonds, they would all be identical as they are all just as bad as each other.

In the case in question, there is no evidence that the aforementioned information was provided to the client before the investment product was contracted. Therefore, Article 42 of the regulations has been breached.

As it has in just about every instance I have ever seen in Spain – and beyond. In fact, one firm in Spain – Blevins Franks – only offers one insurance product and that is Lombard. This is completely illegal.

Therefore, this Claims Service concludes that the mediator must justify the information and prior advice given to his client, so that the obligations imposed by the Law of Mediation can be understood to be fulfilled with the aim of protecting the insured. Failure to comply with their obligations could be considered as one of the causes of the damage that would have occurred to their client.

I have never seen an instance of any firm complying with the obligations imposed by law in Spain. That doesn’t mean it doesn’t happen – and I would love to hear from firms who do comply with this law so that my knowledge can be broadened. However, if this does happen, it is only likely to be in the case of ethical firms, and they are unlikely to use these bogus life assurance policies anyway.

The claim is understood to be founded. In the opinion of this Claims Service, the mediating entity has committed a breach of the regulations regulating the mediation activity – specifically of the provisions of articles 6 and 42 of Law 26/2006 of Mediation of Private Insurance and Reinsurance.

The DGS requires the mediating entity to account to this Service, within a period of one month from the notification of this report, for the decision adopted in view of it, for the purposes of exercising the powers of surveillance and control that are the responsibility of the Ministry of Economy and Enterprise.

The entity – Continental Wealth Management – did not, indeed, comply with the DGS’ requirement. This now gives the green light for this firm and the directors and shadow directors associated with it – as well as the life office which was complicit in this scam – to be subject to criminal proceedings. The life offices, in this case, were complicit as they were effectively profiting from financial crime.

The interested parties are informed that there is no appeal to this judgment. Both the claimant and the mediating entity are made aware of their right to resort to the Courts of Justice to resolve any differences that may arise between them regarding the interpretation and compliance with the regulations in force regarding the mediation of private insurance and reinsurance, in accordance with the provisions of articles 24 and 117 of the Constitution.

THE DEATH OF THE LIFE BOND

I think it would be no understatement to say that this heralds the end of the mis-use and abuse of life bonds (also known as portfolio bonds or insurance bonds). Not just in Spain, but throughout Europe and beyond. This will be warmly welcomed by the thousands of victims who have lost their life savings to rogue insurance companies such as OMI, SEB, FPI and Generali, and unregulated scammers such as Continental Wealth Management.

The ethical sector of the financial advice industry will, of course, be delighted – and there will be a mad scramble by the rogues to find a way round this ruling. And they will fail.

Fighting pension scams needs to be done logically and methodically. Decent advisers need to use high standards to help fight scams. If these standards become the norm, the scammers won’t survive and flourish so easily.

Fighting pension scams needs to be done logically and methodically. Decent advisers need to use high standards to help fight scams. If these standards become the norm, the scammers won’t survive and flourish so easily. Lots of offshore advisers

Lots of offshore advisers

and many others such as

and many others such as  Fighting pension scams – why qualifications are so essential

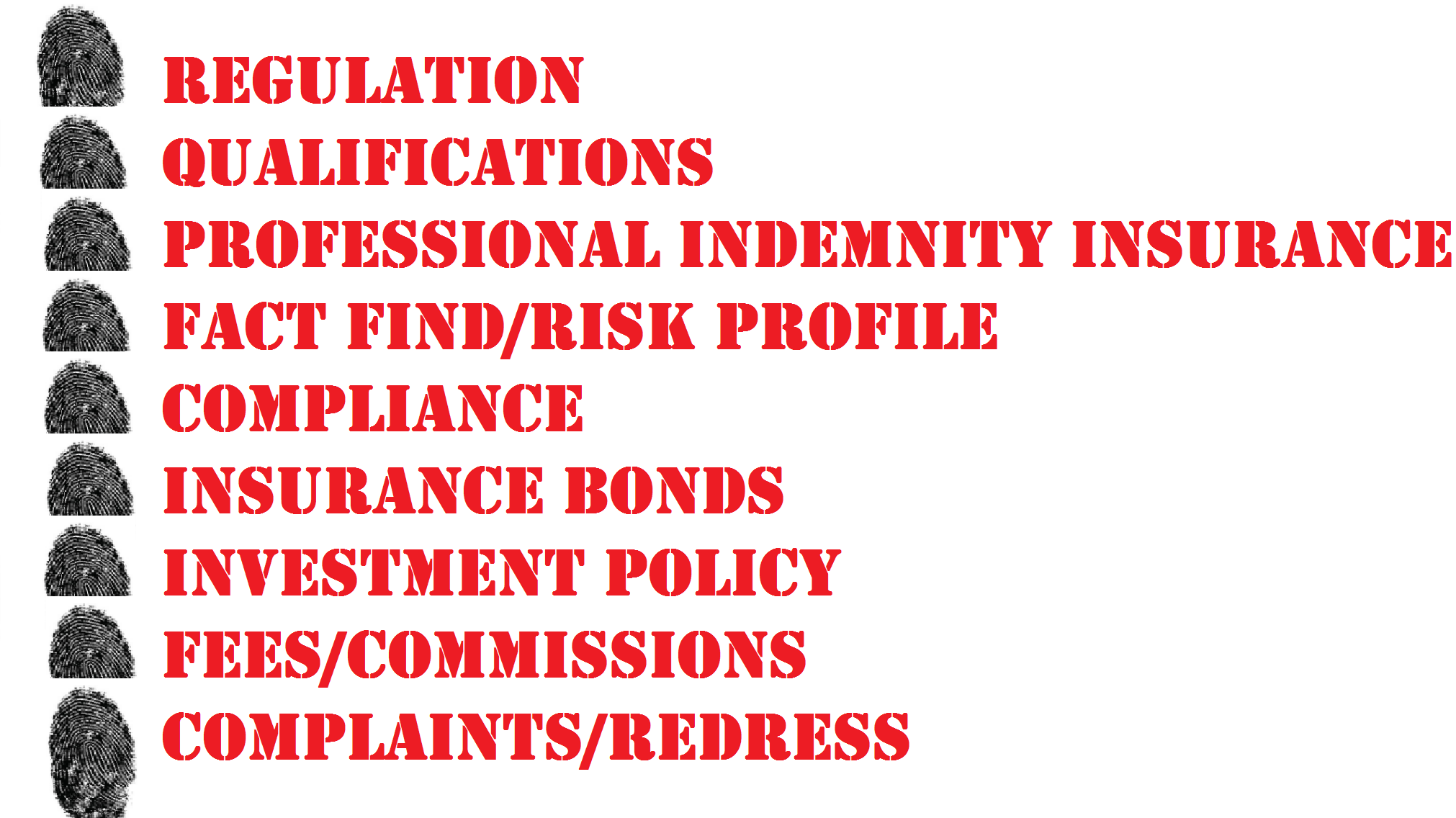

Fighting pension scams – why qualifications are so essential You wouldn’t go to an unqualified solicitor would you? So don’t use an unqualified financial adviser. Being qualified goes hand in hand with being regulated.

You wouldn’t go to an unqualified solicitor would you? So don’t use an unqualified financial adviser. Being qualified goes hand in hand with being regulated.

Fighting pension scams:

Fighting pension scams:  LCF Bond, Blackmore Bond, Blackmore Global Fund, LM, Axiom and Premier New Earth

LCF Bond, Blackmore Bond, Blackmore Global Fund, LM, Axiom and Premier New Earth

Serial

Serial  Firms that give unlicensed advice are breaking the law. Unlicensed advisers often use insurance bonds. These bonds pay high commissions. The funds these advisers use also pay high commissions. The advisers get rich. The clients get fleeced. The funds get destroyed. Insurance bonds such as

Firms that give unlicensed advice are breaking the law. Unlicensed advisers often use insurance bonds. These bonds pay high commissions. The funds these advisers use also pay high commissions. The advisers get rich. The clients get fleeced. The funds get destroyed. Insurance bonds such as  Unlicensed firms

Unlicensed firms  People can avoid being victims of

People can avoid being victims of

Please note these figures are correct as at 2017/2018, so today’s value is now even lower. Despite the funds’ huge decrease in value, Generali continues to take their fees (based on the original amount deposited – not the current depleted value). Therefore, these amounts will continue to fall AND despite the massive loses be locked in for a fixed term.

Please note these figures are correct as at 2017/2018, so today’s value is now even lower. Despite the funds’ huge decrease in value, Generali continues to take their fees (based on the original amount deposited – not the current depleted value). Therefore, these amounts will continue to fall AND despite the massive loses be locked in for a fixed term. Generali are not the only life office guilty of financial crimes: Old Mutual International and SEB were even worse – facilitating losses on a massive scale in the Continental Wealth Management case. OMI bought £94,000,000 worth of ultra-high-risk structured notes for retail investors – resulting in huge losses. Old Mutual was also heavily involved in more than £1,000,000,000 worth of losses in the Axiom, LM and Premier investment scams.

Generali are not the only life office guilty of financial crimes: Old Mutual International and SEB were even worse – facilitating losses on a massive scale in the Continental Wealth Management case. OMI bought £94,000,000 worth of ultra-high-risk structured notes for retail investors – resulting in huge losses. Old Mutual was also heavily involved in more than £1,000,000,000 worth of losses in the Axiom, LM and Premier investment scams.

Much as a master illusionist takes your breath away with his magic, a

Much as a master illusionist takes your breath away with his magic, a

Every year we are seeing an increase in the number of victims falling for pension and investment scams. Despite warnings in the public domain and a huge array of information about how to avoid falling victim to a scam, it seems the scammers are so skilled at their sales techniques, that even the cleverest of people can fall for their slick pitches. Often the scammers use cold-calling techniques to initiate these pitches: using emails, texts, mail shots and the good ol’ phone.

Every year we are seeing an increase in the number of victims falling for pension and investment scams. Despite warnings in the public domain and a huge array of information about how to avoid falling victim to a scam, it seems the scammers are so skilled at their sales techniques, that even the cleverest of people can fall for their slick pitches. Often the scammers use cold-calling techniques to initiate these pitches: using emails, texts, mail shots and the good ol’ phone. Listen to the show here:

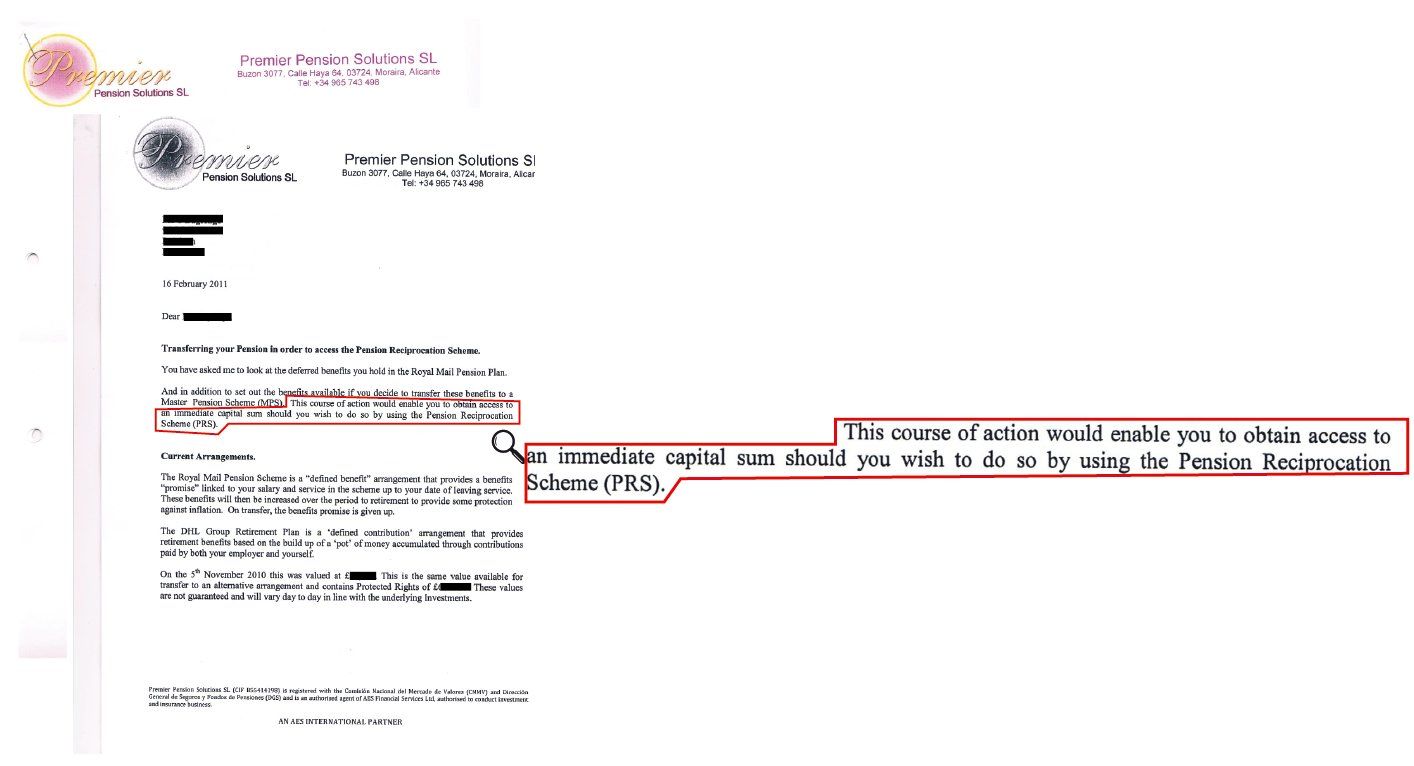

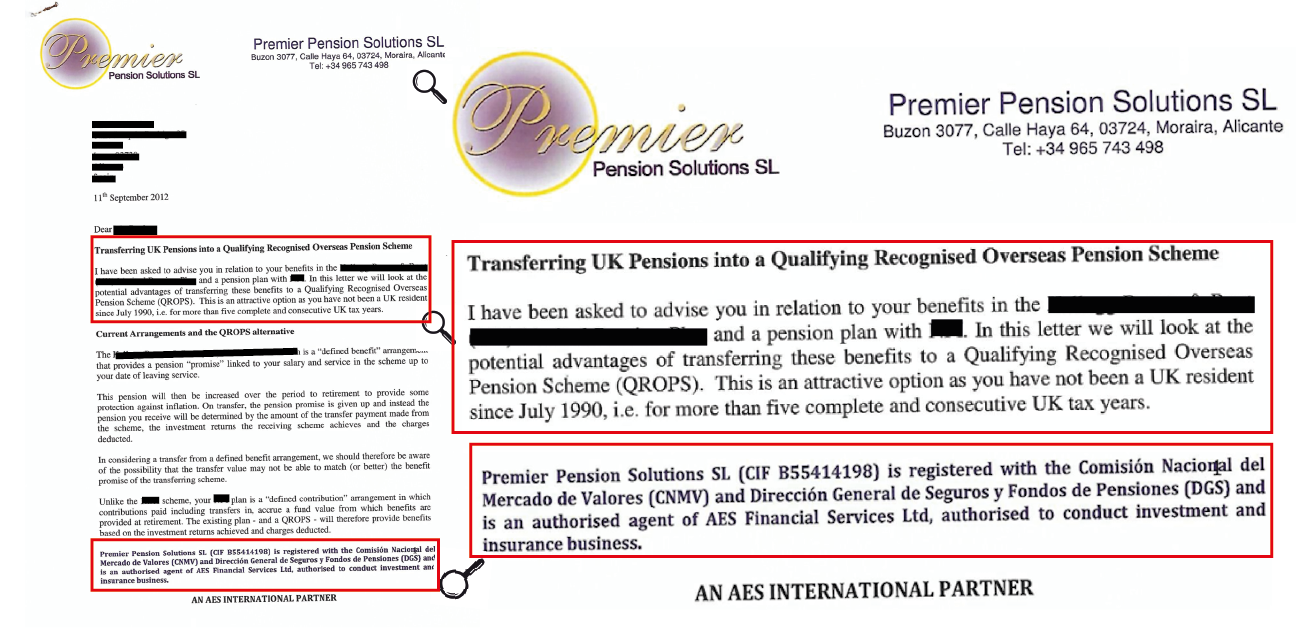

Listen to the show here: Ironically, Standard Life has been one of the worst performers in terms of ceding pension providers who have recklessly and negligently handed over millions of pounds’ worth of pensions to the scammers. Completely ignoring the Pensions Regulator’s warnings in 2010, they shoveled £millions across to pension scams such as Ark, Capita Oak, Westminster, Continental Wealth Management, Global Fiduciary Services and many other QROPS scams.

Ironically, Standard Life has been one of the worst performers in terms of ceding pension providers who have recklessly and negligently handed over millions of pounds’ worth of pensions to the scammers. Completely ignoring the Pensions Regulator’s warnings in 2010, they shoveled £millions across to pension scams such as Ark, Capita Oak, Westminster, Continental Wealth Management, Global Fiduciary Services and many other QROPS scams. It seems the only way to escape the scammers – anywhere in the world – is not to fall for their lies. But the challenge is to know what is true and what is false. And that isn’t easy – the scammers are very clever and can adapt quickly to invalidate public warnings and even use them to their advantage. In addition to the scammers, there are now

It seems the only way to escape the scammers – anywhere in the world – is not to fall for their lies. But the challenge is to know what is true and what is false. And that isn’t easy – the scammers are very clever and can adapt quickly to invalidate public warnings and even use them to their advantage. In addition to the scammers, there are now

Another victim of Berkeley Burke SIPPS investments into Store First storage pods has come forward. 55-year-old factory worker Robert McCarthy, of Ebbw Vale, said he has lost more than £30,000 through a Self-Invested Personal Pension (SIPP). He was duped into the transfer and investment by unregulated firm Jackson Francis which was liquidated in 2014. His investment may or may not be worthless – depending on whether Store First is wound up later in 2019.

Another victim of Berkeley Burke SIPPS investments into Store First storage pods has come forward. 55-year-old factory worker Robert McCarthy, of Ebbw Vale, said he has lost more than £30,000 through a Self-Invested Personal Pension (SIPP). He was duped into the transfer and investment by unregulated firm Jackson Francis which was liquidated in 2014. His investment may or may not be worthless – depending on whether Store First is wound up later in 2019.

Victims were also invested into the Store First storage pods via

Victims were also invested into the Store First storage pods via  Stephen Ward

Stephen Ward

The Spanish Insurance Regulator – the DGS (Dirección General de Seguros y Fondos de Pensiones) – has made a most welcome judgment. This outlaws the mis-selling of bogus life assurance policies as investment “platforms” – aka “life bonds”.

The Spanish Insurance Regulator – the DGS (Dirección General de Seguros y Fondos de Pensiones) – has made a most welcome judgment. This outlaws the mis-selling of bogus life assurance policies as investment “platforms” – aka “life bonds”.

So popular is the use of life bonds among the seedier sector of the financial services industry, that multi-national firm

So popular is the use of life bonds among the seedier sector of the financial services industry, that multi-national firm

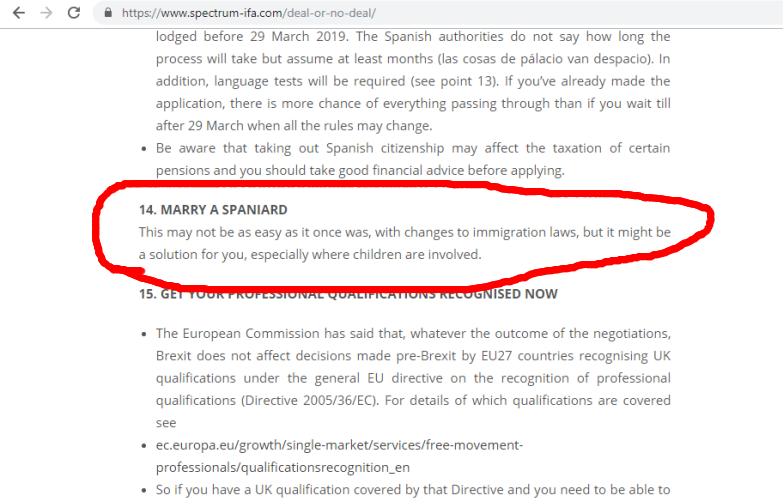

Worrying isn´t it? Offshore companies can try to claim they are international financial advisers, but actually be unregulated and unqualified to carry out the very service they offer! The “advisory” firms have flash websites, and some have several offices around Europe and beyond. Their PR is great at scaremongering expats about their pension investments in the lead up to Brexit.

Worrying isn´t it? Offshore companies can try to claim they are international financial advisers, but actually be unregulated and unqualified to carry out the very service they offer! The “advisory” firms have flash websites, and some have several offices around Europe and beyond. Their PR is great at scaremongering expats about their pension investments in the lead up to Brexit.

Know all the correct questions to ask an adviser before you sign on the dotted line.

Know all the correct questions to ask an adviser before you sign on the dotted line.  How much will the fees and charges be? Remember NO pension transfer is free.

How much will the fees and charges be? Remember NO pension transfer is free.