A victim of the Capita Oak pension scam has had his Pensions Ombudsman’s complaint upheld in part ONLY. His ceding trustee, JLT Benefits Solutions Limited (JLT), has been ordered to pay compensation but has not been held responsible for his loss.

A victim of the Capita Oak pension scam has had his Pensions Ombudsman’s complaint upheld in part ONLY. His ceding trustee, JLT Benefits Solutions Limited (JLT), has been ordered to pay compensation but has not been held responsible for his loss.

When my children were young, I always tried to treat them all equally. They all had the same bedtime; were taught the same standards of behaviour and manners; were given the same food (and expected to eat it all – even the green bits!); and received the same standard of education. And surely this is how our society should operate? Fairly, equally and inclusively.

But when our noble Pensions Ombudsman finds one negligent ceding pension provider guilty of carelessly handing over a pension fund to a scam and orders that provider to reinstate the fund in full, but then lets another provider off the hook for doing exactly the same thing, you have to ask whether the Ombudsman is doing his job properly.

Let us compare the two cases:

1. The ceding provider – the Police Authority – did not check whether it was handing over the member’s pension to a scam

2. The receiving scheme was an occupational scheme

3. The occupational scheme’s sponsoring employer did not trade or employ anybody

4. The member was not employed by the scheme’s sponsoring employer

5. The assets were unregulated, high-risk, illiquid and speculative and paid substantial commissions to the scammers

6. The transfer administration was carried out by Stephen Ward

1. The ceding provider – JLT Benefits Solutions – did not check whether it was handing over the member’s pension to a scam

2. The receiving scheme was an occupational scheme

3. The occupational scheme’s sponsoring employer did not trade or employ anybody

4. The member was not employed by the scheme’s sponsoring employer

5. The assets were unregulated, high-risk, illiquid and speculative and paid substantial commissions to the scammers

6. The transfer administration was carried out by

Stephen Ward

A Capita Oak victim complained to the Pensions Ombudsman and his ceding provider was not ordered to reinstate his pension in full.

Both victims were given £1,000 as compensation for the distress suffered. In the case of the London Quantum victim, that worked out as 55 pence a day for worrying himself sick about losing his pension; in the case of the Capita Oak victim, that worked out at 39 pence a day for worrying himself sick about losing his pension.

The biggest difference between the two cases, however, is that in the London Quantum case, the sponsoring employer –

London Quantum – did actually exist and was on the Companies House register. Whereas, the sponsoring employer for Capita Oak was a non-existent company called R. P. Medplant in Cyprus.

So, let’s take a look at how and why the Pensions Ombudsman failed to uphold the

Capita Oak victim’s complaint in full. And ask ourselves whether our Ombudsman is perhaps as useless as our regulators.

Mr N complained that JLT failed to undertake adequate due diligence on the

Capita Oak Pension Scheme before transferring his pension. However, the ombudsman has ruled that JLT cannot be held responsible for the transfer as Capita Oak was registered with HMRC and they followed the official protocol in the transfer. But then the

London Quantum scheme was also registered with HMRC – so there was no difference.

This leaves the unanswered question:

This leaves the unanswered question:

WHO IS TO BLAME??

The scammers?

The law?

The Pensions Regulator?

The FCA?

The Pensions Ombudsman?

HMRC?

Stephen Ward?

Many other victims are sitting in the wings waiting for the answer, whilst they struggle with the situation they have been left with: a decimated pension fund and little – if any – chance of recovery.

Here are the details from the Ombudsman’s determination on Mr N, a victim of the Capita Oak pension scam.

Ombudsman’s Determination Applicant Mr N Scheme G4S Pension Scheme (Group 4 Section) (the Scheme) Respondents G4S Trustees Limited (the Trustee) JLT Benefits Solutions Limited(JLT) – Outcome

1. Mr N’s complaint against JLT is partly upheld, but there is a part of the complaint I do not agree with. To put matters right, for the part that is upheld, JLT should pay Mr N £1,000 for the very significant distress and inconvenience caused.

2. The complaint against the Trustee is not upheld.

3. My reasons for reaching this decision are explained in more detail below.

Complaint summary:

4. Mr N has complained that the Trustee and JLT failed to undertake adequate due diligence on the Capita Oak Pension Scheme (Capita Oak), before transferring his pension. Had they done so, and alerted him to the risks, he says he would have canceled the transfer.

Background information, including submissions from the parties:

5. In November 2012, Mr N posted a question about financial matters on a website. He was aged 47 and employed.

6. On 28 November 2012, Mr N was contacted by a business named JP Sterling Associates (JP Sterling), which claimed to be regulated. He was informed that he would be able to transfer his pension without an Independent Financial Adviser (IFA) through a legal loophole, avoiding the need to pay any commission. It would charge £1,500 for this service.

7. JP Sterling promoted Capita Oak to Mr N and said that his pension would be invested in store pods. This would provide a minimum return of 8% a year. Mr N received promotional literature on the investment.

8. On the basis of what JP Sterling had told him, Mr N agreed to transfer his pension.

9. On 3 December 2012, Mr N requested a transfer quotation.

10. On 18 December 2012, JLT, the Scheme administrator, issued a transfer pack. This included the following statement:

“We would particularly like to recommend that you take caution if you have received a website promotion, cold – call or advert encouraging you to transfer your benefits in order to access a cash payment or loan. Legislation states that cash from pensions

cannot be accessed before you reach age 55, and any plans that claim to provide you with a loan or cash sum from your pension before that date should be avoided. Such plans may result in you paying substantial tax charges and receiving a lower benefit in retirement. It is recommended that you take financial advice before making a decision on transferring.”

11. On 9 January 2013, Mr N signed the Transfer Request and Discharge document, provided by JLT, instructing his benefits be transferred to Capita Oak.

12. On 30 January 2013, JLT received the completed Transfer Request and Discharge document from Capita Oak. This included the completed Receiving Scheme Warranty, Scheme details and confirmation of HMRC registration, including Capita Oak’s Pension Scheme Tax Reference (PSTR).

13. On the same date, JLT checked the HMRC register to establish the current status of the Capita Oak scheme, which showed that it was registered. A screen print of this was taken and added to the file.

14. On 1 February 2013, Mr N called JLT and advised it that he had been trying to contact Capita Oak but had been unable to get through to them. JLT confirmed that it had received correspondence from Capita Oak on 30 January 2013 and that it would

be reviewed on 13 February 2013.

15. On 6 February 2013, JLT carried out its due diligence checks on Capita Oak. This checklist is referred to as a Trustbusting form. The checks included establishing the type of scheme Capita Oak was, and checking its scheme summary page from Pension Schemes Online, a Government website, to confirm its status.

16. Part 3 is titled ‘Transfers to Occupational Pension Schemes’. This requires that the employer be checked on Companies House and that a screen print be taken. This point on the checklist was initialled, indicating that it was checked.

17. Part 4 goes on to state: “If employer and /or Trustees not found on websites: Contact HMRC and obtain written confirmation that the scheme is tax approved, using 119 [emphasis in original]. Ensure copy of Warranty Form is enclosed. This check is in addition to obtaining the PSTR approval letter/screen print of scheme summary page which will have been obtained in step 1 of this checklist.

Once written confirmation has been received from HMRC refer to Business Risk [emphasis in original] for final decision.”

18. On 14 February 2013, The Pensions Regulator (TPR) issued an announcement (the announcement) highlighting the risks to individuals and pension schemes of pension liberation. In making the announcement, it also issued a warning leaflet aimed at members. JLT has confirmed that this document was added to its intranet page the following day.

19. On 19 February 2013, JLT wrote to Capita Oak confirming that the transfer value would be paid within the next three working days.

20. On 20 February 2013, JLT transferred the funds.

21. On 21 February 2013, Mr N called JLT saying he was unable to contact Capita Oak. JLT referred him to the Capita Oak website for further information.

22. On the same day, JLT wrote to Mr N to confirm that the transfer value of £151,277.91 had been transferred to Capita Oak.

23. On 22 February 2013, Mr N called JLT raising “serious concerns” about Capita Oak, stating that the correspondence appeared to have been “written by a child” and he could not locate information about it on the internet. He subsequently emailed at

9.45am requesting the transfer be put on hold until further checks were undertaken on Capita Oak. He stated: “I have very real concerns about CapitaOak [sic] as I have not been able to trace them through any website or listing anywhere. I did a check for

them with the FSA and it came up blank. I was dealing with a company called JP Sterling who appear to be a very reputable investment broker, however I don’t want to transfer to a company that I have no knowledge of or can’t contact ever.”

24. JLT responded to the email at 10:43 am by calling Mr N. It provided him with alternative contact details for Capita Oak.

25. Mr N followed the call up with an email at 10:58am, stating he did not wish to proceed with the transfer unless “you”, being JLT, “find something to change my mind completely”.

26. At 12.15pm, JLT called Mr N to explain that the transfer had already been processed. JLT informed Mr N that due diligence had been undertaken on Capita Oak and it had passed all the transfer checks. Mr N confirmed he had spoken to Capita Oak and he was due to receive full information on the scheme in the near future.

http://webarchive.nationalarchives.gov.uk/20130402174913/http://www.thepensionsregulator.gov.uk/pension-liberation-

fraud.aspx

27. On 26 February 2013, Imperial Trustee Services Ltd, as trustee for the Capita Oak scheme, wrote to Mr N to acknowledge that his application had been processed.

28. On the same day, JLT called Mr N to query the position of Capita Oak. The call note records that: “The member stated that as far as he was concerned the transfer had gone through and there is no further action from JLT unless he contacted us further.”

29. Mr N subsequently raised a complaint about the transfer. It is unclear how that progressed, but it was not resolved, and the matter was accepted by this Office for investigation.

Adjudicator’s Opinion

30. Mr N’s complaint was considered by one of the Pensions Ombudsman Adjudicators who concluded that further action was required by JLT, but none was required by the Trustee.

31. The Adjudicator’s findings are summarised briefly below:

• The Adjudicator acknowledged that at the time JLT undertook the due diligence on Capita Oak, the Regulator’s announcement had not been made and therefore was during a period of lower industry standards.

• However, JLT’s internal processes were more stringent than the industry standards of the time, and the transfer should be viewed in the context of those processes when deciding whether its actions were correct.

• The Adjudicator considered that JLT’s process in relation to checking the legitimacy of Capita Oak was not accurately followed. He highlighted that there was no apparent way JLT could have made a check of the sponsoring employer at Companies House, as the name of the sponsoring employer had not been communicated to it in the transfer paperwork; and, as a Cypriot company, it would

not have been registered at Companies House anyway.

• In the absence of a record at Companies House, the Adjudicator took the view that, when following the guidance on the Trustbusting checklist, it was necessary for JLT to have contacted HMRC to obtain written confirmation that Capita Oak was tax approved, and to then refer the matter to “Business Risk for final decision.”

• JLT had highlighted that a HMRC screen print had been taken showing Capita Oak’s status, but the Adjudicator concluded that despite that, the guidance still required an extra step to be taken, by contacting HMRC in writing, and it had not been.

•The Adjudicator concluded this was maladministration and went on to consider whether, but for that maladministration, would JLT have refused the transfer or provided Mr N with further warnings which might have caused him to cancel it.

• The Adjudicator noted that there was likely to have been a delay caused by this additional step, and said that in some instances HMRC might issue a letter stating that it was unable to confirm the current status of the scheme enquired about. Such a letter might have resulted in a different outcome. However, the Adjudicator’s understanding was that concerns over Capita Oak did not arise until sometime after March 2013, and so there was no reason to think that had HMRC been contacted, JLT would have received any warning letter or reason for concern. The outcome of the due diligence would have been no different.

• Mr N did request, within 48 of the transfer being completed, that it be canceled. The question was therefore whether, had JLT taken longer to process the transfer, Mr N would have canceled the transfer in time. Was it JLT’s fault that he was given insufficient time to cancel his instruction? The Adjudicator concluded that this was not sufficient in terms of causation and foreseeability to make JLT legally liable for the losses Mr N had suffered. JLT was following Mr N’s instruction to transfer and, in the absence of any grounds to refuse it, was required by legislation to do so.

• The Adjudicator considered that JLT had provided Mr N with warnings about website promotions and cold – calls, both features of his transfer , in excess of what was typical industry practice at the time . It had also recommended he seek advice from an IFA and Mr N had still gone ahead with the transfer despite being aware that it apparently used a “legal loophole” to avoid IFAs.

• Mr N had spoken with JLT prior to the transfer, but the Adjudicator considered that from Mr N’s description of the call, it had not acted in error when discussing the transfer.

• Following the transfer, on 22 February 2013, Mr N had been given inconsistent information giving rise to the expectation that the transfer could be cancelled. However, by this point the transfer had completed and there was no way to reverse it. Whilst this information was incorrect, it had not led to Mr N’s financial loss.

• The Adjudicator could see no fault on the part of the Trustee.

• For JLT’s procedural failure, in failing to contact HMRC, and for the inconsistent information, provided after the transfer had completed, the Adjudicator recommended JLT pay Mr N £1,000.

32. Neither Mr N nor JLT accepted the Adjudicator’s Opinion and the complaint was passed to me to consider. Both parties provided

further comments which do not change the outcome. I agree with the Adjudicator’s Opinion and I will therefore only respond to the key points for completeness.

Ombudsman’s decision

33. Mr N has repeated the content of a series of conversations he had with JLT over the course of February 2013, highlighting that he asked for the transfer to be stopped as he was concerned with the quality of Capita Oak’s communication. He says he was told by JLT that Capita Oak was legitimate and he was reassured by this. He points to the fact that the Adjudicator has shown that JLT failed to undertake the correct checks before transferring, and he says this is negligence, not simply maladministration.

34. I have reviewed the call notes between Mr N and JLT. There was a call prior to the funds being transferred, however Mr N did not request the transfer be put on hold or rescind the request at that point. The note shows that JLT informed him that correspondence had been received and it would be progressing the transfer approximately two weeks later. This was prior to the due diligence being carried out. Mr N has not suggested that this call note misrepresents the conversation, and on the basis of the note I see no reason for JLT to have halted the process.

35. Mr N did request, on 22 February 2013, that the transfer be put on hold. However, by this time the transfer had already completed and could not be reversed by JLT. JLT gave Mr N the false expectation that the transfer could be stopped, but otherwise any reassurance it provided about Capita Oak was just relaying the fact that Capita Oak had passed the due diligence checks.

36. Having reviewed JLT’s due diligence process, I agree with the Adjudicator that it cannot have been followed in its entirety. In the absence of a Companies House record for the employer, JLT should have to written to HMRC to enquire about Capita Oak and this did not happen. Subsequently, the transfer should also have been scrutinised by Business Risk.

37. However, despite this failure to follow its internal process, at the time HMRC had not flagged any concerns regarding Capita Oak, and so there would have been no reason for JLT to legitimately decline the transfer. The additional process may have delayed the transfer, and this might, fortuitously, have given Mr N the opportunity to cancel the transfer by extending the time Mr N had to think about his transfer.

38. However, as Mr N had the opportunity to cancel the transfer at any time between 9 January and 20 February 2013, the date the transfer was made, it was not reasonably foreseeable by JLT that Mr N would try to do so on 22 February. Also, had JLT taken the extra step of contacting HMRC, the positive confirmation, which would most likely have been received at that time, is likely to have

led Mr N to continue rather than cancel the transfer. I do not find that Mr N has a claim for negligence because JLT did not cause the loss. It was transferring to a scheme that, at the time, was properly registered and Mr N had exercised his statutory right to transfer by signing the statutory discharge form.

40. Mr N argues that had he not been reassured by JLT that Capita Oak was genuine, then he would have complained earlier. But there was no reason for JLT to have suggested there were concerns with Capita Oak, and the same would have been true if it had contacted HMRC.

41. I note that during a conversation with JLT on 26 February 2013, following the transfer, Mr N confirmed that he was in contact with “the broker” and he did not expect further action from JLT at that time. It was not until sometime later that Mr N raised a

complaint with JLT. This implies that in February 2013, or shortly thereafter, Mr N was reassured by the broker, or Capita Oak, as to its legitimacy, otherwise he would have complained at that time. Therefore, even if he had been given the opportunity to place the transfer on hold or cancel it, ultimately the broker would more likely than not have reassured Mr N of the security of the transfer and it would have gone ahead despite his reservations.

42. I have great sympathy with the position in which Mr N finds himself. It may be that in the long run some of the value of his pension is recovered, but that is uncertain. This was a significant portion of Mr N’s pension provision and I have no doubt that this matter is extremely distressing for him. However, JLT did recommend he seek independent financial advice and warn him of the risks of pension cold calls. Mr N was recommended the transfer by JP Sterling on the basis that it circumvented the need for an independent financial adviser. In these circumstances, I cannot attribute Mr N’s loss to JLT because of a procedural oversight which would not have flagged any concerns over the transfer, particularly where that procedure already exceeded the standards at the time.

43. JLT has disputed the level of distress and inconvenience award recommended by the Adjudicator, arguing that these circumstances are different from those of the case the Adjudicator had highlighted. In particular, JLT point to the fact that it provided relevant warnings to Mr N; but, in PO-10365, the scheme provided no warnings to the transferring member. I acknowledge the difference JLT has highlighted, but the point remains that it did not properly follow its established process when carrying out Mr N’s transfer. Whilst it cannot be held responsible for his loss, it is very distressing for Mr N to know that steps were missed.

44. Additionally, JLT provided Mr N with the false understanding that the transfer could be put on hold, when this was not possible. In a typical complaint involving an administrative error, I would not normally award £1,000. However, there was more than one administrative error and the risks were high. I would have expected JLT to have exercised more care and accuracy in the way the transfer was carried out and the information conveyed to the member.

45. Therefore, I uphold Mr N’s complaint against JLT in part.

Directions

46. Within 21 days of the date of this Determination, JLT shall pay £1,000 to Mr N for the very significant distress he has suffered.

Anthony Arter

Pension Ombudsman

This leaves the unanswered question:

This leaves the unanswered question:

Henry Tapper has published an interesting article about the problem of the

Henry Tapper has published an interesting article about the problem of the

When it comes to finance, nothing in life comes for free. These free pension reviews are often followed by

When it comes to finance, nothing in life comes for free. These free pension reviews are often followed by

The arrival of wraps allows fee-based financial planners in the UK to offer a sound, client-focused service to expats, who up until recently have been easy prey to

The arrival of wraps allows fee-based financial planners in the UK to offer a sound, client-focused service to expats, who up until recently have been easy prey to

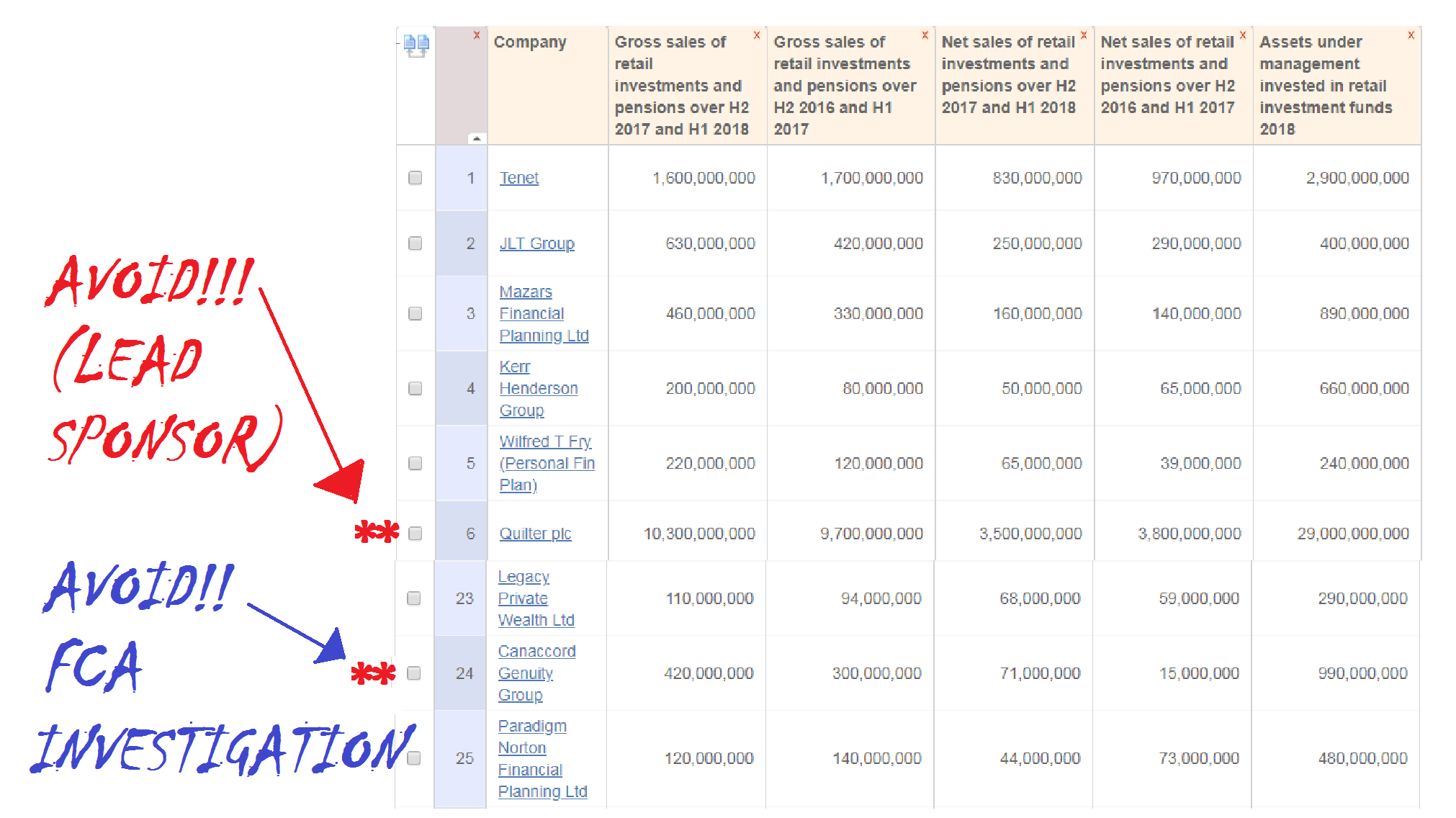

I have enormous respect for FT Adviser. Their articles are written by proper journalists and they generally write competently and professionally. FT Adviser puts

I have enormous respect for FT Adviser. Their articles are written by proper journalists and they generally write competently and professionally. FT Adviser puts  However, Canaccord Genuity Group’s porky pies do pale into a degree of insignificance when compared to Quilter plc which came sixth with £10.3 billion worth of sales and £29 billion worth of assets under management. Quilter plc is

However, Canaccord Genuity Group’s porky pies do pale into a degree of insignificance when compared to Quilter plc which came sixth with £10.3 billion worth of sales and £29 billion worth of assets under management. Quilter plc is  But, despite the embarrassing inclusion of these two dud firms, congratulations to FT Adviser for the hard work which must have gone into producing this hit parade. This is definitely one in the eye for the hopeless nitwits at

But, despite the embarrassing inclusion of these two dud firms, congratulations to FT Adviser for the hard work which must have gone into producing this hit parade. This is definitely one in the eye for the hopeless nitwits at

Long-term savings plans by Friends Provident,

Long-term savings plans by Friends Provident,  So here’s my suggested alternative: the LONG-TERM SAVINGS PIG:

So here’s my suggested alternative: the LONG-TERM SAVINGS PIG:

Remember, it’s your money and your life. Don’t get conned into giving half your savings to the scammer and the life office.

Remember, it’s your money and your life. Don’t get conned into giving half your savings to the scammer and the life office.

This new pension arrangement locked me in for 10 years – definitely a “long-term relationship” – giving all parties the opportunity to drain my pension dry in fees. Credit where credit is due, however. Once I discovered I was in a scam, the director Andy Dawson (bottom row, 3rd from the left) did make an extraordinary effort not only to redeem the investments but successfully persuaded most parties to waive their early exit penalties and refund their fees. Only the greedy Symphony Fund chose to keep the penalties and that’s after mysteriously dropping in value 30% just before redemption. Thanks to Andy Dawson and his team, I did manage to get back 92% of my pension. But the BIG QUESTION is what has happened to the other 1,100+ members? It is inconceivable I was the only one transferred into this scheme via Vilka et al.

This new pension arrangement locked me in for 10 years – definitely a “long-term relationship” – giving all parties the opportunity to drain my pension dry in fees. Credit where credit is due, however. Once I discovered I was in a scam, the director Andy Dawson (bottom row, 3rd from the left) did make an extraordinary effort not only to redeem the investments but successfully persuaded most parties to waive their early exit penalties and refund their fees. Only the greedy Symphony Fund chose to keep the penalties and that’s after mysteriously dropping in value 30% just before redemption. Thanks to Andy Dawson and his team, I did manage to get back 92% of my pension. But the BIG QUESTION is what has happened to the other 1,100+ members? It is inconceivable I was the only one transferred into this scheme via Vilka et al.

Then came the first of Ward’s

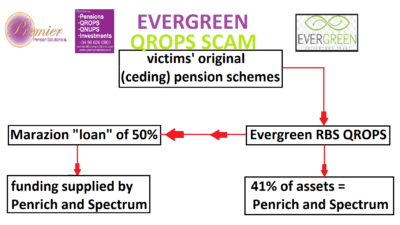

Then came the first of Ward’s  After Ark, Ward went on to run the

After Ark, Ward went on to run the

Following its appointment Dalriada discovered that there were approximately 609 files on record relating to potential new members, each at various stages of progression towards becoming a new member.

Following its appointment Dalriada discovered that there were approximately 609 files on record relating to potential new members, each at various stages of progression towards becoming a new member. SO, WARD CAN STILL OPERATE AS A PENSIONS ADMINISTRATOR? CAN STILL DO PENSION TRANSFERS? HE IS BASICALLY FREE TO CARRY ON AS BEFORE. THIS MAKES HMRC AND TPR COMPLICIT IN WARD’S MANY CRIMES.

SO, WARD CAN STILL OPERATE AS A PENSIONS ADMINISTRATOR? CAN STILL DO PENSION TRANSFERS? HE IS BASICALLY FREE TO CARRY ON AS BEFORE. THIS MAKES HMRC AND TPR COMPLICIT IN WARD’S MANY CRIMES.

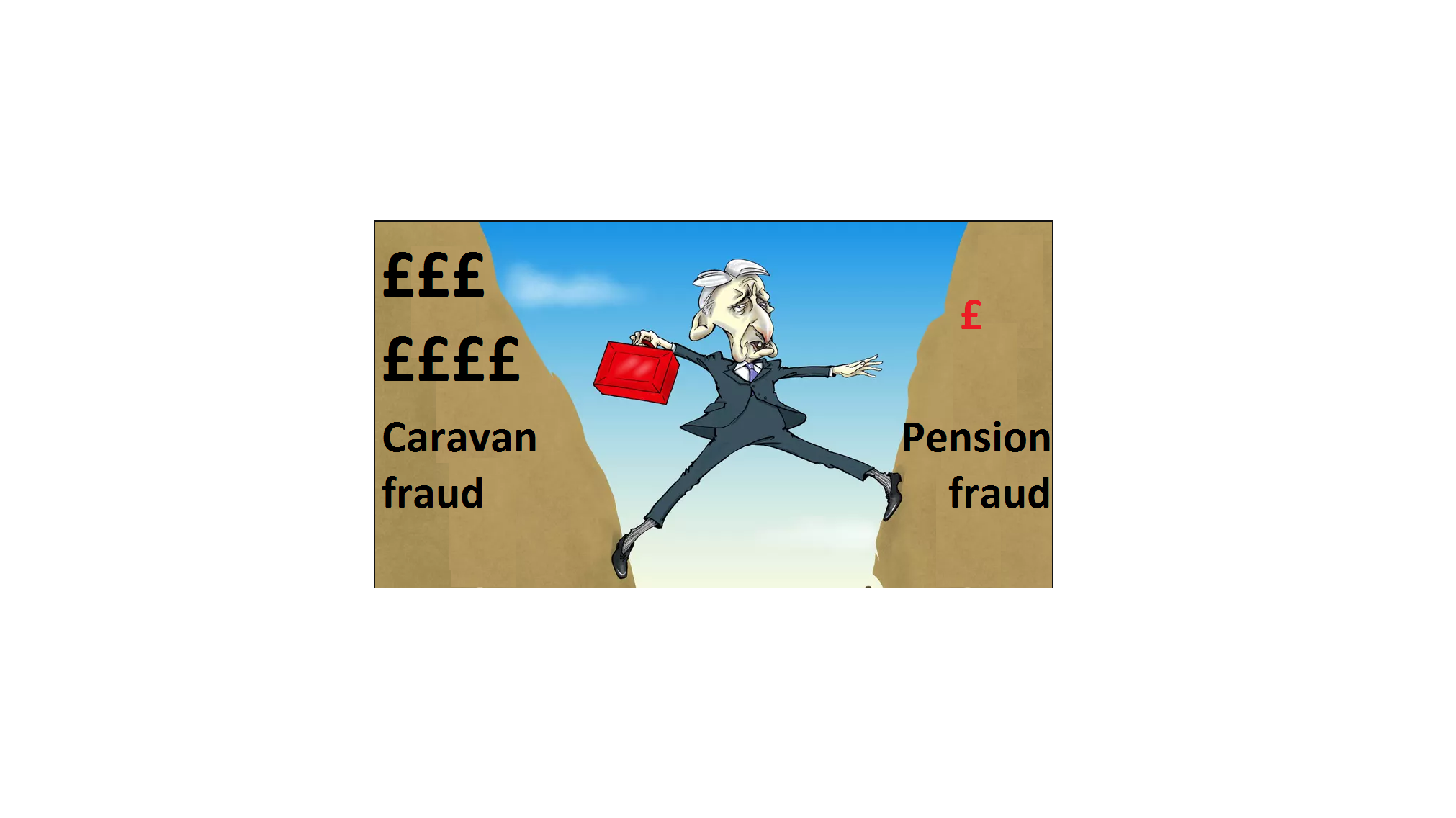

But look hard enough, and you will see how tackling crime can be done successfully. As someone who constantly writes about the failure of our police and courts to bring criminals to justice, I was surprised to hear of a spectacular success story in leafy Surrey recently.

But look hard enough, and you will see how tackling crime can be done successfully. As someone who constantly writes about the failure of our police and courts to bring criminals to justice, I was surprised to hear of a spectacular success story in leafy Surrey recently. Mr. and Mrs. Shore of Thorpe, in Surrey, were successfully prosecuted and jailed for proceeds of crime. Residing in Runnymede Borough Council – presided over by Chancellor Phillip Hammond – this dastardly pair (in their sixties) were both sent down for a heinous crime under the Proceeds of Crime Act 2002 (“POCA”).

Mr. and Mrs. Shore of Thorpe, in Surrey, were successfully prosecuted and jailed for proceeds of crime. Residing in Runnymede Borough Council – presided over by Chancellor Phillip Hammond – this dastardly pair (in their sixties) were both sent down for a heinous crime under the Proceeds of Crime Act 2002 (“POCA”). This spectacular success story on the part of Hammond, Runnymede Borough Council and the CPS has left the good citizens of Surrey relieved that these dangerous caravan owners are now behind bars and dozens of homeless families are now living on the streets.

This spectacular success story on the part of Hammond, Runnymede Borough Council and the CPS has left the good citizens of Surrey relieved that these dangerous caravan owners are now behind bars and dozens of homeless families are now living on the streets.  I am sure that the many thousands of people who have lost millions of pounds’ worth of life savings to scammers such as Stephen Ward, Julian Hanson, George Frost, XXXX XXXX, Phillip Nunn, Patrick McCreesh, Stuart Chapman-Clarke, David Vilka, David Austin, Darren Kirby, Dean Stogsdill, Anthony Downs and James Lau will now understand why the CPS couldn’t dedicate any resources to prosecuting them. And they will, no doubt, be glad that the priority of the judiciary was removing unauthorised caravans in Surrey.

I am sure that the many thousands of people who have lost millions of pounds’ worth of life savings to scammers such as Stephen Ward, Julian Hanson, George Frost, XXXX XXXX, Phillip Nunn, Patrick McCreesh, Stuart Chapman-Clarke, David Vilka, David Austin, Darren Kirby, Dean Stogsdill, Anthony Downs and James Lau will now understand why the CPS couldn’t dedicate any resources to prosecuting them. And they will, no doubt, be glad that the priority of the judiciary was removing unauthorised caravans in Surrey.

Many Brits are naturally suspicious of the Spanish and seek out British professionals whenever they can: builders, plumbers, pool maintainers, car mechanics and manicurists. And you can understand why – most Brits can barely manage things like “my loo won’t flush”, “the pool’s turned green”, “our car won’t start (or stop)” and “I want nails like Kim Kardashian”. So when it comes to “how do I invest my life savings” they don’t really stand a chance.

Many Brits are naturally suspicious of the Spanish and seek out British professionals whenever they can: builders, plumbers, pool maintainers, car mechanics and manicurists. And you can understand why – most Brits can barely manage things like “my loo won’t flush”, “the pool’s turned green”, “our car won’t start (or stop)” and “I want nails like Kim Kardashian”. So when it comes to “how do I invest my life savings” they don’t really stand a chance.

If I really want to impress my prospective victims, I could go on and on: “Russell Emerging Markets Equity Fund, Russel US Equity Fund, Russell Global Real Estate Securities Fund….”. I could even invent some of my own: “Russell Falling Leaves Fund, Russell Falling Value Fund, Russell Falling For It Fund…”

If I really want to impress my prospective victims, I could go on and on: “Russell Emerging Markets Equity Fund, Russel US Equity Fund, Russell Global Real Estate Securities Fund….”. I could even invent some of my own: “Russell Falling Leaves Fund, Russell Falling Value Fund, Russell Falling For It Fund…”