![]()

The Pension Scams Industry Group (PSIG) has carried out a pilot survey on pension scams. The survey has identified seven key findings and concluded that most scams are carried out by rogue advisers and unregulated “introducers”. This is something we write about regularly, so it is great that PSIG has finally caught up.

The Pension Scams Industry Group (PSIG) has carried out a pilot survey on pension scams. The survey has identified seven key findings and concluded that most scams are carried out by rogue advisers and unregulated “introducers”. This is something we write about regularly, so it is great that PSIG has finally caught up.

Henry Tapper wrote a blog about the survey, ‘Shining light on pension scams.‘ He wrote:

“Another significant concern was member awareness of advice. PSIG stated, after they found in almost half (49 per cent) of cases, the member had limited understanding or appeared to be unaware who was providing the advice, the fees being charged, or the receiving scheme to which the transfer would be made.”

A lack of understanding of the way the financial industry works is something that the scammers play on.

Many of our blogs here at Pension Life focus on getting information across to the public. You owe it to yourself to understand how the pension system works. This understanding will empower you and your money, protecting it from the scammers. We provide the platform for this information, you just need to read it.

However, time and time again we find we hit brick walls when sharing information.

Our blogs are shared on lots of social media networks. I find in many cases – especially on Facebook – that the links to our blogs will get deleted after the admins refuse to approve them. Some readers state that the blogs we write about expat scams are not relevant to expat issues.

We have been told that our blogs which highlight what questions to ask your adviser are of a commercial and marketing nature. Yet in none of our blogs do we try to sell anything – we just offer knowledge and warnings about how to safeguard your pension.

When met with this negativity, how do we get the information out there? How do we educate the public?

Future unaware victims need to know what to look out for and how to avoid a scam. Otherwise, the cycle will continue. The scammers will outsmart the public and they will continue to get rich off the ignorance of the public. And the victims will continue to see their life savings vanish.

As the saying goes, “ignorance is bliss”. However, if the ignorance leads to you signing your life savings over to a rogue financial adviser – whose only interest is purloining as much of your fund as possible – ignorance is in fact negligence.

You may think you can trust a financial adviser, but we live in a world full of scammers and crooks – quite a few of which are financial advisers. Some of them are very greedy and will stop at nothing to fatten their bank balance at your expense. They have no conscience when it comes to living a lavish lifestyle funded from another’s grim fate.

You may think you can trust a financial adviser, but we live in a world full of scammers and crooks – quite a few of which are financial advisers. Some of them are very greedy and will stop at nothing to fatten their bank balance at your expense. They have no conscience when it comes to living a lavish lifestyle funded from another’s grim fate.

At school, they teach us about history, geography, maths and more. There is no subject about how to look after your money. Basic education on how to look after our pennies or how to finance our future is not included in the curriculum.

Knowledge is important when it comes to your finances.

I can honestly say that before I started this job, I knew very little about pensions and how they work. I simply knew that a pension was something you get when you are ‘old’.

But ‘old’ comes round too quickly. Whilst working hard, building, saving and living your life. Time flies by.

It is all too easy for a rogue adviser to contact you out of the blue about a

“free pension review” and lure you into a scam.

At Pension Life, we are dedicating our time and words to help educate and inform you about pensions. Our blogs are full of information about scams, what questions to ask when transferring your pension and how to avoid falling victim to a scam.

Make sure you know what questions to ask your IFA.

Above all else – safeguard your pension from the scammers.

Don’t spend your life saving for your future, just to let a rogue adviser snatch it away and spend it on theirs.

We have put together ten essential standards that we believe every financial adviser and their firm should adhere to. Make sure you read the blog and ensure your financial adviser can meet these standards. If he can´t – find one that can.

I read an interesting article recently which has prompted this blog, written by

I read an interesting article recently which has prompted this blog, written by  Blair (pictured) talks about substance and the need for higher standards among financial advisers. Whilst I love her thoughts, I know how difficult this might be to achieve. We see wholly unqualified scammers posing as fully qualified IFAs time and time again. These scammers are very good at acting the part and the victims have no idea they are dealing with a fraudster – and sometimes go on for years believing they are dealing with a proper financial adviser.

Blair (pictured) talks about substance and the need for higher standards among financial advisers. Whilst I love her thoughts, I know how difficult this might be to achieve. We see wholly unqualified scammers posing as fully qualified IFAs time and time again. These scammers are very good at acting the part and the victims have no idea they are dealing with a fraudster – and sometimes go on for years believing they are dealing with a proper financial adviser.

Please note these figures are correct as at 2017/2018, so today’s value is now even lower. Despite the funds’ huge decrease in value, Generali continues to take their fees (based on the original amount deposited – not the current depleted value). Therefore, these amounts will continue to fall AND despite the massive loses be locked in for a fixed term.

Please note these figures are correct as at 2017/2018, so today’s value is now even lower. Despite the funds’ huge decrease in value, Generali continues to take their fees (based on the original amount deposited – not the current depleted value). Therefore, these amounts will continue to fall AND despite the massive loses be locked in for a fixed term. Generali are not the only life office guilty of financial crimes: Old Mutual International and SEB were even worse – facilitating losses on a massive scale in the Continental Wealth Management case. OMI bought £94,000,000 worth of ultra-high-risk structured notes for retail investors – resulting in huge losses. Old Mutual was also heavily involved in more than £1,000,000,000 worth of losses in the Axiom, LM and Premier investment scams.

Generali are not the only life office guilty of financial crimes: Old Mutual International and SEB were even worse – facilitating losses on a massive scale in the Continental Wealth Management case. OMI bought £94,000,000 worth of ultra-high-risk structured notes for retail investors – resulting in huge losses. Old Mutual was also heavily involved in more than £1,000,000,000 worth of losses in the Axiom, LM and Premier investment scams.

When we buy certain products, they have a warning on them. Cigarette packets, for instance, state that smoking is bad for your health. The wrappers show hideous images of what might happen to you if you use tobacco.

When we buy certain products, they have a warning on them. Cigarette packets, for instance, state that smoking is bad for your health. The wrappers show hideous images of what might happen to you if you use tobacco. What worries us most is the lack of regulatory concern or control in respect of expensive and risky investment products. You can’t buy cigarettes without a stern health warning. The same goes for alcohol: bottles and cans clearly state how many units are in the container, and how many units men and women can safely drink per day. They also state that alcohol should not be consumed by pregnant women.

What worries us most is the lack of regulatory concern or control in respect of expensive and risky investment products. You can’t buy cigarettes without a stern health warning. The same goes for alcohol: bottles and cans clearly state how many units are in the container, and how many units men and women can safely drink per day. They also state that alcohol should not be consumed by pregnant women. You can’t buy a gun without going to a registered shop and having a licence. (Although, I guess on the black market you can). If you buy a gun on the black market, it is going to be ‘hot’. The person you buy it from is going to be dodgy and it certainly won’t come with the correct paperwork.

You can’t buy a gun without going to a registered shop and having a licence. (Although, I guess on the black market you can). If you buy a gun on the black market, it is going to be ‘hot’. The person you buy it from is going to be dodgy and it certainly won’t come with the correct paperwork.

Another victim of Berkeley Burke SIPPS investments into Store First storage pods has come forward. 55-year-old factory worker Robert McCarthy, of Ebbw Vale, said he has lost more than £30,000 through a Self-Invested Personal Pension (SIPP). He was duped into the transfer and investment by unregulated firm Jackson Francis which was liquidated in 2014. His investment may or may not be worthless – depending on whether Store First is wound up later in 2019.

Another victim of Berkeley Burke SIPPS investments into Store First storage pods has come forward. 55-year-old factory worker Robert McCarthy, of Ebbw Vale, said he has lost more than £30,000 through a Self-Invested Personal Pension (SIPP). He was duped into the transfer and investment by unregulated firm Jackson Francis which was liquidated in 2014. His investment may or may not be worthless – depending on whether Store First is wound up later in 2019.

Victims were also invested into the Store First storage pods via

Victims were also invested into the Store First storage pods via  Stephen Ward

Stephen Ward

A firm with advisers who are unwilling to answer all of the questions you ask them is clearly a firm to be avoided.

A firm with advisers who are unwilling to answer all of the questions you ask them is clearly a firm to be avoided.

In January 2019, we saw legal challenges going forward against not one but two SIPPS providers for their roles in using and promoting unregulated investments. Berkeley Burke SIPPS Administration and Carey Pensions (the latter now owned by rogue QROPS trustee firm STM Group).

In January 2019, we saw legal challenges going forward against not one but two SIPPS providers for their roles in using and promoting unregulated investments. Berkeley Burke SIPPS Administration and Carey Pensions (the latter now owned by rogue QROPS trustee firm STM Group). Tighter protocols on pension investments are something that we would happily welcome here at Pension Life. With higher standards of compliance and fewer small providers, people investing their pensions into SIPPS should hopefully have a clearer and safer picture.

Tighter protocols on pension investments are something that we would happily welcome here at Pension Life. With higher standards of compliance and fewer small providers, people investing their pensions into SIPPS should hopefully have a clearer and safer picture.

Furthermore, if someone does approach you via a cold call claiming to be a viable company with a convincing sales pitch – how do you know if what they are saying is genuine? How do you know if they are a

Furthermore, if someone does approach you via a cold call claiming to be a viable company with a convincing sales pitch – how do you know if what they are saying is genuine? How do you know if they are a

FT adviser published an article entitled,

FT adviser published an article entitled,  So, as we cannot count on our government to protect us from the cold calling scams, Pension Life is here to help.

So, as we cannot count on our government to protect us from the cold calling scams, Pension Life is here to help.

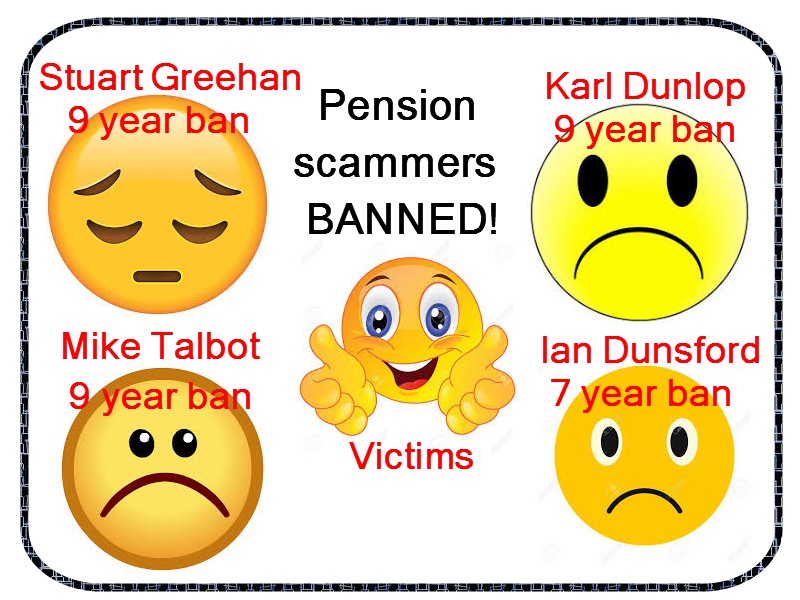

Stephen Ward of Premier Pension Solutions SL and Premier Pension Transfers Ltd

Stephen Ward of Premier Pension Solutions SL and Premier Pension Transfers Ltd Mark Manley of Manleys Solicitors – acting for XXXX XXXX.

Mark Manley of Manleys Solicitors – acting for XXXX XXXX. It is believed that cold calling techniques were used to lure unsuspecting victims into this series of unregulated investment scams. Victims’ pension savings were transferred into bogus occupational pension schemes whose trustees/administrators were Omni Trustees and Imperial Trustee Services. The schemes were

It is believed that cold calling techniques were used to lure unsuspecting victims into this series of unregulated investment scams. Victims’ pension savings were transferred into bogus occupational pension schemes whose trustees/administrators were Omni Trustees and Imperial Trustee Services. The schemes were

4. Insurance bonds are an expensive and unnecessary

4. Insurance bonds are an expensive and unnecessary  8. Time and time again, we see pension scam victims receiving the paperwork on the pension transfer ‘deal’ they have signed, only to realise that large fees and charges have been applied. The scammers are experts at hiding the charges and often quote the term: ‘free pension review’. Whilst they do not charge for all their visits and advice before you sign on the dotted line, they make up for this in transfer fees, commissions and often quarterly charges too! The quarterly charges will be applied no matter how your fund is doing. We have seen pension scam victims´ funds end up in negative equity due to being placed into an inappropriate fund which causes losses and second, continuing fees being applied. (Fees are normally based on the start value of the fund).

8. Time and time again, we see pension scam victims receiving the paperwork on the pension transfer ‘deal’ they have signed, only to realise that large fees and charges have been applied. The scammers are experts at hiding the charges and often quote the term: ‘free pension review’. Whilst they do not charge for all their visits and advice before you sign on the dotted line, they make up for this in transfer fees, commissions and often quarterly charges too! The quarterly charges will be applied no matter how your fund is doing. We have seen pension scam victims´ funds end up in negative equity due to being placed into an inappropriate fund which causes losses and second, continuing fees being applied. (Fees are normally based on the start value of the fund).

Those of you who follow

Those of you who follow