The recent PSIG (Pension Scams Industry Group) Scams Survey Pilot 2018 has identified seven “key” findings in their survey. As scam watchers, we are well aware of these points and are, of course, glad they have been highlighted.

The recent PSIG (Pension Scams Industry Group) Scams Survey Pilot 2018 has identified seven “key” findings in their survey. As scam watchers, we are well aware of these points and are, of course, glad they have been highlighted.

PSIG’s key finding are set out below. So let us admit one key fact:

ALL PENSION SCAMS START WITH A TRANSFER BY A CEDING PENSION PROVIDER.

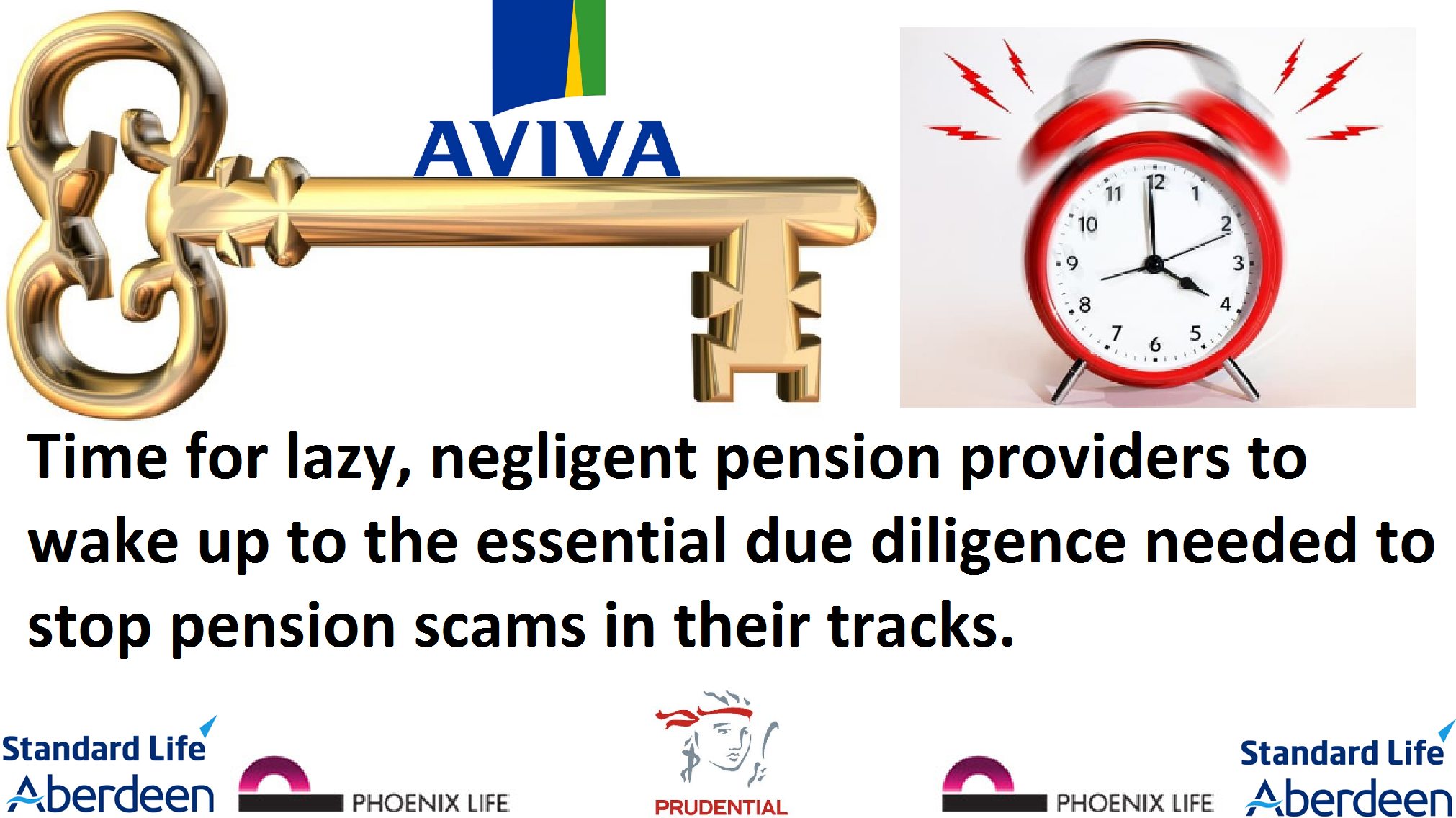

It is interesting that PSIG chose three particular providers to give their answers to the questionnaire sent out: XPS Pensions Group, Phoenix Life Assurance Company and Standard Life Assurance Company. I have no doubt they chose these three providers because of their extensive first-hand expertise at facilitating financial crime. In the Capita Oak and Westminster scams – distributed and administered by serial scammers XXXX and Stephen Ward – and now under investigation by the Serious Fraud Office – Phoenix Life and Standard Life handed over dozens of pensions to the scammers. In Phoenix Life’s case, the total came to nearly half a million pounds’ worth, and in Standard Life’s case it was well over one million.

While there is, of course, substantial hard evidence that both the Pensions Regulator (formerly OPRA) and HMRC had been giving the industry plenty of warnings about scams long before the Scorpion Campaign was published on Valentine’s Day in 2013, it is also true that providers such as Phoenix Life, Standard Life – and other favourite financial crime facilitators such as Aegon, Friends Life, Legal & General, Prudential, Royal London, Scottish Life and Scottish Widows – carried on handing over millions to the scammers well into 2014, 2015 and beyond. And, in fact, they are still at it today.

The “Key Findings” do throw up some interesting facts:

“Information on scams is not readily available at an organisational level”.

“Information on scams is not readily available at an organisational level”.

Seriously? Don’t these organisations know how to do research? Do they really not know what to look for? They’ve had enough experience over the years – and have had enough examples of spending vast amounts of time trying to cook up reasons to deny complaints against their incompetence for handing over pensions to scammers – to write a whole encyclopedia about scams.

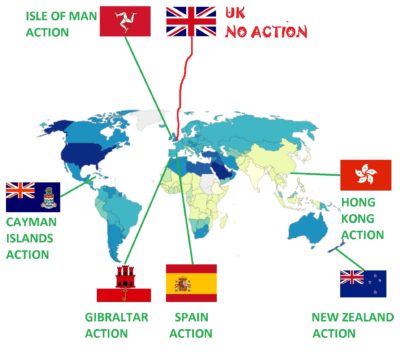

Organisations (such as Phoenix Life and Standard Life) could try talking to TPAS, or tPR, or the FCA, or the SFO, or Dalriada Trustees, or regulators in Malta, the IoM, Gibraltar, Dubai or Hong Kong. Or some of the thousands of victims – who have lost their pensions due to the incompetence and callousness of the ceding providers – who would readily fill in the blanks. There really is no shortage of readily-available, free information. They just need to take the time and trouble to ask for it. It really isn’t difficult. They just have to put their box-ticking pencils down for a few minutes.

“The Scams Code is seen as a good basis for due diligence”

“The Scams Code is seen as a good basis for due diligence”

I agree – it is really great. But it is also 78 pages long. Few people have to the time to read, understand or remember such long documents (with too many long words and not enough pictures). What would be helpful would be to get a few of the worst offenders: Aegon, Aviva, Friends Life, Legal & General, Phoenix, Prudential, Royal London, Scottish Life, Scottish Widows, Standard Life and Zurich, in a room at the same time – and bang their heads together. And threaten them that if they don’t get their acts together and stop handing over pensions to the scammers, they will be made to read and memorise the 78-page Scams Code and recite it every morning before coffee break. Twice. Then snap all their box-ticking pencils in half, and JOB DONE! It really isn’t rocket science – there are usually some hints which are as subtle as a brick, such as: the sponsoring employer doesn’t exist; or the member lives in Scunthorpe and is transferring to a scheme whose sponsoring employer is based in Cyprus. Or Hong Kong. Now, I know there was a bit of a hiccup with the Royal London v Hughes case when Justice Morgan overturned the Ombudsman’s determination. But dear old Hughes had probably had a few Babychams too many – and it had slipped his mind that the law is supposed to be about justice and common sense. And that just because a particular piece of legislation has been written by an ass, it doesn’t have to be interpreted with stupidity.

“Significant time and effort goes into protecting members from scams”

“Significant time and effort goes into protecting members from scams”

This, of course, may be true. I only get to see the cases where the negligent ceding providers do hand over the pensions to the scammers. I rarely get to see the ones that have a narrow escape. But what worries me is that I am in the process of making complaints to the ceding providers who have handed over pensions to the scammers, and not a single one of them thinks they have done anything wrong. So, if they do spend “significant time and effort” doing the protecting bit, how come so many of them still fail so badly? And then try to deny they failed. These providers spend very significant amounts of time and effort writing long, boring letters about how they did nothing wrong – letters which must have taken them at least an hour to write. And yet they won’t spent two minutes checking – and stopping – transfers to obvious scams.

“The more detailed the due diligence, the more suspicious traits are identified”

“The more detailed the due diligence, the more suspicious traits are identified”

I am a bit suspicious that this indicates a touch of porky pies here. I’ve never seen any evidence of ANY due diligence by the ceding providers. A bloke at Aviva once told me that they spent thousands on research and due diligence – but I see no evidence of it. The problem is, the ceding providers don’t know what they don’t know. And, to coin one of my favourite phrases: “they don’t know the questions to ask, and even if they did then they wouldn’t understand the answers”.

Interestingly, if – instead of repeatedly spending hours denying they did anything wrong when they handed over millions of pounds’ worth of pensions to the scammers – they spent some time talking to me and the victims trying to learn what went wrong and what due diligence should have gone into preventing a dodgy transfer, they might learn how to stop failing so badly.

SIPPS (including international SIPPS) are the vehicle of choice by scammers

SIPPS (including international SIPPS) are the vehicle of choice by scammers

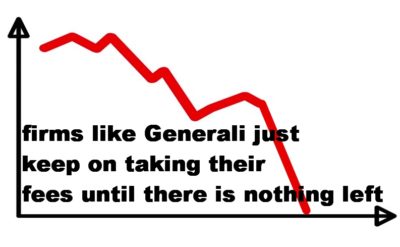

Agreed. But the scammers still love the good old QROPS. But whether it is a SIPPS or a QROPS – both of which are just “wrappers” at the end of the day, it is about what goes inside the wrappers. Where the scammers make their money is in the kickbacks: 8% on the pointless, expensive insurance bond from OMI, SEB, Generali, RL360, Friends Provident etc., and then more fat commissions on the expensive funds or structured notes.

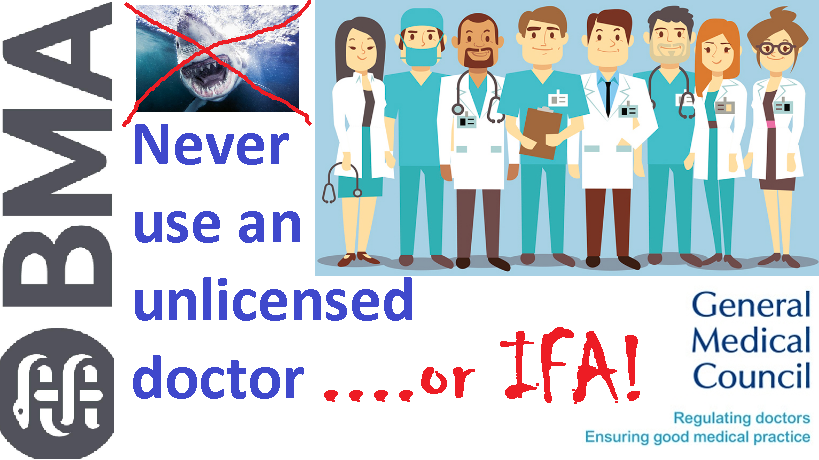

“Quality of adviser tops the list of practitioner concerns, with member awareness a close second”

“Quality of adviser tops the list of practitioner concerns, with member awareness a close second”

And hereby lies one of the main problems: ceding providers don’t know who the good guys are and who the bad guys are. And that is because they don’t ask. And they don’t learn from their mistakes when they get it wrong. And they don’t care when they hand the pensions over to the bad guys and their former member is now financially ruined and contemplating suicide. Instead of trying to use their appalling mistakes to improve their performance and understand what “quality” actually means, and how to tell the difference between good and bad quality, they only care about avoiding responsibility for their own failings.

The problem about “member awareness” is that most people assume their ceding provider will do some sort of due diligence. They think that words like “Phoenix Life”, “Prudential” and “Standard Life” convey some sort of professionalism or duty of care. Most members are simply unaware of the appalling track record of these providers – and the extraordinary and exhaustive lengths to which they will go to avoid being brought to justice for their negligence and laziness.

“Sharing of intelligence would help avoid duplication of effort”

“Sharing of intelligence would help avoid duplication of effort”

Oh, how heartily I agree! I remember a year or so ago, I shared some intelligence and a few beers with a nice chap from Scottish Widows. We met at one of Andy Agathangelou’s symposiums in London – the subject of which was pension scams. The Pensions Regulator was there, Dalriada Trustees were there, Pension Bee were there, lots of interested parties were there (including an American insurer from Singapore), and a couple of victims. I gave a joint presentation with one of the victims who described how he had been scammed and how his provider had handed over his pension so easily – well after the Scorpion watershed. The nice chap from Scottish Widows asked the victim why he hadn’t called the Police. The victim replied: “I am the Police”.

It was very telling that the room wasn’t full of delegates from Aviva, Phoenix Life, Prudential, Standard Life etc. None of them were interested.

Not a single provider has ever phoned me up to ask for advice, or to arrange to speak to some victims to learn something about how they were scammed and how and why their ceding providers had failed them so badly. There are so many victims all over the UK and the rest of the world. And what they all share is a passion to try to prevent other people from being scammed by the bad guys and failed by the bad pension providers. So this invaluable intelligence is freely available.

Until and unless the providers develop a conscience, they are going to continue to fuel the pension scam industry – and nothing will change. And the 79-page code might just as well be consigned to the bathrooms of Aegon, Aviva, Friends Life, Legal & General, Phoenix, Prudential, Royal London, Scottish Life, Scottish Widows, Standard Life and Zurich.

Fighting pension scams:

Fighting pension scams:  LCF Bond, Blackmore Bond, Blackmore Global Fund, LM, Axiom and Premier New Earth

LCF Bond, Blackmore Bond, Blackmore Global Fund, LM, Axiom and Premier New Earth

Serial

Serial  Firms that give unlicensed advice are breaking the law. Unlicensed advisers often use insurance bonds. These bonds pay high commissions. The funds these advisers use also pay high commissions. The advisers get rich. The clients get fleeced. The funds get destroyed. Insurance bonds such as

Firms that give unlicensed advice are breaking the law. Unlicensed advisers often use insurance bonds. These bonds pay high commissions. The funds these advisers use also pay high commissions. The advisers get rich. The clients get fleeced. The funds get destroyed. Insurance bonds such as  Unlicensed firms

Unlicensed firms  People can avoid being victims of

People can avoid being victims of

Much as a master illusionist takes your breath away with his magic, a

Much as a master illusionist takes your breath away with his magic, a

“Information on scams is not readily available at an organisational level”.

“Information on scams is not readily available at an organisational level”. “The Scams Code is seen as a good basis for due diligence”

“The Scams Code is seen as a good basis for due diligence” “Significant time and effort goes into protecting members from scams”

“Significant time and effort goes into protecting members from scams” “The more detailed the due diligence, the more suspicious traits are identified”

“The more detailed the due diligence, the more suspicious traits are identified” SIPPS (including international SIPPS) are the vehicle of choice by scammers

SIPPS (including international SIPPS) are the vehicle of choice by scammers “Quality of adviser tops the list of practitioner concerns, with member awareness a close second”

“Quality of adviser tops the list of practitioner concerns, with member awareness a close second” “Sharing of intelligence would help avoid duplication of effort”

“Sharing of intelligence would help avoid duplication of effort”

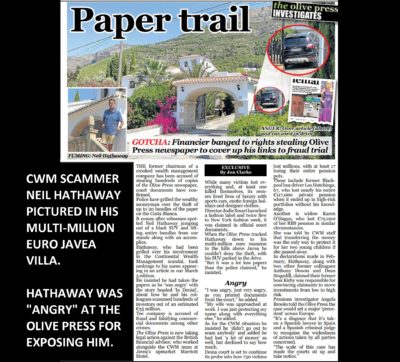

Blacklist – “The Pension Scam (No 69)”

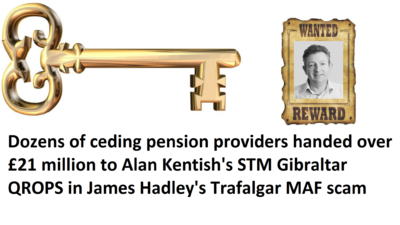

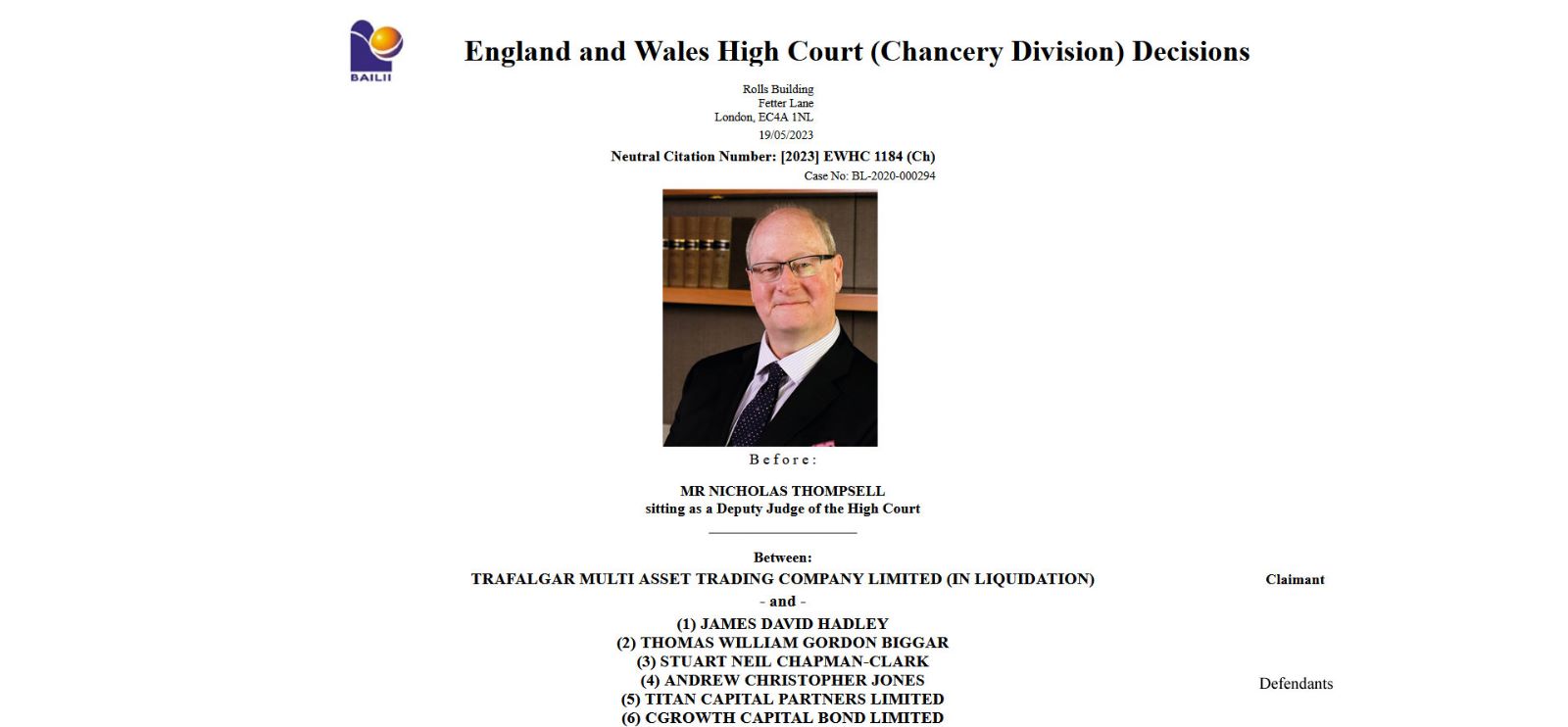

Blacklist – “The Pension Scam (No 69)” than one scam at a time (being male, he can’t multi-task).

than one scam at a time (being male, he can’t multi-task). Kentish is eager to know how much money can be made out of this plot. XXXX explains that 46% was earned out of his Capita Oak and Henley scams and that he hopes to make at least as much out of this one. With Kentish’s “help” (nudge nudge, wink wink). Of course, the proceeds could be split and plenty of brown envelopes used to disguise the handing over of the proceeds.

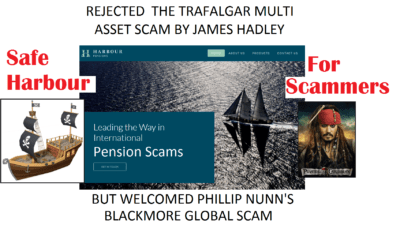

Kentish is eager to know how much money can be made out of this plot. XXXX explains that 46% was earned out of his Capita Oak and Henley scams and that he hopes to make at least as much out of this one. With Kentish’s “help” (nudge nudge, wink wink). Of course, the proceeds could be split and plenty of brown envelopes used to disguise the handing over of the proceeds. Now that the Trafalgar Multi-Asset Fund has been suspended – thanks to the hero of the hour: Reinert – Kentish decides to buy Caffrey’s QROPS firm, Harbour (which is full of Phillip Nunn’s Blackmore Global investment scam). Caffrey swans off into the sunset with £1 million burning a hole in his pocket, quietly humming “Oh Danny Boy”.

Now that the Trafalgar Multi-Asset Fund has been suspended – thanks to the hero of the hour: Reinert – Kentish decides to buy Caffrey’s QROPS firm, Harbour (which is full of Phillip Nunn’s Blackmore Global investment scam). Caffrey swans off into the sunset with £1 million burning a hole in his pocket, quietly humming “Oh Danny Boy”. Sadly, of course, it was real life. As more than 400 victims will attest. So no more script-writing for me. I will stick to blogs in the future.

Sadly, of course, it was real life. As more than 400 victims will attest. So no more script-writing for me. I will stick to blogs in the future. The sophistication of investment scams has reached new levels in Singapore

The sophistication of investment scams has reached new levels in Singapore This is a story about how scammers have used the loopholes within the law to fleece hundreds of millions of dollars

This is a story about how scammers have used the loopholes within the law to fleece hundreds of millions of dollars

Furthermore, if someone does approach you via a cold call claiming to be a viable company with a convincing sales pitch – how do you know if what they are saying is genuine? How do you know if they are a

Furthermore, if someone does approach you via a cold call claiming to be a viable company with a convincing sales pitch – how do you know if what they are saying is genuine? How do you know if they are a

In many pension scam cases, we find victims telling us that they were

In many pension scam cases, we find victims telling us that they were  The only way forward is to go fee-based. And to outlaw commissions and hidden charges altogether. The scammers won’t do it – but decent, ethical firms will. The hard part will be to warn expats against vultures. Ethical firms will help with this initiative. Obviously, the scammers won’t.

The only way forward is to go fee-based. And to outlaw commissions and hidden charges altogether. The scammers won’t do it – but decent, ethical firms will. The hard part will be to warn expats against vultures. Ethical firms will help with this initiative. Obviously, the scammers won’t.