Ten Essential Standards For Pension Advice:

Ten Essential Standards For Pension Advice:

The ongoing war against pension scammers continues with no sign that the end is near. The authorities stand idly by – facilitating mis-selling and outright fraud.

HMRC happily registers pension scam after scam after scam (followed by tax demands). Prosecutions are few and far between.

The only conclusive way to stop scammers is to ensure there are no victims for them to scam. AND the only way to do this is to educate consumers and drum the TEN STANDARDS into them.

PENSION SCAMMERS MUST BE STOPPED!

Ten Essential Standards For Pension Advice:

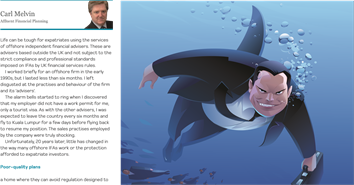

Do you know what a pension scammer looks like? The unfortunate answer is, he looks like any other Tom, Dick or Harry (or James, Stephen or Darren) walking down the street. Not only is he good at disguises, he also has the gift of the gab and he will have you convinced that the pension transfer he is offering you will pave the rest of your life with gold. In reality though, the gold will be short lived (or non-existent), and some or all of your fund will probably go poof! (along with the adviser).

Much as a master illusionist takes your breath away with his magic, a master scammer takes your money away with his silver tongue. You will be left wondering just how this smart-looking, sleek-talking ‘adviser’ managed to leave your pension – and probably your life – in tatters.

Much as a master illusionist takes your breath away with his magic, a master scammer takes your money away with his silver tongue. You will be left wondering just how this smart-looking, sleek-talking ‘adviser’ managed to leave your pension – and probably your life – in tatters.

We have compiled a list of ten standards that EVERY firm offering pension advice should adhere to. Every qualified adviser working for an advisory firm should also be able to meet all of these standards. On Facebook recently, one reader stated: “Why would anyone respond to an unsolicited offer to manage their money from a complete stranger?” The answer is, “I don’t know, but they do!“. So, get to know a financial adviser long before you let them anywhere near your finances.

In the case of Capita Oak, for example, we saw many targeted victims who were struggling financially. So, the offer of a lump sum release and the opportunity of an investment that promised “guaranteed returns” was music to their ears.

Many of the victims didn’t stop to think; didn’t pause to ask the right questions; or do any research to make sure the pension offer came from a viable, credible, regulated firm. The victims just said “yes” as they thought the transfer would make life easier.

For example, with the awful benefit of hindsight – six years on – the Capita Oak victims are grappling with tax demands from HMRC and the possibility that the investment they are trapped in will go into liquidation. These people all wish they had stopped and thought before going ahead.

Sadly, the Capita Oak members who were defrauded by a bunch of scammers, (many of which are under investigation by the Serious Fraud Office) such as XXXX, Stuart Chapman-Clarke and Stephen Ward, are not alone. Thousands of other victims of both UK-based and offshore scams and mis-selling are facing similar regrets: these include victims of scams such as Evergreen New Zealand QROPS; Fast Pensions, Trafalgar Multi Asset Fund/STM Fidecs; Blackmore Global Fund; and Continental Wealth Management.

Mastermind serial scammer Stephen Ward has orchestrated a whole array of different scams over the last nine years. One of the biggest ones was Continental Wealth Management – a 1,000-victim scam. Ward was once a fully qualified and registered adviser and a pension trustee. He has destroyed dozens of pensions funds and thousands of victims’ lives. Yet he has never been prosecuted or forced to pay back even one penny of his victims’ losses. Only at the end of 2018 was he finally banned from being a pension trustee.

Most of the known scams used cold-calling techniques to reel in their victims. Whilst we saw a cold-calling ban on pension sales in 2019, we have already had reports that sneaky firms have changed their scripts to avoid fines. AND we are now seeing scammers focus their targets back onto expats. Which makes us worry there will be more QROPS disasters in the pipeline from now on.

Just a few minutes of research – as well as knowing the right questions to ask and understanding what standards an adviser and firm should adhere to – could have prevented past victims from losing so much of their precious pension pots. We can’t change what happened in the past – other than to take action against the scammers and negligent advisers – but we can help consumers understand what they should be looking for in an adviser:

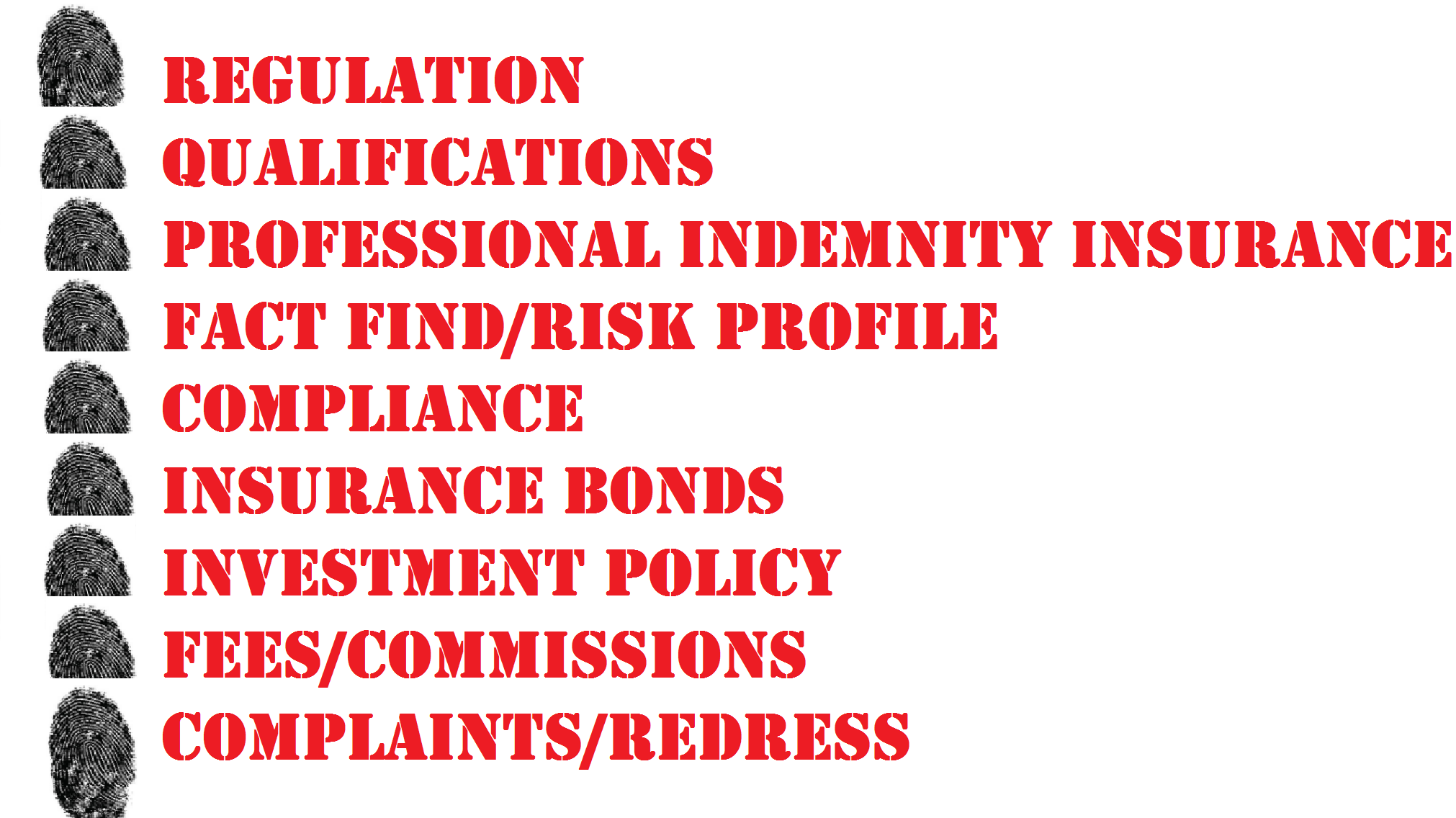

STANDARDS ACCREDITATION CHECKLIST FOR FINANCIAL ADVISERS:

- Proof of regulation for all services provided by the firm and individual advisers in the jurisdiction where advice is given

- Evidence of appropriate qualifications and CPD for all advisers

- Professional Indemnity Insurance

- Details of how fact finds are carried out, and how clients’ risk profiles are determined and adhered to

- Details of the firm’s compliance procedures – assuring clients of the highest possible standards

- Clear and consistent explanation and justification of the use of insurance bonds for pensions and investments

- Clear policy on structured notes, UCIS and in-house funds, non-standard assets and commission-paying investments

- Full disclosure of all fees, charges and commissions on all products and services at time of sale, in writing

- Account of how clients are updated on fund/portfolio performance

- Evidence of customer complaints made, rejected or upheld and redress paid

If the firm you are thinking about using for your pension transfer do not adhere to all of these standards, find one that does. Your pension pot is your life savings – so don’t entrust it to any old unregulated firm or dishonest scammer. Remember, thousands of victims have already failed to ask the above ten questions – and will regret it for the rest of their lives.

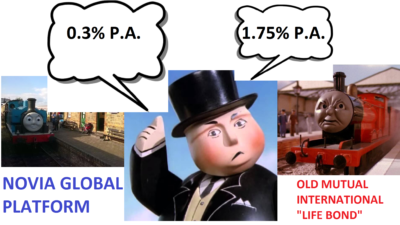

The problem with money is that it blows away if you don’t hold it down, tie it up or stuff it down your knickers. That’s why you need to put it somewhere safe: in a shoe box on top of the wardrobe; under your mattress; in the safe or – if you’re feeling really brave – in the bank. Trouble is, left in cash, money shrinks (inflation, charges, moths). This is why so many advisers recommend a platform – aka “somewhere safe” to keep your money.

The problem with money is that it blows away if you don’t hold it down, tie it up or stuff it down your knickers. That’s why you need to put it somewhere safe: in a shoe box on top of the wardrobe; under your mattress; in the safe or – if you’re feeling really brave – in the bank. Trouble is, left in cash, money shrinks (inflation, charges, moths). This is why so many advisers recommend a platform – aka “somewhere safe” to keep your money.

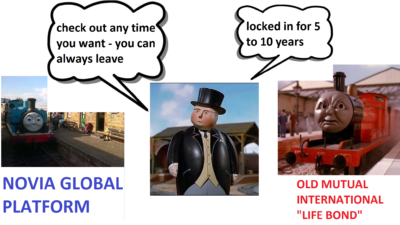

A bit like the lyrics to Hotel California, with an OMI “bond”, you can’t check out any time you want, and you can only leave after between five and ten years. OMI will take that number of years to claw back the commission paid to your adviser – even if you have long since learned that your adviser was an unregulated scammer and has conned you into unsuitable, high-risk, high-commission investments that have badly damaged your fund. You are stuck with paying the quarterly fees to OMI – even after your whole fund has gone. One victim went from plus

A bit like the lyrics to Hotel California, with an OMI “bond”, you can’t check out any time you want, and you can only leave after between five and ten years. OMI will take that number of years to claw back the commission paid to your adviser – even if you have long since learned that your adviser was an unregulated scammer and has conned you into unsuitable, high-risk, high-commission investments that have badly damaged your fund. You are stuck with paying the quarterly fees to OMI – even after your whole fund has gone. One victim went from plus  In Spain, the Supreme Court has ruled that bogus life assurance policies – such as those provided by

In Spain, the Supreme Court has ruled that bogus life assurance policies – such as those provided by

The arrival of wraps allows fee-based financial planners in the UK to offer a sound, client-focused service to expats, who up until recently have been easy prey to

The arrival of wraps allows fee-based financial planners in the UK to offer a sound, client-focused service to expats, who up until recently have been easy prey to

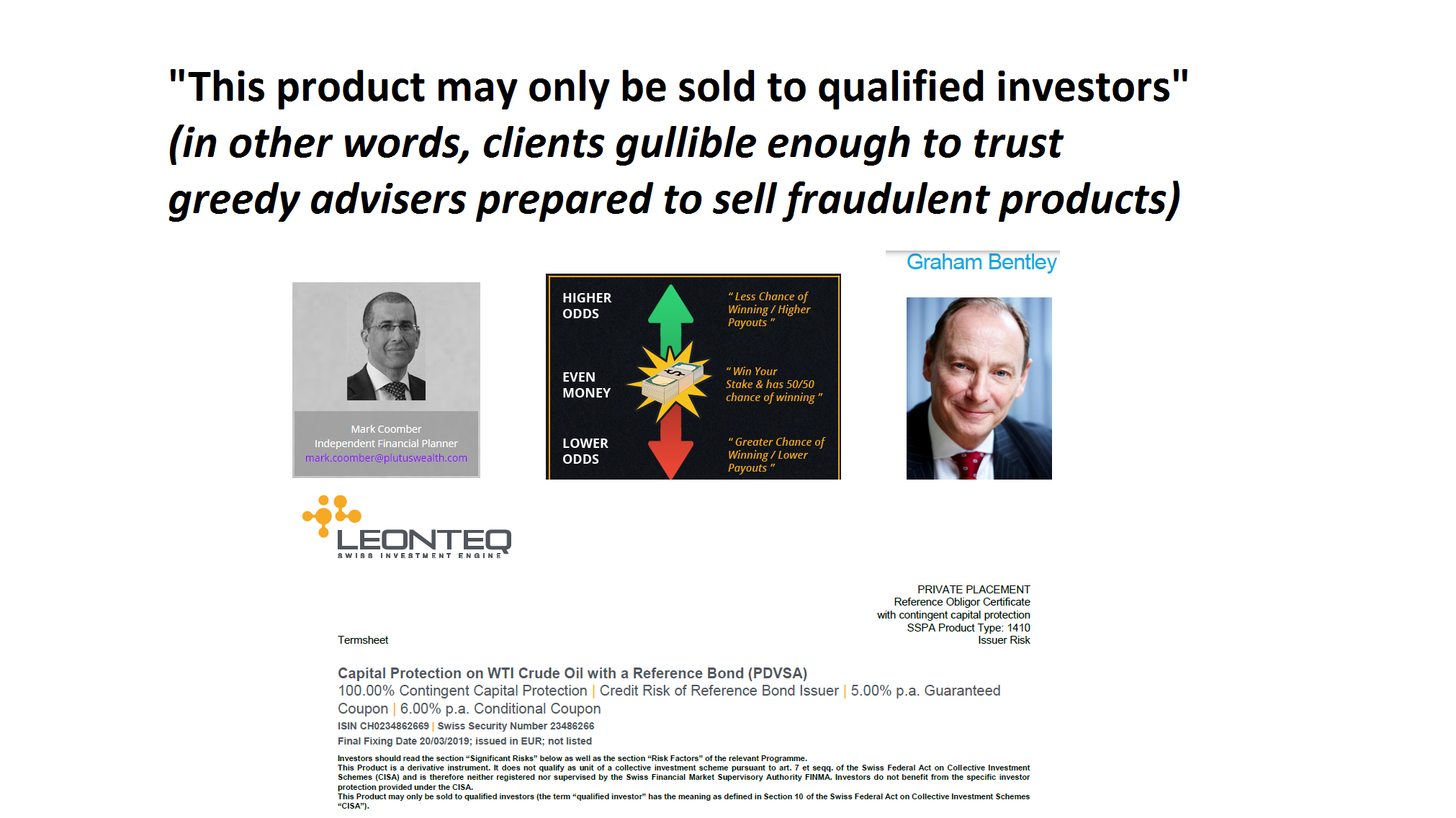

Nitwit or Dragonfly? Gambling or Investing? Are investment losses as a result of a bad adviser or a bad investment? Or both? The real question is: how does the consumer tell the difference? A favourite episode of Fawlty Towers involved Basil’s ill-fated bet on a racehorse called Dragonfly. Confusion sets in – fuelled by the easily-confused Manuel – and “Dragonfly” gets muddled up with “Nitwit”. And that is how clients get confused just as easily: by advisers who spout the usual rubbish: capital protected; guaranteed returns; blue-chip investments; solid providers etc. They just leave out the three most important things: the fat commissions paid to the adviser; the high-risk nature of the “investment” and the fact that

Nitwit or Dragonfly? Gambling or Investing? Are investment losses as a result of a bad adviser or a bad investment? Or both? The real question is: how does the consumer tell the difference? A favourite episode of Fawlty Towers involved Basil’s ill-fated bet on a racehorse called Dragonfly. Confusion sets in – fuelled by the easily-confused Manuel – and “Dragonfly” gets muddled up with “Nitwit”. And that is how clients get confused just as easily: by advisers who spout the usual rubbish: capital protected; guaranteed returns; blue-chip investments; solid providers etc. They just leave out the three most important things: the fat commissions paid to the adviser; the high-risk nature of the “investment” and the fact that  And this guy is chartered! As a member of the CISI he should know better than to spout such rubbish – and I feel deeply sorry for any clients of Plutus Wealth Management as they are clearly in danger of being sold these toxic products. In fact, I would go further and suggest the public should be warned about the dangers of using this firm, as Coomber clearly has every intention of flogging his victims these high-risk products. If he is stupid enough to use them for his own gambling fun, good luck to him. But he has no right to inflict them on retail clients.

And this guy is chartered! As a member of the CISI he should know better than to spout such rubbish – and I feel deeply sorry for any clients of Plutus Wealth Management as they are clearly in danger of being sold these toxic products. In fact, I would go further and suggest the public should be warned about the dangers of using this firm, as Coomber clearly has every intention of flogging his victims these high-risk products. If he is stupid enough to use them for his own gambling fun, good luck to him. But he has no right to inflict them on retail clients. The term sheet did, to be fair, give a clear warning:

The term sheet did, to be fair, give a clear warning:

Those of you who follow

Those of you who follow

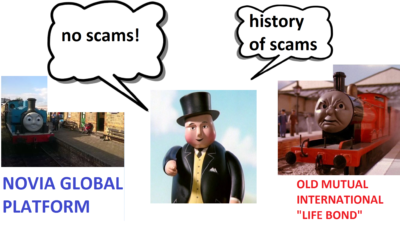

International Adviser and the Old Mutual International/Quilter Scams. Today’s jolly:

International Adviser and the Old Mutual International/Quilter Scams. Today’s jolly: International Adviser should hang its head in shame for failing to make sure that the perpetrators – especially Old Mutual International/Quilter – are brought to justice publicly for the destruction of hundreds of millions of pounds’ worth of life savings. And yet IA’s Old Mother Hubbard is consorting with them and giving Quilter’s Ryan Gardner a speaking slot on the

International Adviser should hang its head in shame for failing to make sure that the perpetrators – especially Old Mutual International/Quilter – are brought to justice publicly for the destruction of hundreds of millions of pounds’ worth of life savings. And yet IA’s Old Mother Hubbard is consorting with them and giving Quilter’s Ryan Gardner a speaking slot on the  Pension Life is based in Spain, and Angie works with clients all over the world. Pension and investment scammers have no boundaries or borders and will weave their evil mischief wherever they can find British expats.

Pension Life is based in Spain, and Angie works with clients all over the world. Pension and investment scammers have no boundaries or borders and will weave their evil mischief wherever they can find British expats. Angie stands up for the masses, where their single complaints are lost in a pile of excuses by the firms responsible for the destruction of their funds. She meets and speaks to as many victims as she can. Each victim has his or her own tragedy – often involving serious health issues and terrible financial hardship as a result of being scammed out of their life savings.

Angie stands up for the masses, where their single complaints are lost in a pile of excuses by the firms responsible for the destruction of their funds. She meets and speaks to as many victims as she can. Each victim has his or her own tragedy – often involving serious health issues and terrible financial hardship as a result of being scammed out of their life savings. here is a reason why I write my blogs. Firstly to warn the public and expose the things that go wrong in the financial services industry – to try to help new people avoid falling victim to scams, negligence and mis-selling; secondly to bring firms to the table to negotiate a solution to a problem where a client has suffered losses in their pension or investment portfolio. Few people have funds to instruct lawyers to sue firms to force them to pay redress for clients’ losses, so it is much better and cheaper to get the firm to volunteer to do so amicably and in a non-contentious manner.

here is a reason why I write my blogs. Firstly to warn the public and expose the things that go wrong in the financial services industry – to try to help new people avoid falling victim to scams, negligence and mis-selling; secondly to bring firms to the table to negotiate a solution to a problem where a client has suffered losses in their pension or investment portfolio. Few people have funds to instruct lawyers to sue firms to force them to pay redress for clients’ losses, so it is much better and cheaper to get the firm to volunteer to do so amicably and in a non-contentious manner. I have in the past had very public spats on social media with deVere AND its CEO, Nigel Green, as well as the others who I have been accused of not writing about. And, if I need to have spats again in the future, I will not hesitate to do so. Like most firms, deVere has indeed made some serious mistakes in the past. However, I do not have any live, unresolved client complaints against the firm.

I have in the past had very public spats on social media with deVere AND its CEO, Nigel Green, as well as the others who I have been accused of not writing about. And, if I need to have spats again in the future, I will not hesitate to do so. Like most firms, deVere has indeed made some serious mistakes in the past. However, I do not have any live, unresolved client complaints against the firm.

Oh dear, Holborn Assets has fallen at the first fence – even before I’ve started the race! You couldn’t make it up. And typical of scammers, Holborn Assets is very concerned about the interests of their company and their profits, but couldn’t care less about the victims it has ruined.

Oh dear, Holborn Assets has fallen at the first fence – even before I’ve started the race! You couldn’t make it up. And typical of scammers, Holborn Assets is very concerned about the interests of their company and their profits, but couldn’t care less about the victims it has ruined. Interestingly, I had an email from a chap this weekend who explained that he and a number of his colleagues had left the firm last year. He was very discreet about the reasons, but it was clear he was smart enough to see the writing on the wall and get out before his personal reputation was damaged. Who knows – maybe he even works for Guardian Wealth Management now?

Interestingly, I had an email from a chap this weekend who explained that he and a number of his colleagues had left the firm last year. He was very discreet about the reasons, but it was clear he was smart enough to see the writing on the wall and get out before his personal reputation was damaged. Who knows – maybe he even works for Guardian Wealth Management now?

Guardian Wealth Management and the two-horse race with Holborn Assets

Guardian Wealth Management and the two-horse race with Holborn Assets

Mark Coomber, Chartered MCSI Independent Financial Planner at Plutus Wealth Management