BREXIT is the question on everybody’s lips at the moment. BREXIT: will we? won´t we? deal? no deal? So many unanswered questions and so much scaremongering. We would like to offer some helpful words and hopefully protect you from making rash decisions. This could help you to safeguard your pension. Many scammers are trying to cash in on Brexit – make sure sure you’re not their next victim.

Remember I am not a financial adviser. I am a blogger, and I write about financial crime. I provide information about past scams and on how to avoid falling victim to new scams – especially pension scams. The words I write are aimed to help you safeguard your pension from the many offshore scammers.

So, Expats, what does Brexit mean for your pension rights? The short answer is that we really do not know! There are currently lots of “coulds” and “mights” being thrown around, but no certainties. And herein lies the risk that you and your pension could fall victim to a scam with all this scaremongering.

We are seeing a lot of adverts for expats to transfer into a QROPS before the dreaded 11pm on March 29, 2019. One company I have noticed that seems to be using Brexit to attract customers is Spectrum IFA. Back on 1st July 2018, we wrote a qualified and registered blog about Spectrum IFA. They didn´t do too well.

Firstly, despite Spectrum IFA advertising themselves as “international financial advisers”, with some digging we were able to find out that they DO NOT in fact have an investment licence. This means they are not legally allowed to advise on pensions or investments. Secondly, they scored rather poorly on the qualified and registered percentage too. Out of the 16 advisers we checked up on, only four were registered with the appropriate institutes. The rest came up red – meaning the institute had no record of them.

Worrying isn´t it? Offshore companies can try to claim they are international financial advisers, but actually be unregulated and unqualified to carry out the very service they offer! The “advisory” firms have flash websites, and some have several offices around Europe and beyond. Their PR is great at scaremongering expats about their pension investments in the lead up to Brexit.

Worrying isn´t it? Offshore companies can try to claim they are international financial advisers, but actually be unregulated and unqualified to carry out the very service they offer! The “advisory” firms have flash websites, and some have several offices around Europe and beyond. Their PR is great at scaremongering expats about their pension investments in the lead up to Brexit.

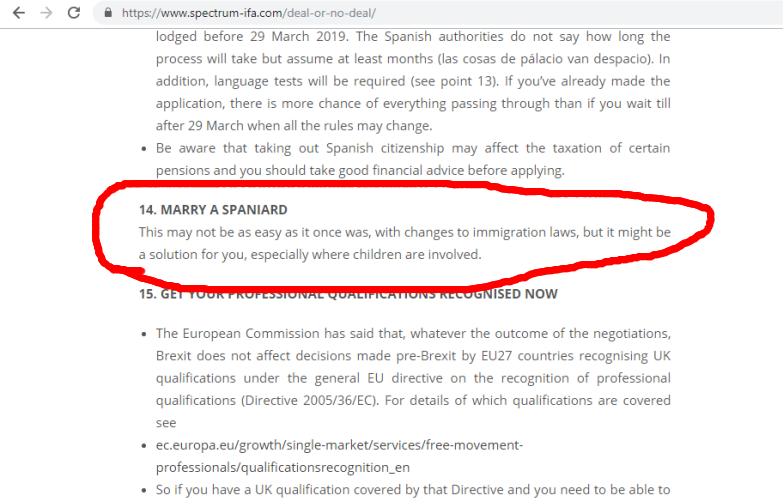

In Spectrum’s ´Deal or no deal´ article number 14, they suggest you marry a Spaniard in order to prepare for Brexit. I´m not sure about you, but I feel that getting hitched to a native to be able to stay in Spain is a pretty drastic measure and definitely more than a little illegal.

Spectrum IFA is just one example of a firm that probably ought to be given a wide berth when transferring your precious pension fund offshore. Safeguard your pension by avoiding unregulated and unqualified firms like this one.

********

It may seem daunting when you read that your UK pension could be subjected to extra taxes if we leave the EU on a no-deal basis. You may be thinking that you should transfer into a QROPS quickly, to save on these taxes. But what you really need to know is that a QROPS is not without punitive costs of its own. They can be expensive and unless you have a good lump sum to transfer you could see a huge chunk of your pension pot taken in transfer and set-up fees anyway! Potentially making you worse off.

Unfortunately, until we make a deal or actually go through with Brexit, nothing is very clear for expats. Which leaves us in an uncertain time and situation. This, I understand, may be daunting for many people, but I urge you to take a deep breath before considering any speedy offshore pension transfers. Thousands of people – especially those who have already fallen victim to scammers such as Continental Wealth Management – would give you exactly the same urgent advice.

If you do want to transfer your pension, please heed this advice to safeguard your pension:

Make sure you choose a reputable firm – one that is regulated, insured and employs fully qualified (and registered) advisers.

We did a series of blogs last year on offshore companies and their advisers. The results were extremely worrying. Aside from their blatant disregard for the necessity of these qualifications – due to being offshore – the number of unqualified advisers offshore was cause for serious concern. Many of the firms had not one single qualified and registered adviser on their team.

Qualified & registered? We do not need to be – we are offshore!

Know all the correct questions to ask an adviser before you sign on the dotted line.

Know all the correct questions to ask an adviser before you sign on the dotted line.

A reputable firm will have a fact-find procedure, and adhere to a client’s risk profile.

A reputable firm will have compliance procedure.

A reputable firm will have clear and consistent explanations and justifications for the use of insurance bonds.

Where will your funds be invested, and how will you know if this is in line with your risk profile?

A pension fund should be placed into a low-medium risk investment.

Scammers tend to go for high-risk, professional-investor-only investments as they offer them the best commissions. But a pension fund should have more protection than this. Avoid investments that involve structured notes (like CWM´s Blue Chip notes), UCIS funds (like Blackmore Global), in-house funds, non-standard assets and any ongoing commission-paying investments.

Insurance bonds – often used by scammers – are usually an unnecessary double wrapper on your fund, that costs you more in fees and charges than a straightforward platform, lining the pockets of the scammers – but making your fund smaller.

How much will the fees and charges be? Remember NO pension transfer is free.

How much will the fees and charges be? Remember NO pension transfer is free.

Legitimate firms will normally have a small transfer charge and a small annual fee.

Scammers will often be vague about fees and charges, and avoid giving you a straight answer so they can cover up the true figures. These hidden figures can see your pension fund decrease by 25% or even more in some cases.

A reputable firm should offer you regular updates on the progress of your fund.

You should receive an annual review and a quarterly update showing the fees, charges and growth of your fund.

If your new firm and adviser fail to do this, alarm bells should ring loudly.

Finally, a reputable company will publish evidence to show records of complaints made, rejected or upheld and redress paid.

If the adviser cannot show you all this information, do not trust them.

If it all sounds to good to be true, it probably is – RUN!

SCAMMER JAILED! Hip hip hooray! we say. What a great start to the new year. Neil Bartlett, 53, of Delamere Road, Ainsdale, used £4.5m of his victims’ money to fund an extravagant lifestyle of foreign travel, top hotels and gambling.

SCAMMER JAILED! Hip hip hooray! we say. What a great start to the new year. Neil Bartlett, 53, of Delamere Road, Ainsdale, used £4.5m of his victims’ money to fund an extravagant lifestyle of foreign travel, top hotels and gambling.

AND to rub salt into the wounds of the Trafalgar victims,

AND to rub salt into the wounds of the Trafalgar victims,  In follow up to our blog ´

In follow up to our blog ´

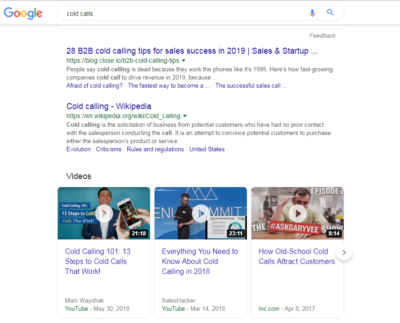

A quick google search of cold call gives untold amounts of advice on how to do it efficiently in 2019! Whilst some of these companies aren´t UK based, the evidence is clear. Cold calling pays and the companies that benefit from cold calling are not going to suddenly stop making them.

A quick google search of cold call gives untold amounts of advice on how to do it efficiently in 2019! Whilst some of these companies aren´t UK based, the evidence is clear. Cold calling pays and the companies that benefit from cold calling are not going to suddenly stop making them.

As 2018 draws to a close, a recap is in order to review the year’s progress in the war against pension scammers. Let us not forget – in the immortal words of the Pensions Regulator’s Lesley Titcombe: “

As 2018 draws to a close, a recap is in order to review the year’s progress in the war against pension scammers. Let us not forget – in the immortal words of the Pensions Regulator’s Lesley Titcombe: “ Neither Garry Williams nor Sue Huxley has ever been convicted or jailed.

Neither Garry Williams nor Sue Huxley has ever been convicted or jailed.

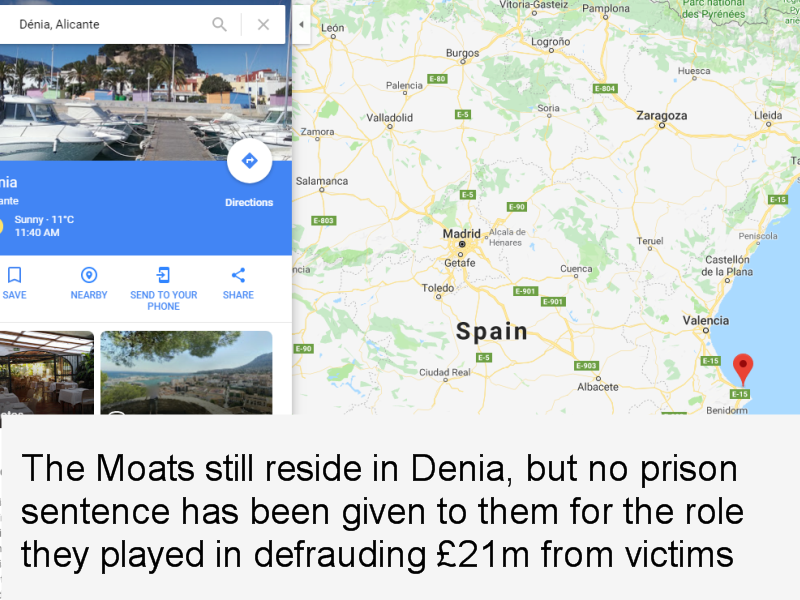

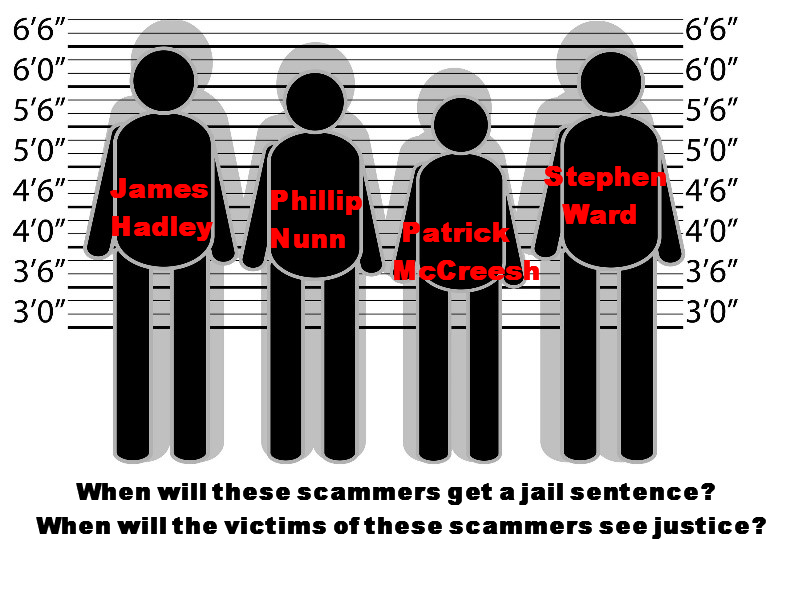

Stephen Ward’s firm Premier Pension Solutions (in Moraira, Spain) was the “sister” firm of Continental Wealth Management, run by scammer Darren Kirby. This was one of the biggest single scams – known as

Stephen Ward’s firm Premier Pension Solutions (in Moraira, Spain) was the “sister” firm of Continental Wealth Management, run by scammer Darren Kirby. This was one of the biggest single scams – known as

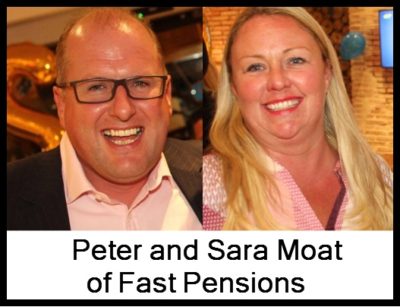

Fast Pensions

Fast Pensions

Another of Stephen Ward’s many pension scams, this one was courtesy of his bogus pension trustee firm

Another of Stephen Ward’s many pension scams, this one was courtesy of his bogus pension trustee firm  116 victims were scammed out of their pensions by James Lau of FCA-regulated Wightman Fletcher McCabe. Victims were assured the loans they were given did not come from their pension funds and would not be taxable by HMRC. The trustees of the scheme – Peter Bradley and Andrew Meeson (both ex HMRC) of Tudor Capital Management – were jailed for eight years for cheating the Public Revenue. James Lau is currently under criminal investigation by the Insolvency Service. The victims are awaiting a verdict on whether they will still have to pay the tax penalties.

116 victims were scammed out of their pensions by James Lau of FCA-regulated Wightman Fletcher McCabe. Victims were assured the loans they were given did not come from their pension funds and would not be taxable by HMRC. The trustees of the scheme – Peter Bradley and Andrew Meeson (both ex HMRC) of Tudor Capital Management – were jailed for eight years for cheating the Public Revenue. James Lau is currently under criminal investigation by the Insolvency Service. The victims are awaiting a verdict on whether they will still have to pay the tax penalties.

1. New Earth Solutions Group Limited (“NESGL”)

1. New Earth Solutions Group Limited (“NESGL”) Deloittes have made the usual “we are limited in what information we can share so that we do not prejudice any potential claims” disclaimer to the distressed shareholders. But I find it worrying that Deloittes is being used at all for this job. Deloittes was used to inspect the books and records of

Deloittes have made the usual “we are limited in what information we can share so that we do not prejudice any potential claims” disclaimer to the distressed shareholders. But I find it worrying that Deloittes is being used at all for this job. Deloittes was used to inspect the books and records of  However noble, environmentally friendly and ethical the concept of turning rubbish into clean energy may sound in theory, this commercial venture was never commercially viable. In fact, looking at the ever-increasing gross losses from 2008 to 2014: from £0.3m in 2008 to £7m in 2014 – and a total spent on “admin costs” of £14.3m – any half-decent accountant or auditor would have blown the whistle long before 2016.

However noble, environmentally friendly and ethical the concept of turning rubbish into clean energy may sound in theory, this commercial venture was never commercially viable. In fact, looking at the ever-increasing gross losses from 2008 to 2014: from £0.3m in 2008 to £7m in 2014 – and a total spent on “admin costs” of £14.3m – any half-decent accountant or auditor would have blown the whistle long before 2016. The name “Premier” will, of course, strike a chord with victims of

The name “Premier” will, of course, strike a chord with victims of  And, of course,

And, of course,

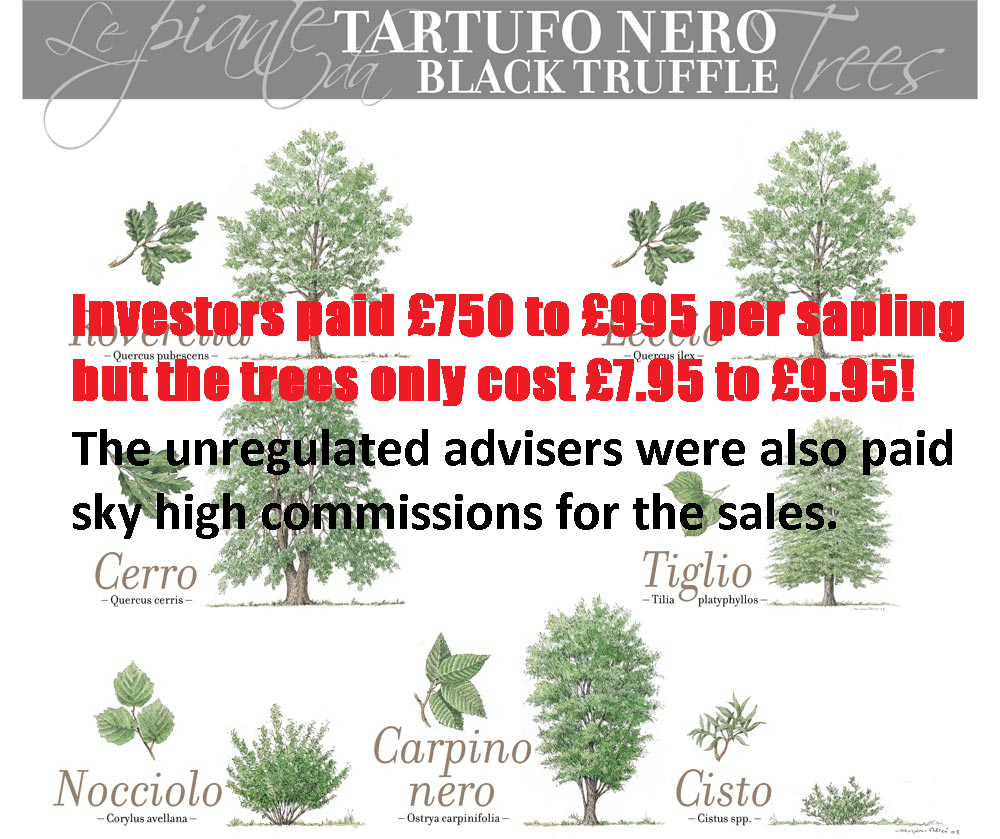

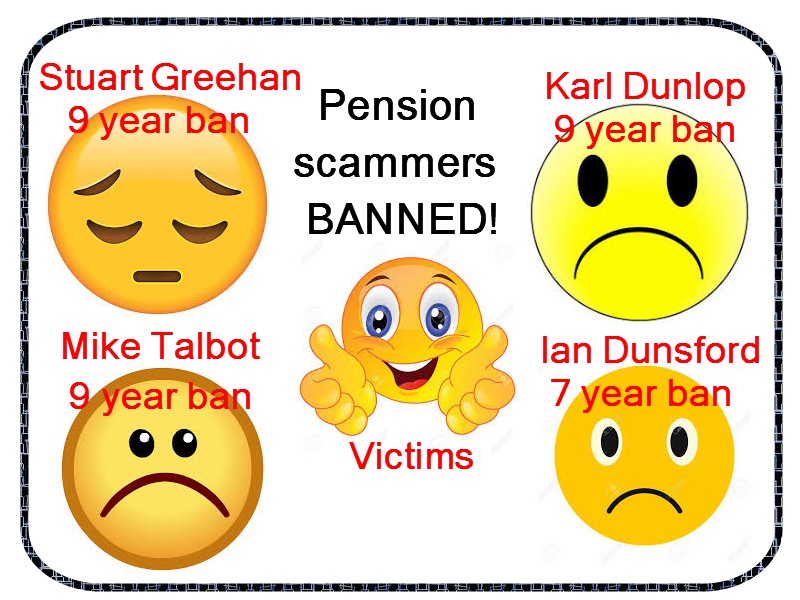

This could possibly be described as wonderful news for the victims of Viceroy Jones New Tech Ltd, Viceroy Jones Overseas PCC Limited, Westcountrytruffles Limited, Truffle Sales Ltd and Credit Free Limited. Or maybe not. The whereabouts of the funds is unknown. This pension liberation and investment scam saw 100 investors conned out of £9m of their pension savings.

This could possibly be described as wonderful news for the victims of Viceroy Jones New Tech Ltd, Viceroy Jones Overseas PCC Limited, Westcountrytruffles Limited, Truffle Sales Ltd and Credit Free Limited. Or maybe not. The whereabouts of the funds is unknown. This pension liberation and investment scam saw 100 investors conned out of £9m of their pension savings.

However, I feel I have to disagree.

However, I feel I have to disagree. Winding up these companies is often of little help to the scam victims. What is left of their funds (if any) is passed on to another trustee (often Dalriada) to deal with the ‘clean up’. This action, however, is not without cost and often the funds just sit there doing nothing.

Winding up these companies is often of little help to the scam victims. What is left of their funds (if any) is passed on to another trustee (often Dalriada) to deal with the ‘clean up’. This action, however, is not without cost and often the funds just sit there doing nothing.

The lawyer from JMW acting for Dolphin Trust – Nick McAleenan – has championed the cause of the supermarket chain: Morrisons.

The lawyer from JMW acting for Dolphin Trust – Nick McAleenan – has championed the cause of the supermarket chain: Morrisons. The case is the leading legal case in the UK concerning “data breach”. It relates to the unauthorised copying and disclosure of Morrisons payroll information by a disgruntled ex-employee. In 2017, the High Court ruled that Morrisons is legally responsible for the data breach. In 2018, Morrisons appealed the High Court’s judgment, but the Court of Appeal dismissed Morrisons’ appeal. Further legal proceedings will take place to determine what compensation must be paid to the victims.

The case is the leading legal case in the UK concerning “data breach”. It relates to the unauthorised copying and disclosure of Morrisons payroll information by a disgruntled ex-employee. In 2017, the High Court ruled that Morrisons is legally responsible for the data breach. In 2018, Morrisons appealed the High Court’s judgment, but the Court of Appeal dismissed Morrisons’ appeal. Further legal proceedings will take place to determine what compensation must be paid to the victims.

This week Henry Tapper wrote a blog entitled, “

This week Henry Tapper wrote a blog entitled, “ They have been asked to pay the money back but by the looks of their social media accounts, I don´t think there is much left. Camilla’s Facebook and Instagram accounts show her sunning herself on beaches and yachts around the world, and posing at luxury alpine ski resorts. David Austin is pictured on a gondola in Venice. They certainly got to enjoy the proceeds of their many victims’ pensions.

They have been asked to pay the money back but by the looks of their social media accounts, I don´t think there is much left. Camilla’s Facebook and Instagram accounts show her sunning herself on beaches and yachts around the world, and posing at luxury alpine ski resorts. David Austin is pictured on a gondola in Venice. They certainly got to enjoy the proceeds of their many victims’ pensions.

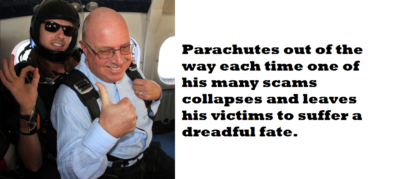

Stephen Ward of Premier Pension Solutions SL and Premier Pension Transfers Ltd

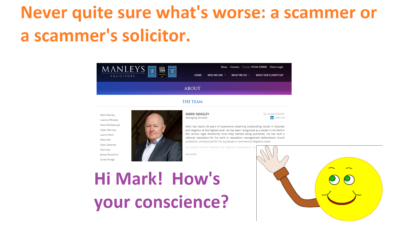

Stephen Ward of Premier Pension Solutions SL and Premier Pension Transfers Ltd Mark Manley of Manleys Solicitors – acting for XXXX XXXX.

Mark Manley of Manleys Solicitors – acting for XXXX XXXX. It is believed that cold calling techniques were used to lure unsuspecting victims into this series of unregulated investment scams. Victims’ pension savings were transferred into bogus occupational pension schemes whose trustees/administrators were Omni Trustees and Imperial Trustee Services. The schemes were

It is believed that cold calling techniques were used to lure unsuspecting victims into this series of unregulated investment scams. Victims’ pension savings were transferred into bogus occupational pension schemes whose trustees/administrators were Omni Trustees and Imperial Trustee Services. The schemes were

One of the updates is that STM Group have appointed a Group Internal Auditor. I wonder if this is going to make their trading any more honest. One can only hope that their future auditing will be considerably better than their past.

One of the updates is that STM Group have appointed a Group Internal Auditor. I wonder if this is going to make their trading any more honest. One can only hope that their future auditing will be considerably better than their past.

I’ve been very concerned about Dolphin Trust GmbH for some time. There’s an awful lot of pension money being loaned to this company – and I don’t get to hear of many (in fact any) people who have had their loans repaid. That doesn’t mean they haven’t been repaid – it just means I haven’t heard about it.

I’ve been very concerned about Dolphin Trust GmbH for some time. There’s an awful lot of pension money being loaned to this company – and I don’t get to hear of many (in fact any) people who have had their loans repaid. That doesn’t mean they haven’t been repaid – it just means I haven’t heard about it. Without the benefit of any assurances from the nice men at Dolphin Trust – Charles Smethurst, Helmut Freitag, Axel Krechberger and Matthias Ruhl – we will just have to hope that Mr Doran manages to offload the second-hand loan notes that STM Fidecs allowed 400+ victims’ life savings to be invested in. Perhaps I’ll drop him a friendly note and suggest he tries ebay.

Without the benefit of any assurances from the nice men at Dolphin Trust – Charles Smethurst, Helmut Freitag, Axel Krechberger and Matthias Ruhl – we will just have to hope that Mr Doran manages to offload the second-hand loan notes that STM Fidecs allowed 400+ victims’ life savings to be invested in. Perhaps I’ll drop him a friendly note and suggest he tries ebay.