Fighting pension scams: Regulation

Fighting pension scams: Regulation

If it was easy to stop pension scams, everyone would be doing it. Clearing up the mess left behind a pension scam is a huge challenge. This is why clear international standards need to be recognised and adopted. The scammers are like flocks of vultures. If people only used regulated firms, they could avoid a lot of scams.

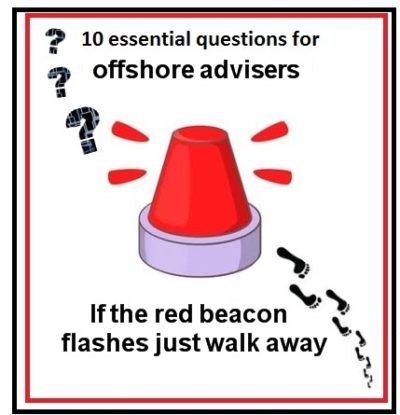

- Firm must be fully regulated – with licenses for insurance and investment advice

- Advisers must be qualified to the right standard

- Firm must have Professional Indemnity Insurance

- Clients must have comprehensive fact finds and risk profiles

- Firm must operate adequate compliance procedures

- Advisers must not abuse insurance bonds

- Clients must understand the investment policy

- All fees, charges and commissions must be disclosed

- Investors must know how their investments are performing

- Firm must keep a log of all customer complaints

Why is regulation so important?:

- If a firm sells insurance, it must have an insurance license.

- If a firm gives investment advice, it must have an investment license.

Many advisers will claim that if they only have an insurance license, they can advise on investments if an insurance bond is used. This practice must be outlawed, because this is how so many scams happen.

Most countries have an insurance and an investment regulator. They provide licenses to firms. Some regulators are better than others. Most regulators do some research and only give licenses to decent firms.

History tells us that most pension scams start with unlicensed firms. Here are some examples:

LCF Bond, Blackmore Bond, Blackmore Global Fund, LM, Axiom and Premier New Earth – all high risk failures. The investors have lost some or all of their money in these bonds and funds. They were mostly sold by advisers without an investment license. Investors lost well over £1 billion. Advisers (introducers) earned £millions in commissions.

LCF Bond, Blackmore Bond, Blackmore Global Fund, LM, Axiom and Premier New Earth – all high risk failures. The investors have lost some or all of their money in these bonds and funds. They were mostly sold by advisers without an investment license. Investors lost well over £1 billion. Advisers (introducers) earned £millions in commissions.

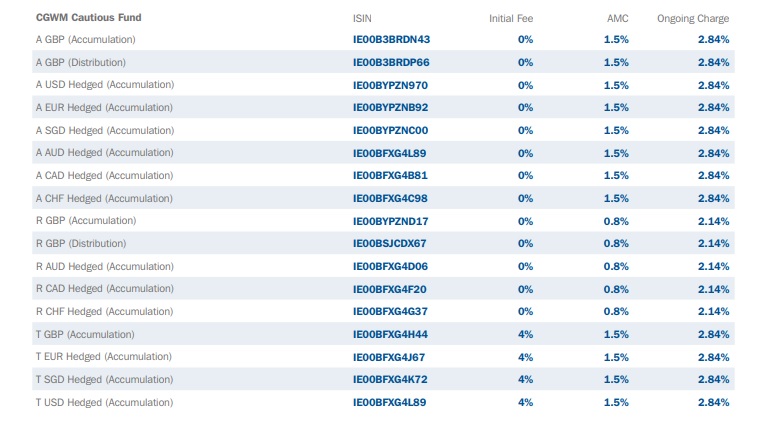

Continental Wealth Management invested 1,000 clients’ funds in high-risk structured notes. Investors started with £100 million. Most have lost at least half. Some have lost everything. Continental Wealth Management had no license from any regulator in any country.

Continental Wealth Management invested 1,000 clients’ funds in high-risk structured notes. Investors started with £100 million. Most have lost at least half. Some have lost everything. Continental Wealth Management had no license from any regulator in any country.

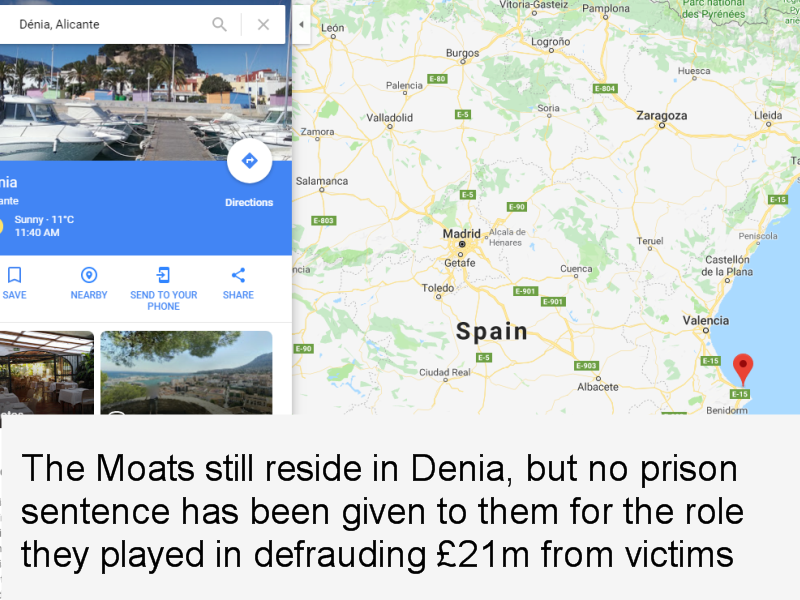

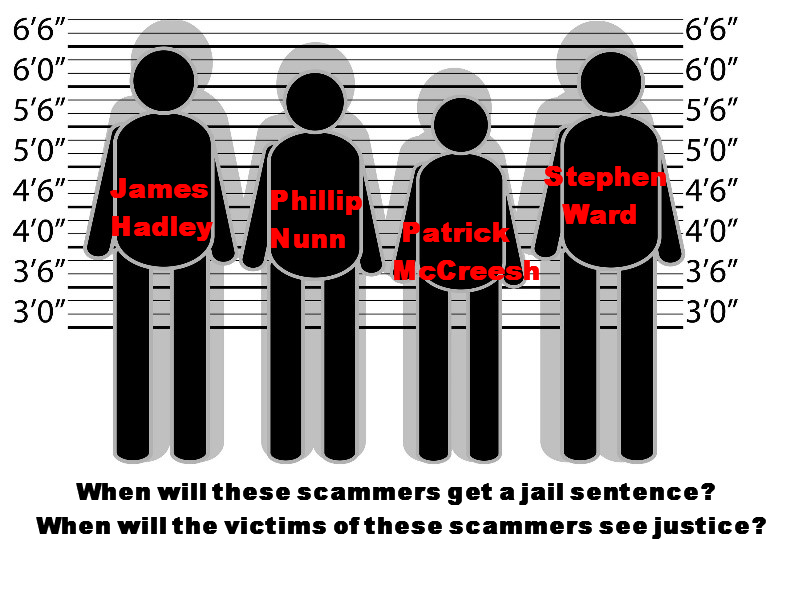

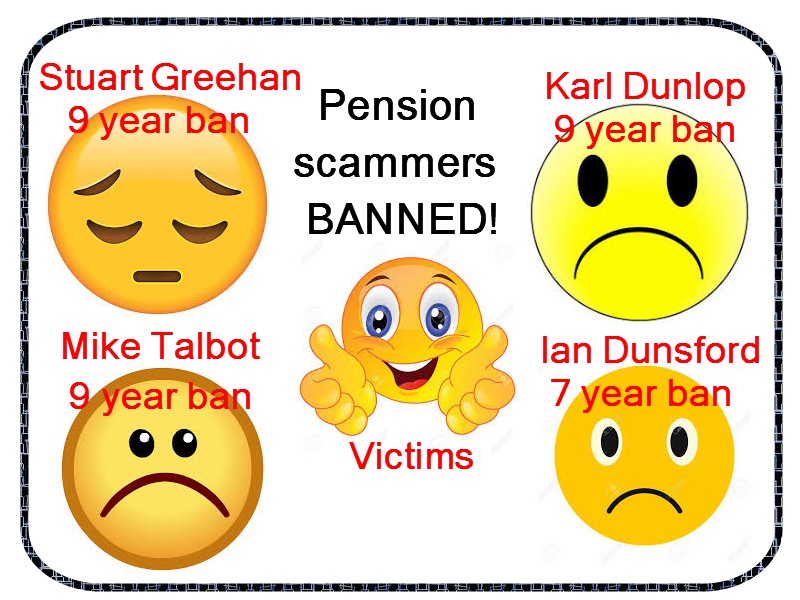

Serial scammers such as Peter Moat, Stephen Ward, Phillip Nunn, and XXXX XXXX all ran unlicensed firms. Peter Moat operated the Fast Pensions scam which cost victims over £21 million. Stephen Ward operated the Ark, Evergreen, Capita Oak, Westminster and London Quantum pension scams which cost victims over £50 million. XXXX XXXX operated the Trafalgar pension scam which cost victims over £21 million.

Serial scammers such as Peter Moat, Stephen Ward, Phillip Nunn, and XXXX XXXX all ran unlicensed firms. Peter Moat operated the Fast Pensions scam which cost victims over £21 million. Stephen Ward operated the Ark, Evergreen, Capita Oak, Westminster and London Quantum pension scams which cost victims over £50 million. XXXX XXXX operated the Trafalgar pension scam which cost victims over £21 million.

Phillip Nunn operates the Blackmore Global Fund which has cost victims over £40 million. Serial scammer David Vilka has been promoting this fund. Over 1,000 people may have lost their pensions.

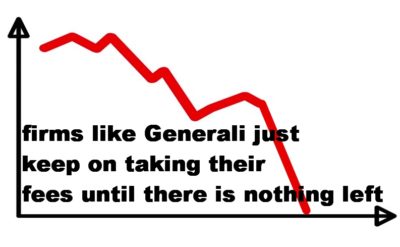

Firms that give unlicensed advice are breaking the law. Unlicensed advisers often use insurance bonds. These bonds pay high commissions. The funds these advisers use also pay high commissions. The advisers get rich. The clients get fleeced. The funds get destroyed. Insurance bonds such as OMI, FPI, SEB and Generali are full of worthless unregulated funds, bonds and structured notes.

Firms that give unlicensed advice are breaking the law. Unlicensed advisers often use insurance bonds. These bonds pay high commissions. The funds these advisers use also pay high commissions. The advisers get rich. The clients get fleeced. The funds get destroyed. Insurance bonds such as OMI, FPI, SEB and Generali are full of worthless unregulated funds, bonds and structured notes.

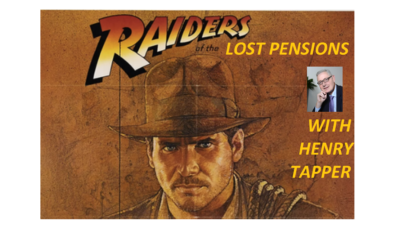

Unlicensed firms hide charges from their clients. Most victims say they would never have invested had they known how expensive it was going to be.

Unlicensed firms hide charges from their clients. Most victims say they would never have invested had they known how expensive it was going to be.

Hidden charges can destroy a fund – even without investment losses. Licensed advisers normally disclose all fees and commissions up front. This way, the client knows exactly how much the advice is going to cost.

People can avoid being victims of pension scammers. Using properly regulated firms is one way. An advisory firm should have both an insurance license and an investment license. Don’t fall for the line: “we don’t need an investment license if we use an insurance bond”. Bond providers such as OMI, FPI, SEB and Generali still offer high-risk investments. The insurance bond provides zero protection. And the bond charges will make investment losses much worse.

People can avoid being victims of pension scammers. Using properly regulated firms is one way. An advisory firm should have both an insurance license and an investment license. Don’t fall for the line: “we don’t need an investment license if we use an insurance bond”. Bond providers such as OMI, FPI, SEB and Generali still offer high-risk investments. The insurance bond provides zero protection. And the bond charges will make investment losses much worse.

YOU WOULDN’T USE AN UNLICENSED DOCTOR.

SO DON’T USE AN UNLICENSED FINANCIAL ADVISER.

I read an interesting article recently which has prompted this blog, written by

I read an interesting article recently which has prompted this blog, written by  Blair (pictured) talks about substance and the need for higher standards among financial advisers. Whilst I love her thoughts, I know how difficult this might be to achieve. We see wholly unqualified scammers posing as fully qualified IFAs time and time again. These scammers are very good at acting the part and the victims have no idea they are dealing with a fraudster – and sometimes go on for years believing they are dealing with a proper financial adviser.

Blair (pictured) talks about substance and the need for higher standards among financial advisers. Whilst I love her thoughts, I know how difficult this might be to achieve. We see wholly unqualified scammers posing as fully qualified IFAs time and time again. These scammers are very good at acting the part and the victims have no idea they are dealing with a fraudster – and sometimes go on for years believing they are dealing with a proper financial adviser.

A firm with advisers who are unwilling to answer all of the questions you ask them is clearly a firm to be avoided.

A firm with advisers who are unwilling to answer all of the questions you ask them is clearly a firm to be avoided.

In January 2019, we saw legal challenges going forward against not one but two SIPPS providers for their roles in using and promoting unregulated investments. Berkeley Burke SIPPS Administration and Carey Pensions (the latter now owned by rogue QROPS trustee firm STM Group).

In January 2019, we saw legal challenges going forward against not one but two SIPPS providers for their roles in using and promoting unregulated investments. Berkeley Burke SIPPS Administration and Carey Pensions (the latter now owned by rogue QROPS trustee firm STM Group). Tighter protocols on pension investments are something that we would happily welcome here at Pension Life. With higher standards of compliance and fewer small providers, people investing their pensions into SIPPS should hopefully have a clearer and safer picture.

Tighter protocols on pension investments are something that we would happily welcome here at Pension Life. With higher standards of compliance and fewer small providers, people investing their pensions into SIPPS should hopefully have a clearer and safer picture.

Furthermore, if someone does approach you via a cold call claiming to be a viable company with a convincing sales pitch – how do you know if what they are saying is genuine? How do you know if they are a

Furthermore, if someone does approach you via a cold call claiming to be a viable company with a convincing sales pitch – how do you know if what they are saying is genuine? How do you know if they are a

In many pension scam cases, we find victims telling us that they were

In many pension scam cases, we find victims telling us that they were  The only way forward is to go fee-based. And to outlaw commissions and hidden charges altogether. The scammers won’t do it – but decent, ethical firms will. The hard part will be to warn expats against vultures. Ethical firms will help with this initiative. Obviously, the scammers won’t.

The only way forward is to go fee-based. And to outlaw commissions and hidden charges altogether. The scammers won’t do it – but decent, ethical firms will. The hard part will be to warn expats against vultures. Ethical firms will help with this initiative. Obviously, the scammers won’t.

SCAMMER JAILED! Hip hip hooray! we say. What a great start to the new year. Neil Bartlett, 53, of Delamere Road, Ainsdale, used £4.5m of his victims’ money to fund an extravagant lifestyle of foreign travel, top hotels and gambling.

SCAMMER JAILED! Hip hip hooray! we say. What a great start to the new year. Neil Bartlett, 53, of Delamere Road, Ainsdale, used £4.5m of his victims’ money to fund an extravagant lifestyle of foreign travel, top hotels and gambling.

AND to rub salt into the wounds of the Trafalgar victims,

AND to rub salt into the wounds of the Trafalgar victims,  In follow up to our blog ´

In follow up to our blog ´

A quick google search of cold call gives untold amounts of advice on how to do it efficiently in 2019! Whilst some of these companies aren´t UK based, the evidence is clear. Cold calling pays and the companies that benefit from cold calling are not going to suddenly stop making them.

A quick google search of cold call gives untold amounts of advice on how to do it efficiently in 2019! Whilst some of these companies aren´t UK based, the evidence is clear. Cold calling pays and the companies that benefit from cold calling are not going to suddenly stop making them.

Henry Tapper has published an interesting article about the problem of the

Henry Tapper has published an interesting article about the problem of the

When it comes to finance, nothing in life comes for free. These free pension reviews are often followed by

When it comes to finance, nothing in life comes for free. These free pension reviews are often followed by

and quotes SCM Direct as saying “Its time for the chief executive of the FCA, Andrew Bailey, to demonstrate that he is willing to be the industry enforcer rather than the industry lapdog.”

and quotes SCM Direct as saying “Its time for the chief executive of the FCA, Andrew Bailey, to demonstrate that he is willing to be the industry enforcer rather than the industry lapdog.”

Just for a laugh, have a look on

Just for a laugh, have a look on

Stephen Ward of Premier Pension Solutions SL and Premier Pension Transfers Ltd

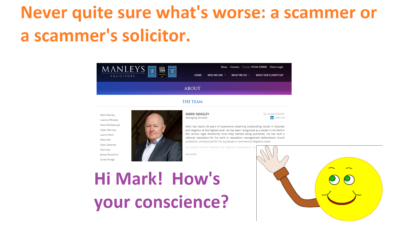

Stephen Ward of Premier Pension Solutions SL and Premier Pension Transfers Ltd Mark Manley of Manleys Solicitors – acting for XXXX XXXX.

Mark Manley of Manleys Solicitors – acting for XXXX XXXX. It is believed that cold calling techniques were used to lure unsuspecting victims into this series of unregulated investment scams. Victims’ pension savings were transferred into bogus occupational pension schemes whose trustees/administrators were Omni Trustees and Imperial Trustee Services. The schemes were

It is believed that cold calling techniques were used to lure unsuspecting victims into this series of unregulated investment scams. Victims’ pension savings were transferred into bogus occupational pension schemes whose trustees/administrators were Omni Trustees and Imperial Trustee Services. The schemes were

4. Insurance bonds are an expensive and unnecessary

4. Insurance bonds are an expensive and unnecessary  8. Time and time again, we see pension scam victims receiving the paperwork on the pension transfer ‘deal’ they have signed, only to realise that large fees and charges have been applied. The scammers are experts at hiding the charges and often quote the term: ‘free pension review’. Whilst they do not charge for all their visits and advice before you sign on the dotted line, they make up for this in transfer fees, commissions and often quarterly charges too! The quarterly charges will be applied no matter how your fund is doing. We have seen pension scam victims´ funds end up in negative equity due to being placed into an inappropriate fund which causes losses and second, continuing fees being applied. (Fees are normally based on the start value of the fund).

8. Time and time again, we see pension scam victims receiving the paperwork on the pension transfer ‘deal’ they have signed, only to realise that large fees and charges have been applied. The scammers are experts at hiding the charges and often quote the term: ‘free pension review’. Whilst they do not charge for all their visits and advice before you sign on the dotted line, they make up for this in transfer fees, commissions and often quarterly charges too! The quarterly charges will be applied no matter how your fund is doing. We have seen pension scam victims´ funds end up in negative equity due to being placed into an inappropriate fund which causes losses and second, continuing fees being applied. (Fees are normally based on the start value of the fund).