The problem with money is that it blows away if you don’t hold it down, tie it up or stuff it down your knickers. That’s why you need to put it somewhere safe: in a shoe box on top of the wardrobe; under your mattress; in the safe or – if you’re feeling really brave – in the bank. Trouble is, left in cash, money shrinks (inflation, charges, moths). This is why so many advisers recommend a platform – aka “somewhere safe” to keep your money.

The problem with money is that it blows away if you don’t hold it down, tie it up or stuff it down your knickers. That’s why you need to put it somewhere safe: in a shoe box on top of the wardrobe; under your mattress; in the safe or – if you’re feeling really brave – in the bank. Trouble is, left in cash, money shrinks (inflation, charges, moths). This is why so many advisers recommend a platform – aka “somewhere safe” to keep your money.

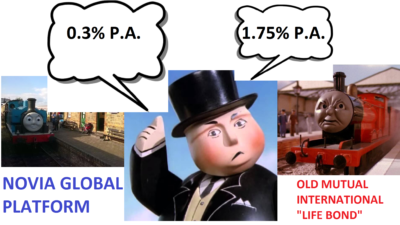

So, let’s look at two possible alternatives: the Novia Global platform and the Old Mutual International “bond”.

I’ve met Bill Vasilieff who runs Novia Global. He serves Earl Grey and nice biscuits. A man of few words, and even fewer syllables, he gave me a quick rundown on how the Novia Global platform works – and how much it costs.

I haven’t met Peter Kenny of Old Mutual International (OMI) – although I have spoken to him several times. As broadly Irish as Bill is Scottish, Peter Kenny also comes across as a softly-spoken and sincere chap. But there the similarity seems to end. Peter stood me up – I got a view of his office waiting room but wasn’t offered a cup of tea (let alone a biscuit).

Mind you, there isn’t much I don’t know about the Old Mutual International bonds. I’ve seen thousands of their policyholders’ statements – and they are frighteningly ugly and depressing. They accurately, faithfully and unemotionally report the destruction of their victims’ atrocious losses. And OMI regularly (like clockwork!) take their quarterly fees – irrespective of how deep the destruction of the policyholders’ funds is. In fact, some victims even find themselves in negative figures as OMI continue to account for their fees long after the whole blooming lot has gone.

Anyway, back to Bill and his welcoming teapot….I can’t really compare him to Pete but I can compare the two products. So here is a brief and brutal side-by-side line up of what the two “platforms” offer. And how much they cost. And how difficult they are to get out of. And how much financial crime they are associated with.

So the OMI “life bond” costs almost six times as much as the Novia Global platform. But that is if you are locked in for five years. You can get it cheaper – 1.15% – if you get locked in for ten years. But you must remember that if you are scammed, then OMI will have paid the scammer an 8% commission and you could get stuck with paying the quarterly fees for the next ten years, even if you’ve figured out you’ve been scammed. And the quarterly fees are based on your original investment – not on the impaired amount. If you’ve been scammed, and your fund value drops inexorably, the 1.15% will become bigger and bigger. And even if you lose your whole fund, OMI will keep taking their charges and pushing you further and further into debt.

A bit like the lyrics to Hotel California, with an OMI “bond”, you can’t check out any time you want, and you can only leave after between five and ten years. OMI will take that number of years to claw back the commission paid to your adviser – even if you have long since learned that your adviser was an unregulated scammer and has conned you into unsuitable, high-risk, high-commission investments that have badly damaged your fund. You are stuck with paying the quarterly fees to OMI – even after your whole fund has gone. One victim went from plus £300k to minus £25k – and counting. As your funds inside the OMI bond shrink, the 1.15% grows and helps destroy what is left of your fund even faster. But with the Novia Global platform, you can leave any time you want. No exit penalties. No hard feelings.

A bit like the lyrics to Hotel California, with an OMI “bond”, you can’t check out any time you want, and you can only leave after between five and ten years. OMI will take that number of years to claw back the commission paid to your adviser – even if you have long since learned that your adviser was an unregulated scammer and has conned you into unsuitable, high-risk, high-commission investments that have badly damaged your fund. You are stuck with paying the quarterly fees to OMI – even after your whole fund has gone. One victim went from plus £300k to minus £25k – and counting. As your funds inside the OMI bond shrink, the 1.15% grows and helps destroy what is left of your fund even faster. But with the Novia Global platform, you can leave any time you want. No exit penalties. No hard feelings.

In Spain, the Supreme Court has ruled that bogus life assurance policies – such as those provided by Old Mutual International – used to hold investments are illegal. This is because they are neither proper insurance policies (which take risk in the interests of the consumer) nor are they proper investment platforms. The Spanish aren’t stupid – they can spot a scam much more easily than other jurisdictions and take action to prevent them from ruining future victims. This is in stark contrast to the likes of the Isle of Man and Gibraltar – which seem to revel in encouraging scams and protecting firms such as Old Mutual International (and STM Group) which facilitate financial crime on a massive scale.

In Spain, the Supreme Court has ruled that bogus life assurance policies – such as those provided by Old Mutual International – used to hold investments are illegal. This is because they are neither proper insurance policies (which take risk in the interests of the consumer) nor are they proper investment platforms. The Spanish aren’t stupid – they can spot a scam much more easily than other jurisdictions and take action to prevent them from ruining future victims. This is in stark contrast to the likes of the Isle of Man and Gibraltar – which seem to revel in encouraging scams and protecting firms such as Old Mutual International (and STM Group) which facilitate financial crime on a massive scale.

A firm with advisers who are unwilling to answer all of the questions you ask them is clearly a firm to be avoided.

A firm with advisers who are unwilling to answer all of the questions you ask them is clearly a firm to be avoided.

Furthermore, if someone does approach you via a cold call claiming to be a viable company with a convincing sales pitch – how do you know if what they are saying is genuine? How do you know if they are a

Furthermore, if someone does approach you via a cold call claiming to be a viable company with a convincing sales pitch – how do you know if what they are saying is genuine? How do you know if they are a

In many pension scam cases, we find victims telling us that they were

In many pension scam cases, we find victims telling us that they were  So how does this illicit commission work? And how do the hidden charges damage a victim’s fund?

So how does this illicit commission work? And how do the hidden charges damage a victim’s fund? The only way forward is to go fee-based. And to outlaw commissions and hidden charges altogether. The scammers won’t do it – but decent, ethical firms will. The hard part will be to warn expats against vultures. Ethical firms will help with this initiative. Obviously, the scammers won’t.

The only way forward is to go fee-based. And to outlaw commissions and hidden charges altogether. The scammers won’t do it – but decent, ethical firms will. The hard part will be to warn expats against vultures. Ethical firms will help with this initiative. Obviously, the scammers won’t.

Worrying isn´t it? Offshore companies can try to claim they are international financial advisers, but actually be unregulated and unqualified to carry out the very service they offer! The “advisory” firms have flash websites, and some have several offices around Europe and beyond. Their PR is great at scaremongering expats about their pension investments in the lead up to Brexit.

Worrying isn´t it? Offshore companies can try to claim they are international financial advisers, but actually be unregulated and unqualified to carry out the very service they offer! The “advisory” firms have flash websites, and some have several offices around Europe and beyond. Their PR is great at scaremongering expats about their pension investments in the lead up to Brexit.

Know all the correct questions to ask an adviser before you sign on the dotted line.

Know all the correct questions to ask an adviser before you sign on the dotted line.  How much will the fees and charges be? Remember NO pension transfer is free.

How much will the fees and charges be? Remember NO pension transfer is free.

SCAMMER JAILED! Hip hip hooray! we say. What a great start to the new year. Neil Bartlett, 53, of Delamere Road, Ainsdale, used £4.5m of his victims’ money to fund an extravagant lifestyle of foreign travel, top hotels and gambling.

SCAMMER JAILED! Hip hip hooray! we say. What a great start to the new year. Neil Bartlett, 53, of Delamere Road, Ainsdale, used £4.5m of his victims’ money to fund an extravagant lifestyle of foreign travel, top hotels and gambling.

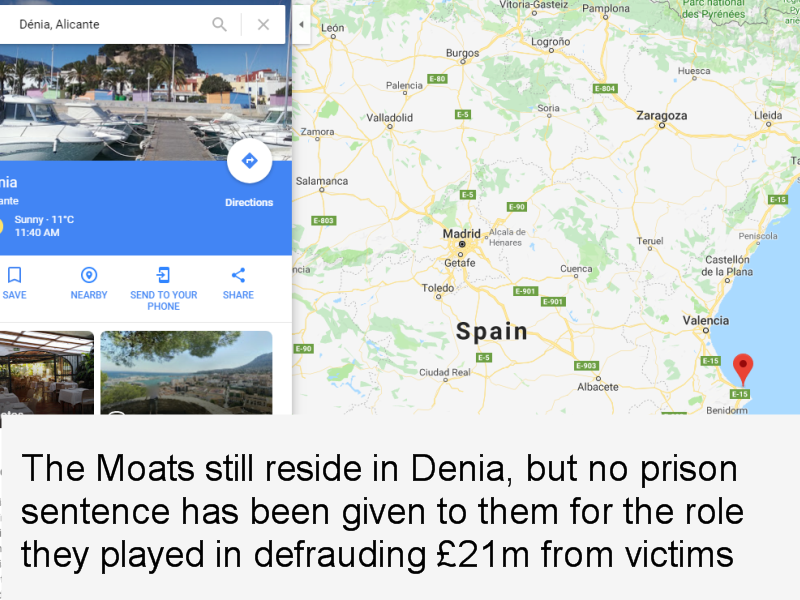

AND to rub salt into the wounds of the Trafalgar victims,

AND to rub salt into the wounds of the Trafalgar victims,  In follow up to our blog ´

In follow up to our blog ´

A quick google search of cold call gives untold amounts of advice on how to do it efficiently in 2019! Whilst some of these companies aren´t UK based, the evidence is clear. Cold calling pays and the companies that benefit from cold calling are not going to suddenly stop making them.

A quick google search of cold call gives untold amounts of advice on how to do it efficiently in 2019! Whilst some of these companies aren´t UK based, the evidence is clear. Cold calling pays and the companies that benefit from cold calling are not going to suddenly stop making them. FT adviser published an article entitled,

FT adviser published an article entitled,  To my relatively informed eye, it was obvious these were scam emails, but the offer of money back from

To my relatively informed eye, it was obvious these were scam emails, but the offer of money back from  So, as we cannot count on our government to protect us from the cold calling scams, Pension Life is here to help.

So, as we cannot count on our government to protect us from the cold calling scams, Pension Life is here to help.

Henry Tapper has published an interesting article about the problem of the

Henry Tapper has published an interesting article about the problem of the

When it comes to finance, nothing in life comes for free. These free pension reviews are often followed by

When it comes to finance, nothing in life comes for free. These free pension reviews are often followed by

The arrival of wraps allows fee-based financial planners in the UK to offer a sound, client-focused service to expats, who up until recently have been easy prey to

The arrival of wraps allows fee-based financial planners in the UK to offer a sound, client-focused service to expats, who up until recently have been easy prey to

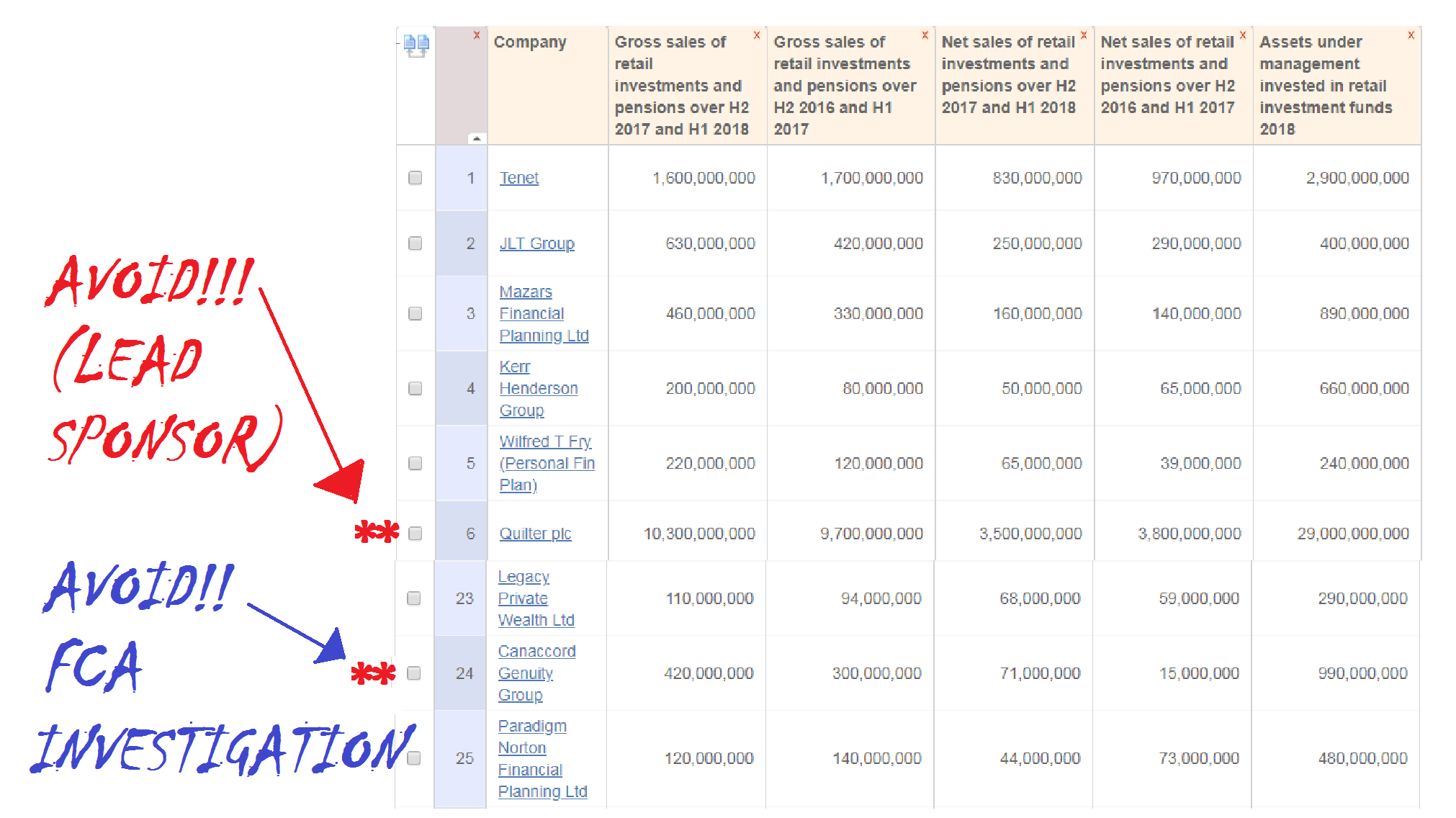

I have enormous respect for FT Adviser. Their articles are written by proper journalists and they generally write competently and professionally. FT Adviser puts

I have enormous respect for FT Adviser. Their articles are written by proper journalists and they generally write competently and professionally. FT Adviser puts  However, Canaccord Genuity Group’s porky pies do pale into a degree of insignificance when compared to Quilter plc which came sixth with £10.3 billion worth of sales and £29 billion worth of assets under management. Quilter plc is

However, Canaccord Genuity Group’s porky pies do pale into a degree of insignificance when compared to Quilter plc which came sixth with £10.3 billion worth of sales and £29 billion worth of assets under management. Quilter plc is  But, despite the embarrassing inclusion of these two dud firms, congratulations to FT Adviser for the hard work which must have gone into producing this hit parade. This is definitely one in the eye for the hopeless nitwits at

But, despite the embarrassing inclusion of these two dud firms, congratulations to FT Adviser for the hard work which must have gone into producing this hit parade. This is definitely one in the eye for the hopeless nitwits at

International Adviser really can’t make up its mind whether it is organising a piss-up in a brewery, a news roundup carefully slewed in favour sponsors

International Adviser really can’t make up its mind whether it is organising a piss-up in a brewery, a news roundup carefully slewed in favour sponsors Bob Pain in the chair as quiz master. A bloke who ran Cayman Islands-based

Bob Pain in the chair as quiz master. A bloke who ran Cayman Islands-based  Capabilities and Harbour (n

Capabilities and Harbour (n Captain of the Army Team I nominate as Sam Instone of AES International. His experience as an Army officer should give him the leadership skills to oppose the Navel Team. Sam’s track record as the “enemy of traditional financial services” should give him the basis for a sound battle plan.

Captain of the Army Team I nominate as Sam Instone of AES International. His experience as an Army officer should give him the leadership skills to oppose the Navel Team. Sam’s track record as the “enemy of traditional financial services” should give him the basis for a sound battle plan.

And the final member of the Army team will be Paul Stanfield, CEO of FEIFA (Federation of European Independent Financial Advisers). Another real gentleman – and handsome to boot – and one who understands the importance of outlawing scammers. Several years ago he excommunicated

And the final member of the Army team will be Paul Stanfield, CEO of FEIFA (Federation of European Independent Financial Advisers). Another real gentleman – and handsome to boot – and one who understands the importance of outlawing scammers. Several years ago he excommunicated