Intro written by Kim: ‘This week Angie travelled for work (yet again): she had to fly from Granada to Barcelona. Disaster struck – her baggage sadly did not make the full journey -it’s sitting in the triangle of lost luggage no doubt. The airline – Vueling – whilst only providing the flight, was still happy to take responsibility for the loss of her bag and its contents, and compensate her. That got her thinking: if an airline can take full responsibility for a loss, why are life offices like OMI turning a blind eye to the massive losses they have caused to thousands of pension scam victims’ funds?

Intro written by Kim: ‘This week Angie travelled for work (yet again): she had to fly from Granada to Barcelona. Disaster struck – her baggage sadly did not make the full journey -it’s sitting in the triangle of lost luggage no doubt. The airline – Vueling – whilst only providing the flight, was still happy to take responsibility for the loss of her bag and its contents, and compensate her. That got her thinking: if an airline can take full responsibility for a loss, why are life offices like OMI turning a blind eye to the massive losses they have caused to thousands of pension scam victims’ funds?

Over to Angie:

The financial services industry (especially offshore) has a lot to learn from the airline industry. Aviation stakeholders internationally provide the highest possible levels of safety for air travellers. This due diligence is constantly reviewed, updated and improved. The same standard of responsibility routinely happens in all jurisdictions. Regulators, as well as air crash investigators, work together when things go right. As well as when they don’t.

The work of the air industry regulators, investigators and safety trainers never ceases with all parties constantly striving to maintain the highest possible standards of performance and safety. And when something goes wrong, everybody swings into action like the A-team, International Rescue and Tom Cruise combined.

The work of the air industry regulators, investigators and safety trainers never ceases with all parties constantly striving to maintain the highest possible standards of performance and safety. And when something goes wrong, everybody swings into action like the A-team, International Rescue and Tom Cruise combined.

I know all this because one of my members is a Captain with a well-known airline (probably quite easy to guess which one!). He also trains pilots from a variety of other airlines in simulators – and this includes Vueling pilots. I will call him Captain BJ.

BJ is a thoroughly decent bloke and has a rather endearing fondness for chickens. He has devoted his professional life to the business of safety in travel. And behind him is a comprehensive and robust system of regulation – internationally. Financial services regulators, on the other hand, stand by and watch (with their hands firmly in their pockets – and their fingers compulsively searching for something with which to fiddle) as the equivalent of hundreds of passenger planes crash every month. The regulators stare blankly at the charred remains of the passengers’ life savings and shrug carelessly at the huge scale of human misery caused so routinely. With such flaccid regulatory regimes in so many jurisdictions, these chocolate-teapot regulators de facto facilitate and encourage losses caused by negligence and scams.

I know all this because Captain BJ is also a pension scam victim – courtesy of Stephen Ward’s Ark £27 million pension scam. Despite the extreme stress of losing his pension, he has to keep a stiff upper lip and continue with his daily routine of flying thousands of passengers safely around the skies of Europe.

My recent experience on a Vueling flight provides an interesting parallel with the “financial services” provided by Old Mutual International. Vueling sells flights. They provide the aircraft; the pilots and the cabin crew. They offer a selection of routes, food and drink, duty free goods, toilets and the expertise to get many thousands of passengers from one destination to another safely and on time; day after day after day.

What Vueling doesn’t do is operate a baggage handling service – this is provided by the airport you travel through. However, no matter how enjoyable a flight has been (if such a thing is possible!) and how punctual the take-off and landing are, the whole experience can be badly marred by the loss of a passenger’s luggage. While Vueling is responsible for the safety of the passengers, it is NOT responsible for the safety of the passengers’ luggage when it is not in the bowels of the aircraft. However, Vueling goes to extraordinary lengths to help people whose luggage has been delayed or lost. Vueling take full responsibility for a loss of luggage, luckily for me.

Earlier this week, it was the baggage handlers at either Granada airport or Barcelona airport who were responsible for my medium-sized, black, tatty suitcase. And they lost it. The case had been full of clothing typically worn by a slightly fat, grey-haired woman on the wrong side of something ending in a nought. So no desirable or valuable designer totty wear, expensive perfume or sparkly jewellery.

But Vueling provide people like me (who end up wearing the same orange jumper and purple socks two days in a row) with an easy to use, online complaints and redress facility. It wasn’t Vueling’s fault that my luggage got lost, but they take responsibility for it anyway because it is part of the whole flight “package”.

But Vueling provide people like me (who end up wearing the same orange jumper and purple socks two days in a row) with an easy to use, online complaints and redress facility. It wasn’t Vueling’s fault that my luggage got lost, but they take responsibility for it anyway because it is part of the whole flight “package”.

Contrast this with Old Mutual International (OMI) and the IoM regulator. And thank your lucky stars that they don’t try to run an airline (because if they did, it is unlikely any passengers or luggage would ever survive). OMI provides “insurance bonds” or bogus life assurance policies. These products serve no purpose except to pay fat commissions to rogue IFAs. And they feature a selection of risky investment products for the IFAs to earn even more commission. What OMI does not provide is financial advice – that is the job of someone else (i.e. the IFAs). But when the IFAs do the equivalent of losing the baggage, OMI takes no interest or responsibility other than to record the loss.

In the air industry, there are two things that can go wrong that can cause customers financial damage: flight delays and loss of luggage. A comprehensive complaints and redress system is routinely provided by all leading airlines. In the financial services industry, there are two things that can go wrong that can cause customers financial damage: investment failures and disproportionately high charges. No complaints and redress system is provided by life offices such as OMI and no one takes full responsibility for a loss.

If an airline experiences a crash, a huge machine swings into action to investigate the cause and take immediate remedial action to prevent the same or similar event from ever causing another accident. If a life office such as OMI experiences a crash, it pretends nothing has happened. Pension scam victims? No pension scam victims here! OMI denies all responsibility. And blames the IFA. Or the weather. Or Brexit. And keeps charging the victims the same disproportionately high fees based on the huge commissions they originally paid to the IFA that caused the crash.

Here are some examples of OMI’s crashes in the past six years:

* Axiom Litigation Fund – this was a PROFESSIONAL-INVESTOR-ONLY fund which was routinely used by rogue IFAs for ordinary, retail investors (and from which the IFAs earned fat commissions). OMI offered the Axiom fund on the bogus “life assurance” platform. And when the fund went into administration in December 2012, OMI shrugged its shoulders and said “not our problem“. And kept charging the victims the same fees as if the £120 million loss hadn’t happened.

OMI knew that many of the IFAs had been neither regulated nor qualified and that the investors were unsophisticated, low-risk, retail customers.

* LM Australian Property Fund – this was a PROFESSIONAL-INVESTOR-ONLY fund which was routinely used by rogue IFAs for ordinary, retail investors (and from which the IFAs earned fat commissions). OMI offered the LM fund on the bogus “life assurance” platform. And when the fund went into administration in March 2013, OMI shrugged its shoulders and said “not our problem“. And kept charging the victims the same fees as if the £240 million loss hadn’t happened.

OMI knew that many of the IFAs had been neither regulated nor qualified and that the investors were unsophisticated, low-risk, retail customers.

OMI knew that many of the IFAs had been neither regulated nor qualified and that the investors were unsophisticated, low-risk, retail customers.

* Premier New Earth Recycling Fund – this was a PROFESSIONAL-INVESTOR-ONLY fund which was routinely used by rogue IFAs for ordinary, retail investors (and from which the IFAs earned fat commissions). OMI offered the PNER fund on the bogus “life assurance” platform. And when the fund went into administration in June 2016, OMI shrugged its shoulders and said “not our problem“. And kept charging the victims the same fees as if the £800 million loss hadn’t happened.

OMI knew that many of the IFAs had been neither regulated nor qualified and that the investors were unsophisticated, low-risk, retail customers. That is £1.16 billion worth of fund losses in just over six years, but they take no responsibility for loss of funds and the pension scam victim gets no redress.

(Note – if you read the above three examples, you will see that although the funds, dates and amounts were different, the circumstances were EXACTLY the same!)

Add to this the £ billions lost through toxic, risky structured notes, and that adds up to quite a cricket score that OMI “wasn’t responsible for“.

The causes were all the same:

UNREGULATED ADVISORY FIRMS

UNQUALIFIED ADVISERS

FUNDS OFFERING HUGE COMMISSIONS

FUNDS SUITABLE FOR HIGH-RISK, PROFESSIONAL INVESTORS SOLD TO LOW-RISK, RETAIL INVESTORS

NO DUE DILIGENCE BY OMI

We know that OMI bought:

£200 million worth of failed Leonteq structured notes

between 2012 and 2016 as OMI is claiming to be suing Leonteq. But this does little to distract attention from OMI’s multiple, long-term failures for allowing such toxic investments in the first place and causing many people to become pension scam victims.

If I give my car keys to someone who is so drunk they can barely stand up – and certainly can’t spell either OMI or IOM – and there is a serious accident, whose fault is it? The drunk’s or mine?

If I give my car keys to someone who is so drunk they can barely stand up – and certainly can’t spell either OMI or IOM – and there is a serious accident, whose fault is it? The drunk’s or mine?

OMI’s CEO is a bloke called Peter Kenny who used to work for the IoM regulator. So he should know better. But he doesn’t. So we must assume he would be happy to hand his car keys over to a drunk or let an unqualified pilot fly a plane with a broken wing. And he would still claim it wasn’t his fault, despite the number of pension scam victims.

The moral of this blog is: never wear orange and purple on a flight; never use an OMI life bond; always use a qualified, regulated and insured IFA. Don’t become the next pension scam victim.

My next dilemma is what to buy with my Vueling compensation. I feel a trip to Marks and Sparks coming on. (I needed a bigger size anyway!).

(Huge thanks to Captain BJ – to whom I owe my sanity).

PS – since we wrote and published this blog, my luggage has been found. Apparently, it never left Granada airport. I suspect somebody pinched it – then found the clothes inside were so dull that they didn’t think it was worth taking it after all.

CWM Pension scam – A victim’s reconstruction

FT adviser published an article entitled,

FT adviser published an article entitled,  To my relatively informed eye, it was obvious these were scam emails, but the offer of money back from

To my relatively informed eye, it was obvious these were scam emails, but the offer of money back from  So, as we cannot count on our government to protect us from the cold calling scams, Pension Life is here to help.

So, as we cannot count on our government to protect us from the cold calling scams, Pension Life is here to help.

As 2018 draws to a close, a recap is in order to review the year’s progress in the war against pension scammers. Let us not forget – in the immortal words of the Pensions Regulator’s Lesley Titcombe: “

As 2018 draws to a close, a recap is in order to review the year’s progress in the war against pension scammers. Let us not forget – in the immortal words of the Pensions Regulator’s Lesley Titcombe: “ Neither Garry Williams nor Sue Huxley has ever been convicted or jailed.

Neither Garry Williams nor Sue Huxley has ever been convicted or jailed.

Stephen Ward’s firm Premier Pension Solutions (in Moraira, Spain) was the “sister” firm of Continental Wealth Management, run by scammer Darren Kirby. This was one of the biggest single scams – known as

Stephen Ward’s firm Premier Pension Solutions (in Moraira, Spain) was the “sister” firm of Continental Wealth Management, run by scammer Darren Kirby. This was one of the biggest single scams – known as

Fast Pensions

Fast Pensions

Another of Stephen Ward’s many pension scams, this one was courtesy of his bogus pension trustee firm

Another of Stephen Ward’s many pension scams, this one was courtesy of his bogus pension trustee firm  116 victims were scammed out of their pensions by James Lau of FCA-regulated Wightman Fletcher McCabe. Victims were assured the loans they were given did not come from their pension funds and would not be taxable by HMRC. The trustees of the scheme – Peter Bradley and Andrew Meeson (both ex HMRC) of Tudor Capital Management – were jailed for eight years for cheating the Public Revenue. James Lau is currently under criminal investigation by the Insolvency Service. The victims are awaiting a verdict on whether they will still have to pay the tax penalties.

116 victims were scammed out of their pensions by James Lau of FCA-regulated Wightman Fletcher McCabe. Victims were assured the loans they were given did not come from their pension funds and would not be taxable by HMRC. The trustees of the scheme – Peter Bradley and Andrew Meeson (both ex HMRC) of Tudor Capital Management – were jailed for eight years for cheating the Public Revenue. James Lau is currently under criminal investigation by the Insolvency Service. The victims are awaiting a verdict on whether they will still have to pay the tax penalties.

1. New Earth Solutions Group Limited (“NESGL”)

1. New Earth Solutions Group Limited (“NESGL”) Deloittes have made the usual “we are limited in what information we can share so that we do not prejudice any potential claims” disclaimer to the distressed shareholders. But I find it worrying that Deloittes is being used at all for this job. Deloittes was used to inspect the books and records of

Deloittes have made the usual “we are limited in what information we can share so that we do not prejudice any potential claims” disclaimer to the distressed shareholders. But I find it worrying that Deloittes is being used at all for this job. Deloittes was used to inspect the books and records of  However noble, environmentally friendly and ethical the concept of turning rubbish into clean energy may sound in theory, this commercial venture was never commercially viable. In fact, looking at the ever-increasing gross losses from 2008 to 2014: from £0.3m in 2008 to £7m in 2014 – and a total spent on “admin costs” of £14.3m – any half-decent accountant or auditor would have blown the whistle long before 2016.

However noble, environmentally friendly and ethical the concept of turning rubbish into clean energy may sound in theory, this commercial venture was never commercially viable. In fact, looking at the ever-increasing gross losses from 2008 to 2014: from £0.3m in 2008 to £7m in 2014 – and a total spent on “admin costs” of £14.3m – any half-decent accountant or auditor would have blown the whistle long before 2016. The name “Premier” will, of course, strike a chord with victims of

The name “Premier” will, of course, strike a chord with victims of  And, of course,

And, of course,

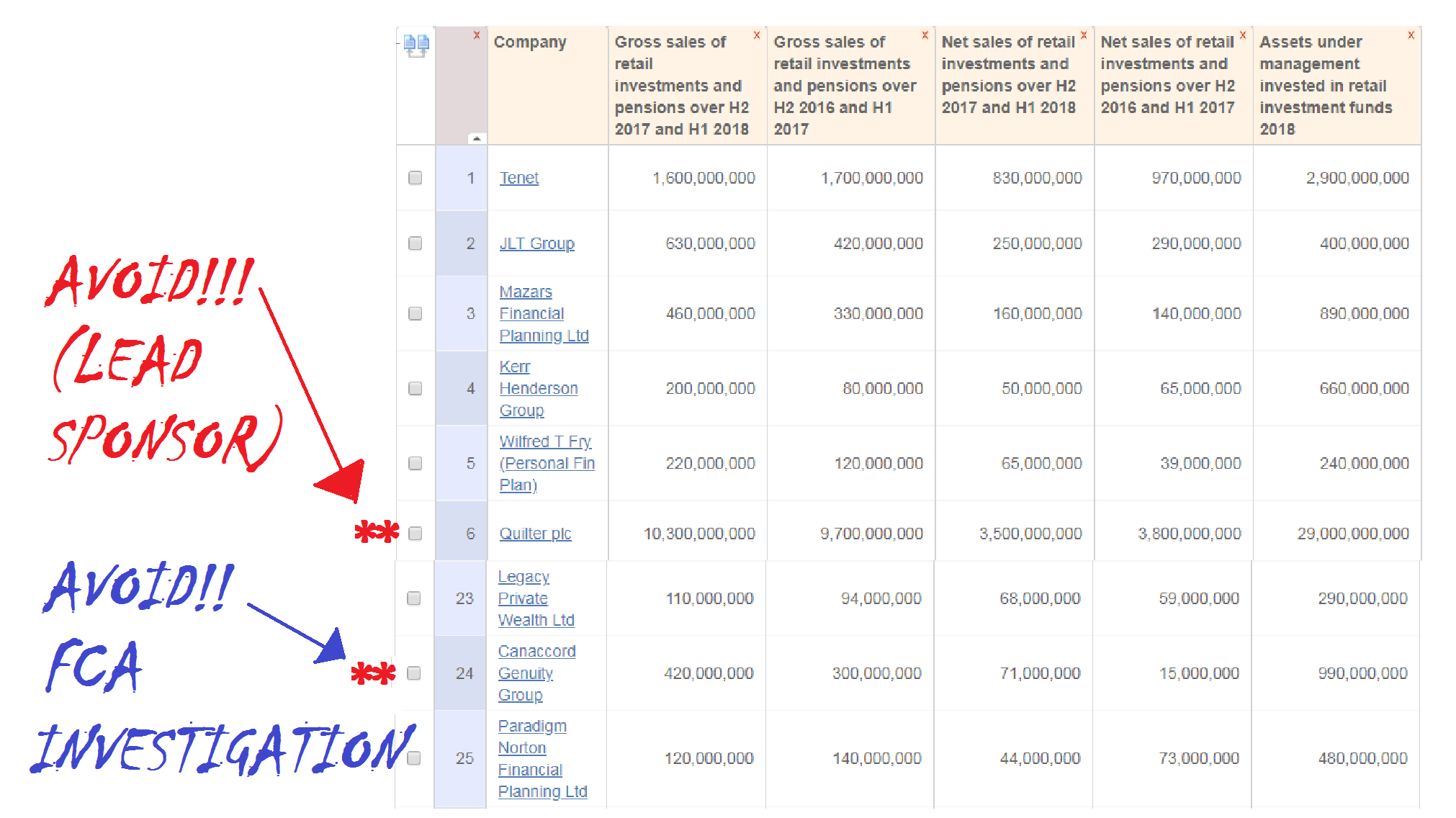

I have enormous respect for FT Adviser. Their articles are written by proper journalists and they generally write competently and professionally. FT Adviser puts

I have enormous respect for FT Adviser. Their articles are written by proper journalists and they generally write competently and professionally. FT Adviser puts  However, Canaccord Genuity Group’s porky pies do pale into a degree of insignificance when compared to Quilter plc which came sixth with £10.3 billion worth of sales and £29 billion worth of assets under management. Quilter plc is

However, Canaccord Genuity Group’s porky pies do pale into a degree of insignificance when compared to Quilter plc which came sixth with £10.3 billion worth of sales and £29 billion worth of assets under management. Quilter plc is  But, despite the embarrassing inclusion of these two dud firms, congratulations to FT Adviser for the hard work which must have gone into producing this hit parade. This is definitely one in the eye for the hopeless nitwits at

But, despite the embarrassing inclusion of these two dud firms, congratulations to FT Adviser for the hard work which must have gone into producing this hit parade. This is definitely one in the eye for the hopeless nitwits at

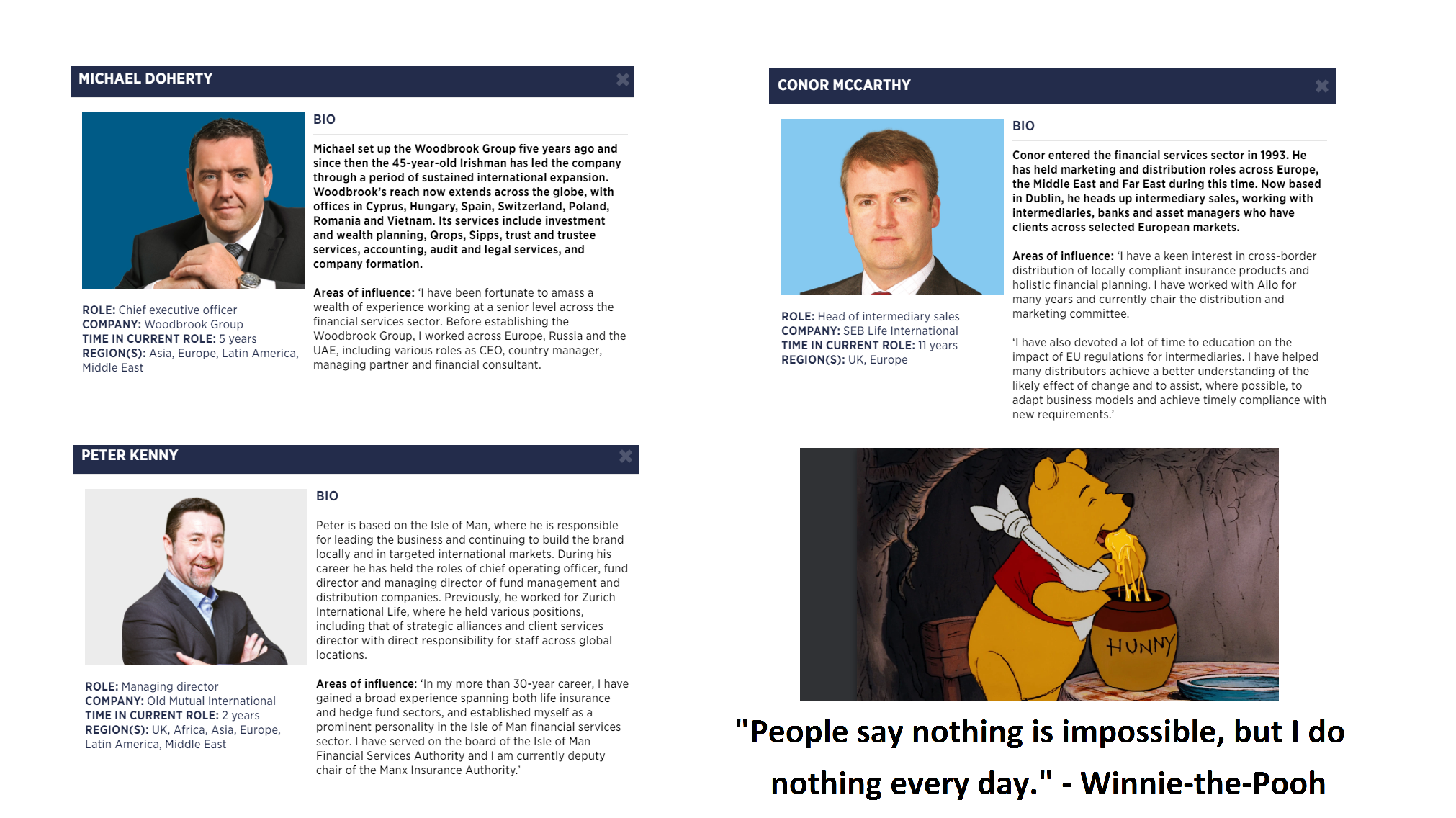

International Adviser really can’t make up its mind whether it is organising a piss-up in a brewery, a news roundup carefully slewed in favour sponsors

International Adviser really can’t make up its mind whether it is organising a piss-up in a brewery, a news roundup carefully slewed in favour sponsors Bob Pain in the chair as quiz master. A bloke who ran Cayman Islands-based

Bob Pain in the chair as quiz master. A bloke who ran Cayman Islands-based  Capabilities and Harbour (n

Capabilities and Harbour (n Captain of the Army Team I nominate as Sam Instone of AES International. His experience as an Army officer should give him the leadership skills to oppose the Navel Team. Sam’s track record as the “enemy of traditional financial services” should give him the basis for a sound battle plan.

Captain of the Army Team I nominate as Sam Instone of AES International. His experience as an Army officer should give him the leadership skills to oppose the Navel Team. Sam’s track record as the “enemy of traditional financial services” should give him the basis for a sound battle plan.

And the final member of the Army team will be Paul Stanfield, CEO of FEIFA (Federation of European Independent Financial Advisers). Another real gentleman – and handsome to boot – and one who understands the importance of outlawing scammers. Several years ago he excommunicated

And the final member of the Army team will be Paul Stanfield, CEO of FEIFA (Federation of European Independent Financial Advisers). Another real gentleman – and handsome to boot – and one who understands the importance of outlawing scammers. Several years ago he excommunicated

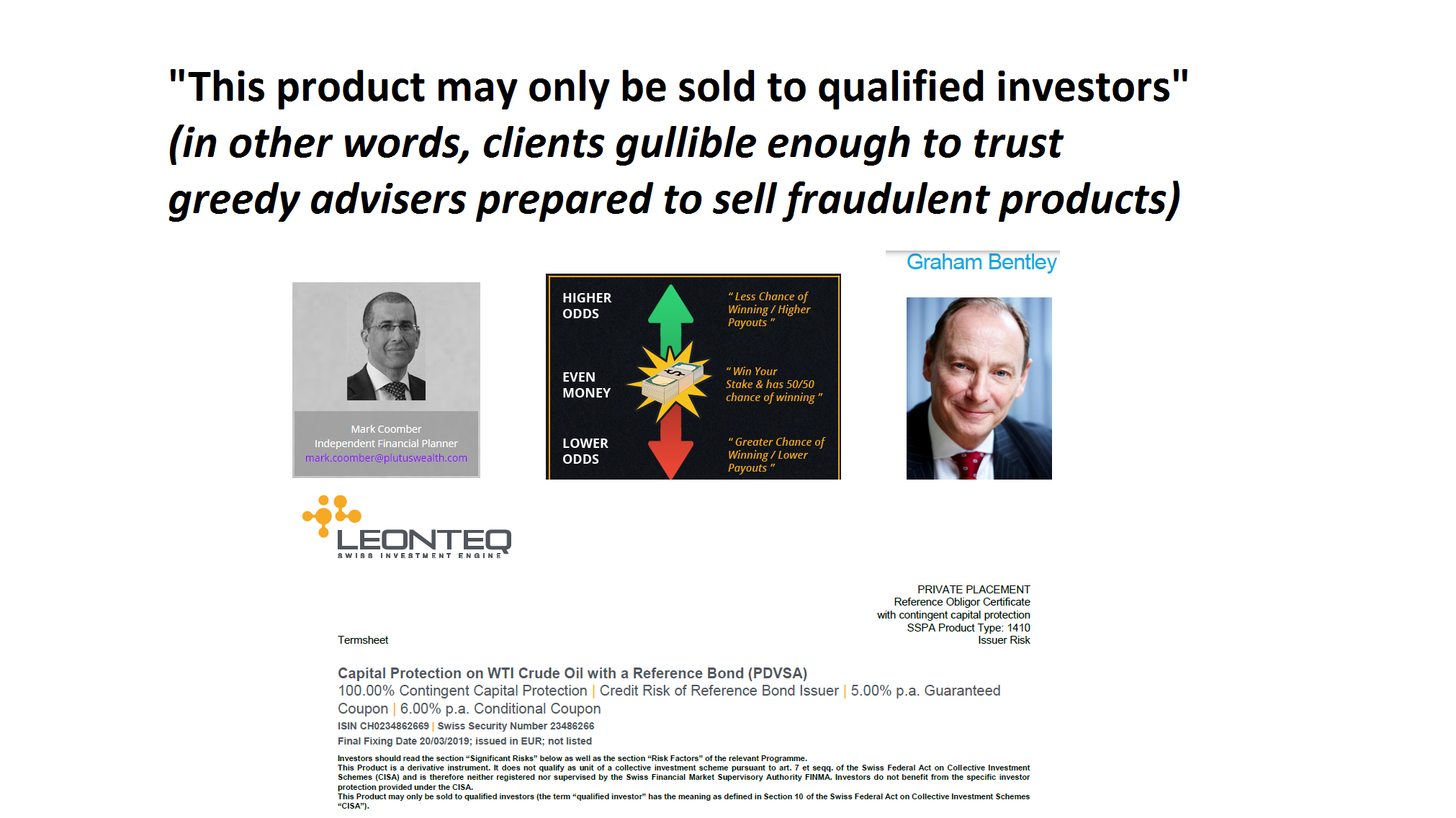

Nitwit or Dragonfly? Gambling or Investing? Are investment losses as a result of a bad adviser or a bad investment? Or both? The real question is: how does the consumer tell the difference? A favourite episode of Fawlty Towers involved Basil’s ill-fated bet on a racehorse called Dragonfly. Confusion sets in – fuelled by the easily-confused Manuel – and “Dragonfly” gets muddled up with “Nitwit”. And that is how clients get confused just as easily: by advisers who spout the usual rubbish: capital protected; guaranteed returns; blue-chip investments; solid providers etc. They just leave out the three most important things: the fat commissions paid to the adviser; the high-risk nature of the “investment” and the fact that

Nitwit or Dragonfly? Gambling or Investing? Are investment losses as a result of a bad adviser or a bad investment? Or both? The real question is: how does the consumer tell the difference? A favourite episode of Fawlty Towers involved Basil’s ill-fated bet on a racehorse called Dragonfly. Confusion sets in – fuelled by the easily-confused Manuel – and “Dragonfly” gets muddled up with “Nitwit”. And that is how clients get confused just as easily: by advisers who spout the usual rubbish: capital protected; guaranteed returns; blue-chip investments; solid providers etc. They just leave out the three most important things: the fat commissions paid to the adviser; the high-risk nature of the “investment” and the fact that  And this guy is chartered! As a member of the CISI he should know better than to spout such rubbish – and I feel deeply sorry for any clients of Plutus Wealth Management as they are clearly in danger of being sold these toxic products. In fact, I would go further and suggest the public should be warned about the dangers of using this firm, as Coomber clearly has every intention of flogging his victims these high-risk products. If he is stupid enough to use them for his own gambling fun, good luck to him. But he has no right to inflict them on retail clients.

And this guy is chartered! As a member of the CISI he should know better than to spout such rubbish – and I feel deeply sorry for any clients of Plutus Wealth Management as they are clearly in danger of being sold these toxic products. In fact, I would go further and suggest the public should be warned about the dangers of using this firm, as Coomber clearly has every intention of flogging his victims these high-risk products. If he is stupid enough to use them for his own gambling fun, good luck to him. But he has no right to inflict them on retail clients. The term sheet did, to be fair, give a clear warning:

The term sheet did, to be fair, give a clear warning:

4. Insurance bonds are an expensive and unnecessary

4. Insurance bonds are an expensive and unnecessary  8. Time and time again, we see pension scam victims receiving the paperwork on the pension transfer ‘deal’ they have signed, only to realise that large fees and charges have been applied. The scammers are experts at hiding the charges and often quote the term: ‘free pension review’. Whilst they do not charge for all their visits and advice before you sign on the dotted line, they make up for this in transfer fees, commissions and often quarterly charges too! The quarterly charges will be applied no matter how your fund is doing. We have seen pension scam victims´ funds end up in negative equity due to being placed into an inappropriate fund which causes losses and second, continuing fees being applied. (Fees are normally based on the start value of the fund).

8. Time and time again, we see pension scam victims receiving the paperwork on the pension transfer ‘deal’ they have signed, only to realise that large fees and charges have been applied. The scammers are experts at hiding the charges and often quote the term: ‘free pension review’. Whilst they do not charge for all their visits and advice before you sign on the dotted line, they make up for this in transfer fees, commissions and often quarterly charges too! The quarterly charges will be applied no matter how your fund is doing. We have seen pension scam victims´ funds end up in negative equity due to being placed into an inappropriate fund which causes losses and second, continuing fees being applied. (Fees are normally based on the start value of the fund).

International Adviser and the Old Mutual International/Quilter Scams. Today’s jolly:

International Adviser and the Old Mutual International/Quilter Scams. Today’s jolly: International Adviser should hang its head in shame for failing to make sure that the perpetrators – especially Old Mutual International/Quilter – are brought to justice publicly for the destruction of hundreds of millions of pounds’ worth of life savings. And yet IA’s Old Mother Hubbard is consorting with them and giving Quilter’s Ryan Gardner a speaking slot on the

International Adviser should hang its head in shame for failing to make sure that the perpetrators – especially Old Mutual International/Quilter – are brought to justice publicly for the destruction of hundreds of millions of pounds’ worth of life savings. And yet IA’s Old Mother Hubbard is consorting with them and giving Quilter’s Ryan Gardner a speaking slot on the

ROLL UP! ROLL UP! ME HEARTY SCAMMERS! OMI’S LATEST

ROLL UP! ROLL UP! ME HEARTY SCAMMERS! OMI’S LATEST  So, what are you waiting for? You’ll earn 8% by selling your victims a useless OMI “PORTFOLIO” bond (don’t mention this is illegal in Spain) and then a further 8% from selling this toxic, high-risk BNP Paribas structured note (rubbish inappropriate structured product) which will tie your victims in for

So, what are you waiting for? You’ll earn 8% by selling your victims a useless OMI “PORTFOLIO” bond (don’t mention this is illegal in Spain) and then a further 8% from selling this toxic, high-risk BNP Paribas structured note (rubbish inappropriate structured product) which will tie your victims in for

Mark Coomber, Chartered MCSI Independent Financial Planner at Plutus Wealth Management